Professional Documents

Culture Documents

FY 2015 Impacts of State Budget Delays

Uploaded by

Fauquier NowCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FY 2015 Impacts of State Budget Delays

Uploaded by

Fauquier NowCopyright:

Available Formats

Potential Impacts

from

State Budget Delay

May 6, 2014

FY 2014 Impacts

! Potential delay of June State or Federal pass-through reimbursements

! Compensation Board reimbursements

! Social Services State and Federal reimbursements

! Comprehensive Services Act (CSA) reimbursements

! Airport maintenance/capital grant reimbursements

! Potential delay of May/June revenue receipts that are distributed at

State level

! Sales Tax, Communications Tax, etc.

! Potential delay of some local revenues processed at the Circuit/

General District Court level such as local recordation/deeds tax, local

fines, etc.

! The impact from these items, on average, would delay approximately

$3.4 million to the County between July-August.

FY 2015 Impacts

! All agencies contacted have said they have no direct guidance at this time,

but they will relay information as it becomes available

! Indirect guidance notes that reimbursements and distributions of revenues

will be delayed

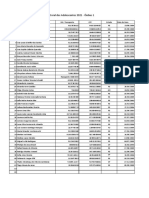

! State-Supported Positions

! Approximately 184 positions with the County receive some level of State funding

! Directly impacts 8 department/divisions of County government

! State funding supports approximately 50% of the total cost for these positions or

approximately $6.8 million

! Level of funding varies by department and positions, ranges from 8-90% state

funded

FY 2015 Impacts Contd

! State direct, indirect, or Federal pass-through funding provides approximately

$28.9 million towards County operations in the FY 2015 budget

! 60% is local funding that support all County operations

! 40% is direct funding that supports specific County departments

! State funding impacts all areas of County services from Bluemont matching

funds to Conservation Easement funding to Landfill Litter Control grants

! Indirect state funding are items such as reimbursement from the State for

rental space

! DSS space in AJC Building

! Health Department

! Federal pass-through funding

! DSS operations and 100% funded programs such as special adoptions

! DFREM/VFRA grant funding

Impacts on School Division

! FY 2014 end of year revenue delays

! State sales tax distributions for Schools

! Federal pass-through grant funding

! FY 2015 budget includes $44.8 million in state funding or 34.5% of

their budget

! Normal monthly distribution of local funding is insufficient to fund

cash flows

! Total salary and benefit costs within Operating Fund exceed local

funding amount

Other potential impacts

! VDOT managed grants

! Revenue share grants

! Vint Hill Roads Network and Brookside Parkway

! TEA-21/MAP-21 Grants

! Salem Meeting House and sidewalks

! Marshall Main Street

! Various Parks and Recreation trail projects

! Historically, 45 day stop work notices were provided and reimbursements

were made after a budget was in place. However, this is only a historical

guidance and no direct guidance is available from VDOT at this time.

Cash Flows

! The Treasurer reviewed historical cash flow need through the first quarter of

the fiscal year and indicated the following:

! Funds should be sufficient to cover all cash flow needs through the month of August

! Excludes anticipated revenues/reimbursements from the State and Federal pass-through

sources

! Excludes the use of the 10% reserve - $15,949,166 for FY 2015 and $16,622,908 for FY 2015

! Drops all accounts to required minimums

! The need for use of a short-term loan or access to the 10% reserve would most

likely occur in September

! Cash flows will be further restrained if the annual PPTRA state payment is not

received in November, approximately $10.2 million

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Abhiraj's Data Comm - I ProjectDocument15 pagesAbhiraj's Data Comm - I Projectabhirajsingh.bscllbNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Islam and PatriarchyDocument21 pagesIslam and PatriarchycarolinasclifosNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Show Catalogue: India's Leading Trade Fair For Organic ProductsDocument58 pagesShow Catalogue: India's Leading Trade Fair For Organic Productsudiptya_papai2007No ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Implications - CSR Practices in Food and Beverage Companies During PandemicDocument9 pagesImplications - CSR Practices in Food and Beverage Companies During PandemicMy TranNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- AGM Minutes 2009Document3 pagesAGM Minutes 2009Prateek ChawlaNo ratings yet

