Professional Documents

Culture Documents

New Auto-Loan-Application-Form - Individual

Uploaded by

Rheneir MoraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

New Auto-Loan-Application-Form - Individual

Uploaded by

Rheneir MoraCopyright:

Available Formats

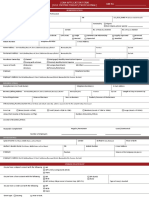

Application Form for Individual Borrowers

Thank you for taking interest in PSBank’s Auto Loan. Please completely fill out this application form or put N/A on fields that are not applicable to you. All fields marked

with asterisk (*) are mandatory fields. Application with incomplete information will not be processed. Please print your answers using BLACK ink only.

Date of Application Dealer Sales Agent Branch Application No.

Brand Year Model Cash Price Downpayment Term (in months)

Model Type of Vehicle Amount Financed Add-on Rate (AOR)

Brand New Pre-owned Reconditioned

PURPOSE OF LOAN

Personal Business Public Use Others, pls. specify

INFORMATION OF BORROWER CO-MAKER

*Name (Last name, First name, Middle name) Mr. Ms. Mrs. Sr. Jr. Others Gender

Male

Female

*Nationality Residency *Birthdate (mm/dd/yy) Age *Birthplace

Filipino Resident (e.g. Filipinos, sea-based OFWs, Aliens with ACR or Special Retirement Visa ID, etc.)

Others Non-Resident (e.g. Aliens, Filipino immigrants, land-based OFWs with contract to work abroad for more than a year, etc.)

Educational Attainment Civil Status * TIN / PhilID (National ID) No. SSS / GSIS No. If co-maker, pls. specify relation to

Elementary High School Vocational Single Legally Separated Principal Applicant

College Undergraduate Postgraduate Married Widow / Widower

*Present Address (House No./ Floor/ Unit No./ Block No./ Lot No./ P.O. Box No./ Bldg./ Apartment Name/ Street Name/ Village/ Subdivision/ Phase/ Barangay/ Barrio/ Municipality/ Province/ City/ Zip Code/ Country)

*Previous Address (House No./ Floor/ Unit No./ Block No./ Lot No./ P.O. Box No./ Bldg./ Apartment Name/ Street Name/ Village/ Subdivision/ Phase/ Barangay/ Barrio/ Municipality/ Province/ City/ Zip Code/ Country)

Home Ownership

Owned

Mortgaged to Term Amort./Mo. PhP Length of Stay

(Bank or Financial Institution)

Rented from Rent / Mo. PhP Years

(Landlord’s Name and Contact No.)

Living with Parents / Relatives Relationship Months

(Names)

*Residential Telephone No. *Cellphone No.

(For non-Metro Manila, please indicate the area code)

*Email Address Your preferred mailing address: Residence Office Address Business Address

Employment

Source of Income Status of Employment

Locally Employed OFW Immigrant OFW Non-Immigrant Unemployed Others Permanent

Private Private Private Remittance / Allottee

Probationary

Government Government Government Pension / Retired

Self-employed Self-employed Self-employed Student Contractual

If employed, please state: If in business or in practice of profession, please state:

Company Name Business Name

Office Address Position in the Company Business Address

Non-Officer

Business Website Address

Company Website Address Jr. Officer

Nature of Business / Work

Nature of Business Supervisor

Job Title Middle Manager Length of Operation Years Months

Length of Stay Years Months Sr. Officer Office Phone / Fax No.

Office Phone / Fax No. Name of Previous Employer / Business

If OFW, please state : Country of destination Employment base: Land Sea Air

Dependents

1. Name Age Level

School Type of School Public Exclusive Private Coed

2. Name Age Level

School Type of School Public Exclusive Private Coed

INFORMATION OF SPOUSE

*Name (Last name, First name, Middle name) Mr. Ms. Mrs. Sr. Jr. Others Gender

Male

Female

*Maiden Name (Last name, First name, Middle name) *Nationality *Birthdate (mm/dd/yy) Age *Birthplace

Filipino

Others

Educational Attainment * TIN / PhilID (National ID) No. SSS / GSIS No.

Elementary High School Vocational

College Undergraduate Postgraduate

Employment

Source of Income Status of Employment

Locally Employed OFW Immigrant OFW Non-Immigrant Unemployed Others Permanent

Private Private Private Remittance / Allottee

Probationary

Government Government Government Pension / Retired

Self-employed Self-employed Self-employed Student Contractual

If employed, please state: If in business or in practice of profession, please state:

Company Name Business Name

Office Address Position in the Company Business Address

Non-Officer

Business Website Address

Company Website Address Jr. Officer

Nature of Business / Work

Nature of Business Supervisor

Job Title Middle Manager Length of Operation Years Months

Length of Stay Years Months Sr. Officer Office Phone / Fax No.

Office Phone / Fax No. Name of Previous Employer / Business

STATEMENT OF INCOME AND EXPENSES*

Borrower Spouse Total

Gross Monthly Income PhP PhP PhP

Gross Monthly Expenses PhP PhP PhP

Net Monthly Income PhP PhP PhP

STATEMENT OF ASSETS AND LIABILITIES*

ASSETS Details (Name of Bank, Etc.) / Type / Description Amount / Estimated Value

Cash on Hand & with Banks PhP

Real Estate Property/ies PhP

Motor Vehicle/s PhP

TOTAL ASSETS PhP

LESS: LIABILITIES Type Bank Amortization Outstanding Balance

Personal / Salary Loan PhP PhP

Loans Car Loan PhP PhP

Housing Loan PhP PhP

Credit Card Credit Card Number Expiry Date Credit Limit Outstanding Balance

Company

Credit Card PhP PhP

PhP PhP

TOTAL LIABILITIES PhP

NET WORTH PhP

*as required by the Bangko Sentral ng Pilipinas under BSP Circular 622

PERSONAL REFERENCES

Name Address Contact Number

CREDIT / BANK REFERENCES

Bank Type Account No. Monthly Amortization Outstanding Balance Maturity Date

SOURCE OF PRODUCT INFORMATION DO YOU HAVE A RELATIVE WORKING IN PSBANK?

How did you learn about PSBank Auto Loan?

Yes No

TV / Radio Website Flyer / Poster / Streamer Newspaper / Magazine Social Media

If yes, please state:

PSBank Personnel Name

PSBank Client Name Name

Agency Name

Relation

Others, pls. Specify

HIGHLIGHTS OF TERMS AND CONDITIONS

Product Features - PSBank Auto Loan with Prime Rebate is a Term Loan facility. FEES AND CHARGES

Loan Range: Minimum of PhP100,000 for brand new cars / Minimum of PhP300,000 for 2nd hand units.

Terms: 12 to 60 months

Interest Rate: Based on prevailing interest rate at time of loan booking. A.) BOOKING FEES AND CHARGES:

Prime Rebate Feature: Allows clients to get a “discount” on his/her loan when he/she makes advance or excess payments CHATTEL MORTGAGE FEES + INSURANCE + OTHER CHARGES (RD Registration fee + LTO Encumbrance (out of town) fee)

on his/her monthly due. B.) POST-BOOKING FEES AND CHARGES:

Events of Default – Each or any of the following shall constitute an event of default. DUE DATE EXTENSION FEE Due date extension fee is computed as:

a.) Client fails to pay the amortization or interest or any amount due; (accrued interest from old due date to new due date) Outstanding Balance x Rate x number of days / 360

b.) Client defaults or fails to pay the loan or any other loan or credit accommodation with the Bank, its SERVICE FEE FOR CERTIFICATE OF A certification fee of PhP100 shall be charged plus a notary fee of PhP500 if

subsidiaries or affiliates or any third party or creditor, whether as borrower, surety or guarantor; ENCUMBRANCE FOR LTO REGISTRATION Certificate of Encumbrance for LTO registration is notarized.

c.) Client violates any of the T&C of the agreement;

d.) Client makes a representation or warranty in any credit or loan documents that are incorrect or untrue in PROCESSING FEES FOR CHANGE OF COLLATERAL -PhP5,000 shall be charged for amendments or change of collateral.

any material respect; AND CONVERSION OF UNIT TO PUV -PhP10,000 shall be charged for conversion of unit to PUV.

e.) Lost, destroyed, damaged or change in form and use of mortgaged property. The property/ies LATE / NON-SUBMISSION FEE ON INSURANCE PhP3,000 shall be charged for late / non-submission of insurance policy

mortgaged shall be deemed lost if Client fails to give additional security (in lieu of the damages, etc. on the POLICY RENEWAL renewal document.

property/ies) to the Bank.

