Professional Documents

Culture Documents

2010-09-02 235812 Euronda

Uploaded by

Kylie TarnateOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2010-09-02 235812 Euronda

Uploaded by

Kylie TarnateCopyright:

Available Formats

1.

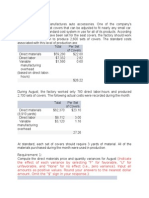

Baaca Corporation has provided the following production and total cost data for two levels of monthly production volume. The company produces a single product.

The best estimate of the total variable manufacturing cost per unit is:

First, calculate the variable manufacturing overhead cost per unit: Variable manufacturing overhead cost Change in cost Change in activity !"1,#1$,### % "1,##&,'##( !),### % *,###( "11.+# Fi,ed cost element of manufacturing overhead Total cost % Variable cost element "1,#1$,### % !"11.+# , ),###( "-&',.## Variable direct materials cost "&.#,'## *,### units "$*.)# Variable direct labor cost "+1,### *,### units "1&.$# Total variable manufacturing cost per unit /irect materials 0 /irect labor 0 1anufacturing overhead Total variable manufacturing cost per unit "$*.)# 0 "1&.$# 0 "11.+# "+'.##

'. 1a,well Company has a total e,pense per unit of "'.## per unit at the 1*,### level of activity and total e,pense per unit of "1.-$ at the '1,### unit level of activity. The best estimate of the total fi,ed cost per period for 1a,well Company is:

To calculate the variable manufacturing cost per unit:

Variable manufacturing overhead cost = Change in cost Change in activity = ($40, !0 " $#$,000% ($&,000 " &',000% = $&() *i+ed cost element of manufacturing overhead = Total cost " Variable cost element = $40, !0 " ($&() + $&,000% = $#,#'0

&. 2nspection costs at one of 3ulley Corporation4s factories are listed below:

1anagement believes that inspection cost is a mi,ed cost that depends on units produced. 5sing the high%low method, the estimate of the variable component of inspection cost per unit produced is: Change in activity = ($&0,,)! " $ , ,0% ()

Variable cost = Change in cost )&&% = $&0(&) (rounded%

"

.. 2n 6ctober, 7aldeman Corporation, a manufacturing company, reported the following financial data:

The company had no beginning or ending inventories. The contribution margin for 6ctober was:

$. Baaca Corporation has provided the following production and total cost data for two levels of monthly production volume. The company produces a single product. The best estimate of the total cost to manufacture *,&## units is8

*irst, calculate the variable manufacturing overhead cost per unit: Variable manufacturing overhead cost = Change in cost Change in activity = ($&,0&!,000 " $&,00#,$00% (),000 " ',000% = $&&(,0 *i+ed cost element of manufacturing overhead = Total cost " Variable cost element = $&,0&!,000 " ($&&(,0 + ),000% = $ #$,400 Variable direct materials cost = $#40,$00 ',000 units = $!'()0 Variable direct labor cost = $,&,000 ',000 units = $&#(!0 Total variable manufacturing cost per unit = -irect materials . -irect labor . /anufacturing overhead Total variable manufacturing cost per unit = $!'()0 . $&#(!0 . $&&(,0 = $,$(00 0 = $ #$,400 . ($,$(00 + ',#00% = $&,44 ,000

*. Ba99en Corporation has provided the following production and average cost data for two levels of monthly production volume. The company produces a single product.

The best estimate of the total variable manufacturing cost per unit is:

-irect materials and direct labor are entirely variable since cost per unit does not change 1ith changes in volume( Thus none of these costs are fi+ed and only manufacturing overhead is used to calculate the monthly fi+ed manufacturing cost( *irst, calculate the variable manufacturing cost per unit:

Variable manufacturing overhead cost = Change in cost Change in activity = ($!4$,!00 " $!$',000% (!,000 " 4,000% = $&'(!0 Variable manufacturing cost = $4!(!0 . $44( 0 . $&'(!0 = $&0'( 0

). The following data pertains to activity and the cost of electricity for two recent months:

The best estimate of the total monthly fi,ed electrical cost is:

To calculate the variable manufacturing cost per unit:

Variable manufacturing overhead cost = Change in cost Change in activity = ($&,,00 " $&,!00% (!,000 " 4,000% = $0(#0 *i+ed cost element of manufacturing overhead = Total cost " Variable cost element = $&,+## % !"#.&# , $,###( "&##

+. :upply costs at ;upard Corporation4s chain of gyms are listed below

1anagement believes that supply cost is a mi,ed cost that depends on client%visits. 5sing the high%low method to estimate the variable and fi,ed components of this cost, those estimates would be closest to:

Variable cost = Change in cost Change in activity = ($$,,)0) " $$,,0 #% (&#, ', " &#,&''% = $0()) *i+ed cost element = Total cost " Variable cost element = $$,,)0) " ($0()) + &#, ',% = $&), !$ Therefore, the cost formula for total supply cost is $&), !$ per period plus $0()) per client"visit, or 0 = $&), !$ . $0())2

-. The following information was collected for one of the costs at /emetra 1anufacturing Corporation over the past two years

<ssuming that there has been no change in the cost structure over the last two years and this activity is within the relevant range, this cost at /emetra would best be described as a /i+ed Cost

Variable component of cost: Variable cost = Change in costs Change in units Variable cost = ($&4),000 " $&$!,000% (',000 " !,000% Variable cost = $$$(00 per unit *i+ed cost: 3igh units: $&4),000 " $$$(00 + ',000 = $&!,000 4o1 units: $&$!,000 " $$$(00 + !,000 = $&!,000 5ince there is a variable component and a fi+ed component, this cost 1ould be considered to be a mi+ed cost(

You might also like

- Exercise 4-24: Job Costing, Journal Entries Given:: Direct TracingDocument22 pagesExercise 4-24: Job Costing, Journal Entries Given:: Direct TracingAlmirNo ratings yet

- Role of QA&QC in Manufacturing - PresentationDocument32 pagesRole of QA&QC in Manufacturing - Presentationimran jamilNo ratings yet

- ABC CostingDocument28 pagesABC CostingKiraYamatoNo ratings yet

- Chapter 4 Cost AccountngDocument4 pagesChapter 4 Cost AccountngFarah YasserNo ratings yet

- RBS Banff Branch Closure FactsheetDocument6 pagesRBS Banff Branch Closure FactsheetMy TurriffNo ratings yet

- SAP PM Tables and Related FieldsDocument8 pagesSAP PM Tables and Related FieldsSunil PeddiNo ratings yet

- MathSoft b2b Case SolutionDocument8 pagesMathSoft b2b Case SolutionsankalpgargmdiNo ratings yet

- 2010-09-02 235812 EurondaDocument6 pages2010-09-02 235812 EurondaJane Michelle EmanNo ratings yet

- Hca14 SM Ch04Document45 pagesHca14 SM Ch04DrellyNo ratings yet

- BA 213 - Test 3 Review (Ch10,13 and 14) Instructor: Usha RamanujamDocument14 pagesBA 213 - Test 3 Review (Ch10,13 and 14) Instructor: Usha RamanujammegafieldNo ratings yet

- Product Evaluation Form: Step 1: Determine Fixed CostsDocument4 pagesProduct Evaluation Form: Step 1: Determine Fixed CostsAshley MorganNo ratings yet

- Managerial Accounting HomeworkDocument40 pagesManagerial Accounting Homeworkyuikokhj0% (2)

- Variable vs. Absorption CostingDocument1 pageVariable vs. Absorption CostingZimbo KigoNo ratings yet

- ABC QuestionsDocument14 pagesABC QuestionsLara Lewis Achilles0% (1)

- Cpa Questions Part XDocument10 pagesCpa Questions Part XAngelo MendezNo ratings yet

- Activity Based Costing Case - Ch5Document3 pagesActivity Based Costing Case - Ch5Nilda CorpuzNo ratings yet

- Exam For Managerial AccountingDocument8 pagesExam For Managerial Accountingសារុន កែវវរលក្ខណ៍No ratings yet

