Professional Documents

Culture Documents

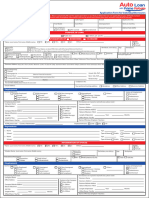

Psbank Auto Loan With Prime Rebate Application Form 2019

Uploaded by

jim pobleteOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Psbank Auto Loan With Prime Rebate Application Form 2019

Uploaded by

jim pobleteCopyright:

Available Formats

Application Form for Individual Borrowers

Thank you for taking interest in PSBank’s Auto Loan. Please completely fill out this application form or put N/A on fields that are not applicable to you. All fields marked with asterisk

(*) are mandatory fields. Application with incomplete information will not be processed. Please print your answers using BLACK ink only.

Date of Application Dealer Sales Agent Branch Application No.

Brand Year Model Cash Price Downpayment Term (in months)

Model Type of Vehicle Amount Financed Add-on Rate (AOR)

Brand New Used Reconditioned

PURPOSE OF LOAN

Personal Business Public Use Others, pls. specify

INFORMATION OF BORROWER CO-MAKER

*Name (Last name, First name, Middle name) Mr. Ms. Mrs. Sr. Jr. Others Gender

Male

Female

*Nationality Residency *Birthdate (mm/dd/yy) Age *Birthplace

Filipino Resident (e.g. Filipinos, sea-based OFWs, Aliens with ACR or Special Retirement Visa ID, etc.)

Others Non-Resident (e.g. Aliens, Filipino immigrants, land-based OFWs with contract to work abroad for more than a year, etc.)

Educational Attainment Civil Status *Tax identification No. SSS / GSIS No. If co-maker, pls. specify relation to

Elementary High School Vocational Single Legally Separated Principal Applicant

College Undergraduate Postgraduate Married Widow / Widower

*Present Address (House No./ Floor/ Unit No./ Block No./ Lot No./ P.O. Box No./ Bldg./ Apartment Name/ Street Name/ Village/ Subdivision/ Phase/ Barangay/ Barrio/ Municipality/ Province/ City/ Zip Code/ Country)

*Previous Address (House No./ Floor/ Unit No./ Block No./ Lot No./ P.O. Box No./ Bldg./ Apartment Name/ Street Name/ Village/ Subdivision/ Phase/ Barangay/ Barrio/ Municipality/ Province/ City/ Zip Code/ Country)

Home Ownership

Owned

Mortgaged to Term Amort./Mo. PhP Length of Stay

(Bank or Financial Institution)

Rented from Rent / Mo. PhP Years

(Landlord’s Name and Contact No.)

Living with Parents / Relatives Relationship Months

(Names)

*Residential Telephone No. *Cellphone No.

(For non-Metro Manila, please indicate the area code)

*Email Address Your preferred mailing address: Residence Office Address Business Address

Employment

Source of Income Status of Employment

Locally Employed OFW Immigrant OFW Non-Immigrant Unemployed Others Permanent

Private Private Private Remittance / Allottee

Probationary

Government Government Government Pension / Retired

Self-employed Self-employed Self-employed Student Contractual

If employed, please state: If in business or in practice of profession, please state:

Company Name Business Name

Office Address Position in the Company Business Address

Non-Officer

Business Website Address

Company Website Address Jr. Officer

Nature of Business / Work

Nature of Business Supervisor

Job Title Middle Manager Length of Operation Years Months

Length of Stay Years Months Sr. Officer Office Phone / Fax No.

Office Phone / Fax No. Name of Previous Employer / Business

If OFW, please state: Country of destination Employment base: Land Sea Air

Dependents

1. Name Age Level

School Type of School Public Exclusive Private Coed

2. Name Age Level

School Type of School Public Exclusive Private Coed

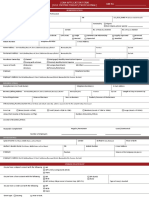

INFORMATION OF SPOUSE

*Name (Last name, First name, Middle name) Mr. Ms. Mrs. Sr. Jr. Others Gender

Male

Female

*Maiden Name (Last name, First name, Middle name) *Nationality *Birthdate (mm/dd/yy) Age *Birthplace

Filipino

Others

Educational Attainment Civil Status *Tax identification No. SSS / GSIS No.

