Professional Documents

Culture Documents

Chepter 1

Uploaded by

Piyush PatelOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chepter 1

Uploaded by

Piyush PatelCopyright:

Available Formats

Introduction of Mergers, Acquisitions

and Restructuring

The Takeover Process

1 Chapter

2

CORPORATE RESTRUCTURING

Broad array of activities that

expand or contract a firms operations

substantially modify its financial structure

change its organizational structure and

internal functioning

3

CORPORATE RESTRUCTURING

Includes different activities such as:

Mergers

Purchases of business units

Takeovers

Slump sales

Demergers

Leveraged buyouts

Organizational restructuring

4

MEANING OF MERGER

A combination of two or more companies into

one company

Absorption: one company acquires another

company

Consolidation: two or more companies combine

to form a new company

Tender offers:

Offer made directly to the shareholders

Hostile when offer made without approval of the

board

5

EXAMPLE OF MERGERS

With corporate banking becoming an

unprofitable business for banks due to

high risk of asset quality, banks including

financial institutions are tapping the retail

finance segment. ICICI's acquisition of

Anagram Finance from Lalbhai group,

HDFC Bank's merger with Times Bank and

ICICI Bank's merger with Bank of Madura

are some of the latest examples of

consolidation in the banking sector.

6

Horizontal: merger of firms engaged in same line of

business

Example: Glaxo Wellcome Plc. and Smithkline Beecham

Plc.

The two british pharmaceutical heavyweights Glaxo

Wellcome Plc. and Smithkline Beecham Plc. merged to

become largest drug manufacturing company globally.

The merger created a company valued at $ 182.4 billion

and with a 7.3 per cent share of the global

pharmaceutical market. The merger company expected

$1.6 billion in pretax cost savings after 3 years of

merger. The two companies had complementary drug

portfolios, and a merger would let them pool their

research and development funds and would give the

merged company a bigger sales and marketing force.

TYPES OF MERGER

7

TYPES OF MERGER

Vertical: merger of firms engaged at different

stages of production in an industry

Vertical mergers take place when both firms

plan to integrate the production process and

capitalize on the demand for the product.

Forward integration take place when a raw

material supplier finds a regular procurer of its

products while backward integration takes place

when a manufacturer finds a cheap source of

raw material supplier.

8

TYPES OF MERGER

Conglomerate: merger of firms engaged in

unrelated lines of business

Congeneric: merger of firms engaged in

related lines of business

9

REASONS FOR MERGERS

Plausible Reasons

Strategic benefit

Economies of Scale

Economies of Scope

Economies of Vertical Integration

Complementary Resources

Tax Shields

Utilization of Surplus Funds

Managerial Effectiveness

10

REASONS FOR MERGERS

Dubious Reasons

Diversification

Lower financing costs

Earnings growth

11

Issues Regarding M&A Activity

In Favor

Critical to healthy

expansion of business

firms

Increase value and

efficiency

Move resources to

optimal uses

Opposed

No improvements

subsequent to the

acquisition

Redistribution of

wealth from labor and

other stakeholders to

shareholders

Speculative activity

12

MECHANICS OF A MERGER

According to Sec 391 to 394 of Indian Companies Act 1956, the

procedure for amalgamation involves:

Examining the object clauses of both companies

Intimating stock exchanges where the amalgamated and

amalgamating companies are listed

Getting draft amalgamation proposal approved by respective boards

of directors

Applying to National Company Law Tribunal

Dispatching notice to shareholders and creditors

Holding meetings of shareholders and creditors

Presenting petition to NCLT for confirming and passing order of

amalgamation

Filing NCLT order with ROC

Transferring assets and liabilities of amalgamating company to

amalgamated company

Issuing shares and/or debentures of the amalgamated company

13

TAXATION ASPECTS

For obtaining tax concessions, the

amalgamated company should satisfy the

following conditions:

all the properties and liabilities of the amalgamating

company should become the properties and liabilities

of the amalgamated company by virtue of the

amalgamation

at least 90% of the shareholders of the

amalgamating company (by value of shares) should

become the shareholders of the amalgamated

company

14

TAXATION ASPECTS

If the amalgamating company is an Indian company,

certain tax concessions are available

Unabsorbed or unfulfilled deductions of the

amalgamating company that are available to the

amalgamated company after the amalgamation:

capital expenditure on scientific research

expenditure on patents, copyrights, know-how

expenditure on license for operating telecommunication

services

amortization of preliminary expenses

carry forward of losses

unabsorbed depreciation

15

TAKEOVERS

Acquisition of a certain block of equity capital

of a company enabling the acquirer to

exercise control over the affairs of the

company

Theoretically, more than 50% of equity

needed for complete control

Practically, 20-40% sufficient for exercising

control

16

TAKEOVERS

Various methods for takeovers:

Open market purchase: buying shares of the listed

company in the stock market; usually hostile

takeovers

Negotiated acquisition: buying shares of target

company from one/more existing shareholders

(mostly promoters) in a negotiated transaction

Preferential allotment: buying shares of target

company through preferential allotment of equity;

friendly acquisition

17

NEED FOR REGULATION OF

TAKEOVERS

Necessary to regulate takeovers in the

following areas:

Transparency

Transparent process will increase acceptance as

legitimate device among all parties involved

Interest of small shareholders

Regulation should ensure that

shareholders holding small numbers of

shares should not suffer

18

NEED FOR REGULATION OF

TAKEOVERS

Realization of economic gains

Ensure that primary rationale for takeover is

efficiency of operations and better utilization of

resources

Provision of suitable fiscal incentives for

takeovers of ailing units

No undue concentration of

market power

Acquirer should not enjoy undue concentration

of market power which may be used to

detriment of customers or others

19

SEBI TAKEOVER CODE

Salient points of SEBIs takeover code:

Disclosure

Any acquirer who acquires holdings

(shares/voting rights) which alongwith existing

holdings add up to 5%, 10% and 14% of the

total, should announce at each stage to the

company and concerned stock exchange about

such holdings

Stock exchanges shall put up such information

on public display

20

SEBI TAKEOVER CODE

Trigger Point

No acquirer can acquire holdings which

alongwith his existing holdings become

equal to or more than 15% of the total

holding

An acquirer can do so only if he makes a

public announcement to acquire shares

through a public offer to the extent of

20%

21

SEBI TAKEOVER CODE

Offer Price

The offer price to the public should be

atleast the highest of the following:

negotiated price

average price paid by acquirer

preferential offer price (if made in last 12

months)

average of weekly high and low for last 26

months

22

SEBI TAKEOVER CODE

Contents of Public

Announcement

The public announcement should provide the

following information:

number of shared proposed to be acquired

minimum offer price

object of acquisition

date by which offer letter will be posted

dates of opening and closing of offer

An acquirer can do so only if he makes a public

announcement to acquire shares through a public

offer to the extent of 20%

23

SEBI TAKEOVER CODE

Creeping Acquisition

No acquirer can acquire more than 5% of

holdings in any financial year without

complying with open offer requirements if his

existing holdings are between 15% and 75%

of the total

An acquirer can do creeping acquisition of up

to 5% per year without triggering off the open

offer requirements

Any purchase/sale of holding amounting to 2%

of the total should be reported within two days

of the transaction

24

ANTI-TAKEOVER DEFENCES IN

THE US

Pre-offer Defenses

Staggered Board: electing one group of directors out

of three every year

Super majority clause: high percentage of votes

(around 80%) required to approve a merger

Poison pills: granting existing shareholders the right

to purchase convertible bonds or preference stock of

the acquiring firm on favorable terms in the event of

a merger

Dual class: creating new class of shareholders with

superior voting rights

Golden parachute: high compensation to incumbent

management in the event of takeover

25

ANTI-TAKEOVER DEFENCES IN

THE US

Post-offer Defenses

Greenmail: buying acquired shares from bidder at a

premium in exchange for his promise of refraining from

hostile takeover

Pacman defence: making counter bid for the stock of the

bidder

Litigation: filing a suit against the bidder for violating

anti-trust or security laws

Asset restructuring: selling the most attractive assets

and/or buying assets that are unwanted or problematic

for the bidder

Liability restructuring: repurchasing own shares at

premium or issuing shares to friendly third party

26

ANTI-TAKEOVER DEFENCES IN

INDIA

Preferential allotment: allotting equity shares or

convertible securities preferentially to promoters

to enhance their equity stake

Creeping enhancement: raising equity holding

by creeping enhancement

Amalgamate group companies: amalgamating

two or more group companies to form a larger

company less vulnerable to takeover

Selling crown jewels: selling the assets which

are attractive to bidder

Searching for white knight: soliciting support

from a friendly third party

27

BUSINESS ALLIANCES

Viable alternatives to mergers and acquisitions

Most commonly used forms:

Joint ventures: independent legal entity in which two or more separate

legal organizations participate preserving their own corporate identity

and autonomy

Strategic alliances: co-operative relationship without creation of

separate legal entity

Equity partnership: co-operative relationship in which one party takes a

minority equity stake in the other

Licensing: licensing of technology/product/process or

trademark/copyright

Franchising alliance: right to sell goods and services to multiple

licensees in different geographical locations

Network alliance: web of inter-connecting alliances for collaborations

between companies

28

RATIONALE FOR BUSINESS

ALLIANCES

Sharing risks and resources

Access to new markets

Cost reduction through sharing or

combining of facilities

Favorable regulatory treatment

Preclude to acquisition or exit

29

SUCCESS FACTORS FOR

BUSINESS ALLIANCES

Complementary strengths of partners

Sharing of exorbitant cost of developing new

product

Ability of partners to cooperate with each other

Clarity of purpose, roles and responsibilities

Perception of equitable division of risks and

rewards among partners

Similar time horizons and financial expectations

of partners

30

MANAGING AN ACQUISITION

DISCIPLINED ACQUISITION PROGRAMME

Manage the Pre-acquisition Phase

Thorough evaluation of itself

Brainstorming for acquisition ideas

Screen Candidates

Evaluate Remaining Candidates

Determine the Mode of Acquisition

Negotiate and Consummate the Deal

Manage the Post-acquisition Integration

31

PITFALLS/SINS OF ACQUISITION

Straying into very unrelated areas

Striving for large size

Failure to investigate thoroughly before

acquisition

Overpaying

Failing in post-acquisition integration

32

DIVESTITURES

Partial Sell-off

Demerger

Equity Carveout

A) PARTIAL SELL-OFF

Sale of business unit/plant of one company to another

Also called slump sale

Motives for Sell-off

Raising capital

Curtailing losses

Strategic realignment

Efficiency gain

33

DIVESTITURES

Financial Evaluation of Sell-off

Estimating divisional post-tax cash flows

Establishing discount rate for the division taking as base

cost of capital of some firm of almost the same size

engaged solely in the same line of business

Calculating PV of division by using discount rate

Finding market value of division specific liabilities i.e. PV

of obligations arising from the divisions liabilities

Deducing parent firms value of ownership position

(VOP)

VOP = PV of divisions CF MV of division-specific

liabilities

Comparing VOP with divestiture proceeds (DP)

Taking decision about sell-off

34

DEMERGER

Transfer of one or more undertaking by a company to

another company

Demerged company: whose undertaking is transferred

Resulting company: to which undertaking is transferred

May take form of spin-off or split-up

Spin-off: undertaking/division of company is spun off

into an independent company; parent and spun off

company are separate corporate entities

Split-up: company is split up into two or more

independent companies; parent company disappears and

new corporate entities emerge

Spin-offs and split-ups enable sharper business focus

Strengthens managerial incentives and increases

accountability

35

EQUITY CARVEOUT

Parent company sells a portion of its

equity in a wholly owned subsidiary

Sale may be made to general public or a

strategic investor

Brings cash infusion to the company

Helps induct strategic investor in a

subsidiary

36

OWNERSHIP RESTRUCTURING

Going Private

Leveraged Buyout

Holding Company

A) GOING PRIVATE

Converting publicly held company into private company

Stock of private company usually held by small group of

investors with incumbent management having

substantial stake

Typically done by buying out shares held by public

Factors prompting management:

Cost savings

Focus on long-term value creation

37

OWNERSHIP RESTRUCTURING

LEVERAGED BUYOUT

Transfer of ownership consummated

mainly with debt

Mostly involve a business unit of a

company

Often buyout is by management (MBO)

After LBO/MBO, unit becomes private

company

38

OWNERSHIP RESTRUCTURING

HOLDING COMPANY

Company holding stocks of other companies to

exercise control over them

Advantages:

Control with fractional ownership

Isolation of risk

Enormous financial leverage

Disadvantages:

Partial multiple taxation

Parental responsibility

39

PRIVATIZATION

Transfer of partial or total ownership

(represented by equity shares) of public

enterprise from the government to

individuals and non-government

institutions

Rationale behind privatization:

Improving efficiency

Generating resources

Promoting popular capitalism

40

ORGANISATIONAL

RESTRUCTURING

Elements in organizational restructuring

programmes:

Regrouping of businesses

Decentralization

Downsizing

Outsourcing

Business process re-engineering (BPR)

Enterprise resource planning (ERP)

Total quality management (TQM)

41

Tender Offers

Bidder seeks target's shareholders

approval

Minority shareholders

Terms may be "crammed down"

May be subject to "freeze-in"

Minority may bring legal actions

2001-2002, many minority squeeze-outs

Usually reversing equity carve-out

Parents often make high bid to avoid shareholder

lawsuits

42

Tender Offers

Kinds of tender offers and provisions

Conditional vs. unconditional

Restricted vs. unrestricted

"Any-or-all" tender offer

Contested offers

Two-tier offers

Three-piece suitor

43

Risk Arbitrage in M&A Activity

In M&A, risk arbitragers take a position in a

merger for short-term profitable resale

Arbitragers bet that a deal will be completed:

bear deal risk & try to minimize market risk

Provide liquidity for target shareholders seeking

to sell to realize gains from premium

Arbitrage funds

Spread deal risk over portfolio of deals

Performance of these funds is often high

But, funds are highly exposed to market crashes

44

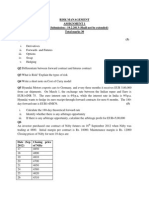

Risk Arbitrage in M&A Activity

Illustrative Example

Sears announced a cash tender offer for Lands End

Tender offer was for $62; at close on announcement

date, LE was at $61.72

Investing at $61.72 would yield 3.7% annual return if

deal closed in the forecasted 45 days

( )

1

72 . 61

72 . 61 62

1 % 7 . 3 return Annual

45

365

|

.

|

\

|

+ = =

You might also like

- Organisational Behaviour Leadership Theory: Vanaja Madam Ajudiya Mayur CDocument8 pagesOrganisational Behaviour Leadership Theory: Vanaja Madam Ajudiya Mayur CPiyush PatelNo ratings yet

- RM Assignmemt I-19!2!2013Document2 pagesRM Assignmemt I-19!2!2013Piyush PatelNo ratings yet

- MinisteryDocument2 pagesMinisteryPiyush PatelNo ratings yet

- Banking TermsDocument11 pagesBanking TermsPiyush PatelNo ratings yet

- EconomicDocument17 pagesEconomicPiyush PatelNo ratings yet

- 2013 New World Day ListDocument6 pages2013 New World Day ListPiyush PatelNo ratings yet

- Acconuting ConceptsDocument35 pagesAcconuting ConceptsPiyush PatelNo ratings yet

- Lec 11Document23 pagesLec 11Piyush PatelNo ratings yet

- Submitted From, G.Hemanth Kumar: Submittedto, Vanaja MamDocument7 pagesSubmitted From, G.Hemanth Kumar: Submittedto, Vanaja MamPiyush PatelNo ratings yet

- Amul DerryDocument58 pagesAmul DerryPiyush PatelNo ratings yet

- Organizational Psychology: Theme: Effective Management of PeopleDocument47 pagesOrganizational Psychology: Theme: Effective Management of PeoplePiyush PatelNo ratings yet

- AlukDocument7 pagesAlukPiyush PatelNo ratings yet

- List of Case Studies-2010Document23 pagesList of Case Studies-2010Piyush PatelNo ratings yet

- Accounts 1Document14 pagesAccounts 1Piyush PatelNo ratings yet

- Chepter 1Document44 pagesChepter 1Piyush PatelNo ratings yet

- List of Case Studies-2009Document17 pagesList of Case Studies-2009Piyush PatelNo ratings yet

- List of Case Studies-2010Document23 pagesList of Case Studies-2010Piyush PatelNo ratings yet

- Broking - Depository - Distribution - Financial Advisory: For Any EnquiryDocument13 pagesBroking - Depository - Distribution - Financial Advisory: For Any EnquiryAbhishek ShankarNo ratings yet

- Innovation in Retail BankingDocument47 pagesInnovation in Retail BankingPiyush PatelNo ratings yet

- Cash Flow StatementDocument9 pagesCash Flow StatementPiyush PatelNo ratings yet

- SFMDocument18 pagesSFMPiyush PatelNo ratings yet

- Assel LiabilityDocument74 pagesAssel LiabilityVinay KumarNo ratings yet

- SFMDocument18 pagesSFMPiyush PatelNo ratings yet

- Banking in IndiaDocument57 pagesBanking in IndiaPiyush PatelNo ratings yet

- Sick CompanyDocument9 pagesSick CompanyPiyush PatelNo ratings yet

- Marketing GlossaryDocument14 pagesMarketing GlossaryKARISHMAATNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Final MBA-suragDocument84 pagesFinal MBA-suragSurag VsNo ratings yet

