Professional Documents

Culture Documents

Commodity Outlook 2013

Uploaded by

Bibekananda DasCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Commodity Outlook 2013

Uploaded by

Bibekananda DasCopyright:

Available Formats

A n n u al Co m m o d i t i es Resear ch M ag az i n e ( Fo r p r i vat e ci r cu l at i o n o n l y)

O U T L O O K 2 0 1 3

C MMO DITY O

St ay ah ead o f m ar k et s

im Roger, the commodity guru, has rightly said Buy Commodities Now, Or You'll

Hate yourself later. The notable return from commodities in past few years has

J

proved that he is right. This hard asset class has outshined other asset classes and

has generated a handsome return at the time when the world is facing tough time.

Subsequent to the turmoil of the second half of 2011, markets were relatively stable in

2012 as fear of severe economic crisis faded away. However the absolute efforts of key

central banks and governments for a solidifying recovery from ongoing crisis,

economic growth was not as per the expectation, especially in the developed nations.

Various interest rate cuts and bailouts bond purchases failed to bring the confidence in

the economy to some extent. Economic crisis, events, elections in major countries and

natural disasters kept investors on their toes throughout the year and they had to

churn their portfolio on regular basis. Victory of Mr. Obama gave some stability later on

in commodities prices apart from other financial markets.

Demand continued to rise in the essential commodities whereas slowed

manufacturing activities slashed the physical demand for some commodities to some

extent. But investment demand in commodities continued to increase terrifically,

especially of ETF's due to its easy usability.

The number of natural disasters such as hurricane, storm, flood, drought, earthquakes

etc. which were the other costliest affair in 2012, sent some commodities prices on

record level, particularly agri commodities. It sent food inflation on alarming level. In

2013, we expect flat movements with little upside in agri commodities.

In the year gone by, currency acted as a catalyst; the increase in Gold price is the

burning example in this regard. Due to sharp depreciation in Indian currency, gold

made a historic high in the domestic market whereas in the International market it was

far behind from its historic high of $1915. It made import costlier, especially pricey

crude oil, fertilizers, medicines, iron ore etc; increase in prices made a big hole in

consumer's pocket. From here in 2013, rupee is most likely to trade in the range of 50-

60. Furthermore, geopolitical tensions may remain a wild card for the energy counter,

though we are expecting a range for this counter on mix fundamentals whereas natural

gas demand supply equilibrium is expected to be moderately tighten, which can give

some strength to the prices. Again silver is likely to outperform gold this year. Bulls may

continue to reign in some base metals. Though we do not expect any major Chinese

stimulus in early 2013 but we expect big move in the later part of the year.

If global growth sustains above the mark of 3% in 2013, then we may see some rebound

coming in commodities, especially in the second half and vice a versa. China, which is

playing an outsized role in global commodity market, is slowing down and

restructuring of growth model may weigh on commodities prices ahead. Its growth for

2013 is projected to be 7.4%, lowest in 15 years. If economic activities improves then it

will cushion up commodities in 2013.

Bull Run doesn't see the end in sightyet but the pace has slowed down. Momentum

and carry were the winning strategy for various asset classes. Wild swings in some

commodities couldn't be denied hence frequent churning of portfolio is advised.

Jagannadham Thunuguntla Head-Research

Commodity Fundamental Team

Vandana Bharti AVP Commodity Research

Sandeep Joon Sr. Research Analyst

Subhranil Dey Sr. Research Analyst

Shivanand Upadhyay Content Editor (Hindi)

Support Team

Kamla Devi Content Editor

Pramod Chhimwal Graphic Designer

Simmi Chibber Research Executive

Corporate Office

11 / 6B, Shanti Chamber, Pusa Road, New Delhi 110005.

Tel: 91-11-30111000, Extn. 6976, 6954, 6944

Fax: 91-11-25754365

SMC Comtrade Ltd.

11/ 6B, Shanti Chamber, Pusa Road, New Delhi-110005

Website: www.smctradeonline.com

Investor Grievance : smc@smcindiaonline.com

Printed and Published on behalf of

Disclaimer: SMC Global Securities Limited is proposing, subject to receipt of requisite approvals, market conditions and other considerations, a further public issue of its equity shares and has filed a Draft Red Herring Prospectus

(DRHP) with the Securities and Exchange Board of India (SEBI). The DRHP is available on the website of the SEBI at www.sebi.gov.in and the website of the Book Running Lead Managers i.e. Tata Securities Limited at

www.tatacapital.com and IL&FS Capital Advisors Limited at www.ilfscapital.com. Investors should note that investment in equity shares involves a high degree of risk. For details please refer to the DRHP and particularly the section

titled Risk Factors in the Draft Red Herring Prospectus.

This report is for the personal information of the authorized recipient and doesn't construe to be any investment, legal or taxation advice to you. It is only for private circulation and use .The report is based upon information that we

consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon as such. No action is solicited on the basis of the contents of the report. The report should not be reproduced or redistributed

to any other person(s)in any form without prior written permission of the SMC. The contents of this material are general and are neither comprehensive nor inclusive. Neither SMC nor any of its affiliates, associates, representatives,

directors or employees shall be responsible for any loss or damage that may arise to any person due to any action taken on the basis of this report. It does not constitute personal recommendations or take into account the particular

investment objectives, financial situations or needs of an individual client or a corporate/ s or any entity/ s. All investments involve risk and past performance doesn't guarantee future results. The value of, and income from

investments may vary because of the changes in the macro and micro factors given at a certain period of time. The person should use his/ her own judgment while taking investment decisions. Please note that we and our affiliates,

officers, directors, and employees, including persons involved in the preparation or issuance if this material;(a) from time to time, may have long or short positions in, and buy or sell the commodities thereof, mentioned here in or

(b) be engaged in any other transaction involving such commodities and earn brokerage or other compensation or act as a market maker in the commodities discussed herein (c) may have any other potential conflict of interest with

respect to any recommendation and related information and opinions. All disputes shall be subject to the exclusive jurisdiction of Delhi High court.

Page No.

1. Performance of 2012, FOMC & ECB

meeting schedule 2013 & Seasonality Index 4

2. Commodity performance 2012 5

3. Asset Class comparison 2012 6

4. Span of Price Movement 7

5. Fundamental Calls performance in 2012 8-9

6. Economic indicators 10-11

7. Base Metals and Bullions production graph 12

8. Currency Movements 13

9. Quantitative Easing & FOMC Statements 14

10. Flashback 2012 & Outlook 2013

i. Bullions 16-19

ii. Energy 20-23

iii. Base Metals 25-31

iv. Spices 33-37

v. Oilseeds 38-44

vi. Other Commodities 45-49

11. Crop Calendar 50

(Vandana Bharti)

Happy Investing in Commodities

Content COMMODITY OUTLOOK 2013

im Roger, the commodity guru, has rightly said Buy Commodities Now, Or You'll

Hate yourself later. The notable return from commodities in past few years has

J

proved that he is right. This hard asset class has outshined other asset classes and

has generated a handsome return at the time when the world is facing tough time.

Subsequent to the turmoil of the second half of 2011, markets were relatively stable in

2012 as fear of severe economic crisis faded away. However the absolute efforts of key

central banks and governments for a solidifying recovery from ongoing crisis,

economic growth was not as per the expectation, especially in the developed nations.