Elementary High School Vocational Single Legally Separated

College Undergraduate Postgraduate Married Widow / Widower

Employment

Source of Income Status of Employment

Locally Employed OFW Immigrant OFW Non-Immigrant Unemployed Others Permanent

Private Private Private Remittance / Allottee

Probationary

Government Government Government Pension / Retired

Self-employed Self-employed Self-employed Student Contractual

If employed, please state: If in business or in practice of profession, please state:

Company Name Business Name

Office Address Position in the Company Business Address

Non-Officer

Business Website Address

Company Website Address Jr. Officer

Nature of Business / Work

Nature of Business Supervisor

Job Title Middle Manager Length of Operation Years Months

Length of Stay Years Months Sr. Officer Office Phone / Fax No.

Office Phone / Fax No. Name of Previous Employer / Business

STATEMENT OF INCOME AND EXPENSES*

Borrower Spouse Total

Gross Monthly Income PhP PhP PhP

Gross Monthly Expenses PhP PhP PhP

Net Monthly Income PhP PhP PhP

STATEMENT OF ASSETS AND LIABILITIES*

ASSETS Details (Name of Bank, Etc.) / Type / Description Amount / Estimated Value

Cash on Hand & with Banks PhP

Real Estate Property/ies PhP

Motor Vehicle/s PhP

TOTAL ASSETS PhP

LESS: LIABILITIES Type Bank Amortization Outstanding Balance

Personal / Salary Loan PhP PhP

Loans Car Loan PhP PhP

Housing Loan PhP PhP

Credit Card Credit Card Number Expiry Date Credit Limit Outstanding Balance

Company

Credit Card PhP PhP

PhP PhP

TOTAL LIABILITIES PhP

NET WORTH PhP

*as required by the Bangko Sentral ng Pilipinas under BSP Circular 622

PERSONAL REFERENCES

Name Address Contact Number

CREDIT / BANK REFERENCES

Bank Type Account No. Monthly Amortization Outstanding Balance Maturity Date

SOURCE OF PRODUCT INFORMATION DO YOU HAVE A RELATIVE WORKING IN PSBANK?

How did you learn about PSBank Auto Loan? Yes No

TV / Radio Website Flyer / Poster / Streamer Newspaper / Magazine Direct Mail If yes, please state:

PSBank Personnel Name

PSBank Client Name Name

Agency Name

Relation

Others, pls. Specify

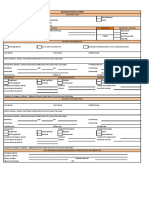

HIGHLIGHTS OF TERMS AND CONDITIONS

Product Features - PSBank Auto Loan with Prime Rebate is a Term Loan facility. FEES AND CHARGES

Loan Range: Minimum of PhP100,000 for brand new cars / Minimum of PhP300,000 for 2nd hand units.

Terms: 12 to 60 months A.) BOOKING FEES AND CHARGES:

CHATTEL MORTGAGE FEES + INSURANCE + OTHER CHARGES (RD Registration (out of town) fee + LTO

Interest Rate: Based on prevailing interest rate at time of loan booking. Encumbrance (out of town) fee)

Prime Rebate Feature: Allows clients to get a “discount” on his/her loan when he/she makes advance or

excess payments on his/her monthly due. B.) POST-BOOKING FEES AND CHARGES:

DUE DATE EXTENSION FEE Due date extension fee is computed as:

Examples: (accrued interest from old due date to new due date) Outstanding Balance x Rate x number of days / 360

Advance Payment - When client pays five days before his/her loan’s monthly due date, he/she earns a

rebate on a daily basis from the day his/her payment was posted to the day before his/her loan’s due SERVICE FEE FOR CERTIFICATE OF A certification fee of PhP50 shall be charged plus a notary fee of

date. ENCUMBRANCE FOR LTO REGISTRATION PhP300 if Certificate of Encumbrance for LTO registration is

notarized.