COLLECTION FEE IN CASE OF DEFAULT A collection fee amounting to 3% of the monthly installment or amount

Consequences of Default – In case of default, the Bank may, without need of notice or demand, exercise any or all of the due shall also be charged in case of default.

following remedies. LATE PAYMENT PENALTY FEE 5% per month or a fraction thereof shall be added on each unpaid

a.) The whole amount remaining unpaid including (interest, fees and charges) shall immediately become installment from its due date until fully paid.

due and payable;

b.) Extrajudicial /Judicial foreclosure; ATTORNEY'S FEES AND LIQUIDATED DAMAGES In case of default and no legal action is filed, borrower shall pay an additional

c.) Exercise the right to offset and/or legal compensation; sum equal to 10% of the amount due as attorney’s fees. In case of litigation,

d.) Deliver the mortgaged property to the Bank, at Client’s own expense; borrower shall pay an additional sum equal to 25% of all amount outstanding

e.) In case of breach of the Terms & Conditions client expressly waives the term of 30 days as the period as attorney’s fees and the further sum of 20% as liquidated damages, in

which must elapse before the Bank shall foreclose the mortgage. addition to cost and other expenses of litigation.

Cooling-off Period - A cooling-off period of two (2) banking days is granted from the signing of the loan documents and/or ISSUANCE OF CANCELLATION DOCUMENTS • 1st issuance: Pay Notarial Fee of PhP500

payment of applicable fees, whichever comes first. During the cooling-off period, the borrower may cancel or terminate the • 2nd and every issuance thereafter:

- Notarial Fee: PhP500

loan without penalties, by submitting a written notice to the Bank, provided that the vehicle and the loan proceeds have not - Processing Fee: PhP2,000

been released; and he/she shall be entitled to a refund of the fees or payments made, if any and as applicable. The Bank,

however, reserves the right to collect reasonable processing and administrative fees to cover the costs incurred during the EARLY SETTLEMENT PROCESSING FEE • PhP10,000

loan processing. The cooling-off period is available for financial consumers who are individuals, or micro and small enterprises

as defined in applicable DTI regulations. • NO CHARGE: - if remaining term is equal or less than 6 months

- if outstanding balance does not exceed PhP50,000

Customer Complaints, Concerns and Other Queries - In case of complaints, concerns and other queries regarding the loan,

the Client may contact the Bank's 24/7 Customer Experience Hotline at (02) 8845-8888; text (63)998-8458888; or e-mail at SAFEKEEPING FEE A fee of PhP2,000 shall be charged if collateral loan document/s is/are unclaimed

customerexperience@psbank.com.ph. The Client may also visit the PSBank Head Office, Mezzanine Floor, PSBank Center, 777 after 90 days to 120 days from loan closure date. An additional fee of PhP1,000

Paseo de Roxas corner Sedeno Streets, Makati City, form 8:30 am to 5:30 pm, Monday to Friday (except holidays). The Client shall be charged for every 30 days exceeding the 120-day period.

may also LiveChat with the Bank at www.psbank.com.ph or ISSA Chatbot at Facebook.com/psbankofficial

Note: All aforesaid fees and charges will take effect immediately and may be cancelled or modified anytime at the Bank’s sole

The Bank is a regulated entity, and supervised by the Bangko Sentral ng Pilipinas (BSP). The Client may contact BSP at discretion. The Bank may impose other fees and charges incidental to the loan provided with prior notice to Client.

(02) 8708-7087 / consumeraffairs@bsp.gov.ph.

CLIENT’S CONSENT/AUTHORITY AND WAIVER OF CONFIDENTIALITY/PRIVACY OF PERSONAL AND OTHER INFORMATION FOR THE BANK’S LEGITIMATE

PURPOSES/NEEDS, AND TERMS AND CONDITIONS OF LOAN APPLICATION/APPROVAL

1. The undersigned loan applicant/borrower (hereinafter the “Client” regardless of number) certifies the correctness of all the personal, sensitive, privileged, records retention period set by the relevant banking laws and regulations for account closure including the period internally set by the Bank

financial, and other information (collectively referred to hereinafter as “Information”) provided by him in this Auto Loan Application Form, and in the course until destruction and/or disposal of my records, unless earlier withdrawn in writing.

of his loan application with Philippine Savings Bank (the “Bank”), including the information which may be obtained from his income tax returns, financial

statements, credit transactions and all other documents (”Supporting Documents”) submitted to the Bank in support of his loan application. ______________________________________________ _____________________________________________

