Professional Documents

Culture Documents

Treasury Department's Alcohol and Tobacco Tax and Trade Bureau Ruling

Uploaded by

Statesman JournalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Treasury Department's Alcohol and Tobacco Tax and Trade Bureau Ruling

Uploaded by

Statesman JournalCopyright:

Available Formats

DEPARTMENT OF THE TREASURY

Alcohol and Tobacco Tax and Trade Bureau

TTB Ruling

Number: 20143 March 11, 2014

Bottling Taxpaid Wine in Growlers or Similar Containers for Consumption Off of the Premises

The filling of wine growlers or similar containers with taxpaid wine for consumption off of the premises is considered bottling or packing under the Internal Revenue Code of 1986, as amended (IRC), and any person who engages in this activity must first qualify as a taxpaid wine bottling house and also must comply with all requirements applicable to taxpaid wine bottling houses, including labeling and recordkeeping requirements under the IRC and the regulations in 27 CFR part 24. TTB RULING 20143 BACKGROUND A. Recent Interest in Wine Growlers Recently, TTB has received inquiries from proprietors of wine premises and retailers about the sale of taxpaid wine in refillable containers known as growlers. For example, TTB has received an inquiry about a State law that allows certain retailers to sell wine at retail in securely covered, refillable containers provided by the consumer for transporting the wine for consumption off of the licensed premises. In that State, empty growlers, which cannot have capacities of more than two gallons each, must be supplied by the consumer; but they may be purchased empty from the retailer and then filled onsite. TTB has been asked whether the filling of growlers with taxpaid wine is permitted under Federal law. For purposes of this ruling, the term growler is used to describe any container that is designed to be securely covered and is intended to be filled (or refilled) with wine for purposes of off-premises consumption, as well as any similar container designed to facilitate the secure transportation of the wine for later consumption off of the premises. It is TTBs position that the filling of growlers with taxpaid wine for the purpose of consumption off of the premises is an activity that may be conducted lawfully only by a qualified taxpaid wine bottling house. The Internal Revenue Code of 1986, as amended (IRC), regulates the bottling, rebottling, packing, and repacking of taxpaid wine by any person. Retailers and proprietors of wine premises are required by law to qualify as a taxpaid wine bottling house prior to conducting such operations.

OPR: RRD

B. Bottling of Taxpaid Wine under the Internal Revenue Code. Section 5352 of the IRC (26 U.S.C. 5352) provides that any person who bottles, packages, or repackages taxpaid wine must first apply for and receive permission from TTB to operate as a taxpaid wine bottling house. Under 24.10 of the TTB regulations (27 CFR 24.10), a bottler is a proprietor who fills wine into a bottle, which is defined in the same section as a container of four liters or less in capacity, regardless of the material from which it is made, used to store or remove wine. A packer is defined by 24.10 as a proprietor who fills wine into a container larger than four liters. For purposes of the regulations and this ruling, the term bottling includes rebottling, and the term packing includes repacking, packaging and repackaging. (See, e.g., 27 CFR 24.102.) Section 5352 of the IRC was enacted by Public Law 83591 on August 16, 1954. The legislative history of this amendment explains that: Under existing law [i.e., before this provision was enacted] the Government cannot supervise the bottling of taxpaid wines or require that such bottlers maintain records revealing the nature and extent of their operations. The lack of such control has led to administrative difficulties as well as frauds on the revenue and the consumer. This section will enable the Government to have consistent requirements regarding the bottling of wines regardless of whether the wines are bottled on bonded premises or after taxpayment. (S. Rep. No. 1622, 83rd Cong., 2d Sess. 527 (1954).) Shortly after enactment of the law, our predecessor agency published a ruling explaining that liquor dealers, in their capacity as such, may not bottle or rebottle wine, but must instead qualify as taxpaid wine bottling houses, even if their bottling operations were infrequent and involved small quantities of wine. See Rev. Rul. 568, 19561 C.B. 749, incorporated into TD ATF299, 55 FR 24974 (June 19, 1990). The only situation in which a retailer may place taxpaid wine into other containers without qualifying as a taxpaid wine bottling house is when this activity occurs for purposes of consumption on the premises of the retailer. In these cases, the containers are not provided for the purpose of facilitating secure transportation of the wine off of the retail premises. Thus, the TTB regulations provide that the decanting of wine by caterers or other retail dealers for table or room service, banquets, or similar purposes is not considered bottling if the decanters are not furnished for the purpose of carrying wine away from the area where served. (27 CFR 31.232.) This exception clearly would not apply to the filling of wine growlers for later consumption off of the premises. Similarly, in ATF Ruling 7321, 1973 ATF C.B. 77, our predecessor agency provided that retail dealers could fill taxpaid wine into containers other than decanters (such as wine casks or barrels, stainless steel tanks, dispensing devices, or coolers) for purposes of dispensing wine to consumers under certain limited circumstances. Among

