Professional Documents

Culture Documents

Lecture Public Expenses For Social Protection

Uploaded by

afmoroz0 ratings0% found this document useful (0 votes)

22 views65 pagesThe document summarizes key aspects of public social protection systems and expenditures in Moldova. It discusses 1) the necessity of public social protection systems and how Moldova's system is regulated by laws, 2) the main forms and principles of social insurance programs in Moldova including unemployment, health, maternity, old age benefits, and 3) sources of funding for Moldova's state social insurance budget including contributions from employers, individuals, and enterprise patents.

Original Description:

Original Title

Social Protection

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document summarizes key aspects of public social protection systems and expenditures in Moldova. It discusses 1) the necessity of public social protection systems and how Moldova's system is regulated by laws, 2) the main forms and principles of social insurance programs in Moldova including unemployment, health, maternity, old age benefits, and 3) sources of funding for Moldova's state social insurance budget including contributions from employers, individuals, and enterprise patents.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

22 views65 pagesLecture Public Expenses For Social Protection

Uploaded by

afmorozThe document summarizes key aspects of public social protection systems and expenditures in Moldova. It discusses 1) the necessity of public social protection systems and how Moldova's system is regulated by laws, 2) the main forms and principles of social insurance programs in Moldova including unemployment, health, maternity, old age benefits, and 3) sources of funding for Moldova's state social insurance budget including contributions from employers, individuals, and enterprise patents.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 65

Lecture Public Expenses for Social

Protection

Lecture 8 Public Expenses for Social Protection Slide 1

Key issues

1.The necessity and economic essence of

Public Social Protection System.

2.Organization of the state Social Insurance

in the Republic of Moldova.

3.Forms of citizens’ support by means of

Social Insurance in the Republic of Moldova.

4.State expenditure on Social Assistance.

Lecture 8 Public Expenses for Social Protection Slide 2

The system of Public Social Protection of the RM is

regulated by basic laws:

1.The LAW of the Republic of Moldova 489/1999

about the state system of social insurance no.489

from: 08.07.1999

2.The LAW of the Republic of Moldova 156/1998

about the state social insurance pensions

3. The LAW of the Republic of Moldova No.289-XV

from 22.07.2004 about indemnities for temporary

work disablement and other allowances of social

insurances

4. The LAW about the budget of the state social

insurance for 2010 N 129-XVIII from 12/23/2009

Lecture 8 Public Expenses for Social Protection Slide 3

The system of Public Social Protection of the RM

is regulated by basic lows

5.The LAW of the Republic of Moldova № 547-XV

about the social assistance

Bibliography

1. “Finantele Publice” Angela Secrieru pag.138-153

2. “Finantele Publice” sinteze,scheme, teste

Rodica Hincu, Eugenia Busmachiu si altii pag. 74-83

Lecture 8 Public Expenses for Social Protection Slide 4

I

Social protection consists of policies and

programs designed to cushion (reduce)

poverty and vulnerability by promoting

efficient labor markets, diminishing people's

exposure to risks, and enhancing their

capacity to protect themselves against

hazards and interruption/loss of income.

Lecture 8 Public Expenses for Social Protection Slide 5

There are five main areas of Social Protection (this

classification is used in international practice):

1.labor market policies and programs designed to promote

employment, the efficient operation of labor markets and the

protection of workers

2. social insurance programs to reduce the risks associated with

unemployment, illness, disability, work-related injury and old age

3.social assistance and welfare service programs for the most

vulnerable groups with no other means of adequate support,

including single mothers, the homeless, or physically or mentally

challenged people

4. micro-and area-based schemes to address vulnerability at the

community level, including micro insurance, agricultural insurance,

social funds and programs to manage natural disasters

5. child protection to ensure the healthy and productive

development of children

Lecture 8 Public Expenses for Social Protection Slide 6

Social insurance programs mitigate

(reduce) risks by providing income support

in the event of illness, disability, work injury,

maternity, unemployment, old age, and

death.

Lecture 8 Public Expenses for Social Protection Slide 7

Social insurance programs include

( this classification is made based on

international practice):

1.unemployment insurance to deal with

frictional or structural unemployment

2. work injury insurance to compensate

workers for work-related injuries or diseases

3. disability and invalidity insurance, linked

to old-age pensions, to cover for full or

partial disability

Lecture 8 Public Expenses for Social Protection Slide 8

Social insurance programs include :

4. sickness and health insurance to protect

workers from diseases

5. maternity insurance to provide benefits to

mothers during pregnancy and recovery

4. old-age insurance to provide income

support after retirement

6. life and survivor insurance to ensure that

dependents are compensated for the loss of

the breadwinner (supporter)

Lecture 8 Public Expenses for Social Protection Slide 9

The main principles of Social Insurance

include:

• Generality of supporting of citizens by

social insurance. This principle provides

social insurance for all workers upon

retirement or due to physical inability, with

no exceptions and independently of sex, age,

nationality, character and place of work,

forms of its payment.

