Professional Documents

Culture Documents

May 2013 Financial Update

Uploaded by

Alfonso RobinsonCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

May 2013 Financial Update

Uploaded by

Alfonso RobinsonCopyright:

Available Formats

FOR IMMEDIATE RELEASE

WEDNESDAY, MAY 1, 2013

Contact: Tara Downes

860-702-3308 Tara.Downes@po.state.ct.us

COMPTROLLER LEMBO REPORTS $150.1-MILLION SURPLUS FOR FISCAL YEAR 2013

Comptroller Kevin Lembo today announced that the states financial outlook has improved and the Fiscal Year 2013 will likely end with a surplus of approximately $150.1 million. This surplus is based on Generally Accepted Accounting Principles (GAAP), whereas the surplus would reach approximately $197.6 million on a modified cash basis accounting. In a letter to Gov. Dannel P. Malloy, Lembo said that he generally agrees with the Office of Policy and Managements (OPM) projection this month, which incorporates the consensus revenue projections announced Tuesday. Lembo cautioned that the surplus is good news for the current fiscal year, but is largely attributed to unreliable revenue sources that the state may be unable to count on in the following years. This growing surplus is good news for this fiscal year but should lead only to cautious optimism for future years, Lembo said. The surplus is largely attributable to unanticipated windfalls from the inheritance and estate tax and capital gains, both unpredictable revenue sources that may not continue into the next fiscal year. Since last month, revenues are up $247.1 million, which is slightly offset by a projected $15.9-million increase in spending. The increase in the capital gains tax rate for 2013 that resulted from the expiration of the Bush-era tax cuts provided an incentive to distribute gains before the end of calendar 2012. According to the Bureau of Economic Analysis data, net dividend distributions in the fourth quarter of 2012 were 23.2 percent higher than in the same period last year. Therefore, taxable gains have been realized in Fiscal Year 2013 that

otherwise would have been paid in future fiscal years. In addition, the stock market has experienced double-digit growth that may not continue into the next biennium, Lembo said. These factors have resulted in the income tax exceeding budget projections by $109.6 million, estimated income tax payments are up more than 20 percent from last year, and final payments are up almost 16 percent. In addition, the inheritance and estate tax, which had been expected to exceed original budget estimates by $150 million, is now projected to generate $262.4 million over the original budget. These one-time revenue gains in Fiscal Year 2013 are tempered by losses in other major recurring revenue sources, Lembo said. The sales tax is projected to fall $189.3 million short of initial projections, showing almost no growth over last years receipts. While the combined income tax exceeds budget projections, the payroll-driven withholding component of the tax, which is the largest component, is not growing. General Fund spending in Fiscal Year 2013 is expected to be about 2 percent above the prior year, which is a historically slow rate of budget growth, Lembo said. I am pleased to hear ongoing discussions about the benefit of using any surplus to replenish the Rainy Day Fund, which would provide the state with greater financial security and budget stability going forward. Continued slow economic growth raises budget concerns moving into the next biennium. Lembo said. Economic data from federal and state Departments of Labor and other sources show:

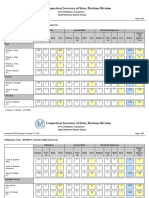

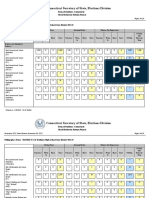

In March the state added 2,600 payroll jobs. This follows Februarys decline of 5,700 positions, which was assumed to be impacted by weather conditions. Connecticut hit its employment peak in March of 2008, which was followed by almost two years of employment declines with the loss totaling over 120,000 jobs. To date, the state has regained 51,200 of the jobs lost to recession or 42.2 percent of the recessionary loss.

