Professional Documents

Culture Documents

CAIR 1994 Articles of Incorp (DCRA File Re WTF Fka CAIR-An As of 6.18.13 - OCR)

Uploaded by

Tim Cavanaugh0 ratings0% found this document useful (0 votes)

164 views6 pagesCERTIFICATE of INCORPORATION is hereby issued to COUNCIL ON AMERICAN-ISLAMIC RELATIONS, INC. As of SEPTEMBER 15TH, 1994. The purpose of The Corporation is to promote interest and understanding among the general public and government officials.

Original Description:

Original Title

CAIR 1994 Articles of Incorp (DCRA File Re WTF Fka CAIR-An as of 6.18.13_OCR)

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCERTIFICATE of INCORPORATION is hereby issued to COUNCIL ON AMERICAN-ISLAMIC RELATIONS, INC. As of SEPTEMBER 15TH, 1994. The purpose of The Corporation is to promote interest and understanding among the general public and government officials.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

164 views6 pagesCAIR 1994 Articles of Incorp (DCRA File Re WTF Fka CAIR-An As of 6.18.13 - OCR)

Uploaded by

Tim CavanaughCERTIFICATE of INCORPORATION is hereby issued to COUNCIL ON AMERICAN-ISLAMIC RELATIONS, INC. As of SEPTEMBER 15TH, 1994. The purpose of The Corporation is to promote interest and understanding among the general public and government officials.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 6

(Page 1 of 1)

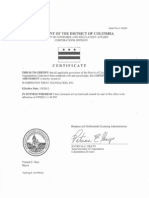

GOVERNMENT OF THE DISTRICT OF COLUMBIA

DEPARTMENT OF CONSUMER AND REGULATORY AFFAfRS

BUSINESS REGULATION ADMINISTRATION

CERTIFICATE

THIS IS TO CERTIFY that all applicable provisions of the DISTRICT

OF COLU:MBIA NONPROFIT CORPORATION ACT have been com:E_li_ed with and

accordingly, this CERTIFICATE of INCORPORATION is hereby

issued to

COUNCIL ON AMERIC.AN .. ISLAMIC RELATIONS, INC.

as of SEPTEMBER 15TH, 1994.

Sharon Pratt Kelly

Mayor

Hampton Cross

Director

Barry K Campbell

Administrator

B/J!ess Regulation Administration

).)1 .A-'.,,-(1,,,.,,,;z.,U_ / 'r.r; . ~ ''rtL-;:J

Desiree M. Jones ;t2 '

Act Asst Superintendent of Corporations

Corporations Division

(Page 1 of 5)

Law OIJ"ICC.I

LNKERT & NORAIR, P.C,

3025 l l l l l l k ~ Court

Fairfu, VA2l031

876-9484

. 9

ARTICLES OF INCORPORATION

OF

COUNCIL ON AMERICAN-ISuAMIC RELATIONS, INC.

TO: Department of Consumer and Regulatory Affairs

Business Regulation Administration

Corporations Division

Washington, D.C.

THE UNDERSIGNED, all of whom are natural persons of the age

of eighteen years or more, acting as incorporators of a

corporation pursuant to the District of Columbia, Nonprofit

Corporation Act, hereby certify:

ARTICLE I

The name of the corporation, hereinafter referred to as the

"Corporation" is COUNCIL ON AMERICAN-ISLAMIC RELATIONS , INC.

ARTICLE II

The period of duration of the Corporation is perpetual .

ARTICLE III

The purpose or purposes for which the corporation is

organized is to promote interest and understanding among the

general public and government officials with regards to Islam and

Muslims in North America; and conduct educational services in the

fields of :religion, culture, education, society, and history

concerning Islamic issues both in the United States and abroad.

Said corporation is organized exclusively for the promotion

of social welfare as stated under Section 501 (c) (4) of the

Internal Revenue Code (or the corresponding provisions of any

future United States Internal Revenue Law) . The Corporation may

receive and administer funds for social welfare purposes within

the meaning of Section 50l(c) (4) of the Internal Revenue Code of

1986 and, to that end, the Corporation is empowered to hold any

property, or any undivided interest therein, without limitation

as to amount or value, to dispose of any such property and to

invest, reinvest, or deal with the principal or the income in

such manner as, in the judgment of the directors, wil 1 best

promote the purposes of the Corporation, without limitation,

except such limitations, if any, as may be contained in the

instrument under which such property is received these Articles

of Incorporation, the By-Laws of the Corporation, or any

1

/ftlfll

~ 151994

~ - - - - - ~ - ~ - ~ ~ - - - - - -

L L ~

r.v I /'} /7 -

!_ - - - - - - - . - - -

(Page 2 of 5)

.e

applicable laws, to do any other act or thing incidental to or

connected with the foregoing purposes or in advancement thereof,

but not for the pecuniary profit or financial gain of its

directors or officers except as permitted under the District of

Columbia Non-Profit Corporation Act.

