Professional Documents

Culture Documents

High Taxes Drive Away US Citizens

Uploaded by

Frank KaufmannCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

High Taxes Drive Away US Citizens

Uploaded by

Frank KaufmannCopyright:

Available Formats

High taxes drive away US citizens

The IRS is a U.S. government program, with the force of the American military behind it, empowered to confiscate earned wages of its citizens. Those who do not comply are imprisoned and broken. Out of control government spending, self interested elected officials, and an entitlement obsessed civil service community drive taxes up. This is the formula primarily responsible for the collapse and bankruptcy of several Mediterranean, European, First world nations, and over time, successfully will hobble Americas economy if nothing is done to reverse the tax addiction of elected officials. Both U.S. political parties are guilty. Margaret Thatcher famously said, The problem with Socialism is that eventually you run out of other peoples money. The current U.S. administration is particularly hostile to private wealth, other than that accrued by government people, or the few big left donors such as entertainers and lawyers, and are relentless provocateurs and instigators of class warfare along with its other habits of divisiveness, including race. The obsession with tax collection of this administration manifests the same exquisite impulse for control and manipulation of populations that characterize the Obama campaign machine. Obamas governing style similarly has invested with great focus on refining to razor thin edges the ability to track down other peoples money. On August 9, The Wall Street Journal, Bloomberg, and many significant economic news outlets reported that the number of US taxpayers who renounced U.S. citizenship hit a record high. The WSJ headline and leader was strong, Number of Americans Renouncing Citizenship Surges, Expert Says 2013 on Pace to See Highest Number of U.S. Expatriations Ever. The prime factor for these defections among the many far reaching, across the board tax crack-downs, relates to the fact that all income earned by citizens and permanent residents, even those living abroad, can be subject to U.S. tax. The U.S. is the only nation in the Organization for Economic Cooperation and Development that taxes citizens wherever they reside. Additionally the US has begun a heavy push to tax all money held overseas. Since 2011, Americans, who disclose their non-U.S. bank accounts to the IRS, must file the more expansive 8938 form that asks for all foreign financial assets, including insurance contracts, loans and shareholdings in non-U.S. Companies. Failure to file the 8938 form can result in a fine of as much as $50,000. This focus on money overseas began following the terrorist attacks of Sept. 11,

by Frank Kaufmann, 08/19/13 Page 1

High taxes drive away US citizens

2001, but in 2009 was ratcheted up to focus on tax collection. The crackdown now ensnares smaller violators who were not intentionally evading U.S. taxes. Average American taxpayers now line up to apply for IRS limited-amnesty programs while trying to pay off stiff penalties for past noncompliance. Jeffrey Neiman, a former federal prosecutor describes the Foreign Account Tax Compliance Act as a web of rules that is overly burdensome. The cost of complying with these rules and regulations can be steep even for people with small tax bills. With this hyper-aggressive, wildly punitive Foreign Account Tax Compliance Act, more of the estimated 6 million Americans living overseas are weighing the cost of holding a U.S. Passport. Already the number of those who have renounced U.S. citizenship in the first half of 2013 stands at 1,810 compared with 235 for the whole of 2008. President Hollande of France similarly has brought high profile loss to his country with obsessive and excessive tax greed, most famously seen with the high profile defection of Frances most popular film star Grard Depardieu. In 2012, Depardieus taxes were 85% of his income. Depardieu turned in his French passport, and lives now in Nechin, Belgium, just over the border, where at least a quarter of the inhabitants are wealthy French tax exiles. When Prime Minister Jean-Marc Ayrault declared that it is Depardieus patriotic duty to stay and pay, the actor responded, I was born in 1948. I started working aged 14, as a printer, as a warehouseman, then as an actor, and Ive always paid my taxes, France also lost Bernard Arnault, reportedly Frances richest man, rock star Johnny Hallyday and at least 6,000 other French citizens in the past decade. The many-fold leap in U.S. defections in response to the growing and oppressive government reach that is the trademark of the Obama administration should be a bell weather. Citizens can be sure that once in place, such realities will not be reversed or repealed. One can only hope that indicators such as a surge in defections, coupled with the patent criminality of the IRS as revealed in its recent scandals and investigations, will arouse sufficient popular protest to awaken elected officials, hold them accountable, and put them on notice.

by Frank Kaufmann, 08/19/13 Page 2

You might also like

- What You Need To Know About The American Tax Trap, Loss of Privacy, and How You Can Join The Globalized EconomyFrom EverandWhat You Need To Know About The American Tax Trap, Loss of Privacy, and How You Can Join The Globalized EconomyNo ratings yet

- Summary: Flat Tax Revolution: Review and Analysis of Steve Forbes's BookFrom EverandSummary: Flat Tax Revolution: Review and Analysis of Steve Forbes's BookNo ratings yet

- Death by a Thousand Cuts: The Fight over Taxing Inherited WealthFrom EverandDeath by a Thousand Cuts: The Fight over Taxing Inherited WealthRating: 4.5 out of 5 stars4.5/5 (3)

- Where To Stash Your Cash Legally PDFDocument560 pagesWhere To Stash Your Cash Legally PDFmahmud suleimanNo ratings yet

- America As Tax HavenDocument4 pagesAmerica As Tax Havensmarak_kgpNo ratings yet

- The Four Questions: Answering Foreign Investors’ Most Frequently Asked Questions on the Founding Principles behind the United States System of TaxationFrom EverandThe Four Questions: Answering Foreign Investors’ Most Frequently Asked Questions on the Founding Principles behind the United States System of TaxationNo ratings yet

- Getting People To Pay Their Taxes: ARTICLE FOR PUBICATION: by Timore B. FrancisDocument4 pagesGetting People To Pay Their Taxes: ARTICLE FOR PUBICATION: by Timore B. FrancisTIMOREGHNo ratings yet

- The Road to Prosperity: How to Grow Our Economy and Revive the American DreamFrom EverandThe Road to Prosperity: How to Grow Our Economy and Revive the American DreamNo ratings yet

- Taxation Thru The AgesDocument12 pagesTaxation Thru The AgesPeter LapsanskyNo ratings yet

- The Origins of Tax Systems: A French-American Comparison: Kjmorgan@gwu - Edu M-Prasad@northwestern - EduDocument65 pagesThe Origins of Tax Systems: A French-American Comparison: Kjmorgan@gwu - Edu M-Prasad@northwestern - EduHa JeepNo ratings yet

- American Tax Resisters (Romain D. Huret)Document381 pagesAmerican Tax Resisters (Romain D. Huret)punktlichNo ratings yet

- SSRN Id4181471Document19 pagesSSRN Id4181471Eve AthanasekouNo ratings yet

- Dropping The BombDocument6 pagesDropping The BombDevi PurnamasariNo ratings yet

- The Die Harder StatesDocument2 pagesThe Die Harder StatesSenator Carla NelsonNo ratings yet

- HW8 ThachNguyetAnh 11196227Document4 pagesHW8 ThachNguyetAnh 11196227Nguyệt Anh ThạchNo ratings yet

- Handouts & Pickpockets - Our Government Gone Berserk 1996Document197 pagesHandouts & Pickpockets - Our Government Gone Berserk 1996Anonymous nYwWYS3ntV100% (2)

- Disband the Corrupt Federal Reserve System and the Irs Now!From EverandDisband the Corrupt Federal Reserve System and the Irs Now!Rating: 5 out of 5 stars5/5 (1)

- The Hidden Wealth of Nations: The Scourge of Tax HavensFrom EverandThe Hidden Wealth of Nations: The Scourge of Tax HavensRating: 4 out of 5 stars4/5 (11)

- Excerpt From "The Hidden Wealth of Nations" by Gabriel Zucman.Document7 pagesExcerpt From "The Hidden Wealth of Nations" by Gabriel Zucman.OnPointRadioNo ratings yet

