Professional Documents

Culture Documents

3D Systems - Piper DDD Quick Look at Q2 Results DDD Falls Short of Expectations

Uploaded by

FluenceMediaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3D Systems - Piper DDD Quick Look at Q2 Results DDD Falls Short of Expectations

Uploaded by

FluenceMediaCopyright:

Available Formats

HOT COMME NT

J u l y 3 1 , 2 0 1 4

3D Systems Corp. (DDD) Overweight

Quick Look at Q2 Results, DDD Falls Short of Expectations

PRICE: US$56.07

TARGET: US$63.00

(7x EV/S based on CY15E Revenue)

Troy D. Jensen, CFA

Sr Research Analyst, Piper Jaffray & Co.

612 303-6291, troy.d.jensen@pjc.com

Matthew E. Lebo, CFA

Research Analyst, Piper Jaffray & Co.

212 284-5042, matthew.e.lebo@pjc.com

RI SKS TO ACHI EVEMENT OF

PRI CE TARGET

Competition; Share loses; Integration risk; ASP

Erosion; Margin consolidation

Price Performance - 1 Year

Aug-13 Oct-13 Dec-13 Feb-14 Apr-14 Jun-14

100

90

80

70

60

50

40

USD

Source: Bloomberg

CONCLUSI ON

3D Systems Q2 EPS and revenues both came in below consensus estimates. Revenue

for the quarter was $151.5M ($162.2M consensus), up 25% year over year, and organic

growth for the quarter was 10%. Revenue was driven by system (up 15% Y/Y), material

(up 30% Y/Y), and service (up 38% Y/Y) sales. System unit sales were up 126% Y/Y,

and 3D noted they are seeing strong demand for their metal printers. Sequentially, direct

metals printing revenue grew 55%. At the end of Q2, 3D Systems had a record order

book of $31.9M, of which $23.9M was for printer orders. 3D Systems announced they

will acquire Simbionix for $120M cash. The deal is expected to close in the next month.

Quick look at Q2 Results. Revenue increased 25% year/year (10% organically) to

$151.5 million, coming in below the street expectations (cons. $162.2M). System,

material, and service sales increased 15%, 30%, and 38%, respectively, on a year

over year basis. Gross margins decreased 330 basis points quarter/quarter. Suppressed

margins mainly came from a one time inventory write down and change in quarterly

sales mix. Non-GAAP EPS of $0.16 came in $0.01 below our assumption and $0.02

beneath consensus.

Raised Guidance. 3D Systems increased full-year guidance from $695-735M to

$700-740M. We believe the increased guidance is 100% related to the recent

acquisition of Simbionix, and does not reflect a change in organic growth. 3D Systems

FY 14 EPS is guided for $0.73-0.85, which is consistent with prior guidance.

COMPANY DESCRI PTI ON

3D Systems is a leading supplier of rapid prototyping systems and 3D printers.

Page 1 of 3 3D Systems Corporation

Piper Jaffray does and seeks to do business with companies covered in its research reports. As a result, investors should be aware

that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as

only a single factor in making their investment decisions. This report should be read in conjunction with important disclosure

information, including an attestation under Regulation Analyst certification, found on pages 2 - 3 of this report or at the following

site: http://www.piperjaffray.com/researchdisclosures

HOT COMME NT

J u l y 3 1 , 2 0 1 4

IMPORTANT RESEARCH DISCLOSURES

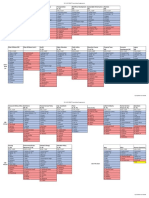

Notes: The boxes on the Rating and Price Target History chart above indicate the date of the Research Note, the rating, and the price target. Each

box represents a date on which an analyst made a change to a rating or price target, except for the first box, which may only represent the first Note

written during the past three years.

Legend:

I: Initiating Coverage

R: Resuming Coverage

T: Transferring Coverage

D: Discontinuing Coverage

S: Suspending Coverage

OW: Overweight

N: Neutral

UW: Underweight

NA: Not Available

UR: Under Review

Distribution of Ratings/IB Services

Piper Jaffray

IB Serv./Past 12 Mos.

Rating Count Percent Count Percent

BUY [OW]

361 62.35 94 26.04

HOLD [N]

206 35.58 21 10.19

SELL [UW]

12 2.07 0 0.00

Note: Distribution of Ratings/IB Services shows the number of companies currently in each rating category from which Piper Jaffray and its affiliates

received compensation for investment banking services within the past 12 months. FINRA rules require disclosure of which ratings most closely

correspond with "buy," "hold," and "sell" recommendations. Piper Jaffray ratings are not the equivalent of buy, hold or sell, but instead represent

recommended relative weightings. Nevertheless, Overweight corresponds most closely with buy, Neutral with hold and Underweight with sell. See

Stock Rating definitions below.

