Professional Documents

Culture Documents

2013 Annual Housing Market Webinar

Uploaded by

C.A.R. Research & Economics0 ratings0% found this document useful (0 votes)

1K views50 pagesThe 2013 CALIFORNIA ASSOCIATION OF REALTORS® Annual Housing Market Survey takes a comprehensive look at the recent developments in the California real estate market and provides an overview for the housing market from different perspectives. In particular, the report examines the sales trends of the distressed and non-distressed markets, discusses the financial aspects of the real estate environment, and provides insights on investors, first-time buyers, and other tiers of the consumer demographics.

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe 2013 CALIFORNIA ASSOCIATION OF REALTORS® Annual Housing Market Survey takes a comprehensive look at the recent developments in the California real estate market and provides an overview for the housing market from different perspectives. In particular, the report examines the sales trends of the distressed and non-distressed markets, discusses the financial aspects of the real estate environment, and provides insights on investors, first-time buyers, and other tiers of the consumer demographics.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1K views50 pages2013 Annual Housing Market Webinar

Uploaded by

C.A.R. Research & EconomicsThe 2013 CALIFORNIA ASSOCIATION OF REALTORS® Annual Housing Market Survey takes a comprehensive look at the recent developments in the California real estate market and provides an overview for the housing market from different perspectives. In particular, the report examines the sales trends of the distressed and non-distressed markets, discusses the financial aspects of the real estate environment, and provides insights on investors, first-time buyers, and other tiers of the consumer demographics.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 50

A GOOD YEAR FOR THE CALIFORNIA

HOUSING MARKET SO FAR, HOW

DID WE GET THERE?

October 31, 2013

Oscar Wei, Senior Research Analyst

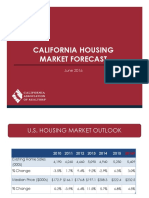

CALIFORNIA HOUSING MARKET

OUTLOOK

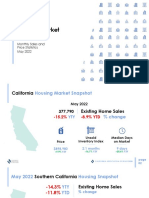

Sales of Existing Detached Homes

California, Sept. 2013 Sales: 412,880 Units, -3.1% YTD, -2.6% YTY

-

100,000

200,000

300,000

400,000

500,000

600,000

700,000

*Sales are seasonally adjusted and annualized SERIES: Sales of Existing Single Family Homes

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

Median Price of Existing Detached Homes

California, September 2013: $428,810, Up 24.4% YTY

$-

$100,000

$200,000

$300,000

$400,000

$500,000

$600,000

$700,000

P: May-07

$594,530

T: Feb-09

$245,230

-59% from

peak

SERIES: Median Price of Existing Single Family Homes

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

CA Unsold Inventory: Nearing Record Lows

California, September 2013: 3.6 Months

Note: Unsold Inventory Index represents the number of months it would take to sell the remaining inventory for the month in question. The

remaining inventory for the month is defined as the number of properties that were Active, Pending, and Contingent (when available) and divide

the sum by the number of Sold properties for the month in question.

0

2

4

6

8

10

12

14

16

18

SERIES: Unsold Inventory Index of Existing Single Family Homes

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

Supply of Inventory Remained Tight, But Continued

to Improve

0

1

2

3

4

Equity Sales REO Sales Short Sales

3.5

2.7

3.8

SERIES: Distressed Unsold Inventory Index

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

UNSOLD INVENTORY INDEX (MONTHS)

California: September 2013

For the 5

th

Month in a Row, the Supply of Distressed

Sales Improved

0

1

2

3

4

5

6

7

8

9

A

u

g

-

1

1

S

e

p

-

1

1

O

c

t

-

1

1

N

o

v

-

1

1

D

e

c

-

1

1

J

a

n

-

1

2

F

e

b

-

1

2

M

a

r

-

1

2

A

p

r

-

1

2

M

a

y

-

1

2

J

u

n

-

1

2

J

u

l

-

1

2

A

u

g

-

1

2

S

e

p

-

1

2

O

c

t

-

1

2

N

o

v

-

1

2

D

e

c

-

1

2

J

a

n

-

1

3

F

e

b

-

1

3

M

a

r

-

1

3

A

p

r

-

1

3

M

a

y

-

1

3

J

u

n

-

1

3

J

u

l

-

1

3

A

u

g

-

1

3

S

e

p

-

1

3

Equity Sales REO Short Sales

SERIES: Distressed Months Supply of Inventory

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

UNSOLD INVENTORY INDEX (MONTHS)

Sales Bounce back in 2014, as Price Continues to

Grow

Units

(Thousand)

430

444

0

100

200

300

400

500

600

700

2005 2007 2009 2011 2013f

T

h

o

u

s

a

n

d

s

Sales of Existing Detached Homes

$409

$433

$0

$100

$200

$300

$400

$500

$600

2005 2007 2009 2011 2013f

T

h

o

u

s

a

n

d

s

Median Price

Price

(Thousand)

