Professional Documents

Culture Documents

Eileen Segall of Tildenrow Partners: Long On ReachLocal

Uploaded by

currygoatOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Eileen Segall of Tildenrow Partners: Long On ReachLocal

Uploaded by

currygoatCopyright:

Available Formats

Produced by

Institutional Investor and SumZero are not registered investment advisors or broker-dealers, and are not licensed nor

qualied to provide investment advice. There is no requirement that any of the Information Providers presented here be

registered investment advisors or broker-dealers. Nothing published or made available by or through Institutional Investor

and SumZero should be considered personalized investment advice, investment services or a solicitation to BUY, SELL, or

HOLD any securities or other investments mentioned by Institutional Investor, SumZero or the Information Providers. Nev-

er invest based purely on our publication or information, which is provided on an as is basis without representations.

Past performance is not indicative of future results. YOU SHOULD VERIFY ALL CLAIMS, DO YOUR OWN DUE DILIGENCE

AND/OR SEEK YOUR OWN PROFESSIONAL ADVISOR AND CONSIDER THE INVESTMENT OBJECTIVES AND RISKS

AND YOUR OWN NEEDS AND GOALS BEFORE INVESTING IN ANY SECURITIES MENTIONED. INVESTMENT DOES

NOT GUARANTEE A POSITIVE RETURN AS STOCKS ARE SUBJECT TO MARKET RISKS, INCLUDING THE POTENTIAL

LOSS OF PRINCIPAL. You further acknowledge that Institutional Investor, SumZero, the Information Providers or their

respective afliates, employers, employees, ofcers, members, managers and directors, may or may not hold positions

in one or more of the securities in the Information and may trade at any time, without notication to you, based on the

information they are providing and will not necessarily disclose this information, nor the time the positions in the securities

were acquired. You conrm that you have read and understand, and agree to, this full disclaimer and terms of use and that

neither Institutional Investor, SumZero nor any of the Information Providers presented here are in any way responsible for

any investment losses you may incur under any circumstances.

On Tuesday, November 12, 2013, Institutional Investor and SumZero, the worlds largest online

membership community of buy-side investment professionals, hosted an idea competition at

Columbia University Business Schools Uris Hall Auditorium.

Nineteen emerging managers were selected from within the SumZero community on the basis of

strong performance and high-quality peer reviews. Each manager gave a three minute pitch on their

best idea to an audience of analysts and investors who rated their pitch for validity of the thesis,

strength of the argument, feasibility of the trade and originality.

We invite you to view these ideas and register to download each presenters bio and full pitch paper.

If youre a professional investment ofcer or analyst, we invite you to register to vote for the winning

idea.

Favorite Investment Book:

The Most Important Thing by Howard Marks

Favorite Quote/Author:

I dont want a lot of good investments - I want a few out-

standing ones. Philip Fisher

Most Attractive Area of the Market Right Now:

Undervalued stocks in good businesses that have pricing

power, healthy balance sheets, opportunity for secular

revenue growth, and management teams concerned with

shareholder value.

Least Attractive Area of the Market Right Now:

Overvalued stocks with competitively disadvantaged busi-

ness models, weak balance sheets, and burning cash from

operations.

Languages Spoken:

English

Best Past Investment Made:

TYPE in 2013. Purchased in 2011 at an average cost of

$11.67 and sold last shares recently at $26.10. Owns the

trademarks to the worlds most popular fonts and one of

the better business models I have ever come across.

Worst Past Investment Made:

RIMG in 2007. Although historically a good business and

cheap, it was ghting the end of a demand curve in CD/

DVD publishing equipment. I am now more careful about

technological obsolescence.

Personal Investing Style:

Value

Areas of Personal Expertise:

Equities, General, North America

Eileen Segall Tildenrow Partners, LP

Age: 35 Title: Founder and Portfolio Manager Location: New York, NY

Education (Undergrad/Grad/Certications):

M.I.T B.S. in Materials Science and Engineering

Previous Employers/Positions: Assistant Portfolio Manager and Director of Research, Nicusa

Capital Partners, LP (2003-2006); Equity Research Associate, Robertson Stephens.