- Ii Internal Management Accounting and Control Systems: 3 MarksDocument5 pagesIi Internal Management Accounting and Control Systems: 3 MarksSunil BharadwajNo ratings yet

- 2009 B-5 Class Questions PreviewDocument10 pages2009 B-5 Class Questions PreviewMarizMatampaleNo ratings yet

- Chapter 2 MathDocument4 pagesChapter 2 MathfuriousTaherNo ratings yet

- Job Order CostingDocument39 pagesJob Order CostingCharisse Ahnne Toslolado100% (1)

- Attempt-1: The Company's Accountant Used A Denominator of Budgeted Machine Hours For The Current Accounting PeriodDocument18 pagesAttempt-1: The Company's Accountant Used A Denominator of Budgeted Machine Hours For The Current Accounting Periodpragadeeshwaran100% (2)

- Practice Test 1 New For Summer 2010Document16 pagesPractice Test 1 New For Summer 2010samcarfNo ratings yet

- Cost Accounting 1Document3 pagesCost Accounting 1Rudy Setiawan KamadjajaNo ratings yet

- Answers Homework # 15 Cost MGMT 4Document7 pagesAnswers Homework # 15 Cost MGMT 4Raman ANo ratings yet

- Chapter 3 Cost AccountingDocument6 pagesChapter 3 Cost AccountingFarah Yasser0% (1)

- Expected Manufacturing Overhead Cost $2,200,000 Estimated Direct Labor-Hours 50,000 Dlhs $44 Per DLHDocument5 pagesExpected Manufacturing Overhead Cost $2,200,000 Estimated Direct Labor-Hours 50,000 Dlhs $44 Per DLHiceds01No ratings yet

- Acc312 Platt Spr07 Exam1 Solution PostedDocument13 pagesAcc312 Platt Spr07 Exam1 Solution Posted03322080738No ratings yet

- 202E03Document29 pages202E03Ariz Joelee ArthaNo ratings yet

- FINC2011 Assignment 2012Document9 pagesFINC2011 Assignment 2012Robert BarkleyNo ratings yet

- MGMT 027 Connect 07 HW PDFDocument7 pagesMGMT 027 Connect 07 HW PDFFarzana AkhterNo ratings yet

- 19 Blue Print - 2Document4 pages19 Blue Print - 2ShaoPuYu100% (1)

- Praktikum Akuntansi-BiayaDocument27 pagesPraktikum Akuntansi-BiayaK-AnggunYulianaNo ratings yet

- Folk Exam Questions - Chapter 9: SolutionDocument4 pagesFolk Exam Questions - Chapter 9: SolutionDeepshikha GoelNo ratings yet

- Rexona Business PlanDocument5 pagesRexona Business Planspectrum_48No ratings yet

- Sap FiDocument69 pagesSap FiSunando Narayan BiswasNo ratings yet

- Computer PROJECTFall 2012Document6 pagesComputer PROJECTFall 2012qhn9999_359999443No ratings yet

- Systems Design: Job-Order CostingDocument46 pagesSystems Design: Job-Order CostingRafay Salman MazharNo ratings yet

- Exam 1 Review (Document7 pagesExam 1 Review (cymclaugNo ratings yet

- Assignment Atul SharmaDocument22 pagesAssignment Atul SharmaAtul SharmaNo ratings yet

- Solution:: Step: 1 of 7: Job Costing, Accounting For Manufacturing Overhead, Budgeted Rates. The PisanoDocument5 pagesSolution:: Step: 1 of 7: Job Costing, Accounting For Manufacturing Overhead, Budgeted Rates. The PisanoHerry SugiantoNo ratings yet

- Cost and Management AccountingDocument9 pagesCost and Management AccountingFlora ChauhanNo ratings yet

- Total Factory/Manuf. Cost Cogm Cogm: Manufacturing Overhead Budget DefinitionDocument44 pagesTotal Factory/Manuf. Cost Cogm Cogm: Manufacturing Overhead Budget DefinitionChinh Lê Đình100% (1)

- Investment and BEP AnalysisDocument31 pagesInvestment and BEP AnalysisSuhadahafiza ShafieeNo ratings yet