SERIES: CA Housing Market Outlook

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

CA: Dollar Volume Steadily Improving

Up 25.3% in 2013, Up 9.3% in 2014

$301

$244

$164

$133

$131

$127

$121

$140

$176

$192

-40%

-30%

-20%

-10%

0%

10%

20%

30%

$0

$50

$100

$150

$200

$250

$300

$350

$400

2005 2006 2007 2008 2009 2010 2011 2012 2013f 2014f

$ Volume of Sales Percent Change

% Change $ in Billion

-60%

SERIES: CA Housing Market Outlook

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

2013 ANNUAL HOUSING

MARKET SURVEY

Methodology

C.A.R. has conducted the Annual Housing Market Survey since 1981. The

questions and methodology have stayed essentially the same throughout

that time.

The survey was sent via email to a random sample of 20,199 REALTORS

throughout California. The sample represented the geographical

distribution of C.A.R. membership across the state. The survey asked

REALTORS to provide information from their most recent sales

transaction that closed escrow in the second quarter of 2013.

The survey instrument was a questionnaire with both multiple choice and

open-ended questions. There were 976 valid survey responses, equivalent

to a response rate of 4.8 percent. The margin of error for this survey was +/-

3.2 percent at a 95 percent confidence level.

Equity Sales vs. REO vs. Short Sales (2013)

Equity Sales REO Sales Short Sales

Share of Total Sales 80.8% 4.9% 14.0%

Median Home Price $456,635 $175,500 $276,500

Square Footage 1,678 1,400 1,650

Price / SF $270 $101 $146

Sales-to-List Price Ratio 100.0% 100.0% 103.0%

% of Sales With Multiple Offers 69.0% 91.2% 75.7%

Avg. Number of Offers 5.2 7.4 7.1

% of All Cash Sales 25.2% 50.0% 35.7%

Days on MLS 10 15 14

Days in Escrow 30 35 60

SERIES: 2013 Housing Market Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

Equity Sales (2011 vs. 2012 vs. 2013)

2011 2012 2013

Share of Total Sales 58.7% 64.7% 80.8%

Median Home Price $431,000 $448,000 $456,635

Square Footage 1,783 1,750 1,678

Price / SF $250 $243 $270

Sales-to-List Price Ratio 95.9% 97.3% 100.0%

% of Sales With Multiple Offers 35.2% 50.9% 69.0%

Avg. Number of Offers 3.0 4.0 5.2

% of All Cash Sales 25.5% 27.3% 25.2

Days on MLS 67 32 10

Days in Escrow 35 35 30

SERIES: 2013 Housing Market Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

REO Sales (2011 vs. 2012 vs. 2013)

2011 2012 2013

Share of Total Sales 19.7% 12.3% 4.9%

Median Home Price $189,500 $185,000 $175,500

Square Footage 1,500 1,500 1,400

Price / SF $112 $116 $101

Sales-to-List Price Ratio 98.0% 100.0% 100.0%

% of Sales With Multiple Offers 58.3% 70.8% 91.2%

Avg. Number of Offers 4.3 4.2 7.4

% of All Cash Sales 34.0% 43.1% 50.0%

Days on MLS 50 30 15

Days in Escrow 35 45 35

SERIES: 2013 Housing Market Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

Short Sales (2011 vs. 2012 vs. 2013)

