Professional Documents

Culture Documents

Trend Lines

Uploaded by

Vigneshwaran VelumaniCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Trend Lines

Uploaded by

Vigneshwaran VelumaniCopyright:

Available Formats

Trend Lines

Prices do not only rise or fall but most of the time they actually move in narrow ranges. So, in accordance with the Dow Theory we can therefore divide trends into three types: "bull" (or "uptrend") => prices rise; "bear" (or "downtrend")=> prices fall; "flat" (or "sideways") ?=>prices are in a narrow range. As a general rule, market consolidates prior to a rapid price rise or fall. First of all, it is very important to determine if the market is uptrending or downtrending (this can be done with the help of trend indicators and trend lines or channels) and if the prevailing trend is strong or weak (with the help of oscillators and charts patterns).

Uptrend means that every next bottom is above the previous one, and every next high is above the previous one, so in this case, the trend line is drawn between bottom points. Obviously a trend line created by joining only two points will be less effective than a trend line created by three or more points

Downtrend means that every next bottom is under the previous bottom and every next high is under the previous high, so in this case, the trend line is created by using the highest points. Any trend (bullish or bearish) must be confirmed by trade volume. Put it simply: when prices move in accordance with the prevailing trend, the trade volume increases; when prices move against the prevailing trend (rebound), then trade volume decreases. Once the situation changes and trade volume during rebounds becomes greater than that during the trend price movement, it is a serious signal that the trend may not be so strong (but it is not the signal to open the opposite position, as there is no confirmation of the trend reversal).

What is the Wolfe Wave?

Simply put, the Wolfe Wave is a natural rhythm that exists in all markets. It is made up of waves of supply and demand that form their own equilibrium. . The key to its accuracy is in properly identifying the 1, 2, 3, 4 & 5 points. These are what give it its proper balance of equilibrium. It is very important to identify the dominant Wave. It is somewhat like recognizing those 3-D pictures. After a while a smile comes to your face and you say: "WOW, I see it."

Rules for Bullish WolfeWave Structure:

Please note the odd sequence in counting, as you will see, it is necessary for the inductive analysis. By starting with a top we are assured of beginning our count on a new wave. (The reverse would apply for a bearish wave.) Please note the odd sequence in counting, as you will see, it is necessary for the inductive analysis. By starting with a top we are assured of beginning our count on a new wave. (The reverse would apply for a bearish wave.)

Support and Resistance levels are patterns of classical technical analysis. All trend (channel) lines, reversal and continuation chart patterns are only combinations of support and resistance levels. Support level is a starting point of an uptrend, and is actually a tangent to the minimum prices. It is commonly thought that when the price falls down to the support level, Bulls (buyers) start to resist against further price decrease thus giving it support. This explains why is many cases the price will bounce back and start rising after having reached a support level. After attempts the price may break the support level. Once the support is broken, it becomes resistance level.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- UstDocument6 pagesUstVigneshwaran VelumaniNo ratings yet

- Business QuizDocument1 pageBusiness QuizVigneshwaran VelumaniNo ratings yet

- Business QuizDocument1 pageBusiness QuizVigneshwaran VelumaniNo ratings yet

- Cognizent Technology Solutions (CTS) Sample Paper Section - IDocument3 pagesCognizent Technology Solutions (CTS) Sample Paper Section - IVigneshwaran VelumaniNo ratings yet

- OS2Document10 pagesOS2Vigneshwaran VelumaniNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Self-Efficacy and Academic Stressors in University StudentsDocument9 pagesSelf-Efficacy and Academic Stressors in University StudentskskkakleirNo ratings yet

- Water Flow Meter TypesDocument2 pagesWater Flow Meter TypesMohamad AsrulNo ratings yet

- Dehydration AssessmentDocument2 pagesDehydration AssessmentzaheerbdsNo ratings yet

- Catalog de Aparatura Si Instrumentar Veterinar Eikemeyer-GermaniaDocument336 pagesCatalog de Aparatura Si Instrumentar Veterinar Eikemeyer-GermaniaDr. Dragos CobzariuNo ratings yet

- Yuzu InstallerDocument3 pagesYuzu InstallerJohnnel PrietosNo ratings yet

- Technical Data - Tad1342veDocument9 pagesTechnical Data - Tad1342veRachid SmailiNo ratings yet