Lecture 8 Public Expenses for Social Protection Slide 10

• General availability, i.e. the conditions,

which define the right to the pension, are

accessible to all.

Lecture 8 Public Expenses for Social Protection Slide 11

• Universality – means the big variety of

kinds of social security by means of payment

of pensions and indemnifications,

employment, various actions for health

growing, the prevention and disease

decrease, prosthetics, leaving in boarding

schools for invalids and aged people etc.

Lecture 8 Public Expenses for Social Protection Slide 12

• Establishment of dependence of the sizes

of pensions and indemnifications on the

previous work: duration of the experience of

work, wages, working conditions and other

factors connected with labour and public

work.

Lecture 8 Public Expenses for Social Protection Slide 13

• Pensions and grants on social insurance

are not assessed with taxes and tax

collections.

Lecture 8 Public Expenses for Social Protection Slide 14

• Democratic character of the organization

and management of social insurance system.

The big role in it belongs to trade unions.

Lecture 8 Public Expenses for Social Protection Slide 15

• Optimum combination of interests of the

persons, labour collectives and society at use

of means of social insurance.

Lecture 8 Public Expenses for Social Protection Slide 16

Social assistance and welfare services

provide protection to society's most

vulnerable groups, i.e., those with no other

means of support such as single parent

households, victims of natural disasters or

civil conflict, handicapped people, or the

destitute poor.

Lecture 8 Public Expenses for Social Protection Slide 17

Social assistance interventions may

include

1. welfare and social services to highly

vulnerable groups such as the physically or

mentally disabled, orphans;

2. cash or in-kind transfers such as food

stamps and family allowances

3. temporary subsidies such as life-line

tariffs, housing subsidies, or support of lower

prices of staple food in times of crisis

Lecture 8 Public Expenses for Social Protection Slide 18

II.

Social insurance in the Republic of

Moldova represents the system of monetary

relations, which form and spend funds of

money resources for the financial support of

the insured old persons or persons who lost

capacity, supporter (breadwinner) or other

persons requiring the help

Lecture 8 Public Expenses for Social Protection Slide 19

According to Law RМ № 489 – XIV from

July, 8th, 1999 «About the state system of

social insurance» the state system of

insurance is formed and operates on the basis

of following major principles:

Lecture 8 Public Expenses for Social Protection Slide 20

a) principle of uniformity, according to

which the state shall organize and guarantee

the public system of social insurance based

on uniform legal standards;

Lecture 8 Public Expenses for Social Protection Slide 21

b) principle of fairness, that shall ensure a

non-discriminatory treatment; in terms of

rights and obligations, provided for by law to

all participants of the public social insurance

system both contributors and beneficiaries;

Lecture 8 Public Expenses for Social Protection Slide 22

c) principle of social solidarity, between

and inside generations, under which the

public system participants assume

consciously and reciprocally obligations, and

enjoy the right, which prevents, limits or

removes social risks, as provided by law;

Lecture 8 Public Expenses for Social Protection Slide 23

d) principle of mandatory execution,

according to which individuals and legal

entities are committed under the law to

participate in public system;

Lecture 8 Public Expenses for Social Protection Slide 24

e) principle of contribution, according to

which the social insurance funds shall be

created form the contributions payable by the

individuals and legal entities - participants to

the public system; the rights to social

benefits are offered based on paid

contributions to the social fund;

Lecture 8 Public Expenses for Social Protection Slide 25

f) principle of distribution, based on which

the generated funds shall be redistributed for

mandatory payments the public system has

to make under the law;

Lecture 8 Public Expenses for Social Protection Slide 26

According to The LAW of Republic of Moldova

489/1999 about the state system of social insurance

no.489 from: 08.07.1999

The budget of the public system of social

insurance is a component part of public

finances and is independent of the national

(state) budget.

The budget of public social insurance system

includes the revenue side, the expenditure

side and financial results in the public system

of social insurance.