2011 2012 2013

Share of Total Sales 20.2% 21.7% 14.0%

Median Home Price $287,000 $235,000 $276,500

Square Footage 1,600 1,600 1,650

Price / SF $175 $154 $146

Sales-to-List Price Ratio 95.9% 99.9% 103.0%

% of Sales With Multiple Offers 57.5% 66.1% 75.7%

Avg. Number of Offers 3.6 4.3 7.1

% of All Cash Sales 23.3% 26.7% 35.7%

Days on MLS 141 90 14

Days in Escrow 45 50 60

SERIES: 2013 Housing Market Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

Home Buyer Profile (By Type of Sales) - 2012

Equity Sales REO Sales Short Sales

Median Age of Buyers 45 40 40

Median Household Income $120,000 $85,000 $75,000

% of First Time Buyers 30.3% 40.6% 44.9%

% of International Buyers 6.7% 3.7% 4.9%

% Bought as Investment to Flip 2.2% 4.6% 0.5%

% Bought as Investment to Rent 8.8% 19.3% 23.5%

Median Down Payment $84,000 $28,000 $23,500

% of Down Payment 20.0% 10.0% 13.0%

SERIES: 2013 Housing Market Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

Home Buyer Profile (By Type of Sales) - 2013

Equity Sales REO Sales Short Sales

Median Age of Buyers 44 50 43

Median Household Income $100,000 $60,000 $75,000

% of First Time Buyers 28.6% 19.5% 22.1%

% of International Buyers 7.8% 4.8% 10.2%

% Bought as Investment to Flip 2.0% 12.8% 8.0%

% Bought as Investment to Rent 13.8% 20.5% 27.7%

Median Down Payment $80,000 $20,000 $28,000

% of Down Payment 20.0% 10.1% 7.1%

SERIES: 2013 Housing Market Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

Share of First-Time Buyers is the Lowest Since 2006

Q. Was the buyer a first-time buyer?

28%

0%

10%

20%

30%

40%

50%

2005 2006 2007 2008 2009 2010 2011 2012 2013

% First-Time Home Buyers Long Run Average

Long Run Average = 38%

SERIES: 2013 Housing Market Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

Reasons for Buying

Q. What was the single most important reason for buying the property?

Tired of Renting, 22.5%

Desired Larger Home,

16.6%

Investment/ Tax

Considerations, 21.0%

Desired Better

Location, 15.1%

Change in Family

Status, 4.4%

Changed Jobs, 3.6%

Foreclosure/Short

Sale/Default, 1.6%

Desired Smaller Home,

3.8%

Retirement/Move

to Retirement

Community, 2.6%

Other, 8.8%

SERIES: 2013 Housing Market Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

First-Time Buyers Bought Because They Were Tired

of Renting, Highest in Three Years

Q. Was the buyer a first-time buyer?

55%

40%

50%

60%

70%

2007 2008 2009 2010 2011 2012 2013

% Bought Because of Tired of Renting

SERIES: 2013 Housing Market Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

$65,000

$70,000

20%

0%

5%

10%

15%

20%

25%

$0

$10,000

$20,000

$30,000

$40,000

$50,000

$60,000

$70,000

$80,000

$90,000

2005 2006 2007 2008 2009 2010 2011 2012 2013

Median Down Payment % of Down Payment to Price

Q. What was the amount of downpayment?

The Median Down Payment Up 8% from 2012, As

Home Prices Continue to Increase

SERIES: 2013 Housing Market Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

Median Down Payment

First-Time Homebuyers Vs. Repeat Homebuyers

Q. What was the amount of downpayment?

$20,500

$31,420

$100,000

$96,300

$0

$20,000

$40,000

$60,000

$80,000

$100,000

$120,000

$140,000

2005 2006 2007 2008 2009 2010 2011 2012 2013

First-Time Buyers Repeat Buyers

SERIES: 2013 Housing Market Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

Cash Source for Down Payment

First-Time Buyer vs. Repeat Buyer

Q. What was the source of the cash the buyer used for a downpayment or to purchase the residence?

First-time Buyers Repeat Buyers All Buyers

Personal saving 70.5% 55.7% 59.0%

Proceeds from sale of previous

residence

0.0% 21.5% 15.7%

Borrowed or gift from relatives 13.9% 4.3% 7.0%

Sale of personal assets other than real

property

2.4% 2.3% 2.3%

Inheritance 2.0% 3.0% 2.8%

Proceeds from sale or refi of another

property

0.0% 3.1% 2.2%

Other 11.2% 10.1% 11.0%

SERIES: 2013 Housing Market Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

Repeat Buyers Rely on Personal Savings

As Down Payment

Q. What was the source of the cash the buyer used for a down payment or to purchase the residence?

22%

56%

0%

10%

20%

30%

40%

50%

60%

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

Sale of Previous Residence Savings

SERIES: 2013 Housing Market Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

Country of International Buyer

China (34%)

Canada (10%)

Mexico (15%)

SERIES: 2013 Housing Market Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

REALTORS Worked with International Buyers in

the Past 12 Months

Q. How many properties have you sold to an international buyer in the last 12 months?

71%

14%

6%

4%

2%

4%

79%

9%

5%

3%

1%

3%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

0 1 2 3 4 5+

2013

2012

# of Properties

% Who Sold to International Buyers

# of Properties Sold to International Buyers in the Last 12 Months

SERIES: 2013 Housing Market Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

Reasons For Selling

Q. What was the single most important reason for selling the property?

Foreclosure/Short

Sale/Default, 15.5%

Change in Family

Status, 11.6%

Retirement/Move

to Retirement

Community, 9.5%

Investment/ Tax

Considerations, 10.8%

Desired Better

Location, 11.0%

Desired Smaller Home,

6.0%

Changed Jobs, 6.3%

Desired Larger Home,

12.6%

Other, 16.7%

SERIES: 2013 Housing Market Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

One of Six Sellers Sold Because Their Properties

Were in Distressed Status

Q. What was the single most important reason for selling/buying the property?

16%

0%

5%

10%

15%

20%

25%

30%

35%

2005 2006 2007 2008 2009 2010 2011 2012 2013

% of Homes Sold Due to Foreclosure/Short Sale/Default

SERIES: 2013 Housing Market Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

Seller Household Formation

Equity vs. REO vs. Short Sales

Equity Sales REO Sales Short Sales

Single 25.8% 0.0% 31.6%

Married Couple with Dependents 31.2% 2.6% 38.6%

Married Couple without Dependents 26.3% 5.3% 18.4%

2 or More Individuals (Related or Unrelated) 9.0% 0.0% 7.0%

Banks/Lending Institutions 0.3% 84.2% 0.9%

Other 7.3% 7.9% 3.5%

Total 100.0% 100.0% 100.0%

SERIES: 2013 Housing Market Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

Q. What was the net cash gain or net loss to the seller as a result of this sale?

$55,000

$0

$50,000

$100,000

$150,000

$200,000

$250,000

2005 2006 2007 2008 2009 2010 2011 2012 2013

After Reaching a Record Low in 2012, the Median

Net Cash Gain to Sellers Bounced Back.