Analyst Certification Troy D. Jensen, CFA, Sr Research Analyst

Analyst Certification Matthew E. Lebo, CFA, Research Analyst

The views expressed in this report accurately reflect my personal views about the subject company and the subject security. In addition, no part of

my compensation was, is, or will be directly or indirectly related to the specific recommendations or views contained in this report.

Page 2 of 3 3D Systems Corporation

HOT COMME NT

J u l y 3 1 , 2 0 1 4

Research Disclosures

Piper Jaffray was making a market in the securities of 3D Systems Corporation at the time this research report was published. Piper Jaffray will

buy and sell 3D Systems Corporation securities on a principal basis.

Piper Jaffray has received compensation for investment banking services from or has had a client relationship with 3D Systems Corporation within

the past 12 months.

Within the past 3 years Piper Jaffray participated in a public offering of, or acted as a dealer manager for, 3D Systems Corporation securities.

Piper Jaffray research analysts receive compensation that is based, in part, on overall firm revenues, which include investment banking revenues.

Rating Definitions

Stock Ratings: Piper Jaffray ratings are indicators of expected total return (price appreciation plus dividend) within the next 12 months. At times

analysts may specify a different investment horizon or may include additional investment time horizons for specific stocks. Stock performance

is measured relative to the group of stocks covered by each analyst. Lists of the stocks covered by each are available at www.piperjaffray.com/

researchdisclosures. Stock ratings and/or stock coverage may be suspended from time to time in the event that there is no active analyst opinion

or analyst coverage, but the opinion or coverage is expected to resume. Research reports and ratings should not be relied upon as individual

investment advice. As always, an investors decision to buy or sell a security must depend on individual circumstances, including existing holdings,

time horizons and risk tolerance. Piper Jaffray sales and trading personnel may provide written or oral commentary, trade ideas, or other

information about a particular stock to clients or internal trading desks reflecting different opinions than those expressed by the research

analyst. In addition, Piper Jaffray technical research products are based on different methodologies and may contradict the opinions contained

in fundamental research reports.

Overweight (OW): Anticipated to outperform relative to the median of the group of stocks covered by the analyst.

Neutral (N): Anticipated to perform in line relative to the median of the group of stocks covered by the analyst.

Underweight (UW): Anticipated to underperform relative to the median of the group of stocks covered by the analyst.

Other Important Information

The material regarding the subject company is based on data obtained from sources we deem to be reliable; it is not guaranteed as to accuracy and

does not purport to be complete. This report is solely for informational purposes and is not intended to be used as the primary basis of investment

decisions. Piper Jaffray has not assessed the suitability of the subject company for any person. Because of individual client requirements, it is not, and

it should not be construed as, advice designed to meet the particular investment needs of any investor. This report is not an offer or the solicitation

of an offer to sell or buy any security. Unless otherwise noted, the price of a security mentioned in this report is the market closing price as of the

end of the prior business day. Piper Jaffray does not maintain a predetermined schedule for publication of research and will not necessarily update

this report. Piper Jaffray policy generally prohibits research analysts from sending draft research reports to subject companies; however, it should be

presumed that the analyst(s) who authored this report has had discussions with the subject company to ensure factual accuracy prior to publication,

and has had assistance from the company in conducting diligence, including visits to company sites and meetings with company management and

other representatives.

Notice to customers: This material is not directed to, or intended for distribution to or use by, any person or entity if Piper Jaffray is prohibited or

restricted by any legislation or regulation in any jurisdiction from making it available to such person or entity. Customers in any of the jurisdictions

where Piper Jaffray and its affiliates do business who wish to effect a transaction in the securities discussed in this report should contact their local

Piper Jaffray representative. Europe: This material is for the use of intended recipients only and only for distribution to professional and institutional

investors, i.e. persons who are authorised persons or exempted persons within the meaning of the Financial Services and Markets Act 2000 of

the United Kingdom, or persons who have been categorised by Piper Jaffray Ltd. as professional clients under the rules of the Financial Conduct

Authority. United States: This report is distributed in the United States by Piper Jaffray & Co., member SIPC, FINRA and NYSE, Inc., which accepts

responsibility for its contents. The securities described in this report may not have been registered under the U.S. Securities Act of 1933 and, in such

case, may not be offered or sold in the United States or to U.S. persons unless they have been so registered, or an exemption from the registration

requirements is available.