Various interest rate cuts and bailouts bond purchases failed to bring the confidence in

the economy to some extent. Economic crisis, events, elections in major countries and

natural disasters kept investors on their toes throughout the year and they had to

churn their portfolio on regular basis. Victory of Mr. Obama gave some stability later on

in commodities prices apart from other financial markets.

Demand continued to rise in the essential commodities whereas slowed

manufacturing activities slashed the physical demand for some commodities to some

extent. But investment demand in commodities continued to increase terrifically,

especially of ETF's due to its easy usability.

The number of natural disasters such as hurricane, storm, flood, drought, earthquakes

etc. which were the other costliest affair in 2012, sent some commodities prices on

record level, particularly agri commodities. It sent food inflation on alarming level. In

2013, we expect flat movements with little upside in agri commodities.

In the year gone by, currency acted as a catalyst; the increase in Gold price is the

burning example in this regard. Due to sharp depreciation in Indian currency, gold

made a historic high in the domestic market whereas in the International market it was

far behind from its historic high of $1915. It made import costlier, especially pricey

crude oil, fertilizers, medicines, iron ore etc; increase in prices made a big hole in

consumer's pocket. From here in 2013, rupee is most likely to trade in the range of 50-

60. Furthermore, geopolitical tensions may remain a wild card for the energy counter,

though we are expecting a range for this counter on mix fundamentals whereas natural

gas demand supply equilibrium is expected to be moderately tighten, which can give

some strength to the prices. Again silver is likely to outperform gold this year. Bulls may

continue to reign in some base metals. Though we do not expect any major Chinese

stimulus in early 2013 but we expect big move in the later part of the year.

If global growth sustains above the mark of 3% in 2013, then we may see some rebound

coming in commodities, especially in the second half and vice a versa. China, which is

playing an outsized role in global commodity market, is slowing down and

restructuring of growth model may weigh on commodities prices ahead. Its growth for

2013 is projected to be 7.4%, lowest in 15 years. If economic activities improves then it

will cushion up commodities in 2013.

Bull Run doesn't see the end in sightyet but the pace has slowed down. Momentum

and carry were the winning strategy for various asset classes. Wild swings in some

commodities couldn't be denied hence frequent churning of portfolio is advised.

Jagannadham Thunuguntla Head-Research

Commodity Fundamental Team

Vandana Bharti AVP Commodity Research

Sandeep Joon Sr. Research Analyst

Subhranil Dey Sr. Research Analyst

Shivanand Upadhyay Content Editor (Hindi)

Support Team

Kamla Devi Content Editor

Pramod Chhimwal Graphic Designer

Simmi Chibber Research Executive

Corporate Office

11 / 6B, Shanti Chamber, Pusa Road, New Delhi 110005.

Tel: 91-11-30111000, Extn. 6976, 6954, 6944

Fax: 91-11-25754365

SMC Comtrade Ltd.

11/ 6B, Shanti Chamber, Pusa Road, New Delhi-110005

Website: www.smctradeonline.com

Investor Grievance : smc@smcindiaonline.com

Printed and Published on behalf of

Disclaimer: SMC Global Securities Limited is proposing, subject to receipt of requisite approvals, market conditions and other considerations, a further public issue of its equity shares and has filed a Draft Red Herring Prospectus

(DRHP) with the Securities and Exchange Board of India (SEBI). The DRHP is available on the website of the SEBI at www.sebi.gov.in and the website of the Book Running Lead Managers i.e. Tata Securities Limited at

www.tatacapital.com and IL&FS Capital Advisors Limited at www.ilfscapital.com. Investors should note that investment in equity shares involves a high degree of risk. For details please refer to the DRHP and particularly the section

titled Risk Factors in the Draft Red Herring Prospectus.

This report is for the personal information of the authorized recipient and doesn't construe to be any investment, legal or taxation advice to you. It is only for private circulation and use .The report is based upon information that we

consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon as such. No action is solicited on the basis of the contents of the report. The report should not be reproduced or redistributed

to any other person(s)in any form without prior written permission of the SMC. The contents of this material are general and are neither comprehensive nor inclusive. Neither SMC nor any of its affiliates, associates, representatives,

directors or employees shall be responsible for any loss or damage that may arise to any person due to any action taken on the basis of this report. It does not constitute personal recommendations or take into account the particular

investment objectives, financial situations or needs of an individual client or a corporate/ s or any entity/ s. All investments involve risk and past performance doesn't guarantee future results. The value of, and income from

investments may vary because of the changes in the macro and micro factors given at a certain period of time. The person should use his/ her own judgment while taking investment decisions. Please note that we and our affiliates,

officers, directors, and employees, including persons involved in the preparation or issuance if this material;(a) from time to time, may have long or short positions in, and buy or sell the commodities thereof, mentioned here in or

(b) be engaged in any other transaction involving such commodities and earn brokerage or other compensation or act as a market maker in the commodities discussed herein (c) may have any other potential conflict of interest with

respect to any recommendation and related information and opinions. All disputes shall be subject to the exclusive jurisdiction of Delhi High court.

Page No.

1. Performance of 2012, FOMC & ECB

meeting schedule 2013 & Seasonality Index 4

2. Commodity performance 2012 5

3. Asset Class comparison 2012 6

4. Span of Price Movement 7

5. Fundamental Calls performance in 2012 8-9

6. Economic indicators 10-11

7. Base Metals and Bullions production graph 12

8. Currency Movements 13

9. Quantitative Easing & FOMC Statements 14

10. Flashback 2012 & Outlook 2013

i. Bullions 16-19

ii. Energy 20-23

iii. Base Metals 25-31

iv. Spices 33-37

v. Oilseeds 38-44

vi. Other Commodities 45-49

11. Crop Calendar 50

(Vandana Bharti)

Happy Investing in Commodities

Content COMMODITY OUTLOOK 2013

Performance & Seasonality Index

Seasonality Index

We have used the annual average method, which generates a

seasonal pattern and is helpful in predicting the future prices of the

commodity. This seasonal price index is derived by calculating the

annual average price, and then by expressing the price for each

month during the year as a percent of the annual average. Here, the

data used to derive the seasonal price patterns are the monthly

prices. In every chart, line chart is showing the monthly price

movement of particular commodity in 2012 while bar chart is

showing the seasonal trend. We hope that this will guide investors

to decide the proper time to invest into any particular commodity.

Commodity Performance

4

Performance Of Calls Given In Our

Annual Magazine Commodity Outlook 2012

Range

(Annual Magz. '12) Low* High*

2012 2012

Gold (COMEX) 1400-2100 1528.20 1798.10

Gold (MCX) 24000-33000 27170.00 32464.00

Silver(COMEX) 23-50 26.07 37.48

Silver(MCX) 38000-75000 51000.00 65723.00

Crude Oil (NYMEX) 75-125 77.28 110.55

Crude Oil (MCX) 4200-6000 4448.00 5635.00

Natural gas(NYMEX) 2.50-4.80 1.90 3.93

Natural gas (MCX) 155-230 99.50 217.20

Copper 320-500 397.00 463.00

Zinc 85-120 96.30 115.20

Lead 85-150 99.10 127.40

Nickel 750-1350 848.00 1086.80

Aluminium 80-130 100.60 117.60

Turmeric 4000-7000 3336.00 6748.00

Pepper 27000-45000 28810.00 45880.00

Cummin 13000-20000 11275.00 16975.00

Chilli 4000-8500 4430.00 6748.00

Cardamom 550-1200 570.00 1508.00

Chana 2500-4200 3020.00 4999.00

Kapas 660-950 801.00 1184.00

Wheat 1050-1350 1111.00 1705.00

Sugar 2600-3500 2635.00 3672.00

Soybean (NCDEX) 2000-3200 2257.00 5064.50

Soybean (CBOT) 1000-1500 1150.00 1794.75

RM Seed 2600-4800 3235.00 4538.00

Ref. Soy oil 600-810 611.50 817.00

CPO (MCX) 440-700 393.00 632.20

CPO (BMD) 2600-4200 2040.00 3655.00

* Up to 21 December 2012

World Interest Rates Of Key Central Banks At Present

Central banks Country Current interest rates Previous rates Date of change interest