Lecture 8 Public Expenses for Social Protection Slide 27

Sources of incomes of the state budget of Social

Insurance for 2010:

I. Own incomes

1. Current incomes

1.1. Payments (fees) of obligatory state social insurance

a) The payments of obligatory state social insurance

transfered by employers

b)Individual payments of obligatory state social insurance

c)The individual payments of the state social insurance

listed by physical persons, concluded the individual

contract

d)The payments of obligatory state social insurance

Lecture 8 Public Expenses for Social Protection Slide 28

transfered by owners of the enterprise patent

1.2. Other incomes from the enterprinorial activity and the

property

a) Percent on the rests of money resources of the budget

of the state social insurance on current accounts in

banking institutions

2. Other incomes

Lecture 8 Public Expenses for Social Protection Slide 29

II. Transfers

a) Transfers from the state budget to the

budget of the state social insurance

b) Difference indemnification in tariffs of

obligatory state social insurance in

agricultural production sphere

c) Transfers from the state budget for a

covering of a budgeted deficit of the state

social insurance

Lecture 8 Public Expenses for Social Protection Slide 30

Sources of expenditures of the state budget of Social

Insurance for 2010:

A. Social insurance payments

1. Social insurance pensions

a) Pensions on age

b) Disability pensions

c) Pensions on the occasion of loss of the supporter

d) Long-service pensions

e) Pensions to deputies

f) Pensions to members of the Government

j) Pensions to public servants

h) Pensions to local elective persons

i) Pensions to employees of customs bodies

j) Pensions to public prosecutors and judges

k) The remaining sum after partial payment of pensions to the

pensioners leaving in institutes of guardianship

Lecture 8 Public Expenses for Social Protection Slide 31

2. Social insurance aids:

a) Single payment at a birth of a child, for the insured persons

b) The monthly aid on upbringing of the child before achievement of age of three

years, for the insured persons

c) Temporary disablement allowances in connection with industrial traumas or

occupational diseases

d) Temporary disablement allowances

e) Aid on motherhood

f) Disability pensions

j) Aids to burial owing to an industrial trauma or occupational disease

i) Aids to burial for the recipients of pensions of social insurance

f) Aids to burial for the employed

i) Aids to burial for the unemployed

j) The unemployment benefit and social payments to the unemployed

3. Other payments of social insurance

a) Expenses on improvement of the insured persons by means of sanatorium

treatment and rehabilitation

Lecture 8 Public Expenses for Social Protection Slide 32

4. Expenses for the organization and functioning

of the state system of social insurance

a) Expenses on delivery of pensions, aids and

indemnifications, including postal orders

b) Expenses on bank service

c) Expenses on development and conducting the

State register of the individual account in the state

system of social insurance

d) Charges of National Agency of social insurance

including capital expenses

Lecture 8 Public Expenses for Social Protection Slide 33

According to The LAW about the budget of

the state social insurance for 2010 N 129-XVIII

from 12/23/2009 list of programs included in the

budget of the state Social insurance for 2010 is the

following :

Lecture 8 Public Expenses for Social Protection Slide 34

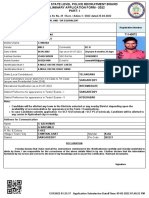

The List of programs, Included in the budget of the state Social

insurance for 2010 (thousands MDL)

The program The program purpose Program Sources of Sources of

Costs financing financing

State Social State

Insurance Budget

Budget

Activity for Management of the 193296,8 180469,1 12827,7

supporting the budget of the state

system of social social insurance

protection

Protection in case Compensation of not 1614409,9 1425073,4 189336,5

of disease or received income due

temporary to temporary

disability disability, physical

inability, accidents

and motherhood

The List of programs, Included in the budget of the state

Social insurance for 2010 (thousands MDL)

The program The program purpose Program Sources of Sources of

Costs financing financing

State Social State

Insurance Budget

Budget

Social protection Compensation of not 4843182,2 4710782,8 132399,4

due to old age received income due

approach to pension age

achievement

Protection in case Rendering of social 168544,6 165234,4 3310,2

of loss of the protection to

supporter successors in case of

loss of the supporter

The List of programs, Included in the budget of the state

Social insurance for 2010 (thousands MDL)

The program The program purpose Program Sources of Sources of

Costs financing financing

State Social State

Insurance Budget

Budget

Family and child Financial support of 614369,9 452237,5 162132,4

protection families with children

Employment of Financial support of 46265,0 46265,0

the population the unemployed

and protection in

case of

unemployment

The List of programs, Included in the budget of the state

Social insurance for 2010 (thousands MDL)

The program The program purpose Program Sources of Sources of

Costs financing financing

State Social State

Insurance Budget

Budget

Protection against Rendering of the 586396,7 586396,7

exception from social help by social

the society payments to the

persons who are in a

difficult situation

Additional support Financial support of 210912,4 10000,0 200912,4

to some categories the persons having

of citizens special merits before

the state

According to the law RМ № 489 – XIV from

July, 8th, 1999 «About the state system of

social insurance» management of the state

system of social insurance is carried out by

National Social Insurance Agency –

independent official body.