SERIES: 2013 Housing Market Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

Home Seller Profile

(By Type of Sales)

Equity Sales Short Sales

Median Age of Sellers 55 50

Median Household Income $100,000 $60,000

Years Seller Lived in Home 9 8

Percent of Sales with Net Cash Loss 6.2% 40.4%

Median Net Cash Gain/Net Cash Loss to Seller $80,000 $0

SERIES: 2013 Housing Market Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

For Those Who Do Not Plan to Repurchase, Here

Are Their Top 5 Reasons:

14.4%

8.1%

15.3%

8.6%

8.8%

22.0%

7.3%

7.1%

5.5%

5.0%

0% 5% 10% 15% 20% 25%

Seller prefers to have less financial

obligation

Decide to live with family/friends

Seller is a lender/bank

Lack of cash for down payment

Poor credit background

2012 2013

SERIES: 2013 Housing Market Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

Reasons Sellers Not Planning to Buy Another Home

(2012)

Q. Why is the seller not planning to purchase another home?

Equity Sales REO Sales Short Sales

Seller is lender/bank 0% 88% 3%

Seller prefers to have less financial obligation 20% 0% 12%

Poor credit background 0% 3% 31%

Lack of cash for down payment 6% 3% 17%

Out of work/unemployment 3% 0% 10%

Decide to live with family/friends 11% 0% 9%

Waiting for market to bottom 1% 0% 0%

Other 57% 6% 19%

Total 100% 100% 100%

SERIES: 2013 Housing Market Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

Reasons Sellers Not Planning to Buy Another Home

(2013)

Q. Why is the seller not planning to purchase another home?

Equity Sales REO Sales Short Sales

Seller is lender/bank 0% 88% 5%

Seller prefers to have less financial obligation 26% 0% 18%

Poor credit background 1% 0% 19%

Lack of cash for down payment 3% 0% 18%

Out of work/unemployment 4% 0% 9%

Decide to live with family/friends 7% 0% 9%

Waiting for market to bottom 3% 4% 0%

Other 56% 8% 23%

Total 100% 100% 100%

SERIES: 2013 Housing Market Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

Top Reasons Under Other for Equity Sellers Not

Planning to Buy Another Home

13.2%

7.6%

4.5%

3.4%

2.8%

2.0%

0% 2% 4% 6% 8% 10% 12% 14%

Seller Has Another Home

Moved to Retirement Facility/Nursing Home

Deceased

Change in Family Status

Inheritance

Seller Is a Builder

SERIES: 2013 Housing Market Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

IS THE HOUSING RECOVERY

SUSTAINABLE?

Buyers Have More Skin in the Game

2006 2012 2013

% of buyers with 20% or more down

payment

43.2% 54.4% 52.2%

% of buyers with zero down payment 21.1% 4.6% 5.9%

% of cash buyers 11.0% 29.6% 27.4%

% of home buyers with a second

mortgage

43.4% 1.8% 2.2%

% of buyer with ARM 32.6% 3.5% 4.0%

SERIES: 2013 Housing Market Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

5.9%

7.9%

5.1%

0%

10%

20%

30%

40%

50%

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

All Hombuyers First-Time Buyers Repeat Buyers

Percent of Buyers with Zero Down Payment

SERIES: 2013 Housing Market Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

Proportion of Transactions With Second Mortgages

Q. In addition to the first mortgage or assumption, was there a second mortgage?

2%

0%

10%

20%

30%

40%

50%

2005 2006 2007 2008 2009 2010 2011 2012 2013

Percent of Home Sales with Second Mortgage

SERIES: 2013 Housing Market Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

Percent of Buyers with Second Mortgage

0%

10%

20%

30%

40%

50%

60%

70%

2005 2006 2007 2008 2009 2010 2011 2012 2013

First-Time Buyers Repeat Buyers

SERIES: 2013 Housing Market Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

Q. Please indicate the type of mortgage.

Share of FHA Still Significantly Higher than 2007,

But Was the Lowest in 6 Years (First Mortgage)