Federal Reserve(FED) US 0.25% 1.00% 16-Dec-08

European Central Bank(ECB) Euro 0.75% 1.00% 5-Jul-12

Bank of England(BOE) England 0.50% 1.00% 5-Mar-09

Bank of Japan(BOJ) Japan 0.10% 0.10% 5-Oct-10

Reserve Bank of India(RBI) India 8.00% 8.50% 17-Apr-12

People Bank of China(PBOC) China 6.00% 6.31% 5-Jul-12

Reserve Bank of Australia(RBA) Australia 3.00% 3.25% 3-Dec-12

Brazil Central Bank(BACEN) Brazil 7.25% 7.50% 10-Oct-12

FOMC & ECB Meeting Schedule For 2013

Months 2013 FOMC meeting ECB meeting

January 30th 10th & 24th

February NA 7th & 21st

March 20th 7th & 21st

April NA 4th & 18th

May 1st 2nd & 16th

June 19th 6th & 20th

July 31st 4th & 18th

August NA 1st

September 18th 5th & 19th

October 30th 2nd & 17th

November NA 7th & 21st

December 18th 5th & 19th

COMMODITY OUTLOOK 2013

5

-31.97

-25.15

-25.06

-7.76

-2.23

0.84

9.19

10.73

11.39

11.65

12.15

13.53

13.73

18.63

22.12

23.27

25.30

31.07

32.33

42.57

-40.00 -30.00 -20.00 -10.00 0.00 10.00 20.00 30.00 40.00 50.00

Crude palm oil (BMD)

Crude palm oil(MCX)

Chilli

Jeera

Ref. Soy oil

Gur

RM Seed

Turmeric

Mentha Oil

Sugar

Potato

Maize

Cotton oilseed cake

Pepper

Soyabean (CBOT)

Chana

Kapas

Wheat

Soyabean

Cardamom

Return Of Agri Commodities From 1st Jan '12 Till 14th Dec '12

Source: Reuters & SMC Research

Return Of Bullions, Metals And Energy From 4th Jan '12 Till 14th Dec '12

Source: Reuters & SMC Research

% Change

% Change

COMMODITY OUTLOOK 2013

8.16

4.91

14.24

14.68

12.28

20.18

-13.01

-10.73

11.62

12.14

5.22

9.82

2.61

7.14

10.63

14.45

10.96

15.36

-6.29

-2.25

- 15.00 -10.00 -5.00 0.00 5.00 10.00 15.00 20.00 25.00

COMEX

LME Spot

MCX

COMEX

LME Spot

MCX

NYMEX

MCX

NYMEX

MCX

LME

MCX

LME

MCX

LME

MCX

LME

MCX

LME

MCX

G

o

l

d

S

i

l

v

e

r

C

r

u

d

e

O

i

l

N

a

t

u

r

a

l

G

a

s

C

o

p

p

e

r

A

l

u

m

i

n

i

u

m

Z

i

n

c

L

e

a

d

N

i

c

k

e

l

Performance & Seasonality Index

Seasonality Index

We have used the annual average method, which generates a

seasonal pattern and is helpful in predicting the future prices of the

commodity. This seasonal price index is derived by calculating the

annual average price, and then by expressing the price for each

month during the year as a percent of the annual average. Here, the

data used to derive the seasonal price patterns are the monthly

prices. In every chart, line chart is showing the monthly price

movement of particular commodity in 2012 while bar chart is

showing the seasonal trend. We hope that this will guide investors

to decide the proper time to invest into any particular commodity.

Commodity Performance

4

Performance Of Calls Given In Our

Annual Magazine Commodity Outlook 2012

Range

(Annual Magz. '12) Low* High*

2012 2012

Gold (COMEX) 1400-2100 1528.20 1798.10

Gold (MCX) 24000-33000 27170.00 32464.00

Silver(COMEX) 23-50 26.07 37.48

Silver(MCX) 38000-75000 51000.00 65723.00

Crude Oil (NYMEX) 75-125 77.28 110.55

Crude Oil (MCX) 4200-6000 4448.00 5635.00

Natural gas(NYMEX) 2.50-4.80 1.90 3.93

Natural gas (MCX) 155-230 99.50 217.20

Copper 320-500 397.00 463.00

Zinc 85-120 96.30 115.20

Lead 85-150 99.10 127.40

Nickel 750-1350 848.00 1086.80

Aluminium 80-130 100.60 117.60

Turmeric 4000-7000 3336.00 6748.00

Pepper 27000-45000 28810.00 45880.00

Cummin 13000-20000 11275.00 16975.00

Chilli 4000-8500 4430.00 6748.00

Cardamom 550-1200 570.00 1508.00

Chana 2500-4200 3020.00 4999.00

Kapas 660-950 801.00 1184.00

Wheat 1050-1350 1111.00 1705.00

Sugar 2600-3500 2635.00 3672.00

Soybean (NCDEX) 2000-3200 2257.00 5064.50

Soybean (CBOT) 1000-1500 1150.00 1794.75

RM Seed 2600-4800 3235.00 4538.00

Ref. Soy oil 600-810 611.50 817.00

CPO (MCX) 440-700 393.00 632.20

CPO (BMD) 2600-4200 2040.00 3655.00

* Up to 21 December 2012

World Interest Rates Of Key Central Banks At Present

Central banks Country Current interest rates Previous rates Date of change interest

Federal Reserve(FED) US 0.25% 1.00% 16-Dec-08

European Central Bank(ECB) Euro 0.75% 1.00% 5-Jul-12

Bank of England(BOE) England 0.50% 1.00% 5-Mar-09

Bank of Japan(BOJ) Japan 0.10% 0.10% 5-Oct-10

Reserve Bank of India(RBI) India 8.00% 8.50% 17-Apr-12

People Bank of China(PBOC) China 6.00% 6.31% 5-Jul-12

Reserve Bank of Australia(RBA) Australia 3.00% 3.25% 3-Dec-12

Brazil Central Bank(BACEN) Brazil 7.25% 7.50% 10-Oct-12

FOMC & ECB Meeting Schedule For 2013

Months 2013 FOMC meeting ECB meeting

January 30th 10th & 24th

February NA 7th & 21st

March 20th 7th & 21st

April NA 4th & 18th

May 1st 2nd & 16th

June 19th 6th & 20th

July 31st 4th & 18th

August NA 1st

September 18th 5th & 19th

October 30th 2nd & 17th

November NA 7th & 21st

December 18th 5th & 19th

COMMODITY OUTLOOK 2013

5

-31.97

-25.15

-25.06

-7.76

-2.23

0.84

9.19

10.73

11.39

11.65

12.15

13.53

13.73

18.63

22.12

23.27

25.30

31.07

32.33

42.57

-40.00 -30.00 -20.00 -10.00 0.00 10.00 20.00 30.00 40.00 50.00

Crude palm oil (BMD)

