Professional Documents

Culture Documents

3 Behavioral Mistakes in Retirement

Uploaded by

Manmik8252Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3 Behavioral Mistakes in Retirement

Uploaded by

Manmik8252Copyright:

Available Formats

4/5/2014 Print

http://news.morningstar.com/articlenet/HtmlTemplate/PrintArticle.htm?time=123932589 1/3

Personal Finance

3 Behavioral Mistakes in Retirement

By John F. Wasik | 04-05-14 | 06:00 AM | Email Article

Once you've hit retirement age, it's often too late to make up for inadequate

savings and bad portfolio allocation. But even if you got those key tasks right, a

whole new raft of bad behaviors may be in play. Are you withdrawing too much

money? Are you beating inflation? Are you underestimating your life expectancy?

There's often no reliable way of avoiding mistakes because you have no benchmark

of best practices to model. Few have any education in portfolio management or

long-term financial planning. There's no buzzer that goes off when you're doing

something that's going to harm your long-term goals.

Thanks to the burgeoning field of behavioral economics, though, you can at least

identity what you're doing wrong and take corrective action. Here are some common

errors and how to approach them from a behavioral perspective:

1. Underestimating Life Expectancy

No one is really good at this, but there are some guidelines. You can scan the life

expectancy numbers from the Centers for Disease Control or Social Security, or use

some simple rules of thumb.

A common error is to underestimate how long you're going to live, which brings up

the specter of outliving your money. Here are some useful guidelines from the Center

for Retirement Research (CRR) at Boston College:

Life expectancy at 65 has increased by four years since 1980. If you're in

reasonably good health and not suffering from chronic or acute diseases, you

could live well into your ninth decade. But the CRR found that there is often

no correlation between retirees' longevity estimate and how long they actually

live. They often underestimate based on recent information such as illness or

job history. It's better to take a longer view than a shorter one.

Read more: How Long You'll Live: A Guide to Guessing

Those (often incorrectly) predicting that they won't live very long take Social

Security at 62. That has the permanent effect of locking in a low benefit for

the remainder of one's life compared with taking benefits at 70. So being more

realistic about lifespan can have a direct financial consequence. The longer

you wait, the greater the benefit. A person who would normally receive $1,000

a month at age 66, for example, would receive $1,320 monthly if he waited

four years. The math tells the story, and it's much more positive than a

pessimistic prediction about how long you think you'll live.

Read more: Social Security--Delaying Equals Staying Power for Your Portfolio

Suppose you're forced to retire due to illness or unemployment? That may not

4/5/2014 Print

http://news.morningstar.com/articlenet/HtmlTemplate/PrintArticle.htm?time=123932589 2/3

impact your total life expectancy. You may still be able to do some work,

allowing you to delay taking Social Security and dipping into your nest egg.

"Workers who think they have excellent chances of living to ages 75 and 85

expect to work longer and retire later than workers who think their chances

are poor," according to the CRR. The best behavioral route here? Look at your

family history. How long did your parents live? Be rational about your chances

to live decades past retirement age. You also may need to re-evaluate any

decision to leave the workforce completely.

2. Spending Too Much Money in Retirement

Once you stop working, other than dividends and capital gains in your portfolio, the

cash flowing into your retirement kitty also comes to a halt. Those who want to

spend heavily earlier in their retirement are prone to what economists call

"hyberbolic discounting."

This phenomenon could also be called the "spend it while I have it" syndrome--that

is, you spend money in the present thinking it won't be around in the future. Many

tend to think that consumption now is better than savings or investment.

How do you short-circuit hyberbolic discounting? It's pretty simple. Look at the time

value of money and build a graph using a basic savings calculator. See how it can

grow over time versus taking a payment now. Once you see the magic of

compounding at work, it should easily outweigh most other uses for that money

today.

3. Going It Alone

If you haven't been working with third parties, then maybe now is the time. There

are a host of professionals from retirement planners to certified financial planners

who can help you create a rational plan.

It's often said by many retirees that "I've gotten this far without help, why do I

need someone now?" There's no shame in hiring a professional who can either craft

or guide a plan. They can spot some common errors in investment allocations,

withdrawals, spending, taxes, and longevity risk. They can also keep you (or put

you back) on course so that you don't outlive your money.

A key element in bringing in some outside advice is trust. You need to know whether

the people you involve in correcting retirement planning mistakes have done it

before and have the expertise to guide you.

Use advisors who are not focused on selling you products, which would exclude

most brokers and agents. Pay for their time and expertise and avoid those working

exclusively on commission.

"The most powerful and least-studied factor is trust," notes Russell Yazdipour,

professor of finance at California State University. "It's the glue that holds the

system together."

Once broken, trust is difficult to regain. That's why it's important to get references

for advisors--and check them out. They can facilitate learning and keep you

focused on your goals. But you have to make sure they are fiduciaries, that is, they

4/5/2014 Print

http://news.morningstar.com/articlenet/HtmlTemplate/PrintArticle.htm?time=123932589 3/3

have a stated legal obligation to put your interests above those of the firm.

Fiduciaries include most financial planners, registered investment advisers, chartered

financial analysts, and lawyers.