17%

6%

0%

10%

20%

30%

40%

2005 2006 2007 2008 2009 2010 2011 2012 2013

FHA VA

SERIES: 2013 Housing Market Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

Less Likelihood to Default as

Monthly Payment Is More Affordable

2006 2012 2013

Average mortgage rate (FRM) 6.4% 3.7% 3.8%

Median home price for existing single-family

homes

$556,430 $319,310 $408,600

Median household income for home buyers $100,000 $100,000 $100,000

Housing Affordability Index 12.0% 51.0% 36.0%

SERIES: 2013 Housing Market Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

How Client Found Their Agent

Q. How did your client find and select you to represent them?

0% 2% 4% 6% 8% 10% 12% 14% 16% 18% 20%

Referral from a client

Represented Them in Previous Home Transaction

Client was Friend/Relative/Neighbor

Recommendations of Friends

Referral from Business Associates

Web page/Internet/Socia Media

Open House

Walk in /Floor Call

Yard Signs

Door-to-Door Farming

Listing Agent for Home Purchased

Relocation Referral

Print Ads/Newspaper & Magazine

Direct Mail Marketing

Telephone Marketing

Other

SERIES: 2013 Housing Market Survey

SOURCE: CALIFORNIA ASSOCIATION OF REALTORS

Real Estate Symposium

November 13, 2013

9 AM 4 PM

Skirball Cultural Center

Los Angeles, CA

car.org/MarketData/REVoic

es

SPEAKERS

Chief Economists of:

Other

Organizations:

Next Webinar

California's Future Home Buyers--What You Need to

Know to Convert Renters into Buyers

Thursday, Nov. 21

2 3 p.m.

To register, visit car.org/MarketData

http://www.car.org/marketdata/map

For more information:

http://www.facebook.com/CARResearchgroup

Delivered online available 24/7

Choose from over 20 courses

Learn from most tablet devices

Accredited by the DRE

A member benefit from C.A.R.

Another 12 FREE hours of online CE courses -

must be selected in 2014

store.car.org/12FreeCE

Turn Prospects Into Clients!

Never be limited to a static PDF again

Edit and update your presentations with fresh MLS data

Available for all your devices

Try for FREE today

www.clarustouchcma.com

The best presentation tool available for REALTORS

THANK YOU!

WWW.CAR.ORG/MARKETDATA

OSCARW@CAR.ORG

You might also like

- The Little Book of Valuation: How to Value a Company, Pick a Stock, and ProfitFrom EverandThe Little Book of Valuation: How to Value a Company, Pick a Stock, and ProfitRating: 4 out of 5 stars4/5 (7)

- 2015 Annual Housing Market SurveyDocument73 pages2015 Annual Housing Market SurveyC.A.R. Research & EconomicsNo ratings yet

- Elliman 1Q2016Document4 pagesElliman 1Q2016wardavisNo ratings yet

- TRNDGX PressRelease Aug2011Document2 pagesTRNDGX PressRelease Aug2011deedrileyNo ratings yet

- Lyon Real Estate Press Release April 2012Document2 pagesLyon Real Estate Press Release April 2012Lyon Real EstateNo ratings yet

- Lyon Real Estate Press Release May 2012Document2 pagesLyon Real Estate Press Release May 2012Lyon Real EstateNo ratings yet

- MLS SampleDocument10 pagesMLS Samplediademny09No ratings yet

- Weekly Market Update Week Ending 2016 July 24Document5 pagesWeekly Market Update Week Ending 2016 July 24Australian Property ForumNo ratings yet

- Residential Economic Issues & Trends ForumDocument56 pagesResidential Economic Issues & Trends ForumNational Association of REALTORS®No ratings yet

- Market Pulse-November 2015Document24 pagesMarket Pulse-November 2015C.A.R. Research & EconomicsNo ratings yet

- Santa Clara County Market Update - October 2011Document4 pagesSanta Clara County Market Update - October 2011Gwen WangNo ratings yet

- Market MetricsDocument4 pagesMarket MetricsMichael KozlowskiNo ratings yet

- College Park Real Estate Market Report Nov 3 2013Document5 pagesCollege Park Real Estate Market Report Nov 3 2013Marc CormierNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2016 October 16Document6 pagesCoreLogic Weekly Market Update Week Ending 2016 October 16Australian Property ForumNo ratings yet

- Luxury Homes-FORT Lauderdale 33301 Market Update Sept 5th 2011Document11 pagesLuxury Homes-FORT Lauderdale 33301 Market Update Sept 5th 2011Ekaterina Bazyka, Realtor MiamiNo ratings yet

- Weekly Market Update Week Ending 2015 October 25Document5 pagesWeekly Market Update Week Ending 2015 October 25Australian Property ForumNo ratings yet

- Weekly Market Update Week Ending 2015 December 6Document5 pagesWeekly Market Update Week Ending 2015 December 6Australian Property ForumNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2016 August 28Document5 pagesCoreLogic Weekly Market Update Week Ending 2016 August 28Australian Property ForumNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2016 December 4Document6 pagesCoreLogic Weekly Market Update Week Ending 2016 December 4Australian Property ForumNo ratings yet

