Professional Documents

Culture Documents

Risk Management Presentation July 23 2012

Written by

George LekatisCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Risk Management Presentation July 23 2012

Written by

George LekatisCopyright:

Available Formats

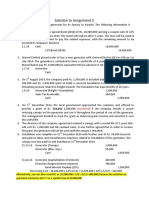

Page |1

International Association of Risk and Compliance Professionals (IARCP)

1200 G Street N W Suite 800 Washington, DC 20005-6705 USA Tel: 202-449-9750 www.risk-compliance-association.com

Top 10 risk and compliance management related news stories and world events that (for better or for worse) shaped the week's agenda, and what is next

George Lekatis President of the IARCP

Dear Member,

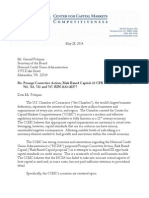

Who said that? The hundreds of rules and regulations that Dodd-Frank demands of the SEC and other financial regulators indicate just how far the government has reached into the private sector and just how heavy the governments hand will be.

Or, stated differently , the regulatory change demonstrates the degree to which government decision making, effectuated as it is through more regulation, will displace and distort private sector decision making. To put it more directly, I have been and remain troubled that the Dodd-Frank regulatory regime goes too far.

Who said that? Commissioner Troy A. Paredes, from the U.S. Securities and Exchange Commission, Washington, D.C.

Commissioner Troy A. Paredes continues: The key question, therefore, is not whether we will or should have regulation. The answer to that question is straightforward: we will and we should.

The real question is, How much?

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

Page |2

When it comes to the question of How much?, I am concerned that the present wave of regulation will prove to be excessive, unduly burdening and restricting our financial system and suppressing private sector innovation, entrepreneurism, and competition at the expense of our countrys economic growth and global competitiveness.

My concern that we are overregulating is accentuated when instead of evaluating each rule and regulation one-by-one, the totality of the regulation that the private sector must bear is added up. As regulatory mandates mount, I worry that the cumulative impact of the aggregation of rules and regulations will make it more difficult for companies to raise capital and to manage their risks effectively; will make it more costly for individuals to borrow when they need to; will stifle the cutting-edge innovation that we depend on to drive our economy forward; will leave investors with fewer valuable opportunities for building their wealth; and will undercut job creation. Read more at N umber 5. Welcome to the Top 10 list.

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

Page |3

FINMA publishes circulars on implementing Basel I I I and TBTF requirements FINMA will put a new circular on eligible capital into effect starting 1 January 2013 as well as revised circulars on capital planning, credit and market risk, disclosure and risk diversification.

Remarks by Under Secretary Lael Brainard on China at the Center for American Progress The choices China makes as it navigates its next phase of development will matter greatly for the kind of international playing field our companies, workers, farmers, and ranchers will face.

FI proposes higher requirements for the banks liquidity buffers Sweden shall act ahead of the EU and introduce quantitative requirement s regardin g the ban ks liqu idit y bu ffers . The aim is to ensure that large banks and credit institutions hold sufficient liquid assets to be able to manage short periods without access to market funding.

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

Page |4

Building deeper economic union: what to do and what to avoid Speech by Jrg Asmussen, Member of the Executive Board of the ECB, Policy Briefing at the European Policy Centre, Brussels, 17 July 2012

Does the Dodd-Frank regulatory regime go too far? Remarks at Society of Corporate Secretaries & Governance Professionals, 66th National Conference on The Shape of Things to Come by Commissioner Troy A. Paredes, U.S. Securities and Exchange Commission, Washington, D.C.

Advise the Advisor: Streamlining, Improving, and Simplifying Rules and Regulations

Islamic Finance: Not such an alien world at all, from Jrg Rieger, BaFin

Could the financial crisis have been prevented if the financial world had followed the rules of Islamic or Sharia law?

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

Page |5

Opening Statement of Chairwoman Debbie Stabenow (D-Mich) Dodd-Frank Wall Street Reform and Consumer Protection Act: 2 Years Later July 17, 2012

EIOPA hosts a meeting of the EU - US insurance dialogue The European I nsurance and Occupational Pensions Authority (EIOPA) hosted on 1 1 July a Steering Committee Meeting of the EU/ US insurance dialogue project.

Towards a Financially Literate Nation Speech by Lee Chuan Teck, Chairman, Financial Education Steering Committee and Assistant Managing Director, Monetary Authority of Singapore at the launch of the MoneySENSE Singapore Polytechnic Institute for Financial Literacy

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

Page |6

NUMBER 1

FINMA publishes circulars on implementing Basel I I I and TBTF requirements

FINMA will put a new circular on eligible capital into effect starting 1 January 2013 as well as revised circulars on capital planning, credit and market risk, disclosure and risk diversification. In doing so, the supervisory authority presents its implementing provisions on the recently revised Capital Adequacy Ordinance (CAO) regarding the implementation of the Basel I I I requirements and the "too big to fail" (TBTF) legislation. Following the financial market crisis in 2008/ 2009, the new Basel I I I regulations were drawn up under the leadership of the Group of Governors and H eads of Supervision (GHOS) and the Basel Committee on Banking Supervision (BCBS). In line with these regulations, banks must hold more and qualitatively better capital.

At the same time, the TBTF regime was drafted which sets out additional regulatory requirements for systemically important institutions.

In order to implement the Basel I I I requirements and the new TBTF regime in Switzerland, FINMA is publishing today updated circulars as implementing provisions for the revised CAO which was adopted by the Federal Council in June 2012.

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

Page |7

The new circular and the aforementioned amended circulars will enter into force along with the CAO on 1 January 2013.

The implementing provisions set out in the FINM A circulars do not, nevertheless, put all the elements of the Basel I I I framework into practice. Still to be implemented are the detailed disclosure obligations for eligible capital decided recently by the Basel Committee, and the precise handling of credit risk exposure to central counterparties which has yet to be published. FINMA intends publishing its implementing provisions on these matters as soon as possible so that those Basel I I I elements can also come into force as of 1 January 2013.

Minimum changes compared with the consultation drafts

Integration of the Basel I I I international standards into the Swiss regulatory framework was conducted by an existing national working group whose representatives are from official bodies and the industry. The revised drafts of the circulars were therefore not unexpected for many market participants and have been broadly supported. Any adjustments have mostly involved editorial changes. Most reaction was triggered by the new circular on eligible capital (FINM A-RS 13/ 01). As this circular has absorbed the key content of FINM A-Circ. 08/34 "Core Capital Banks", the latter has become redundant and will be repealed as of 1 January 2013.

Changes to other circulars

The newly defined capital categories in the CAO have resulted in amending the quality of capital specified in FINM A Circ. 1 1/2 "Capital buffer and capital planning banks". The objections brought forward in the consultation claiming that the adjustments involved go beyond the ordinance in terms of tightening capital requirements were partly in FIN MA's interests. Changes to FINMA Circ. 1 1/2 will also enter into force on 1 January 2013.