The strongest job sectors on a year-to-year basis have been leisure and hospitality (+4,800), education and health services (+3,700) and construction (+1,700). The sectors experiencing the largest job losses are manufacturing (-2,700), government (-2,500), financial activities (-2,300), and transportation and public utilities (-1,800). According to the State Department of Labor, five of the six major Connecticut Labor Market Areas (LMAs) posted job gains in March 2013, as just one of the major state LMAs declined. The Bridgeport-Stamford-Norwalk LMA (1,200, 0.3%) added the most jobs in March, followed by the New Haven LMA (800, 0.3 percent). The largest LMA by employment, the Hartford-West Hartford-East Hartford LMA (300, 0.1%), added a small number of jobs as did the Waterbury LMA (200, 0.3%) and the Danbury LMA (100, 0.2%). The Norwich-New London LMA (-400, -0.3%), which was unchanged during the February blizzard month was the only region to lose jobs in March 2013. Connecticuts unemployment rate in March remained fixed at 8 percent; the national rate was 7.6 percent that month. Average weekly claims for unemployment insurance have continued to fall.

In 2012 Connecticut personal income advanced 2 percent, ranking the state 49th nationally in income growth. The strongest growth in the New England region was in Vermont with growth of 3.4 percent. Nationally, income grew at a 3.5-percent rate in 2012. Quarterly personal income in Connecticut performed better in the first half of 2012 than the second half (the income figures for the first quarter of 2013 will be available in June).

Average hourly earnings at $27.99, not seasonally adjusted, were down twenty-five cents, or -0.9 percent from the March 2012 hourly pay estimate. Private sector weekly pay was estimated at $932.07, down $25.27, or -2.6 percent over the year. The Consumer Price Index (CPI) for all urban consumers was advancing at a 1.5percent rate in March.

Housing permits in Connecticut have continued to post strong gains coming into 2013. For the 12-month period ending in March, housing permits were up just over 50 percent from the same period last year. According to the Census Bureau, U.S. new home sales increased 18.5 percent from last March. Sales in the Northeast were up 32.3 percent from March of last year. Both nationally and in the Northeast March sales exceeded Februarys total. Results for the larger existing home sales market were as follows, according to the National Association of Realtors (NAR). Nationally, March sales were down 0.6 percent from the previous month, but sales were up 10.3 percent from March of last year. Home prices were up a solid 11.8 percent from one year ago. Existing home sales in the Northeast were unchanged on a month-over-month basis in March. Sales were up 6.8 percent from March of last year. Home prices in the Northeast were up 3.0 percent for the year to a median price of $237,000. There were other signs in the existing-home sales report pointing toward greater market stability. More expensive homes were also seeing strong gains. Homes priced below $100,000 posted a 16-percent drop in sales, NAR says. Meanwhile, homes in all other price ranges were up year-over-year. Homes priced from $250,000 to $500,000, for instance, saw sales jump 22 percent year over year. Almost 2 million fewer homeowners were underwater at the end of last year than a year prior, according to data from Zillow. Nationwide, 13.8 million homeowners with a mortgage were underwater at the end of last year. According to research from the Federal Reserve Bank of New York, student debt is making it harder for young people to buy homes. Student debt has grown dramatically over the last decade some 43 percent of Americans under the age of 25 had student debt in 2012, with the average debt burden now $20,326. By contrast, back in 2003, just 25 percent of younger Americans had debt, and the average burden was $10,649. Student loans appear to be crowding out other types of borrowing for younger consumers. Historically, Americans with student debt were more likely to own homes than those without largely because educational attainment corresponds to higher income. But that trend has reversed:

This has some interesting long-term economic implications. Home ownership is an important asset in most consumer portfolios. That asset can be leveraged to fuel higher amounts of consumer spending. To the extent that the asset purchase is absent or deferred, consumer spending could be dampened.

At this writing, the Dow was advancing at a rate of almost 12 percent over last year.

DOW:

Consumers

In March, advance retail sales were up 2.8 percent from the same period last year. Sales were down from February, and still well off the pace set in FY 12. The strongest growth was in automobiles and non-store retailer sales. Automakers reported that March sales of new cars and trucks were the highest monthly total in five years, providing more evidence of a sustained turnaround in the industry. According to Autodata, 1.45 million vehicles were sold during the month, a 3.4percent improvement over last year, as a strengthening housing market and low interest rates spurred consumers and businesses to replace aging models. General Motors, the largest American automaker, said it sold 246,000 new vehicles during March, a 6.4-percent increase over the same period last year.

