Professional Documents

Culture Documents

North Adams Tax Classification & Rates Fiscal 2011

Uploaded by

iBerkshires.com0 ratings0% found this document useful (0 votes)

312 views14 pagesInformation, comparisons and recommendations for the tax classification and rates for fiscal 2011.

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentInformation, comparisons and recommendations for the tax classification and rates for fiscal 2011.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

312 views14 pagesNorth Adams Tax Classification & Rates Fiscal 2011

Uploaded by

iBerkshires.comInformation, comparisons and recommendations for the tax classification and rates for fiscal 2011.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 14

CITY OF NORTH ADAMS, MASSACHUSETTS

Office of the Mayor

Richard J. Alcombright

November 23, 2010

495

‘The Honorable City Council

North Adams, Massachusetts

Re: Tax Classification - FY 2011

Honorable Members:

Tonight you will be voting on a Council Order establishing the CIP shift which establishes the

percentages of tax levy for the different classes of property.

In doing so, you will be approving an increase inthe tax rates for both residential and commercial

taxpayers. As we have discussed at length throughout the year, the need for the increase in taxes

is necessary to offset continued reductions in state aid as well as past fiscal years utilization of

reserves to keep the budget balanced. Our FY 2011 budget included utilization of reserves as

‘well as increases in fees and taxes to assure continuity in services to include public safety, public

services and of course, our schools.

‘As we set this rate tonight, we are assuring our community that we will be able to provide

services that they have all come to expect. Unfortunately and despite all of our best efforts, the

reality and resulting fiscal chaos brought on by this recession will come down on this community

hard and heavy in FY 2012. The Massachusetts Taxpayers Foundation as well as the

Massachusetts Municipal Association are both predicting deep cuts in state aid for the next fiscal

year. For North Adams, that spells trouble at many levels as our dependency on state aid is very

hhigh and our cash position and reserves are very low.

am predicting a $2-3 million dollar budget shortfall in FY 2012. This will certainly result in

very difficult decisions with respect to potential losses in programming and services throughout

the city. As we did this fiscal year, we will look once again at both sides of the budget to include

both expenses and revenues. We will be examining further ways to create efficiencies however

that alone will not be able to close such a large gap.

10 Main Street + North Adams, Massachusetts 01247

413) 662-3000

will continue to meet with department heads, the city’s financial team and the DOR on a very

regular basis over the next several months on a variety of levels to:

Keep a very close eye on city revenues to be certain we are on target.

‘© Closely monitor city expense accounts.

‘* Assess month end numbers and iff necessary, place a spending freeze on all departments.

‘© Meet with bargaining units to effectively settle contracts that will have minimal impact

on the budget helping to preserve current staffing levels.

‘Additionally, I will be meeting regularly with the council's finance committee to keep it up to

date on all fiscal matters.

Until the Governor announces his FY 2012 budget, we can only monitor and speculate. In early

January, I will be giving a “State of the City” address. Iam hoping to have better indications of

‘what lies ahead at that time. Until then, I assure you and this community that I am doing

everything in my power to control costs, monitor revenue, review processes to create efficiencies

‘and working hard to plan for the brighter days that I know are coming.

Sincerely,

10 Main Street + North Adams, Massachusetts 01247

413) 662-3000

City of North Adams

In City Council

November 23, 2010

That the Board of Assessors be and is herby authorized to establish the following percentages of

tax levy for the following classes of property for Fiscal Year 2011:

Class 1 - Residential 60.0365

Class 2 - Open Space 0.0000

Class 3 - Commercial 25.7241

Class 4 Industrial 6.2143

Class 5 - Personal Property 8.0251

AND BE IT FURTHER ORDERED: That a residential factor of 77.8041% be employed.

