Professional Documents

Culture Documents

3 Aug 2016 Email To ENR Chiefs - Does Debt Solve "The Glut of Supply and Lack of Materially Growing Demand"?

Uploaded by

Doug GrandtOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3 Aug 2016 Email To ENR Chiefs - Does Debt Solve "The Glut of Supply and Lack of Materially Growing Demand"?

Uploaded by

Doug GrandtCopyright:

Available Formats

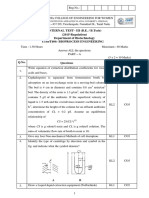

From:

Subject:

Date:

To:

Douglas Grandt answerthecall@icloud.com

Does debt solve "the glut of supply and lack of materially growing demand"?

August 3, 2016 at 3:05 PM

David Cleary (Sen. Alexander) David_Cleary@alexander.senate.gov, Dan Kunsman (Sen. Barrasso)

Dan_Kunsman@barrasso.senate.gov, Joel Brubaker (Sen. Capito) Joel_Brubaker@capito.senate.gov,

James Quinn (Sen. Cassidy) James_Quinn@cassidy.senate.gov, Jason Thielman (Sen. Daines)

Jason_Thielman@daines.senate.gov, Chandler Morse (Sen. Flake) Chandler_Morse@flake.senate.gov,

Chris Hansen (Sen. Gardner) Chris_Hansen@gardner.senate.gov, Ryan Bernstein (Sen. Hoeven)

Ryan_Bernstein@hoeven.senate.gov, Boyd Matheson (Sen. Lee) Boyd_Matheson@lee.senate.gov,

Mark Isakowitz (Sen. Portman) Mark_Isakowitz@portman.senate.gov, John Sandy (Sen. Risch) John_Sandy@risch.senate.gov,

Travis Lumpkin (Sen. Cantwell) Travis_Lumpkin@cantwell.senate.gov, Jeff Lomonaco (Sen. Franken)

Jeff_Lomonaco@franken.senate.gov, Joe Britton (Sen. Heinrich) Joe_Britton@heinrich.senate.gov, Betsy Lin (Sen. Hirono)

Betsy_Lin@hirono.senate.gov, Patrick Hayes (Sen. Manchin) Patrick_Hayes@manchin.senate.gov,

Bill Sweeney (Sen. Stabenow) Bill_Sweeney@stabenow.senate.gov, Jeff Michels (Sen. Wyden) Jeff_Michels@wyden.senate.gov,

Michaeleen Crowell (Sen. Sanders) Michaeleen_Crowell@sanders.senate.gov, Kay Rand (Sen. King) Kay_Rand@king.senate.gov

, Joe Hack (Sen. Fischer) Joe_Hack@fischer.senate.gov, Derrick Morgan (Sen. Sasse) Derrick_Morgan@sasse.senate.gov,

Angela Becker-Dippmann (Senate ENR Ctee) Angela_Becker-Dippmann@energy.senate.gov, Ginger Willson (Sen. Sasse)

Ginger_Willson@sasse.senate.gov, Ali Aafedt (Sen. Hoeven) Alexis_Aafedt@hoeven.senate.gov,

Colin Hayes (Senate ENR Ctee) Colin_Hayes@energy.senate.gov, Michael Pawlowski (Sen. Murkowski)

michael_pawlowski@murkowski.senate.gov

Dear Chiefs of Staff:

Please read these excerpts from Josh Arnold's critique "Even Exxon Mobil Is In Trouble

"Total earnings were $825M but weaker refining margins cut earnings by $850M during the quarter. This is the problem

that XOM and others are facing in this horrible environment for oil companies; the glut of supply and lack of materially

growing demand has destroyed their ability to extract profits from their revenue base. And while XOM is doing a

better job than most, it is susceptible all the same. But unlike at the end of last year when I said XOM was a decent buy

at $82, the situation has worsened substantially but the stock is even higher now.

XOM's 1H2016 cash flow from operations and asset sales was $10.5B, roughly equivalent to the amount it

spent on capex. That means there is quite literally nothing left over to pay the $3.1B it owes shareholders every

quarter in dividend payments. That's not a good situation and it means that XOM is now in a similar situation as CVX....

"So what has XOM done? It has started borrowing, of course.

"... There is no other way for XOM to continue to pay its dividend; it simply cannot afford it. And with the outlook

for oil prices so weak, there is no reason to think that is going to change anytime soon. The one thing I know will not

happen - despite the overwhelming evidence that it should - is a dividend cut. That means XOM will have no choice but

to keep borrowing until it can't.

