Professional Documents

Culture Documents

Beta PQU

Uploaded by

lisahun0 ratings0% found this document useful (0 votes)

4 views2 pageshow to calculate beta finance for leverage

Original Title

betaPQU.xls

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documenthow to calculate beta finance for leverage

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views2 pagesBeta PQU

Uploaded by

lisahunhow to calculate beta finance for leverage

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 2

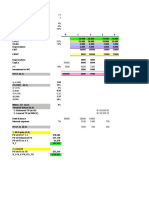

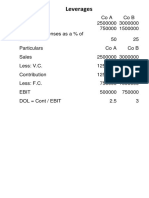

BETA

To show the impact of operating leverage on beta

Case 1: High Fixed Costs (30000) and

Case 2: Low Fixed Costs (5000) and

low variable costs ($2.5 per unit)

high variable costs ($6 per unit)

Fixed cost =

30000

5000

Volume

Revenue

Variable costs

Profit

Variable Costs

Profit

0

0

0

-30000

0

-5000

1

10000

2500

-22500

6500

-1500

2

20000

5000

-15000

13000

2000

3

30000

7500

-7500

19500

5500

4

40000

10000

0

26000

9000

5

50000

12500

7500

32500

12500

6

60000

15000

15000

39000

16000

7

70000

17500

22500

45500

19500

8

80000

20000

30000

52000

23000

9

90000

22500

37500

58500

26500

10

100000

25000

45000

65000

30000

11

110000

27500

52500

71500

33500

12

120000

30000

60000

78000

37000

13

130000

32500

67500

84500

40500

14

140000

35000

75000

91000

44000

Relation between Volume a

Fixed Costs $30,000; Var. Co

Revenues, Costs and Profits

Revenues, Costs and Profits

Relation Between Volume and Profits

Fixed Costs $5,000; Var. Costs $6.00

160000

140000

120000

100000

80000

60000

40000

20000

0

-20000

Volume

Page 1

160000

140000

120000

100000

80000

60000

40000

20000

0

-20000 0

-40000

BETA

Fixed Costs (5000) and

costs ($6 per unit)

Relation between Volume and Profit

Fixed Costs $30,000; Var. Costs $2.50

10

15

Volume

Page 2

You might also like

- Advanced Financial Management: Prof. Rajiv Chandra Mba (Iima), Icwa, Cs Semester 2 Class of 2020Document24 pagesAdvanced Financial Management: Prof. Rajiv Chandra Mba (Iima), Icwa, Cs Semester 2 Class of 2020Atul DurejaNo ratings yet

- Investment/ Financing Decisions: S.ClementDocument33 pagesInvestment/ Financing Decisions: S.Clementjohnkm28No ratings yet

- Advanced Financial Management: Prof. Rajiv Chandra Mba (Iima), Icwa, Cs Semester 2 Class of 2022Document27 pagesAdvanced Financial Management: Prof. Rajiv Chandra Mba (Iima), Icwa, Cs Semester 2 Class of 2022GAURAV SAININo ratings yet

- Chapter 15Document10 pagesChapter 15Gazjon RusiNo ratings yet

- Questions & Problems 2Document9 pagesQuestions & Problems 2Suman MahmoodNo ratings yet

- Costing For Decision-Making: Cost Defined As Total ExpenseDocument44 pagesCosting For Decision-Making: Cost Defined As Total ExpenseUttam Kr PatraNo ratings yet

- Topic 4 Notes On - Cost Curves DerivationDocument24 pagesTopic 4 Notes On - Cost Curves DerivationsilasmafungaNo ratings yet

- Break Even Analysis ActivityDocument3 pagesBreak Even Analysis ActivityHriday AmpavatinaNo ratings yet

- (A) Value of The Marginal Propensity To Save DecreasesDocument5 pages(A) Value of The Marginal Propensity To Save DecreasesAkhilNo ratings yet

- Semi Variable Cost ExamplesDocument5 pagesSemi Variable Cost Examplestanmay agrawalNo ratings yet

- SVKM'S Nmims Anil Surendra Modi School of Commerce Batch: 2018 - 2021 Academic Year: 2020 - 2021 Subject: Management Accounting Date: 5 January 2021Document24 pagesSVKM'S Nmims Anil Surendra Modi School of Commerce Batch: 2018 - 2021 Academic Year: 2020 - 2021 Subject: Management Accounting Date: 5 January 2021Madhuram SharmaNo ratings yet

- Flexible and Static Budgets ReviewerDocument13 pagesFlexible and Static Budgets ReviewerLilac heartNo ratings yet