In furtherance of its exclusive promotion of social welfare,

the Corporation shall have all the general powers enumerated in

Section 29-505 of the District of Columbia Nonprofit Corporation

Act as now in effect or as may hereafter be amended, together

with the power to solicit grants and contributions for such

purpose.

ARTICLE IV

Provisions for the regulation of the internal affairs of the

Corporation, including provisions for distribution of assets or

dissolution or final liquidation are as follows:

A. No part of the net earnings of the Corporation

shall inure to the benefit of, or be distributable to its

directors, officer (s) of the Corporation, or other private

persons, except that the Corporation shall be authorized and

empowered to pay reasonable compensation for services rendered

and to make payments and distributions in furtherance of the

purposes set forth in this Article Third.

B. The Corporation shall not participate in, or

intervene in (including the publishing or distribution of

statements) any political campaign on behalf of (or in opposition

to) any candidate for public office .

C. Notwithstanding any of the provisions of these

articles, the Corporation shall not carry on any other activities

not permitted to be carried on (a) by a corporation exempt from

federal income tax under Section 501 (c) (4) of the Internal

Revenue Code (or the Revenue Law) _

D. Upon dissolution of the Corporation, the Board of

Directors shall, after paying or making provision for the payment

of all the liabilities of the corporation, dispose of all of the

assets of the Corporation exclusively for the purposes of the

Corporation in such manner, or to such organization(s) organized

and operated exclusively for the purpose of the promotion of

social welfare, as the time shall qualify as an exempt

organization(s) under Section 501(c) (4) of the internal Revenue

Code (or the corresponding provision of any United States

Internal Revenue Law), as the Board of Directors shall determine.

Any suoh assets not so disposed of shall be disposed of by the

court of general jurisdiction of the jurisdiction in which the

principal off ice of the incorporation is then located,

exclusively for such purposes or to such organization (s), as said

2

(Page 3 of 5 )

. e

court shall determine which are organized and operated

exclusively for such purposes.

E. The Corporation shall distri bute its i ncome for

each taxable year at such time and in such manner as not to

become subject to the tax on undistributed income imposed by

Section 4942 of the Internal Revenue Code of 1 954, or

corresponding provisions of any subsequent federal tax laws .

F. The Corporation shall not engage in any act of

self-dealing as defined in Section 4941 (d) of the Internal

Revenue Code of 1954, or corresponding provisions of any

subsequent federal tax laws .

G. The Corporation shall not retain any excess

business holdings as defined in Section 4943(c) of the Internal

Revenue code of 1954, or corresponding provision of any

subsequent federal tax laws.

H. The Corporation shall not make any

expenditures as defined in Section 4845 (d) of the

Revenue Code of 1954 , or corresponding provisi ons

subsequent federal tax laws .

ARTICLE V

taxable

Internal

of any

The Corporation shall have one class of non-voting members .

Jt1/lt/./,'C4;;;P{/5 SV!Cr/ SH4LL &' /h //IC t'-

ARTICLE VI --,,., . '

The initial street address in the District of Columbia of

the initial registered office of the corporation is 1090 Vermont

Avenue, N.W., Suite 430, Washington, D.C. 20005, and the name of

the initial registered agent at such address is the Prentice-Hall

Corporation System, Inc.

ARTICLE VII

The territory in which the operations of the corporation are

principally to be conducted is the United States of America and

its territories and possessions, but the operations of the

Corporation shall not be limited to such territory.

ARTICLE VIII

There shall be at least three (3) directors who shall be

elected or appointed as provided by the by-laws.

3

(Page 4 of 5)

.e

ARTICLE IX

The number of directors constituting the initial Board of

Directors is three (3), and the names and addresses, including

street and number of the persons who are to serve as the initial

directors until the first annual meeting or unti l their

successors are elected and qualified, are as follows:

B..Hq Jaber

9748 South Meade

GJ.aahoma, 60453

CIJ!ttJ

Omar Ahmad

3335 Homestead Road

Unit 46

Santa Clara, California 95051

Nehad Hammad

5804 Merton Court

Suite 82

Alexandria, Virginia 22311

ARTICLE X

The names and addresses of the initial incorporators are as

follows:

9748 South Meade

60453

t:JJrK, t-ftvi,;,

Omar Ahma

3335 Homestead Road

Unit 46

Santa Clara, California

Nehad Hammad

5804 Merton Court

Suite 82

95051

Alexandria, Virginia 22311

4

(Page 5 of 5 )

.e

IN WITNESS WHEREOF, the undersigned have made and subscribed

Articles of Incorporation ..... .....

