Professional Documents

Culture Documents

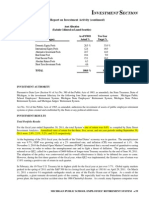

Mpsers 2009 Investment Return

Uploaded by

Rob LawrenceCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mpsers 2009 Investment Return

Uploaded by

Rob LawrenceCopyright:

Available Formats

INTRODUCTORY SECTION

Letter of Transmittal (continued)

Independent Auditors and Actuary

The Office of the Auditor General (OAG), independent auditors, conducted an annual audit of the System. The independent

auditor’s report on the System’s financial statements is included in the Financial Section of this report.

Statute requires that an annual actuarial valuation be conducted. The purpose of the valuation is to evaluate the mortality,

service, compensation and other financial experience of the System and to recommend employer-funding rates for the

subsequent year. The annual actuarial valuation was completed by Gabriel Roeder Smith & Company for the fiscal year

ended September 30, 2008. Actuarial certification and supporting statistics are included in the Actuarial Section of this

report.

Management’s Discussion and Analysis (MD&A)

Generally Accepted Accounting Principles (GAAP) require that management provide a narrative introduction, overview,

and analysis to accompany the Basic Financial Statements in the form of MD&A. This letter of transmittal is intended to

complement MD&A and should be read in conjunction with it. The MD&A can be found immediately following the

Independent Auditor’s Report.

PROFILE OF THE GOVERNMENT

In accordance with Public Act 300 of 1980, on October 31, 1980, the Public School Employees’ Chapter I Retirement Fund

merged with the Public School Employees’ Chapter II Retirement Fund to establish the Public School Employees’

Retirement System. Public Acts 136 of 1945 and 259 of 1974, respectively, created the two original funds. A twelve-

member board governs administrative policy.

Employer contributions and investment earnings provide financing for the System. Under Public Act 91 of 1985, employees

may contribute additional amounts into a “member investment plan.”

ECONOMIC CONDITIONS AND OUTLOOK

Despite challenging economic times, the System continues to show steady performance over the long-term.

Investments

The State Treasurer is the investment fiduciary and custodian of all investments of the System pursuant to State law. The

primary investment objective is to maximize the rate of return on the total investment portfolio, consistent with a high

degree of prudence and sufficient diversity to eliminate inordinate risks and to meet the actuarial assumption for the

investment return rate. The investment activity for the year produced a total rate of return on the portfolio of (6.1)%. For

the last five years, the System has experienced an annualized rate of return of 4.2%. A summary of asset allocation and rates

of return can be found in the Investment Section of this report.

Accounting System

Transactions of the System are reported on the accrual basis of accounting. Revenues are recorded when earned, and

expenses are recorded when incurred. Participants’ benefits are recorded when payable by law. We believe that the

accounting and administrative internal controls established by the System provide reasonable assurance the System is

carrying out its responsibilities in safeguarding its assets, in maintaining the reliability of the financial records for preparing

financial statements, and in maintaining accountability for its assets.

Funding

Funds are derived from the excess of additions to plan net assets over deductions from plan net assets. Funds are

accumulated by the System to meet future benefit obligations to retirees and beneficiaries. The percentage computed by

dividing the actuarial value of assets by the actuarial accrued liability is referred to as the “funded ratio.” This ratio

provides an indication of the funding status of the System and generally, the greater this percentage, the stronger

MICHIGAN PUBLIC SCHOOL EMPLOYEES’ RETIREMENT SYSTEM • 7

You might also like

- Top Ten MEA Earners 2017Document1 pageTop Ten MEA Earners 2017Rob LawrenceNo ratings yet

- MPSERS 2011 Assets Pg23Document1 pageMPSERS 2011 Assets Pg23Rob LawrenceNo ratings yet

- Comparative MEA Salaries 2018 To 2019Document3 pagesComparative MEA Salaries 2018 To 2019Rob LawrenceNo ratings yet

- Comparative MEA Salareis 2019 To 2020Document3 pagesComparative MEA Salareis 2019 To 2020Rob LawrenceNo ratings yet

- MEA Top 10 Pay 2020Document1 pageMEA Top 10 Pay 2020Rob LawrenceNo ratings yet

- Comparative Salaries of MEA 2015 To 2016Document4 pagesComparative Salaries of MEA 2015 To 2016Rob LawrenceNo ratings yet

- MPSERS - Michigan Teachers Pension Fund Deceptive On Its Financial PerformanceDocument1 pageMPSERS - Michigan Teachers Pension Fund Deceptive On Its Financial PerformanceRob LawrenceNo ratings yet

- MPSERS 2011 Investment Section pg68Document1 pageMPSERS 2011 Investment Section pg68Rob LawrenceNo ratings yet

- MPSERS 2011 Investment Return pg59Document1 pageMPSERS 2011 Investment Return pg59Rob LawrenceNo ratings yet

- MPSERS 2011 Financial Assumptions Pg36Document1 pageMPSERS 2011 Financial Assumptions Pg36Rob LawrenceNo ratings yet

- Increae Base (+$100k) From '06 Increae Total (+$100k) From '06Document6 pagesIncreae Base (+$100k) From '06 Increae Total (+$100k) From '06Rob LawrenceNo ratings yet

- Ruth Beier Tesimony HB 5963Document6 pagesRuth Beier Tesimony HB 5963Rob LawrenceNo ratings yet

- MEA Salaries 10-11Document5 pagesMEA Salaries 10-11Rob LawrenceNo ratings yet

- MEA Salaries 08-09Document5 pagesMEA Salaries 08-09Rob LawrenceNo ratings yet

- MEA Top Ten Salaries 2010Document1 pageMEA Top Ten Salaries 2010Rob LawrenceNo ratings yet