Excess Payment - When a client pays in excess of the amount required on his/her due date, he/she will PROCESSING FEES FOR CHANGE OF -PhP5,000 shall be charged for amendments or change of

earn a rebate on a daily basis from the date of posting. COLLATERAL AND CONVERSION OF UNIT collateral.

TO PUV -PhP10,000 shall be charged for conversion of unit to PUV.

Events of Default – Each or any of the following shall constitute an event of default. LATE / NON-SUBMISSION FEE ON PhP2,500 shall be charged for late / non-submission of

a.) Client fails to pay the amortization amount and interest due; INSURANCE POLICY RENEWAL insurance policy renewal document.

b.) Client violates any of the T&C of the agreement;

c.) Client refuses to deliver the foreclosed property to the Bank; COLLECTION FEE IN CASE OF DEFAULT A collection fee amounting to 3% of the monthly installment or

d.) Client fails to register the motor vehicle with the LTO; amount due shall also be charged in case of default.

e.) Lost, destroyed, damaged or change in form and use of mortgaged property. 5% per month or a fraction thereof shall be added on each

The property/ies mortgaged shall be deemed lost if Client fails to give additional LATE PAYMENT PENALTY FEE unpaid installment from its due date until fully paid.

security (in lieu of the damages, etc. on the property/ies) to the Bank.

In case of default and no legal action is filed, borrower shall pay an

Consequences of Default – In case of default, the Bank may, without need of notice or demand, exercise additional sum equal to 10% of the amount due as attorney’s fees.

any or all of the following remedies. ATTORNEY'S FEES AND LIQUIDATED In case of litigation, borrower shall pay an additional sum equal to

a.) Cancellation of the Contract of Sale; DAMAGES 25% of all amount outstanding as attorney’s fees and the further

b.) The whole amount remaining unpaid including (interest, fees and charges) sum of 20% as liquidated damages, in addition to cost and other

shall immediately become due and payable; expenses of litigation.

c.) Extrajudicial /Judicial foreclosure; NOTARY FEE FOR RELEASE OF CHATTEL A notary fee of PhP300 shall be charged for the release of

d.) Exercise the right to offset and/or legal compensation; MORTGAGE Chattel Mortgage.

e.) Deliver the mortgaged property to the Bank, at Client’s own expense;

f.) In case of breach of the Terms & Conditions client expressly waives the term of 30 days PRE-TERMINATION CHARGES / FREE OF CHARGE

as the period which must elapse before the Bank shall foreclose the mortgage. EARLY SETTLEMENT FEE

Customer Complaints, Concerns and Other Queries - In case of complaints, concerns and other A fee of PhP1,000 shall be charged if collateral loan document/s

SAFEKEEPING FEE is/are unclaimed after 90 days to 120 days from loan closure date. An

queries regarding PSBank Auto Loan with Prime Rebate, the Client may contact the Bank's 24/7 additional fee of PhP500 shall be charged for every 30 days

Customer Experience Hotline at (02)845-8888; text (63)998-8458888; or e-mail at exceeding the 120-day period.

customerexperience@psbank.com.ph. The Client can also get in touch with the Bank via the

PSBank LiveChat by visiting www.psbank.com.ph. Note: All aforesaid fees and charges will take effect immediately and may be cancelled or modified anytime at the Bank’s sole

discretion. The Bank may impose other fees and charges incidental to the loan provided with prior notice to Client.

CLIENT’S CONSENT/AUTHORITY AND WAIVER OF CONFIDENTIALITY/PRIVACY OF PERSONAL AND OTHER INFORMATION FOR THE BANK’S LEGITIMATE

PURPOSES/NEEDS, AND TERMS AND CONDITIONS OF LOAN APPLICATION/APPROVAL

1. The undersigned loan applicant/borrower (hereinafter the “Client” regardless of number) certifies the correctness 1. Bank Deposits), RA No. 6426 (The Foreign Currency Deposit Act), RA No. 8971 (General Banking Law of 2000),

The undersigned loan applicant/borrower (hereinafter the “Client” regardless of number) certifies the correctness of RA No. 10173 (Data Privacy Act of 2012), or all other applicable laws, which may be in conflict with the Bank

all the personal, sensitive, privileged, financial, and other information (collectively referred to hereinafter as in carrying out the said authorities.