-2-

other conditions, the wine had to be consumed on the premises where served. Again, this ruling would not apply to the filling of wine growlers for consumption off of the premises. Accordingly, under the provisions of the IRC, retailers and proprietors of wine premises who wish to fill growlers with taxpaid wine for consumption off of the premises must first qualify as a taxpaid wine bottling house, regardless of whether the containers are provided by the consumer or the retailer or proprietor and regardless of whether the containers are filled before or after the sale occurs. C. Requirements Applicable to Taxpaid Wine Bottling Houses Only certain activities may be conducted on taxpaid wine bottling house premises. Section 5363 of the IRC (26 U.S.C. 5363) and 24.102 of the TTB regulations (27 CFR 24.102) provide that a taxpaid wine bottling house, in addition to bottling, packing and removing taxpaid wine, may receive and store taxpaid wine, mix it with wine of the same kind, tax class and country of origin to facilitate handling, and recondition it. The blending of wines of different kinds, tax classes, or countries of origin prior to bottling or packing is not authorized on taxpaid wine bottling house premises, nor is the addition of other alcohol beverages or non-alcoholic beverages to the taxpaid wine prior to bottling or packing. Proprietors of taxpaid wine bottling houses must also comply with various regulatory requirements, including, but not limited to, the following: Proprietors must maintain records in accordance with 27 CFR part 24, subpart O. In particular, 27 CFR 24.311 requires proprietors to keep records of taxpaid wine received, bottled or packed, and removed. Proprietors are responsible for measuring the contents of the container and ensuring an accurate fill level and alcohol content as required in 27 CFR 24.255. Pursuant to 27 CFR 24.257, proprietors must label each bottle or other container with certain information: the name and address of the premises where bottled or packed; the brand name (if different from the name of the premises); the alcohol content; the kind of wine and the net contents of the container. Proprietors are responsible for ensuring that the label accurately describes the wine being placed in the container, and for removing or completely covering any preexisting labels on containers that do not accurately describe the wine being placed in the container.

D. Reason for Different Treatment of Beer and Wine Growlers The IRC requirements for wine growlers are not the same as the IRC requirements for beer growlers. As reflected in this ruling, the IRC has very specific requirements regarding the bottling of taxpaid wine. Section 5352 of the IRC requires any person