Lecture 8 Public Expenses for Social Protection Slide 39

Functions executed by the National Social

Insurance Agency:

a) guidance and monitoring of the implementation of legal

provisions by local agencies, branches, funds, individuals

and legal entities, which have rights and obligations

pursuant to this law;

b) providing data, necessary to formulate and substantiate

the budget of social insurance;

c) submitting reports about management of the social

insurance budget to the Government and social partners;

d) publication of annual reports of the National Social

Insurance Agencies;

Lecture 8 Public Expenses for Social Protection Slide 40

Functions executed by the National Social Insurance Agency:

e) transfer of social insurance contributions,

unemployment and other contributions, in

accordance with current legislation;

f) monitoring of the receipt of revenues of

the public social insurance budget, in

conformity with the current legislation;

g) taking measures, as established by the law,

to improve and administer the public system

efficiently, and maintain its integrity and

comprehensiveness;

Lecture 8 Public Expenses for Social Protection Slide 41

Functions executed by the National Social Insurance Agency:

h) taking measures for protection of the social

insurance funds;

i) accounting of all contributors to the public

system of social insurance at the national level;

j) keeping records of rights for social insurance

benefits and obligations at the national level,

based on the personal social insurance number ;

k) issue of annual certificate to each insured

person confirming the period during which

contributions have been made;

Lecture 8 Public Expenses for Social Protection Slide 42

Functions executed by the National Social Insurance Agency:

l) guidance and monitoring of activity of the

board of medical experts, which certify

recovery of capability to work;

m) providing data for updating benefits in the

public system of social insurance in the

course of execution of the social insurance

budget;

n) ensuring the implementation of

international conventions on social insurance,

to which Moldova is a part;

Lecture 8 Public Expenses for Social Protection Slide 43

Functions executied by the National Social Insurance Agency:

(o) developing relations with similar social

insurance organizations of other countries;

(p) selection, training and improvement of skills of

the personnel in the sector of public social

insurance;

(q) provision for introduction, , expansion,

maintenance and protection of computerized

accounting systems;

(s) representation in court in the cases it is

involved following the implementation of the

provisions of this law;

Lecture 8 Public Expenses for Social Protection Slide 44

III. The right for allowances of social insurance

is accomplished by the means of public system

of social insurances. The insured persons resident

in the Republic of Moldova and unemployed ones

entitled to receive the unemployment benefit have

to the right to allowances of social insurances. A

person has the right to allowances of social

insurances related to the social risks against which

he / she is insured.

Lecture 8 Public Expenses for Social Protection Slide 45

Insured persons from public system of social

insurance have the right to the following

allowances:

a) indemnity for temporary work disablement

caused by ordinary illnesses or by work-unrelated

accidents;

b) allowance for preventing the illnesses

(quarantine);

c) allowance for recovering the work capacity;

d) indemnity of maternity;

e) single indemnity at childbirth;

f) indemnity for child rising till the age of 3 years;

g) indemnity for maintenance of a sick child;

Lecture 8 Public Expenses for Social Protection Slide 46

h) aid in case of death.

Conditions for granting the allowances of social

insurances are the following:

1) Insured persons have the right to allowances of

social insurance if they have a total length of

insurance of at least 3 years.

2) Insured persons who have a total length of

insurance till 3 years benefit from the allowances

of social insurances if they have a total length of

insurance of at least 3 months, accomplished

during the last 12 months previous to the

occurrence of the insured risks.

Lecture 8 Public Expenses for Social Protection Slide 47

Conditions for granting the allowances of social

insurances:

3) Insured persons who activate the individual

work contract on unlimited period, including those

who work seasonally, benefit from allowances of

social insurance if they have the length of

insurance specified in items (1) or (2) or at least

12 months, accomplished in the last 24 months

previous to the occurrence of the insured risk.