DEPARTMENT OF REVENUE

BUREAU OF ACCOUNTS

CLASSIFICATION TAX ALLOCATION

NORTH ADAMS

City/TownDistrict

Retum to: Bureau of Accounts, Boston, Springfield, Worcester

4, The selected Residential Factor is --- 0.778041,

If you desire each class to maintain 100% of its full value tax share,

indicate a residential factor of "1" and go to question 3.

2. In computing your residential factor, was a discount granted to Open Space?

Yes No x

If Yes, what is the percentage discount?

3. Was a residential exemption adopted?

Yes No

If Yes, please complete the following:

Class | Total Assessed Value

= x =

Class | Total Parcel Count* Selected Res. _Ressidential

Exemption % Exemption

* Include all parcels with a Mixed-Use Residential designation

Applicable number of parcels to receive exemption

4, Was a small commercial exemption adopted?

Yes No x

% Selected

If Yes, please complete the following:

No. of parcels eligible

Total value of parcels

Total value to be exempted

6. The following information was derived from the LA-7. Please indicate in column D percentages

(accurate to 4 digits to the right of the decimal point) which resuit from your selected residential

factor. (If a residential factor of "1" has been selected, you may leave Column D blank.)

A B c D

ca Cerified Full and | Percentage Full Value | New Percentage

Eaic Cash Val hares of Total Tax | Shares of Total_|

1. Residential 551,223,772 77.1637%| 60.0365%|

12. Open Space o 0.0000%| 0.0000%|

13. Commercial 105,006,719 14,6995%| 25.7241%|

J4. Industrial 25,366,412 3.5510%| 6.2143%|

5. Personal Property _ 32,759,040 4.5858% 8.0251%|

Totals 714,355,943 100.0000%| 100.0000%|

6. [hereby attest that notice was given to taxpayers that a public hearing on the issue of

adopting the tax levy percentages for fiscal year 2011 would be held on (date),

(time), at (place), by

(describe type of notice).

CityTown/District Clerk

7. We hereby attest that on (ate) (time), at

(place) @ public hearing was held on the issue of adopting the

percentages for fiscal year 2011, that the Board of Assessors presented information and data relevant to

making such determination and the fiscal effect of the available alternatives at the hearing and that the

percentages set forth above were duly adopted in public session on (date),

8. We have been informed by the Assessors of excess levy capacity $776.13

For cities: City Councilors, Aldermen, Mayor

For towns: Board of Selectmen

For districts: Prudential Committee or Commissioners

(LAS)

THE COMMONWEALTH OF MASSACHUSETTS

DEPARTMENT OF REVENUE

FISCAL 2011 TAX LEVY LIMITATION FOR

NORTH ADAMS.

FOR BUDGET PLANNING PURPOSES

1. TO CALCULATE THE FY2010 LEVY LIMIT

A. FY2009 Levy Limit 12,059,380

1 ADD Amended FY2009 Growth 0

B. ADD (IA+IA1)X2.5% 301,485,

C. ADD FY2010 New Growth 88,026

D. ADD FY2010 Override 0

E. FY2010 Subtotal 12,448,891

F. FY2010 Levy Ceiling 18,179,587.

Il. TO CALCULATE THE FY2011 LEVY LIMIT

A. FY2010 Levy Limit from 1. 12,448,891

At ADD Amended FY2010 Growth o

B. ADD (IIA+IA1)X2.5% 311,222

C. ADD FY2011 New Growth 94,828

D. ADD FY2011 Override

E. FY2011 Subtotal 12,854,941

$

12,448,891

FY2010 Levy Limit

F. FY2011 Levy

17,858,899

Ill, TO CALCULATE THE FY2011

MAXIMUM ALLOWABLE LEVY

A, FY2011 Levy Limit from IL. 12,854,941

B. FY2011 Debt Exclusion(s) 0

C. FY2011 Capital Expenditure Exclusion(s)

D. FY2011 Other Adjustment

E. FY2011 Water / Sewer

F. FY2011 Maximum Allowable Levy $12,854,941

u|

$

12,854,941

FY2011 Levy Limit

11/13/2010 8:51 AM

SETTING THE TAX RATE

‘The process of setting the tax rate involves a number of steps. Assessors first

determine the value of each parcel of property and classify all property into four classes