Workers are seeing decreased take-home pay since the expiration of the two-year payroll tax reduction. The tax change is expected to remove about $125 billion in expendable income from consumers. Connecticuts share of the loss would be about $2 billion. According to the Federal Reserve, in February, consumer credit increased at a seasonally adjusted annual rate of 7.75 percent. Revolving credit increased at an annual rate of 0.75%, while non-revolving credit increased at an annual rate of 11 percent (non-revolving credit includes automobile and educational loans).

Business and Economic Growth

Based on advance estimates, real Gross Domestic Product grew at an annual rate of 2.5 percent in the first quarter of 2013. This follows fourth-quarter growth of just 0.4 percent. Current-dollar personal income decreased $109.1 billion (3.2 percent) in the first quarter, in contrast to an increase of $262.3 billion (8.1 percent) in the fourth. The downturn in personal income primarily reflected a sharp downturn in personal dividend income and a sharp acceleration in contributions for government social insurance -- a subtraction in the calculation of personal income. Fourth-quarter personal dividend income was boosted by the payment of accelerated and special dividends. The acceleration in contributions for government social insurance in the first quarter resulted from the expiration of the "payroll tax holiday." First-quarter corporate profit data will be released on June 26. Corporate profits advanced 6.8 percent in 2012 after growth of 7.3 percent in 2011. Net dividend distributions in the fourth quarter of 2012 were up 23.2 percent from the same quarter a year ago. In 2012, American banks increased their commercial and industrial loans by $174 billion or 13 percent. Since 1990, the annual growth in such loans has averaged 4.2 percent. The combined pension deficit of companies in the Standard & Poor's 1,500-stock index fell to $372 billion at the end of March, according to Mercer. The figure marks a $185-billion drop from the record $557 billion at the end of the year. Stock market gains in March contributed heavily to this improvement. The Labor Departments scorecard of business activity was mixed in 2012. But down sharply at the start of 2013.

New business starts in Connecticut have been down by double-digit percentages from last year in each of the first three months of 2013. ***END***

You might also like

- July 2013 Financial UpdateDocument5 pagesJuly 2013 Financial UpdateHelen BennettNo ratings yet

- December 2012 Financial UpdateDocument6 pagesDecember 2012 Financial UpdateAlfonso RobinsonNo ratings yet

- July 2012 Financial UpdateDocument5 pagesJuly 2012 Financial UpdateHelen BennettNo ratings yet

- September 2014 Financial StatusDocument9 pagesSeptember 2014 Financial StatusAlfonso RobinsonNo ratings yet

- October 2013 Financial UpdateDocument5 pagesOctober 2013 Financial UpdateAlfonso RobinsonNo ratings yet

- U.S. Economic Forecast: Gale WarningDocument9 pagesU.S. Economic Forecast: Gale Warningapi-227433089No ratings yet

- February 2012 Economic Forecast Summary 022912Document11 pagesFebruary 2012 Economic Forecast Summary 022912James RagsdaleNo ratings yet

- January Financial OutlookDocument4 pagesJanuary Financial OutlookJordan FensterNo ratings yet

- American Association of State Colleges & Universities: 2012 State Outlook (2011)Document8 pagesAmerican Association of State Colleges & Universities: 2012 State Outlook (2011)Melonie A. FullickNo ratings yet

- June 2016 Financial StatusDocument10 pagesJune 2016 Financial StatusHelen BennettNo ratings yet

- 2010 0113 EconomicDataDocument11 pages2010 0113 EconomicDataArikKanasNo ratings yet

- Illinois Revenue Nov 2014Document6 pagesIllinois Revenue Nov 2014Lennie JarrattNo ratings yet

- Economy Is On The Brink-Unless We Change Our Spending Habits The Economy Will CollapseDocument2 pagesEconomy Is On The Brink-Unless We Change Our Spending Habits The Economy Will Collapsepritpal40No ratings yet