“Information”) provided by him in this Auto Loan Application Form, and in the course of his loan application with

Philippine Savings Bank (the “Bank”), including the information which may be obtained from his income tax returns, 3. The Client understands that the Bank may disapprove his loan application, revoke prior loan approvals, or

financial statements, credit transactions and all other documents (”Supporting Documents”) submitted to the Bank terminate existing loan availments on the ground of misrepresentation and/or concealment of the Client’s

in support of his loan application. Information, whether willful or not, without prejudice to any other legal remedies that the Bank may take.

2. In providing the Information and related Documents to the Bank, the Client hereby authorizes the Bank, without 4. The Client understands that the approval of his loan application shall be at the sole discretion of the Bank,

need of prior notice, to use, process, store, make profile, receive from, and/or share to any of its affiliates and/or and subject to:

subsidiaries within the Metrobank Group, or its agents or service providers, or third parties (including but not a) The Bank’s existing credit policies and procedures on its Auto Loan Facility;

limited to vendors and credit bureaus), whether in or outside the Philippines, which provide related services or b) Existing rules and regulations of the Bangko Sentral ng Pilipinas;

have contractual obligations with the Bank, or any government agency/regulatory body/branch (including but not c) Payment by the Client of all fees and charges relative to the processing of his loan application;

limited to Bangko Sentral ng Pilipinas, Anti-Money Laundering Council, and Credit Information Corporation), which d) Submission by the Client of all documentary requirements and compliance with all other

in turn is/are authorized to disclose to and/or receive from the Bank, the Information, relevant account conditions imposed by the Bank for the approval of his loan application as prescribed under

information/data/opinion pertaining to the Client, and any and all other information pertaining to Client’s existing Bank credit policies or those that may be prescribed by the Bank’s Legal Department;

account/s now existing or which may hereafter to be opened, whether or not secured and/or assigned as collateral, e) The terms and conditions of the Loan/Mortgage Agreement and this Loan Application Form.

for the following purposes: (a) in order to commence and facilitate the efficient delivery, administration, operation,

and/or implementation of loan and other products and services of the Bank; (b) for the protection of the Client or In case of disapproval of the Client’s loan application, the Bank shall not be obliged to disclose the reason/s for

the Bank against fraudulent, unauthorized, or illegal transactions; (c) in the validation, verification, and/or such disapproval.

updating of the Information and related Documents; (d) in order for the Bank to enforce its rights or perform its

obligations by reason of any law, rules and regulations, contract, or orders from any court or quasi-judicial and 5. The Client authorizes the Bank to send updates about the Client’s loan application via SMS/text, email, mail

administrative offices with corresponding duty to keep such information confidential in accordance with the or other means of communication.

Bank’s Data Privacy Policy; (e) in the prosecution or defense of the Bank or its directors/officers/employees with

regards to disputes or claims pertaining to the products and services of the Bank; and (f ) in order for the Bank, its 6. The Client‘s loan application may be withdrawn or cancelled at any time prior to booking, without incurring

affiliates and/or subsidiaries within the Metrobank Group to offer or provide other related products and services to additional charges. The Client shall course all complaints or concerns, if any, at the Bank’s Customer Experience

the Client, including but not limited to cross-referencing, cross-selling, status inquiry, making credit opinion and Group or Indirect Auto Loans Channel Department.

evaluation. The consent and authorization of Client shall remain valid and subsisting unless otherwise revoked or

cancelled in writing. 7. The Loan Application Form and all Supporting Documents shall remain the Bank’s property and the same

may be used in accordance with the above-mentioned paragraph no. 2 of the terms of this Auto Loan

In granting the above authorities, the Client hereby waives its/his rights to confidentiality and privacy of the Application Form at the Bank’s discretion whether the loan is granted or not.

Information and such other rights as may be provided under Republic Act (RA) No. 1405 (Law on the Secrecy of Form at the Bank’s discretion whether the loan is granted or not.