-3-

who bottles, packages, or repackages taxpaid wine to first apply for and receive permission to operate as a taxpaid wine bottling house. There is no analogous provision with respect to beer. As previously noted, section 5352 was enacted for the purpose of ensuring Federal regulation of the activity of bottling taxpaid wine in order to protect the revenue. The IRC has different rules with respect to the bottling of beer, wine, and distilled spirits, and the bottling of distilled spirits is subject to even more restrictive requirements under the IRC. E. TTBs Policy on Wine Growlers Under the Federal Alcohol Administration Act and the Alcoholic Beverage Labeling Act A growler that is filled in advance of sale is treated like any other bottle or container for purposes of compliance with all applicable requirements under the Federal Alcohol Administration Act (FAA Act), including the requirement that containers of wine be covered by a certificate of label approval or a certificate of exemption from label approval before the bottling of the wine and its subsequent removal from the taxpaid wine bottling house. See 27 U.S.C. 205(e) and 27 CFR 24.258. Such containers are also subject to the labeling requirements of the Alcoholic Beverage Labeling Act of 1988 (ABLA), which requires the placement of a health warning statement on each container of alcoholic beverages manufactured, imported, or bottled for sale or distribution in the United States. See 27 U.S.C. 215 and 27 CFR 16.20. However, if the taxpaid wine is first sold to the consumer and then placed into the growler in the presence of the consumer, the growler is not treated as a bottle under the FAA Act or a container under the ABLA, and thus it is not subject to the labeling requirements of those statutes. Under the FAA Act, a bottle is defined to include any container, irrespective of the material from which made, for use for the sale of distilled spirits, wine, or malt beverages at retail. 27 U.S.C. 211 (a)(8). Under the ABLA, the term container means the innermost sealed container irrespective of the material from which made, in which an alcoholic beverage is placed by the bottler and in which such beverage is offered for sale to members of the general public. 27 U.S.C. 214(5). Accordingly, it is TTBs position that when the taxpaid wine is sold to the consumer prior to being placed in the growler in the presence of the consumer, the growler is not a bottle under the FAA Act, because it was not used for the sale of wine at retail. Instead, the wine was sold to the consumer prior to being placed in the growler. Similarly, under those circumstances, the growler is not a container under the ABLA, because the wine was not being offered for sale in the growler. As mentioned earlier, this rationale does not apply to containers that are filled in advance of sale, which would be treated as containers and bottles subject to all applicable requirements of the FAA Act, the ABLA and the IRC. Nonetheless, TTB strongly encourages the labeling of growlers in compliance with the FAA Act labeling regulations and with a health warning statement under the ABLA, in order to ensure that consumers are adequately informed about the product. As noted above, even wine growlers that are filled after the sale of the wine are still subject to all requirements under the IRC and 27 CFR part 24, including the labeling requirements.

-4-

Industry members should also note that individual State and local laws and regulations may also apply to the operations described in this guidance. Before filling growlers for consumption off of the premises, taxpaid wine bottling house proprietors should consult State and local authorities to ensure compliance with State and local requirements. TTB DETERMINATION: Held, the filling of growlers or similar containers with taxpaid wine for the purpose of consumption off of the premises is considered bottling or packing under the IRC and is an activity that may be conducted lawfully only by a qualified taxpaid wine bottling house. Such activity is subject to all of the provisions applicable to taxpaid wine bottling houses under the IRC and 27 CFR part 24, including the labeling and recordkeeping requirements in those regulations. These requirements apply regardless of whether the containers are provided by the consumer or the retailer/proprietor and regardless of whether the containers are filled before or after the sale occurs. Held further, the labeling requirements of the FAA Act and ABLA do not apply to growlers or similar containers, provided that the taxpaid wine is sold to the consumer prior to being placed in the growler in the presence of the consumer. Consumers may furnish their own growler or may purchase it from the proprietor. However, any such containers that are filled in advance of the sale of the wine are subject to all applicable requirements of the FAA Act and ABLA, in addition to the requirements of the IRC.

Date signed: March 11, 2014

/s/ John J. Manfreda, John J. Manfreda Administrator Alcohol and Tobacco Tax and Trade Bureau

-5-

You might also like

- Letter To Judge Hernandez From Rural Oregon LawmakersDocument4 pagesLetter To Judge Hernandez From Rural Oregon LawmakersStatesman JournalNo ratings yet

- Cedar Creek Fire Sept. 3Document1 pageCedar Creek Fire Sept. 3Statesman JournalNo ratings yet

- Roads and Trails of Cascade HeadDocument1 pageRoads and Trails of Cascade HeadStatesman JournalNo ratings yet

- Cedar Creek Vegitation Burn SeverityDocument1 pageCedar Creek Vegitation Burn SeverityStatesman JournalNo ratings yet

- Complaint Summary Memo To Superintendent Re 8-9 BD Meeting - CB 9-14-22Document4 pagesComplaint Summary Memo To Superintendent Re 8-9 BD Meeting - CB 9-14-22Statesman JournalNo ratings yet

- Matthieu Lake Map and CampsitesDocument1 pageMatthieu Lake Map and CampsitesStatesman JournalNo ratings yet

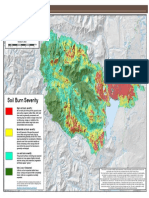

- Cedar Creek Fire Soil Burn SeverityDocument1 pageCedar Creek Fire Soil Burn SeverityStatesman JournalNo ratings yet