Bio:

Eileen Segall is the Founder and Portfolio Manager of Tildenrow Partners, LP. Ms. Segall has thirteen years of experience

in the investment industry and has managed Tildenrow Advisors, LLC since November 2006. Ms. Segall is a value inves-

tor and employs fundamental analysis and a disciplined investment process to research equities mis-priced by the mar-

ket. Previously she spent four years at Nicusa Capital, where she helped to develop Nicusas value-oriented investment

strategy in her primary role as Assistant Portfolio Manager. Ms. Segall started her career as an equity research associate

covering telecommunications equipment at Robertson Stephens Investment Bank in New York City. She has a Bachelors

of Science degree in Materials Science and Engineering from the Massachusetts Institute of Technology (M.I.T.)

AUM: $1-50 million Firm Focus: North America Equities Past Ideas Submitted on SumZero: Long PRCP

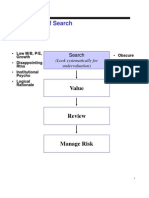

Firm Strategy: Long-biased, concentrated capital in great businesses, often niche, unknown, or misunderstood, selling

at cheap prices.

Fund Disclaimer: Please see section 4 of appendix.

Fund Description:

Tildenrow Partners, LP runs a concentrated value strategy in primarily North American equities. The fund is long-biased

in undervalued stocks with high return on invested capital (ROIC), strong free cash ow, growing market opportunity,

sustainable competitive advantage, and shareholder-friendly management. Most of Tildenrows opportunities are uncov-

ered through a disciplined quantitative screening process. They are typically executed in inefciently traded stocks where

extensive due diligence can yield a tangible edge. Short positions are smaller in size and are opportunistic in expensive,

competitively weak businesses. The fund has a long-term investment horizon and is not overly concerned with short-

term uctuations in individual stock prices. Tildenrow Partners, LP is a private investment partnership open to accredited

investors that meet the funds investment criteria. The partnership began investing assets under management on January

1, 2008. Tildenrow Advisors, LLC, launched in November 2006, is the investment advisor to the partnership.

Eileen Segall

Tildenrow Partners, LP

Company: ReachLocal Inc.

Ticker: RLOC (NASDAQ)

Action: Long

Asset Class: Common Stock

Expected Timeframe: 2-3 years

Situation: Value

Current Price: $12.17 USD

Target Price: $33.50

Diluted Shares: 28 million

Cash and Cash Equivalent: $85 million

Debt: $0 million

Market Cap: $336 million

Enterprise Value: $250 million

2012 Revenues: $455 million

2012 Adjusted EBITDA: $24 million

2012 GAAP EPS: ($.01)

2012 Free Cash Flow: $26 million

Currency: USD

Thesis: Long. RLOC is a good business undervalued and misunderstood by the buy side, with 17% of the

stock's float short. At first glance, RLOC can appear to be only a low-barrier search engine optimization

(SEO) technology company. In reality, RLOC has ~1000 marketing executives who work closely with local

businesses, helping them to maximize their online marketing and commerce strategy. As a result, RLOC

has above-average ROIC and strong free cash flow, understated by U.S. GAAP net income. Furthermore,

the company has a healthy balance sheet, active share repurchase program, and is in an industry with

strong secular tailwinds. In 2-3 years, RLOC could be worth $33.50, almost 3x its current stock price of

$12.17, based on EBITDA margin expansion from current depressed levels and reversion to higher

valuation multiples.

Description: ReachLocal, Inc (NASDAQ: RLOC) manages online lead generation, conversion, and

transaction solutions for 24,600 local small and medium sized businesses (SMBs) and national brands

with local presence. The company's typical customer offers a needs-based service such as plumbing,

auto repair, or dentistry in their metro area and spends an average of $22,000 per year with ReachLocal.

Products include ReachSearch (search engine optimization platform), ReachCast (display advertising),

ReachRetargeting (re-marketing), TotalTrack (marketing analytics), TotalLiveChat (click-to-chat),

ReachEdge (SaaS analytics and lead conversion), ReachCommerce (website, mobile, booking and back

office management), and ClubLocal (consumer portal.) The company employs roughly 1000 full-time

marketing executives, called Internet Marketing Consultants "IMCs", in addition to resellers and

partners, and is in 16 countries with headquarters in Woodland Hills, CA.

RLOC is a buy at $12.17 because:

Stock is cheap with low investor sentiment Trades at 0.5x EV/Revenue and 10x EV/FCF on 2012

financials. The stock's float is 17% short, with 24 days to cover, and is below its IPO price of $13.00. The

stock has lagged the run in the S&P 500 by more than 70% the past 3+ years.

Margin expansion EBITDA margins can triple from the current 5.5% reported to the mid teens.

Margins are depressed from roughly $60 million in expenses due to reinvestment in its sales force,

International market expansion, and major new product launches in 2013. EBITDA margins could go to

15% in 2-3 years.

GAAP understates Strong Free Cash Flow and High ROIC - GAAP net income reported on the company's

Income Statement significantly understates free cash flow. GAAP net income was a loss of $232k versus

positive free cash flow of $26 million in 2012. Differences are primarily due to a positive working capital

model as the company grows, arising from prepayments by customers (deferred revenue) and media

purchases (accounts payable.) Return on Invested Capital (ROIC) is above-average at roughly 15-20%,

and is the result of a RLOC's scalable and capital-light business model.

Some "Stickiness" with Customer Base -- Customers interviewed had very positive feedback on RLOC,

with most noting high return on investment (ROI) from products purchased and an active relationship

with their IMC's. Most said they were not interested in switching away from RLOC, and that they would

consider additional products and services from the company. These relationships appear to be

somewhat sticky as revenue from older clients (>1 year) continues to climb as a percentage of RLOCs

total revenue from 11% in 2006 to 47% in 2012.

RLOC can be easily dismissed as a low-barrier search engine optimization (SEO) technology company

because its number one selling product is ReachSearch. ReachSearch optimizes ad spend on search

engines like Google, depending on the SMB's budget and the dynamic pricing of keywords. ReachSearch

customers said the product eases a significant pain point in their business by effectively managing this

portion of their business and were generally unconcerned with RLOC's markup on cost-per-clicks they

could otherwise buy directly from Google. I believe this is a sign RLOC has some pricing power.

Furthermore, RLOC has expanded its products beyond lead generation (ReachSearch being the most

popular) over the past several years to include lead conversion and analytics, website, mobile, and social

media optimization solutions, and online booking and back office management, which are generally too

sophisticated and time consuming for most local SMBs to develop or manage independently or

effectively. I believe these additional products create further stickiness within their customer base.

Revenue growth New product launches (ReachEdge, ReachCommerce, and ClubLocal) in 2013 and

International revenues (growing approximately 40% y/y and now 34% of total revenues) should drive

the majority of revenue growth over next few years. Overall, the industry should have secular tailwinds

for many years as local services transactions (a roughly $3 trillion market) increasingly move online.

North America revenue growth has slowed due to the maturity of the market, U.S. economy, and the

significant decrease in the number of marketing executives (IMCs) selling in North America (in favor of

hiring IMCs for International markets.) I believe further sluggish growth is already priced into the stock

given the high profile of this topic on earnings calls and the stock's cheap valuation. Any positive results

from new products or salesforce spend, which I believe could re-invigorate North American revenues,

would act as a catalyst to the stock.

Strong balance sheet - $3.10 per share in cash, or $85 million, which is 25% of market cap. No debt.

Ownership philosophy -- Share buyback program expanded by $21 million to $47million in March 2013

and to-date the company has repurchased 3.4 million shares for $36 million. 54% of the stock has been

owned for a long time by two of its original venture capital investors. Former and current management

own an additional 10%.

Estimates:

2013E Revenues = $517 million

2013E Adj. EBITDA = $30 million, 5.8% margin

2013E FCF = $24 million

Valuation on 2013 Estimates:

EV/Revenues: 0.5x

EV/Adj. EBITDA = 8.3x

EV/FCF = 10.6x

Price Target of $33.50 is based on multiple of 18x EV/FCF (an average multiple for US stocks historically)

on 2015 estimates, adjusted for the cost of options:

2015E Revenues = $587M (6.6% CAGR over next two years)

2015E Adjusted EBITDA = $92 million, 15.7% margin

2015E FCF = $55 million

Catalysts: improving EBITDA margins from current depressed levels, valuation multiple expansion, any

upside to current low expectations for slowing North America revenue growth.

Some Risks:

RLOCs marketing executives fail to offer a high level of service important to maintain revenue.

Increased competition. RLOC has a head start in its market by building and training a team of ~1000

marketing executives over the last nine years, focused only on online marketing solutions for local SMBs.