- MIAMI Homes Market Update Sept 5th2011Document246 pagesMIAMI Homes Market Update Sept 5th2011Ekaterina Bazyka, Realtor MiamiNo ratings yet

- April Sales StatisticsDocument11 pagesApril Sales StatisticsAmy Pendergraft DolanNo ratings yet

- Week of Oct 31 - Market Update For Single Family Homes - North Miami Beach, FLDocument6 pagesWeek of Oct 31 - Market Update For Single Family Homes - North Miami Beach, FLSoraya E. CaciciNo ratings yet

- May 2013 - On The MoveDocument4 pagesMay 2013 - On The MoveBryant StadlerNo ratings yet

- Texas Housing Market - 2016Document29 pagesTexas Housing Market - 2016cutmytaxesNo ratings yet

- Metropolitan Denver Real Estate Statistics As of November 30, 2011Document10 pagesMetropolitan Denver Real Estate Statistics As of November 30, 2011Michael KozlowskiNo ratings yet

- Pacific Grove Real Estate Sales Market Report For June 2015Document4 pagesPacific Grove Real Estate Sales Market Report For June 2015Nicole TruszkowskiNo ratings yet

- 10-31-12 Contra Costa AORDocument97 pages10-31-12 Contra Costa AORjavthakNo ratings yet

- Market Pulse-September 2016 (Public)Document28 pagesMarket Pulse-September 2016 (Public)C.A.R. Research & EconomicsNo ratings yet

- Pleasanton Full Market Report (Week of January 27th, 2014)Document6 pagesPleasanton Full Market Report (Week of January 27th, 2014)Harry KharaNo ratings yet

- San Diego, CA 92154 Market ConditionsDocument2 pagesSan Diego, CA 92154 Market ConditionsBrian WardNo ratings yet

- Pebble Beach Real Estate Sales Market Report For September 2015Document4 pagesPebble Beach Real Estate Sales Market Report For September 2015Nicole TruszkowskiNo ratings yet

- 171 Stanford Ave PDFDocument8 pages171 Stanford Ave PDFJonathan MarksNo ratings yet

- Lyon Real Estate Press Release January 2012Document2 pagesLyon Real Estate Press Release January 2012Lyon Real EstateNo ratings yet

- Pacific Grove Real Estate Sales Market Report For May 2015Document4 pagesPacific Grove Real Estate Sales Market Report For May 2015Nicole TruszkowskiNo ratings yet

- Weekly Market Update Week Ending 2016 June 05Document5 pagesWeekly Market Update Week Ending 2016 June 05Australian Property ForumNo ratings yet

- REALTORS® Land Institute February 2015 Land Business Survey Conducted by The National Association of REALTORS®Document38 pagesREALTORS® Land Institute February 2015 Land Business Survey Conducted by The National Association of REALTORS®National Association of REALTORS®No ratings yet

- Lyon Real Estate Press Release June 2012Document2 pagesLyon Real Estate Press Release June 2012Lyon Real EstateNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2016 September 25Document6 pagesCoreLogic Weekly Market Update Week Ending 2016 September 25Australian Property ForumNo ratings yet

- Ekaterina Bazyka, Miami Realtor Market Update (Condo) FORT Lauderdale 33301 Week of September 5th 20011Document11 pagesEkaterina Bazyka, Miami Realtor Market Update (Condo) FORT Lauderdale 33301 Week of September 5th 20011Ekaterina Bazyka, Realtor MiamiNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2016 September 11Document5 pagesCoreLogic Weekly Market Update Week Ending 2016 September 11Australian Property ForumNo ratings yet

- Nest Realty Q2 2013 Charlottesville Real Estate Market ReportDocument9 pagesNest Realty Q2 2013 Charlottesville Real Estate Market ReportJonathan KauffmannNo ratings yet

- Weekly Market Update Week Ending 2015 November 15 PDFDocument5 pagesWeekly Market Update Week Ending 2015 November 15 PDFAustralian Property ForumNo ratings yet

- Weekly Market Update Week Ending 2016 May 29Document5 pagesWeekly Market Update Week Ending 2016 May 29Australian Property ForumNo ratings yet

- 2015 Home Owners SurveyDocument47 pages2015 Home Owners SurveyC.A.R. Research & EconomicsNo ratings yet

- Union City Full Market Report (Week of February 10, 2014)Document6 pagesUnion City Full Market Report (Week of February 10, 2014)Harry KharaNo ratings yet

- REBGV Stats Package, August 2013Document9 pagesREBGV Stats Package, August 2013Victor SongNo ratings yet

- Pebble Beach Homes Market Action Report Real Estate Sales For October 2014Document4 pagesPebble Beach Homes Market Action Report Real Estate Sales For October 2014Nicole TruszkowskiNo ratings yet

- California Housing Market Forecast: June 2016Document7 pagesCalifornia Housing Market Forecast: June 2016C.A.R. Research & EconomicsNo ratings yet

