Professional Documents

Culture Documents

Derby North Gateway TIF District Feasibility Study

Uploaded by

Bob WeeksCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Derby North Gateway TIF District Feasibility Study

Uploaded by

Bob WeeksCopyright:

Available Formats

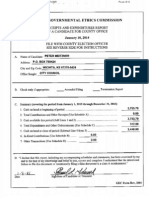

MEMORANDUM

TO: Sedgwick County Finance Division Staff

FROM: Tom Kaleko, Senior Vice President/Client Representative

Tom Denaway, Analyst

DATE: March 29, 2013

SUBJECT: Sedgwick County tax increment finance policy minimum data requirements

The purpose of this memorandum is to outline the location of the minimum data requirements, as specified by the

Sedgwick County Tax Increment Finance Policy, within the Derby North Gateway TIF District Financial Feasibility

Study.

Minimum Data Requirements Location

Legal description and district map

The legal description is in Exhibit V

Map of TIF district is in Exhibit I.

Existing assessed valuation and list of owners Parcel listing in Exhibit VI

Existing zoning classifications and proposed land

uses

Zoning map in Exhibit IX

No proposed changes in land use

Description of proposed project

Section 3 describes projects

Section 5 outlines public improvements to be funded

Market feasibility

Exhibit VII indicates how district will be timed to coincide with

market support

Private pro forma Not applicable

Public sources and uses

Section 4 outlines the analysis of public funding

Exhibits II and II illustrate assumptions and annual projections

Section 5 outlines proposed public uses

Exhibit IV illustrates annual debt-service

Evidences of private funding

Exhibit VII indicates how district will be timed to coincide with

market support

Description of expanding municipal services Exhibit VII

Springsted Incorporated

9229 Ward Parkway, Suite 104N

Kansas City, MO 64114-3311

Tel: 816-333-7200

Fax: 816-333-6899

www.springsted.com

Redevelopment Project Financial Feasibility Study

Derby North Gateway TIF District

City of Derby, Kansas

March 29, 2013

1 OVERVIEW ...................................................................................... 1

2 GENERAL DESCRIPTION OF TAX INCREMENT ...................................... 3

3 PROJECT DESCRIPTION ................................................................... 4

4 PROJECTED REVENUES (BENEFITS) .................................................. 6

5 PROJECTED EXPENDITURES (COSTS) ................................................ 8

6 CONCLUSIONS ................................................................................ 9

MAP OF PROPOSED REDEVELOPMENT DISTRICT & PROJECT ............ EXHIBIT I

TIF DISTRICT AND REDEVELOPMENT

PROJECT AREA ASSUMPTIONS ........................................................... EXHIBIT II

PROJECTED PROPERTY TAX INCREMENT ......................................... EXHIBIT III

BOND PROJECTIONS ......................................................................... EXHIBIT IV

LEGAL DESCRIPTION .......................................................................... EXHIBIT V

PARCEL LISTING ................................................................................ EXHIBIT VI

MARKET FEASIBILITY STATEMENT .................................................. EXHIBIT VII

DESCRIPTION OF EXPANDED MUNICIPAL SERVICES ....................... EXHIBIT VIII

ZONING MAP ...................................................................................... EXHIBIT IX

BLIGHT STUDY .................................................................................... EXHIBIT X

Mission Statement

Springsted provides high quality, independent financial

and management advisory services to public

and non-profit organizations, and works with them

in the long-term process of building their communities

on a fiscally sound and well-managed basis.

Table of Contents

Introduction 1

City of Derby, Kansas. Redevelopment Project Financial Feasibility Study.

1. Introduction

The City of Derby, Kansas is proposing creation of a tax increment financing

(TIF) district as a means to fund public road improvements. Specifically,

realignment of Nelson Drive to the east, allowing it to intersect East Patriot

Avenue aligned with the private roadway serving the existing Lowes/Kohls

development. This Redevelopment Project Financial Feasibility Study has been

prepared to meet the requirements of state statute which are described below

and to assist the impacted taxing districts in consideration of this proposed

financing district.

Statutory Basis and Process

Sections 12-1770 through 12-1780 of the Kansas Statutes ("the Act") provide a

means for cities to finance public development and redevelopment costs

through tax increment financing. The purpose of the Act is to "promote,

stimulate and develop the general and economic welfare of the State of Kansas

and its communities and to assist in the development and redevelopment of

eligible areas within and without a city thereby promoting the general welfare

of the citizens of this state

A city may exercise the powers conferred under the Act by approval of an

ordinance adopting a plan (the District Plan) which describes the boundaries

of the specific area to be developed or redeveloped and the types of

improvements to occur. Prior to adoption of the District Plan, the city must

pass a resolution setting a public hearing and finding that the specific area

sought to be developed or redeveloped (the Redevelopment District or

District) is an eligible area under the Act.

One or more redevelopment projects (the Redevelopment Project or

Project) may be undertaken within each District. For each Redevelopment

Project undertaken within the District, a project plan ("the Project Plan") must

be prepared in consultation with the controlling planning commission. The

Project Plan must include the following:

1. A summary or copy of the Financial Feasibility Study (this document).

2. A reference to the District Plan for the District.

3. A description and map of the area to be redeveloped.

4. A Relocation Assistance Plan.

5. A detailed description of all buildings and facilities proposed to be

constructed or improved.

6. Any other information the city deems necessary to advise the general

public of the intent of the Project Plan.

The Act requires all Projects to be completed within 20 years from the date of

the approval of a Project Plan, with the exception of environmental

investigation and remediation projects which must be completed within 20

Introduction 2

City of Derby, Kansas. Redevelopment Project Financial Feasibility Study.

years from the date the city enters into a consent decree with the Kansas

Department of Health and Environment or the U.S. Environmental Protection

Agency.

The Financial Feasibility Study must show that: a) the Projects benefits, tax

increment revenue, and other available revenues under K.S.A. 12-1774(a)(1)

are expected to exceed or be sufficient to pay for all Project costs as defined by

K.S.A. 12-1773, including the payment of principal and interest of debt used to

finance the redevelopment project; and b) the effect, if any, the redevelopment

project costs will have on any outstanding special obligation bonds payable

from the revenues described in K.S.A. 12-1774(a)(1)(D).

General Description of Tax Increment 3

City of Derby, Kansas. Redevelopment Project Financial Feasibility Study.

2. General Description of Tax Increment

Tax increment generated within the proposed Project Area will consist only of

ad valorem property tax revenues. The Project will not redirect any portion of

the sales tax increment. Therefore, this summary description of how tax

increment is calculated and captured to fund redevelopment project costs

addresses only the property tax increment.

Upon establishment of a Redevelopment District, the total assessed valuation of

all taxable real estate within the District is determined. This valuation is

referred to as the District's "Base Year Assessed Valuation." Property taxes

attributable to the District's Base Year Assessed Valuation are annually

collected and distributed by the county treasurer to the appropriate city, county,

school district and all other applicable taxing jurisdictions in the same manner

as other property taxes.

As new development occurs within the Redevelopment District, the total

assessed valuation of the District in any given year will presumably exceed its

Base Year Assessed Valuation. The real property taxes attributable to this

increase in valuation above the Base Year Valuation represents the tax

increment that will be utilized by the District to pay eligible project costs. All

tax increment collected by the county and distributed to the city is deposited

into a segregated fund established solely for that purpose.

Tax increment funds may only be used to pay for specified eligible project

costs, including principal and interest on debt used, in whole or in part, to

finance projects within a Redevelopment Project. Such debt includes notes,

special obligation bonds, full faith and credit tax increment bonds, and other

debt instruments. Tax increment also may be paid to a developer/owner over

time as reimbursement for eligible costs incurred up-front. This payment

mechanism is commonly referred to as pay-as-you-go financing and may

include not only the principal amount of such costs but also all or a portion of

the interest accrued thereon.

Project Description 4

City of Derby, Kansas. Redevelopment Project Financial Feasibility Study.

3. Project Description

The City of Derby is initiating the creation of the proposed TIF District. The

Derby North Gateway TIF District consists of 37 individual parcels of land

located largely on the south side of East Patriot Avenue, and bordered by K-15

Highway on the west and North Buckner Street on the east. The boundaries of

the TIF District are illustrated in Exhibit I. The District Plan which will be

proposed provides for the inclusion of a single Project Area with boundaries

coterminous to the Redevelopment District.

The City anticipates realignment of Nelson Drive within the TIF District in

conjunction with private development consisting of construction of a Menards

home improvement store and creation of 6 pad-ready development sites

adjacent to the Menards. The proposed Menards and commercial pad sites will

be classified as commercial and have a statutory property classification rate of

25.0%. Menards has previously acquired its development site. The City

intends to acquire the property necessary to accommodate the realignment of

Nelson Drive as part of the Redevelopment Project.

Realignment of Nelson Drive is anticipated to provide the following benefits to

the community and to the participating taxing entities.

Improved traffic safety through the realignment of Nelson Drive to the

east. The current intersection alignment has northbound and

southbound approaches which are slightly offset. This particular

alignment has led to right-of-way confusion and resulted in dangerous

traffic conditions. A traffic study determined that during the 40-month

period preceding the study, there were 22 accidents at the intersection.