The most similar competitor, Dex Media (DXM), has appeared this year as a merger of two bankrupt

yellow pages companies (Dex One and SuperMedia.) With its history in offline rather than online

advertising, however, along with a huge debt load, I believe Dex Media will have trouble competing

profitably with RLOC. Furthermore, much larger companies with resources to build a similar size team

and interested in the local market (like Google, Yahoo, etc.) have typically eschewed business models

that are relationship-based.

Churn is not reported by management and increase may not be immediately apparent in the financials.

Google decides to no longer offer favorable status to ReachLocal as a Gold partner and significantly

reduces its rebates (~4% of revenues) to the Company.

Google, Yahoo, Bing, etc. take actions either technically or business-wise that would force RLOC readjust

its business at RLOC's own expense.

Many of the original founders of the company have recently left, including the CEO. The new CEO, yet-

to-be-decided, and management may not be as good as in the past.

The economy worsens and impacts advertising spend by local businesses.

____________________________

Legal Disclosures:

This investment write-up in no way incorporates any non-public information and/or

unsubstantiated rumors or misrepresentations and does not involve any act, practice, or course of

business which operates or would operate as a fraud or deceit upon any person in connection with an

investment.

I have obtained all necessary approvals from my employer to submit this investment write-up to the

SumZero Idea Database and it complies with all applicable policies of my employer.

This submission does not violate any agreements to which I may be subject (including, without limitation,

any confidentiality agreements), insider trading regulations, SEC regulations, and/or other applicable

laws, rules and regulations.

My fund and/or I have a position (long or short) in this security and may trade in and out of this position

without informing the SumZero community. Note: if you click this checkbox, this sentence will be

displayed at the top of your write-up.

Please refer to the SumZero Terms of Use for additional provisions you are agreeing to abide by

when you contribute content to the SumZero Idea Database.

You might also like

- Gary Brode of Silver Arrow Investment Management: Long NCRDocument0 pagesGary Brode of Silver Arrow Investment Management: Long NCRcurrygoatNo ratings yet

- Investing in Credit Hedge Funds: An In-Depth Guide to Building Your Portfolio and Profiting from the Credit MarketFrom EverandInvesting in Credit Hedge Funds: An In-Depth Guide to Building Your Portfolio and Profiting from the Credit MarketNo ratings yet

- Coho Capital Letter 2016Document13 pagesCoho Capital Letter 2016raissakisNo ratings yet

- The Playing Field - Graham Duncan - MediumDocument11 pagesThe Playing Field - Graham Duncan - MediumPradeep RaghunathanNo ratings yet

- BAM Airport Thesis 2020.08 FINALDocument17 pagesBAM Airport Thesis 2020.08 FINALYog MehtaNo ratings yet

- VII MairsPower Reprint2Document8 pagesVII MairsPower Reprint2Mitesh ParonawalaNo ratings yet

- 5x5x5 InterviewDocument7 pages5x5x5 InterviewspachecofdzNo ratings yet

- Sequoia Fund Investor Day 2014Document24 pagesSequoia Fund Investor Day 2014CanadianValueNo ratings yet

- Ragupati Chandrasekaran's Notes From The Biglari Holdings 2012 Annual MeetingDocument10 pagesRagupati Chandrasekaran's Notes From The Biglari Holdings 2012 Annual MeetingThe Manual of Ideas100% (1)

- Indian Banks - Lay of The LandDocument7 pagesIndian Banks - Lay of The LandAshok LambaNo ratings yet

- Mick McGuire Value Investing Congress Presentation Marcato Capital ManagementDocument70 pagesMick McGuire Value Investing Congress Presentation Marcato Capital Managementmarketfolly.comNo ratings yet

- RV Capital June 2015 LetterDocument8 pagesRV Capital June 2015 LetterCanadianValueNo ratings yet

- Greenlight Capital Open Letter To AppleDocument5 pagesGreenlight Capital Open Letter To AppleZim VicomNo ratings yet

- Graham & Doddsville Spring 2011 NewsletterDocument27 pagesGraham & Doddsville Spring 2011 NewsletterOld School ValueNo ratings yet

- 9 - Case Shopping MallDocument11 pages9 - Case Shopping MallRdx ProNo ratings yet

- Value: InvestorDocument4 pagesValue: InvestorAlex WongNo ratings yet

- Graham & Doddsville - Issue 20 - Winter 2014 - FinalDocument68 pagesGraham & Doddsville - Issue 20 - Winter 2014 - Finalbpd3kNo ratings yet

