0% found this document useful (0 votes)

79 views8 pagesOperating Leverage Analysis and Examples

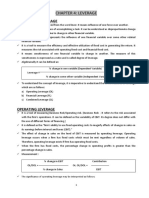

This document provides an example of operating leverage and calculates the degree of operating leverage (DOL) for two companies, Co A and Co B, based on a 10% increase or decrease in sales. It shows that for Co A, a 10% increase in sales led to a 30% increase in operating profit, resulting in a DOL of 3. For Co B, a 10% increase in sales led to a 45% increase in operating profit, resulting in a DOL of 4.5. The DOL represents the percentage change in operating profit divided by the percentage change in sales.

Uploaded by

AAM26Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

79 views8 pagesOperating Leverage Analysis and Examples

This document provides an example of operating leverage and calculates the degree of operating leverage (DOL) for two companies, Co A and Co B, based on a 10% increase or decrease in sales. It shows that for Co A, a 10% increase in sales led to a 30% increase in operating profit, resulting in a DOL of 3. For Co B, a 10% increase in sales led to a 45% increase in operating profit, resulting in a DOL of 4.5. The DOL represents the percentage change in operating profit divided by the percentage change in sales.

Uploaded by

AAM26Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd