Professional Documents

Culture Documents

TaxPackageOverview SenateBill6143

Uploaded by

Scott Frank0 ratings0% found this document useful (0 votes)

16 views1 pageOriginal Title

TaxPackageOverview_SenateBill6143

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views1 pageTaxPackageOverview SenateBill6143

Uploaded by

Scott FrankCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 1

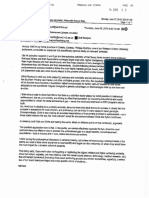

Tax Package Overview - Senate Bill 6143

Description Effective 2009-11 | 2011-13 Notes

Date ($in

millions)

(0.30% B&O tax increase on all services S/O $483.1 [Includes permanent doubling of small

lexcept hospitals, scientficresearch and [business B&O credit and increase in

[development (expires June 30, 2013) Ieporting threshold for service business from

'$28,000 to $46,667.

[B&O tax increase on direat sellers S/O $155.0 $199.4 [Dot Foods Court Case: Complete repeal of

|exemption as of Mey I, 2010

[Cigarette and other tobacco tax increases S/O s1014 S19TS [SI per pack for cigarettes, OTP from 75% to

[CHB 2493) [95% of wholesale price, 65 cent cap for

cigars, weight-based tax for moist snuff.

[B&O tax on economic income e/illo S847 $407.3 | Changes standard for applying B&O taxes

from physical presence to economic

Ipresence. B&O deduction for aircraft loans

(Alaska Airlines).

[Beer tax increase ~50 cents per gallon @8 | 6/1/10 3590 STI810 _ [Exempts microbrews (60,000 barrels or less

|cents per six pack) per year);

[Sales tax on bottled water erinlo 3328 $692 [Provides a refund for tax paid on

[prescriptions and those without an available

[source of potable water.

[Soda pop tax increase —2 cents per 12 TANO 3335 $724 |Exempts carbonated bottled water. Exempts

lounces first $10 million of carbonsted beverage

sales

[Sales tax on candy and gum e/illo 3305 $624 includes $1,900 B&O tax credit for in-state

[candy manufacturers until July 2012;

[Department of Revenue (DOR) must compile

a list of candy that is taxable and not taxable,

[Taxes on business structure transactions S/ANO 385 $304 |Gives DOR authority to disregard certain

[business transactions or arrangements;

creates legisiative commitice to monitor

{implementation.

[B&O tax increase on property management | 6/1/10 369 S148 |Exempts non-profit property management

salaries [companies and private companies that

lcontract with public housing authorities.

[B&O tax increase on certain canned meat e/illo S41 ‘S88 [Applies to canned meats, such as chili, soups,

[products (irom 0.138% to 0.4846) land certain canned fruits and vegetables

[B&O tax increase on mortgages e/inlO 336 S79___ [Narrows definition of what can be deducted

[B&O tax on corporate officer salaries TAO S21 S46 |Applics 18% BAO tax rate to corporate

[board of director income.

[Tax increase on bad debts SAO 37 ‘S41 |Limits deduction for uncollectable sales taxes

lonly tothe seller.

Livestock nutrient management ax inerease [7/1/10 S13 ‘S28 |Repeals sales tax exemption until Tune 30,

2013,

[PUD clectri bills ix increase S/NO S12 ‘$22 [Directly affects Clark and Grays Harbor

PUDs.

[Personal liability for tax debts S/O Sr ‘$20 [Expands number of corporate officers

[personally liable for unpaid sales taxes.

[Additional lottery marketing (SB 6409) TBO S150 [Assumes aggressive marketing of lottery for

Ihigher educetion will generate more money.

Washington State Convention and Trade 6730111 S100 [Convention center pays state yearly for hotel

|Center hotel tax payment (SB 6889) hax credit against general fund. Not a tax

increase, but shown as revenue on balance

sheet.

TOTAL $794.1 | $1,687.2

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Back To School Information For Parents 2011-2012Document4 pagesBack To School Information For Parents 2011-2012Scott FrankNo ratings yet

- MSD 2011-12 Bus Routes 3Document27 pagesMSD 2011-12 Bus Routes 3Scott FrankNo ratings yet

- Sno. Co. Prosecutor LetterDocument2 pagesSno. Co. Prosecutor LetterScott FrankNo ratings yet

- Boardemailsset 2Document14 pagesBoardemailsset 2Scott FrankNo ratings yet

- Speeding QuizDocument1 pageSpeeding QuizScott FrankNo ratings yet

- MSDboardemails 2Document11 pagesMSDboardemails 2Scott FrankNo ratings yet

- Marysville Director 4Document1 pageMarysville Director 4Scott FrankNo ratings yet

- MSD 2011-12 Bus Routes 3Document27 pagesMSD 2011-12 Bus Routes 3Scott FrankNo ratings yet

- Crenshaw ResignsDocument1 pageCrenshaw ResignsScott FrankNo ratings yet

- Michael Kundu LetterDocument1 pageMichael Kundu LetterScott FrankNo ratings yet

- L Marysville SCH Dir Michael KunduletterDocument4 pagesL Marysville SCH Dir Michael KunduletterScott FrankNo ratings yet

- No. 09-559, Doe v. ReedDocument67 pagesNo. 09-559, Doe v. Reedmacrospect7211No ratings yet

- Conference Tax Package2Document2 pagesConference Tax Package2Scott FrankNo ratings yet

- Bond Election GuideDocument2 pagesBond Election GuideScott FrankNo ratings yet

- Marysville School District Town MeetingDocument1 pageMarysville School District Town MeetingScott FrankNo ratings yet

- Trafton Status Report March 2010Document60 pagesTrafton Status Report March 2010Scott FrankNo ratings yet

- WASL ChartDocument1 pageWASL ChartScott FrankNo ratings yet

- Conference Tax Package2Document2 pagesConference Tax Package2Scott FrankNo ratings yet

- Ped InterfaceDocument1 pagePed InterfaceScott FrankNo ratings yet

- Fire Dept ShowerDocument1 pageFire Dept ShowerScott Frank100% (2)

- Student Health Issue 051309Document1 pageStudent Health Issue 051309Scott FrankNo ratings yet

- Kickball Playoffs 2009 v2Document1 pageKickball Playoffs 2009 v2Scott Frank100% (2)

- Budget FAQ 090508Document1 pageBudget FAQ 090508Scott FrankNo ratings yet

- 2009 Marysville Strawberry Festival ScheduleDocument1 page2009 Marysville Strawberry Festival ScheduleScott FrankNo ratings yet

- Budget News #5Document2 pagesBudget News #5Scott FrankNo ratings yet

- Golf Tournament Sponsorship FlyerDocument1 pageGolf Tournament Sponsorship FlyerScott Frank100% (4)

- Solid Waste Increase ProposalDocument1 pageSolid Waste Increase ProposalScott FrankNo ratings yet

- 2009 - 2010 Staff - Public Meeting DatesDocument2 pages2009 - 2010 Staff - Public Meeting DatesScott FrankNo ratings yet

- Budget News 4Document2 pagesBudget News 4Scott FrankNo ratings yet