- Chxapter05 Activity Based CostingDocument31 pagesChxapter05 Activity Based CostingJayson Hoang100% (2)

- Chapter 4 Activity Based Costing SummaryDocument4 pagesChapter 4 Activity Based Costing SummaryNurhayati NainggolanNo ratings yet

- Managerial Accounting Sample QuestionsDocument5 pagesManagerial Accounting Sample QuestionsScholarsjunction.comNo ratings yet

- HorngrenIMA14eSM ch13Document73 pagesHorngrenIMA14eSM ch13Piyal Hossain100% (1)

- Computer Lab - Practical Question Bank Faculty of Commerce, Osmania UniversityDocument11 pagesComputer Lab - Practical Question Bank Faculty of Commerce, Osmania UniversitysanagavarapuNo ratings yet

- Chapter 5Document8 pagesChapter 5Tariku KolchaNo ratings yet

- Economics Test PaperDocument6 pagesEconomics Test PaperShravan DaraNo ratings yet

- AkbiDocument37 pagesAkbiCenxi TVNo ratings yet

- Post Test Chapter 1Document4 pagesPost Test Chapter 1Randelle James FiestaNo ratings yet

- Asiment SolutionDocument4 pagesAsiment Solutionmansoor1307100% (1)

- Ch.4 Job CostingDocument39 pagesCh.4 Job Costingvinn albatraozNo ratings yet

- Chapter Two Professor McdermottDocument31 pagesChapter Two Professor McdermottJason100% (2)

- Job Order Costing ADocument31 pagesJob Order Costing AAnji GoyNo ratings yet

- Job Order CostingDocument40 pagesJob Order CostingKristel Abuana100% (1)

- What Is Product CostingDocument12 pagesWhat Is Product CostingAtulWalvekarNo ratings yet

- Actual Costing SystemDocument19 pagesActual Costing SystemFarid MahdaviNo ratings yet

- Cost AacctDocument19 pagesCost AacctKiraYamatoNo ratings yet

- Cost BehaviorDocument17 pagesCost BehaviorRona Mae Ocampo ResareNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Commercial Packages. When The Nature of The Project and The Needs of The User Permit, MostDocument3 pagesCommercial Packages. When The Nature of The Project and The Needs of The User Permit, MostKylie TarnateNo ratings yet

- Industry Analysis Provides Management With An Analysis of The Driving Forces That Affect TheirDocument2 pagesIndustry Analysis Provides Management With An Analysis of The Driving Forces That Affect TheirKylie TarnateNo ratings yet

- Lesson 13: Why Do They Do That?Document2 pagesLesson 13: Why Do They Do That?Kylie TarnateNo ratings yet

- Auditing Theory - Test BankDocument15 pagesAuditing Theory - Test BankKylie TarnateNo ratings yet

- Auditing Theory - Test BankDocument15 pagesAuditing Theory - Test BankKylie TarnateNo ratings yet

- English Under The Hood: IO OODocument2 pagesEnglish Under The Hood: IO OOKylie TarnateNo ratings yet

- Pract 1Document12 pagesPract 1Kylie TarnateNo ratings yet

- Regular Way Purchase or Sale of Financial AssetsDocument1 pageRegular Way Purchase or Sale of Financial AssetsKylie TarnateNo ratings yet

- Johnny Air Plus Personal and Corporate Client Profile Form: Physical Mailing (If Different Than Physical Address)Document1 pageJohnny Air Plus Personal and Corporate Client Profile Form: Physical Mailing (If Different Than Physical Address)Kylie TarnateNo ratings yet

- Chapter 3 Recognition and Derecognition 3.1 Initial RecognitionDocument1 pageChapter 3 Recognition and Derecognition 3.1 Initial RecognitionKylie TarnateNo ratings yet

- Juridical Necessity 333Document1 pageJuridical Necessity 333Kylie TarnateNo ratings yet

