Professional Documents

Culture Documents

BNI 111709 v2

Uploaded by

fcfroicCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BNI 111709 v2

Uploaded by

fcfroicCopyright:

Available Formats

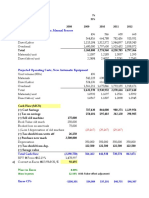

Railroad Company Comparables Analysis

BNI

2008 2007 2006 2005 2004 2003 2002

Revenues $18,018 $15,802 $14,985 $12,987 $10,946 $9,413 $8,979

less: COGS 12,709 11,023 10,288 8,949 8,248 6,838 6,392

Gross Profit $5,309 $4,779 $4,697 $4,038 $2,698 $2,575 $2,587

less: SG&A 0 0 0 0 0 0 0

EBITDA $5,309 $4,779 $4,697 $4,038 $2,698 $2,575 $2,587

less: D&A 1,397 1,293 1,176 1,111 1,012 910 931

less: Operating Leases 686 706 665 565 496 462 448

EBIT $3,226 $2,780 $2,856 $2,362 $1,190 $1,203 $1,208

less: Taxes 1,253 1,128 1,107 919 482 454 456

NOPAT $1,973 $1,652 $1,749 $1,443 $708 $749 $752

Total Debt $9,555 $8,146 $7,385 $7,154 $6,516 $6,684 $6,814

PV of Operating Leases 6,980 7,498 7,496 6,143 5,412 5,346 5,537

Total Preferred Stock 0 0 0 0 0 0 0

Total Equity 11,131 11,144 10,528 9,508 9,311 8,495 7,932

Total Capital $27,666 $26,788 $25,409 $22,805 $21,239 $20,525 $20,283

ROIC 7.4% 6.5% 7.7% 6.8% 3.4% 3.7% 3.8%

Gross Margin 29.5% 30.2% 31.3% 31.1% 24.6% 27.4% 28.8%

EBITDA Margin 29.5% 30.2% 31.3% 31.1% 24.6% 27.4% 28.8%

EBIT Margin 17.9% 17.6% 19.1% 18.2% 10.9% 12.8% 13.5%

NOPAT Margin 11.0% 10.5% 11.7% 11.1% 6.5% 8.0% 8.4%

Debt/EBITDA 1.80x 1.70x 1.57x 1.77x 2.42x 2.60x 2.63x

Debt/Total Capital 34.5% 30.4% 29.1% 31.4% 30.7% 32.6% 33.6%

CFO $3,977 $3,492 $3,189 $2,706 $2,377 $2,285 $2,106

Capex 3,116 2,248 2,014 1,750 1,527 1,726 1,358

FCF $861 $1,244 $1,175 $956 $850 $559 $748

CFO / Revs 22.1% 22.1% 21.3% 20.8% 21.7% 24.3% 23.5%

Capex / Revs 17.3% 14.2% 13.4% 13.5% 14.0% 18.3% 15.1%

FCF / Revs 4.8% 7.9% 7.8% 7.4% 7.8% 5.9% 8.3%

Total Assets $36,403 $33,583 $31,797 $30,304 $28,925 $26,947 $25,767

Asset Turnover 0.49x 0.47x 0.47x 0.43x 0.38x 0.35x 0.35x

Issuance of Stock $0 $0 $0 $0 $0 $0 $0

Repurchase of Stock (1,147) (1,265) (730) (1,399) (376) (217) (353)

Net Repurchases $1,147 $1,265 $730 $1,399 $376 $217 $353

Dividends (471) (380) (310) (267) (231) (191) (183)

Return of Capital $1,618 $1,645 $1,040 $1,666 $607 $408 $536

RoC/CFO 40.7% 47.1% 32.6% 61.6% 25.5% 17.9% 25.5%

2001 2000 1999

$9,208 $9,205 $9,195

6,549 6,202 6,093

$2,659 $3,003 $3,102

0 0 0

$2,659 $3,003 $3,102

909 895 897

443 424 435

$1,307 $1,684 $1,770

442 605 682

$865 $1,079 $1,088

$6,651 $6,846 $5,813

5,537 4,606 3,722

0 0 0

7,849 7,480 8,172

$20,037 $18,932 $17,707

4.6% 6.1% 6.1%

28.9% 32.6% 33.7%

28.9% 32.6% 33.7%

14.2% 18.3% 19.2%

9.4% 11.7% 11.8%

2.50x 2.28x 1.87x

33.2% 36.2% 32.8%

$2,197 $2,317 $2,424

1,459 1,399 1,788

$738 $918 $636

23.9% 25.2% 26.4%

15.8% 15.2% 19.4%

8.0% 10.0% 6.9%

$24,721 $24,375 $23,700

0.37x 0.38x 0.39x

$0 $0 $0

(317) (1,496) (688)