"Dividends are supposed to be distributions of profits, not the product of borrowing from someone else.

"XOM's cash flow is very concerning at this point and while XOM is still the best O&G player, that isn't saying much. The

entire sector is rubbish at this point because everyone's financial condition is deteriorating rapidly and the

outlook for recovery is bleak indeed."

ExxonMobil is a critical part of Americas energy and economic fabric, and we are observing precursor spasms leading to death

throes in its financial demise. ExxonMobil Management must be reigned in and admonished to act in the National Interest.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Low Cost Building ConstructionDocument15 pagesLow Cost Building ConstructionAtta RehmanNo ratings yet

- General Diesel Engine Diagnostic Guide PDFDocument3 pagesGeneral Diesel Engine Diagnostic Guide PDFan0th3r_0n3No ratings yet

- Gender Ratio of TeachersDocument80 pagesGender Ratio of TeachersT SiddharthNo ratings yet

- Avalon LF GB CTP MachineDocument2 pagesAvalon LF GB CTP Machinekojo0% (1)

- Income Statement, Its Elements, Usefulness and LimitationsDocument5 pagesIncome Statement, Its Elements, Usefulness and LimitationsDipika tasfannum salamNo ratings yet

- Efs151 Parts ManualDocument78 pagesEfs151 Parts ManualRafael VanegasNo ratings yet

- Job Description For QAQC EngineerDocument2 pagesJob Description For QAQC EngineerSafriza ZaidiNo ratings yet

- Address MappingDocument26 pagesAddress MappingLokesh KumarNo ratings yet

- TSR KuDocument16 pagesTSR KuAngsaNo ratings yet

- Hager Pricelist May 2014Document64 pagesHager Pricelist May 2014rajinipre-1No ratings yet

- Microsoft Word - Claimants Referral (Correct Dates)Document15 pagesMicrosoft Word - Claimants Referral (Correct Dates)Michael FourieNo ratings yet

- 4 Bar LinkDocument4 pages4 Bar LinkConstance Lynn'da GNo ratings yet

- Ucm6510 Usermanual PDFDocument393 pagesUcm6510 Usermanual PDFCristhian ArecoNo ratings yet

- Aircraftdesigngroup PDFDocument1 pageAircraftdesigngroup PDFsugiNo ratings yet

- TEVTA Fin Pay 1 107Document3 pagesTEVTA Fin Pay 1 107Abdul BasitNo ratings yet

- Simoreg ErrorDocument30 pagesSimoreg Errorphth411No ratings yet

- Guide For Overseas Applicants IRELAND PDFDocument29 pagesGuide For Overseas Applicants IRELAND PDFJasonLeeNo ratings yet

- Chapter 5Document3 pagesChapter 5Showki WaniNo ratings yet

- Material Safety Data Sheet (According To 91/155 EC)Document4 pagesMaterial Safety Data Sheet (According To 91/155 EC)Jaymit PatelNo ratings yet

- Intermediate Accounting (15th Edition) by Donald E. Kieso & Others - 2Document11 pagesIntermediate Accounting (15th Edition) by Donald E. Kieso & Others - 2Jericho PedragosaNo ratings yet

- LOG-2-8-FLEETWAREHOUSE-TEMPLATE-Waybill-Delivery Note-IFRCDocument1 pageLOG-2-8-FLEETWAREHOUSE-TEMPLATE-Waybill-Delivery Note-IFRCMNo ratings yet

- ARUP Project UpdateDocument5 pagesARUP Project UpdateMark Erwin SalduaNo ratings yet

- Linux For Beginners - Shane BlackDocument165 pagesLinux For Beginners - Shane BlackQuod Antichristus100% (1)

- Research Article: Finite Element Simulation of Medium-Range Blast Loading Using LS-DYNADocument10 pagesResearch Article: Finite Element Simulation of Medium-Range Blast Loading Using LS-DYNAAnonymous cgcKzFtXNo ratings yet

- Apm p5 Course NotesDocument267 pagesApm p5 Course NotesMusumbulwe Sue MambweNo ratings yet

- Online EarningsDocument3 pagesOnline EarningsafzalalibahttiNo ratings yet

- IPO Ordinance 2005Document13 pagesIPO Ordinance 2005Altaf SheikhNo ratings yet

- Lab 6 PicoblazeDocument6 pagesLab 6 PicoblazeMadalin NeaguNo ratings yet

- Unit 1Document3 pagesUnit 1beharenbNo ratings yet

- A PDFDocument2 pagesA PDFKanimozhi CheranNo ratings yet