Of these accidents, 3 were rear-end crashes, 4 were left-turn crashes,

and 15 were right-angle collisions. According to the traffic study,

right-angle collisions are of particular concern as they tend to be of

higher severity. The traffic study indicated this intersection has a

higher crash frequency than the rest of the Nelson Drive corridor,

which averages between 4 and 11 crashes per year. The realignment of

Nelson Drive will alleviate the traffic issues caused by the intersection

alignment.

Reinvestment in the Project Area and strengthening of the local

economy. Currently, the west half of the Project Area has excellent

visibility from highway K-15, but very poor access. As a result, the

Area has seen very little investment since buildings were constructed in

the 1950s through 1970s. Improved access is essential to the

proposed Menards project and will likely result in additional

development and redevelopment in the balance of the Project Area.

Transformation of a major community gateway. As this area is

improved through redevelopment and reinvestment, it will improve the

appearance of a major community entry. It is estimated that

approximately 21,000 cars per day pass the site along K-15.

Project Description 5

City of Derby, Kansas. Redevelopment Project Financial Feasibility Study.

Based on the 2012 assessment, the total Base Year Fair Market Valuation of the

Redevelopment Area is $4,951,370, while the total Base Year Assessed

Valuation is estimated at $888,210, (see Exhibit VI for individual parcel

details).

Springsted has prepared post-development market value projections for the

Menards store for the purpose of calculating future TIF property tax revenues.

The market value projections for the proposed Menards store were based on a

review of comparable Menards stores located within Sedgwick County. Based

on these comparable projects, we have assumed a building size of 165,426

square feet and a per square foot market value of $46.65 (excluding the value of

the underlying land). These assumptions result in an increased fair market

value of $7,717,123 and an increased assessed value of $1,929,281 resulting

from the Menards development. We have assumed the value of the Menards

store will be added to the tax rolls over a 2-year period, with construction

estimated to occur over an approximately 18-month timeline.

To be conservative, our revenue projections are based on development of the

Menards building only. No additional market value growth was projected for

the 6 pad sites adjacent to the Menards building, nor any additional market

value growth on the remaining parcels located within the District.

Utilizing these assumptions, we estimate that the Project Areas total fair

market value upon project completion in 2015 (assessed January 1, 2016) at

$12,668,493. The fair market value equates to an assessed valuation of

$2,817,491. The property tax increment generated in any given year will be

determined by the increase in Current Assessed Valuation over the Base Year

Assessed Valuation (value as of January 1, 2013). It is assumed that the City

will initiate the Redevelopment Project in January of 2014.

The existing zoning classifications for land within the District is a mix of B-5

(Restricted Commercial, Warehousing, and Limited Manufacturing District)

and B-3 (General Business District). The City does not anticipate any changes

to current land uses, beyond the transition from currently vacant land into

commercial use. The zoning is projected to remain the same.

Projected Revenues (Benefits) 6

City of Derby, Kansas. Redevelopment Project Financial Feasibility Study.

4. Projected Revenues (Benefits)

Tax Increment Revenue Base Assumptions

Base Appraised value of $4,951,370

Base Assessed value of $888,210

Current Assessment Rates assumed constant over term

Post Development Total Appraised Value of $12,668,493

Post Development Assessed value of $2,817,491

Incremental Appraised Value Growth of $7,717,123

Incremental Assessed Value Growth of $1,929,281

2012/2013 Mill Rate total 138.455, with TIF Eligible rate of 116.945

assumed constant over term

No market value inflation assumed

Increased Assessed Value

The City has the ability to use up to 100% of the property tax increment

generated by the Project Area based on its increase in Current Assessed

Valuation over its Base Year Assessed Valuation, as is illustrated below for the

Project Area at full assessment in 2016.

Project Area

Projected Total

Fair Market

Value

(1/1/2016)

Class/Rate

Projected Total

Assessed

Value

(1/1/2016)

$7,717,123 New Commercial Development $1,929,281

$4,951,370 Existing Value $ 888,210

Original Assessed Value ($ 888,210)

Increased Assessed Value $1,929,281

Exhibit II (TIF District and Redevelopment Project Area Assumptions)

details many of the assumptions used in the projection of values and tax

increment for the Project Area. Column 6 in Exhibit III (Projected Property

Tax Increment Revenue) shows the projected increased assessed valuation of

the Project Area over the maximum duration of the District.

Property Tax Rates

In order to determine the amount of tax increment generated by the Project

Area in any given year, the increased assessed value must be multiplied by the

sum of the tax rates for all TIF-applicable tax authorities for that year. For

taxes levied in 2012 and payable in 2012/2013, this total TIF-applicable rate is

Projected Revenue (Benefits) 7

City of Derby, Kansas. Redevelopment Project Financial Feasibility Study.

116.945 mills. We assume this rate remains fixed throughout the term of the

District.

The Unified School District 260 tax rate does not include the general

20.00 mills collected by the State as this is not TIF Eligible. Includes

levy for the Derby Recreation Commission (DRC).

Projected Property Tax Increment

The projected tax increment generated for the Project Area over a 20-year

period is shown in column 9 of Exhibit III (Projected Property Tax Increment

Revenue). If the Redevelopment Project is approved by the City in early 2014,

it would be eligible to receive increment in 2014/2015 through the second-half

2033/2034 collection. The tax increment projections are based on Base Year

Assessed Valuations, increased assessed valuations, and tax rates as previously

discussed. It is assumed in all years of the report that 100% of property taxes

are paid when due. The total property tax increment projected for the Project

Area is $4,173,965.

City Administration

The City will not retain tax increment for costs of administering the District.

Jurisdiction

TIF Eligible

Mill Rate

(2012/2013)

City of Derby 47.153

Sedgwick County 29.447

Cemetery District 1.040

USD 260

*

39.305

Total 116.945

Projected Expenditures (Costs) 8

City of Derby, Kansas. Redevelopment Project Financial Feasibility Study.

5. Projected Expenditures (Costs)

The Redevelopment Project will fund eligible project costs of $2,050,000 to

realign Nelson Drive within the Project Area. The public improvement costs

have the following line-item breakdown:

Public Improvement Costs

Line-Item Amount

Nelson Drive Realignment Construction $1,100,000

Nelson Drive Realignment Land

Acquisition

$ 500,000

Drainage Improvements $ 350,000

Landscaping $ 100,000

Total Cost $2,050,000

The City intends to fund these project costs through up-front financing of

approximately $2,215,000 ($2,050,000 in estimated public improvement costs,

and approximately $165,000 in transaction costs and capitalized interest).

Financing is anticipated to be in the form of general obligation TIF revenue

bonds with the debt service to be paid from tax increment generated by the

Redevelopment Project.

The bond issuance is likely to result in the payment of principal of $2,215,000

and interest of $438,220, for total debt service of $2,653,220. The final form,

amount and timing of the financing may differ from these terms, but this

methodology was used for purpose of forecasting Project feasibility. The bond

principal and interest payments of $2,653,220 represent the total costs to be

reimbursed by TIF revenues generated by the Project Area.

The projected total property tax TIF revenue of $4,173,965 generated by the

Project Area is sufficient to cover this total cost of $2,653,220. Based upon

current projections, bonds issued to fund project costs are anticipated to be

repaid over a period of 15-years. If the Project Area revenues are received at a

greater rate than currently projected, it is the Citys intention to accelerate

repayment of the assumed debt obligation, thereby hastening transfer of the

property tax increment to the affected taxing districts. Should the City

ultimately elect to secure the obligation with its full faith and credit (general

obligation) pledge, the City would be required to pay the bond debt service

from other legally available funds to the degree that tax increment was

insufficient.

Conclusions 9

City of Derby, Kansas. Redevelopment Project Financial Feasibility Study.

6. Conclusions

Project Area Conclusions The Act requires that the Financial Feasibility Study demonstrate that a

Projects benefits and other available revenues are expected to equal or exceed

all Project costs.

The project benefits can be described in two forms: a) the amount of total

revenues and other contributions received over the 20-year term of the Project;

and b) the amount of project costs which can be financed by the revenues

received over the applicable term. This second category represents the

principal amount of bonds which may be supported by the future revenues plus

any other financial contributions.

The Project Area Costs, including estimated interest expenditures, are estimated

to be $2,653,220. Project Area revenues, specifically property tax increment,

through the second-half 2033/2034 collection are forecasted to be $4,173,965.

Given the assumptions and representations of the various parties to the process

and our analysis, this Feasibility Study concludes that the Project Area benefits

are sufficient to pay the Project Area costs.

The Act also requires a determination of the effect the redevelopment project

will have on any outstanding special obligation bonds. There are no

outstanding special obligation bonds that would be impacted by this

redevelopment project.

EXHIBIT I

MAP OF PROPOSED REDEVELOPMENT

DISTRICT & PROJECT AREAS

EXHIBIT II

TIF DISTRICT AND REDEVELOPMENT

PROJECT AREA ASSUMPTIONS

Exhibit II Page 1 of 2

City of Derby, Kansas

Redevelopment Tax Increment Financing District

Sedwick Comp Scenario - 165,426SF - $46.65 psf value

Original Assessed Value (1/1/12) 888,210

TIF

2012/13 Mill Rates Total Applicable

State of Kansas 1.500 0.000

Sedgwick County 29.447 29.447

City of Derby 47.153 47.153

USD 260 (includes DRC) 39.305 39.305

USD 260 20.000 0.000

Cemetery District 1.040 1.040

Total 138.445 116.945

Assume fixed rate

Property TIF Inflation Rate: 0.00%

Sales Tax Inflation Rate: 0.00%

Derby North Gateway TIF District

Exhibit II - Page 2 of 2

City of Derby, Kansas

Redevelopment Tax Increment Financing District

Derby North Gateway TIF District

Sedgwick Comp Scenario - 165,426SF - $46.65 psf.

Property Tax Increment

Base and Current Values Appraised Assessed

Base - Assess January 1, 2012 4,951,370 888,210

Est. Base - Assess January 1, 2012 4,951,370 888,210

Assessment Rate: 25.00%

Project Components New Menards Building Existing Values Total Value

Estimated Square Footage 165,426

Estimated Appraised Value per SF

1)

$46.65

Total Appraised Value 7,717,123 4,951,370 12,668,493

Total Assessed Value 1,929,281 888,210 2,817,491

New Development Appraised

2)

Total Value

January 1, 2013 0%

January 1, 2014 0%

January 1, 2015 50%

January 1, 2016 100%

Estimated Appraised Value Total Value

January 1, 2013 4,951,370

January 1, 2014 4,951,370

January 1, 2015 8,809,931

January 1, 2016 12,668,493

Estimated Assessed Value Total Value

January 1, 2013 888,210

January 1, 2014 888,210

January 1, 2015 1,852,850

January 1, 2016 2,817,491

Tax Increment Total Original Captured

Assessed Assessed Assessed

Assess 20013/Distrib 2014 888,210 888,210 0

Assess 2014/Distrib 2015 888,210 888,210 0

Assess 2015/Distrib 2016 1,852,850 888,210 964,640

Assess 2016/Distrib 2017 2,817,491 888,210 1,929,281

NOTES:

1) Estimated commercial value of 165,426 square feet at a per square foot of $46.65 is based upon

size and value of existing Menards stores in Sedgwick County.

2) A one and one-half year construction period is assumed for the Menards store.

3) New Development value based only on Menards store construction. It is assumed that the

balance of the Redevelopment Area will remain at the Original Assessed Value.

EXHIBIT III

PROJECTED PROPERTY TAX

TIF REVENUE

City of Derby, Kansas

Redevelopment Tax Increment Financing District

Derby North Gateway TIF District

Projected Property Tax Increment

Sedgwick Comp Scenario - 165,426SF - $46.65 psf value

(4) - (5)

Assess & Original TIF Increased Projected Projected Projected

TIF Tax Levy Tax Distrib. Total Assessed Assessed Property Tax Sales Tax Total

Year Year Year Assessed (a) Value Value Increment (b) Increment Increment

(1) (2) (3) (4) (5) (6) (7) (8) (9)

0 2012 2013 888,210 888,210 0 0 0

0 2013 2014 888,210 888,210 0 0 0 0

1 2014 2015 888,210 888,210 0 0 0 0

2 2015 2016 1,852,850 888,210 964,640 112,810 0 112,810

3 2016 2017 2,817,491 888,210 1,929,281 225,620 0 225,620

4 2017 2018 2,817,491 888,210 1,929,281 225,620 0 225,620

5 2018 2019 2,817,491 888,210 1,929,281 225,620 0 225,620

6 2019 2020 2,817,491 888,210 1,929,281 225,620 0 225,620

7 2020 2021 2,817,491 888,210 1,929,281 225,620 0 225,620

8 2021 2022 2,817,491 888,210 1,929,281 225,620 0 225,620

9 2022 2023 2,817,491 888,210 1,929,281 225,620 0 225,620

10 2023 2024 2,817,491 888,210 1,929,281 225,620 0 225,620

11 2024 2025 2,817,491 888,210 1,929,281 225,620 0 225,620

12 2025 2026 2,817,491 888,210 1,929,281 225,620 0 225,620

13 2026 2027 2,817,491 888,210 1,929,281 225,620 0 225,620

14 2027 2028 2,817,491 888,210 1,929,281 225,620 0 225,620

15 2028 2029 2,817,491 888,210 1,929,281 225,620 0 225,620

16 2029 2030 2,817,491 888,210 1,929,281 225,620 0 225,620

17 2030 2031 2,817,491 888,210 1,929,281 225,620 0 225,620

18 2031 2032 2,817,491 888,210 1,929,281 225,620 0 225,620

19 2032 2033 2,817,491 888,210 1,929,281 225,620 0 225,620

20 2033 2034 2,817,491 888,210 1,929,281 225,620 0 225,620

21 2034 2035 2,817,491 2,817,491 0 0 0 0

Totals $4,173,965 $0 $4,173,965

(a) Assumes TIF Project value will be assessed according to a 1.5-year completion schedule, with no inflation

(b) Assumes 100% collection of property taxes. Since TIF expenditures are limited to 20 years from City approval of Project estimated to occur January, 2014,

final collection would be second-half 2033 collection, distributed to City in January 2034. Assume 2012/2013 Mill Levy Rate held flat.

EXHIBIT IV

BOND PROJECTIONS

Exhibit IV - Page 1 of 3

$2,215,000

City of Derby, Kansas

General Obligation Tax Increment Revenue Bonds, Series 2014

Market Comp - January 18, 2013

Sources & Uses

Dated 02/01/2014 | Delivered 02/01/2014

Sources Of Funds

Par Amount of Bonds..................................................................................................................................................................................... $2,215,000.00

Total Sources........................................................................................................................................................................................... $2,215,000.00

Uses Of Funds

Deposit to Project Construction Fund.................................................................................................................................................................... 2,050,000.00

Deposit to Capitalized Interest (CIF) Fund.............................................................................................................................................................. 94,055.68

Costs of Issuance....................................................................................................................................................................................... 40,000.00

Total Underwriter's Discount (1.200%).................................................................................................................................................................. 26,580.00

Rounding Amount......................................................................................................................................................................................... 4,364.32

Total Uses.............................................................................................................................................................................................. $2,215,000.00

Series 2014 GO TIF Bonds | SINGLE PURPOSE | 1/21/2013 | 3:49 PM

Exhibit IV - Page 2 of 3

$2,215,000

City of Derby, Kansas

General Obligation Tax Increment Revenue Bonds, Series 2014

Market Comp - January 18, 2013

NET DEBT SERVICE SCHEDULE

Date Principal Coupon Interest Total P+I Cap.Interest Net New D/S Revenue Surpls(Deficit)

12/01/2014 - - 42,750.68 42,750.68 (42,750.68) - - -

12/01/2015 - - 51,305.00 51,305.00 (51,305.00) - - -

12/01/2016 55,000.00 1.160% 51,305.00 106,305.00 - 106,305.00 112,810.00 6,505.00

12/01/2017 160,000.00 1.310% 50,667.00 210,667.00 - 210,667.00 225,620.00 14,953.00

12/01/2018 165,000.00 1.460% 48,571.00 213,571.00 - 213,571.00 225,620.00 12,049.00

12/01/2019 165,000.00 1.660% 46,162.00 211,162.00 - 211,162.00 225,620.00 14,458.00

12/01/2020 170,000.00 1.880% 43,423.00 213,423.00 - 213,423.00 225,620.00 12,197.00

12/01/2021 170,000.00 2.080% 40,227.00 210,227.00 - 210,227.00 225,620.00 15,393.00

12/01/2022 175,000.00 2.280% 36,691.00 211,691.00 - 211,691.00 225,620.00 13,929.00

12/01/2023 180,000.00 2.480% 32,701.00 212,701.00 - 212,701.00 225,620.00 12,919.00

12/01/2024 185,000.00 2.640% 28,237.00 213,237.00 - 213,237.00 225,620.00 12,383.00

12/01/2025 190,000.00 2.780% 23,353.00 213,353.00 - 213,353.00 225,620.00 12,267.00

12/01/2026 195,000.00 2.900% 18,071.00 213,071.00 - 213,071.00 225,620.00 12,549.00

12/01/2027 200,000.00 3.010% 12,416.00 212,416.00 - 212,416.00 225,620.00 13,204.00

12/01/2028 205,000.00 3.120% 6,396.00 211,396.00 - 211,396.00 225,620.00 14,224.00

12/01/2029 - - - - - - 225,620.00 225,620.00

12/01/2030 - - - - - - 225,620.00 225,620.00

12/01/2031 - - - - - - 225,620.00 225,620.00

12/01/2032 - - - - - - 225,620.00 225,620.00

12/01/2033 - - - - - - 225,620.00 225,620.00

12/01/2034 - - - - - - 225,620.00 225,620.00

Total $2,215,000.00 - $532,275.68 $2,747,275.68 (94,055.68) $2,653,220.00 $4,173,970.00 $1,520,750.00

SIGNIFICANT DATES

Dated................................................................................................................................................................................................... 2/01/2014