Signature of Principal Borrower / Co-Maker Date Automatic Debit Arrangement Account Number

Signature Verified, Authenticated, Approved by:

Signature of Spouse Date

Rev. January 2019

You might also like

- Purpose of Loan Information of Borrower Co-MakerDocument2 pagesPurpose of Loan Information of Borrower Co-MakerSophia GonzalesNo ratings yet

- Auto Loan Application Form - IndividualDocument2 pagesAuto Loan Application Form - IndividualKlarise EspinosaNo ratings yet

- New Auto-Loan-Application-Form - IndividualDocument2 pagesNew Auto-Loan-Application-Form - IndividualRheneir MoraNo ratings yet

- PSBank Auto Loan With Prime Rebate FormDocument2 pagesPSBank Auto Loan With Prime Rebate FormMark Anthony Carreon Malate100% (1)

- PSBank Auto Loan Application Form - IndividualDocument2 pagesPSBank Auto Loan Application Form - IndividualJp Dela CruzNo ratings yet

- BDO Auto LoanDocument2 pagesBDO Auto LoanRalph Christian Lusanta FuentesNo ratings yet

- Employee Loan ApplicationDocument2 pagesEmployee Loan Applicationdexdex110% (1)

- Metrobank Car Loan Application Form Individual Oct 2022Document2 pagesMetrobank Car Loan Application Form Individual Oct 2022rhu penarandaNo ratings yet

- AL Form Individual RevisedDocument3 pagesAL Form Individual RevisedMicaela ImperialNo ratings yet

- Personal Details: Customer Information RecordDocument2 pagesPersonal Details: Customer Information RecordErnesto G. Flores Jr.No ratings yet

- Customer detailsDocument2 pagesCustomer detailsHeaven San DiegoNo ratings yet

- BBG CIR Personal 09 06 2017 PDFDocument2 pagesBBG CIR Personal 09 06 2017 PDFKaren CariagaNo ratings yet

- Personal Details: Customer Information RecordDocument2 pagesPersonal Details: Customer Information RecordAnonymous Pxq5M31No ratings yet

- BBG CIR Personal 09 06 2017 PDFDocument2 pagesBBG CIR Personal 09 06 2017 PDFMaria Elizabeth PonceNo ratings yet

- Customer detailsDocument2 pagesCustomer detailsLomiNo ratings yet

- Bdo Cir Form PDFDocument2 pagesBdo Cir Form PDFLeslie Ann Cabasi TenioNo ratings yet

- Customer detailsDocument2 pagesCustomer detailsDianne B. BalderasNo ratings yet

- BBG CIR Personal 09 06 2017 PDFDocument2 pagesBBG CIR Personal 09 06 2017 PDFMarco LagahitNo ratings yet

- BBG CIR Personal 09 06 2017 PDFDocument2 pagesBBG CIR Personal 09 06 2017 PDFIsagani AbonNo ratings yet

- BBG CIR Personal 09 06 2017 PDFDocument2 pagesBBG CIR Personal 09 06 2017 PDFKaren CariagaNo ratings yet

- BBG CIR Personal 09 06 2017 PDFDocument2 pagesBBG CIR Personal 09 06 2017 PDFLomiNo ratings yet

- Real BDO Form PDFDocument2 pagesReal BDO Form PDFJehara AbdullahNo ratings yet

- BBG CIR Personal 09 06 2017 PDFDocument2 pagesBBG CIR Personal 09 06 2017 PDFKatyambotNo ratings yet

- BBG CIR Personal 09 06 2017 PDFDocument2 pagesBBG CIR Personal 09 06 2017 PDFJohn Paul Pacheco LealNo ratings yet

- BBG CIR Personal 09-06-2017Document2 pagesBBG CIR Personal 09-06-2017Catalina VianaNo ratings yet

- Personal Details: Customer Information RecordDocument2 pagesPersonal Details: Customer Information RecordLeslie Ann Cabasi TenioNo ratings yet

- Bdo bankBBG-CIR-Personal-09-06-2017 PDFDocument2 pagesBdo bankBBG-CIR-Personal-09-06-2017 PDFapollo degulaNo ratings yet