- ICICI Pru Smart Kid Premier BrochureDocument14 pagesICICI Pru Smart Kid Premier Brochuredencybk123No ratings yet

- Project On Reliance Mutual FundDocument13 pagesProject On Reliance Mutual FundNancy AroraNo ratings yet

- Chapter 4Document7 pagesChapter 4Gilang PurwoNo ratings yet

- Proposed IIM Indore Alumni Angel Fund 2Document8 pagesProposed IIM Indore Alumni Angel Fund 2navin_iNo ratings yet

- Examiner's Report: FA/FFA Financial Accounting Key Themes From Examiner Reports 2015 - 2018Document8 pagesExaminer's Report: FA/FFA Financial Accounting Key Themes From Examiner Reports 2015 - 2018Grace EtwaruNo ratings yet

- Indian Stock Market PDFDocument14 pagesIndian Stock Market PDFDeepthi Thatha58% (12)

- Assignment 3 - Financial MarketsDocument4 pagesAssignment 3 - Financial MarketsToni MarquezNo ratings yet

- Rootstock SCI Worldwide Flexible Fund - Minimum Disclosure DocumentDocument4 pagesRootstock SCI Worldwide Flexible Fund - Minimum Disclosure DocumentMartin NelNo ratings yet

- Day 11 - Writing A Function Rule Homework WorksheetDocument1 pageDay 11 - Writing A Function Rule Homework WorksheetSeth AikensNo ratings yet

- Case 5 - Conrail A&B (Questions)Document1 pageCase 5 - Conrail A&B (Questions)syeda alinaNo ratings yet

- 5 To 7 Fundamental AnalysisDocument47 pages5 To 7 Fundamental AnalysisnomanNo ratings yet

- Rosetta Stone - Pricing The 2009 IPODocument16 pagesRosetta Stone - Pricing The 2009 IPOjack louis100% (1)

- InvIT HandbookDocument80 pagesInvIT Handbookabhishek dubeyNo ratings yet

- Abhay RPR First DrapDocument20 pagesAbhay RPR First DrapAbhay SrivastavaNo ratings yet

- FIN 370 Final Exam 30 Questions With AnswersDocument11 pagesFIN 370 Final Exam 30 Questions With Answersassignmentsehelp0% (1)

- Portfolio Manager's Review, February 2009 (By The Manual of Ideas)Document241 pagesPortfolio Manager's Review, February 2009 (By The Manual of Ideas)The Manual of IdeasNo ratings yet

- BDPL4103Document147 pagesBDPL4103Merah Princess DieysNo ratings yet

- Examining Risk and Return Characteristics of A Two Asset PortfolioDocument10 pagesExamining Risk and Return Characteristics of A Two Asset Portfoliosushant ahujaNo ratings yet

- LIC Wealth PlusDocument3 pagesLIC Wealth Plussatish kumarNo ratings yet

- Basics of Structured Finance PDFDocument22 pagesBasics of Structured Finance PDFNaomi Alberg-BlijdNo ratings yet

- Accounting+ Chapter 1Document21 pagesAccounting+ Chapter 1pronab kumarNo ratings yet

- Pas 28Document27 pagesPas 28Nicah Shayne B. MadayagNo ratings yet

- Slides Week 2 PDFDocument91 pagesSlides Week 2 PDFYash ModiNo ratings yet

- Chapter 5 - Asset Investment Decisions and Capital RationingDocument31 pagesChapter 5 - Asset Investment Decisions and Capital RationingInga ȚîgaiNo ratings yet

- Mohd Azzarain Bin Abdul Aziz: Injection WithdrawalDocument2 pagesMohd Azzarain Bin Abdul Aziz: Injection WithdrawalAffeif AzzarainNo ratings yet

- Value at Risk & Expected ShortfallDocument97 pagesValue at Risk & Expected ShortfallKM AgritechNo ratings yet

- Coffee Can NotesDocument4 pagesCoffee Can NotesBharat BajoriaNo ratings yet

- Module 2-Corporate Governance PDFDocument5 pagesModule 2-Corporate Governance PDFBhosx KimNo ratings yet

- Restu AgDocument2 pagesRestu AgAzhar AhmadNo ratings yet