Delivery Date........................................................................................................................................................................................... 2/01/2014

First Coupon Date....................................................................................................................................................................................... 12/01/2014

Yield Statistics

Bond Year Dollars....................................................................................................................................................................................... $20,900.83

Average Life............................................................................................................................................................................................ 9.436 Years

Average Coupon..........................................................................................................................................................................................2.5466720%

Net Interest Cost (NIC)................................................................................................................................................................................. 2.6738440%

True Interest Cost (TIC)................................................................................................................................................................................ 2.6708111%

Bond Yield for Arbitrage Purposes....................................................................................................................................................................... 2.5249789%

All Inclusive Cost (AIC)................................................................................................................................................................................2.8945710%

Net Interest Cost in Dollars............................................................................................................................................................................532,275.68

Weighted Average Maturity............................................................................................................................................................................... 9.436 Years

Series 2014 GO TIF Bonds | SINGLE PURPOSE | 1/21/2013 | 3:49 PM

Exhibit IV - Page 3 of 3

$2,215,000

City of Derby, Kansas

General Obligation Tax Increment Revenue Bonds, Series 2014

Market Comp - January 18, 2013

Coverage Ratio

Date Total Revenues Total D/S Coverage

12/01/2014 42,750.68 42,750.68 1.0000000x

12/01/2015 51,305.00 51,305.00 1.0000000x

12/01/2016 112,810.00 106,305.00 1.0611919x

12/01/2017 225,620.00 210,667.00 1.0709793x

12/01/2018 225,620.00 213,571.00 1.0564168x

12/01/2019 225,620.00 211,162.00 1.0684688x

12/01/2020 225,620.00 213,423.00 1.0571494x

12/01/2021 225,620.00 210,227.00 1.0732209x

12/01/2022 225,620.00 211,691.00 1.0657987x

12/01/2023 225,620.00 212,701.00 1.0607378x

12/01/2024 225,620.00 213,237.00 1.0580715x

12/01/2025 225,620.00 213,353.00 1.0574963x

12/01/2026 225,620.00 213,071.00 1.0588959x

12/01/2027 225,620.00 212,416.00 1.0621610x

12/01/2028 225,620.00 211,396.00 1.0672860x

12/01/2029 225,620.00 - -

12/01/2030 225,620.00 - -

12/01/2031 225,620.00 - -

12/01/2032 225,620.00 - -

12/01/2033 225,620.00 - -

12/01/2034 225,620.00 - -

Total $4,268,025.68 $2,747,275.68 -

Series 2014 GO TIF Bonds | SINGLE PURPOSE | 1/21/2013 | 3:49 PM

EXHIBIT V

LEGAL DESCRIPTION

A tract of land located in the SE and the SW , Section 25, Township 28 South,

Range 1 East and in the NW , SW and the NE of Section 36, Township 28 South,

Range 1 E of the 6

th

Principal Meridian, Derby, Sedgwick County, Kansas, more

particularly described as:

Beginning at the southwest corner of Lot 3, Block C, Stone Creek Addition; thence west

150 to the southeast corner of Lot 1, Block A, Stone Creek Commercial Addition;

thence west along the south line of said Lot 1 and along the south line of Stone Creek

Commercial 3

rd

Addition to a point 10 feet east of the southwest corner of Lot 1, Block

A; thence north along a line 10 east of and parallel with the east right-of-way line of

Commerce Drive to the south line of reserve A as platted in Stone Creek Commercial

3

rd

Addition; thence west along the south side said Reserve A to the west line of Stone

Creek Commercial 3

rd

Addition; thence north along the west line of said Stone Creek

Commercial 3

rd

Addition to a point on said west line and 325 north of the south line said

Reserve A, thence west 70 to the east line of Stone Creek Commercial 2

nd

Addition;

thence south along the said east line to the south line of said Stone Creek Commercial

2

nd

Addition; thence west along said south line to a point on the easterly right-of-way

line of State Highway K-15; thence southeasterly on said right-of-way line to a point on

the S line of said Sec. 25, 188.61 feet, more or less, east of southwest Corner of said

Sec. 25; thence south 60 feet; thence west parallel with said south line 39.09 feet, more

or less, to a point on the extended westerly edge of the State Highway K-15 Frontage

Road pavement; thence southerly on said westerly edge of pavement, and westerly

edge of pavement extended to a point on the north line extended of Wal-Mart Addition

said point also being on the north line of the southwest Section 36, Township 28

south, Range 1E; thence east along north line of said Wal-Mart Addition extended to the

east line of State Highway K-15 right-of-way; thence east 233.82 feet, north 128.01 feet

and east 814.90 feet more or less, along the northerly line of said Wal-Mart Addition to a

point being 24.73 west of the northeast corner of said Wal-Mart Addition, said point also

being on the west line of Lot 20, Block 1, Old Ranch Addition; thence northerly 43.74

feet to the northwest corner of said Lot 20; thence east along the north line said Lot 20

to the west line of Duckcreek Lane; thence north along the west line of Duckcreek Lane

to the southeast corner of Lot 19, Block 1, Old Ranch Addition; thence west along south

line of said Lot 19 to the southwest corner said Lot 19; thence northeasterly along the

westerly line of Lots 6-19 inclusive to the north line of said Old Ranch Addition; thence

east along said north line and north line extended to a point being 40 east of the west

line of NE Section 36, T28S, R1E; said point being on the east right-of-way line of

Buckner Street; thence north along east right-of-way line of Buckner to the northwest

corner Lot 1, Block 1, Ridgepoint 4

th

Addition; thence north 150 to the point of

beginning.

EXHIBIT VI

PARCEL LISTING

Proposed TIF District Properties

Derby, KS

PropertyAddress Key#

Appraised

LandValue

Appraised

Improvement

Value

2012Total

Appraised

Value

Assessed

Land

Value

Assessed

Improvement

Value

2012Total

Assessed

Value

LegalDescription OwnerName OwnerAddress City State Zip Control#(PIN)

2433NBUCKNERST RIDY01349 $0 $103,900 $103,900 $0 $12,100 $12,100 COM955FTSOFNECORNW1/4THS407

FTWLY514.62FTN440.22FTELY514.28

FTTOBEGEXCRDONESEC36281E

MENARDINC

5101MENARDDRIVE

EAUCLAIRE WI 54703 346760

RIDY01343 $110 $0 $110 $33 $0 $33 LOT2BLOCK2 MENARDINC

5101MENARDDRIVE

EAUCLAIRE WI 54703 345438

RIDY01342 $90 $0 $90 $27 $0 $27 LOT1BLOCK2 MENARDINC

5101MENARDDRIVE

EAUCLAIRE WI 54703 345437

RIDY01346 $60 $0 $60 $18 $0 $18 RESERVEB,OLDRANCHCOMMERCIAL

ADD.

MENARDINC

5101MENARDDRIVE

EAUCLAIRE WI 54703 345441

RIDY01344 $50 $0 $50 $15 $0 $15 LOT3BLOCK2 MENARDINC

5101MENARDDRIVE

EAUCLAIRE WI 54703 345439

RIDY01334 $80 $0 $80 $24 $0 $24 LOT1BLOCK1 MENARDINC

5101MENARDDRIVE

EAUCLAIRE WI 54703 345429

RIDY01345 $80 $0 $80 $24 $0 $24 RESERVEA,OLDRANCHCOMMERCIAL

ADD.

MENARDINC

5101MENARDDRIVE

EAUCLAIRE WI 54703 345440

RIDY01335 $70 $0 $70 $21 $0 $21 LOT2BLOCK1 MENARDINC

5101MENARDDRIVE

EAUCLAIRE WI 54703 345430

RIDY01336 $390 $0 $390 $117 $0 $117 LOT3BLOCK1 MENARDINC

5101MENARDDRIVE

EAUCLAIRE WI 54703 345431

RIDY01337 $850 $0 $850 $255 $0 $255 LOT4BLOCK1 MENARDINC

5101MENARDDRIVE

EAUCLAIRE WI 54703 345432

RIDY01338 $730 $0 $730 $219 $0 $219 LOT5BLOCK1 MENARDINC

5101MENARDDRIVE

EAUCLAIRE WI 54703 345433

RIDY01339 $440 $0 $440 $132 $0 $132 LOT6BLOCK1 MENARDINC

5101MENARDDRIVE

EAUCLAIRE WI 54703 345434

RIDY01340 $1,270 $0 $1,270 $328 $0 $328 LOT7BLOCK1 MENARDINC

5101MENARDDRIVE

EAUCLAIRE WI 54703 345435

RIDY01341 $60 $0 $60 $18 $0 $18 LOT8BLOCK1 MENARDINC

5101MENARDDRIVE

EAUCLAIRE WI 54703 345436

RIDY01361 $261,200 $0 $261,200 $31,344 $0 $31,344 LOT2EXCE214.48FTTHEREOFBLOCK1

MAYFIELDMINGEROLISONADD.

DERBYKANSASLLC

8515ENSLEYPLACE

LEEWOOD KS 66206 446496

325WPATRIOTAVE RI

DY01361000

1

$318,600 $77,700 $396,300 $79,650 $19,425 $99,075 E214.48FTLOT2BLOCK1

MAYFIELDMINGEROLISONADD.