of real and personal property. The classes of real property are residential, open space,

commercial and industrial. Once Assessors have calculated the total assessed value of all

real and personal property, they submit the Total Valuation of all property (FORM LA-4)

to the Division of Local Services. The Division determines and computes the minimum

residential factor for the community. This information is sent to the Board of Assessors

on the Minimum Residential Factor Computation Form (FORM LA-7) with a blank copy

of the Tax Allocation Form (FORM LA-5). There must then be a public hearing to

decide whether or not all classes of property should be taxed at the same rate,

Chapter 40, Section 56 allows communities to tax commercial and industrial real

property and personal property at a higher rate than residential and open space real

property. At the public hearing, the Board of Assessors presents information on the fiscal

effects of the various alternatives. After input from interested citizens, the Board of

Selectmen, Town Council, or the City Council, with approval from the Mayor, makes the

decision of whether to tax all classes of property at the same rate.

Chapter 3 of the Acts of 2004 provides relief for those communities in which the

maximum shift results in a residential share which is larger than that of the prior year.

For those communities, the limits have been raised. They may increase the C.LP. share

of the levy by 175.000% if the residential class is not reduced to less than 50% of its

share, This new residential share cannot be less than the residential share in any year

since the community’s values were first certified at full and fair cash value.

-l-

TAX RATES SINCE FISCAL 2001

FISCAL,

YEAR R&O CAP.

2001 (Reval Year) 13.99 28.12

2002 14.33 28.31

2003 14.69 28.22

2004 (Reval Year) 13.28 27.50

2005 12.22 28.76

2006 11.57 28.98

2007 (Reval Year) 11.13 26.62

2008 11.32 26.72

2009 11.71 27.03

2010 (Reval Year) 12.44 27.92

2011 14.00 31.49

R & O= RESIDENTIAL AND OPEN SPACE

C.LP. = COMMERCIAL, INDUSTRIAL AND PERSONAL PROPERTY

IF A SINGLE TAX RATE WERE CHOSEN FOR FY 2011 IT WOULD BE $17.99

TAX BASE GROWTH SUMMARY - FISCAL 2011

New construction, additions, alternations and business improvements.

Allowable Value X

Adjustments ___Tax Rate

Residential $ 839,400 $ 35,322

Open Space $ - :

Commercial $ 617,700 $ 17,246

Industrial $ 102,700 $ 2,867

Personal Property $ 1,410,933 $ 39,393

JOTALNEWGROWTH $ — 4,970,733 $ 94,828

New growth value based upon FY2010 tax rates of $12.44 for R & O and $27.92 for C.1.P.

EXCESS LEVY CAPACITY: FISCAL YEAR 2011

FY 2011 Maximum Allowable Tax Levy:

Net amount to be raised by taxation as

appears on Page 1, Item 1 - d of State Tax

Form 31C. Tax Rate Recapitulation Sheet.

EXCESS LEVY CAPACITY:

$

$

12,854,941

12,854,165

776

YEAR OVER YEAR COMPARISON OF VALUATIONS & TAX LEVIES

‘SINCE 2001

YEAR VALUATION, TAX LEVY.

2001 $ 437,428,330 $ 7,712,300

2002 $ 439,771,350 $ 7,906,485

2003 $ 445,769,750 $ 8,155,380

2004 $ 507,137,872 $ 8,555,000

2005 $ 553,363,255 $ 8,856,420

2006 $ 598,703,101 $ 9,199,382

2007 $ 659,151,904 $ 9,652,561

2008 $ 722,842,694 $ 10,552,561

2009 $ 731,941,734 $ 11,052,561

2010 $ 727,183,465 $ 11,601,589

2011 $ 714,355,943 $ 12,854,165

ASSESSED VALUATIONS - FY2010 VS. FY2011

INCR/

FY10 FY11 DECR

Class 1 Residential $ 862,104,232 $ 551,223,772 $ (10,880,460)