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

Page |8

Moreover, FINM A is repealing FINMA Circular 08/ 9 "Supervision of large banks" as of 31 July 2012. I t will not be replaced, since established supervisory practice and other regulations adequately cover its content. Its repeal does not in any way change the current supervisory practice with respect to the two large banks: no additional obligations will arise and those that exist will neither be amended nor abolished.

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

Page |9

NUMBER 2

Remarks by Under Secretary Lael Brainard on China at the Center for American Progress (CAP)

WASHINGTON - Our countrys economic future lies primarily in our own hands. But the choices China makes as it navigates its next phase of development will matter greatly for the kind of international playing field our companies, workers, farmers, and ranchers will face. That is why the President has worked hard from day one to make our economic relationship with China more balanced so that it yields greater benefits for American workers and exporters and China no longer plays by a different set of rules. At every juncture, the President and his economic team have pressed China to abide by international norms, especially given its outsized role in the international trading system. We have highlighted the costs of not adopting these norms, and we have moved forward with forging higher standards with like-minded countries. The President has demanded changes where our core economic interests are at stake, and we have used all available mechanisms effectively and aggressively to defend themincluding through the World Trade Organization (WTO) and the newly-created trade enforcement center that investigates unfair trading practices. We have sought to work with the grain of the reform agenda many in China are advocating.

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 10

We have highlighted the importance of rebalancing growth and leveling the playing field so that China avoids the middle-income trap and navigates its demographic transition.

And we have done so without undue drama by cultivating greater clarity and predictability in our bilateral engagement. We have worked hard to find common ground, recognizing that the first and second largest economies share an overwhelming interest in building a more robust global economy.

Today, our approach is yielding measurable gains.

Exports to China have grown by over 50 percent since 2009in line with the Presidents strategy of doubling exports in five years. For the first time in decades, consulting companies are highlighting the attraction for global companies of bringing jobs to the United States, or insourcing their operationsciting heightened competitiveness relative to other markets. And employment in U.S. manufacturing has increased month after month, adding more than 500,000 new jobs since 2010. Let me briefly elaborate on these four aspects of our approach. First, Chinas economy is now too large for it to pick and choose which rules it will follow without risking the integrity and legitimacy of the international system on which Chinas growth depends. Chinas persistent exchange rate undervaluation in the years following its admission to the WTO is a vivid example of the impact Chinas policy choices have on the international system. From the time China joined the WTO to 2006, its trade-weighted exchange rate depreciated by 15 percent, adjusting for inflation. Of course, with Chinas productivity growth outpacing that of its trading partners, we should have seen strong appreciation throughout the period.

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 11

This was not just our assessment; it was the I nternational Monetary Funds (IM F) as well.

Chinas current account surplus shot up from roughly 1 percent of GDP to over 10 percent by 2007. To compensate for the RMBs growing undervaluation, Chinas trading partners either resisted appreciation of their own exchange rates, thereby amplifying the distortion, or bore an undue burden of adjustment. The strains placed on the global economy sorely tested the legitimacy of the WTO and the I MF. From day one, we have stressed that this approach is bad for China and unacceptable to the United States. With demand in many advanced economies expected to remain weak for some time, and with a steep demographic cliff fast approaching, China faces tough choices to sustain growth and avoid the middle-income trap. The policy choices China makes will be important to Americas economic intereststo our exports, our workers, our businesses, and our farmers. Only by moving from an economy dependent on external demand and exports to one driven by domestic consumer demand; an economy dependent on over-investment in resource-intensive industries to reliance on higher value activities; and an economy dependent on adoption and adaptation of foreign technology to one that nurtures innovation, can China sustain its growth. As it makes this transition, Chinas domestic goals will be well served by the same principles that we pursue in our trade and investment agenda. China will be able to transition to higher value activities and develop robust innovation capacity only if it protects and enforces intellectual property rights, opens its government procurement market, eliminates preferential treatment of state-owned enterprises (SOEs), and compels its exporters to compete on the strength of their product offerings.

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 12

It will not work with below-market input prices, an undervalued exchange rate, and pervasive intellectual property violations.

Of course, as China makes this transition, it will have a growing interest in improving access to investment opportunities in Americas dynamic markets and to our highly innovative products and services. We are willing to make progress on these issues, but our ability to do so will depend on how much progress we see from China. And we are seeing some progress. Alongside Chinas growth in wagesa welcome boost to household incomesexchange rate appreciation is starting to make a difference for our exporters and our workers. Chinas current account surplus has fallen by over 6 percentage points of GDP, reflecting an 1 1 percent appreciation of the currency against the dollar in inflation-adjusted terms. China has taken a number of steps in recent months to reform and open its financial markets, which are critical to leveling the playing field and making the transition to sustainable growth. China has widened its exchange rate bands and reduced intervention in the foreign exchange market. Chinas capital controls are being cautiously dismantled. Financial authorities are allowing greater market determination of interest rates. Through the U.S.-China Strategic and Economic Dialogue (S&ED), we have secured improved access for foreign financial services firms in securities and casualty insurance, as well as a greater ability for them to expand their offerings of financial products. But this is not enough. We will continue to press China to make more progress and provide greater transparency to meet its G-20 commitment to enhance exchange

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 13

rate flexibility, avoid persistent exchange rate misalignment, and refrain from competitive devaluation.

We will continue to press China to address the rampant theft of intellectual property, including trade secrets, to meet international standards. Following intense engagement at the highest levels, China reversed a set of policies that would have discriminated against foreign intellectual property.

In large part because of efforts by the Department of Commerce and the U.S. Trade Representative (USTR), China established a high-level mechanism under the leadership of Chinas State Council to oversee enforcement efforts, including efforts to discourage government use of pirated software.

But far greater resolve will be needed if China is to re-join the ranks of the most innovative economiesincluding working together to stem the growing challenge of cyber-enabled intellectual property violations.

It is also important to address the privileges enjoyed by Chinas SOEs, which create an unfair advantage that hurts Chinas private enterprises no less than for U.S. competitors.

That is why it was significant when Chinese authorities committed in this years S&ED to ensure that credit, taxation, and regulatory policies would apply on a non-discriminatory basis across enterprises of all types and to increase the portion of profits Chinas SOEs must pay out in dividends comparable to other publicly-listed companies. During the years when Chinas external imbalances ballooned, the high profits retained by Chinas SOEs were a major contributor to those imbalances. Going forward, unlocking SOE savings will help level the playing field and provide resources to boost social spending.

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 14

Second, with China now big enough to have a systemic impact across a range of dimensions, China can no longer insist on one set of standards for the big players and another set of standards for itself.