- Blog On Bribery: ReportsDocument4 pagesBlog On Bribery: ReportsHarry BlutsteinNo ratings yet

- Offshore: Tax Havens and the Rule of Global CrimeFrom EverandOffshore: Tax Havens and the Rule of Global CrimeRating: 3.5 out of 5 stars3.5/5 (4)

- The Hypocritical Hegemon: How the United States Shapes Global Rules against Tax Evasion and AvoidanceFrom EverandThe Hypocritical Hegemon: How the United States Shapes Global Rules against Tax Evasion and AvoidanceNo ratings yet

- Summary: The Fair Tax Book: Review and Analysis of Neal Boortz and John Linder's BookFrom EverandSummary: The Fair Tax Book: Review and Analysis of Neal Boortz and John Linder's BookNo ratings yet

- Case Study. The Underground Economy and The Tax GapDocument4 pagesCase Study. The Underground Economy and The Tax GapdexcalmaNo ratings yet

- Illegal Immigration - Jordan BouchairDocument9 pagesIllegal Immigration - Jordan Bouchairapi-315471759No ratings yet

- Dirty Secrets: How Tax Havens Destroy the EconomyFrom EverandDirty Secrets: How Tax Havens Destroy the EconomyRating: 4.5 out of 5 stars4.5/5 (3)

- Deportations for Money: The American Government’s Secret Behind Massive DeportationsFrom EverandDeportations for Money: The American Government’s Secret Behind Massive DeportationsRating: 5 out of 5 stars5/5 (1)

- The Rise of Strategic Corruption: How States Weaponize GraftDocument15 pagesThe Rise of Strategic Corruption: How States Weaponize GraftSUDIPTADATTARAYNo ratings yet

- An Appalling Practice Used in Only Two NationsDocument3 pagesAn Appalling Practice Used in Only Two NationseliforuNo ratings yet

- Solution Manual For Economics of Macro Issues 6Th Edition by Miller and Benjamin Isbn 0132991284 9780132991285 Full Chapter PDFDocument21 pagesSolution Manual For Economics of Macro Issues 6Th Edition by Miller and Benjamin Isbn 0132991284 9780132991285 Full Chapter PDFmarcia.northover971100% (11)

- The End of Politcs and the Birth of iDemocracyFrom EverandThe End of Politcs and the Birth of iDemocracyRating: 4 out of 5 stars4/5 (2)

- Greece's Economic Troubles & More Economic UpdatesDocument22 pagesGreece's Economic Troubles & More Economic UpdatesTimothy100% (1)

- The History of Tax HavensDocument10 pagesThe History of Tax HavensdhawaljaniNo ratings yet

- Secret Empires: How the American Political Class Hides Corruption and Enriches Family and FriendsFrom EverandSecret Empires: How the American Political Class Hides Corruption and Enriches Family and FriendsRating: 4 out of 5 stars4/5 (21)

- Taking The Long Way Home: Offshore Investments in U.S. Equity and Debt Markets and U.S. Tax EvasionDocument63 pagesTaking The Long Way Home: Offshore Investments in U.S. Equity and Debt Markets and U.S. Tax EvasionClinton BrowningNo ratings yet

- The Real World of Money and Taxation in AmericaDocument9 pagesThe Real World of Money and Taxation in AmericaPotomacOracleNo ratings yet

- IRS FRAUD - Proven by Quotes From IRS OfficialsDocument17 pagesIRS FRAUD - Proven by Quotes From IRS OfficialseNo ratings yet

- Patriotic Millionaires Present Renegotiating Power and Money in AmericaFrom EverandPatriotic Millionaires Present Renegotiating Power and Money in AmericaNo ratings yet

- 10 Reasons State Lotteries RuinDocument3 pages10 Reasons State Lotteries Ruinkaddour7108No ratings yet

- Time To Shake Down The Swiss BanksDocument4 pagesTime To Shake Down The Swiss Banksrvaidya2000No ratings yet