- Gary Shilling Review and Forecast: Low Interest RatesDocument22 pagesGary Shilling Review and Forecast: Low Interest Ratesrichardck61No ratings yet

- U.S. Economic Forecast: The Summer WindDocument13 pagesU.S. Economic Forecast: The Summer Windapi-227433089No ratings yet

- July 2014 - Real Estate Market UpdateDocument1 pageJuly 2014 - Real Estate Market UpdateTeam SchuCo Real Estate & LifestyleNo ratings yet

- HIM2016Q1NPDocument9 pagesHIM2016Q1NPlovehonor0519No ratings yet

- HIM2016Q1Document7 pagesHIM2016Q1Puru SaxenaNo ratings yet

- States Continue To Feel Recession'S Impact: Updated June 27, 2012Document12 pagesStates Continue To Feel Recession'S Impact: Updated June 27, 2012kevin7645No ratings yet

- Hat To Xpect In: HE Conomy at A LanceDocument2 pagesHat To Xpect In: HE Conomy at A LancetheowlfundNo ratings yet

- U.S. Economic Forecast: Legends of The FallDocument11 pagesU.S. Economic Forecast: Legends of The Fallapi-227433089No ratings yet

- Weekly Economic Commentary 8/26/2013Document5 pagesWeekly Economic Commentary 8/26/2013monarchadvisorygroupNo ratings yet

- Morningstar - RobertDocument7 pagesMorningstar - Robertcfasr_programsNo ratings yet

- 09.07.12 JPM Fiscal Cliff White PaperDocument16 pages09.07.12 JPM Fiscal Cliff White PaperRishi ShahNo ratings yet

- Spring 2014 Optimal Bundle: Issue XIIIDocument2 pagesSpring 2014 Optimal Bundle: Issue XIIIColennonNo ratings yet

- May 2012 Revenue LetterDocument5 pagesMay 2012 Revenue Letterjulie3935No ratings yet

- April 2010 U.S. Building Market Intelligence Report: Building Stats For The Real Estate Market For This MonthDocument9 pagesApril 2010 U.S. Building Market Intelligence Report: Building Stats For The Real Estate Market For This MonthdbeisnerNo ratings yet

- 2009 State Tax TrendsDocument16 pages2009 State Tax TrendsArgyll Lorenzo BongosiaNo ratings yet

- General Fund Revenue OutlookDocument14 pagesGeneral Fund Revenue OutlookThunder PigNo ratings yet

- ArticleDocument2 pagesArticleSteveNo ratings yet

- CRE Long Memo Nov2011Document8 pagesCRE Long Memo Nov2011shadesofyellow03No ratings yet

- Fitch Bond Statement On NH GO Bond Sale 10-18-2011Document3 pagesFitch Bond Statement On NH GO Bond Sale 10-18-2011Grant BosseNo ratings yet

- Revenue Status Report FY 2011-2012 - General Fund 20111231Document19 pagesRevenue Status Report FY 2011-2012 - General Fund 20111231Infosys GriffinNo ratings yet

- 2 D & C Income Decline 10-28-09 3pDocument3 pages2 D & C Income Decline 10-28-09 3pxjaxNo ratings yet

- Revenue Status Report FY 2011-2012 - General Fund 20111031Document19 pagesRevenue Status Report FY 2011-2012 - General Fund 20111031Infosys GriffinNo ratings yet

- Nys Go Report 1109Document5 pagesNys Go Report 1109jspectorNo ratings yet

- U.S. State and Local Government Credit Conditions Forecast: Waiting - . - and Waiting To ExhaleDocument17 pagesU.S. State and Local Government Credit Conditions Forecast: Waiting - . - and Waiting To Exhaleapi-227433089No ratings yet

- Global Weekly Economic Update - Deloitte InsightsDocument8 pagesGlobal Weekly Economic Update - Deloitte InsightsSaba SiddiquiNo ratings yet

- CBRE Los Angeles Retail Marketview Q1 2014Document5 pagesCBRE Los Angeles Retail Marketview Q1 2014Robert AbelsonNo ratings yet