- Dreizler EDocument265 pagesDreizler ERobis OliveiraNo ratings yet

- 3 HVDC Converter Control PDFDocument78 pages3 HVDC Converter Control PDFJanaki BonigalaNo ratings yet

- Research in International Business and Finance: Huizheng Liu, Zhe Zong, Kate Hynes, Karolien de Bruyne TDocument13 pagesResearch in International Business and Finance: Huizheng Liu, Zhe Zong, Kate Hynes, Karolien de Bruyne TDessy ParamitaNo ratings yet

- CIVE2304 C1-1 Hydrological CycleDocument54 pagesCIVE2304 C1-1 Hydrological CyclenaserNo ratings yet

- Evidence Based Practice in Nursing Healthcare A Guide To Best Practice 3rd Edition Ebook PDFDocument62 pagesEvidence Based Practice in Nursing Healthcare A Guide To Best Practice 3rd Edition Ebook PDFwilliam.tavares69198% (50)

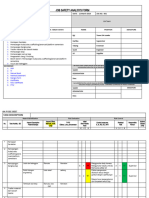

- JSA FormDocument4 pagesJSA Formfinjho839No ratings yet

- Clock of Destiny Book-1Document46 pagesClock of Destiny Book-1Bass Mcm87% (15)

- Data Mining For Business Analyst AssignmentDocument9 pagesData Mining For Business Analyst AssignmentNageshwar SinghNo ratings yet

- B1 Editable End-of-Year TestDocument6 pagesB1 Editable End-of-Year TestSyahira Mayadi50% (2)

- Body Temperature PDFDocument56 pagesBody Temperature PDFBanupriya-No ratings yet

- Mars Atlas MOM 8 13Document6 pagesMars Atlas MOM 8 13aldert_pathNo ratings yet

- CFodrey CVDocument12 pagesCFodrey CVCrystal N FodreyNo ratings yet

- C7.5 Lecture 18: The Schwarzschild Solution 5: Black Holes, White Holes, WormholesDocument13 pagesC7.5 Lecture 18: The Schwarzschild Solution 5: Black Holes, White Holes, WormholesBhat SaqibNo ratings yet

- IRJ November 2021Document44 pagesIRJ November 2021sigma gaya100% (1)

- Chapter 8 - Current Electricity - Selina Solutions Concise Physics Class 10 ICSE - KnowledgeBoatDocument123 pagesChapter 8 - Current Electricity - Selina Solutions Concise Physics Class 10 ICSE - KnowledgeBoatskjNo ratings yet

- Group 3 Presenta Tion: Prepared By: Queen Cayell Soyenn Gulo Roilan Jade RosasDocument12 pagesGroup 3 Presenta Tion: Prepared By: Queen Cayell Soyenn Gulo Roilan Jade RosasSeyell DumpNo ratings yet

- Growth Kinetic Models For Microalgae Cultivation A ReviewDocument16 pagesGrowth Kinetic Models For Microalgae Cultivation A ReviewJesús Eduardo De la CruzNo ratings yet

- Venere Jeanne Kaufman: July 6 1947 November 5 2011Document7 pagesVenere Jeanne Kaufman: July 6 1947 November 5 2011eastendedgeNo ratings yet

- Promoting Services and Educating CustomersDocument28 pagesPromoting Services and Educating Customershassan mehmoodNo ratings yet

- Chapter 3.seed CertificationDocument9 pagesChapter 3.seed Certificationalemneh bayehNo ratings yet

- 3-CHAPTER-1 - Edited v1Document32 pages3-CHAPTER-1 - Edited v1Michael Jaye RiblezaNo ratings yet

- Alan Freeman - Ernest - Mandels - Contribution - To - Economic PDFDocument34 pagesAlan Freeman - Ernest - Mandels - Contribution - To - Economic PDFhajimenozakiNo ratings yet

- - Анализ текста The happy man для ФЛиС ЮФУ, Аракин, 3 курсDocument2 pages- Анализ текста The happy man для ФЛиС ЮФУ, Аракин, 3 курсJimmy KarashNo ratings yet

- Lab Activity 5Document5 pagesLab Activity 5Jasmin CeciliaNo ratings yet