- Unit 2.exercisesDocument8 pagesUnit 2.exercisesclaudiazdeandresNo ratings yet

- Beaconhouse National University Fee Structure - Per Semester Year 2017-18Document1 pageBeaconhouse National University Fee Structure - Per Semester Year 2017-18usman ghaniNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- 175 Mendoza V GomezDocument2 pages175 Mendoza V GomezAnonymous bOncqbp8yiNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- MOP Annual Report Eng 2021-22Document240 pagesMOP Annual Report Eng 2021-22Vishal RastogiNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- E3 - Mock Exam Pack PDFDocument154 pagesE3 - Mock Exam Pack PDFMuhammadUmarNazirChishtiNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Lesson Agreement Pronoun Antecedent PDFDocument2 pagesLesson Agreement Pronoun Antecedent PDFAndrea SNo ratings yet

- Cw3 - Excel - 30Document4 pagesCw3 - Excel - 30VineeNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Business Finance: Quarter 2 - Module 6: Philosophy and Practices in Personal FinanceDocument2 pagesBusiness Finance: Quarter 2 - Module 6: Philosophy and Practices in Personal FinanceClemente AbinesNo ratings yet

- Travel Insurance CertificateDocument9 pagesTravel Insurance CertificateMillat PhotoNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Economic Question PaperDocument3 pagesEconomic Question PaperAMIN BUHARI ABDUL KHADERNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Rizal FamilyDocument3 pagesRizal FamilyPamela MarquezNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Hedge Fund Ranking 1yr 2012Document53 pagesHedge Fund Ranking 1yr 2012Finser GroupNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Biopolitics and The Spectacle in Classic Hollywood CinemaDocument19 pagesBiopolitics and The Spectacle in Classic Hollywood CinemaAnastasiia SoloveiNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Just Design Healthy Prisons and The Architecture of Hope (Y.Jewkes, 2012)Document20 pagesJust Design Healthy Prisons and The Architecture of Hope (Y.Jewkes, 2012)Razi MahriNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Individual Paper Proposal For Biochar Literature ReviewDocument2 pagesIndividual Paper Proposal For Biochar Literature ReviewraiiinydaysNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- 3 Longman Academic Writing Series 4th Edition Answer KeyDocument21 pages3 Longman Academic Writing Series 4th Edition Answer KeyZheer KurdishNo ratings yet

- Oracle Fusion Global Human Resources Payroll Costing GuideDocument90 pagesOracle Fusion Global Human Resources Payroll Costing GuideoracleappshrmsNo ratings yet

- CCC Guideline - General Requirements - Feb-2022Document8 pagesCCC Guideline - General Requirements - Feb-2022Saudi MindNo ratings yet

- Pankaj YadavSEPT - 2022Document1 pagePankaj YadavSEPT - 2022dhirajutekar990No ratings yet

- Edgeworth, Matt. 2018. Rivers As Material Infrastructure: A Legacy From The Past To The FutureDocument14 pagesEdgeworth, Matt. 2018. Rivers As Material Infrastructure: A Legacy From The Past To The FutureMauro FernandezNo ratings yet

- Sample OTsDocument5 pagesSample OTsVishnu ArvindNo ratings yet

- Types of Love in Othello by ShakespeareDocument2 pagesTypes of Love in Othello by ShakespeareMahdi EnglishNo ratings yet

- Top 10 Division Interview Questions and AnswersDocument16 pagesTop 10 Division Interview Questions and AnswersyawjonhsNo ratings yet

- Coral Dos Adolescentes 2021 - Ônibus 1: Num Nome RG / Passaporte CPF Estado Data de NascDocument1 pageCoral Dos Adolescentes 2021 - Ônibus 1: Num Nome RG / Passaporte CPF Estado Data de NascGabriel Kuhs da RosaNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Alembic LTD.,: International Standards Certifications (South Asia) Pvt. LTDDocument7 pagesAlembic LTD.,: International Standards Certifications (South Asia) Pvt. LTDJamil VoraNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)