- Kevin Byun's Q1 2010 Denali Investors LetterDocument9 pagesKevin Byun's Q1 2010 Denali Investors LetterThe Manual of IdeasNo ratings yet

- Eric Khrom of Khrom Capital 2012 Q4 LetterDocument5 pagesEric Khrom of Khrom Capital 2012 Q4 LetterallaboutvalueNo ratings yet

- The End of Arbitrage, Part 1Document8 pagesThe End of Arbitrage, Part 1Carmine Robert La MuraNo ratings yet

- Valeant Presentation PershingDocument47 pagesValeant Presentation PershingNick SposaNo ratings yet

- Value Investing Congress NY 2010 AshtonDocument26 pagesValue Investing Congress NY 2010 Ashtonbrian4877No ratings yet

- Corner of Berkshire & Fairfax Message Board: Hello ShoelessDocument15 pagesCorner of Berkshire & Fairfax Message Board: Hello Shoelessgl101No ratings yet

- IDT Corp. (NYSE: IDT) : Unlocking Value With One of The World's Best Capital AllocatorsDocument55 pagesIDT Corp. (NYSE: IDT) : Unlocking Value With One of The World's Best Capital Allocatorsatgy1996No ratings yet

- Sequoia Ann 14Document36 pagesSequoia Ann 14CanadianValueNo ratings yet

- Insight: Prime PropertiesDocument8 pagesInsight: Prime PropertiesvahssNo ratings yet

- East Coast Asset Management (Q4 2009) Investor LetterDocument10 pagesEast Coast Asset Management (Q4 2009) Investor Lettermarketfolly.comNo ratings yet

- Mark Yusko LetterDocument43 pagesMark Yusko LetterValueWalk100% (2)

- Best Stock Picks of Best Hedge FundsDocument141 pagesBest Stock Picks of Best Hedge FundsstockholmesNo ratings yet

- Orvana Minerals Report Stonecap SecuritiesDocument22 pagesOrvana Minerals Report Stonecap SecuritiesOld School ValueNo ratings yet

- Graham Doddsville - Issue 23 - FinalDocument43 pagesGraham Doddsville - Issue 23 - FinalCanadianValueNo ratings yet

- ThirdPoint Q1 16Document9 pagesThirdPoint Q1 16marketfolly.comNo ratings yet

- The Purpose of This CourseDocument6 pagesThe Purpose of This CourseSasha GrayNo ratings yet

- David Einhorn NYT-Easy Money - Hard TruthsDocument2 pagesDavid Einhorn NYT-Easy Money - Hard TruthstekesburNo ratings yet

- Michael Guichon Sohn Conference Presentation - Fiat Chrysler AutomobilesDocument49 pagesMichael Guichon Sohn Conference Presentation - Fiat Chrysler AutomobilesCanadianValueNo ratings yet

- When Entry Multiples Don't Matter - Andreessen Horowitz PDFDocument12 pagesWhen Entry Multiples Don't Matter - Andreessen Horowitz PDFbrineshrimpNo ratings yet

- David Einhorn MSFT Speech-2006Document5 pagesDavid Einhorn MSFT Speech-2006mikesfbayNo ratings yet

- Viking Form 2 ADVDocument36 pagesViking Form 2 ADVSOeNo ratings yet

- Cadbury Trian LetterDocument14 pagesCadbury Trian Letterbillroberts981No ratings yet

- Icahn LetterDocument3 pagesIcahn Lettergrw7No ratings yet

- BuybacksDocument22 pagesBuybackssamson1190No ratings yet

- 1 L I LL I: WWW EscDocument4 pages1 L I LL I: WWW EscforexmastertanNo ratings yet

- Opko Health - Lakewood Short ThesisDocument48 pagesOpko Health - Lakewood Short ThesisCanadianValueNo ratings yet

- A Trillion-Dollar BusinessDocument6 pagesA Trillion-Dollar BusinesssiewyukNo ratings yet

- Downside Protection Report - 2009 Recap and ScorecardDocument3 pagesDownside Protection Report - 2009 Recap and ScorecardThe Manual of IdeasNo ratings yet

- How To Save The Bond Insurers Presentation by Bill Ackman of Pershing Square Capital Management November 2007Document145 pagesHow To Save The Bond Insurers Presentation by Bill Ackman of Pershing Square Capital Management November 2007tomhigbieNo ratings yet