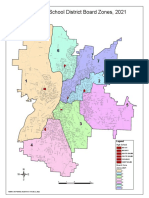

- School Board Zones Map 2021Document1 pageSchool Board Zones Map 2021Statesman JournalNo ratings yet

- Revised Closure of The Beachie/Lionshead FiresDocument4 pagesRevised Closure of The Beachie/Lionshead FiresStatesman JournalNo ratings yet

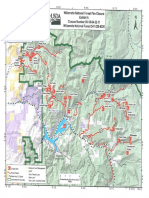

- Windigo Fire ClosureDocument1 pageWindigo Fire ClosureStatesman JournalNo ratings yet

- Cedar Creek Fire Aug. 16Document1 pageCedar Creek Fire Aug. 16Statesman JournalNo ratings yet

- Mount Hood National Forest Map of Closed and Open RoadsDocument1 pageMount Hood National Forest Map of Closed and Open RoadsStatesman JournalNo ratings yet

- LGBTQ Proclaimation 2022Document1 pageLGBTQ Proclaimation 2022Statesman JournalNo ratings yet

- Social-Emotional & Behavioral Health Supports: Timeline Additional StaffDocument1 pageSocial-Emotional & Behavioral Health Supports: Timeline Additional StaffStatesman JournalNo ratings yet

- Proclamation Parent & Guardian Engagement in Education 1-11-22 Final, SignedDocument1 pageProclamation Parent & Guardian Engagement in Education 1-11-22 Final, SignedStatesman JournalNo ratings yet

- Salem-Keizer Parent and Guardian Engagement in Education Month ProclamationDocument1 pageSalem-Keizer Parent and Guardian Engagement in Education Month ProclamationStatesman JournalNo ratings yet

- BG 7-Governing StyleDocument2 pagesBG 7-Governing StyleStatesman JournalNo ratings yet

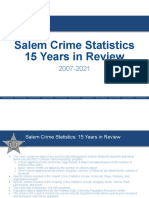

- Salem Police 15-Year Crime Trends 2007 - 2021Document10 pagesSalem Police 15-Year Crime Trends 2007 - 2021Statesman JournalNo ratings yet

- Salem Police 15-Year Crime Trends 2007 - 2015Document10 pagesSalem Police 15-Year Crime Trends 2007 - 2015Statesman JournalNo ratings yet

- WSD Retention Campaign Resolution - 2022Document1 pageWSD Retention Campaign Resolution - 2022Statesman JournalNo ratings yet

- All Neighborhoods 22X34Document1 pageAll Neighborhoods 22X34Statesman JournalNo ratings yet

- Salem Police Intelligence Support Unit 15-Year Crime TrendsDocument11 pagesSalem Police Intelligence Support Unit 15-Year Crime TrendsStatesman JournalNo ratings yet

- Failed Tax Abatement ProposalDocument8 pagesFailed Tax Abatement ProposalStatesman JournalNo ratings yet

- All Neighborhoods 22X34Document1 pageAll Neighborhoods 22X34Statesman JournalNo ratings yet

- SIA Report 2022 - 21Document10 pagesSIA Report 2022 - 21Statesman JournalNo ratings yet

- Salem-Keizer Discipline Data Dec. 2021Document13 pagesSalem-Keizer Discipline Data Dec. 2021Statesman JournalNo ratings yet

- Zone Alternates 2Document2 pagesZone Alternates 2Statesman JournalNo ratings yet

- Oregon Annual Report Card 2020-21Document71 pagesOregon Annual Report Card 2020-21Statesman JournalNo ratings yet

- SB Presentation SIA 2020-21 Annual Report 11-9-21Document11 pagesSB Presentation SIA 2020-21 Annual Report 11-9-21Statesman JournalNo ratings yet

- Crib Midget Day Care Emergency Order of SuspensionDocument6 pagesCrib Midget Day Care Emergency Order of SuspensionStatesman JournalNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- A Study On Product Packaging Impact On Consumer Buying BehaviourDocument9 pagesA Study On Product Packaging Impact On Consumer Buying BehaviourNovelty JournalsNo ratings yet