- Running Head: ECONOMICS PAPERDocument7 pagesRunning Head: ECONOMICS PAPERVa SylNo ratings yet

- Inequality Could Be Lower Than You ThinkDocument4 pagesInequality Could Be Lower Than You ThinkPRANAY GOYALNo ratings yet

- Taxing History of Taxes (Isaac Szijjarto)Document8 pagesTaxing History of Taxes (Isaac Szijjarto)Bleeping564No ratings yet

- Corporate Layoffs Lists 2000 To 2005 Volume IIDocument310 pagesCorporate Layoffs Lists 2000 To 2005 Volume IIJaggy GirishNo ratings yet

- Proyecto Final (VF) ModifDocument11 pagesProyecto Final (VF) ModifLiu Mendoza PérezNo ratings yet

- Fleeced: How Barack Obama, Media Mockery of Terrorist Threats, Liberals Who Want to Kill Talk Radio, the Self-Serving Congress, Companies That Help Iran, and Washington Lobbyists for Foreign Governments Are Scamming Us...and What to Do About ItFrom EverandFleeced: How Barack Obama, Media Mockery of Terrorist Threats, Liberals Who Want to Kill Talk Radio, the Self-Serving Congress, Companies That Help Iran, and Washington Lobbyists for Foreign Governments Are Scamming Us...and What to Do About ItRating: 3 out of 5 stars3/5 (22)

- The History of Taking - Part 1Document32 pagesThe History of Taking - Part 1jpesNo ratings yet

- This Massive Bubble Is Just Weeks Away From Bursting. andDocument24 pagesThis Massive Bubble Is Just Weeks Away From Bursting. andAdiy666No ratings yet

- 25 Corruption Scandals That Shook The World - NewsDocument27 pages25 Corruption Scandals That Shook The World - NewsYu Sum WaiNo ratings yet

- 20sep16 Anna Von Reitz The Truth Has Come Out Finally and ConclusivelyDocument6 pages20sep16 Anna Von Reitz The Truth Has Come Out Finally and ConclusivelyNadah8100% (2)

- Undocumented ImmigrantsDocument21 pagesUndocumented Immigrantsfabrignani@yahoo.comNo ratings yet

- Will A Clinton Victory and Pending Hillary Indictment Kill The Bull Market?Document23 pagesWill A Clinton Victory and Pending Hillary Indictment Kill The Bull Market?Hugo JamesNo ratings yet

- The Benefit and The Burden: Tax Reform-Why We Need It and What It Will TakeFrom EverandThe Benefit and The Burden: Tax Reform-Why We Need It and What It Will TakeRating: 3.5 out of 5 stars3.5/5 (2)

- Notes On The First AmendmentDocument7 pagesNotes On The First AmendmentFrank KaufmannNo ratings yet

- Trac5 Executive Summary On Ukraine PeaceDocument1 pageTrac5 Executive Summary On Ukraine PeaceFrank KaufmannNo ratings yet

- HIgh Level Political Forum On Sustainable DevelopmentDocument3 pagesHIgh Level Political Forum On Sustainable DevelopmentFrank KaufmannNo ratings yet

- Diversity, Harmony and ReconciliationDocument14 pagesDiversity, Harmony and ReconciliationFrank KaufmannNo ratings yet

- Twelve Gates Foundation Braver Angels Style Conversation Christian MuslimDocument8 pagesTwelve Gates Foundation Braver Angels Style Conversation Christian MuslimFrank KaufmannNo ratings yet

- Twelve Gates Foundation Braver Angels Style Conversation, Religious ConscientiousDocument7 pagesTwelve Gates Foundation Braver Angels Style Conversation, Religious ConscientiousFrank KaufmannNo ratings yet

- Rachel Hobin (Mary Braybrooke OOS) ProofDocument8 pagesRachel Hobin (Mary Braybrooke OOS) ProofFrank KaufmannNo ratings yet

- Settlement Project Conference Agenda, March 26Document1 pageSettlement Project Conference Agenda, March 26Frank KaufmannNo ratings yet