In turn, we recognize that China must be at the table as global standards are set. So, for instance, it was critical for China to be at the table as the Financial Stability Board and the G-20 negotiated global standards for bank capital, orderly liquidation of financial institutions, and over-the-counter derivatives. Along with the other emerging market members, China has taken on the same set of responsibilities as advanced economies, which is essential as its financial markets grow. While export finance in the United States and other key export nations have long been bound to a set of understandable international disciplines, Chinas exporters have derived benefit from a confusing and opaque export financing system. Early this year, President Obama made clear we were prepared to match unfair financing to ensure a level playing field for our exporters. And since then, China has agreed to join negotiations on international rules where they will be included for the first timea critical step as we ensure that our world class exporters are able to compete once again on the strength of quality and price, with trade finance to support, not supplant, market competition. Chinas vast procurement market has also been outside the international system for too long, despite its repeated promises to join the WTO Agreement on Government Procurement (GPA). But we are no longer idly sitting by.

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 15

The United States has been clear that access to much of our government procurement would depend on commensurate access under the terms of an accession agreement by China to the GPA.

We are pushing China to incorporate these elements and look forward to seeing a stronger offer before the end of this year. It is critical that Chinas accession to the GPA provide U.S. businesses with improved access not just to its large central government procurement market, but also to sub-central procurement that accounted for an estimated 93 percent of total government procurement in 2010. And through the Trans-Pacific Partnership (TPP) Agreement we are designing the standards that will constitute the new frontiers for 21st century trade agreements in the key export markets of the Asia-Pacific region. With product cycles and competitive advantage being driven in market time, international standards must continue to move forward. It is thus vital that the TPP address the full scope of disciplines relevant to an open and fair trading system. By working with like-minded countries, we are setting high standards, with the open architecture of the TPP a pathway for additional countries to raise their standards to commensurate levels. Third, President Obama has demonstrated his determination to use the legitimate enforcement tools we have available to ensure our trading partners play by the rules as a core part of our trade strategy. That is why it was important to demonstrate early on this Administrations determination to enforce the Section 421 China-specific safeguard mechanism after eight years of disuse, during which safeguards were not imposed in a single one of the cases brought successfully by private industry.

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 16

That is why the President created a new Interagency Trade Enforcement Center to coordinate enforcement and focus tirelessly on challenging unfair trade practices around the world.

That is also why USTR has pursued WTO challenges at twice the prevailing rate of prior administrations. Earlier this month, USTR launched a WTO case against China for imposing unfair duties on more than $3 billion on 80 percent of U.S. auto exports.

USTR has strategically taken cases forward so that each case, such as that of export restraints of certain raw materials, lays strong foundations that can be used to dismantle restraints in other key export areas, including rare earths, which are key inputs in U.S. advanced manufacturing products like wind turbines and lithium ion batteries.

And earlier this week, we successfully challenged Chinas discriminatory limitations against foreign electronic payment systems in the WTO. Finally, it is essential that we place these efforts in the broader context of systematic efforts across the Administration to expand and strengthen channels of communication with Chinese decision makers. We have pursued our agenda with China in a way that creates predictability and clarity, pursuing areas of cooperation even as we press to resolve problems. The challenging external environment has necessitated close collaboration with China to steer a more resilient global recovery. We supported a greater role for China in key international economic groups, recognizing that Chinese authorities have been pragmatic and active in supporting growth in the face of recurring bouts of financial stress from Europe.

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 17

The Administrations engagement with China has been intensive and highly prioritized since day one, from the White House and across all economic agencies.

We have maintained continuous interaction at all levels with the Chinese government across the full range of economic issues through mechanisms such as the Joint Commission on Commerce and Trade, the Innovation Dialogue, and the I nvestment Forum, to mention a few. Under the leadership of Secretary Geithner and Secretary Clinton, the U.S.-China Strategic and Economic Dialogue has strengthened relationships and mechanisms that have enabled us to pursue these priorities effectively at the highest levels. China is critically important to us. Getting this relationship right is essential. We have made significant progress, but we know, just as you do, that what matters is not just what we agree to on paper, but what really happens on the ground. Thats why we remain vigilant and focused, using all appropriate tools and leverage to make a difference for our workers and our businesses. Thank you.

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 18

Testimony By Fiscal Assistant Secretary Richard Gregg Before The Senate Committee On Homeland Security And Governmental Affairs

WASHINGTON - Chairman Lieberman, Ranking Member Collins, and members of the Committee, thank you for inviting me to discuss the Department of the Treasury's initiatives to increase Federal financial data transparency and accountability. As the Federal government's financial manager, the Department of the Treasury is uniquely positioned to improve the transparency and accountability of Federal financial transactions. Each year Treasury processes billions of financial transactions on behalf of Federal agencies, including payments, revenue and debt collections, and intra-governmental transfers. Treasury is committed to making sure that these transactions are carried out with the highest standards of performance, accountability, and transparency.

With these goals in mind, over the past several years Treasury has launched a number of initiatives to modernize its financial systems, improve transparency, and streamline its transaction execution and reporting processes.

Transparency

In processing billions of financial transactions each year, Treasury accumulates extensive Federal financial data. Treasury's goal is to ultimately provide this data to Federal agencies, Congress, and the public in a usable, easy-to-understand format. For Federal payments, Treasury makes one billion payments each year, which represents approximately 85 percent of all government payments. Historically, Treasury's goal has been to make sure every payment is made accurately and on time.

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 19

However, more recently Treasury recognized that we are uniquely positioned to make more payment information available to the public and to have that information available quickly and presented in a way that is meaningful.

To achieve greater payment transparency, Treasury is developing a robust business intelligence and data analytics system as part of our efforts to simplify and streamline the Federal payment process. This new system, called the Payment I nformation Repository (PIR), will allow information from payment systems to be viewed and analyzed in a single application that consolidates data from all Federal spending, including grants, contracts, loans, and agency expenses, thereby increasing Federal payment transparency. The PIR will capture and make available payment transaction data that can be linked to other government databases, such as USASpending.gov, to enable the public to follow a payment through the complete spending cycle from appropriations to the disbursements of grants, contracts, and administrative spending. In support of this effort to streamline the payment process, we have already developed the Payment Automation Manager (PAM), which replaces over 30 mainframe-based software applications previously used by Treasury into a single, standardized application. A key component of PAM is that it requires agencies to submit data in a newly defined Standard Payment Request format. Beginning in August of this year, most agencies will be able to submit payment data along with the related appropriation data in this standard electronic format. We will encourage agencies to adopt this new format as quickly as possible, but no later than October 1, 2014 all agencies for which Treasury disburses payments will be required to submit their payment data into PAM using this standard format. PAM will also be able to collect an assortment of other payment related data from agencies, including procurement information (for contracts),

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 20

grant or other program-related data, and data on recipients or payees, including payee location.