- Lyon Real Estate Press Release March 2012Document2 pagesLyon Real Estate Press Release March 2012Lyon Real EstateNo ratings yet

- Pacific Grove Homes Market Action Report Real Estate Sales For October 2014Document4 pagesPacific Grove Homes Market Action Report Real Estate Sales For October 2014Nicole TruszkowskiNo ratings yet

- Cynthia's Weekly Redwood City Market Update - 7/6/15Document5 pagesCynthia's Weekly Redwood City Market Update - 7/6/15Hollie JohnsonNo ratings yet

- CoreLogic Weekly Market Update Week Ending 2016 September 18Document5 pagesCoreLogic Weekly Market Update Week Ending 2016 September 18Australian Property ForumNo ratings yet

- O'Fallon, MO Marketing Report For January 16, 2012Document1 pageO'Fallon, MO Marketing Report For January 16, 2012Finding Homes for YouNo ratings yet

- 2016 California Economic & Market ForecastDocument131 pages2016 California Economic & Market ForecastC.A.R. Research & EconomicsNo ratings yet

- Nest Report Charlottesville: May 2011Document2 pagesNest Report Charlottesville: May 2011Jonathan KauffmannNo ratings yet

- RP Data Weekend Market Summary Week Ending 2013 October 27 PDFDocument2 pagesRP Data Weekend Market Summary Week Ending 2013 October 27 PDFAustralian Property ForumNo ratings yet

- Weekly Market Update Week Ending 2015 NovemberDocument5 pagesWeekly Market Update Week Ending 2015 NovemberAustralian Property ForumNo ratings yet

- Hayward Full Market Report (Week of October 28, 2013)Document6 pagesHayward Full Market Report (Week of October 28, 2013)Harry KharaNo ratings yet

- Trading with Intermarket Analysis: A Visual Approach to Beating the Financial Markets Using Exchange-Traded FundsFrom EverandTrading with Intermarket Analysis: A Visual Approach to Beating the Financial Markets Using Exchange-Traded FundsRating: 5 out of 5 stars5/5 (1)

- 2024-03 Monthly Housing Market OutlookDocument57 pages2024-03 Monthly Housing Market OutlookC.A.R. Research & EconomicsNo ratings yet

- 2024-02 Monthly Housing Market OutlookDocument57 pages2024-02 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- Monthly Housing Market OutlookDocument57 pagesMonthly Housing Market OutlookC.A.R. Research & EconomicsNo ratings yet

- 2023-12 Monthly Housing Market OutlookDocument57 pages2023-12 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2024-02 Monthly Housing Market OutlookDocument57 pages2024-02 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2023-11 Monthly Housing Market OutlookDocument57 pages2023-11 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2023-12 Monthly Housing Market OutlookDocument57 pages2023-12 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2023-05 Monthly Housing Market OutlookDocument57 pages2023-05 Monthly Housing Market OutlookC.A.R. Research & EconomicsNo ratings yet

- 2023-Q1 Traditional Housing Affordability Index (HAI)Document9 pages2023-Q1 Traditional Housing Affordability Index (HAI)C.A.R. Research & EconomicsNo ratings yet

- Traditional HAI PresentationDocument9 pagesTraditional HAI PresentationC.A.R. Research & EconomicsNo ratings yet

- Traditional HAI PresentationDocument9 pagesTraditional HAI PresentationC.A.R. Research & EconomicsNo ratings yet

- 2023-03 Monthly Housing Market OutlookDocument57 pages2023-03 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2021-12 Monthly Housing Market OutlookDocument55 pages2021-12 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2022-05 Monthly Housing Market OutlookDocument56 pages2022-05 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2022-12 Monthly Housing Market OutlookDocument58 pages2022-12 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- Traditional HAI PresentationDocument9 pagesTraditional HAI PresentationC.A.R. Research & EconomicsNo ratings yet

- 2022-09 Monthly Housing Market OutlookDocument57 pages2022-09 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2022-06 Monthly Housing Market OutlookDocument57 pages2022-06 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2022-08 Monthly Housing Market OutlookDocument57 pages2022-08 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- 2022-03 Monthly Housing Market OutlookDocument55 pages2022-03 Monthly Housing Market OutlookC.A.R. Research & Economics100% (2)

- 2022-02 Monthly Housing Market OutlookDocument55 pages2022-02 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- Traditional HAI PresentationDocument9 pagesTraditional HAI PresentationC.A.R. Research & EconomicsNo ratings yet

- 2021-11 Monthly Housing Market OutlookDocument55 pages2021-11 Monthly Housing Market OutlookC.A.R. Research & EconomicsNo ratings yet

- 2021-07 Monthly Housing Market OutlookDocument54 pages2021-07 Monthly Housing Market OutlookC.A.R. Research & Economics100% (2)

- 2021 AHMS For Press Release (Fina Finall)Document41 pages2021 AHMS For Press Release (Fina Finall)C.A.R. Research & EconomicsNo ratings yet