- The Future of Common Stocks Benjamin Graham PDFDocument8 pagesThe Future of Common Stocks Benjamin Graham PDFPrashant AgarwalNo ratings yet

- Arlington Value 2014 Annual Letter PDFDocument8 pagesArlington Value 2014 Annual Letter PDFChrisNo ratings yet

- Buffett On Valuation PDFDocument7 pagesBuffett On Valuation PDFvinaymathew100% (1)

- What Makes A MoatDocument5 pagesWhat Makes A MoatMohammed ShakilNo ratings yet

- Private Equity Unchained: Strategy Insights for the Institutional InvestorFrom EverandPrivate Equity Unchained: Strategy Insights for the Institutional InvestorNo ratings yet

- The Financial Advisor M&A Guidebook: Best Practices, Tools, and Resources for Technology Integration and BeyondFrom EverandThe Financial Advisor M&A Guidebook: Best Practices, Tools, and Resources for Technology Integration and BeyondNo ratings yet

- The Art of Vulture Investing: Adventures in Distressed Securities ManagementFrom EverandThe Art of Vulture Investing: Adventures in Distressed Securities ManagementNo ratings yet

- Performance of Private Equity-Backed IPOs. Evidence from the UK after the financial crisisFrom EverandPerformance of Private Equity-Backed IPOs. Evidence from the UK after the financial crisisNo ratings yet

- The Value Killers: How Mergers and Acquisitions Cost Companies Billions—And How to Prevent ItFrom EverandThe Value Killers: How Mergers and Acquisitions Cost Companies Billions—And How to Prevent ItNo ratings yet

- Cale Smith InvestPitch2013Document11 pagesCale Smith InvestPitch2013BowenQianNo ratings yet

- VIChallenge ASH DanielLawrenceDocument88 pagesVIChallenge ASH DanielLawrencecurrygoatNo ratings yet

- VIChallenge LOCK DavidSwartzDocument57 pagesVIChallenge LOCK DavidSwartzcurrygoatNo ratings yet

- Scott Miller of Greenhaven Road Capital: Long On Zix CorpDocument0 pagesScott Miller of Greenhaven Road Capital: Long On Zix CorpcurrygoatNo ratings yet

- VIChallenge FMI StevenWoodDocument13 pagesVIChallenge FMI StevenWoodcurrygoatNo ratings yet

- VIChallenge JACK RyanFusaroDocument7 pagesVIChallenge JACK RyanFusarocurrygoatNo ratings yet

- Cincinnati Bell (Nyse: CBB) : by Matthew Kirk, Lonestar Capital ManagementDocument19 pagesCincinnati Bell (Nyse: CBB) : by Matthew Kirk, Lonestar Capital ManagementcurrygoatNo ratings yet

- VII332Document21 pagesVII332currygoatNo ratings yet

- Valuation MetricsDocument18 pagesValuation MetricsVALUEWALK LLCNo ratings yet

- VIS2Document18 pagesVIS2currygoatNo ratings yet

- 16 Ways To Find Undervalued StocksDocument14 pages16 Ways To Find Undervalued Stockscurrygoat100% (1)

- Investing For The Long Run - Ang, KjaerDocument15 pagesInvesting For The Long Run - Ang, KjaercurrygoatNo ratings yet

- 01 - Greenlea Lane Capital - VALUEx Vail 2011 - Pricing PowerDocument27 pages01 - Greenlea Lane Capital - VALUEx Vail 2011 - Pricing PowercurrygoatNo ratings yet

- 06 - Jake Rosser - Valuex Vail Oshkosh PresentationDocument18 pages06 - Jake Rosser - Valuex Vail Oshkosh PresentationcurrygoatNo ratings yet

- 6-17-11 Dan Amoss VALUEx VailDocument17 pages6-17-11 Dan Amoss VALUEx VailcurrygoatNo ratings yet

- Barry WRLS - ValueXDocument8 pagesBarry WRLS - ValueXcurrygoatNo ratings yet

- 202 824 1 PBDocument12 pages202 824 1 PBZihr EllerycNo ratings yet

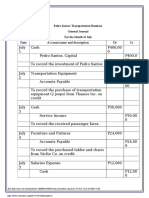

- Pedro Santos' Transportation Business General Journal For The Month of JulyDocument8 pagesPedro Santos' Transportation Business General Journal For The Month of Julyლ itsmooncakes ́ლNo ratings yet