- THE CASE FOR ISRAELI-PALESTINIAN CONFEDERATION Alon Ben-Meir-August 3, 2021Document19 pagesTHE CASE FOR ISRAELI-PALESTINIAN CONFEDERATION Alon Ben-Meir-August 3, 2021Frank KaufmannNo ratings yet

- SP Columbus Conference InvitationDocument4 pagesSP Columbus Conference InvitationFrank KaufmannNo ratings yet

- Investor Integrity Speaker BiosDocument7 pagesInvestor Integrity Speaker BiosFrank KaufmannNo ratings yet

- Columbus Settlement Invitation, August 2022Document4 pagesColumbus Settlement Invitation, August 2022Frank KaufmannNo ratings yet

- TEMPLATE For School Public Records Request Under FOIADocument2 pagesTEMPLATE For School Public Records Request Under FOIAFrank Kaufmann100% (1)

- March 26 Settlement Project Conference InvitationDocument2 pagesMarch 26 Settlement Project Conference InvitationFrank KaufmannNo ratings yet

- Sponsors Poster For Settlement Project Event MAR26 2022Document1 pageSponsors Poster For Settlement Project Event MAR26 2022Frank KaufmannNo ratings yet

- Buying Time A Proposal For The Lia Thomas ProblemDocument3 pagesBuying Time A Proposal For The Lia Thomas ProblemFrank KaufmannNo ratings yet

- Settlement Project Agenda - Los Angeles, March 2022Document1 pageSettlement Project Agenda - Los Angeles, March 2022Frank KaufmannNo ratings yet

- The Country The COVID Cultists Dont Want To DiscussDocument3 pagesThe Country The COVID Cultists Dont Want To DiscussFrank KaufmannNo ratings yet

- NRB Exhibitor Directory 2022Document17 pagesNRB Exhibitor Directory 2022Frank KaufmannNo ratings yet

- Civics 101 EbookDocument25 pagesCivics 101 EbookBubo Virginianus100% (3)

- Rights Abuse by Big TechDocument5 pagesRights Abuse by Big TechFrank KaufmannNo ratings yet

- NRB ProgramDocument5 pagesNRB ProgramFrank KaufmannNo ratings yet

- Dueling Populisms EbookDocument8 pagesDueling Populisms EbookFrank KaufmannNo ratings yet

- Settlement Full Introduction 2021Document5 pagesSettlement Full Introduction 2021Frank KaufmannNo ratings yet

- Settlement Abridged Introduction 2021Document2 pagesSettlement Abridged Introduction 2021Frank KaufmannNo ratings yet

- Interfaith and EnvironmentalismDocument4 pagesInterfaith and EnvironmentalismFrank KaufmannNo ratings yet

- Yoga and ChristianityDocument6 pagesYoga and ChristianityFrank KaufmannNo ratings yet

- Twleve Gates Welcome LetterDocument1 pageTwleve Gates Welcome LetterFrank KaufmannNo ratings yet

- Settlement Narrative Introduction 2021Document2 pagesSettlement Narrative Introduction 2021Frank KaufmannNo ratings yet

- Curriculum Vitae of Professor Rattan LalDocument15 pagesCurriculum Vitae of Professor Rattan LalFrank KaufmannNo ratings yet

- Microfinance Sector in GhanaDocument20 pagesMicrofinance Sector in GhanaSandeep YadNo ratings yet

- SLS Geotechnical Design PDFDocument10 pagesSLS Geotechnical Design PDFStelios PetridisNo ratings yet

- DLT 11Document15 pagesDLT 11prasadNo ratings yet

- Distributors and Their Bio Cide S 2017Document9 pagesDistributors and Their Bio Cide S 2017Sérgio - ATC do BrasilNo ratings yet

- Chapter 9 Discretionary Benefits: Strategic Compensation, 8e, Global Edition (Martocchio)Document2 pagesChapter 9 Discretionary Benefits: Strategic Compensation, 8e, Global Edition (Martocchio)NotesfreeBookNo ratings yet