-

OMAR AHMAD

NEHAD HAMMAD

STATE

COUNTY OF ,

The foregfing instrument before me by

JABER, this 0 day of 1994_

My

"OFFICIAL !:Ei'1."

SUI f1onlka

Commission 11r1mnois

r.;y-co.nm ... Expires 7/15/95

4 ..

Notary Public

STATE OF

COUNTY OF , to-wit;

The f oregoi_]lg instrument was before me by OMAR

AHMAD, this Lt 'fl.- day of lH'ff1'<-2 ( , 1994.

iM

My_Commission Expires:

flM:i l"i-97

The instrumen,t") was acknowledge before me by NEHAD

HAMMAD, this day of , 1994-

Not&'ry Public

5

1

You might also like

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Timeline Dismantle Immigration EnforcementDocument16 pagesTimeline Dismantle Immigration EnforcementTim CavanaughNo ratings yet

- MRC Letter To Gov Martin OmalleyDocument1 pageMRC Letter To Gov Martin OmalleyTim CavanaughNo ratings yet

- Unsealed Yee AffidavitDocument137 pagesUnsealed Yee Affidavitjeremybwhite100% (1)

- Citizen Petition From Sabra Dipping Co LLCDocument11 pagesCitizen Petition From Sabra Dipping Co LLCAnonymous 2NUafApcVNo ratings yet

- Mid-Mar Enrollment Report 3-10-14Document29 pagesMid-Mar Enrollment Report 3-10-14Tim CavanaughNo ratings yet

- Wastebook 2013Document177 pagesWastebook 2013Caroline MayNo ratings yet

- Feb 2014 Donor LetterDocument4 pagesFeb 2014 Donor LetterTim CavanaughNo ratings yet

- Buffett AbortionDocument54 pagesBuffett AbortionTim CavanaughNo ratings yet

- Council of Economic Advisers: Year in Review Economic BriefingDocument22 pagesCouncil of Economic Advisers: Year in Review Economic BriefingThe White HouseNo ratings yet

- QHP CMS Agreement For 2014-1Document9 pagesQHP CMS Agreement For 2014-1Tim CavanaughNo ratings yet

- Warning: Graphic Content: USPIS Statement of FactsDocument3 pagesWarning: Graphic Content: USPIS Statement of Factskballuck1No ratings yet

- Rice STOP ResolutionDocument4 pagesRice STOP ResolutionCaroline MayNo ratings yet

- Laurie Cum Bo JewsDocument3 pagesLaurie Cum Bo JewsTim CavanaughNo ratings yet

- Median Obamacare SubsidiesDocument3 pagesMedian Obamacare SubsidiesTim CavanaughNo ratings yet

- Grand Jury Subpoena To DOA - 20130107 - 115259Document4 pagesGrand Jury Subpoena To DOA - 20130107 - 115259Tim CavanaughNo ratings yet

- Ulbricht Criminal ComplaintDocument39 pagesUlbricht Criminal ComplaintbrianrbarrettNo ratings yet

- Exchange Enrollment Flow ChartDocument1 pageExchange Enrollment Flow ChartTim CavanaughNo ratings yet

- Awad Hammad, NihadDocument163 pagesAwad Hammad, NihadTim CavanaughNo ratings yet

- FCC Wheeler 2Document20 pagesFCC Wheeler 2Tim CavanaughNo ratings yet

- Awad Hammad, NihadDocument163 pagesAwad Hammad, NihadTim CavanaughNo ratings yet

- Awad Hammad, NihadDocument163 pagesAwad Hammad, NihadTim CavanaughNo ratings yet

- Ex. 2 To Ex. ADocument33 pagesEx. 2 To Ex. ATim CavanaughNo ratings yet

- CAIR-F 2007 Articles of Incorp (Ex. 10 To Ex. A - OCR)Document5 pagesCAIR-F 2007 Articles of Incorp (Ex. 10 To Ex. A - OCR)Tim CavanaughNo ratings yet

- CAIR Inc Last - Confidential - Filing 2007Document7 pagesCAIR Inc Last - Confidential - Filing 2007Tim CavanaughNo ratings yet

- Awad Hammad, NihadDocument163 pagesAwad Hammad, NihadTim CavanaughNo ratings yet

- Awad Hammad, NihadDocument163 pagesAwad Hammad, NihadTim CavanaughNo ratings yet

- WTF Incorporation Docs (DCRA File Re WTF Fka CAIR-An As of 6.18.13 - OCRDocument7 pagesWTF Incorporation Docs (DCRA File Re WTF Fka CAIR-An As of 6.18.13 - OCRTim CavanaughNo ratings yet

- CAIR-F 2013 IRS Reinstatement (Ex. 10 To Ex. A - OCR)Document4 pagesCAIR-F 2013 IRS Reinstatement (Ex. 10 To Ex. A - OCR)Tim CavanaughNo ratings yet