BLTENTERPRISESLLC

1430E63RDSTS

WICHITA KS 67216 493272

401WPATRIOTAVE RIDY01587 $322,900 $0 $322,900 $0 $0 $0 LOT1BLOCKAPORTERADD. DERBYCITYOF

611MULBERRY

DERBY KS 67037 539862

407WPATRIOTAVE RIDY01588 $203,000 $161,930 $364,930 $0 $0 $0 LOT2BLOCKAPORTERADD. DERBYCITYOF

611MULBERRY

DERBY KS 67037 539863

RIDY01589 $324,400 $0 $324,400 $0 $0 $0 RESERVEAPORTERADD. DERBYCITYOF 611MULBERRY DERBY KS 67037 539864

2630NNELSONDR RIDY01378 $29,800 $6,600 $36,400 $7,450 $1,650 $9,100 BEG40FTS&963.94FTWNECORW1/2

NW1/4S312.64FTW161.08FTMLTOE

ROWLIK15HYNW181.70FTNE149.87

FTE132.67FTTO

MCGAUGHEYROBERTJ

&CAROLL

7508NANTUCKET

WICHITA KS 67212 465138

2636NNELSONDR RIDY01376 $47,800 $12,560 $60,360 $11,950 $3,140 $15,090 S108.50FTN208.5FTOFTRACTBEG40FT

S&963.94FTWNECORW1/2NW1/4S

312.53FTW161.08FTMLTOEROWLIK

15HWYTHNW181

BALDERASROBERTO

6125NBROADWAY

WICHITA KS 67219 464869

2624NNELSONDR RIDY01377 $25,400 $50,600 $76,000 $6,350 $12,650 $19,000 N100.9FTS208.6FTTRBEG40FTS&

963.94FTWNECORW1/2NW1/4S521.24

FTWTOK15NW395.32FTNE149.87FTE

132.61FTTOBEGE

PORTERWILLIAME&

CORINEE

645NMCLEAN

WICHITA KS 67203 464870

2012AppraisedValue 2012AssessedValue

3/21/2013

Proposed TIF District Properties

Derby, KS

PropertyAddress Key#

Appraised

LandValue

Appraised

Improvement

Value

2012Total

Appraised

Value

Assessed

Land

Value

Assessed

Improvement

Value

2012Total

Assessed

Value

LegalDescription OwnerName OwnerAddress City State Zip Control#(PIN)

2618NNELSONDR RIDY01375 $22,600 $64,130 $86,730 $4,125 $15,478 $19,603 S107.7FTOFTR.BEG40FTS&963.94FT

WNECORW1/2NW1/4S521.24FTW

115FTMLTOELIK15ROWNWLY395.32

FTNELY149.87

PORTERWILLIAME&

CORINEE

645NMCLEAN

WICHITA KS 67203 464868

2612NNELSONDR RIDY01373 $21,500 $12,780 $34,280 $5,375 $3,195 $8,570 S127.7FTOFTRBEG40FTS&870.99FT

WNECORW1/2NW1/4W84.66FTS

521.24FTE84.66FTN521.24FTTOBEG.

SEC3628

PORTERWILLIAME&

CORINEE

645NMCLEAN

WICHITA KS 67203 464865

2536NNELSONDR RIDY01608 $65,800 $8,730 $74,530 $10,054 $2,183 $12,237 LOT1PHILLIPSK15ADD PHILLIPSREALESTATE

LLC 1822SMEAD

WICHITA KS 67211 580269

2600NNELSONDR RIDY01609 $22,700 $0 $22,700 $5,675 $0 $5,675 RESERVEAPHILLIPSK15ADD PHILLIPSREALESTATE

LLC 1822SMEAD

WICHITA KS 67211 580270

2526NNELSONDR RIDY01363 $33,200 $2,660 $35,860 $5,427 $665 $6,092 LOT1BLOCKAK15INDUSTRIALPARK

ADD.

KUHNCO

POBOX44

DERBY KS 67037 446499

2524NNELSONDR RIDY01364 $36,400 $141,700 $178,100 $9,100 $35,425 $44,525 LOT2BLOCKAK15INDUSTRIALPARK

ADD.

KUHNCO

POBOX44

DERBY KS 67037 446500

2500NNELSONDR RIDY01365 $132,700 $68,970 $201,670 $27,104 $17,243 $44,347 BEG1197FTNSECORW1/2NW1/4W

869.09FTTOELIHYK15NW486.44FT

E977.64FTS476FTTOBEGEXCCCA

78971&EXC.10A

KEMMERERNANCYG

2500NNELSONDR

DERBY KS 67037 446501

2400NNELSONDR RIDY01355 $122,200 $589,430 $711,630 $28,903 $133,705 $162,608 LOT1BLOCKAKUHNEVANSADD. KUHNCO

POBOX44

DERBY KS 67037 446486

2300NNELSONDR RIDY01356 $112,000 $372,500 $484,500 $27,541 $93,125 $120,666 LOT2BLOCKAKUHNEVANSADD. KUHNCO

POBOX44

DERBY KS 67037 446487

2250NNELSONDR RIDY01357 $29,100 $162,500 $191,600 $7,275 $40,625 $47,900 LOT1BLOCKABAYLESSINDUSTRIAL

PARK

DOUBLEDENTERPRISES

INC 2250NNELSONDR

DERBY KS 67037 446527

2230NNELSONDR RIDY01358 $245,100 $9,800 $254,900 $46,572 $2,450 $49,022 LOT2BLOCKABAYLESSINDUSTRIAL

PARKADD.

ASTMORGAN

1813SFLORENCE

WICHITA KS 67209 446492

2212NNELSONDR RIDY01362 $304,900 $237,100 $542,000 $76,225 $59,275 $135,500 LOT1EXCS128.01FTMLBLOCKA

J.W.METZADD.

DAVISDOYLEDREVOC

TRUST 230SHADYBROOK

DERBY KS 67037 446498

2142NNELSONDR RIDY01366 $143,500 $34,600 $178,100 $35,875 $8,650 $44,525 BEGINTSECSLINW1/4&ELIK15ROW

NW145FTE264.33FTS144FTWTOBEG.

SEC36281E

M&MDECORATING

INC

3333SKESSLER

WICHITA KS 67217 446503

RIDY01374 $4,100 $0 $4,100 $0 $0 $0 BEG955.65FTW&40FTSNECORW1/2

NW1/4S521.24FTW8.29FTN521.24FT

E8.29FTTOBEGEXCPORTERADD

DERBYCITYOF

611MULBERRY

DERBY KS 67037 464867

2155NDUCKCREEK

LN

RIDY01333 $0 $0 $0 $0 $0 $0 RESERVEAOLDRANCHADD. OLDRANCHADDITION

HOMEOWNERS'ASSOC

2236DUCKCREEKLN

DERBY KS 67037 335696

Totals: $2,833,180 $2,118,190 $4,951,370 $427,226 $460,984 $888,210

3/21/2013

EXHIBIT VII

MARKET FEASIBILITY STATEMENT

March 29, 2013

Honorable Chairman James Skelton

Sedgwick County Commissioners

525 N. Main #320

Wichita, KS 67203

Honorable President Janet Sprecker

Derby Public Schools USD 260

120 E. Washington

Derby, KS 67037

Honorable Chairman James Skelton and Honorable President Janet Sprecker:

With regard to the market feasibility of the proposed Derby North Gateway Tax Increment Financing District, it is our

understanding that Menards Inc. purchased a 50.63-acre tract within the proposed District in September 2012. We do

not yet know the company's schedule for construction. However, it is the City's intention to adopt a Project Plan for

the proposed tax increment financing district only after Menards has committed to construction through acquisition of

a building permit.

The proposed District will enable the City to address traffic safety concerns identified in a Corridor Analysis of Nelson

Drive along K-15, completed in September 2010 through the Kansas Traffic Engineering Assistance Program. In

addition to improving traffic flow and safety, this Project is also expected to have a positive economic impact by

improving access to nearby vacant, and in some cases blighted, properties. Over time, this should contribute to

higher property values and increased investment in the area.

We have a high level of confidence that the proposed tax increment financing district will be financially feasible for the

following reasons:

The tax increment Project will not be created until it is known that the Menards store will be constructed.

Property tax increment will be the sole source of Project revenues. This source of revenue will almost

certainly be collected regardless of the store's performance.

Estimated property tax increment generated by the Menards store is one and one-half times the projected

cost of the improvements to be funded by the District. Current projections estimate that the project costs can

be repaid over a period of 15 years; however, it is the City's intention to pay off the bonds early if possible.

The revenue projections in the Redevelopment Project Financial Feasibility Study do not take into account

additional development likely to occur within the Project Area. Project revenue in excess of the Menards tax

increment will be used to pay the Project costs more quickly, thus more rapidly returning the property tax

increment to the affected taxing entities.

Respectfully,

Kathleen B. Sexton

City Manager

EXHIBIT VIII

DESCRIPTION OF EXPANDED MUNICIPAL SERVICES

Page 1 of 15

Extension of Major Municipal Services

A. Public Streets

Arterial Streets. The proposed TIF District is bounded by a State Highway (K-15) on the west and has

access to arterial streets on the north and east sides.