This standardized payment information from PAM will be provided to the PIR to capture richer data for analysis. The flow of this information from PAM into the PIR is expected to begin in the third quarter of 2013:

By July 2013, information on payments issued by agencies, such as the Social Security Administration, I nternal Revenue Service, and Veteran's Administration, will be stored in the PIR. At the same time, agencies that issue their own payments, such as the Department of Defense, will be able to submit standard files directly into the PIR, and will be required to do so by October 1, 2014.

By October 2014, international payments data and grant payment data will be stored in the PIR.

Also by October 2014, additional payment details from agencies and post-payment related activity such as adjustments, cancellations, and returns will be stored in the PIR. This information will allow taxpayers, agencies, and policymakers to more easily track Federal spending.

Users will be able to chart which areas of the country the government is spending the most on contracts, grants, benefit payments, salary payments, etc. The reports and dashboards will allow the user to filter information by specific attributes such as agency, state, or zip code where the payment is received, and type of payment. Reports, queries, and analytics will incrementally be made available to the public.

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 21

We expect the standard reports to be available to the public by July 2013 and structured queries to be available by December 2013.

More detailed queries and data analytics will be available in the following months. Personally Identifiable Information (PII) will be highly protected and not available to the public. For example, the reports will show summary information on how much the government paid in Social Security benefits in a particular area, but will not disclose an individual's name, address, or Social Security number.

Long-term vision for increasing transparency

Treasury's long-term vision is to provide a consolidated view of Federal financial management information on accounting, collections, debts, and payments through a single repository that serves as the single point of entry. The Financial Information Repository (FIR) will allow users to integrate and correlate information to analyze and create composite views of data across our major business lines. While the FIR is in its nascent state, it will ultimately address the growing need to manage and centrally analyze and report on financial data related to Federal collections, payments, debts, and intra-governmental transactions that will be available to agencies, the Office of Management and Budget (OMB), Congress, and the public.

Accountability

Following the President's June 2010 Memorandum directing agencies to improve payment accuracy by using a "Do Not Pay List," Treasury, in collaboration with OMB, began developing the "Do N ot Pay" (DNP) Business Center. The Business Center is comprised of the Do Not Pay Portal and Data Analytics Service.

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 22

The Portal serves as a one-stop shop for agencies to check several key databases to verify eligibility before making a payment or award.

The databases that are currently available include the Death Master File, Excluded Parties List System, Debt Check Database, List of Excluded Individuals/ Entities, and the Work Numbera commercially available data source with wage and employment information. The Data Analytics Service provides customized analysis allowing agencies to compare program, payment, and vendor data with secondary sources to find patterns that might suggest fraud, waste, or abuse. In April 2012, the DNP Business Center developed a partnership with Treasury's Financial Crimes Enforcement Network (FinCEN) in order to further enhance the analytic services provided to agencies. This partnership will leverage FinCEN's investment in data analytics tools and their existing relationships with the law enforcement community. We are working to identify how and when the Data Analytics Service will transfer potential fraud cases to FinCEN for further investigation. DNP serves as a tool agencies can use to increase their own financial accountability. The services offered by DNP allow agencies to evaluate payment eligibility based upon their internal business rules and the statutes governing their programs. Treasury expects this financial accountability to increase even further with the release of OMB guidance that directs executive agencies to develop a plan for using a "centralized solution" to reduce improper payments. The DNP program is already assisting 27 programs in preventing improper payments, and this number continues to grow as agencies respond to the guidance.

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 23

Data Standards

Data standardization, or the consistent use of common terms, formats, and definitions for key financial data elements, supports sound financial management decision-making by improving the consistency and accuracy of the government's financial data. To achieve the transparency and accountability we all want, Treasury is working to improve government-wide data definitions and standards. Widely accepted and used data standards will foster the easy aggregation of financial data for external reporting and facilitate the movement towards greater use of shared technologies and services throughout government, reducing the operational cost of government. In addition to the payments modernization efforts I previously mentioned, Treasury has in the past worked closely with OMB to implement a Common Government-wide Accounting Classification (CGAC) structure. In the future, Treasury will use standardized data through our modernization efforts. We will also build on our CGAC structure initiative by collaborating with OMB, GSA, and additional representatives from across the Federal financial community to form working groups dedicated to standardizing key financial data elements. These data elements will include agency and bureau identifiers, program identifiers, project and activity codes, and individual award identifiers (e.g., contracts, grants, loans, etc.).

Conclusion

Treasury's transparency and accountability initiatives will change the landscape of Federal financial management. The Payment I nformation Repository will enable citizen participation and two-way communication between the public and government officials for the purpose of deriving and maintaining public trust in government financial information.

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 24

The DNP program will increase government accountability while reducing, waste, fraud, and abuse.

We look forward to working with Congress to help ensure the success of these initiatives. Thank you.

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 25

Testimony of Under Secretary for Terrorism and Illicit Finance David Cohen before the Senate Committee on H omeland Security and Governmental Affairs Permanent Subcommittee on Investigations on U.S. Vulnerabilities to Money Laundering, Drugs, and Terroris

WASHINGTON - Chairman Levin, Ranking Member Coburn, distinguished members of the Subcommittee, thank you for inviting me to testify today.

I am pleased to have the opportunity to discuss the importance of the Department of the Treasurys efforts to identify and combat money laundering and terrorist financing vulnerabilities in the U.S. banking sector.

I would also like to commend this Subcommittee for the leadership it has demonstrated historically and again today by focusing much-needed attention on these critically important issues. At the outset, it is important to recognize that the United States maintains one of the strongest and most effective anti-money laundering and counter-terrorist financing (AML/CFT) regimes in the world. But the scale, efficiency and sophistication of the United States financial systemparticularly its banking sectormake it a prime target for those who seek to conceal and move illicit money. This involves not just money launderers, of course, but terrorists, proliferators, drug lords and organized crime figures, who must, at some point, rely on the financial system to move or launder the illicit funds supporting or derived from their operations. Recent enforcement actions against financial institutions in the United States are a powerful reminder to us that challenges remain. To meet these challenges, we closely monitor evolving threats and work to adapt and strengthen our anti-money laundering and counter-terrorist financing and sanctions policies, regulations and authorities.

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 26

This work is a key component of our governments national security effortsit serves to protect the integrity of our financial system from abuse by terrorists, drug traffickers and other illicit actors and gives us tools to impede and halt their dangerous activities.