- In Case of Manufacturing Enterprises The Calculations of Original Cost ofDocument12 pagesIn Case of Manufacturing Enterprises The Calculations of Original Cost ofVimal kumarNo ratings yet

- Chapter Two: Asset Classes and Financial InstrumentsDocument28 pagesChapter Two: Asset Classes and Financial Instrumentskaylakshmi831450% (2)

- Calculating Profit - Extra ExercisesDocument4 pagesCalculating Profit - Extra ExercisesРустам РажабовNo ratings yet

- Auditing NotesDocument121 pagesAuditing Noteslipsa PriyadarshiniNo ratings yet

- Par CorDocument15 pagesPar CorKim Nayve57% (7)

- Using The Altman Z-Score Model To Test Bankruptcy in The Oil IndustryDocument103 pagesUsing The Altman Z-Score Model To Test Bankruptcy in The Oil IndustrySumayya SiddiquaNo ratings yet

- 900 23 006 GLB Annual Report 2023Document140 pages900 23 006 GLB Annual Report 202312346itkfdvNo ratings yet

- Ch. 4: Financial Forecasting, Planning, and BudgetingDocument41 pagesCh. 4: Financial Forecasting, Planning, and BudgetingFahmia Winata8No ratings yet

- Transmitted, Without The Permission of The Indian School of BusinessDocument4 pagesTransmitted, Without The Permission of The Indian School of BusinessSomnath MitraNo ratings yet

- Fa2 Ch-2 Current LiabilitiesDocument82 pagesFa2 Ch-2 Current LiabilitiesTsi AwekeNo ratings yet

- Module For AccountingDocument46 pagesModule For AccountingJhefz KhurtzNo ratings yet

- Exercises I - Journalizing and PostingDocument7 pagesExercises I - Journalizing and PostingJowjie TV50% (2)

- Reliance IndustriesDocument32 pagesReliance IndustriesZia AhmadNo ratings yet

- P2 Joint Arrangements - GuerreroDocument17 pagesP2 Joint Arrangements - GuerreroCelen OchocoNo ratings yet

- CH 1 QuizDocument3 pagesCH 1 Quizricty0% (1)

- Sap Fico Configuration Set (A Set of 8 CDS) Learn Sap Fico Configuration in 30 Days Set Your Sap Career On A Fast TrackDocument16 pagesSap Fico Configuration Set (A Set of 8 CDS) Learn Sap Fico Configuration in 30 Days Set Your Sap Career On A Fast Tracksuhradam0% (1)

- Corporation Definition The Most Common Form ofDocument20 pagesCorporation Definition The Most Common Form ofmtayyab_786100% (2)

- Jaimni Astrology A Case Study of A Systems Analyst Chara DashaDocument138 pagesJaimni Astrology A Case Study of A Systems Analyst Chara DashaPoonam AggarwalNo ratings yet

- CH 17 Incomplete Records: Statement of Financial PositionDocument4 pagesCH 17 Incomplete Records: Statement of Financial Positionlam hang yuk100% (1)

- RECEIVABLESDocument8 pagesRECEIVABLESE.D.JNo ratings yet

- Learning Activity Sheet Abm 12 Fundamentals of Abm 2 (Q2-Wk1-2) Bank Reconciliation IDocument14 pagesLearning Activity Sheet Abm 12 Fundamentals of Abm 2 (Q2-Wk1-2) Bank Reconciliation IKimverlee Anne GarciaNo ratings yet

- Sources of FinanceDocument39 pagesSources of Financemohammedakbar88No ratings yet

- Lesson 3 Sample Problem #3Document3 pagesLesson 3 Sample Problem #3not funny didn't laughNo ratings yet

- Investing ProcedureDocument15 pagesInvesting ProcedurepopoyotNo ratings yet

- Corporate Law II SyllabusDocument8 pagesCorporate Law II SyllabusRaghav KhadriaNo ratings yet

- FABM2 1st Half of 1st Quarter Reviewer ACRSDocument2 pagesFABM2 1st Half of 1st Quarter Reviewer ACRSAfeiyha Czarina SantiagoNo ratings yet

- Balance Sheet of Reliance IndustriesDocument5 pagesBalance Sheet of Reliance IndustriesMukesh bariNo ratings yet

- Nestle Balance Sheet Common SizeDocument8 pagesNestle Balance Sheet Common SizeHimanshu Koli0% (1)