(Signature Over Borrower’s / Co-Maker’s Printed Name) (Signature Over Spouse’s Printed Name)

2. In providing the Information and related Documents to the Bank, the Client hereby authorizes the Bank, without need of prior notice, to use, process,

store, make profile, receive from, and/or share to any of its affiliates and/or subsidiaries within the Metrobank Group, or its agents or service providers,

To support the Bank’s reasonable efforts to protect the Information against unauthorized use or disclosure, and ensure that the above

or third parties (including but not limited to vendors and credit bureaus), whether in or outside the Philippines, which provide related services or have

authorities given are carried out by the Bank without any conflict, the Client hereby dispenses his/her rights to confidentiality

contractual obligations with the Bank, or any government agency/regulatory body/branch (including but not limited to Bangko Sentral ng Pilipinas,

and privacy of the Information and such other rights as may be provided under Republic Act (RA) No. 1405 (Law on the Secrecy of Bank

Anti-Money Laundering Council, and Credit Information Corporation), which in turn is/are authorized to disclose to and/or receive from the Bank, the

Deposits), RA No. 6426 (The Foreign Currency Deposit Act), RA No. 8971 (General Banking Law of 2000), RA No. 10173 (Data Privacy Act

Information, relevant account information / data/opinion pertaining to the Client, and any and all other information pertaining to Client’s account/s

of 2012), or all other applicable laws, which are inconsistent with those authorities.

now existing or which may hereafter to be opened, whether or not secured and/or assigned as collateral, for the following purposes: (a) in order to

commence and facilitate the efficient delivery, administration, operation, and/or implementation of loan and other products and services of the Bank;

3. The Client understands that the Bank may disapprove his loan application, revoke prior loan approvals, or terminate existing loan

(b) for the protection of the Client or the Bank against fraudulent, unauthorized, or illegal transactions; (c) in the validation, verification, and/or updating

availments on the ground of misrepresentation and/or concealment of the Client’s Information, whether willful or not, without prejudice

of the Information and related Documents; (d) in order for the Bank to enforce its rights or perform its obligations by reason of any law, rules and

to any other legal remedies that the Bank may take.

regulations, contract, or orders from any court or quasi-judicial and administrative offices with corresponding duty to keep such information

confidential in accordance with the Bank’s Data Privacy Policy; e) in the registration of the security interest with the Personal Property Security Registry

4. The Client understands that the approval of his loan application shall be at the sole discretion of the Bank, and subject to:

(PPSR); and (f) in the prosecution or defense of the Bank or its directors/officers/employees with regards to disputes or claims pertaining to the products

a) The Bank’s existing credit policies and procedures on its Auto Loan Facility;

and services of the Bank.

b) Existing rules and regulations of the Bangko Sentral ng Pilipinas;

I further consent that my other personal data, such as but not limited to, telco score, telco usage data, etc., in the possession of mobile network c) Payment by the Client of all fees and charges relative to the processing of his loan application;

operators, and other parties, and which are necessary for credit scoring, credit evaluation, collection, and credit/fraud investigation by the Bank in the d) Submission by the Client of all documentary requirements and compliance with all other conditions imposed by the Bank for the

administration, operation, and implementation of its products and/or services that I applied for or availed of, may be collected, accessed, used, approval of his loan application

processed, stored in or outside of the Philippines, and shared by/to the Bank and/or its service providers in order to achieve the same purposes. as prescribed under existing Bank credit policies or those that may be prescribed by the Bank’s Legal Department;

In addition to the above authorities, e) The terms and conditions of the Loan/Mortgage Agreement and this Loan Application Form;

f) Submission to the Bank of the Certificate of Registration/Official Receipt (CR/OR) issued by the Land Transportation Office on the

I consent: _______________________________ __________________ vehicle. The Client shall follow-up with the dealer, from whom he acaquired the vehicle, the issuance, availability, and submission to the

(Borrower’s / Co-Maker’s signature) (Spouse’s signature) Bank of the original CR/OR, and hold the Bank harmless and free from any liability in the event the CR/OR is not submitted.

I do not consent: _________________________ __________________ In case of disapproval of the Client’s loan application, the Bank shall not be obliged to disclose the reason/s for such disapproval.