Crude palm oil(MCX)

Chilli

Jeera

Ref. Soy oil

Gur

RM Seed

Turmeric

Mentha Oil

Sugar

Potato

Maize

Cotton oilseed cake

Pepper

Soyabean (CBOT)

Chana

Kapas

Wheat

Soyabean

Cardamom

Return Of Agri Commodities From 1st Jan '12 Till 14th Dec '12

Source: Reuters & SMC Research

Return Of Bullions, Metals And Energy From 4th Jan '12 Till 14th Dec '12

Source: Reuters & SMC Research

% Change

% Change

COMMODITY OUTLOOK 2013

8.16

4.91

14.24

14.68

12.28

20.18

-13.01

-10.73

11.62

12.14

5.22

9.82

2.61

7.14

10.63

14.45

10.96

15.36

-6.29

-2.25

- 15.00 -10.00 -5.00 0.00 5.00 10.00 15.00 20.00 25.00

COMEX

LME Spot

MCX

COMEX

LME Spot

MCX

NYMEX

MCX

NYMEX

MCX

LME

MCX

LME

MCX

LME

MCX

LME

MCX

LME

MCX

G

o

l

d

S

i

l

v

e

r

C

r

u

d

e

O

i

l

N

a

t

u

r

a

l

G

a

s

C

o

p

p

e

r

A

l

u

m

i

n

i

u

m

Z

i

n

c

L

e

a

d

N

i

c

k

e

l

Span Of Price Movement (Agro Commodities)

Span Of Price Movement (Metals & Energy)

COMMODITY EXCHANGE LIFE TIME HIGH LIFE TIME LOW 2012 HIGH* 2012 LOW*

Gold COMEX 1915.00 252.50 1798.10 1528.50

MCX 32464.00 5600.00 32464.00 27170.00

Silver COMEX 5035.00 194.50 3748.00 2607.00

MCX 73600.00 7551.00 65723.00 51000.00

Crude Oil MCX 6333.00 1626.00 5635.00 4448.00

NYMEX 147.27 9.75 110.55 77.28

Natural Gas MCX 591.80 99.50 217.20 99.50

NYMEX 15.78 1.04 3.93 1.90

Copper MCX 466.20 117.60 463.00 397.00

Aluminium MCX 151.50 62.20 117.60 100.60

Zinc MCX 208.30 49.85 115.20 96.30

Lead MCX 154.40 40.50 127.40 99.10

Nickel MCX 1416.00 442.30 1086.80 848.00

Source: Reuters & SMC Research

COMMODITY EXCHANGE LIFE TIME HIGH LIFE TIME LOW 2012 HIGH* 2012 LOW*

SPICES

OTHER COMMODITIES

OILSEEDS

Turmeric NCDEX 16350.00 1666.00 6748.00 3336.00

Jeera NCDEX 17520.00 4877.40 16975.00 11275.00

Chilli NCDEX 10970.00 1731.00 6748.00 4430.00

Pepper NCDEX 45880.00 5350.00 45880.00 28810.00

Cardamom MCX 2097.00 218.20 1508.00 570.00

Chana NCDEX 4999.00 1331.00 4999.00 3020.00

Wheat NCDEX 1705.00 662.00 1705.00 1111.00

Mentha Oil MCX 2564.80 342.00 2564.80 1111.00

Gur NCDEX 1323.00 361.40 1323.00 1030.00

Sugar NCDEX 3672.00 2635.00 3672.00 2635.00

Kapas NCDEX 1262.00 398.90 1184.00 801.00

Crude Palm Oil MCX 632.20 154.20 632.20 393.00

Crude Palm Oil BMD 4298.00 425.00 3655.00 2040.00

Soybean NCDEX 5064.50 1104.50 5064.50 2257.00

Soybean CBOT 1794.75 401.50 1794.75 1150.00

RM Seed NCDEX 4538.00 1586.25 4538.00 3235.00

Ref. Soy Oil NCDEX 817.00 337.70 817.00 611.50

* Closing till 14 December 2012

* Closing till 14 December 2012 Source: Reuters & SMC Research

Asset Class Comparison

Momentum And Carry Were The Winning Strategy For Various Asset Classes

Optimism on monetary easing and various steps to revive the ailing economy by major countries gave some confidence to investors and thus we

saw better return in the year 2012 as compared to 2011; but it is true that it was not a trouble-free year for investors.

Most of the year, the path of global growth shifted downwards and concerns about the sustainability of euro area government debt, elections in

many countries amid various natural disasters, raised the fear of multi dip recession. Downbeat economic indicators from advanced economy

also triggered selling. Other global engines of growth also softened. Not only growth slowed in China and India, even Canada and other countries

also witnessed slow down.

Despite the negative economic data's and other problems, buying returned as there was a firm belief that major countries would come with some

aggressive quantitative easing to rescue the economy. Confidence also returned into the market as it noticed serial quantitative easing in many

major countries. Many central banks loosened monetary policy, cutting interest rates or expanding unconventional policies and it triggered large

asset price reactions. The central banks of Brazil, China, Colombia, Czech Republic, Israel, Korea, Philippines, United Kingdom, Euro zone, South

Africa and many more countries lowered their policy rates.

Low or negative yields on advanced economy government bonds spurred investors to search for investment opportunities that offered some

extra return. It resulted in surge in equity and other riskier asset. Equity prices also reacted strongly to the announcements of additional central

bank measures to support the economy. In 2011, capital outflow occurred in riskier assets and investors preferred to put their money into hard

and safe investment avenue. In 2012 trend was reverse, investors put their money in riskier assets associated with the performance of the

economy. All the key equity markets gave whopping return; Hang Seng, Nifty and DAX gave more than 20% return whereas US market also closed

the year in the positive territory. Strangely Chinese market gave negative return of more than 2.77%.

Victory of Obama was another buy trigger for the riskier asset classes. US treasury, which gave more than 18% return in 2011, only rose by 5% in

2012.

Commodity prices saw wide fluctuations over the past year as seen in the volatile course of energy, agricultural, and precious metal values.

Multiyear Bull Run continued in bullions raised the concern that despite all efforts, fear prevailed in the financial market that's why investors kept

a chunk of their money in bullion counter, which is better known as Flight to Safety. Despite positive return, Gold is down by about 13% and

silver is down by 35% from its all-time high. Furthermore, negative price movements of Baltic Dry Index, which is a strong indicator for shipping

activities, raised the question if the upside was on the back of investment demand or on core economic activities.