- MEA Top Ten Salaries 2011Document1 pageMEA Top Ten Salaries 2011Rob LawrenceNo ratings yet

- Ruth Beier Tesimony HB 5963Document6 pagesRuth Beier Tesimony HB 5963Rob LawrenceNo ratings yet

- Mpsers 2009 Audit 109Document1 pageMpsers 2009 Audit 109Rob LawrenceNo ratings yet

- Audit and Actuary Letters MPSERSDocument4 pagesAudit and Actuary Letters MPSERSRob LawrenceNo ratings yet

- Mpsers 2009 Audit Page 34Document1 pageMpsers 2009 Audit Page 34Rob LawrenceNo ratings yet

- MPSERS - Michigan Teachers' Pension Fund Lost $9.2 Billion in 2008Document1 pageMPSERS - Michigan Teachers' Pension Fund Lost $9.2 Billion in 2008Rob LawrenceNo ratings yet

- Mpsers 2009 Audit Page 36Document1 pageMpsers 2009 Audit Page 36Rob LawrenceNo ratings yet

- State Aid 20j Impact 2009-10 UpdatedDocument1 pageState Aid 20j Impact 2009-10 UpdatedRob LawrenceNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- About The Co-Operative Society: Karnataka University DharwadDocument62 pagesAbout The Co-Operative Society: Karnataka University DharwadArun SavukarNo ratings yet

- Principles of Marketing Chapter 5 Managing The Marketing EffortDocument8 pagesPrinciples of Marketing Chapter 5 Managing The Marketing EffortAnghelica Eunice90% (10)

- HW 1-SolnDocument8 pagesHW 1-SolnZhaohui ChenNo ratings yet

- Audit of The Acquisition and Payment Cycle: Tests of Controls, Substantive Tests of Transactions, and Accounts PayableDocument13 pagesAudit of The Acquisition and Payment Cycle: Tests of Controls, Substantive Tests of Transactions, and Accounts Payableዝምታ ተሻለNo ratings yet

- Energy Audit of Commercial Building Paper PublishDocument4 pagesEnergy Audit of Commercial Building Paper PublishInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Samsung C&T 2014 - Consolidated Financial StatementsDocument126 pagesSamsung C&T 2014 - Consolidated Financial StatementsJinay ShahNo ratings yet

- Bid Doc GTCDocument19 pagesBid Doc GTCGloria CanapiNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- The Guidance of Filling The Halal Internal AuditDocument19 pagesThe Guidance of Filling The Halal Internal AuditEmmy RindaNo ratings yet

- Thirteen Foundation 2013Document127 pagesThirteen Foundation 2013cmf8926No ratings yet

- BTEC National Business Unit 3 MCQ Revision Pack Vol 1 SampleDocument6 pagesBTEC National Business Unit 3 MCQ Revision Pack Vol 1 SampleAnonymous BNnIEKkNtNo ratings yet

- Tata AIA Life Insurance Company Ltd. Notice of 21st AGM 29-Jun-2021Document15 pagesTata AIA Life Insurance Company Ltd. Notice of 21st AGM 29-Jun-2021Varun ChaudhariNo ratings yet

- DISA 3.0 Mod1 Day 1 Quiz 1Document3 pagesDISA 3.0 Mod1 Day 1 Quiz 1Jackson Abraham ThekkekaraNo ratings yet

- Local Government Job Description PDFDocument482 pagesLocal Government Job Description PDFMawanda Ssekibuule Suudi100% (2)

- Lecture 2Document32 pagesLecture 2Maham AhsanNo ratings yet

- All Commerce Colleges Pune 2019Document117 pagesAll Commerce Colleges Pune 2019Madhurie Singh100% (1)

- Comprehensive Reviewer Auditing TheoryDocument91 pagesComprehensive Reviewer Auditing TheoryMary Rose JuanNo ratings yet

- NRB Bank ReportDocument49 pagesNRB Bank ReportTanvirBariNo ratings yet

- Auditing Management AssertionsDocument3 pagesAuditing Management AssertionsMichelle R. TumandayNo ratings yet

- Problem 4 2aDocument12 pagesProblem 4 2aHCM Nguyen Do Huy HoangNo ratings yet

- RBGH Financials 31 December 2020 Colour 18.03.2021 3 Full PageseddDocument3 pagesRBGH Financials 31 December 2020 Colour 18.03.2021 3 Full PageseddFuaad DodooNo ratings yet

- Article CritiqueDocument5 pagesArticle CritiqueFauzi Al nassarNo ratings yet

- Induction MaterialDocument56 pagesInduction Materialvirender rawatNo ratings yet

- Class Action SuitsDocument18 pagesClass Action SuitsAyush Ghiya100% (2)

- CH 4 Acc106Document36 pagesCH 4 Acc106Mas Ayu0% (1)

- All Sections of Companies Act 2013Document53 pagesAll Sections of Companies Act 2013pratishthit mittalNo ratings yet

- What Is Clause 49Document3 pagesWhat Is Clause 49Kaushik ShahNo ratings yet

- CRT Learning Module: Subject Code Subject Title Duration Module TitleDocument17 pagesCRT Learning Module: Subject Code Subject Title Duration Module TitleLove Jcw100% (1)

- Agency Teory Dan Internal ControlDocument6 pagesAgency Teory Dan Internal Controlarfahpiliang22No ratings yet

- Red Clay School District - Special Investigations ReportDocument26 pagesRed Clay School District - Special Investigations ReportJohn AllisonNo ratings yet