Professional Documents

Culture Documents

Employer Participation in Refinancing Act (S.2429)

Uploaded by

MarkWarnerCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Employer Participation in Refinancing Act (S.2429)

Uploaded by

MarkWarnerCopyright:

Available Formats

OTT14311 S.L.C.

113TH CONGRESS

2D SESSION

S. ll

To amend the Internal Revenue Code of 1986 to extend the exclusion for

employer-provided educational assistance to employer payment of interest

on certain refinanced student loans.

IN THE SENATE OF THE UNITED STATES

llllllllll

Mr. WARNER introduced the following bill; which was read twice and referred

to the Committee on llllllllll

A BILL

To amend the Internal Revenue Code of 1986 to extend

the exclusion for employer-provided educational assist-

ance to employer payment of interest on certain refi-

nanced student loans.

Be it enacted by the Senate and House of Representa- 1

tives of the United States of America in Congress assembled, 2

SECTION 1. SHORT TITLE. 3

This Act may be cited as the Employer Participation 4

in Refinancing Act. 5

2

OTT14311 S.L.C.

SEC. 2. EXCLUSION FOR EMPLOYER PAYMENT OF INTER- 1

EST ON CERTAIN REFINANCED STUDENT 2

LOANS. 3

(a) IN GENERAL.Paragraph (1) of section 127(c) 4

of the Internal Revenue Code of 1986 is amended by strik- 5

ing and at the end of subparagraph (A), by redesig- 6

nating subparagraph (B) as subparagraph (C), and by in- 7

serting after subparagraph (A) the following new subpara- 8

graph: 9

(B) the payment by an employer, whether 10

paid to the employee or to a lender, of any in- 11

debtedness of the employee under a qualified 12

education refinance loan or any interest relating 13

to such a loan, and. 14

(b) QUALIFIED EDUCATION REFINANCE LOAN. 15

Subsection (c) of section 127 of the Internal Revenue Code 16

of 1986 is amended by adding at the end the following 17

new paragraph: 18

(8) QUALIFIED EDUCATION REFINANCE 19

LOAN.The term qualified education refinance 20

loan means any indebtedness used solely to refi- 21

nance a qualified education loan (within the meaning 22

of section 221(d)(1)) with respect to which the lend- 23

er offers the borrower protection in the event of un- 24

employment or financial hardship (as reasonably de- 25

3

OTT14311 S.L.C.

termined by the lender, including periods of forbear- 1

ance or career assistance).. 2

(c) CONFORMING AMENDMENT; DENIAL OF DOUBLE 3

BENEFIT.Paragraph (1) of section 221(e) of the Inter- 4

nal Revenue Code of 1986 is amended by inserting before 5

the period the following: , or for which an exclusion is 6

allowable under section 127 to the taxpayers employer by 7

reason of the payment by such employer of any indebted- 8

ness on a qualified education loan of the taxpayer. 9

(d) EFFECTIVE DATE.The amendments made by 10

this section shall apply to expenses paid after December 11

31, 2014. 12

You might also like

- Save Rural Hospitals Act of 2021 Bill TextDocument4 pagesSave Rural Hospitals Act of 2021 Bill TextMarkWarnerNo ratings yet

- Save Rural Hospitals Act of 2021 One PagerDocument1 pageSave Rural Hospitals Act of 2021 One PagerMarkWarnerNo ratings yet

- Resolution Honoring Hispanic Heritage MonthDocument6 pagesResolution Honoring Hispanic Heritage MonthMarkWarnerNo ratings yet

- Deepfakes Letter To TwitterDocument2 pagesDeepfakes Letter To TwitterMarkWarnerNo ratings yet

- 5.15.19 MRW ASD BFRDP Grant Support LetterDocument1 page5.15.19 MRW ASD BFRDP Grant Support LetterMarkWarnerNo ratings yet

- Deepfakes Letter To YouTubeDocument2 pagesDeepfakes Letter To YouTubeMarkWarnerNo ratings yet

- Syrian Allies Protection ActDocument6 pagesSyrian Allies Protection ActMarkWarnerNo ratings yet

- ACCESS Act Section by Section FINAL.Document3 pagesACCESS Act Section by Section FINAL.MarkWarnerNo ratings yet

- GOE19968Document17 pagesGOE19968MarkWarner100% (1)

- Insurance Commission Signed LetterDocument2 pagesInsurance Commission Signed LetterMarkWarnerNo ratings yet

- Deepfakes Letter To SnapchatDocument2 pagesDeepfakes Letter To SnapchatMarkWarnerNo ratings yet

- Signed Pre-Ex LetterDocument4 pagesSigned Pre-Ex LetterMarkWarner100% (1)

- Deepfakes Letter To FacebookDocument2 pagesDeepfakes Letter To FacebookMarkWarnerNo ratings yet

- Deepfakes Letter To TwitchDocument2 pagesDeepfakes Letter To TwitchMarkWarnerNo ratings yet

- Deepfakes Letter To TikTokDocument2 pagesDeepfakes Letter To TikTokMarkWarnerNo ratings yet

- Deepfakes Letter To TumblrDocument2 pagesDeepfakes Letter To TumblrMarkWarnerNo ratings yet

- Deepfakes Letter To LinkedInDocument2 pagesDeepfakes Letter To LinkedInMarkWarnerNo ratings yet

- Deepfakes Letter To PinterestDocument2 pagesDeepfakes Letter To PinterestMarkWarnerNo ratings yet

- Deepfakes Letter To ImgurDocument2 pagesDeepfakes Letter To ImgurMarkWarnerNo ratings yet

- Deepfakes Letter To RedditDocument2 pagesDeepfakes Letter To RedditMarkWarnerNo ratings yet