- 02c Analysis of FADocument12 pages02c Analysis of FASaad ZamanNo ratings yet

- Accounts - FIFO and WA For FinalDocument11 pagesAccounts - FIFO and WA For FinalRohan SinghNo ratings yet

- β - U (VS) 1.5 β - U (HE) 2 Risk-free 4% Risk Premium 8% tax 50%Document1 pageβ - U (VS) 1.5 β - U (HE) 2 Risk-free 4% Risk Premium 8% tax 50%Young-Hun KimNo ratings yet

- Case 16-1 - Hospital Supply, Inc.Document5 pagesCase 16-1 - Hospital Supply, Inc.Ebans Castillo BennettNo ratings yet

- DR Rachna Mahalwla - B.Com III Year Management Accounting Flexible BudgetingDocument6 pagesDR Rachna Mahalwla - B.Com III Year Management Accounting Flexible BudgetingSaumya JainNo ratings yet

- Solutions and DiscussionsDocument4 pagesSolutions and DiscussionsChryshelle LontokNo ratings yet

- Final Economy 2010 SolutionDocument6 pagesFinal Economy 2010 SolutionValadez28No ratings yet

- ME QuestionsDocument11 pagesME QuestionsDharmesh GoyalNo ratings yet

- Chapter # 10Document2 pagesChapter # 10kqandeelNo ratings yet

- ME Chap - 3 Cost AnalDocument11 pagesME Chap - 3 Cost Analgeneralpurpose1729No ratings yet

- Same Questions - F303 - 1st MidDocument5 pagesSame Questions - F303 - 1st MidRafid Al Abid SpondonNo ratings yet

- Club MembershipDocument13 pagesClub MembershipVishal Vijay SoniNo ratings yet

- FM Assignment1Document6 pagesFM Assignment1Rishi Kumar SainiNo ratings yet

- Break Even2Document2 pagesBreak Even2Edward KahwaiNo ratings yet

- CostingDocument4 pagesCostingPaulNo ratings yet

- Q1Document31 pagesQ1Bhaskkar SinhaNo ratings yet

- New Income Slab Rates CalculationsDocument6 pagesNew Income Slab Rates Calculationsphani raja kumarNo ratings yet

- Assumptions:: 11. Financial PlanDocument5 pagesAssumptions:: 11. Financial PlanAkib xabedNo ratings yet

- SampaSoln EXCELDocument4 pagesSampaSoln EXCELRasika Pawar-HaldankarNo ratings yet

- Tax TablesDocument1 pageTax TablesEmman NepacenaNo ratings yet

- Leverage Example 2Document8 pagesLeverage Example 2AAM26No ratings yet

- Assignment No. 1Document2 pagesAssignment No. 1Sharmaine JoyceNo ratings yet

- FFM 1013Document55 pagesFFM 1013Suzana MerchantNo ratings yet

- Cost AnalysisDocument47 pagesCost AnalysisAkarsh BhattNo ratings yet

- Problem Set 005 Q AnswersDocument5 pagesProblem Set 005 Q AnswersDennis Korir100% (1)

- (M-5) Budgeting 2Document26 pages(M-5) Budgeting 2Yolo GuyNo ratings yet

- Econ 201 Exam 2 Study GuideDocument6 pagesEcon 201 Exam 2 Study GuideprojectilelolNo ratings yet

- 610 Midterm 2 S11 02 With SolDocument6 pages610 Midterm 2 S11 02 With SolabuzarNo ratings yet

- Solution Set - Costing & O.R.-4th EditionDocument417 pagesSolution Set - Costing & O.R.-4th EditionRonny Roy50% (4)

- Ballou10 ImDocument13 pagesBallou10 ImCarlos Huerta OrellanaNo ratings yet

- Illustration1: For The Production of 10000 Units of A Product, The Following Are The Budgeted ExpensesDocument4 pagesIllustration1: For The Production of 10000 Units of A Product, The Following Are The Budgeted ExpensesGabriel BelmonteNo ratings yet

- 7.chapter 16 - Capital StructureDocument23 pages7.chapter 16 - Capital StructureMohamed Sayed FadlNo ratings yet

- SumsDocument25 pagesSumsNeedhi NagwekarNo ratings yet

- Particulars SQ FT Rate Amount (RS)Document4 pagesParticulars SQ FT Rate Amount (RS)deekaayNo ratings yet

- RQ.22.17 O1 O2 Sales Variable Cost ContributionDocument6 pagesRQ.22.17 O1 O2 Sales Variable Cost ContributionDiana D'souzaNo ratings yet

- Unit Test 2 Term 1 S4 (2022 - 2023)Document3 pagesUnit Test 2 Term 1 S4 (2022 - 2023)Olieve Jacqueline FangNo ratings yet