$317 $1,496 $688

(190) (206) (224)

$507 $1,702 $912

23.1% 73.5% 37.6%

You might also like

- Sbux, Peet, and Pro-Forma Pete-DdrxDocument12 pagesSbux, Peet, and Pro-Forma Pete-DdrxfcfroicNo ratings yet

- Genzyme DCF PDFDocument5 pagesGenzyme DCF PDFAbinashNo ratings yet

- Lady M DCF TemplateDocument4 pagesLady M DCF Templatednesudhudh100% (1)

- Bbby 4Q2014Document3 pagesBbby 4Q2014RahulBakshiNo ratings yet

- Tire City Case AnalysisDocument10 pagesTire City Case AnalysisVASANTADA SRIKANTH (PGP 2016-18)No ratings yet

- ანრი მაჭავარიანი ფინალურიDocument40 pagesანრი მაჭავარიანი ფინალურიAnri MachavarianiNo ratings yet

- UST Debt Policy Spreadsheet (Reduced)Document9 pagesUST Debt Policy Spreadsheet (Reduced)Björn Auðunn ÓlafssonNo ratings yet

- Pacific Grove Spice CompanyDocument3 pagesPacific Grove Spice CompanyLaura JavelaNo ratings yet

- 1/29/2010 2009 360 Apple Inc. 2010 $1,000 $192.06 1000 30% 900,678Document18 pages1/29/2010 2009 360 Apple Inc. 2010 $1,000 $192.06 1000 30% 900,678X.r. GeNo ratings yet

- Case 28 AutozoneDocument39 pagesCase 28 AutozonePatcharanan SattayapongNo ratings yet

- Netflix Financial StatementsDocument2 pagesNetflix Financial StatementsGoutham RaoNo ratings yet

- Bac DCFDocument7 pagesBac DCFVivek GuptaNo ratings yet

- 04 06 Public Comps Valuation Multiples AfterDocument19 pages04 06 Public Comps Valuation Multiples AfterShanto Arif Uz ZamanNo ratings yet

- 07 12 Sensitivity Tables AfterDocument30 pages07 12 Sensitivity Tables Aftermerag76668No ratings yet

- Apple & RIM Merger Model and LBO ModelDocument50 pagesApple & RIM Merger Model and LBO ModelDarshana MathurNo ratings yet

- Meerut Adventure Company CV1Document9 pagesMeerut Adventure Company CV1Ayushi GuptaNo ratings yet

- Supplement Du Pont 1983Document13 pagesSupplement Du Pont 1983Eesha KNo ratings yet

- Blaine Kitchenware: Case Exhibit 1Document15 pagesBlaine Kitchenware: Case Exhibit 1Fahad AliNo ratings yet

- Polaroid Corporation ENGLISHDocument14 pagesPolaroid Corporation ENGLISHAtul AnandNo ratings yet

- Valuation AssignmentDocument20 pagesValuation AssignmentHw SolutionNo ratings yet

- Harley-Davidson, Inc. (HOG) Stock Financials - Annual Income StatementDocument5 pagesHarley-Davidson, Inc. (HOG) Stock Financials - Annual Income StatementThe Baby BossNo ratings yet

- Mercury CaseDocument23 pagesMercury Caseuygh gNo ratings yet

- NetflixDocument13 pagesNetflixRamesh SinghNo ratings yet

- CCME Financial Analysis ReportDocument5 pagesCCME Financial Analysis ReportOld School ValueNo ratings yet

- Financial Statement Analysis: I Ntegrated CaseDocument13 pagesFinancial Statement Analysis: I Ntegrated Casehtet sanNo ratings yet

- Raw Input Calculated Financial Projections and ValuationDocument5 pagesRaw Input Calculated Financial Projections and ValuationFırat ŞıkNo ratings yet