(Borrower’s / Co-Maker’s signature) (Spouse’s signature)

5. The Client authorizes the Bank to send its correspondence or notice to the Client via SMS/text, email, personal delivery or other means of

for the Bank to share my personal data to its affiliates and/or subsidiaries within the Metrobank Group for legitimate business purposes such as to communication at the option of the Bank.

provide me relevant marketing information and promotional advisories/campaigns and for them to carry out market research , customer profiling, and

data analytics so they can send me customized communications and improve my banking experience. I will be contacted by automated or electronic 6. The Loan Application Form and all Supporting Documents shall remain the Bank’s property and the same may be used in accordance

means including email, phone, mobile applications, and post or automated calls. I understand that adequate security measures shall be employed to with the above-mentioned paragraph no. 2 of the terms of this Auto Loan Application Form at the Bank’s discretion whether the loan is

protect my personal data. granted or not.

Above consent shall continue to be valid and subsisting for as long as my relationship with the Bank exists and until the expiration of the applicable

Signature of Principal Borrower / Co-Maker Date

Signature Verified, Authenticated, Approved by:

Signature of Spouse Date Automatic Debit Arrangement Account Number

Rev. November 2023 | Print Date: November 2023

You might also like

- Rich Dad 49 Retirement Income SecretsDocument230 pagesRich Dad 49 Retirement Income Secretsjhohans_to100% (6)

- Complete Guide To Money by Dave Ramsey PDFDocument332 pagesComplete Guide To Money by Dave Ramsey PDFLEVVLEVVNo ratings yet

- Job Descriptions List - CompressedDocument207 pagesJob Descriptions List - CompressedChiro Juba100% (3)

- Updated Japan Visa RequirementsDocument2 pagesUpdated Japan Visa RequirementsRheneir MoraNo ratings yet

- Fundamentals of Real Estate FinanceDocument16 pagesFundamentals of Real Estate Financemudge2008No ratings yet

- 2019 Safc Application FormDocument1 page2019 Safc Application FormSheredapple OrticioNo ratings yet

- Criminal Complaint of 138Document4 pagesCriminal Complaint of 138AayushNo ratings yet

- Employee Loan ApplicationDocument2 pagesEmployee Loan Applicationdexdex110% (1)

- Consumer LendingDocument51 pagesConsumer LendingAvi ThakurNo ratings yet

- Session 1 - QAR Audit Methodology Manual Presentation - Fundamentals of PSA AuditDocument34 pagesSession 1 - QAR Audit Methodology Manual Presentation - Fundamentals of PSA AuditRheneir MoraNo ratings yet

- Session 2 - QAR Audit Methodology Manual - IsQMDocument49 pagesSession 2 - QAR Audit Methodology Manual - IsQMRheneir MoraNo ratings yet

- Session 3 - QAR Audit Methodology Manual Presentation - Intro To The ManualDocument12 pagesSession 3 - QAR Audit Methodology Manual Presentation - Intro To The ManualRheneir MoraNo ratings yet

- Guide To Original Issue Discount (OID) Instruments: Publication 1212Document17 pagesGuide To Original Issue Discount (OID) Instruments: Publication 1212api-242377800No ratings yet

- Motor Vehicle Loan Application Form: (Months)Document2 pagesMotor Vehicle Loan Application Form: (Months)Pam Bisares100% (1)

- The Mathematics of Finance Chapter 6 GuideDocument55 pagesThe Mathematics of Finance Chapter 6 GuideGil John Awisen100% (1)

- Guide to Educational LoansDocument32 pagesGuide to Educational Loansvinodkulkarni100% (2)

- AF - Sole and CAL BB DocusignDocument9 pagesAF - Sole and CAL BB DocusignManuel Castro IINo ratings yet

- Session 6 - QAR Audit Methodology Manual Presentation - Review and FinalizationDocument23 pagesSession 6 - QAR Audit Methodology Manual Presentation - Review and FinalizationRheneir MoraNo ratings yet

- HOME - 2011 Best of GuideDocument88 pagesHOME - 2011 Best of Guidedeepsky45No ratings yet

- Session 5 - QAR Audit Methodology Manual Presentation - Detailed ProcedureDocument18 pagesSession 5 - QAR Audit Methodology Manual Presentation - Detailed ProcedureRheneir MoraNo ratings yet

- NUJS-HSF Moot Court Competition, 2014: Finalists - RespondentsDocument34 pagesNUJS-HSF Moot Court Competition, 2014: Finalists - RespondentsAmol Mehta33% (3)