- Economy of PakistanDocument14 pagesEconomy of Pakistanghorishahab34100% (2)

- CH IIDocument8 pagesCH IISaso M. KordyNo ratings yet

- Efektifitas Penerapan Belok Kiri Langsung (Studi Kasus Simpang Tiga Yogya Mall Kota Tegal)Document11 pagesEfektifitas Penerapan Belok Kiri Langsung (Studi Kasus Simpang Tiga Yogya Mall Kota Tegal)Didit Prasojo secondNo ratings yet

- Tax Invoice: Sri Kakatiya Industries (India) Private Limited - 2023-24Document2 pagesTax Invoice: Sri Kakatiya Industries (India) Private Limited - 2023-24BJRUSS PKG-2No ratings yet

- Canadian Securities Course Volume One Supplemental QuestionsDocument140 pagesCanadian Securities Course Volume One Supplemental QuestionsTrần Huỳnh Thanh BìnhNo ratings yet

- Philips 3580Document4 pagesPhilips 3580gabymourNo ratings yet

- Canara Bank Deposit RatesDocument3 pagesCanara Bank Deposit RatesvigyaniNo ratings yet

- General AwarenessDocument137 pagesGeneral AwarenessswamyNo ratings yet

- Facts About FASBDocument8 pagesFacts About FASBvssvaraprasadNo ratings yet

- Globalization and International BusinessDocument14 pagesGlobalization and International BusinesskavyaambekarNo ratings yet

- Status of Solid Waste Management in The Philippines: Alicia L. Castillo " Suehiro Otoma University of Kitakyushu, JapanDocument3 pagesStatus of Solid Waste Management in The Philippines: Alicia L. Castillo " Suehiro Otoma University of Kitakyushu, JapanPrietos KyleNo ratings yet

- RFBT Chapter2 OutlineDocument20 pagesRFBT Chapter2 OutlineCheriferDahangCoNo ratings yet

- Chapter 4. International Economic Institutions and AgreementsDocument17 pagesChapter 4. International Economic Institutions and AgreementsReshma RaoNo ratings yet

- Ratio Analysis & Financial Benchmarking-Bob Prill & Tori BrysonDocument38 pagesRatio Analysis & Financial Benchmarking-Bob Prill & Tori BrysonRehan NasirNo ratings yet

- Insha Spreadsheet Marketing Contact DataDocument14 pagesInsha Spreadsheet Marketing Contact DataAbhishek SinghNo ratings yet

- Invoice 41071Document2 pagesInvoice 41071Zinhle MpofuNo ratings yet

- Automotive Events CalendarDocument2 pagesAutomotive Events CalendarsdqsNo ratings yet

- Check Disbursement4Document24 pagesCheck Disbursement4Jeff Jeansen BagcatNo ratings yet

- 945-Jeevan Umang: Prepared byDocument7 pages945-Jeevan Umang: Prepared byVishal GuptaNo ratings yet

- FactoringDocument36 pagesFactoringmaninder1419699No ratings yet

- Executive Shirt CompanyDocument9 pagesExecutive Shirt CompanyAshish Adike0% (1)

- Coatings Word October 2012Document84 pagesCoatings Word October 2012sami_sakrNo ratings yet

- Rayanne Ramdass Moore MENG 1013 Individual PaperDocument7 pagesRayanne Ramdass Moore MENG 1013 Individual PaperRayanne MooreNo ratings yet

- 07 Opportunities For PoA in Energy Efficiency by Konrad Von RitterDocument11 pages07 Opportunities For PoA in Energy Efficiency by Konrad Von RitterThe Outer MarkerNo ratings yet

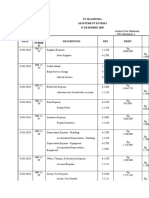

- PT SejahteraDocument2 pagesPT Sejahtera202010415109 ADITYA FIRNANDONo ratings yet