Lecture 8 Public Expenses for Social Protection Slide 48

Conditions for granting the allowances of social

insurances

4) Unemployed people benefit from allowances of

social insurance with the condition that for this

period the payment of unemployment other

benefit or the scholarship are suspended.

Lecture 8 Public Expenses for Social Protection Slide 49

The insured persons constantly living in Republic

Moldova have the right to pension, also the

persons who at the date of pension age are not

insured persons, but correspond to the conditions

stipulated by the present law. This right is realized

according to the legislation through the public

system of insurance upon social risks in case of

disability (due to an pension age, invalidity) and

also in case of loss of the supporter.

Lecture 8 Public Expenses for Social Protection Slide 50

Categories of persons that are subject of

obligatory insurance that, according to the

requirements of the legislation, are defined in the

Law on the state system of social insurance.

Agriculturists also have the right to pension on the

conditions stipulated by the Moldovan Legislation.

Lecture 8 Public Expenses for Social Protection Slide 51

Pensions appointed according to the present

are paid from the pension fund.

Incomes of pension fund are formed of:

a) employers payments;

b) insured persons contributions;

c) contributions from other funds;

d) receipts from the state budget;

e) other incomes.

Lecture 8 Public Expenses for Social Protection Slide 52

The following types of pensions are paid by

the public system of the RM:

a) old-age pension;

b) disability pension;

c) survivor’s pension.

Lecture 8 Public Expenses for Social Protection Slide 53

IV. Social Assistance in the Republic

of Moldova is the component of the

national system of social protection.

Following this system the state and

society undertakes to prevent, to limit or

eliminate the effects of temporary or

permanent events which are regarded as

social risks.

Lecture 8 Public Expenses for Social Protection Slide 54

The social assistance (welfare ) is based on

the following principles:

a) recognizing the independence and

autonomy personality, respect human

dignity;

b) universality entitlement to welfare;

c) social solidarity ;

Lecture 8 Public Expenses for Social Protection Slide 55

The social assistance (welfare ) is based on

the following principles:

d) flexibility measures of social assistance,

bringing in accordance with their real needs

of the person or family in difficulty;

e) partnership as a means of making and

assessment of the measures of social

assistance;

f) personal responsibility of the recipient of

social assistance.

Lecture 8 Public Expenses for Social Protection Slide 56

From social assistance benefit individuals

and families who, (because of economical,

physical, psychological or social factors),

have no possibility to ensure the decent level

of life, i.e.:

a) children and young people whose health,

development and physical, mental or moral

integrity is damaged in the environment they

live;

Lecture 8 Public Expenses for Social Protection Slide 57

b) families who fail to fulfill the

appropriately obligations on care,

maintenance and educating children.

c) families without income or low income;

d) persons without family, which cannot

household themselves, which require care

and supervision or are unable to cover

medical needs;

e) children with disabilities until the age of

18 years;

f) families with children;

Lecture 8 Public Expenses for Social Protection Slide 58

i) disabled persons;

j) other categories of individuals and families

in difficulty.

Lecture 8 Public Expenses for Social Protection Slide 59

Social assistance is given in the form of:

(a) cash benefits (allowances, compensation,

benefits, etc.);

(b) social services.

Social assistance can be granted indirectly, in

the form of discounts to the procurement of

goods or current payment of services and

utilities.

Lecture 8 Public Expenses for Social Protection Slide 60

The categories of individuals and

families that need social assistance

are determined according to criteria

established by the Ministry of health

and social protection, in agreement

with the Ministry of Finance (LAW

of the Republic of Moldova № 547-XV

about social assistance )

Lecture 8 Public Expenses for Social Protection Slide 61

The sources of financing of Social

Assistance are the following:

a) the state budget

b) the budgets of administrative territorial

units

c) the Republican and local funds of

supporting the population

d) donations

e) sponsorships

f) contributions from recipients of social

assistance.

Lecture 8 Public Expenses for Social Protection Slide 62

Types of social assistance benefits are regulated

by the LAW of Republic of Moldova Nr. 133

from 6/13/2008 about the social benefits

Lecture 8 Public Expenses for Social Protection Slide 63

Size of the minimum monthly income on each member of

a family stipulated as follows:

a) 100 percent of the minimum guaranteed monthly

income for the applicant;

b) 70 percent of the minimum guaranteed monthly

income for each following adult member of a family;

c) 50 percent of the minimum guaranteed monthly

income for each child;

Lecture 8 Public Expenses for Social Protection Slide 64

Size of the minimum monthly income on each member of a family

is:

d) in addition 30 percent of the minimum guaranteed monthly

income for each adult member of a family having group of physical

inability;

e) in addition 50 percent of the minimum guaranteed monthly

income for each child-invalid;

f) in addition 10 percent of the minimum guaranteed monthly

income if the unique adult member of a family is the invalid.