This report is produced for the use of Piper Jaffray customers and may not be reproduced, re-distributed or passed to any other person or published

in whole or in part for any purpose without the prior consent of Piper Jaffray & Co. Additional information is available upon request.

Copyright 2014 Piper Jaffray. All rights reserved.

Page 3 of 3 3D Systems Corporation

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Masters of Private Equity and Venture CapitalDocument307 pagesThe Masters of Private Equity and Venture CapitalRamon George Atento75% (12)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Banker BlueprintDocument58 pagesBanker BlueprintGeorge TheocharisNo ratings yet

- LETTER: Former Gov. Arne Carlson To Minnesota Governor Tim WalzDocument7 pagesLETTER: Former Gov. Arne Carlson To Minnesota Governor Tim WalzFluenceMediaNo ratings yet

- Letter From Speaker Melissa Hortman To The MediaDocument1 pageLetter From Speaker Melissa Hortman To The MediaFluenceMediaNo ratings yet

- LETTER: Blandin Request For Huber After Action FinalDocument2 pagesLETTER: Blandin Request For Huber After Action FinalFluenceMedia100% (1)

- Humphrey Institute Study On Ranked Choice VotingDocument3 pagesHumphrey Institute Study On Ranked Choice VotingFluenceMediaNo ratings yet

- Vireo Fact Sheet - MinnesotaDocument4 pagesVireo Fact Sheet - MinnesotaFluenceMediaNo ratings yet

- Letter: October 11th - Opera Managment Letter To OrchestraDocument6 pagesLetter: October 11th - Opera Managment Letter To OrchestraFluenceMediaNo ratings yet

- POLL: Key Findings MN Protect Our Charities Feb 2023Document4 pagesPOLL: Key Findings MN Protect Our Charities Feb 2023FluenceMediaNo ratings yet

- Sen. John Marty Letter To U of MN Regents Regarding Conflict of Interest For President Joan GabelDocument1 pageSen. John Marty Letter To U of MN Regents Regarding Conflict of Interest For President Joan GabelFluenceMediaNo ratings yet

- Twins Announce 2023 Spring Training Promo Dates and Ticket InfoDocument3 pagesTwins Announce 2023 Spring Training Promo Dates and Ticket InfoFluenceMediaNo ratings yet

- 2023 Infrastructure Plan Fact SheetDocument2 pages2023 Infrastructure Plan Fact SheetFluenceMediaNo ratings yet

- Focus On Ag (1-24-22)Document3 pagesFocus On Ag (1-24-22)FluenceMediaNo ratings yet

- Focus On Ag (1-16-23)Document3 pagesFocus On Ag (1-16-23)FluenceMediaNo ratings yet

- Focus On Ag (1-30-23)Document3 pagesFocus On Ag (1-30-23)FluenceMediaNo ratings yet

- Press Release December 22Document1 pagePress Release December 22FluenceMediaNo ratings yet

- Minnesotans Against Marijuana Legalization - ScorecardDocument2 pagesMinnesotans Against Marijuana Legalization - ScorecardFluenceMediaNo ratings yet

- Wisconsin Take20221219Document6 pagesWisconsin Take20221219FluenceMediaNo ratings yet

- 2023 Minnesota Senate Committee AssignmentsDocument9 pages2023 Minnesota Senate Committee AssignmentsFluenceMediaNo ratings yet

- 2023-24 Minnesota House Committee MembershipDocument2 pages2023-24 Minnesota House Committee MembershipFluenceMediaNo ratings yet

- 2023-24 Minnesota House Committee MembershipDocument2 pages2023-24 Minnesota House Committee MembershipFluenceMediaNo ratings yet

- Focus On Ag (12-05-22)Document3 pagesFocus On Ag (12-05-22)FluenceMediaNo ratings yet

- MSCA Leadership Press Release 2022Document1 pageMSCA Leadership Press Release 2022FluenceMediaNo ratings yet

- For Immediate Release - Minnesota Counties Announce Top 2023 Legislative Priorities15DEC22Document5 pagesFor Immediate Release - Minnesota Counties Announce Top 2023 Legislative Priorities15DEC22FluenceMediaNo ratings yet

- Focus On Ag (12-12-22)Document3 pagesFocus On Ag (12-12-22)FluenceMediaNo ratings yet

- Focus On Ag (11-14-22)Document3 pagesFocus On Ag (11-14-22)FluenceMediaNo ratings yet

- Groundbreaking News Release Dist 11-7-22Document2 pagesGroundbreaking News Release Dist 11-7-22FluenceMediaNo ratings yet