Several primary authorities and activities drive the Treasury Departments work to combat money laundering and terrorist financing. They include our role through the Financial Crimes Enforcement Network (FinCEN) as administrator of the Bank Secrecy Act (BSA), which enables us to impose special regulatory measures and requirements to combat money laundering and terrorist financing on a broad array of financial institutions. They also include authorities delegated to us by Executive Orders issued pursuant to the International Emergency Economic Powers Act (IEEPA) to impose financial and economic sanctions, based on all-source intelligence, to disrupt and dismantle illicit financial networks, such as those that support weapons of mass destruction, proliferation, drug traffickers, transnational organized criminal groups and terrorists. Given the maturity, scope and depth of the anti-money laundering and counter-terrorist financing regime today, Treasury works closely with its interagency partners in the regulatory, law enforcement, and national security communities, as well as the private sector, to combat the various illicit financing threats we face. Furthermore, given the increasingly global nature of the financial system, our efforts to strengthen our own anti-money laundering and counter-terrorist financing regime rely on cooperation and collaboration with international counterparts.

Nature and Scope of the Threat

Financial crime and associated money laundering activity are difficult to measure with great precision.

But by any estimate, the total amount of illicit money moved through and concealed within the U.S. financial system is massivein the hundreds of

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 27

billionseven if it represents only a small percentage of the funds in the financial system.

The sheer volume of money moving through the banking system makes banks the primary and most important line of defense against money laundering and terrorist financing. Therefore, our regulatory framework was built to require banks and other financial institutions to take a number of precautions against financial crime, including the establishment of AML programs and reporting and record keeping requirements to provide useful information to law enforcement and national security authorities for the purpose of combating the full range of illicit finance. This includes screening clients and transactions against Treasurys Specially Designated Nationals (SDN) Lista list of drug traffickers, proliferators, terrorists and other illicit actors or entitiesto help ensure that funds associated with these actors do not enter the financial system. This regulatory framework aids banks in identifying and managing risk, provides valuable information to law enforcement, and creates the foundation of financial transparency required to apply targeted financial measures against the various national security threats that seek to operate within the financial system. However when these safeguards are not stringently enforced, money launderers, terrorist financiers and other illicit actors are able to take advantage of the U.S. financial system. Some recent civil enforcement actions by FinCEN and the federal banking regulators illustrate how this can occur: - In one case, failure to effectively monitor foreign correspondent banking relationships with high-risk customers and file suspicious activity reports (SARs) resulted in the processing of $420 billion in cross-border financial transactions with thirteen high-risk Mexican casas de cambio from 2004-2007, through wire transfers, bulk cash and pouch and remote deposits, including millions of dollars subsequently used to purchase airplanes for narcotics traffickers.

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 28

- In several cases, foreign banks stripped out the names of Iran or other sanctioned entities in transactions routed through the United States, resulting in billions of dollars of benefits to sanctioned parties.

A Swiss bank developed elaborate procedures to alter payments and used code names to disguise identities of sanctioned entities. A Dutch bank used misleading payment messages, shell companies and even advised sanctioned clients on how to conceal their involvement in U.S. dollar transactions.

- One banks failure to have a written AML policy and inadequate procedures to ensure the timely reporting of suspicious activity resulted in the processing of billions of dollars through accounts controlled by thirteen Mexican casas de cambio in just one year without filing suspicious activity reports.

- Inadequate AML staffing and procedures at another bank resulted in deficient monitoring and subsequent processing of large volumes of travelers checks and third party checks indicative of money laundering, including through sequentially numbered instruments. On account of these and other substantial vulnerabilities in anti-money laundering and counter-terrorist financing and sanctions compliance, the United States government has instituted criminal fines and forfeitures totaling more than $4.6 billion in approximately 20 BSA and I EEPA criminal prosecutions of financial institutions over the past 6 years. These civil and criminal enforcement actions reveal not only how illicit financiers abuse our banking system, but also how compliance with our anti-money laundering and counter-terrorist financing and sanctions requirements is critical to protecting our financial system from such abuse.

Improving Our AML/ CFT Regime

These cases also point to significant vulnerabilities in the framework and enforcement of anti-money laundering and counter-terrorist financing requirements that require immediate attention.

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 29

Treasury is working together with its interagency partners and the private sector to better understand the anti-money laundering and counter-terrorist financing and compliance challenges faced by financial institutions, clarify U.S. government expectations of financial institutions, and strengthen the overall anti-money laundering and counter-terrorist financing regulatory regime.

I will briefly outline just a few of our efforts. Ongoing Targeting of I llicit Actors

One of the most important activities for which my office is responsible is the listing of illicit actors on OFACs SDN list.

As banks and financial institutions screen their business dealings against the sanctioned entities on this list, they are able to prevent the entrance of terrorist funds, drug-trafficking proceeds or other illicit money into our formal financial system, or freeze transactions by designees where they occur. All major global banks, and many smaller foreign ones, screen transactions against the OFAC list to protect themselves, even though they are not required to do so. This markedly amplifies the impact of our sanctions by preventing the movement of illicit funds by terrorists, organized crime figures or proliferation networks outside of U.S. jurisdiction. We watch closely for illicit actors evading anti-money laundering and counter-terrorist financing controls at banks in the U.S. and abroad and for their attempts to seek back door entry into the financial system, including through the various evasive tactics evident in the cases described above.

Customer Due Diligence Advance Notice of Proposed Rulemaking

Customer due diligence, and the financial transparency it facilitates, is central to our efforts to combat all manner of illicit financial activity, from

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 30

proliferation and terrorist financing to more traditional forms of financial crime like money laundering and securities fraud.

Treasury issued an Advance Notice of Proposed Rulemaking (ANPRM) on March 4 to clarify , consolidate and strengthen customer due diligence requirements for financial institutions, including an obligation to collect beneficial ownership information. This rulemaking will improve financial institutions ability to detect suspicious activity and provide more useful information to law enforcement. The comment period for the ANPRM closed on June 1 1 and Treasury will hold the first in a series of public hearings to collect additional comments on July 31. Our engagement with industry in the customer due diligence rulemaking process is facilitating a broad understanding of higher risk type accounts and transactions with respect to money laundering and terrorist financing, and how we can work with industry and our interagency partners to better identify and manage such risks, including through more effective anti-money laundering and counter-terrorist financing safeguards.

Enhancing Transparency in the Company Formation Process

Criminals can easily disguise their ownership and control of illicit proceeds through shell companies and other seemingly impenetrable legal structures. We are working closely with you, Mr. Chairman, and other members of Congress to enact legislation requiring disclosure of beneficial ownership information in the company formation process.

Promoting and Strengthening the Global AML/ CFT Framework

Helping to strengthen anti-money laundering and counter-terrorist financing regimes abroad has a direct benefit to the safety and integrity of the U.S. financial system, given the global nature of money laundering

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 31

and the terrorist financing threat and the relationships between banks abroad.