- Attacking The Fiscal Crisis - What The States Have Taught Us About The Way ForwardDocument7 pagesAttacking The Fiscal Crisis - What The States Have Taught Us About The Way ForwardDamian PanaitescuNo ratings yet

- Budget FAIL Plan Awaiting Gov. Quinn's Signature Grows Spending, DebtDocument5 pagesBudget FAIL Plan Awaiting Gov. Quinn's Signature Grows Spending, DebtIllinois PolicyNo ratings yet

- 01491-msr Factsheet 071107Document1 page01491-msr Factsheet 071107losangelesNo ratings yet

- Nys Econ Trends15-2012Document4 pagesNys Econ Trends15-2012jspectorNo ratings yet

- Builders Utlook: Housing Recovery Picks Up Steam Despite Persistent HeadwindsDocument16 pagesBuilders Utlook: Housing Recovery Picks Up Steam Despite Persistent HeadwindsTedEscobedoNo ratings yet

- 1 10 UpdateDocument3 pages1 10 Updatenatdogg1No ratings yet

- Uline Presentation: Bill BroydrickDocument31 pagesUline Presentation: Bill BroydrickAwsaf Amanat Khan AuzzieNo ratings yet

- Economic Snapshot For December 2011Document6 pagesEconomic Snapshot For December 2011Center for American ProgressNo ratings yet

- Weekly Economic Commentary 01-30-12Document4 pagesWeekly Economic Commentary 01-30-12monarchadvisorygroupNo ratings yet

- U.S. Weekly Financial Notes: Still Holding On: Economic ResearchDocument14 pagesU.S. Weekly Financial Notes: Still Holding On: Economic Researchapi-227433089No ratings yet

- US Policies Fail To Avert HyperinflationDocument7 pagesUS Policies Fail To Avert HyperinflationbowssenNo ratings yet

- The Economy and Construction Review of Recent Indicators - February 2008Document4 pagesThe Economy and Construction Review of Recent Indicators - February 2008Krish DoodnauthNo ratings yet

- JP Morgam GDPDocument2 pagesJP Morgam GDPbubbleuppNo ratings yet

- ArticleDocument4 pagesArticleSteveNo ratings yet

- The Us Consumer in 2009Document7 pagesThe Us Consumer in 2009Denis OuelletNo ratings yet

- Commercial Real Estate Outlook August 2013Document9 pagesCommercial Real Estate Outlook August 2013National Association of REALTORS®No ratings yet

- September Revenue LetterDocument5 pagesSeptember Revenue LetterJulie CoggsdaleNo ratings yet

- Good News Is Bad News Once Again As Stronger Employment Growth Spooks MarketsDocument12 pagesGood News Is Bad News Once Again As Stronger Employment Growth Spooks Marketsjjy1234No ratings yet

- Americas: Economic Review January 2011: at A GlanceDocument9 pagesAmericas: Economic Review January 2011: at A Glancemathew_rexNo ratings yet

- Re-Elect Mayor Esposito SEEC 20 January 10Document29 pagesRe-Elect Mayor Esposito SEEC 20 January 10Alfonso RobinsonNo ratings yet

- 3 Lake Ave Extension LLC V City of Danbury Zoning Commission JudgementDocument36 pages3 Lake Ave Extension LLC V City of Danbury Zoning Commission JudgementAlfonso RobinsonNo ratings yet

- St. Hiliare v City of Danbury (complaint)Document91 pagesSt. Hiliare v City of Danbury (complaint)Alfonso RobinsonNo ratings yet

- Danbury November 2023 Municipal Election Returns (Amended)Document91 pagesDanbury November 2023 Municipal Election Returns (Amended)Alfonso RobinsonNo ratings yet

- Roberto Alves SEEC 20 January 10 (Termination)Document31 pagesRoberto Alves SEEC 20 January 10 (Termination)Alfonso RobinsonNo ratings yet