Performance

Asset Class Performance From 4th Jan'12 To 14th Dec'12

COMMODITY OUTLOOK 2013

6

% Change

Source: Reuters & SMC Research

-51.72

-13.01

-3.11

-2.77

-2.19

-0.72

2.23

3.68

4.51

5.22

5.53

6.22

7.77

8.16

10.28

10.34

11.62

13.59

13.90

14.68

15.04

20.01

26.72

28.69

-60.00 -50.00 -40.00 -30.00 -20.00 -10.00 0.00 10.00 20.00 30.00 40.00

Baltic Dry Index

Crude Oil (NYMEX)

GSCI commodity index

Shanghai Composite

INR/ USD

Dollar Index

Euro/ USD

US Treasury

Bovespa

Copper (LME)

FTSE

LMEX

Dow Jones

Gold (COMEX)

Japanese Yen/ USD

S&P 500

Natural Gas (NYMEX)

DJ EuroStoxx

Nikkei

Silver (COMEX)

CAC

Hang Seng

Nifty

DAX

COMMODITY OUTLOOK 2013

7

Span Of Price Movement (Agro Commodities)

Span Of Price Movement (Metals & Energy)

COMMODITY EXCHANGE LIFE TIME HIGH LIFE TIME LOW 2012 HIGH* 2012 LOW*

Gold COMEX 1915.00 252.50 1798.10 1528.50

MCX 32464.00 5600.00 32464.00 27170.00

Silver COMEX 5035.00 194.50 3748.00 2607.00

MCX 73600.00 7551.00 65723.00 51000.00

Crude Oil MCX 6333.00 1626.00 5635.00 4448.00

NYMEX 147.27 9.75 110.55 77.28

Natural Gas MCX 591.80 99.50 217.20 99.50

NYMEX 15.78 1.04 3.93 1.90

Copper MCX 466.20 117.60 463.00 397.00

Aluminium MCX 151.50 62.20 117.60 100.60

Zinc MCX 208.30 49.85 115.20 96.30

Lead MCX 154.40 40.50 127.40 99.10

Nickel MCX 1416.00 442.30 1086.80 848.00

Source: Reuters & SMC Research

COMMODITY EXCHANGE LIFE TIME HIGH LIFE TIME LOW 2012 HIGH* 2012 LOW*

SPICES

OTHER COMMODITIES

OILSEEDS

Turmeric NCDEX 16350.00 1666.00 6748.00 3336.00

Jeera NCDEX 17520.00 4877.40 16975.00 11275.00

Chilli NCDEX 10970.00 1731.00 6748.00 4430.00

Pepper NCDEX 45880.00 5350.00 45880.00 28810.00

Cardamom MCX 2097.00 218.20 1508.00 570.00

Chana NCDEX 4999.00 1331.00 4999.00 3020.00

Wheat NCDEX 1705.00 662.00 1705.00 1111.00

Mentha Oil MCX 2564.80 342.00 2564.80 1111.00

Gur NCDEX 1323.00 361.40 1323.00 1030.00

Sugar NCDEX 3672.00 2635.00 3672.00 2635.00

Kapas NCDEX 1262.00 398.90 1184.00 801.00

Crude Palm Oil MCX 632.20 154.20 632.20 393.00

Crude Palm Oil BMD 4298.00 425.00 3655.00 2040.00

Soybean NCDEX 5064.50 1104.50 5064.50 2257.00

Soybean CBOT 1794.75 401.50 1794.75 1150.00

RM Seed NCDEX 4538.00 1586.25 4538.00 3235.00

Ref. Soy Oil NCDEX 817.00 337.70 817.00 611.50

* Closing till 14 December 2012

* Closing till 14 December 2012 Source: Reuters & SMC Research

Asset Class Comparison

Momentum And Carry Were The Winning Strategy For Various Asset Classes

Optimism on monetary easing and various steps to revive the ailing economy by major countries gave some confidence to investors and thus we

saw better return in the year 2012 as compared to 2011; but it is true that it was not a trouble-free year for investors.

Most of the year, the path of global growth shifted downwards and concerns about the sustainability of euro area government debt, elections in

many countries amid various natural disasters, raised the fear of multi dip recession. Downbeat economic indicators from advanced economy

also triggered selling. Other global engines of growth also softened. Not only growth slowed in China and India, even Canada and other countries

also witnessed slow down.

Despite the negative economic data's and other problems, buying returned as there was a firm belief that major countries would come with some

aggressive quantitative easing to rescue the economy. Confidence also returned into the market as it noticed serial quantitative easing in many

major countries. Many central banks loosened monetary policy, cutting interest rates or expanding unconventional policies and it triggered large

asset price reactions. The central banks of Brazil, China, Colombia, Czech Republic, Israel, Korea, Philippines, United Kingdom, Euro zone, South

Africa and many more countries lowered their policy rates.

Low or negative yields on advanced economy government bonds spurred investors to search for investment opportunities that offered some

extra return. It resulted in surge in equity and other riskier asset. Equity prices also reacted strongly to the announcements of additional central

bank measures to support the economy. In 2011, capital outflow occurred in riskier assets and investors preferred to put their money into hard

and safe investment avenue. In 2012 trend was reverse, investors put their money in riskier assets associated with the performance of the

economy. All the key equity markets gave whopping return; Hang Seng, Nifty and DAX gave more than 20% return whereas US market also closed

the year in the positive territory. Strangely Chinese market gave negative return of more than 2.77%.

Victory of Obama was another buy trigger for the riskier asset classes. US treasury, which gave more than 18% return in 2011, only rose by 5% in

2012.

Commodity prices saw wide fluctuations over the past year as seen in the volatile course of energy, agricultural, and precious metal values.

Multiyear Bull Run continued in bullions raised the concern that despite all efforts, fear prevailed in the financial market that's why investors kept

a chunk of their money in bullion counter, which is better known as Flight to Safety. Despite positive return, Gold is down by about 13% and

silver is down by 35% from its all-time high. Furthermore, negative price movements of Baltic Dry Index, which is a strong indicator for shipping

activities, raised the question if the upside was on the back of investment demand or on core economic activities.

Performance

Asset Class Performance From 4th Jan'12 To 14th Dec'12

COMMODITY OUTLOOK 2013

6

% Change

Source: Reuters & SMC Research

-51.72

-13.01

-3.11

-2.77

-2.19

-0.72

2.23

3.68

4.51

5.22

5.53

6.22

7.77

8.16

10.28

10.34

11.62

13.59

13.90

14.68

15.04

20.01

26.72

28.69

-60.00 -50.00 -40.00 -30.00 -20.00 -10.00 0.00 10.00 20.00 30.00 40.00

Baltic Dry Index

Crude Oil (NYMEX)

GSCI commodity index

Shanghai Composite

INR/ USD

Dollar Index

Euro/ USD

US Treasury

Bovespa

Copper (LME)

FTSE

LMEX

Dow Jones

Gold (COMEX)

Japanese Yen/ USD

S&P 500

Natural Gas (NYMEX)

DJ EuroStoxx

Nikkei

Silver (COMEX)

CAC

Hang Seng

Nifty

DAX

COMMODITY OUTLOOK 2013

7

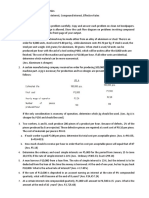

Performance of Fundamental Positional calls

Note:

a) These fundamental calls are for duration of one to three weeks time frame and do not confuse with these with intraday calls.

b) It is presumed that investor take position in two lots and square off one lot in case of partial profit and trail stop loss for second lot to buying/ selling price.

Note:

a) These fundamental calls are for duration of one to three weeks time frame and do not confuse with these with intraday calls.

b) It is presumed that investor take position in two lots and square off one lot in case of partial profit and trail stop loss for second lot to buying/ selling price.

Performance of Fundamental Positional calls

S

l

.

N

o

.