- Group4 SectionA SampavideoDocument5 pagesGroup4 SectionA Sampavideokarthikmaddula007_66No ratings yet

- AFM IBSB Leverages WordDocument16 pagesAFM IBSB Leverages WordSangeetha K SNo ratings yet

- Chapter 8 7e SolutionsDocument50 pagesChapter 8 7e Solutionsmuudey sheikhNo ratings yet

- Afm Long - Term Financing - LeveragesDocument8 pagesAfm Long - Term Financing - LeveragesDaniel HaileNo ratings yet

- MA CHAPTER 4 Marginal Costing 1Document79 pagesMA CHAPTER 4 Marginal Costing 1Mohd Zubair KhanNo ratings yet

- Management Accounting: Support-Department Cost AllocationDocument29 pagesManagement Accounting: Support-Department Cost AllocationbelalangkupukupukupuNo ratings yet

- LeverageDocument36 pagesLeveragereddyhareeNo ratings yet

- HW Chap 12Document6 pagesHW Chap 12phương vũNo ratings yet

- Basic Income and Sovereign Money: The Alternative to Economic Crisis and Austerity PolicyFrom EverandBasic Income and Sovereign Money: The Alternative to Economic Crisis and Austerity PolicyNo ratings yet

- Customer Cat ET OverviewDocument36 pagesCustomer Cat ET Overviewlisahun100% (5)

- Manpower Calculator Introduction V1.5Document18 pagesManpower Calculator Introduction V1.5lisahunNo ratings yet

- Beyond Mine Dispatch - Optimizing The Mining Value Chain - Wenco Mining SystemsDocument5 pagesBeyond Mine Dispatch - Optimizing The Mining Value Chain - Wenco Mining Systemslisahun100% (1)

- Geosat 8 UpdDocument19 pagesGeosat 8 UpdlisahunNo ratings yet

- AMMJ DownloadDocument4 pagesAMMJ DownloadlisahunNo ratings yet

- 773E ToolingListDocument12 pages773E ToolingListlisahunNo ratings yet

- Gps Positioning and SurveyingDocument62 pagesGps Positioning and SurveyinglisahunNo ratings yet

- DT-94 EventDocument6 pagesDT-94 EventlisahunNo ratings yet

- DT 102 EventDocument17 pagesDT 102 EventlisahunNo ratings yet

- Fuel Dilution of Engine OilDocument2 pagesFuel Dilution of Engine Oillisahun100% (3)

- Fuel Filter RestrictionDocument2 pagesFuel Filter RestrictionlisahunNo ratings yet

- Dealer Stocking ListDocument6 pagesDealer Stocking ListlisahunNo ratings yet

- Parameter Yang Di DataloggerDocument1 pageParameter Yang Di DataloggerlisahunNo ratings yet

- Maintenance ORSDocument4 pagesMaintenance ORSlisahun100% (1)

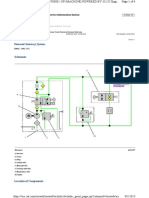

- ORS Hardware and SchematicsDocument11 pagesORS Hardware and Schematicslisahun100% (1)

- McBride Music Company - Woodwind and Brass Instrument RepairDocument2 pagesMcBride Music Company - Woodwind and Brass Instrument Repairlisahun0% (1)

- Powered Stairway SystemDocument4 pagesPowered Stairway Systemlisahun0% (1)

- Automatic Retarder Control (ARC)Document5 pagesAutomatic Retarder Control (ARC)lisahun100% (1)

- Powered Stairway SystemDocument4 pagesPowered Stairway Systemlisahun0% (1)

- PECJ0003-05 July2014Document448 pagesPECJ0003-05 July2014lisahunNo ratings yet

- MEHH3000-00 - H75Es H95Es Hammers Specalog Indonesia and SEADocument8 pagesMEHH3000-00 - H75Es H95Es Hammers Specalog Indonesia and SEAlisahunNo ratings yet

- The Orchestra: A User'S Manual: Orchestration Orchestration Resources HistoricalDocument15 pagesThe Orchestra: A User'S Manual: Orchestration Orchestration Resources HistoricallisahunNo ratings yet

- Part1 of 2Document3 pagesPart1 of 2lisahunNo ratings yet

- C519 - Wind, Brass and Percussion: Akg Micromic Instrument SeriesDocument1 pageC519 - Wind, Brass and Percussion: Akg Micromic Instrument SerieslisahunNo ratings yet

- Drive ReportDocument2 pagesDrive ReportlisahunNo ratings yet