- NRSC Landrieu FlyerDocument2 pagesNRSC Landrieu FlyerTim CavanaughNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Alternative forms of 'R' and 'H' in shorthandDocument14 pagesAlternative forms of 'R' and 'H' in shorthandAnshil SharmaNo ratings yet

- Transmit Securities BondDocument2 pagesTransmit Securities BondSunita BasakNo ratings yet

- The Maharashtra Prevention of Dangerous Activities of Slumlords, Bootleggers, Drug-Offenders, DanDocument10 pagesThe Maharashtra Prevention of Dangerous Activities of Slumlords, Bootleggers, Drug-Offenders, DanNk JainNo ratings yet

- ED Advanced 1 - WorkbookDocument135 pagesED Advanced 1 - WorkbookAdriana Rosa PailloNo ratings yet

- Residences by Armani CasaDocument2 pagesResidences by Armani CasaHakanNo ratings yet

- Intercepting Android HTTPDocument13 pagesIntercepting Android HTTPJurgen DesprietNo ratings yet

- Foodpanda OrderDocument2 pagesFoodpanda OrderMohd Azfarin100% (1)

- role of the allama iqbal in the creation of pakistanDocument2 pagesrole of the allama iqbal in the creation of pakistandeadson03No ratings yet

- TM-3534 AVEVA 12-1 - Diagrams AdministrationDocument108 pagesTM-3534 AVEVA 12-1 - Diagrams AdministrationWelingtonMoraesNo ratings yet

- RODRIGUEZ VS TAN HEIRS' RIGHT TO ADMINISTER ESTATEDocument2 pagesRODRIGUEZ VS TAN HEIRS' RIGHT TO ADMINISTER ESTATEtops videosNo ratings yet

- Ashley Furniture Industries, Inc. Arcadia, Wisconsin 54612Document4 pagesAshley Furniture Industries, Inc. Arcadia, Wisconsin 54612picfixerNo ratings yet

- Judicial Interference ComplaintDocument6 pagesJudicial Interference ComplaintNC Policy WatchNo ratings yet

- How I LAWFULLY Claimed 4 Houses Free and ClearDocument75 pagesHow I LAWFULLY Claimed 4 Houses Free and ClearSonof Godd100% (4)

- Gstinvoice 0047Document1 pageGstinvoice 0047Kalpatharu OrganicsNo ratings yet

- LIM v. SABAN G.R. No. 163720. December 16, 2004Document3 pagesLIM v. SABAN G.R. No. 163720. December 16, 2004SSNo ratings yet

- Apollo Contacts ExportDocument36 pagesApollo Contacts Exportanasakram701No ratings yet

- Business Formation & Business Credit GuideDocument14 pagesBusiness Formation & Business Credit GuideMonique100% (4)

- 2013 Legal and Ethical Issues in Nursing 6th Edition Test BankDocument14 pages2013 Legal and Ethical Issues in Nursing 6th Edition Test BankEricaPhillipsaszpc100% (29)

- Munit Blue Manual 1.8 enDocument21 pagesMunit Blue Manual 1.8 engiambi-1No ratings yet

- Is Participant - Simplified v3Document7 pagesIs Participant - Simplified v3Ajith V0% (1)

- Zicta Annual Report 2019 PDFDocument172 pagesZicta Annual Report 2019 PDFCurter Lance LusansoNo ratings yet

- 2019 - Pooja - Social Media Ethical Challenges PDFDocument15 pages2019 - Pooja - Social Media Ethical Challenges PDFNeha sharmaNo ratings yet

- SAFC Biosciences - Technical Bulletin - The Science of LONG®R3IGF-I: Features and BenefitsDocument4 pagesSAFC Biosciences - Technical Bulletin - The Science of LONG®R3IGF-I: Features and BenefitsSAFC-GlobalNo ratings yet

- Indian Stock Market MechanismDocument2 pagesIndian Stock Market Mechanismneo0157No ratings yet

- Performance Evaluation of RAK Ceramics & Standard Ceramics.Document24 pagesPerformance Evaluation of RAK Ceramics & Standard Ceramics.Emon HossainNo ratings yet

- Crimpro - Warrantless ArrestDocument84 pagesCrimpro - Warrantless ArrestMarie Mariñas-delos Reyes50% (2)

- Financial GlobalizationDocument10 pagesFinancial GlobalizationAlie Lee GeolagaNo ratings yet

- WEB Threat AssessmentDocument3 pagesWEB Threat AssessmentWilliam N. GriggNo ratings yet

- Bdu-Jl Vol 7 No 1Document156 pagesBdu-Jl Vol 7 No 1Auto squadNo ratings yet

- MCQDocument6 pagesMCQArup Kumar DasNo ratings yet