G

i

v

e

n

P

r

i

c

e

p

e

r

l

o

t

D

a

t

e

C

o

m

m

o

d

i

t

y

C

o

n

t

r

a

c

t

T

r

e

n

d

C

a

l

l

I

n

i

t

i

a

t

e

d

T

a

r

g

e

t

s

S

t

o

p

L

o

s

s

R

e

m

a

r

k

s

R

e

t

u

r

n

(

%

)

G

a

i

n

/

L

o

s

s

1

1

8

-

J

a

n

-

1

2

C

r

u

d

e

o

i

l

M

a

r

c

h

S

e

l

l

5

1

8

5

.

0

0

4

8

0

0

a

n

d

4

6

0

0

5

4

2

0

.

0

0

F

i

r

s

t

t

a

r

g

e

t

m

e

t

7

.

4

3

3

8

5

0

0

.

0

0

2

2

0

-

J

a

n

-

1

2

G

o

l

d

A

p

r

i

l

S

e

l

l

2

7

6

6

0

.

0

0

2

5

8

0

0

a

n

d

2

5

5

0

0

2

8

5

5

0

.

0

0

S

t

o

p

l

o

s

s

h

i

t

-

3

.

2

2

-

8

9

0

0

0

.

0

0

3

2

0

-

J

a

n

-

1

2

S

i

l

v

e

r

M

a

r

c

h

S

e

l

l

5

3

3

8

0

.

0

0

5

1

0

0

0

a

n

d

5

0

0

0

0

5

4

6

0

0

.

0

0

S

t

o

p

l

o

s

s

h

i

t

-

2

.

2

9

-

3

6

6

0

0

.

0

0

4

7

-

F

e

b

-

1

2

N

a

t

u

r

a

l

g

a

s

M

a

r

c

h

B

u

y

1

3

6

.

0

0

1

6

5

a

n

d

1

7

0

1

2

0

.

0

0

S

t

o

p

l

o

s

s

h

i

t

-

1

1

.

7

6

-

2

0

0

0

0

.

0

0

5

2

4

-

F

e

b

-

1

2

S

i

l

v

e

r

M

a

y

B

u

y

6

0

1

5

0

.

0

0

6

6

0

0

0

5

8

5

0

0

.

0

0

B

o

o

k

e

d

p

a

r

t

i

a

l

p

r

o

f

i

t

a

t

6

3

4

0

0

5

.

4

0

1

7

5

5

0

0

.

0

0

6

5

-

M

a

r

-

1

2

C

o

p

p

e

r

J

u

n

e

S

e

l

l

4

3

4

.

5

0

4

1

2

a

n

d

4

0

0

4

4

4

.

0

0

B

o

o

k

e

d

p

a

r

t

i

a

l

p

r

o

f

i

t

a

t

4

2

4

2

.

4

2

1

0

5

0

0

.

0

0

7

5

-

M

a

r

-

1

2

Z

i

n

c

A

p

r

i

l

S

e

l

l

1

0

5

.

2

0

9

8

a

n

d

9

6

1

0

8

.

5

0

B

o

o

k

e

d

p

a

r

t

i

a

l

p

r

o

f

i

t

a

t

1

0

2

3

.

0

4

1

6

0

0

0

.

0

0

8

5

-

M

a

r

-

1

2

L

e

a

d

A

p

r

i

l

S

e

l

l

1

0

8

.

4

0

1

0

0

a

n

d

9

8

1

1

2

.

0

0

B

o

o

k

e

d

p

a

r

t

i

a

l

p

r

o

f

i

t

a

t

1

0

5

3

.

1

4

1

7

0

0

0

.

0

0

9

2

7

-

M

a

r

-

1

2

G

o

l

d

J

u

n

e

B

u

y

2

8

7

7

0

.

0

0

3

0

0

0

0

2

7

3

0

0

.

0

0

E

x

i

t

a

t

2

8

2

5

0

-

1

.

8

1

-

5

2

0

0

0

.

0

0

1

0

2

7

-

M

a

r

-

1

2

S

i

l

v

e

r

M

a

y

B

u

y

5

7

6

3

0

.

0

0

6

2

0

0

0

a

n

d

6

3

0

0

0

5

5

7

5

0

.

0

0

E

x

i

t

a

t

5

6

9

0

0

-

1

.

2

7

-

2

1

9

0

0

.

0

0

1

1

4

-

A

p

r

-

1

2

N

a

t

u

r

a

l

g

a

s

M

a

y

B

u

y

1

2

0

.

0

0

1

4

5

1

0

8

.

0

0

E

x

i

t

a

t

1

1

6

-

3

.

3

3

-

2

0

0

0

0

.

0

0

1

2

2

7

-

A

p

r

-

1

2

L

e

a

d

J

u

n

e

B

u

y

1

1

1

.

1

0

1

2

0

1

0

6

.

0

0

B

o

o

k

p

a

r

t

i

a

l

p

r

o

f

i

t

a

t

1

1

4

2

.

6

1

1

4

5

0

0

.

0

0

1

3

2

7

-

A

p

r

-

1

2

Z

i

n

c

J

u

n

e

B

u

y

1

0

6

.

4

0

1

1

4

1

0

3

.

0

0

B

o

o

k

p

a

r

t

i

a

l

p

r

o

f

i

t

a

t

1

0

8

.

7

0

2

.

1

6

1

1

5

0

0

.

0

0

1

4

2

7

-

A

p

r

-

1

2

N

i

c

k

e

l

J

u

n

e

B

u

y

9

5

7

.

0

0

1

0

8

0

9

1

0

.

0

0

B

o

o

k

p

a

r

t

i

a

l

p

r

o

f

i

t

a

t

9

7

9

2

.

3

0

5

5

0

0

.

0

0

1

5

2

7

-

A

p

r

-

1

2

A

l

u

m

i

n

i

u

m

J

u

n

e

B

u

y

1

0

9

.

2

0

1

1

7

1

0

6

.

0

0

B

o

o

k

p

a

r

t

i

a

l

p

r

o

f

i

t

a

t

1

1

2

.

3

0

2

.

8

4

1

5

5

0

0

.

0

0

1

6

3

0

-

A

p

r

-

1

2

s

i

l

v

e

r

J

u

l

y

B

u

y

5

7

6

0

0

.

0

0

6

1

0

0

0

5

6

0

0

0

.

0

0

S

t

o

p

l

o

s

s

h

i

t

-

2

.

7

8

-

4

8

0

0

0

.

0

0

1

7

3

-

M

a

y

-

1

2

N

i

c

k

e

l

J

u

n

e

B

u

y

9

4

2

.

0

0

1

0

6

0

8

9

0

.

0

0

b

o

o

k

e

d

p

a

r

t

i

a

l

a

t

9

5

4

1

.

2

7

3

0

0

0

.

0

0

1

8

1

5

-

M

a

y

-

1

2

N

a

t

u

r

a

l

g

a

s

J

u

n

e

S

e

l

l

1

3

6

.

0

0

1

1

8

a

n

d

1

1

0

1

4

8

.

0

0

e

x

i

t

a

t

1

4

2

-

4

.

4

1

-

7

5

0

0

.

0

0

1

9

1

7

-

M

a

y

-

1

2

S

i

l

v

e

r

S

e

p

B

u

y

5

3

7

5

0

.

0

0

6

2

0

0

0

5

0

0

0

0

.

0

0

b

o

o

k

e

d

p

a

r

t

i

a

l

a

t

5

6

0

0

0

5

.

2

7

6

7

5

0

0

.

0

0

2

0

1

7

-

M

a

y

-

1

2

C

r

u

d

e

o

i

l

J

u

l

y

B

u

y

5

1

6

0

.