- Housing Loan Application Form (HLA-2019-001)Document2 pagesHousing Loan Application Form (HLA-2019-001)Michael DaviesNo ratings yet

- BDO CirDocument2 pagesBDO CirCPANo ratings yet

- 2021 Loanappformsoleprop 85 X 13Document4 pages2021 Loanappformsoleprop 85 X 13Jeffrey Ru LouisNo ratings yet

- Auto Loan Application Form For Individual and Sole PropietorshipsDocument1 pageAuto Loan Application Form For Individual and Sole PropietorshipsChristianNo ratings yet

- Customer Information RecordDocument4 pagesCustomer Information RecordLeonidas SpartacusNo ratings yet

- ACCOUNTABILITYDocument3 pagesACCOUNTABILITYJaniceNo ratings yet

- Auto Loan Application Form Motorcycle Loan Application Form: A Commercial Bank A Commercial BankDocument3 pagesAuto Loan Application Form Motorcycle Loan Application Form: A Commercial Bank A Commercial BankChristine GuyalaNo ratings yet

- AF - Sole and CAL BB DocusignDocument9 pagesAF - Sole and CAL BB DocusignManuel Castro IINo ratings yet

- Consolidated Application FormDocument9 pagesConsolidated Application FormPSC.CLAIMS1No ratings yet

- 2019 Safc Application FormDocument1 page2019 Safc Application FormSheredapple OrticioNo ratings yet

- Application Form for Corporate Auto LoanDocument2 pagesApplication Form for Corporate Auto LoanRymnd OtimajNo ratings yet

- HPL Application - Individual (CBG-003 (05-23) TMP)Document2 pagesHPL Application - Individual (CBG-003 (05-23) TMP)Richard Conrad Foronda SalangoNo ratings yet

- New Existing Deposits Loans Others Cards: Contact InformationDocument3 pagesNew Existing Deposits Loans Others Cards: Contact InformationPat ManahanNo ratings yet

- Customer agreement form for Vodafone mobile connectionDocument2 pagesCustomer agreement form for Vodafone mobile connectionViraf Dastur100% (1)

- Application FormDocument3 pagesApplication Formfrancismagno14No ratings yet

- RBD - Common Retail Loan Application Form Co - ApplicantDocument2 pagesRBD - Common Retail Loan Application Form Co - Applicantr_awadhiyaNo ratings yet

- Bdo Application FormDocument2 pagesBdo Application FormAnonymous pnCfNWeCUZ100% (1)

- Personal Loan Application Form 2019Document5 pagesPersonal Loan Application Form 2019bamarteNo ratings yet

- Housing Loan Application FormDocument2 pagesHousing Loan Application FormJudy Ann DivinoNo ratings yet

- Mirae Asset Global Commodity Stocks Fund Application FormDocument4 pagesMirae Asset Global Commodity Stocks Fund Application FormDrashti Investments100% (1)

- Consolidated Application Form 2023Document11 pagesConsolidated Application Form 2023Charlie CharlieNo ratings yet

- Personal Loan Form Form New To Bdo Client Jul 2022Document7 pagesPersonal Loan Form Form New To Bdo Client Jul 2022delmontecarlofNo ratings yet

- Health Ensure PFDocument3 pagesHealth Ensure PFShobhit JainNo ratings yet

- Forms For Principal BorrowerDocument8 pagesForms For Principal Borrowerlucia l astorgaNo ratings yet

- Consolidated Application FormDocument10 pagesConsolidated Application Formsantinaerikalee.flores-20No ratings yet

- Revised Reservation FormDocument2 pagesRevised Reservation FormTed anadiloNo ratings yet

- Referral InformationDocument2 pagesReferral Informationabe madridNo ratings yet

- Chinatrust Bank Application FormDocument2 pagesChinatrust Bank Application FormJoel VerbNo ratings yet

- FINAL PL Form NewDocument8 pagesFINAL PL Form NewEpifanio Delos SantosNo ratings yet

- Personal Loan Form Form New To Bdo Client Jul 2022Document6 pagesPersonal Loan Form Form New To Bdo Client Jul 2022Mark BondocNo ratings yet