Patriot Avenue (63

rd

Street South) is a 4-lane urban arterial with standard curbs and gutter adjacent to

the north side of the district. Patriot Avenue offers a continuous left turn lane and an eastbound

continuous right turn lane for the length of the proposed TIF District. Patriot Avenue is maintained by

the City of Derby. No substantial improvements to Patriot Avenue are anticipated to be necessary.

Buckner Street along the east side of the proposed TIF District is also a 4-lane urban arterial with

standard curb and gutter. Although the portion of Buckner Street adjacent to the proposed district does

not include designated turn lanes, the City has received petitions from the adjacent property owner to

install a southbound right turn lane and southbound acceleration lane if warranted by traffic as the

properties develop. Buckner Street is maintained by the City of Derby and was milled-and-overlaid in

November of 2012.

State Highway K-15 is located along the west side of the proposed TIF District. K-15 is a 4-lane divided

highway with open ditches. Access to the TIF District area from K-15 is afforded via a frontage road,

Nelson Drive. K-15 adjacent to the proposed district was reconstructed in 1992, and is maintained by

the Kansas Department of Transportation.

Local Streets. Nelson Drive is a frontage road for State Highway K-15 and is the only local public street

adjacent to the proposed TIF District. Nelson Drive is approximately 26 ft. wide with asphalt pavement

and open ditches for drainage. Nelson Drive is maintained by the City of Derby and received an asphalt

overlay in 1993. The City plans to realign Nelson Drive to improve safety and access to the properties in

the proposed TIF District. As proposed, the re-aligned Nelson Drive will align with Commerce Drive at

Patriot Avenue (Map 1); the re-alignment project will include signalization of the intersection.

Street Services. All streets adjacent to the proposed TIF District currently receive routine maintenance

as part of Derbys Pavement Maintenance Program. This includes crack sealing and repair, patching,

seal coats and mill-and-overlay projects based on pavement condition. Streets within the City of Derby

are rated and scheduled for maintenance by the Director of Public Works.

Street Signs. Derby Public Works personnel are responsible for assuring that all traffic signs are in

compliance with the Manual for Uniform Traffic Control Devices (MUTCD) and providing for

maintenance and replacement as necessary.

Driveway Approaches. Driveway approaches located within the street right-of-way are required to be

constructed to the Citys specifications. All new approaches will be required to be constructed to the

specified standards.

Page 2 of 15

Map 1: Proposed Nelson Drive Realignment

- THE REMAINDER OF PAGE INTENTIONALLY LEFT BLANK -

C

o

m

m

e

r

c

e

D

r

.

Page 3 of 15

B. Water

Water service is presently available, or can easily be made available to all properties within the

proposed TIF District. A City of Derby water metering facility is located on the south side of Patriot

Avenue. Water is supplied to the City of Derby through a 36-inch line from the City of Wichita to the

metering facility. The Citys distribution system includes a 24-inch main line located along the south side

of Patriot Avenue; a 16-inch main along the east side of Buckner Street and a 16-inch main that extends

south and west from the metering station where it is then parallel along the east side of Nelson Drive.

When development begins on lots within the Derby Menards Addition, a 12-inch line will be installed by

boring under Buckner Street to connect to the existing 16-inch line. This loop will provide service to

each of the lots of the Derby Menards Addition.

With the addition of the proposed 12-inch line in the Menards addition, the City will be capable of

providing water service to all lots within the proposed TIF District.

Map 2 on the following page shows a layout of the existing City of Derby water system as well as

expected future extensions to serve the Derby Menards Addition lots.

- THE REMAINDER OF PAGE INTENTIONALLY LEFT BLANK -

Page 4 of 15

Map 2: Existing and Future Water System

Page 5 of 15

C. Sanitary Sewer

All of the tracts within the proposed TIF District are or can be easily connected to existing City of Derby

sanitary sewer lines. The proposed TIF District lies within the service boundaries of the Citys West Side

Interceptor. This interceptor is an 18-inch sewer generally located along the east side of Nelson Drive

and is easily accessible to the tracts with street frontage on Nelson Drive. Sewer laterals have been

extended east from the interceptor to serve anticipated new development. In conjunction with platting

of the Derby Menards Addition the City received petitions to install additional lines to serve lots within

the addition. The petitioned lines will be installed by the City when requested by the developer.

Existing lines have sufficient capacity to handle future wastewater flows from the proposed TIF District.

Map 3 shows locations of existing sewer lines in the area and the proposed locations to serve future

development.

- THE REMAINDER OF PAGE INTENTIONALLY LEFT BLANK

Page 6 of 15

Map 3: Existing and Future Sanitary System Layout

Page 7 of 15

D. Flood Protection and Stormwater Management

Drainage in the proposed TIF District is accomplished through a combination of open ditches, enclosed

storm water systems, earthen channels and stormwater detention ponds. The proposed district

includes: public stormwater sewer systems along Patriot Avenue, Buckner Street, and Nelson Drive; an

existing retention pond located in Reserve A of the Old Ranch addition; several open channels and

ditches; and an existing pond in the Menards Derby Addition.

The public stormwater systems along Buckner Street, Nelson Drive, and Patriot Avenue are owned and

maintained by the City of Derby. The retention pond in Reserve A of the Old Ranch Addition is owned

and maintained by the Old Ranch Homeowners Association. The proposed development of the Derby

Menards Addition includes construction of a private stormwater system including stormwater piping

and three retention ponds to be located in Reserves A, B, and C of the Addition. The private

stormwater improvements and retention ponds required to develop the Menards Derby Addition will be

owned and maintained by the owner of Lot 1 Block A of the Addition.

According to the Federal Emergency Management Agency (FEMA) Flood Insurance Rate Map for

Sedgwick County dated February 7, 2007, All property included in the proposed TIF District is located in

Zone X Areas Determined to be Outside the 0.2% Annual Chance Floodplain. See attached Map 4.

The City of Derby enacted a stormwater fee beginning in 2013. Residential properties are assessed a

base fee of one Equivalent Residential Unit (ERU) per month, which is paid concurrently with the

monthly water bill. Commercial property rates are established by determining the number of ERUs

based on the actual impervious area constructed on the commercial property. The cost per ERU is

determined by City Council and adopted by resolution. For properties that are not connected to the City

water distribution system, the stormwater fee will be mailed twice annually, each reflecting the

stormwater fee for a six-month period. Revenue collected from the stormwater fee is utilized to

maintain and improve the Citys stormwater system. Maintenance and construction of improvements is

prioritized and scheduled by the Director of Public Works as funding permits.

- THE REMAINDER OF PAGE INTENTIONALLY LEFT BLANK -

Page 8 of 15

Map 4: FEMA Flood Zone

Page 9 of 15

E. Fire Protection

Fire protection is currently provided for this area by Derby Fire and Rescue. Fire protection will be

provided from Derby Fire Station #81 at 128 W. Market and Derby Fire Station #82 at 1401 N. Rock

Road. Additionally, the City of Derby has purchased land within the TIF District at 2433 N. Buckner

Street for construction of a new fire station in the future. The new station will provide better fire

protection for the northwest area of Derby, including the proposed TIF District. Currently, Derby Fire

and Rescue provides a 4 minute or less response 82% of the time within the city limits of Derby.

Derby Fire and Rescue and Sedgwick County Fire Dist. #1 have an automatic aid agreement for response

to structure fires in this area, which is expected to continue.

The number and location of fire hydrants along Nelson Drive is sufficient to provide fire protection for

the western properties of the proposed TIF District. As new development occurs, additional fire

hydrants will be added in conjunction with other improvements to the Citys water system to ensure

there is adequate fire protection coverage for all portions of the TIF District area.

- THE REMAINDER OF PAGE INTENTIONALLY LEFT BLANK -

Page 10 of 15

Map 5: Fire Stations

Page 11 of 15

F. Police Protection

Police protection for the proposed TIF District is presently provided by the Derby Police Department

headquartered at 229 N. Baltimore Avenue. The proposed District is located within the area covered by

Beat No. 1. There are three officers assigned to Beat No. 1 over a 24-hour period. No changes in Police

protection are expected as a result of the proposed TIF District.

Animal Control services are also provided through the Derby Police Department. Businesses or

properties located within the TIF area may contact 911 to report animal control concerns.

- THE REMAINDER OF PAGE INTENTIONALLY LEFT BLANK -

Page 12 of 15

Map 6: Derby Police Beats

Page 13 of 15

G. Sidewalks and Paths

There is an existing 5-foot wide sidewalk along the south side of Patriot Avenue, the north side of the

proposed TIF District boundary. The east boundary of the area is served by a 10-foot wide multi-use

path in the street right-of-way west of Buckner Street. Sidewalks and paths in this area provide

excellent pedestrian connectivity to other commercial areas as well as residential neighborhoods.

The City of Derby also has an extensive network of more than 25 miles of Hike and Bike paths

throughout the city which connect many of the Citys parks, schools and other destinations. A portion of

the existing Hike and Bike path is located along Buckner Street, adjacent to the east side of the proposed

TIF District.