- 2021 AHMS For Press Release (120821)Document41 pages2021 AHMS For Press Release (120821)C.A.R. Research & EconomicsNo ratings yet

- 2021-10 Monthly Housing Market OutlookDocument55 pages2021-10 Monthly Housing Market OutlookC.A.R. Research & EconomicsNo ratings yet

- Latitudes Not AttitudesDocument7 pagesLatitudes Not Attitudesikonoclast13456No ratings yet

- Superstocks Final Advance Reviewer'sDocument250 pagesSuperstocks Final Advance Reviewer'sbanman8796% (24)

- 2022 06 15 LT Hyderabad Metro Rail Unveils Metro Bazar ShoppingonthegoDocument2 pages2022 06 15 LT Hyderabad Metro Rail Unveils Metro Bazar ShoppingonthegoKathir JeNo ratings yet

- The Pioneer 159 EnglishDocument14 pagesThe Pioneer 159 EnglishMuhammad AfzaalNo ratings yet

- 2.3 Movie Time: Antonia TasconDocument2 pages2.3 Movie Time: Antonia TasconAntonia Tascon Z.100% (1)

- 12 CONFUCIUS SY 2O23 For Insurance GPA TemplateDocument9 pages12 CONFUCIUS SY 2O23 For Insurance GPA TemplateIris Kayte Huesca EvicnerNo ratings yet

- Womens Hostel in BombayDocument5 pagesWomens Hostel in BombayAngel PanjwaniNo ratings yet

- Sim CBM 122 Lesson 3Document9 pagesSim CBM 122 Lesson 3Andrew Sy ScottNo ratings yet

- Complete Project Marketing ManagementDocument36 pagesComplete Project Marketing ManagementAbhushkNo ratings yet

- Attacking and Defending Through Operations - Fedex: Assignment Submitted By: Pradeep DevkarDocument14 pagesAttacking and Defending Through Operations - Fedex: Assignment Submitted By: Pradeep Devkarsim4misNo ratings yet

- COA Resolution Number 2015-031Document3 pagesCOA Resolution Number 2015-031gutierrez.dorie100% (7)

- Ol NW Mock 2022 Economics 2Document2 pagesOl NW Mock 2022 Economics 2Lukong EmmanuelNo ratings yet

- Taxation As A Fiscal Policy FinalDocument34 pagesTaxation As A Fiscal Policy FinalLetsah BrightNo ratings yet

- Tata-AIG Organisational ChartDocument4 pagesTata-AIG Organisational ChartTarun BajajNo ratings yet

- Commissioner of Internal Revenue vs. Primetown Property Group, Inc.Document11 pagesCommissioner of Internal Revenue vs. Primetown Property Group, Inc.Queenie SabladaNo ratings yet

- New Smart Samriddhi Brochure 09.03.2021Document12 pagesNew Smart Samriddhi Brochure 09.03.2021GAJALAKSHMI LNo ratings yet

- Chapter 18Document16 pagesChapter 18Norman DelirioNo ratings yet

- Vol. 1: Basic Planning: Overseas Customer Service Facility GuideDocument35 pagesVol. 1: Basic Planning: Overseas Customer Service Facility GuideMishell TatianaNo ratings yet

- Itinerario Cosco ShippingDocument2 pagesItinerario Cosco ShippingRelly CarrascoNo ratings yet

- Phil Government Procument Policy BoardDocument4 pagesPhil Government Procument Policy BoardRyan JD LimNo ratings yet

- Secure QualityDocument15 pagesSecure QualityAnonymous e2wolbeFsNo ratings yet

- Rethinking Social Protection Paradigm-1Document22 pagesRethinking Social Protection Paradigm-1herryansharyNo ratings yet

- Important InformationDocument193 pagesImportant InformationDharmendra KumarNo ratings yet

- AntiglobalizationDocument26 pagesAntiglobalizationDuDuTranNo ratings yet

- Anand Vihar Railway Stn. RedevelopementDocument14 pagesAnand Vihar Railway Stn. RedevelopementPratyush Daju0% (1)

- Economic Development Complete NotesDocument36 pagesEconomic Development Complete Notessajad ahmadNo ratings yet

- In Re: Rnnkeepers Usa Trust. Debtors. - Chapter LL Case No. 10 13800 (SCC)Document126 pagesIn Re: Rnnkeepers Usa Trust. Debtors. - Chapter LL Case No. 10 13800 (SCC)Chapter 11 DocketsNo ratings yet

- ANX6732AAQDocument1 pageANX6732AAQRathod GunvantrayNo ratings yet

- Rasanga Curriculum VitaeDocument5 pagesRasanga Curriculum VitaeKevo NdaiNo ratings yet

- Subject: Issues in Pakistan'S EconomyDocument13 pagesSubject: Issues in Pakistan'S EconomyTyped FYNo ratings yet