- Gyaan SessionDocument25 pagesGyaan SessionVanshGuptaNo ratings yet

- Flash - Memory - Inc From Website 0515Document8 pagesFlash - Memory - Inc From Website 0515竹本口木子100% (1)

- Projected Operating Costs, Manual Process: Inflatio Mexico 7% Tax Rate 35%Document4 pagesProjected Operating Costs, Manual Process: Inflatio Mexico 7% Tax Rate 35%Cesar CameyNo ratings yet

- Cariboo Case StudyDocument6 pagesCariboo Case Studyzahraa aabedNo ratings yet

- Chapter Iv - Data Analysis and Interpretation: Property #1Document12 pagesChapter Iv - Data Analysis and Interpretation: Property #1karthiga312No ratings yet

- Chapter Iv - Data Analysis and Interpretation: Property #1Document32 pagesChapter Iv - Data Analysis and Interpretation: Property #1karthiga312No ratings yet

- Bakery Break-even Analysis and 5 Year Financial ProjectionsDocument6 pagesBakery Break-even Analysis and 5 Year Financial ProjectionsMOHIT MARHATTANo ratings yet

- Excel To Business Analys ExamDocument15 pagesExcel To Business Analys Examrhea23aNo ratings yet

- Common Size Income StatementDocument7 pagesCommon Size Income StatementUSD 654No ratings yet

- IFS - Simple Three Statement ModelDocument1 pageIFS - Simple Three Statement ModelMohamedNo ratings yet

- Purchases / Average Payables Revenue / Average Total AssetsDocument7 pagesPurchases / Average Payables Revenue / Average Total AssetstannuNo ratings yet

- 61 10 Shares Dividends AfterDocument10 pages61 10 Shares Dividends Aftermerag76668No ratings yet

- Mini Case Chapter 3 Final VersionDocument14 pagesMini Case Chapter 3 Final VersionAlberto MariñoNo ratings yet

- Model Assignment Aug-23Document3 pagesModel Assignment Aug-23Abner ogegaNo ratings yet

- TN-1 TN-2 Financials Cost CapitalDocument9 pagesTN-1 TN-2 Financials Cost Capitalxcmalsk100% (1)

- Solucion Caso Lady MDocument13 pagesSolucion Caso Lady Mjohana irma ore pizarroNo ratings yet

- Apple Case StudyDocument2 pagesApple Case StudyPrakhar MorchhaleNo ratings yet

- Active Gear Historical Income Statement Operating Results Revenue Gross ProfitDocument20 pagesActive Gear Historical Income Statement Operating Results Revenue Gross ProfitJoan Alejandro MéndezNo ratings yet

- Mercury AthleticDocument9 pagesMercury AthleticfutyNo ratings yet

- Lesson 3Document29 pagesLesson 3Anh MinhNo ratings yet

- Polaroid 1996 CalculationDocument8 pagesPolaroid 1996 CalculationDev AnandNo ratings yet

- Pro Forma Balance Sheet - FinalDocument18 pagesPro Forma Balance Sheet - FinalsssssNo ratings yet

- Bec-Exercises - Chapter 4Document1 pageBec-Exercises - Chapter 4gharavii2063No ratings yet

- Buffets Bid For Media GeneralDocument23 pagesBuffets Bid For Media GeneralTerence TayNo ratings yet

- Revenue: Mcdonald'S Corporation Income Statement Horizontal Analysis For The Year Ended December 31,2010 and 2012Document11 pagesRevenue: Mcdonald'S Corporation Income Statement Horizontal Analysis For The Year Ended December 31,2010 and 2012Reymark BaldoNo ratings yet

- Case StudyDocument9 pagesCase Studyzahraa aabedNo ratings yet

- Johnson & Johnson JNJ Stock-Sample Analysis Report Intrinsic ValueDocument12 pagesJohnson & Johnson JNJ Stock-Sample Analysis Report Intrinsic ValueOld School Value100% (2)

- Sample Business Plan Excel TemplateDocument27 pagesSample Business Plan Excel TemplateAndriyadi MardinNo ratings yet

- Income Statement and Cash Flow AnalysisDocument2 pagesIncome Statement and Cash Flow AnalysisAnam AbrarNo ratings yet