There are currently no sidewalks along the west side of the proposed TIF District since the businesses

located there predate requirements for provision of sidewalks. The design of the Nelson Drive

realignment project will include public sidewalks to further enhance pedestrian opportunities.

The Citys Subdivision and Zoning Regulations require sidewalks on both sides of new streets and that all

new developments provide pedestrian paths that connect to the public sidewalks. These requirements

ensure that future developments will continue to provide adequate sidewalks to accommodate and

promote pedestrian access.

- THE REMAINDER OF PAGE INTENTIONALLY LEFT BLANK -

Page 14 of 15

Map 7: Sidewalks and Hike & Bike Path

Page 15 of 15

Timetable for Services

The proposed timetable for the extension of municipal services to the proposed TIF District is shown in

the following table - Timing of Services. Most city-wide municipal services are currently available and

are provided to the proposed TIF District.

Timing of Services

Proposed for

Service TIF District Timing

Street Maintenance Yes Currently Provided

Local Street Improvements Yes Currently Provided/Planned

Stream Maintenance Yes Currently Provided

Water Mains Yes Currently Provided

Water Laterals & Fire Hydrants Yes Currently provided/Upon Development

Sewer Mains Yes Currently Provided

Sewer Laterals Yes Currently Provided/Upon development

Fire Protection Yes Currently Provided

Police Protection Yes Currently Provided

City Building Code Enforcement Yes Currently Provided

City Health Code Enforcement Yes Currently Provided

Zoning Code Enforcement Yes Currently Provided

- THE REMAINDER OF PAGE INTENTIONALLY LEFT BLANK -

EXHIBIT IX

ZONING MAP

Meadowlark Blvd

Dry Creek Cir

Dry St ream Ct

D r y C reek Ct

Dry Brook Ct

W

o o d l a w n B l v d

Communi ty Ct

Morningview St

Lincol n St

Sunrise St

Greenway Ct

Greenway Ct

Goeldner Ln

James St

Cy St

Dry Creek Dr

Pat ri ck Henry St

Armst rong Ct

Armst rong Ct

Armst rong Ct

Armst rong Ave

Jay Ct

W

indmi ll Rd

Windmi ll Ct

Wagon Wheel Ct

Meadowlark Blvd

Mont ana St

Rawhi de St

Longhorn Ct

Longhorn St

Briarwood Rd

Bria rwood Pl

Broadmoor St

Buckboard Ct

Windmi ll Rd

Sunset Dr

Sunset Dr

R o c k R d

S u n s e t D r

Warren Ave

McClelland Dr

Horizon Dr

Ri dgecrest Rd WarrenAv eWarren Ct

James St B r i a r w o o d R d

Briarwood Ct

James St

Crestway Ave

Marguerite Pkwy

Marguerite Pkwy

Kristen Rd

Morrison Dr

Wedgewood Dr

Kristen Ct

W

oodlawn Blvd

Sommerhauser Cir

Sommerhauser St

Wedgewood Dr

Morrison Ct

Wedgewood Ct

Bodin e Dr

F a r m i n g t o n D r

R o c k f o r d S t

M a r g u e r i t e P k w y

W

illow Dr

Bodine Ct

Madison Ave

B r o o k F o r e s t R d

Hickory Branch St

Brook Forest Ct

Bea ver Tr ai l R d

Brookfiel d Ln

Oakwood Ct

Brook Forest Rd

Evergreen Ln

Hi ckory Branch St

Ri dgecrest Rd

Pine Tree Rd

Pini on Rd

Brendonwood Rd

B r i a r w o o d R d

Cresthi ll Rd Cresthi ll Rd

Brendonwood Rd

Pini on Rd

Tanglewood Rd

P i n O a k R d

Rock Rd Sum

ac Rd

Evergreen Ct

P i n O a k C t

Walnut Grove Rd

M u l b e r r y R d

Madison Ave

Tanglewood Ct

T a n g l e w o o d R d

O a k F o r e s t L n

Oak Ct

B r i a r w o o d R d

Summerch ase Cir

Sum

merchase St Tri pl e Cr ee k D r

Summerchase Ct W

o o d l a w n B l v d

Waters Edge St

Wat ers Edge St Cross Creek Ct

C r o ss

C r e ekS t

Cl earl ake St

Cross Creek Pl

T r i p l e

C re ekD

r

Waters Edge Ct

Waters Edge Cir

Wa t er s Edg eSt

Lookout St

L o o k o u t C t

R awh i d eS t

Ar b o r M e a d o w s

S t

R a w h i d e C t

R a w h i d e C i r

Lookout T er

Lookout Cir

Lookout Pl

R o c k R d

Rock Rd

Cambridge St

N e w b e r r y S t

Tall Tree Rd

Tall Tree Rd

N e w b e r r y S t

Pat ri ot Ave

Pat ri ot Ave

T r i p l e C r e e k D

r

Rough Creek Loop

Rough Creek Rd

S a w g r a s s C t

Fairway Cir

Arb o r Meadows St

Rough Creek Rd

F a i r w a y L n

F a i rw ay Ct

Sawgrass Cir

Triple Creek Dr

Tall Tree Rd

St one Path St

Moss Wood St

Rough Creek Rd

Lost Hil ls Ct

Triple Creek Dr

Thorn Apple St

Balt im

ore Ave

Meadowlark Pl

Warren St

Rai nbow Dr

Rai nbow Dr

Rock Bridge St

Rock Bridge Ct

Rough Creek Cir

Winding Lane St

Lost Hil ls St

Rough Creek Rd

Spli twood Way St Splitwood WayCt

Winding Lane St

Timber Creek St

Timber Creek St

W i n d i n g L a n e C t

Ramblewood St

Maurine Dr

Jackson Bl vd

N a n c y L n

R o c k R d

R o c k R d

55th St S

W

hitt ier St

Joel Ln

55th St S

58th St S

W

o o d l a w n B l v d

W

o o d l a w n B l v d

W

o o d l a w n B l v d

Kay St

Market St

Mary Etta St

C i r c l e D r

L a u b e r L n

W

i l l o w D r

Lauber Ln

Redwood Rd

Hackberry Rd

Chest nut Rd

B r o o k w o o d D r

Market St

Cot tonwood Rd

Post Oak Rd

W

i l l o w D r

Brook wood

Dr

Willow Dr

Brook F o r e s t Rd

Oak Forest Ln

Oak Forest Rd

Maple St

Virgini a St

A s p e n R d

Oak Forest Rd

Carolyn St

Ash St

Blue Spruce Rd

Blue Spruce Cir

M a x i n e C t

Deer Trail St

B r o o k F o r e s t R d

Redbud Ct

O s a g e R d

Osage Rd Rock Rd

Rock Rd

Chet Smith Ave

Sout hri dge Ct Sout hri dge Cir

Oxf ord Cir Oxf ord Ct

Pine Grove Ct

Sont ag St

Windwood Cir

Windwood Ct

Kay St

C r e e k s i d e C t

B e n t T ree

Ct

Kay St

Tiara Pines Ct

Tiara Pines St

Ti ara Pines St Ti ar a Pines Cir

T i a r a

Pi nes Pl

Par k L an e Ct

English C t

Engli sh Ct

Spring Creek Dr

Ci rcle Dr

Mary Ett a St

Juniper Ct

Chet Smith Ave

W

oo dla w

n Hei ght s Ct

Woodlawn Height s Rd

M e a d o w h a v e n L n

H i l l t o p R d

W

oodlawn Blvd

Meadowhaven Ln

Gasaway Dr

Gasaway Ct

Rushwood Ct

Hawt horne Dr

Cedarbrook Rd

Southcrest Dr

Southcrest Ct

C y p r e s s C t

T e r r a c e C t

H i l l t o p R d

Rushwood Dr

Hawthorne Ct

Sout hcrest Cir

Pembrook Rd Pembrook Ct

Madapalla Ct

Madapalla Ct

K r i s t a L n

Black Dog Trl

W

o o d l a w n B l v d

95th St S

95th St S

Rock Rd

Rockhill Ct

R o c k R d

Woodbrook St

Pointer Ln

BoxElder Ct

Meadow Ridge Ct

Park Hill St

Pa rkwoodCt

A r b o r Me a d o ws Ct

Ivy Hill Ct

Hiddenridge Ct

H i d d e n r i d g e C i r

Park Hill St

S u m m i t C i r

Sum

mit Rd

Woodbrook st

A r b o r M e a d o w s S t

A r b o r M e a d o w s C i r

Wood b ro o k C t

Summerlyn Dr

R a v e n w o o d S t Ravenwood Ct

Rushwood Dr

R i d g e R d

Com

muni ty Dr

Arrowhead Dr

Woodlawn Blvd

But ton Bush St

St one Path St

Forest Park St

St one Path St

Fieldstone St Fieldstone Ct

M i d w a y S t

St one Creek St

Buckner St

Co m

m

e rce Dr

Buckner St

Oliver St

60t h St S

Buckner St

95th St S

95th St S

W

e b b R d

W

e b b R d

June Ct

P o s e y C t

87th St S

87th St S 87th St S

G l e n a D r

F a w n T r a i l

W

ebb Rd

W

ebb Rd

79th St S

Madison Ave

Stonegate Cir

W

i l l o w c r e e k S t

W

a l n u t C r e e k D r

Glen Hi lls Dr

Glen Hi lls Ct

Glen Hi lls Dr

Col lege Park St

Meadowlark Blvd

Meadowlark Blvd 71st St S

Old Spring Rd Old Spring Cir

O l d S p r i n g C t

Quail Hollow St

Keys Ct

Keys Dr

Keys Pl

K e y s C i r

S p r i n g R i d g e D r

Mason Ridge Ct Mason Ridge Dr Mason Ridge Dr

Glen Hi lls Dr

Fernell St

Harral St

K-15 Hwy

Meadowlark Blvd

Nel son Dr

McInt osh Rd

W

ild Turkey Ct

Woodland Dr

White Tail St

White Tail St

W

ild Turkey Dr

Vall ey St Songbird Cir Songbird St Songbird Ct

Lincol n St.