- The Illicit Cash Act One PagerDocument2 pagesThe Illicit Cash Act One PagerMarkWarner100% (1)

- MCG 19647 LatestDocument3 pagesMCG 19647 LatestMarkWarnerNo ratings yet

- 9.25.19 Letter To AgriLogic Industrial Hemp Crop InsuranceDocument2 pages9.25.19 Letter To AgriLogic Industrial Hemp Crop InsuranceMarkWarnerNo ratings yet

- ILLICIT CASH Act, As IntroducedDocument133 pagesILLICIT CASH Act, As IntroducedMarkWarner100% (1)

- VA Beach Tax Letter 6.13.19Document1 pageVA Beach Tax Letter 6.13.19MarkWarnerNo ratings yet

- 09.17.2019 MRW To Pompeo Re EDC ProgramDocument2 pages09.17.2019 MRW To Pompeo Re EDC ProgramMarkWarnerNo ratings yet

- The ILLICIT CASH Act Section by SectionDocument5 pagesThe ILLICIT CASH Act Section by SectionMarkWarnerNo ratings yet

- MCG 19610Document3 pagesMCG 19610MarkWarnerNo ratings yet

- 2019.09.23 Warner USIP China SpeechDocument13 pages2019.09.23 Warner USIP China SpeechMarkWarnerNo ratings yet

- MobileXUSA Letter23Document2 pagesMobileXUSA Letter23MarkWarnerNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Advanced Engineering Economy & CostingDocument84 pagesAdvanced Engineering Economy & Costingduraiprakash83No ratings yet

- Act 51 Public Acts 1951Document61 pagesAct 51 Public Acts 1951Clickon DetroitNo ratings yet

- Yr1 Yr2 Yr3 Sales/year: (Expected To Continue)Document7 pagesYr1 Yr2 Yr3 Sales/year: (Expected To Continue)Samiksha MittalNo ratings yet

- The Role of Government in The Housing Market. The Eexperiences From AsiaDocument109 pagesThe Role of Government in The Housing Market. The Eexperiences From AsiaPUSTAKA Virtual Tata Ruang dan Pertanahan (Pusvir TRP)No ratings yet

- Advt Tech 09Document316 pagesAdvt Tech 09SHUVO MONDALNo ratings yet

- ASOS Factory List November 2021 Final ListDocument45 pagesASOS Factory List November 2021 Final Listishika maluNo ratings yet

- PLCPD Popdev Media AwardsDocument21 pagesPLCPD Popdev Media AwardsMulat Pinoy-Kabataan News NetworkNo ratings yet

- PROJECT PROFILE ON SPINNING MILL (14400 SPINDLESDocument6 pagesPROJECT PROFILE ON SPINNING MILL (14400 SPINDLESAnand Arumugam0% (1)

- Beximco Pharmaceuticals International Business AnalysisDocument5 pagesBeximco Pharmaceuticals International Business AnalysisEhsan KarimNo ratings yet

- CIR vs. First Express PawnshopDocument1 pageCIR vs. First Express PawnshopTogz Mape100% (1)

- Chapter 16 Planning The Firm's Financing Mix2Document88 pagesChapter 16 Planning The Firm's Financing Mix2api-19482678No ratings yet

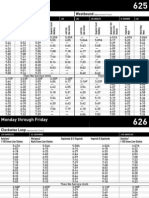

- LA Metro - 625-626Document4 pagesLA Metro - 625-626cartographicaNo ratings yet

- PDACN634Document69 pagesPDACN634sualihu22121100% (1)

- Financial Planning For Salaried Employee and Strategies For Tax SavingsDocument8 pagesFinancial Planning For Salaried Employee and Strategies For Tax SavingsNivetha0% (2)

- IIP - Vs - PMI, DifferencesDocument5 pagesIIP - Vs - PMI, DifferencesChetan GuptaNo ratings yet

- NSE ProjectDocument24 pagesNSE ProjectRonnie KapoorNo ratings yet

- DocxDocument11 pagesDocxKeir GaspanNo ratings yet

- ALO StrategyDocument1 pageALO StrategyChayse BarrNo ratings yet

- Rapaport Diamond ReportDocument2 pagesRapaport Diamond ReportMorries100% (1)

- SWOT Analysis for Reet in QatarDocument3 pagesSWOT Analysis for Reet in QatarMahrosh BhattiNo ratings yet

- Project 1Document20 pagesProject 1pandurang parkarNo ratings yet

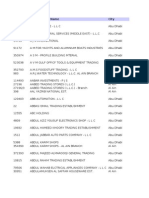

- Partner Ledger Report: User Date From Date ToDocument2 pagesPartner Ledger Report: User Date From Date ToNazar abbas Ghulam faridNo ratings yet

- Macro and Micro AnalysisDocument20 pagesMacro and Micro AnalysisRiya Pandey100% (1)

- Constant Elasticity of Subs...Document3 pagesConstant Elasticity of Subs...Masoud BaratiNo ratings yet

- AUH DataDocument702 pagesAUH DataParag Babar33% (3)

- Nifty MasterDocument35 pagesNifty MasterAshok Singh BhatiNo ratings yet

- 2021-09-21 Columbia City Council - Public Minutes-2238Document8 pages2021-09-21 Columbia City Council - Public Minutes-2238jazmine greeneNo ratings yet

- INKP - Annual Report - 2018 PDFDocument225 pagesINKP - Annual Report - 2018 PDFKhairani NisaNo ratings yet

- Career PlanDocument3 pagesCareer PlanMaria Cristina HonradaNo ratings yet

- Recitation 1 Notes 14.01SC Principles of MicroeconomicsDocument3 pagesRecitation 1 Notes 14.01SC Principles of MicroeconomicsDivya ShahNo ratings yet