- Adidas Chartgenerator ArDocument2 pagesAdidas Chartgenerator ArTrần Thuỳ NgânNo ratings yet

- American Cheminal Corp SpreadsheetDocument16 pagesAmerican Cheminal Corp SpreadsheetRahul PandeyNo ratings yet

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachFrom EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachRating: 3 out of 5 stars3/5 (3)

- Dollar ThriftyDocument80 pagesDollar ThriftyfcfroicNo ratings yet

- The ATlAnTic CenTuryDocument40 pagesThe ATlAnTic CenTurywinfly9038No ratings yet

- Secondaries Q1 2010Document4 pagesSecondaries Q1 2010fcfroicNo ratings yet

- CDO Meltdown Harvard PaperDocument115 pagesCDO Meltdown Harvard PaperpframpNo ratings yet

- Real Exchange Rates and Cap Flows 011011Document34 pagesReal Exchange Rates and Cap Flows 011011fcfroicNo ratings yet

- Key Numbers CFO SurveyDocument2 pagesKey Numbers CFO SurveyfcfroicNo ratings yet

- Solving The Present Crisis and Managing The Leverage Cycle: John GeanakoplosDocument31 pagesSolving The Present Crisis and Managing The Leverage Cycle: John GeanakoplosfcfroicNo ratings yet

- Financial Crisis of 2007-2010Document36 pagesFinancial Crisis of 2007-2010fcfroic100% (2)

- Kahneman and Renshon Why Hawks WinDocument6 pagesKahneman and Renshon Why Hawks WinfcfroicNo ratings yet

- SEC OIG Report Stanford April 2010Document159 pagesSEC OIG Report Stanford April 2010lynch4814No ratings yet

- Tiffanys Measures of ProfitabilityDocument1 pageTiffanys Measures of ProfitabilityfcfroicNo ratings yet

- Singleton 1979 ForbesDocument6 pagesSingleton 1979 ForbesfcfroicNo ratings yet

- Serco Group PLC: Cash Flow (Indirect) - Annual - Standardised in Millions of GBPDocument4 pagesSerco Group PLC: Cash Flow (Indirect) - Annual - Standardised in Millions of GBPfcfroicNo ratings yet

- Serco Ratio AnalysisDocument4 pagesSerco Ratio Analysisfcfroic0% (1)

- Week 3 - Discussion 1Document4 pagesWeek 3 - Discussion 1fcfroicNo ratings yet

- Financing Affordable Housing in EuropeDocument62 pagesFinancing Affordable Housing in EuropeUnited Nations Human Settlements Programme (UN-HABITAT)100% (2)

- Recent Raytheon News 120209Document1 pageRecent Raytheon News 120209fcfroicNo ratings yet

- China Green Agriculture Working Capital AnalysisDocument2 pagesChina Green Agriculture Working Capital AnalysisfcfroicNo ratings yet

- NVCA's 4-Pillar Plan To Restore Liquidity in The US VC IndustryDocument3 pagesNVCA's 4-Pillar Plan To Restore Liquidity in The US VC IndustryfcfroicNo ratings yet

- Broadridge Financial Solutions: Company Most Recent Report DateDocument12 pagesBroadridge Financial Solutions: Company Most Recent Report DatefcfroicNo ratings yet

- GT Wakeup CallDocument44 pagesGT Wakeup CallZerohedgeNo ratings yet

- Water Comps 2Q09 v23Document739 pagesWater Comps 2Q09 v23fcfroicNo ratings yet

- Risk MGMT and RailRoad IndustryDocument6 pagesRisk MGMT and RailRoad IndustryfcfroicNo ratings yet

- DHR Analysis 3Q09 vFINALDocument83 pagesDHR Analysis 3Q09 vFINALfcfroicNo ratings yet

- Still Living Without The BasicsDocument215 pagesStill Living Without The BasicsfcfroicNo ratings yet

- Tci Final Testimony W AttachmentsDocument41 pagesTci Final Testimony W Attachmentsfcfroic100% (1)

- Executive CompensationDocument64 pagesExecutive CompensationfcfroicNo ratings yet

- Executive Pay: Regulation vs. Market Competition, Cato Policy Analysis No. 619Document16 pagesExecutive Pay: Regulation vs. Market Competition, Cato Policy Analysis No. 619Cato InstituteNo ratings yet