- MN DFL Leaders Letter To DNC CommitteeDocument1 pageMN DFL Leaders Letter To DNC CommitteeFluenceMediaNo ratings yet

- Webster V DEED Complaint FINAL AcceptedDocument26 pagesWebster V DEED Complaint FINAL AcceptedFluenceMediaNo ratings yet

- Focus On Ag (11-28-22)Document3 pagesFocus On Ag (11-28-22)FluenceMediaNo ratings yet

- Focus On Ag (11-21-22)Document3 pagesFocus On Ag (11-21-22)FluenceMediaNo ratings yet

- Focus On Ag (11-07-22)Document3 pagesFocus On Ag (11-07-22)FluenceMediaNo ratings yet

- Internship ReportDocument54 pagesInternship ReportKeerat KhoranaNo ratings yet

- MS WS 2 (LP Formulation)Document5 pagesMS WS 2 (LP Formulation)maz_bd0% (1)

- Reverse Convertible Bonds AnalyzedDocument31 pagesReverse Convertible Bonds AnalyzedРегина МуратоваNo ratings yet

- Strategy of Design TerminalDocument38 pagesStrategy of Design TerminalDesignTerminalNo ratings yet

- NISM Investment Adviser Level 1 PDFDocument190 pagesNISM Investment Adviser Level 1 PDFTrinath SharmaNo ratings yet

- The Role of Multinational Corporation in The Global EconomnyDocument30 pagesThe Role of Multinational Corporation in The Global EconomnyJmNo ratings yet

- The XYZ Clothing-Business PlanDocument20 pagesThe XYZ Clothing-Business Plangarimadhamija02No ratings yet

- Real EstateDocument11 pagesReal EstateBarbie BleuNo ratings yet

- Dean Grazazios Student Secrets RevealedDGSS - BookDocument145 pagesDean Grazazios Student Secrets RevealedDGSS - BookFrederico M'BakassyNo ratings yet

- Les Banques Publiques Algeriennes AlheurDocument253 pagesLes Banques Publiques Algeriennes AlheuratktaouNo ratings yet

- MC 0419Document16 pagesMC 0419mcchronicleNo ratings yet

- DSE (BSP) Credit CooperativeDocument7 pagesDSE (BSP) Credit CooperativeGabriel Manuel100% (1)

- JP Morgan PresentationDocument22 pagesJP Morgan PresentationramleaderNo ratings yet

- A Project Report On MFDocument76 pagesA Project Report On MFsantoshbansodeNo ratings yet

- Private Equity Returns, Cash Flow Timing, and Investor ChoicesDocument50 pagesPrivate Equity Returns, Cash Flow Timing, and Investor ChoicesДмитрий АльпинNo ratings yet

- Hand Out 2 - Ramakar Jha - PM - Hedging of PortfolioDocument3 pagesHand Out 2 - Ramakar Jha - PM - Hedging of PortfolioRakesh KumarNo ratings yet

- Finance Talk PHDocument19 pagesFinance Talk PHGeoffrey GaweNo ratings yet

- The Grow Rich BluePrint PDFDocument13 pagesThe Grow Rich BluePrint PDFAnonymous OKLEZIuf3m76% (17)

- A Summer Training Project Report ON Market Share of Religare SecuritiesDocument65 pagesA Summer Training Project Report ON Market Share of Religare SecuritiessanchitNo ratings yet

- Smart Beta WPDocument7 pagesSmart Beta WPBrentjaciowNo ratings yet

- Le Message March 2009Document12 pagesLe Message March 2009National University of Singapore Students' Political AssociationNo ratings yet

- Anchoring Effect in Making DecisionDocument11 pagesAnchoring Effect in Making DecisionSembilan Puluh DuaNo ratings yet

- A Summer Internship ProjectDocument36 pagesA Summer Internship ProjectRubina MansooriNo ratings yet

- Neural Fair Value 25 User GuideDocument2 pagesNeural Fair Value 25 User GuideCosta MoullasNo ratings yet

- What To Do With Excess Cash - UBSDocument48 pagesWhat To Do With Excess Cash - UBSno nameNo ratings yet

- Introduction To Corporate Finance, Megginson, Smart and LuceyDocument6 pagesIntroduction To Corporate Finance, Megginson, Smart and LuceyGvz HndraNo ratings yet

- Fin223 DraftDocument25 pagesFin223 DraftJane Susan ThomasNo ratings yet

- Welthee LiteDocument22 pagesWelthee LiteMioara MihaiNo ratings yet