- Session 4 - QAR Audit Methodology Manual - Pre-Engagement, Planning and Test of ControlsDocument55 pagesSession 4 - QAR Audit Methodology Manual - Pre-Engagement, Planning and Test of ControlsRheneir Mora100% (1)

- Business Plan EditedDocument24 pagesBusiness Plan EditedEduardo Anerdez86% (14)

- Customer agreement form for Vodafone mobile connectionDocument2 pagesCustomer agreement form for Vodafone mobile connectionViraf Dastur100% (1)

- Auto Loan Application Form - IndividualDocument2 pagesAuto Loan Application Form - IndividualKlarise EspinosaNo ratings yet

- Psbank Auto Loan With Prime Rebate Application Form 2019Document2 pagesPsbank Auto Loan With Prime Rebate Application Form 2019jim poblete0% (1)

- Purpose of Loan Information of Borrower Co-MakerDocument2 pagesPurpose of Loan Information of Borrower Co-MakerSophia GonzalesNo ratings yet

- PSBank Auto Loan With Prime Rebate FormDocument2 pagesPSBank Auto Loan With Prime Rebate FormMark Anthony Carreon Malate100% (1)

- PSBank Auto Loan Application Form - IndividualDocument2 pagesPSBank Auto Loan Application Form - IndividualJp Dela CruzNo ratings yet

- BDO Auto LoanDocument2 pagesBDO Auto LoanRalph Christian Lusanta FuentesNo ratings yet

- Housing Loan Application Form (HLA-2019-001)Document2 pagesHousing Loan Application Form (HLA-2019-001)Michael DaviesNo ratings yet

- Metrobank Car Loan Application Form Individual Oct 2022Document2 pagesMetrobank Car Loan Application Form Individual Oct 2022rhu penarandaNo ratings yet

- AL Form Individual RevisedDocument3 pagesAL Form Individual RevisedMicaela ImperialNo ratings yet

- Health Ensure PFDocument3 pagesHealth Ensure PFShobhit JainNo ratings yet

- Customer Information Form IndividualDocument9 pagesCustomer Information Form IndividualJean MojadoNo ratings yet

- RBD - Common Retail Loan Application Form Co - ApplicantDocument2 pagesRBD - Common Retail Loan Application Form Co - Applicantr_awadhiyaNo ratings yet

- BBG CIR Personal 09 06 2017 PDFDocument2 pagesBBG CIR Personal 09 06 2017 PDFKatyambotNo ratings yet

- BBG CIR Personal 09 06 2017 PDFDocument2 pagesBBG CIR Personal 09 06 2017 PDFIsagani AbonNo ratings yet

- Personal Details: Customer Information RecordDocument2 pagesPersonal Details: Customer Information RecordErnesto G. Flores Jr.No ratings yet

- BBG CIR Personal 09 06 2017 PDFDocument2 pagesBBG CIR Personal 09 06 2017 PDFMaria Elizabeth PonceNo ratings yet

- BBG CIR Personal 09 06 2017 PDFDocument2 pagesBBG CIR Personal 09 06 2017 PDFMarco LagahitNo ratings yet

- BBG CIR Personal 09-06-2017Document2 pagesBBG CIR Personal 09-06-2017Catalina VianaNo ratings yet

- Real BDO Form PDFDocument2 pagesReal BDO Form PDFJehara AbdullahNo ratings yet

- BBG CIR Personal 09 06 2017 PDFDocument2 pagesBBG CIR Personal 09 06 2017 PDFKaren CariagaNo ratings yet

- Personal Details: Customer Information RecordDocument2 pagesPersonal Details: Customer Information RecordLeslie Ann Cabasi TenioNo ratings yet

- Customer detailsDocument2 pagesCustomer detailsLomiNo ratings yet

- BBG CIR Personal 09 06 2017 PDFDocument2 pagesBBG CIR Personal 09 06 2017 PDFJohn Paul Pacheco LealNo ratings yet

- Bdo bankBBG-CIR-Personal-09-06-2017 PDFDocument2 pagesBdo bankBBG-CIR-Personal-09-06-2017 PDFapollo degulaNo ratings yet

- Bdo Cir Form PDFDocument2 pagesBdo Cir Form PDFLeslie Ann Cabasi TenioNo ratings yet

- BBG CIR Personal 09 06 2017 PDFDocument2 pagesBBG CIR Personal 09 06 2017 PDFLomiNo ratings yet