- Notes Inc Module 2Document6 pagesNotes Inc Module 2Euneze LucasNo ratings yet

- Civ Case Digest - QQDocument18 pagesCiv Case Digest - QQRitzelle CabangbangNo ratings yet

- HMM OutputDocument3,770 pagesHMM OutputbiodinesNo ratings yet

- BaupostDocument34 pagesBaupostFaiz RinaldyNo ratings yet

- Flexible Fast FundsDocument2 pagesFlexible Fast Fundsjjtheadman100% (1)

- SPECIAL POWER OF ATTORNEY To MortgageDocument2 pagesSPECIAL POWER OF ATTORNEY To MortgageMichie BeeNo ratings yet

- Following The Money: The Beneficiaries of Fraudulent Mortgage AssignmentsDocument14 pagesFollowing The Money: The Beneficiaries of Fraudulent Mortgage AssignmentsMarina ReadNo ratings yet

- Obligation Cases (G Uribe Outline)Document290 pagesObligation Cases (G Uribe Outline)Vince AbucejoNo ratings yet

- Villaluz V LBP Case DigestDocument3 pagesVillaluz V LBP Case Digestjong fabileNo ratings yet

- Financial Institutions Management - Chap011Document21 pagesFinancial Institutions Management - Chap011sk625218No ratings yet

- 2019 05 01 Money AustraliaDocument91 pages2019 05 01 Money AustraliaRodrigo Oliveira RosaNo ratings yet

- Court rules on MOA rescissionDocument7 pagesCourt rules on MOA rescissionJustine Vincent PascualNo ratings yet

- Statement PDFDocument7 pagesStatement PDFGovardhanGurramNo ratings yet

- Case Study: Case 14-1: Camella & Palmera Homes, Inc.: Philippine Christian UniversityDocument9 pagesCase Study: Case 14-1: Camella & Palmera Homes, Inc.: Philippine Christian UniversityHarsey Joy Punzalan100% (2)

- Become Your Own Banker with Whole Life Insurance"TITLE"Dividend Paying Whole Life: Finance with InsuranceDocument14 pagesBecome Your Own Banker with Whole Life Insurance"TITLE"Dividend Paying Whole Life: Finance with Insuranceeagleye794% (17)

- Chapter 12 Income ManagementDocument61 pagesChapter 12 Income Managementsiraaj patelNo ratings yet

- Commercial Law Review AbellaDocument174 pagesCommercial Law Review AbellaMae NavarraNo ratings yet

- Sales Cases (FullText)Document40 pagesSales Cases (FullText)Nhaz PasandalanNo ratings yet

- Local MediaDocument18 pagesLocal MediaRM AlarconNo ratings yet

- Tanzania Mortgage Market Update 30 June 2021Document6 pagesTanzania Mortgage Market Update 30 June 2021Arden Muhumuza KitomariNo ratings yet

- Vitug v. AbudaDocument20 pagesVitug v. Abudamarites ongtengcoNo ratings yet

- Moneylife 13 Oct 2016 PDFDocument68 pagesMoneylife 13 Oct 2016 PDFUpendra KumarNo ratings yet

- Banking AdamjeeDocument60 pagesBanking AdamjeePREMIER INSTITUTENo ratings yet

- Court of Appeals Reverses RTC Ruling in Lease DisputeDocument37 pagesCourt of Appeals Reverses RTC Ruling in Lease DisputeAn DinagaNo ratings yet

- Conv. 215Document19 pagesConv. 215h100% (1)

- Case For Odd GroupsDocument2 pagesCase For Odd GroupsBrennan BarnettNo ratings yet

- AIA Home Loan TrainingDocument82 pagesAIA Home Loan TrainingltlimNo ratings yet

- Agency Bar Q and ADocument3 pagesAgency Bar Q and ADeneb DoydoraNo ratings yet

- Take Home Test Credit Transactions May 2020Document7 pagesTake Home Test Credit Transactions May 2020Patatas SayoteNo ratings yet

- 2.CFA一级基础段另类 Tom 打印版Document30 pages2.CFA一级基础段另类 Tom 打印版Evelyn YangNo ratings yet