- Warehouse ManagementDocument27 pagesWarehouse ManagementAhsan Ali100% (1)

- En - jrc104198 - FCM Baseline Final Report 2017-01-16 - AllDocument332 pagesEn - jrc104198 - FCM Baseline Final Report 2017-01-16 - Allanalyn_a_ariendaNo ratings yet

- Fulfill Instructions Quotation Analysis FormDocument5 pagesFulfill Instructions Quotation Analysis FormAnonymous VRspXsmNo ratings yet

- Final PPT ProductDocument109 pagesFinal PPT ProductShreyash SahariyaNo ratings yet

- Project Charter: Wilmont's Pharmacy Drone Delivery SystemDocument2 pagesProject Charter: Wilmont's Pharmacy Drone Delivery SystemcamanjarresvNo ratings yet

- Arun Deshmukh: Professional ProfileDocument3 pagesArun Deshmukh: Professional ProfileAakansha DNo ratings yet

- Centek Industries Product CatalogDocument48 pagesCentek Industries Product CatalogAnand Smart100% (1)

- CP Project-1 Raj - PdfToWordDocument38 pagesCP Project-1 Raj - PdfToWordprenil dakharaNo ratings yet

- Massilly Closures RangeDocument4 pagesMassilly Closures RangePaolo MarinNo ratings yet

- 最终-Manual for Doypack Machine BHD-240DSDocument85 pages最终-Manual for Doypack Machine BHD-240DSRitche Lim BragaisNo ratings yet

- Supplier Requirements Manual 2017Document103 pagesSupplier Requirements Manual 2017Nanda Win LwinNo ratings yet

- Ekom DK50 DSDocument38 pagesEkom DK50 DSRudi CanicelaNo ratings yet

- Operations:: Producing Goods and ServicesDocument28 pagesOperations:: Producing Goods and ServicesHASHEMNo ratings yet

- Curs 6 Warehouse Management 2018Document176 pagesCurs 6 Warehouse Management 2018Ion100% (1)

- Aspirating Smoke Detector: Operating ManualDocument90 pagesAspirating Smoke Detector: Operating ManualRaduNo ratings yet

- 2D Barcode Verification Process Implementation GuidelineDocument40 pages2D Barcode Verification Process Implementation GuidelineDanish HermawanNo ratings yet

- 6823-Article Text-29055-1-10-20230327Document16 pages6823-Article Text-29055-1-10-20230327Auliatur RohmahNo ratings yet

- NIN3499 Switch PackagingGuidelines PDFDocument2 pagesNIN3499 Switch PackagingGuidelines PDFGyen Ming AngelNo ratings yet

- Direct Marketing Plan For Products ExampleDocument6 pagesDirect Marketing Plan For Products ExampleBertrand KwibukaNo ratings yet

- D7161 16Document2 pagesD7161 16ertfgbdfb100% (2)

- Perform Mensuration and Calculations (PM) : Content Content Standard Performance Standard Learning Competencies CodeDocument20 pagesPerform Mensuration and Calculations (PM) : Content Content Standard Performance Standard Learning Competencies CodeJuana Arapan ArvesuNo ratings yet

- PHC Suspension PartsDocument10 pagesPHC Suspension PartsMauricio GuzmanNo ratings yet

- Zt200 Series Parts Catalog en UsDocument10 pagesZt200 Series Parts Catalog en UsJonel BuenaventuraNo ratings yet

- Precautionary Labeling For Consumer ProductsDocument16 pagesPrecautionary Labeling For Consumer ProductsBiopharmaNo ratings yet

- GM1738 HVO - Plant Specific Packaging RequirementsDocument18 pagesGM1738 HVO - Plant Specific Packaging RequirementsMaryana cNo ratings yet

- A-A 59503A (Nitrogen)Document6 pagesA-A 59503A (Nitrogen)mtcengineeringNo ratings yet

- Specimen: Sanitary CertificateDocument2 pagesSpecimen: Sanitary CertificateDemanielNo ratings yet

- Hermetic CompressorsDocument102 pagesHermetic CompressorsMalau Arief100% (1)

- Grow Management ConsultantsDocument7 pagesGrow Management ConsultantsDiana Jeane RaymundoNo ratings yet