- Customer detailsDocument2 pagesCustomer detailsHeaven San DiegoNo ratings yet

- Customer detailsDocument2 pagesCustomer detailsDianne B. BalderasNo ratings yet

- BBG CIR Personal 09 06 2017 PDFDocument2 pagesBBG CIR Personal 09 06 2017 PDFKaren CariagaNo ratings yet

- Personal Details: Customer Information RecordDocument2 pagesPersonal Details: Customer Information RecordAnonymous Pxq5M31No ratings yet

- Ford Credit Application SummaryDocument2 pagesFord Credit Application Summarykhairul ihsanNo ratings yet

- Pag-IBIG Conversion ApplicationDocument2 pagesPag-IBIG Conversion ApplicationEve GranadaNo ratings yet

- Customer Information RecordDocument4 pagesCustomer Information RecordLeonidas SpartacusNo ratings yet

- Housing Loan Application FormDocument2 pagesHousing Loan Application FormJudy Ann DivinoNo ratings yet

- Application Form for Corporate Auto LoanDocument2 pagesApplication Form for Corporate Auto LoanRymnd OtimajNo ratings yet

- 2021 Loanappformsoleprop 85 X 13Document4 pages2021 Loanappformsoleprop 85 X 13Jeffrey Ru LouisNo ratings yet

- BDO CirDocument2 pagesBDO CirCPANo ratings yet

- Consolidated Application FormDocument9 pagesConsolidated Application FormPSC.CLAIMS1No ratings yet

- New Existing Deposits Loans Others Cards: Contact InformationDocument3 pagesNew Existing Deposits Loans Others Cards: Contact InformationPat ManahanNo ratings yet

- Contact Information: Same As Home AddressDocument6 pagesContact Information: Same As Home AddressJeremy CabilloNo ratings yet

- Reactivation Application Form 2Document4 pagesReactivation Application Form 2alina aguirre de la cruzNo ratings yet

- Home Loan Application FormDocument2 pagesHome Loan Application Formchin deguzmanNo ratings yet

- SLF065 MultiPurposeLoanApplicationForm V06Document2 pagesSLF065 MultiPurposeLoanApplicationForm V06Cacafranca Cherry Jean R.No ratings yet

- Common Retail Loan Application Form For GuarantorDocument2 pagesCommon Retail Loan Application Form For GuarantorNukamreddy Venkateswara ReddyNo ratings yet

- (For IISP Branch Only) : Application AgreementDocument2 pages(For IISP Branch Only) : Application AgreementRachel CabanlitNo ratings yet

- Personal Loan Application Form 2019Document5 pagesPersonal Loan Application Form 2019bamarteNo ratings yet

- No. of Years: For Individuals and Sole ProprietorshipsDocument2 pagesNo. of Years: For Individuals and Sole Proprietorshipsjunil rejanoNo ratings yet

- Buyers Information SheetDocument1 pageBuyers Information SheetOrle VillacarlosNo ratings yet

- Education Loan Application FormDocument6 pagesEducation Loan Application FormJap KhambholiyaNo ratings yet

- Consolidated Application Form 2023Document11 pagesConsolidated Application Form 2023Charlie CharlieNo ratings yet

- HLF069 HousingLoanApplicationCoBorrower V06Document2 pagesHLF069 HousingLoanApplicationCoBorrower V06Rouselle RaraNo ratings yet

- Personal Loan Form Form New To Bdo Client Jul 2022Document7 pagesPersonal Loan Form Form New To Bdo Client Jul 2022delmontecarlofNo ratings yet

- Forms For Principal BorrowerDocument8 pagesForms For Principal Borrowerlucia l astorgaNo ratings yet

- Differences PFRSDocument11 pagesDifferences PFRSRheneir MoraNo ratings yet

- Peach.confirmation.EU88X5Document3 pagesPeach.confirmation.EU88X5Rheneir MoraNo ratings yet

- Fun Golf SolicitationDocument2 pagesFun Golf SolicitationRheneir MoraNo ratings yet

- Peach.confirmation.QQ5775Document3 pagesPeach.confirmation.QQ5775Rheneir MoraNo ratings yet

- Or Wiib511710389303Document1 pageOr Wiib511710389303Marjorie Unabia HernandoNo ratings yet

- Certificate SphinxDocument1 pageCertificate SphinxRheneir MoraNo ratings yet

- Electronic Ticket Receipt 26MAR For RHENEIR PARAN MORADocument3 pagesElectronic Ticket Receipt 26MAR For RHENEIR PARAN MORARheneir MoraNo ratings yet