- Alves For Danbury SEEC 20 April 10 2023Document201 pagesAlves For Danbury SEEC 20 April 10 2023Alfonso RobinsonNo ratings yet

- Re-Elect Mayor Esposito SEEC 20 October 10 2023Document75 pagesRe-Elect Mayor Esposito SEEC 20 October 10 2023Alfonso RobinsonNo ratings yet

- Re-Elect Mayor Esposito SEEC Form 20 January 10 2023Document54 pagesRe-Elect Mayor Esposito SEEC Form 20 January 10 2023Alfonso RobinsonNo ratings yet

- Re-Elect Mayor Esposito SEEC 20 April 10 2023Document88 pagesRe-Elect Mayor Esposito SEEC 20 April 10 2023Alfonso RobinsonNo ratings yet

- Danbury November 2023 Municipal Election Returns (Amended)Document91 pagesDanbury November 2023 Municipal Election Returns (Amended)Alfonso RobinsonNo ratings yet

- Alves For Danbury SEEC 20 July 10 2023Document102 pagesAlves For Danbury SEEC 20 July 10 2023Alfonso RobinsonNo ratings yet

- Re-Elect Mayor Esposito SEEC Form 20 October 10 2022Document32 pagesRe-Elect Mayor Esposito SEEC Form 20 October 10 2022Alfonso RobinsonNo ratings yet

- Danbury 2021 Election TotalsDocument9 pagesDanbury 2021 Election TotalsAlfonso RobinsonNo ratings yet

- Danbury 2022 Head Moderators ReturnsDocument7 pagesDanbury 2022 Head Moderators ReturnsAlfonso RobinsonNo ratings yet

- To City of Danbury Election WardsDocument13 pagesTo City of Danbury Election WardsAlfonso RobinsonNo ratings yet

- Governor Lamont Nominates 20 Jurists To Serve As Judges of The Connecticut Superior CourtDocument5 pagesGovernor Lamont Nominates 20 Jurists To Serve As Judges of The Connecticut Superior CourtAlfonso RobinsonNo ratings yet

- Danbury Democrats Ward Reappointment Proposal (Plan A)Document6 pagesDanbury Democrats Ward Reappointment Proposal (Plan A)Alfonso RobinsonNo ratings yet

- 2022 Danbury Head Moderators Return DataDocument118 pages2022 Danbury Head Moderators Return DataAlfonso RobinsonNo ratings yet

- Danbury Republican Party Ward Reapportionment Proposal (Plan B)Document8 pagesDanbury Republican Party Ward Reapportionment Proposal (Plan B)Alfonso RobinsonNo ratings yet

- Joe DaSilva For Judge of Probate, Danbury CT 2022Document2 pagesJoe DaSilva For Judge of Probate, Danbury CT 2022Alfonso RobinsonNo ratings yet

- Alves For Danbury Form 20 January 10Document37 pagesAlves For Danbury Form 20 January 10Alfonso RobinsonNo ratings yet

- 2021 Danbury Head Moderator Return DataDocument136 pages2021 Danbury Head Moderator Return DataAlfonso RobinsonNo ratings yet

- Alves For Danbury Form 20 October 26 (7 Days Until Election)Document35 pagesAlves For Danbury Form 20 October 26 (7 Days Until Election)Alfonso RobinsonNo ratings yet

- 2012-2013 Danbury City Proposed Operating BudgetDocument342 pages2012-2013 Danbury City Proposed Operating BudgetAlfonso RobinsonNo ratings yet

- Dean Esposito Form 20 October 2021Document104 pagesDean Esposito Form 20 October 2021Alfonso RobinsonNo ratings yet

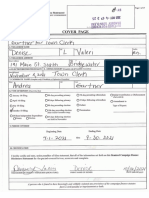

- Gartner Town Clerk Form 20 October 12Document33 pagesGartner Town Clerk Form 20 October 12Alfonso RobinsonNo ratings yet

- Chief Ridenhour Memo, Super 8 09.22.21Document9 pagesChief Ridenhour Memo, Super 8 09.22.21Alfonso RobinsonNo ratings yet