Conyers Ave

Mahoney Dr

Conyers Ave

Ni xon Ave

Osage Rd Vall ey St ream Dr

Valley St ream Ct

Meadowbrook St Zachary Dr

Quail Hollow St

Z a c h a r y D r

Osage Rd

Crosswood Ln

Springwood Ln

Count ry View Dr

Count ry View Dr

Brookst one St

Brookst one St

B e l R u e S t

Bel Arbor St

Bel Arbor St

T i m b e r l e a f D r Timberleaf Ct

Timberl eaf Ci r Klei n St

Split Rai l Ct

Linden Ln

Timber Creek St

Timber Creek St

W

i s t e r i a C i r

W

isteria St

Timber Lane St Timber Lane Cir

Myrtlewood Cir Myrtlewood Ct Timberleaf Dr

James St

Carriage Dr

Surrey Ln

Trail Ri dge Dr

Glen Hi lls Dr

Timberl eaf Dr Rai ntree Dr

Fontenel le Dr

L a k e R i d g e C i r

Mason Ridge Dr

Hi gh Park Dr

Lake Ridge Dr

Spring Ridge Dr

Creek Ri dge Dr

Creek Ri dge Ct

James St

L a k e

R i d ge Ct

Spring Ridge Ct

Summerset St

A m

b e r R i d g e S t

Amber Ridge Ct

Amber Ridge Cir

Amber Ridge Pl

Curt is Ct Curt is St

Walnut Creek Ct

W

alnut Creek Dr

Walnut Creek Dr

63rd St S 63rd St S

Bryant St Bryant Ct

Walnut Creek Dr

95th St S

C h a p a r r a l S t

K-15 Hwy Chaparral Ct

Pecos Dr C h a p a r r a l S t

La Mesa St

La Mesa Ct

L a g u n a C t

V e r d e C t

Ri o Verde Blvd

Rio Verde Blvd Hacienda Ct

Alam

eda St

91st St S

Georgie Ave

B a l t i m

o r e A v e

Washi ngton Ave

Pit tman Dr

Market St

Main St

Emma St

Louisa St

K o k o m o A v e

Madison Ave

Cherry St

B u c k n e r S t

W

ater St

Ri ver St

Market St

Buckner St W

a t e r S t

Washi ngton Ave

Pit tman Dr

Kay St

91st St S

B u c k n e r S t

B u c k n e r S t

K-15 Hwy

K-15 Hwy

B a l t i m

o r e D r

Shady Brook Ln

Croo k e d

Cr eek

C t

Park Place Ct P a r k P l a c e C t

Park Lane St

Williams St

Springdale St

Kokomo Ave

Edgemoor St

Engli sh St

K-15 Hwy

Lakeview Dr

Buckner St

Belmont St

B a l t i m

o r e D r

Georgie Ave

K o k o m o A v e

D e r b y A v e Belmont St

Sunnydell St

Kay St

L a k e v i e w D r

W

e s t v i e w D r

R i v e r v i e w A v e

Grace St

Eng l i sh St

Ri verview Ave

Park Lane St

Kay St

Kokomo Ave

Pit tman Dr

W

e s t v i e w D r

L a k e v i e w D r

D e r b y A v e

Madison Ave.

Ri ver St

M c I n t o s h R d

Beau Jardin St

Beau Jardin St

B u c k n e r S t

G e o r g i e A v e

D e r b y A v e

Walnut St

Brit ain St

Nel son Dr K o k o m o A v e

Nel son Dr

Buckner St

B a l t i m

o r e A v e G e o r g i e A v e

Kokomo Ave

Derby Ave

Lakeview Dr

W

e s t v i e w D r

Milt on Ave

Meadowlark Blvd.

Meadowlark Blvd

Short St

Maryland St

Ohio St

Balt im

ore Ave

Georgie Ave

K o k o m o A v e

Pleasant view Dr

Communi ty Dr

P r a i r i e L n

E l P a s o D r

E l P a s o D r

W

est view Dr

Lakeview Dr

D e r b y A v e

Kokomo Ave

G e o r g i e A v e

Balt im

ore Ave

W

e s t v i e w D r

Wedgewood Dr

Crestway Ave

B a l t i m

o r e A v e

K-15 Hwy

Crestway Ave

Nel son Dr

K-15 Hwy

James St

E l P a s o D r

Crestway Ave

El Paso Dr

Wedgewood Dr

El Paso Dr

Madison Dr

Wa lnut St W al nut St

E l P a s o D r

Greenway St

B u c k n e r S t

Lincol n St

Greenway St

Mark Twain Ct

Mark Twain Dr

Blueberry Ln H u c k l e b e r r y D r

Finn Ln

Mark Twain Dr

Huckleberry Cir

Wild Plum Rd

O l i v e r S t

Milt on Ct

M i l t o n D r

Milt on Dr

F u l t o n A v e

Vil lage Lake Dr

Red Powel l Dr

J o h n s o n D r

Mallard Dr

Teal Dr

Duckcreek Ln

Hunt er St

Rosewood Ln

Tall Tree Rd

H o r s e s h o e C i r

Duckcreek Ln

Sandhil l Rd

Wild Plum Rd

Cat alpa Ct Cat alpa St

F o r e s t P a r k S t

Buckthorn Rd

Wild Plum Cir

Tamarisk St

Wahoo Cir

Wahoo St

B u t t o n B u s h C i r

T a m a r i s k S t

Persimm

on St

Sandhil l Rd

Dogwood Ct

Sandhil l Ct

Sandhil l Rd

Oak Meadows Rd

Forest Park Ct

Sandhil l Rd

W

oodlawn Blvd

I r o n w o o d C t

Basswood Ct

Fallen Tree Ct

Tall Tree Rd Tall Tree Rd

W

o o d l a w n B l v d

Pecan Ln

Burning Tree Rd Burr Hil l Rd

W

h i t e O a k R d

F o r e s t P a r k S t

Bel Arbor St

James St

T i m

b e r R i d g e C i r

Kay St

Sharon Ct

Partr i dge Ci r

Partridge Ln Pheasant Run St T i m

b e r R i d g e S t

Cardinal Ct

Cardin al Ln

Mockingbird Ct

Quail Ct M o c k i n g b i r d L n

W

hippoorwill Rd

Honeybrook Ln

Chet Smith Ave

S h a r o n D r

H i l a S t

S pringdale St

Rosewood Ct

Pepper Corn Rd

Burning Tree Rd

Nort h Point Dr

Fore st Par k St

Birchwood Rd

Twisted Oak Rd

W

oodlawn Blvd

Ridge Ct Derby Hi lls Dr

Derby Hi lls Dr

Overlook Dr

Baltimore Ct

V a l l e y V i e w S t

Baltimore Pl

B a l t i m

o r e A v e

Derby Hi lls Ct

60th St S

55th St S 55th St S

83rd St S

Moss W

ood Ct

Summerchase Pl

Red Powel l Dr

Lookout St

Newberry Ct . Newberry Cir.

Newberry St Newberry Pl.

N e w b e r r y S t

W

oodard St

B e a u J a r d i n C t

B e a u J a r d i n C i r

B e l A r b o r C i r

Bel Arbor Ct

Sharon Dr

W

oodlawn Blvd

K-15 Hwy

Nel son Dr

Pat ri ot Ave

Pat ri ot Ave

Buckner St

B u c k n e r S t

K-15 Hwy

Nel son Dr

Lee Ct

Overlook Dr

K-15 Hwy

57th St S

Pershing St

56th St S

Sout heast Dr

61st St S

55th St S

103rd St E

W

e b b R d

103rd St E

99th St E Tall Tree Rd

Birchwood Rd Birchwood Ct

Walnut Creek Dr

Tall Tree Cir

Tall Tree Rd

Am

ber Ridge St

Q u a i l R u n S t

Quail Run Ct

Quail Run Cir

Quail Run Pl

Quail Run Trl

B r i d l e B e n d S t

Kay St

Kay St

Jonah St

Jonah Pl

Jonah Ct

Kay Cir

Jonah Cir

Tawny Ln

Covey St

Fallbrook St

Hampdon Woods St

S h a d o w B r o o k S t