The Office of Terrorism and Financial I ntelligence (TFI) works with others in the U.S. government to strengthen the global anti-money laundering and counter-terrorist financing framework as a foundation for the effective implementation of sound financial controls worldwide. Several intergovernmental and international organizations, such as the Financial Action Task Force, the I MF, the World Bank, the United Nations, and various FATF-style regional bodies, collectively develop, assess and facilitate jurisdictional implementation of measures that are essential to combating various forms of illicit finance. Treasury and its interagency partners play a key leadership and participatory role in these organizations as well as other organizations that support our capacity building objectives, lending technical expertise in standard-setting, evaluation and policy recommendations related to the combating of money laundering, terrorist and proliferation financing. One of the key substantive accomplishments that we have achieved in developing the global anti-money laundering and counter-terrorist financing framework is to integrate targeted financial sanctions against terrorist financing and proliferation finance into the global standards for combating money laundering. This is some of the most innovative work my office conducts and an area in which we are able to urge the international community forward in highly constructive ways.

Conclusion

I began todays testimony by noting that the U.S. is home to one of the strongest anti-money laundering and counter-terrorist financing systems in the world.

In order to continue in this role, we must push ourselves to identify where we can do better, and work tirelessly to get there.

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 32

I look forward to continuing work with this committee to this end. Thank you.

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 33

NUMBER 3

FI proposes higher requirements for the banks liquidity buffers

Sweden shall act ahead of the EU and introduce quantitative requirement s regardin g the ban ks liqu idit y bu ffers .

The aim is to ensure that large banks and credit institutions hold sufficient liquid assets to be able to manage short periods without access to market funding. This is proposed by Finansinspektionen in a new regulation. *** Finansinspektionen proposes quantitative requirements regarding the liquidity buffers held by large banks and credit institutions. To further contribute to a stable and smoothly-functioning financial system Finansinspektionen also wants the levels of the liquidity buffers to be made public. The requirement for a liquidity coverage ratio means that a banks liquid assets must manage outflows over a period of 30 days of market stress. The requirement is based on guidelines from the international Basel Committee on Banking Supervision regarding a Liquidity Coverage Ratio (LCR), which are planned to be introduced within the EU during 2015. The requirement to hold a liquidity buffer includes rules regarding when the buffer can be used. It is proposed that banks under stress that affects liquidity are not required to meet the liquidity coverage ratio.

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 34

The companies affected are those with a balance-sheet total as of 30 September of the previous year that is higher than SEK 100 billion.

The proposal applies to financial groups on group-level and is not applied to individual companies that are part of a group. At present, eight companies in Sweden would be covered by this regulation. The proposal will come into force on 1 January 2013.

About Finansinspektionen

The Swedish Financial Supervisory Authority, Finansinspektionen, is a public authority. Our role is to promote stability and efficiency in the financial system as well as to ensure an effective consumer protection. We authorise, supervise and monitor all companies operating in Swedish financial markets. Finansinspektionen is accountable to the Ministry of Finance. We supervise 3,900 companies - Banks and other credit institutions - Securities companies and fund management companies - Stock exchanges, authorised marketplaces and clearing houses - Insurance companies, insurance brokers and mutual benefit societies

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 35

NUMBER 4

Building deeper economic union: what to do and what to avoid

Speech by Jrg Asmussen, Member of the Executive Board of the ECB, Policy Briefing at the European Policy Centre, Brussels, 17 July 2012 Ladies and gentlemen, The crisis has made us all a few experiences richer.

The question is whether we can draw the right lessons from those experiences.

After all, experience is the name everyone gives to their mistakes [Oscar Wilde]. And there have been a few mistakes in the way economic policies and governance were managed inside monetary union. Policies and governance clearly needed to be strengthened. What is less clear is how best to do it. What to do and what to avoid is what I would like to discuss today. Thanks for inviting me to share my thoughts with you here at the European Policy Centre. Without a doubt: over the past two years, much has happened in the field of economic governance. There have been a lot of proposals; the number of suggested Pacts, Compacts, Agreements and Treaties is almost inflationary.

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 36

We are having a healthy debate about the future of EMU. But it is not only talk.

The report Towards a genuine Economic and Monetary Union presented to the June European Council by the four Presidents van Rompuy, Barroso, Juncker and Draghi sets out a shared vision for EMU over the next decade. Its content will be fleshed out over the coming months. But the devil is, of course, in the detail. Let me structure my thoughts around three main themes:

Are we on the right path with the reforms so far? Are we tackling the right issues with reflections currently underway? What does this imply for the ECB?

1. Are we on the right path with the reforms so far?

Here in Brussels, much of the attention is naturally focused on European institutions and processes. But we should not deceive ourselves: The proper management of euro area economy needs both EU and national action. Any governance process at European level is only as good as its record of actual application. That needs determined action by those responsible at the EU level notably the Commission and the Council. And of course, implementation at national level.

On paper, significant progress has been achieved at EU level with the six pack, the Fiscal Compact and the 2012 European Semester.

This package of reforms has the potential to fundamentally change the way we conduct mutual surveillance.

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 37

Common oversight of national economic policies is broader and more intrusive.

Take the Commissions in-depth studies which revealed the existence of various degrees of imbalances in 12 countries. Or the new more automatic decision-making rules, in particular the new comply or explain procedure for the Commissions country-specific recommendations. These were all premieres.

This procedure puts a great responsibility on the Commission to present accurate recommendations.

It also reinforces the collective responsibility of the Council. Last but by no means least, the European Parliament introduces a degree of openness into the policy discussion. It has conducted two economic dialogues with national finance Ministers. Our democracies require and deserve this additional layer of common public scrutiny of the economic policies. So far, so good. But none of this is worth the great fanfare, if it remains without consequences. Member States have to address the identified problems through determined reforms. Unfortunately, the past track record of implementation of recommendation has not been very good in this regard. Many Member States accumulated large fiscal and economic imbalances. Essential structural reforms had been postponed because of resistance of vested interests. The political costs were seen as too high, and the pressure from the EU level as too intangible.

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 38

Multilateral efforts, such as the Lisbon Strategy or the Europe 2020 programme have been not effective in stimulating reforms.

Why was this? I see two main weaknesses:

First, excessive politeness and the principle of non-intervention. Second, a misunderstanding of the principle of equal treatment. Let me take them in turn.

Much has been written about the excessive politeness and the culture of non-intervention among Ministers. And, indeed also on pre-emptive obedience on the part of the Commission when presenting its proposals and recommendations. But this lack of peer pressure among decision-makers has real costs as we had to learn painfully during this crisis. And, it seems, the lesson still has not been learnt completely: deadlines for the correction of excessive deficits are being relaxed; the corrective tools that are available even under the new procedures, are simply not being used as the cases of Spain and Cyprus in the recently conducted macroeconomic imbalance procedure illustrate. If mutual surveillance is meant to be effective, this needs to change. Second, differentiation among countries is still largely a no-go area in economic surveillance. And this despite the fact that the crisis has amply demonstrated the detrimental effect of excessive divergence and heterogeneity. Countries are different.