- Npa in IndiaDocument13 pagesNpa in IndiaTroeeta BhuniyaNo ratings yet

- Inventory ValuationDocument2 pagesInventory ValuationJonathan WilderNo ratings yet

- Bookmakers NightmareDocument50 pagesBookmakers NightmarefabihdroNo ratings yet

- Vol. 1: Basic Planning: Overseas Customer Service Facility GuideDocument35 pagesVol. 1: Basic Planning: Overseas Customer Service Facility GuideMishell TatianaNo ratings yet

- KM 3Document4 pagesKM 3Ilham Binte AkhterNo ratings yet

- Itinerario Cosco ShippingDocument2 pagesItinerario Cosco ShippingRelly CarrascoNo ratings yet

- Deloitte With World Economic Forum Future of Food - Partnership-GuideDocument40 pagesDeloitte With World Economic Forum Future of Food - Partnership-GuideFred NijlandNo ratings yet

- Global Wealth Databook 2017Document165 pagesGlobal Wealth Databook 2017Derek ZNo ratings yet

- Dalal Street Investment Journal PDFDocument26 pagesDalal Street Investment Journal PDFShailesh KhodkeNo ratings yet

- SwapsDocument33 pagesSwapsAshish SaxenaNo ratings yet

- Booking Invoice M06ai23i01024843Document2 pagesBooking Invoice M06ai23i01024843AkshayMilmileNo ratings yet

- Superstocks Final Advance Reviewer'sDocument250 pagesSuperstocks Final Advance Reviewer'sbanman8796% (24)

- Chapter 2Document18 pagesChapter 2FakeMe12No ratings yet

- DocxDocument5 pagesDocxChy BNo ratings yet

- Full Report Case 4Document13 pagesFull Report Case 4Ina Noina100% (4)

- Public Expenditure PFM handbook-WB-2008 PDFDocument354 pagesPublic Expenditure PFM handbook-WB-2008 PDFThơm TrùnNo ratings yet

- The Economic Crisis in Pakistan and Their Solutions: T E C P T SDocument6 pagesThe Economic Crisis in Pakistan and Their Solutions: T E C P T SRaja EhsanNo ratings yet

- 5th Sanction Letter 2Document2 pages5th Sanction Letter 2Tamalika DasNo ratings yet

- Dornbusch Overshooting ModelDocument17 pagesDornbusch Overshooting Modelka2010cheungNo ratings yet

- Nabl 500Document142 pagesNabl 500Vinay SimhaNo ratings yet

- Tata-AIG Organisational ChartDocument4 pagesTata-AIG Organisational ChartTarun BajajNo ratings yet

- Latitudes Not AttitudesDocument7 pagesLatitudes Not Attitudesikonoclast13456No ratings yet

- Position PaperDocument2 pagesPosition PaperMaria Marielle BucksNo ratings yet

- Curriculum Vitae: Personal DataDocument3 pagesCurriculum Vitae: Personal DataAgungBolaangNo ratings yet

- The Proof of Agricultural ZakatDocument7 pagesThe Proof of Agricultural ZakatDila Estu KinasihNo ratings yet

- Course Outline Atty. Joanne L. Ranada Negotiable Instruments Law First Semester, AY 2019 - 2020Document12 pagesCourse Outline Atty. Joanne L. Ranada Negotiable Instruments Law First Semester, AY 2019 - 2020Nica Cielo B. LibunaoNo ratings yet

- Sustainability at Whole FoodsDocument13 pagesSustainability at Whole FoodsHannah Erickson100% (1)

- Perkembangan Kebun Teh Danau Kembar Dari Tahun 2000 - 2017.Document12 pagesPerkembangan Kebun Teh Danau Kembar Dari Tahun 2000 - 2017.niaputriNo ratings yet

- Complete Project Marketing ManagementDocument36 pagesComplete Project Marketing ManagementAbhushkNo ratings yet

- Cir v. Citytrust InvestmentDocument12 pagesCir v. Citytrust InvestmentJor LonzagaNo ratings yet