Level of the minimum guaranteed monthly income is established

annually in the Law on the state budget.

Lecture 8 Public Expenses for Social Protection Slide 65

You might also like

- Pension and Social Insurance ACS 420 - INS 423 - Lecture Material 4Document9 pagesPension and Social Insurance ACS 420 - INS 423 - Lecture Material 4Yomi BrainNo ratings yet

- Report - Summary - Group 3 - MKT201Document4 pagesReport - Summary - Group 3 - MKT201Long Nguyễn HảiNo ratings yet

- Fund For Local Cooperation (FLC) : Application FormDocument9 pagesFund For Local Cooperation (FLC) : Application FormsimbiroNo ratings yet

- Social SecurityDocument10 pagesSocial SecurityParth DevNo ratings yet

- ENNHRI Statement The EU Must Put Economic and Social Rights at The Heart of Its Economic Response To COVID 19 6 May 2020Document4 pagesENNHRI Statement The EU Must Put Economic and Social Rights at The Heart of Its Economic Response To COVID 19 6 May 2020PeterNo ratings yet

- Economic and Social Council: United NationsDocument21 pagesEconomic and Social Council: United NationsLuis Fernando Carrillo CórdovaNo ratings yet

- Labor WelfareDocument83 pagesLabor WelfareEkroop KaurNo ratings yet

- ConventionDocument12 pagesConventionKnowledge PlanetNo ratings yet

- Social Security Legislations - Course - Unit 01 - Social Security in India - PPT - Part 01 - Omkar BapatDocument47 pagesSocial Security Legislations - Course - Unit 01 - Social Security in India - PPT - Part 01 - Omkar Bapatdiksha singhNo ratings yet

- NtroductionDocument6 pagesNtroductionkimsmakicheNo ratings yet

- Social Insurance ProgramsDocument12 pagesSocial Insurance Programsermirakastrati2004No ratings yet

- Unit 1Document24 pagesUnit 1Shivani KaurNo ratings yet

- Concept of Social SecurityDocument8 pagesConcept of Social SecurityPrateek MishraNo ratings yet

- Labour Law-Ii Project Social Security and Second National Commission On Labour in IndiaDocument19 pagesLabour Law-Ii Project Social Security and Second National Commission On Labour in IndiaVineethSundarNo ratings yet

- Concept of Social SecurityDocument5 pagesConcept of Social Securitycr7yukashoutaNo ratings yet

- Social Policy - Social Security - Winter 2023 - 24Document37 pagesSocial Policy - Social Security - Winter 2023 - 24Isaac MhakaNo ratings yet

- Assignment Social SecurityDocument12 pagesAssignment Social SecurityLulamela ChristinaNo ratings yet

- Elama Asignmente ProposalDocument11 pagesElama Asignmente ProposalEliphaz KalaweNo ratings yet

- Social Security and Health Rights of Migrant Workers in IndiaDocument4 pagesSocial Security and Health Rights of Migrant Workers in IndiaPriyanshi AgarwalNo ratings yet

- General Comment Right To Social Security - United NationsDocument21 pagesGeneral Comment Right To Social Security - United NationsRocioNo ratings yet

- 4th Esr Chap 6Document64 pages4th Esr Chap 6SIVIWE SINPHORIA XABANo ratings yet

- Social Protection - Module VDocument17 pagesSocial Protection - Module Vmarcel weussouabeNo ratings yet

- The Sss MandateDocument6 pagesThe Sss MandateDa YeNo ratings yet

- Employee Benefits 6th Edition Martocchio Solutions Manual DownloadDocument21 pagesEmployee Benefits 6th Edition Martocchio Solutions Manual DownloadIda Tomasini100% (24)

- Social Security Concept of Social SecurityDocument4 pagesSocial Security Concept of Social SecurityvengataraajaneNo ratings yet

- Social WelfareDocument6 pagesSocial WelfareKamrankhan KamranNo ratings yet

- Lecture 5Document56 pagesLecture 5Castro Osei WusuNo ratings yet

- Right To Social Security DisturaDocument44 pagesRight To Social Security DisturaBo DistNo ratings yet

- Social Insurance in Social ProtectionDocument11 pagesSocial Insurance in Social Protectionnikolay.g.kanchevNo ratings yet