The severity of imbalances varies, and so does the urgency to address those vulnerabilities.

They need to be treated differently under the governance procedures. It is self-defeating to treat all countries similarly, for sake of alleged consistency, equal treatment or avoidance of stigma effects.

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 39

We all know that inappropriate policies in some euro area countries create negative externalities for the rest of the monetary union.

And we cannot afford to allow some euro area countries to run policies which create a burden on others and destabilise the whole of EMU. This begs the most important question in the debate: Are we at the end of the road with EU coordination? Do we need a qualitative leap forward?I s it time for a transfer of competencies to the European level? This leads me to my second point:

2. Are we tackling the right issues in the ongoing reflections?

The report Towards a genuine Economic and Monetary Union presented to the June European Council provides an answer to this question implicitly. The report recognises that we are at a crossroads and states upfront: national policies cannot be decided in isolation if their effects quickly propagate to the euro area as a whole [and that] there have to be ways on ensuring compliance when there are negative effects on other EMU members.

The vision for the future of EMU is built around four building blocks: integrated financial market, budgetary and economic policy frameworks as well as strengthened democratic legitimacy and accountability.

This is very much what we at the ECB had been suggesting, motivated by three reasons:

First, a shared vision of EMU ten years down the road will anchor expectations. The euro is here to stay. This should mitigate doubts about the survival or integrity of our currency. It is a clear signal to the markets: underestimate the degree of political commitment to the single currency at your own risk.

Second, the four building blocks present a holistic view. Policy-makers have understood that the time for partial solutions,

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 40

for tinkering at the edges, is over. Muddling through, with hesitant and incomplete steps at each and every summit, will no longer do the trick. Progress needs to be achieved on all four fronts.

Third, it is acknowledged that euro area countries need a strong institutional framework which is commensurate with their high degree of economic and financial interdependence. The problems in Greece did not spill-over to its geographically closest EU neighbours in south-eastern Europe. The contagion channel from Greece did not lead to Bulgaria or Romania but the western Mediterranean were affected. The deeper union in the euro area is necessary and is not in contradiction with the process of integration among all 27 EU Member States.

This longer-term vision has now to be turned into a fully-fledged roadmap. Matters are moving forward, in a very concrete manner, especially with regard to the creation of a financial market union with a unified supervisor, involving the ECB. This brings me to my third point:

3. What does it imply for the ECB?

The Commission will present proposals on the basis of Article 127(6) after the summer. Naturally, also the ECB Governing Council has started its own reflections. But here again, there are things to do, and things to avoid. The ECB stands ready to play a role of supervisor for the banks of the euro area as requested. But it is of utmost importance that this framework allows the ECB to act with effectiveness, independence and without risks to its reputation.

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 41

We will need strict arrangements to safeguard the independence of the ECBs monetary policy.

Moreover, with the new tasks, higher standards of democratic accountability will have to be fulfilled. We are fully aware of that and stand ready to satisfy them. Carrying out of the new supervisory task will be challenging. But its implementation will be greatly facilitated by the fact that the ECB can count on the central banks of the Eurosystem. Most of them are already responsible for banking supervision in their own countries and have a full wealth of expertise and knowledge. To say that the task ahead is complex is probably the understatement of the year. But we have to get it right. Even if it means that we need more time. Let me also stress that unified supervision is only the starting point of a financial market union.

The latter should also provide for common mechanisms to resolve banks and to guarantee customer deposits.

This is necessary to break the vicious circle between banks and sovereigns which is at the source of the fragility of the euro area financial system. You are surely aware of the public debate about banking union that is currently raging: we see open letters by economists for example, which can be very influential on the public at large. Although it is not always clear, if these academics are aware of the responsibility they have in public debate, because they seem to either deliberately or light-heartedly blur the facts and play with clichs. The steps we are about to take are very significant. This is why it is good to have this debate.

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 42

But there should be no hesitation that ultimately we need to take those steps.

This leads me to my conclusion.

4. Conclusion

The core of the current debate about the future of economic union has a name: the further sharing of sovereignty. It means endowing the euro area with the power to effectively prevent and correct unsustainable policies in every euro area Member State.

Concretely, this would imply that a euro area authority would have competence to limit countries ability to issue debt and have intervention rights into national budgets, and to compel Member States to correct their policies, be that in the fiscal, structural and financial fields.

Intervention rights into national policies would be confined to cases where policies substantially deviate from agreed reform commitments and pose a serious risk to the smooth functioning of the EMU. Those powers would have to be strongly legitimised.

Whatever we do as further integrative steps, we need to strengthen democratic legitimacy.

Deeper euro area integration can only be sustainable with corresponding progress on democratic legitimacy and accountability. Incidentally, it should not be the central bank that continuously emphasises this point. Already now, steps could be taken to better involve the national parliaments.

Domestic parliamentary debate and political decision-making needs to internalise what it means to be part of monetary union.

If one looks at any of the national media, and the discourse of the domestic debates, one can see how sorely this is missing. EU recommendations are often perceived as a Brussels diktat.

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 43

This must be overcome.

One idea to ensure that would be for the Commission to present the country-specific policy recommendations to national parliaments and social partners. This would foster a political debate and national ownership. Another one would be to disentangle more clearly in communication that reform requested by Brussels are actually improving social justice, for example, more efficient tax system, or the end to rent-seeking by vested interests. Those policy prescriptions are not only about austerity, which gives them a negative connotation. When governments implement the Commission recommendations they do this not only to comply with Brussels but for the good of their own countries. Ladies and Gentlemen, Thank you very much for your attention. I look forward to a stimulating debate.

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 44

NUMBER 5

Important parts from an interesting speech. Does the Dodd-Frank regulatory regime go too far?

Remarks at Society of Corporate Secretaries & Governance Professionals, 66th National Conference on

The Shape of Things to Come

By Commissioner Troy A. Paredes, U.S. Securities and Exchange Commission, Washington, D.C. Thank you for the kind introduction. I am pleased to join you at this years National Conference of the Society of Corporate Secretaries & Governance Professionals. Before saying anything else, though, I d like to remind you that the views I express here today are my own and do not necessarily reflect those of the Securities and Exchange Commission or my fellow Commissioners. In considering the shape of things to come the theme that focuses this conference one thing is certain:

The regime regulating our financial markets is undergoing dramatic change.

The case in point is the Dodd-Frank Act, which represents a historic exp ansion of the federal gov ernme nt s power over t he econ omy .

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 45

The hundreds of rules and regulations that Dodd-Frank demands of the SEC and other financial regulators indicate just how far the government has reached into the private sector and just how heavy the governments hand will be.

Or, stated differently , the regulatory change demonstrates the degree to which government decision making, effectuated as it is through more regulation, will displace and distort private sector decision making. To put it more directly, I have been and remain troubled that the Dodd-Frank regulatory regime goes too far.