0

0

5

5

5

0

5

0

0

0

.

0

0

E

x

i

t

a

t

5

1

4

0

-

0

.

3

9

-

2

0

0

0

.

0

0

2

1

2

1

-

M

a

y

-

1

2

C

o

p

p

e

r

J

u

n

e

B

u

y

4

2

1

.

0

0

4

4

5

4

1

3

.

0

0

B

o

o

k

e

d

p

a

r

t

i

a

l

a

t

4

2

7

1

.

4

3

6

0

0

0

.

0

0

2

2

2

1

-

M

a

y

-

1

2

L

e

a

d

J

u

n

e

B

u

y

1

0

8

.

3

0

1

1

5

1

0

5

.

0

0

B

o

o

k

e

d

p

a

r

t

i

a

l

a

t

1

0

9

0

.

6

5

3

5

0

0

.

0

0

2

3

2

1

-

M

a

y

-

1

2

Z

i

n

c

J

u

n

e

B

u

y

1

0

4

.

8

0

1

1

0

1

0

3

.

0

0

B

o

o

k

e

d

p

a

r

t

i

a

l

a

t

1

0

6

1

.

1

5

1

1

5

0

0

.

0

0

2

4

2

1

-

M

a

y

-

1

2

A

l

u

m

i

n

i

u

m

J

u

n

e

B

u

y

1

1

2

.

0

0

1

1

8

1

0

9

.

0

0

E

x

i

t

a

t

b

r

e

a

k

e

v

e

n

0

.

0

0

0

.

0

0

2

5

2

8

-

M

a

y

-

1

2

N

a

t

u

r

a

l

g

a

s

J

u

l

y

S

e

l

l

1

4

7

.

6

0

1

2

4

a

n

d

1

1

5

1

6

2

.

0

0

B

o

o

k

e

d

f

u

l

l

p

r

o

f

i

t

a

t

1

2

6

1

4

.

6

3

2

7

0

0

0

.

0

0

2

6

6

-

J

u

n

-

1

2

C

o

p

p

e

r

A

u

g

B

u

y

4

1

5

.

0

0

4

3

5

a

n

d

4

4

5

4

0

7

.

0

0

B

o

o

k

f

u

l

l

p

r

o

f

i

t

a

t

4

2

4

2

.

5

5

9

0

0

0

.

0

0

2

7

6

-

J

u

n

-

1

2

L

e

a

d

J

u

l

y

B

u

y

1

0

7

.

1

5

1

1

3

a

n

d

1

1

5

1

0

3

.

5

0

B

o

o

k

p

a

r

t

i

a

l

a

t

1

0

7

.

3

0

.

1

4

7

5

0

.

0

0

2

8

6

-

J

u

n

-

1

2

Z

i

n

c

J

u

l

y

B

u

y

1

0

5

.

5

0

1

1

0

a

n

d

1

1

2

1

0

3

.

5

0

B

o

o

k

p

a

r

t

i

a

l

a

t

1

0

5

.

8

5

0

.

3

3

1

7

5

0

.

0

0

2

9

6

-

J

u

n

-

1

2

N

i

c

k

e

l

J

u

l

y

B

u

y

9

0

9

.

0

0

9

9

0

8

7

0

.

0

0

B

o

o

k

p

a

r

t

i

a

l

a

t

9

6

5

6

.

1

6

1

4

0

0

0

.

0

0

3

0

6

-

J

u

n

-

1

2

A

l

u

m

i

n

i

u

m

J

u

l

y

B

u

y

1

0

9

.

8

0

1

1

5

1

0

7

.

5

0

B

o

o

k

p

a

r

t

i

a

l

a

t

1

1

0

.

6

0

.

7

3

4

0

0

0

.

0

0

3

1

6

-

J

u

n

-

1

2

C

r

u

d

e

o

i

l

J

u

l

y

B

u

y

4

7

6

0

.

0

0

5

1

0

0

a

n

d

5

2

0

0

4

6

4

0

.

0

0

B

o

o

k

e

d

p

a

r

t

i

a

l

a

t

4

8

0

0

0

.

8

4

4

0

0

0

.

0

0

3

2

2

1

-

J

u

n

-

1

2

N

a

t

u

r

a

l

g

a

s

A

u

g

u

s

t

B

u

y

1

4

9

.

1

0

1

8

0

1

3

8

.

0

0

B

o

o

k

e

d

f

u

l

l

p

r

o

f

i

t

a

t

1

6

4

.

8

0

1

0

.

5

3

1

9

6

2

5

.

0

0

3

3

1

0

-

J

u

l

-

1

2

N

a

t

u

r

a

l

g

a

s

A

u

g

u

s

t

S

e

l

l

1

6

2

.

5

0

1

4

1

a

n

d

1

3

5

1

7

2

.

0

0

B

o

o

k

e

d

p

a

r

t

i

a

l

a

t

1

5

3

.

4

0

5

.

6

0

1

1

3

7

5

.

0

0

3

4

1

3

-

J

u

l

-

1

2

C

o

p

p

e

r

A

u

g

u

s

t

B

u

y

4

2

3

.

5

0

4

4

5

a

n

d

4

5

0

4

2

0

.

0

0

B

o

o

k

e

d

p

a

r

t

i

a

l

a

t

4

3

0

.

4

5

1

.

6

4

6

9

5

0

.

0

0

3

5

1

3

-

J

u

l

-

1

2

N

i

c

k

e

l

A

u

g

u

s

t

B

u

y

9

0

0

.

0

0

9

6

0

8

7

0

.

0

0

S

t

o

p

l

o

s

s

h

i

t

-

3

.

3

3

-

7

5

0

0

.

0

0

3

6

1

3

-

J

u

l

-

1

2

L

e

a

d

A

u

g

u

s

t

B

u

y

1

0

5

.

0

0

1

1

2

1

0

3

.

0

0

B

o

o

k

e

d

p

a

r

t

i

a

l

a

t

1

0

6

.

2

5

1

.

1

9

6

2

5

0

.

0

0

3

7

1

3

-

J

u

l

-

1

2

Z

i

n

c

A

u

g

u

s

t

B

u

y

1

0

3

.

9

0

1

0

9

1

0

1

.

0

0

E

x

i

t

a

t

1

0

2

.

6

0

-

1

.

2

5

-

6

5

0

0

.

0

0

3

8

1

3

-

J

u

l

-

1

2

A

l

u

m

i

n

i

u

m

A

u

g

u

s

t

B

u

y

1

0

6

.

2

0

1

1

2

1

0

3

.

0

0

S

t

o

p

l

o

s

s

h

i

t

-

3

.

0

1

-

1

6

0

0

0

.

0

0

3

9

1

3

-

J

u

l

-

1

2

C

r

u

d

e

o

i

l

A

u

g

u

s

t

B

u

y

4

8

2

5

.

0

0

5

1

0

0

4

7

0

0

.

0

0

T

a

r

g

e

t

m

e

t

5

.

7

0

4

0

0

0

0

.

0

0

4

0

1

8

-

S

e

p

-

1

2

C

r

u

d

e

o

i

l

O

c

t

S

e

l

l

5

2

7

0

.

0

0

5

0

0

0

a

n

d

4

9

0

0

5

4

0

0

.

0

0

B

o

o

k

e

d

f

u

l

l

p

r

o

f

i

t

a

t

4

9

1

0

6

.