- Social Security: These Contingencies Include - Employment, Injury, Sickness, Invalidism, Occupational DiseaseDocument7 pagesSocial Security: These Contingencies Include - Employment, Injury, Sickness, Invalidism, Occupational DiseaseS M Arefin ShahriarNo ratings yet

- Labour Law 2 Class ReportDocument5 pagesLabour Law 2 Class ReportCharran saNo ratings yet

- Economics and Sociability in new tools for Integrated WelfareFrom EverandEconomics and Sociability in new tools for Integrated WelfareNo ratings yet

- Missoc SSG IT 2022 enDocument62 pagesMissoc SSG IT 2022 enpolina.kosolapNo ratings yet

- Social Security For EPFO Exam: Powered byDocument18 pagesSocial Security For EPFO Exam: Powered byNirula SinghNo ratings yet

- Law of Social Insurance of Vietnam - 2006Document41 pagesLaw of Social Insurance of Vietnam - 2006Binh NguyenNo ratings yet

- Module 4Document9 pagesModule 4Chetanya KapoorNo ratings yet

- Research Paper Topics On Social Security MeasuresDocument5 pagesResearch Paper Topics On Social Security MeasuresPrachi GuptaNo ratings yet

- Voluntary Pension Funds in AlbaniaDocument29 pagesVoluntary Pension Funds in Albaniaxhetan peposhiNo ratings yet

- LaborDocument3 pagesLaborSsenfuka ShafikNo ratings yet

- p035-062 U3 Topic 2Document28 pagesp035-062 U3 Topic 2ParisNo ratings yet

- Social Security Legislations - Course - Unit 01 - Social Security in India - PPT - Part 02 - Omkar BapatDocument26 pagesSocial Security Legislations - Course - Unit 01 - Social Security in India - PPT - Part 02 - Omkar Bapatdiksha singhNo ratings yet

- Lecture 1Document17 pagesLecture 1Pradeep ChoudharyNo ratings yet

- Social Security Legislation: Chapter - 29Document26 pagesSocial Security Legislation: Chapter - 29surajNo ratings yet

- Social Security Dynamics in UgandaDocument7 pagesSocial Security Dynamics in Ugandaawech francisNo ratings yet

- Social SecurityDocument9 pagesSocial Securitysukande100% (1)

- Inequalities in Access To Healthcare: A Study of National Policies 2018Document74 pagesInequalities in Access To Healthcare: A Study of National Policies 2018MedicinaNo ratings yet

- Healthcare in The European Union: Short HistoryDocument3 pagesHealthcare in The European Union: Short HistoryAchiteiGeorgianaNo ratings yet

- Priyanshi Agarwal - Assignment - CHRDocument4 pagesPriyanshi Agarwal - Assignment - CHRPriyanshi AgarwalNo ratings yet

- Social Welfare Systems - China, Japan, Denmark, FranceDocument43 pagesSocial Welfare Systems - China, Japan, Denmark, Francetruezeta100% (1)

- InsuranceDocument44 pagesInsuranceBabul YumkhamNo ratings yet

- Social Security DissertationDocument8 pagesSocial Security DissertationWriteMyCustomPaperCanada100% (1)

- Engendering Social Security and ProtectionDocument14 pagesEngendering Social Security and ProtectionUnited Nations Research Institute for Social Development100% (1)

- Textbook of Sociology For Physiotherapy Students-365-386 Social SecurityDocument22 pagesTextbook of Sociology For Physiotherapy Students-365-386 Social SecurityNabilNo ratings yet

- Mod 6Document6 pagesMod 6AvniNo ratings yet

- TST Issues Brief: Social ProtectionDocument7 pagesTST Issues Brief: Social Protectionashu548836No ratings yet

- ESPN AL SocialProtectionDisability 2022Document22 pagesESPN AL SocialProtectionDisability 2022Blerona BogdaniNo ratings yet

- Critical Analysis of The Unemployment Schemes in IndiaDocument35 pagesCritical Analysis of The Unemployment Schemes in IndiaArtika AshdhirNo ratings yet

- Social Security in India - 2Document24 pagesSocial Security in India - 2Amitav TalukdarNo ratings yet

- Concept and Evolution of Social Security PDFDocument10 pagesConcept and Evolution of Social Security PDFparas diwanNo ratings yet

- Social Security and Labor Welfare (MBA-961) : Q.1 What Is The Concept of Social Security?Document16 pagesSocial Security and Labor Welfare (MBA-961) : Q.1 What Is The Concept of Social Security?Nisha RineshNo ratings yet