Without question, there is a fundamental role for government, including the SEC, in regulating our financial markets and our economy more generally; and we need a regulatory framework that is resilient and that fits our increasingly interconnected and complex financial system.

None of us welcomes the kind of hardship and turmoil that the financial crisis wrought. The key question, therefore, is not whether we will or should have regulation. The answer to that question is straightforward: we will and we should.

The real question is, How much?

When it comes to the question of How much?, I am concerned that the present wave of regulation will prove to be excessive, unduly burdening and restricting our financial system and suppressing private sector innovation, entrepreneurism, and competition at the expense of our countrys economic growth and global competitiveness. My concern that we are overregulating is accentuated when instead of evaluating each rule and regulation one-by-one, the totality of the regulation that the private sector must bear is added up. As regulatory mandates mount, I worry that the cumulative impact of the aggregation of rules and regulations will make it more difficult for companies to raise capital and to manage their risks effectively; will make it more costly for individuals to borrow when they need to; will stifle the cutting-edge innovation that we depend on to drive our economy forward;

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 46

will leave investors with fewer valuable opportunities for building their wealth; and will undercut job creation.

All of which is to say that in thinking about the future, a great deal will turn on how financial regulators craft and implement the financial regulatory regime. The SEC, for example, still has many choices to make as the agency determines the scope and nature of securities regulation, whether it is pursuant to our rulemaking obligations under Dodd-Frank or otherwise. Notwithstanding how far-reaching the sweep of Dodd-Frank is, not everything on the Commissions regulatory agenda flows from the legislation. As the Commission continues fashioning the securities law regime, there will undoubtedly be disagreements over policy from time to time over what shape the regime ought to take. Whatever the policy differences might be, however, there should be widespread agreement over this: That the agencys decision-making process needs to be robust; that the Commission needs to be thorough and even-handed in assessing the potential consequences of our options; that we need to carefully evaluate whether the intended goals of our actions will be achieved; and that we need to identify and give due regard to the possible undesirable effects and unintended consequences of our choices. In other words, the SEC must engage in rigorous cost-benefit analysis rooted in economics and the available data when fashioning the securities law regime. Simply put, by obligating us to justify our actions, cost-benefit analysis is an argument for regulatory decision making that fully accounts for both the good and the bad that nets the costs against the benefits to ensure that we have smart regulation that advances the SECs mission to protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation.

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 47

Accordingly, I am pleased that the SECs Division of Risk, Strategy, and Financial Innovation and Office of the General Counsel have worked together to develop new guidance for performing economic analysis in the agencys rulemakings.

The guidance marks significant progress toward improving the analysis that underpins the Commissions decisions. As the guidance itself puts it: High-quality economic analysis is an essential part of SEC rulemaking.

It ensures that decisions to propose and adopt rules are informed by the best available information about a rules likely economic consequences, and allows the Commission to meaningfully compare the proposed action with reasonable alternatives, including the alternative of not adopting a rule.

The Commission has long recognized that a rules potential benefits and costs should be considered in making a reasoned determination that adopting a rule is in the public interest. ****

The wide range of topics this conference is addressing reflects just how much is on your minds and remains unsettled.

At least part of the changing regulatory landscape that companies and their investors are encountering stems from several new rules that the SEC has adopted over the past few years. The practical impact of these regulatory developments including everything from new corporate governance disclosures; to affording shareholders an opportunity to propose proxy access bylaws; to instituting bounties for whistleblowers will continue to play out. In addition, the SEC has announced that next month the Commission is scheduled to consider final rules regarding conflict minerals pursuant to Section 1502 of Dodd-Frank and regarding resource extraction pursuant to Section 1504 of Dodd-Frank, as well as rules required by the J OBS Act to eliminate the prohibition against general solicitation and general

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 48

advertising in securities offerings under Rule 506 of Regulation D and Rule 144A.

Perhaps more than any other aspect of corporate governance, attention and sometimes controversy seems to center on how management gets paid and on the sums that executives take home. So, since I cannot cover everything, let me focus some additional thoughts on executive pay something that Dodd-Frank addresses in several ways. How executives are paid influences how they behave. Executive behavior reveals itself in how the company evaluates risk; in whether the management team is too timid or, by contrast, overconfident in pursuing new growth opportunities; in the extent to which innovation and entrepreneurism are rewarded; and in the extent to which the corporate culture emphasizes ethics, legal compliance, and personal responsibility. As you know, among what Dodd-Frank provides for is a mix of SEC rulemakings addressing executive compensation. The Commission has already adopted final rules providing for so-called shareholder say-on-pay; for shareholder approval of certain golden parachutes; and for new compensation committee listing standards. Other Dodd-Frank rules are still to come. In particular, Dodd-Frank directs the agency to adopt rules regarding the clawback of incentive compensation that was awarded to executives based on erroneous data, as evidenced by a companys financial restatement; and the Commission is obligated to adopt new disclosure requirements regarding (1)Executive pay as compared to the firms financial performance, (2)The ratio of the median annual total compensation of the issuers employees (excluding the CEO) to the CEOs annual total compensation, and (3) Employee and director hedging of the value of the issuers stock.

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 49

With these provisions in mind especially the clawback and the CEO pay ratio disclosure I want to share three sets of observations that express some of my take on executive pay and on the considerations that I think should inform the policy judgments that will be made.

First, regulation needs to be workable in practice for those who have to comply with it. This seems to be a particular concern when it comes to the CEO pay ratio disclosure. Having to compile extensive data for their employees in the U.S., let alone around the globe, and then ensure that the data is standardized so that the ratio can be calculated would seem to present significant practical difficulties that could be quite costly for companies. In my view, due consideration will need to be given to alternative approaches to the rule that could advance the goal of providing investors with material information about CEO pay but in a way that does not impose excessive obligations on companies that yield little marginal benefit. Second, to anticipate the consequences of any new regulation, one has to consider how the regulatory developments might affect the incentives of boards, senior executives, and shareholders. Some of the effects may be undesirable. For example, what steps might a company take to lower the multiple of the CEOs pay as compared to the median compensation of the other employees? How, if at all, might an issuers efforts to manage the ratio impact how the business is structured and operated? Might a CEO come to believe that he is underpaid because the multiple of his compensation to the median employee compensation is lower for him than for his peers at other companies? Lets also consider Section 954 of Dodd-Frank, the clawback provision. Section 954 provides for the clawback of certain incentive compensation, including stock option awards.

I nternational Association of Risk and Compliance Professionals (I ARCP) www.risk-compliance-association.com

P a g e | 50

More specifically, the statutory provision requires companies that trade on an exchange to claw back incentive compensation from any current or former executive officer who erroneously received incentive compensation during the three years before the company is required to restate its financials, if such a restatement is required.