- Cebu Pacific Air MoraDocument4 pagesCebu Pacific Air MoraRheneir MoraNo ratings yet

- Annual Business BudgetDocument22 pagesAnnual Business BudgetGeisson Martinez GenaoNo ratings yet

- 49 Insights July 2022Document41 pages49 Insights July 2022Rheneir MoraNo ratings yet

- SourceTech Consultancy LLCDocument11 pagesSourceTech Consultancy LLCRheneir MoraNo ratings yet

- MS Call CardsDocument3 pagesMS Call CardsRheneir MoraNo ratings yet

- 1MSADocument1 page1MSARheneir MoraNo ratings yet

- GMM ProgramDocument1 pageGMM ProgramRheneir MoraNo ratings yet

- Talisay Central Eagles ClubDocument5 pagesTalisay Central Eagles ClubRheneir MoraNo ratings yet

- PAREB AMLC Online Registration System GuideDocument72 pagesPAREB AMLC Online Registration System GuideRheneir MoraNo ratings yet

- 2019notice New Forms and Pre EvaluationDocument29 pages2019notice New Forms and Pre EvaluationRheneir MoraNo ratings yet

- 77th ANC CebuDocument7 pages77th ANC CebuRheneir MoraNo ratings yet

- Amcham Phil. Membership SurveyDocument2 pagesAmcham Phil. Membership SurveyRheneir Mora100% (1)

- Accreditation of APO and AIPODocument24 pagesAccreditation of APO and AIPOteguhsunyotoNo ratings yet

- 04 Property PicturesDocument1 page04 Property PicturesRheneir MoraNo ratings yet

- 03 - List of PropertiesDocument4 pages03 - List of PropertiesRheneir MoraNo ratings yet

- Midterm Exam - Ac-2Document7 pagesMidterm Exam - Ac-2Lyca ArcenaNo ratings yet

- A Report On Standard Chartered Bank in IndiaDocument81 pagesA Report On Standard Chartered Bank in IndiaVishnu SoniNo ratings yet

- Bayanihan Act FAQ'sDocument11 pagesBayanihan Act FAQ'sHero MirasolNo ratings yet

- Cambridge IGCSE: Economics For Examination From 2020Document16 pagesCambridge IGCSE: Economics For Examination From 2020Mohammed ZakeeNo ratings yet

- Functions of Central BanksDocument3 pagesFunctions of Central BanksSenelwa AnayaNo ratings yet

- A Loan Management System For SaccosDocument17 pagesA Loan Management System For SaccosGILBERT KIRUINo ratings yet

- NBT2 GuideDocument10 pagesNBT2 GuideHein Htet100% (1)

- Terms & Conditions and Schedule of Charges - PL-SmartDocument2 pagesTerms & Conditions and Schedule of Charges - PL-SmartSunil DadhichNo ratings yet

- Pipeline Hedging: The New Imperative For The Independent Mortgage Banker.Document8 pagesPipeline Hedging: The New Imperative For The Independent Mortgage Banker.Andrew ArmstrongNo ratings yet

- Money and Banking ANSWER KEYDocument11 pagesMoney and Banking ANSWER KEYmeeraNo ratings yet

- ZOLINA, ZANDRIX WEN B. - Homework & SeatworkDocument4 pagesZOLINA, ZANDRIX WEN B. - Homework & SeatworkZOLINA, ZANDRIX WEN B.No ratings yet

- Investigative Report of FindingDocument34 pagesInvestigative Report of FindingAndrew ChammasNo ratings yet

- Multiple Choice Questions: Chapter FourDocument6 pagesMultiple Choice Questions: Chapter FourMuluken MulatNo ratings yet

- Sonovision Electronics Store Near YouDocument10 pagesSonovision Electronics Store Near YouGenie TASNo ratings yet

- Rose Chap 16Document29 pagesRose Chap 16Mashnun HabibNo ratings yet

- VJ2Document4 pagesVJ2Thư TrầnNo ratings yet

- Jimmy Ledford v. Shelby Peeples, JR., 11th Cir. (2011)Document86 pagesJimmy Ledford v. Shelby Peeples, JR., 11th Cir. (2011)Scribd Government DocsNo ratings yet

- Nestle Pakistan Limited2Document57 pagesNestle Pakistan Limited2Faizan HassanNo ratings yet