- Blueprint For The Development of Local Economies of SamarDocument72 pagesBlueprint For The Development of Local Economies of SamarJay LacsamanaNo ratings yet

- Analyze Author's Bias and Identify Propaganda TechniquesDocument14 pagesAnalyze Author's Bias and Identify Propaganda TechniquesWinden SulioNo ratings yet

- Company Profile-SIPLDocument4 pagesCompany Profile-SIPLShivendra SinghNo ratings yet

- CIA AirlinesLaosDocument36 pagesCIA AirlinesLaosMey SamedyNo ratings yet

- SYD611S Individual Assignment 2024Document2 pagesSYD611S Individual Assignment 2024Amunyela FelistasNo ratings yet

- Exam Notes PDFDocument17 pagesExam Notes PDFmmeiring1234No ratings yet

- Planning With People in MindDocument20 pagesPlanning With People in MindYun CheNo ratings yet

- Pilot Registration Process OverviewDocument48 pagesPilot Registration Process OverviewMohit DasNo ratings yet

- English The Salem Witchcraft Trials ReportDocument4 pagesEnglish The Salem Witchcraft Trials ReportThomas TranNo ratings yet

- Hue University Faculty Labor ContractDocument3 pagesHue University Faculty Labor ContractĐặng Như ThànhNo ratings yet

- MP Newsletter 6Document24 pagesMP Newsletter 6acmcNo ratings yet

- Career Decision-Making Difficulties QuestionnaireDocument2 pagesCareer Decision-Making Difficulties Questionnaireapi-251146669No ratings yet

- Decathlon - Retail Management UpdatedDocument15 pagesDecathlon - Retail Management UpdatedManu SrivastavaNo ratings yet

- ThangkaDocument8 pagesThangkasifuadrian100% (1)

- Sunway Berhad (F) Part 2 (Page 97-189)Document93 pagesSunway Berhad (F) Part 2 (Page 97-189)qeylazatiey93_598514100% (1)

- 0500 w16 Ms 13Document9 pages0500 w16 Ms 13Mohammed MaGdyNo ratings yet

- Test Bank For Goulds Pathophysiology For The Health Professions 5 Edition Karin C VanmeterDocument36 pagesTest Bank For Goulds Pathophysiology For The Health Professions 5 Edition Karin C Vanmetermulctalinereuwlqu100% (41)

- The Emergence of Provincial PoliticsDocument367 pagesThe Emergence of Provincial PoliticsHari Madhavan Krishna KumarNo ratings yet

- The Constitution of The Student Council of Pope John Paul II Catholic High SchoolDocument4 pagesThe Constitution of The Student Council of Pope John Paul II Catholic High Schoolapi-118865622No ratings yet

- Russell's View On World Government in His Essay The Future of MankindDocument3 pagesRussell's View On World Government in His Essay The Future of MankindRafaqat Ali100% (1)

- 2024 JanuaryDocument9 pages2024 Januaryedgardo61taurusNo ratings yet

- Human Resource Management: Functions and ObjectivesDocument26 pagesHuman Resource Management: Functions and ObjectivesABDUL RAZIQ REHANNo ratings yet

- Notice WritingDocument2 pagesNotice WritingMeghana ChaudhariNo ratings yet

- Human Resource Management in HealthDocument7 pagesHuman Resource Management in HealthMark MadridanoNo ratings yet

- 5 City Sheriff of Iligan City v. Fortunado (CANE)Document2 pages5 City Sheriff of Iligan City v. Fortunado (CANE)Jerry CaneNo ratings yet

- SAS HB 06 Weapons ID ch1 PDFDocument20 pagesSAS HB 06 Weapons ID ch1 PDFChris EfstathiouNo ratings yet

- CV Experienced Marketing ProfessionalDocument2 pagesCV Experienced Marketing ProfessionalPankaj JaiswalNo ratings yet

- Electricity TariffsDocument5 pagesElectricity TariffsaliNo ratings yet

- Pradeep Kumar SinghDocument9 pagesPradeep Kumar SinghHarsh TiwariNo ratings yet

- Mobile phone controlled car locking systemDocument13 pagesMobile phone controlled car locking systemKevin Adrian ZorillaNo ratings yet