- Older Persons' Rights to Social Protection, Safety and ParticipationFrom EverandOlder Persons' Rights to Social Protection, Safety and ParticipationNo ratings yet

- Economic implications of medical liability claims:: Insurance and compensation schemes in EuropeFrom EverandEconomic implications of medical liability claims:: Insurance and compensation schemes in EuropeNo ratings yet

- DOLE Vacancies As of 01 - 10 - 13Document17 pagesDOLE Vacancies As of 01 - 10 - 13sumaychengNo ratings yet

- Resume 202309040934Document5 pagesResume 202309040934dubai eyeNo ratings yet

- DoctorTecar Brochure MECTRONIC2016 EngDocument16 pagesDoctorTecar Brochure MECTRONIC2016 EngSergio OlivaNo ratings yet

- Forecasting and Demand Management PDFDocument39 pagesForecasting and Demand Management PDFKazi Ajwad AhmedNo ratings yet

- 9MFY18 MylanDocument94 pages9MFY18 MylanRahul GautamNo ratings yet

- UntitledDocument1 pageUntitledsai gamingNo ratings yet

- Report - Fostering The Railway Sector Through The European Green Deal PDFDocument43 pagesReport - Fostering The Railway Sector Through The European Green Deal PDFÁdámHegyiNo ratings yet

- Rule 63Document43 pagesRule 63Lady Paul SyNo ratings yet

- SPI To I2C Using Altera MAX Series: Subscribe Send FeedbackDocument6 pagesSPI To I2C Using Altera MAX Series: Subscribe Send FeedbackVictor KnutsenbergerNo ratings yet

- GDN-206 - Guidelines On Safety Management System in Petroleum IndustryDocument49 pagesGDN-206 - Guidelines On Safety Management System in Petroleum IndustrykarpanaiNo ratings yet

- Method Statement: Vetotop XT539Document4 pagesMethod Statement: Vetotop XT539محمد عزتNo ratings yet

- Raport de Incercare TL 82 Engleza 2015 MasticDocument3 pagesRaport de Incercare TL 82 Engleza 2015 MasticRoxana IoanaNo ratings yet

- C++ & Object Oriented Programming: Dr. Alekha Kumar MishraDocument23 pagesC++ & Object Oriented Programming: Dr. Alekha Kumar MishraPriyanshu Kumar KeshriNo ratings yet

- Summer Training Report On: Prepared and Presented ToDocument95 pagesSummer Training Report On: Prepared and Presented ToShubh SinghalNo ratings yet

- Complete Governmental Structure of PakistanDocument6 pagesComplete Governmental Structure of PakistanYa seen khan0% (1)

- About FW TaylorDocument9 pagesAbout FW TaylorGayaz SkNo ratings yet

- Food Truck Ordinance LetterDocument7 pagesFood Truck Ordinance LetterThe Daily News JournalNo ratings yet

- 580N 580SN 580SN WT 590SN With POWERSHUTTLE ELECTRICAL SCHEMATICDocument2 pages580N 580SN 580SN WT 590SN With POWERSHUTTLE ELECTRICAL SCHEMATICEl Perro100% (1)

- Application Rebuilding Kits: Kit BulletinDocument2 pagesApplication Rebuilding Kits: Kit Bulletinhidraulic100% (1)

- HOVAL Dati Tecnici Caldaie IngleseDocument57 pagesHOVAL Dati Tecnici Caldaie Ingleseosama alabsiNo ratings yet

- DOL, Rotor Resistance and Star To Delta StarterDocument8 pagesDOL, Rotor Resistance and Star To Delta StarterRAMAKRISHNA PRABU GNo ratings yet

- Covid ReportDocument89 pagesCovid ReportBrynne ConnollyNo ratings yet

- University of MauritiusDocument4 pagesUniversity of MauritiusAtish KissoonNo ratings yet

- Define Constitution. What Is The Importance of Constitution in A State?Document2 pagesDefine Constitution. What Is The Importance of Constitution in A State?Carmela AlfonsoNo ratings yet

- Question BankDocument42 pagesQuestion Bank02 - CM Ankita AdamNo ratings yet

- Goal of The Firm PDFDocument4 pagesGoal of The Firm PDFSandyNo ratings yet

- CPCDocument6 pagesCPCpranjalNo ratings yet

- Java PT Android PDFDocument201 pagesJava PT Android PDFlaurablue96No ratings yet