- 1Document3 pages1Kylie TarnateNo ratings yet

- Bond Principal Payment: Face Interest Rate Nominal Interest Rate Coupon Interest Rate Contractual Interest RateDocument2 pagesBond Principal Payment: Face Interest Rate Nominal Interest Rate Coupon Interest Rate Contractual Interest RateKylie TarnateNo ratings yet

- Through Studying This Chapter, You Will Be Able To Achieve These Learning Objectives: 1Document2 pagesThrough Studying This Chapter, You Will Be Able To Achieve These Learning Objectives: 1Kylie TarnateNo ratings yet

- Heartland Bank Brand Guidelines - 3 October 2017Document22 pagesHeartland Bank Brand Guidelines - 3 October 2017nainaNo ratings yet

- Testimonial YakultDocument3 pagesTestimonial YakultRahmanTigerNo ratings yet

- Rutgers Newark Course Schedule Spring 2018Document2 pagesRutgers Newark Course Schedule Spring 2018abdulrehman786No ratings yet

- Financial Market and Institutions Ch16Document8 pagesFinancial Market and Institutions Ch16kellyNo ratings yet

- (Rahul) InfowizDocument39 pages(Rahul) InfowizRahul Mehta0% (1)

- 01 RFI Technical Form BiodataDocument8 pages01 RFI Technical Form BiodataRafiq RizkiNo ratings yet

- GE Honeywell.Document20 pagesGE Honeywell.Sripal ShahNo ratings yet

- Types of SamplingDocument16 pagesTypes of SamplingNidhin NalinamNo ratings yet

- BesorDocument3 pagesBesorPaul Jures DulfoNo ratings yet

- Lesson 1 Part 1 Introduction To ICTDocument25 pagesLesson 1 Part 1 Introduction To ICTChou PapiNo ratings yet

- BCM Development SDN BHD V The Titular Roman Catholic Bishop of Malacca JohorDocument18 pagesBCM Development SDN BHD V The Titular Roman Catholic Bishop of Malacca JohorfatinsaraNo ratings yet

- Leagal Challenges For The Customs Regarding The Counterfeit Goods in Transit - A Study With Refernce To The Nokia CaseDocument49 pagesLeagal Challenges For The Customs Regarding The Counterfeit Goods in Transit - A Study With Refernce To The Nokia CaseAmit Sudarsan/ VideaimIPNo ratings yet

- J2EE Design PatternDocument36 pagesJ2EE Design Patternsunny_ratra100% (1)

- Section 3b Elasticity of Demand & SupplyDocument15 pagesSection 3b Elasticity of Demand & SupplyNeikelle CummingsNo ratings yet

- Natalie ResumeDocument1 pageNatalie Resumeapi-430414382No ratings yet

- Graduate School BrochureDocument2 pagesGraduate School BrochureSuraj TaleleNo ratings yet

- Business Tour, DubaiDocument12 pagesBusiness Tour, DubaiVIVEKNo ratings yet

- KTPDocument8 pagesKTPSahil Shashikant BhosleNo ratings yet

- 1.supply Chain MistakesDocument6 pages1.supply Chain MistakesSantosh DevaNo ratings yet

- Hall Mark ScamDocument4 pagesHall Mark ScamSharika NahidNo ratings yet

- DI Test 76: Archives Forums B-Schools Events MBA VocabularyDocument4 pagesDI Test 76: Archives Forums B-Schools Events MBA VocabularycomploreNo ratings yet

- Sip Zudus PerformanceDocument104 pagesSip Zudus PerformanceAkshay Jiremali100% (1)

- Counter-Brand and Alter-Brand Communities: The Impact of Web 2.0 On Tribal Marketing ApproachesDocument16 pagesCounter-Brand and Alter-Brand Communities: The Impact of Web 2.0 On Tribal Marketing ApproachesJosefBaldacchinoNo ratings yet

- List of HW Transporters May 2020 For PostingDocument41 pagesList of HW Transporters May 2020 For Posting2020dlb121685No ratings yet

- Advanced Cost and Management Accounting ConceptsDocument17 pagesAdvanced Cost and Management Accounting ConceptsharlloveNo ratings yet

- Induction MaterialDocument56 pagesInduction Materialvirender rawatNo ratings yet