Read more: 6 Steps to Hiring a Financial Planner

By combining an environment of trust with a focused, fact-based approach to

retirement, you may not be able to completely overcome your worst tendencies, but

you could at least build a new knowledge base. That, in itself, could lead to some

positive changes.

John F. Wasik is a freelance columnist for Morningstar.com and author of the book Keynes's Way to Wealth, from which some of this

column has been excerpted. The views expressed in this article do not necessarily reflect the views of Morningstar.com.

John F. Wasik is a freelance columnist for Morningstar and author of 13 books, including The

Audacity of Help: Obama's Economic Plan and the Remaking of America

(www.audacityofhelp.net).

You might also like

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Review: Curar, Persuadir, Gobernar: La Construcción Histórica de La Profesión Médica en Buenos Aires (1852-1886), by R. González LeandriDocument2 pagesReview: Curar, Persuadir, Gobernar: La Construcción Histórica de La Profesión Médica en Buenos Aires (1852-1886), by R. González LeandriXoyyo Xoyyodevuelta0% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Presentation Hong Kong 2021Document16 pagesPresentation Hong Kong 2021elena_faNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Correlates To Work-Related Stress of Newly-Graduated Nurses in Critical-Care UnitsDocument11 pagesCorrelates To Work-Related Stress of Newly-Graduated Nurses in Critical-Care UnitsbabiNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- UAE Physiotherapy Organization FormationDocument1 pageUAE Physiotherapy Organization FormationDaniel Rivano-FischerNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Pepper PDFDocument52 pagesPepper PDFMarie GregorioNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Method Statement For Lifting WorksDocument12 pagesMethod Statement For Lifting WorksRachel Flores85% (26)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Pharma IndiaDocument58 pagesPharma IndiaSaravana Kumar50% (4)

- AKAPULKODocument4 pagesAKAPULKOMaricelPlacioNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Jurnal AsiDocument6 pagesJurnal AsiAmeliarNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Adherence - An Analysis of Concept - Gardner, 2015 PDFDocument6 pagesAdherence - An Analysis of Concept - Gardner, 2015 PDFRicardo Costa da SilvaNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Checklist With RationalesDocument174 pagesChecklist With RationalesZoey Francisco100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Statistical Abstract of The United States 2009Document996 pagesThe Statistical Abstract of The United States 2009Aaron MonkNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- 2 Tissue Culture at Home ReportDocument7 pages2 Tissue Culture at Home ReportXwag 12No ratings yet

- Let'S Dive Deeply!: Discussion Points: Read The Case Scenario and Relate It To The TheoryDocument1 pageLet'S Dive Deeply!: Discussion Points: Read The Case Scenario and Relate It To The TheoryAnn Mariz DominguezNo ratings yet

- Suggestive Questions of Isc 2023 BiologyDocument12 pagesSuggestive Questions of Isc 2023 Biologyjahnvipatel2004No ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Value of Urine Specific Gravity in Detecting Diabetes Insipidus in A Patient With DMDocument2 pagesThe Value of Urine Specific Gravity in Detecting Diabetes Insipidus in A Patient With DMFaryalBalochNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Hotel and Room Facilities (Part3g1)Document14 pagesHotel and Room Facilities (Part3g1)Mary Joy CelamorNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- 51 - Methemoglobin ProducersDocument20 pages51 - Methemoglobin ProducersCabinet VeterinarNo ratings yet

- Arguments: THW Ban Miss UniverseDocument3 pagesArguments: THW Ban Miss UniverseGen eralNo ratings yet

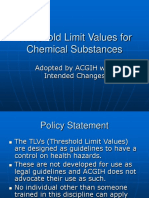

- Threshold Limit Values For Chemical Substances: Adopted by ACGIH With Intended ChangesDocument18 pagesThreshold Limit Values For Chemical Substances: Adopted by ACGIH With Intended ChangesrosaNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Cognitive-Behavioral Therapy: Instructor's ManualDocument68 pagesCognitive-Behavioral Therapy: Instructor's ManualzingpalmsNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Evs 3Document22 pagesEvs 3Shillin KsNo ratings yet

- Indonesia Disaster ManagementDocument16 pagesIndonesia Disaster ManagementjaxassssNo ratings yet

- Hypnosis in Surgery - Under The Knife, Under HypnosisDocument5 pagesHypnosis in Surgery - Under The Knife, Under HypnosismotmagicNo ratings yet

- 2 - GFSI Overview One Pager 1Document2 pages2 - GFSI Overview One Pager 1Diego GordoNo ratings yet

- Subdermal HematomaDocument2 pagesSubdermal HematomaDristi KhanalNo ratings yet

- How Physical Activity Boosts Your Overall HealthDocument9 pagesHow Physical Activity Boosts Your Overall HealthankiblogsNo ratings yet

- Position PaperDocument2 pagesPosition PaperJake Angelo BiraquitNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- 39 Suggestions For Preliminary Survey QuestionsDocument32 pages39 Suggestions For Preliminary Survey QuestionsStefan PastiNo ratings yet

- Hydrogen Sulfide (h2s) Training CourseDocument78 pagesHydrogen Sulfide (h2s) Training CourseMichael Angelo RamirezNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)