8

3

2

6

0

0

0

.

0

0

4

1

3

-

O

c

t

-

1

2

N

a

t

u

r

a

l

g

a

s

O

c

t

B

u

y

1

8

3

.

5

0

1

9

5

a

n

d

2

0

5

1

7

8

.

0

0

S

t

o

p

l

o

s

s

h

i

t

-

3

.

0

0

-

6

8

7

5

.

0

0

4

2

5

-

O

c

t

-

1

2

A

l

u

m

i

n

i

u

m

N

o

v

B

u

y

1

0

9

.

5

0

1

1

6

1

0

7

.

0

0

S

t

o

p

l

o

s

s

h

i

t

-

2

.

2

8

-

1

2

5

0

0

.

0

0

4

3

1

-

N

o

v

-

1

2

S

i

l

v

e

r

M

a

r

c

h

B

u

y

6

1

8

0

0

.

0

0

6

4

0

0

0

6

0

8

0

0

.

0

0

S

t

o

p

l

o

s

s

h

i

t

-

1

.

6

2

-

3

0

0

0

0

.

0

0

4

4

2

0

-

N

o

v

-

1

2

S

i

l

v

e

r

M

a

r

c

h

B

u

y

6

3

6

0

0

.

0

0

6

6

0

0

0

6

2

4

0

0

.

0

0

T

a

r

g

e

t

m

e

t

3

.

7

7

7

2

0

0

0

.

0

0

4

5

4

-

D

e

c

-

1

2

S

i

l

v

e

r

M

a

r

c

h

S

e

l

l

6

3

7

0

0

.

0

0

6

1

0

0

0

6

5

1

0

0

.

0

0

T

a

r

g

e

t

m

e

t

4

.

2

4

8

1

0

0

0

.

0

0

4

6

6

-

D

e

c

-

1

2

N

a

t

u

r

a

l

g

a

s

J

a

n

B

u

y

2

0

3

.

0

0

2

2

0

a

n

d

2

2

5

1

9

4

.

0

0

S

t

o

p

l

o

s

s

h

i

t

-

4

.

4

3

-

1

1

2

5

0

.

0

0

N

e

t

r

e

t

u

r

n

5

6

.

0

0

3

3

2

0

7

5

.

0

0

P

e

r

f

o

r

m

a

n

c

e

o

f

M

e

t

a

l

s

A

n

d

E

n

e

r

g

y

F

u

n

d

a

m

e

n

t

a

l

P

o

s

i

t

i

o

n

a

l

C

a

l

l

s

(

J

a

n

u

a

r

y

-

D

e

c

e

m

b

e

r

)

2

0

1

2

M

e

t

a

l

&

E

n

e

r

g

y

A

n

a

l

y

s

t

:

S

a

n

d

e

e

p

J

o

o

n

COMMODITY OUTLOOK 2013

8

P

e

r

f

o

r

m

a

n

c

e

o

f

A

g

r

i

C

o

m

m

o

d

i

t

i

e

s

F

u

n

d

a

m

e

n

t

a

l

P

o

s

i

t

i

o

n

a

l

C

a

l

l

s

(

J

a

n

u

a

r

y

-

D

e

c

e

m

b

e

r

)

2

0

1

2

A

g

r

o

A

n

a

l

y

s

t

:

S

u

b

h

r

a

n

i

l

D

e

y

S

.

N

.

D

a

t

e

C

o

m

m

o

d

i

t

y

C

o

n

t

r

a

c

t

T

r

e

n

d

G

i

v

e

n

P

r

i

c

e

T

a

r

g

e

t

s

b

e

l

o

w

/

a

b

o

v

e

S

t

o

p

L

o

s

s

p

e

r

l

o

t

C

a

l

l

I

n

i

t

i

a

t

e

d

S

t

o

p

L

o

s

s

c

l

o

s

i

n

g

T

r

a

i

l

i

n

g

R

e

m

a

r

k

s

R

e

t

u

r

n

(

%

)

P

r

o

f

i

t

/

L

o

s

s

1

1

9

-

D

e

c

-

1

1

K

a

p

a

s

A

p

r

i

l

B

u

y

7

5

0

.

0

0

8

8

0

-

9

0

0

6

6

0

.

0

0

7

5

0

.

0

0

B

o

o

k

e

d

F

u

l

l

p

r

o

f

i

t

a

t

8

4

7

.

0

0

5

.

2

0

1

9

,

4

0

0

.

0

0

2

4

-

J

a

n

-

1

2

R

e

f

.

S

o

y

o

i

l

F

e

b

r

u

a

r

y

B

u

y

7

4

7

.

7

0

8

1

0

.

0

0

6

9

0

.

0

0

-

-

E

x

i

t

a

t

7

0

9

.

7

0

-

5

.

0

8

(

3

8

,

0

0

0

.

0

0

)

3

4

-

J

a

n

-

1

2

C

P

O

F

e

b

r

u

a

r

y

B

u

y

5

5

7

.

0

0

6

1

0

.

0

0

5

2

0

.

0

0

-

-

E

x

i

t

a

t

5

2

9

.

2

0

-

4

.

9

9

(

2

7

,

8

0

0

.

0

0

)

4

4

-

J

a

n

-

1

2

M

u

s

t

a

r

d

A

p

r

i

l

B

u

y

3

,

4

6

6

.

0

0

3

,

9

8

0

.

0

0

3

,

2

0

0

.

0

0

-

-

E

x

i

t

a

t

3

3

4

1

.

0

0

-

3

.

6

1

(

1

2

,

5

0

0

.

0

0

)

5

4

-

J

a

n

-

1

2

S

o

y

b

e

a

n

M

a

r

c

h

B

u

y

2

,

6

3

5

.

0

0

3

,

1

0

0

.

0

0

2

,

3

4

0

.

0

0

-

-

E

x

i

t

a

t

2

5

1

0

.

0

0

-

4

.

7

4

(

1

2

,

5

0

0

.

0

0

)

6

1

7

-

J

a

n

-

1

2

C

a

r

d

a

m

o

m

M

a

r

c

h

B

u

y

6

7

2

.

7

0

8

1

0

.

0

0

5

9

0

.

0

0

6

7

2

.

7

0

B

o

o

k

e

d

F

u

l

l

p

r

o

f

i

t

a

t

7

8

0

.

8

0

1

6

.

0

7

1

0

,

8

1

0

.

0

0

7

1

-

F

e

b

-

1

2

S

u

g

a

r

M

a

r

c

h

B

u

y

2

,

9

2

3

.

0

0

3

,

2

0

0

.

0

0

2

,

7

8

0

.

0

0

-

-

E

x

i

t

a

t

2

8

7

3

.

0

0

-

1

.

7

1

(

5

,

0

0

0

.

0

0

)

8

9

-

F

e

b

-

1

2

T

u

r

m

e

r

i

c

M

a

y

B

u

y

4

,

5

5

6

.

0

0

5

,

4

0

0

.

0

0

4

,

0

9

0

.

0

0

4

5

5

6

.

0

0

B

o

o

k

e

d

P

a

r

t

i

a

l

p

r

o

f

i

t

a

t

4

7

3

6

.

0

0

3

.

9

5

9

,

0

0

0

.

0

0

9

2

8

-

F

e

b

-

1

2

C

h

i

l

l

i

A

p

r

i

l

B

u

y

5

,

5

4

0

.

0