Class 2 Open Space $ - $ - $ -

Class 3 Commercial $ 105,965,641 $ 105,006,719 $ (958,922)

Class 4 Industrial $ 25,940,412 $ 25,366,412 $ (574,000)

Class 5 Personal Property $ 33,173,180 $ 32,759,040 $ (414,140)

TOTAL $ 727,183,465 $ 714,355,943 $ (12,827,522)

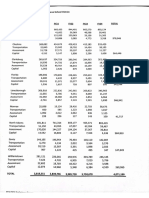

VALUATION BASE SINCE 2007

CLASS: 2007, 2008 2009 2010 2014

Class 1 Residential $ 509,623,146 $ 568,828,343 $ 569,989,276 $ 562,104,232 $ 551,223,772

Class 2 Open Space * $ - $8 - 8 - 8 - 8 -

Class 3 Commercial $ 96,497,096 $ 99,356,409 $ 102,130,248 $ 105,965,641 $ 105,006,719

Class 4 Industrial $ 27,475,520 $ 27,994,580 $ 27,677,280 $ 25,040,412 $ 25,366,412

Class 5 Personal Property $ 25,656,142 $ 26,663,272 $ 32,144,930 $ 33,173,180 $ 32,759,040

TOTAL $ 659,151,904 $ 722,842,694 $ 731,941,734 $ 727,183,465 $ 714,355,943

* Because North Adams has not adopted formal guidelines for the designation of Open Space the DOR has

requested the City consolidate the land into other land classification codes. For the purpose of this report,

commencing with FY 2007, Open Space values have been consolidated to Class 1 Residential values.

PERSONAL PROPERT TAX CODE SUMMARY REPORT FY 2011

Tax Hof Total

Code Description Accounts Value

501 Individual, Partnerships, Trusts 148 $ 6,868,820

502 Corporations (Domestic & Foreign) 198 $ 7,694,740

503, Manufacturing Corporations 0 s -

504 Locally Assessed Utilities 3 $ 14,092,250

505 DOR Assessed Telephone Co. 2 $ 3,853,100

506 DOR Assessed Gas Pipeline Co. 1 $ 94,200

508 Locally Assessed Wireless Co. 3 $ 155,930

Totals for FY 2014 354 $ 32,759,040

Totals for FY 2010 365, $ 33,173,180

Difference “14 $ (414,140)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Pittsfield Bike Lane Report 2022Document30 pagesPittsfield Bike Lane Report 2022iBerkshires.comNo ratings yet

- Pittsfield Cellular Telephone Co. v. Board of Health of The City of PittsfieldDocument10 pagesPittsfield Cellular Telephone Co. v. Board of Health of The City of PittsfieldiBerkshires.comNo ratings yet

- McCann Technical School Assessments FY24Document1 pageMcCann Technical School Assessments FY24iBerkshires.comNo ratings yet

- CARES Project Complete ReportDocument64 pagesCARES Project Complete ReportiBerkshires.comNo ratings yet

- Dalton Annual Town Meeting 2023Document4 pagesDalton Annual Town Meeting 2023iBerkshires.comNo ratings yet

- Williamstown Select Board - Ceasefire Resolution - 20240212Document2 pagesWilliamstown Select Board - Ceasefire Resolution - 20240212iBerkshires.comNo ratings yet

- Determination - 4-25-2023 - Oml 2023-65 - North Adams City CouncilDocument4 pagesDetermination - 4-25-2023 - Oml 2023-65 - North Adams City CounciliBerkshires.comNo ratings yet

- Student Chromebook Deployment Survey ResultsDocument10 pagesStudent Chromebook Deployment Survey ResultsiBerkshires.comNo ratings yet

- Pittsfield Pickleball CourtsDocument8 pagesPittsfield Pickleball CourtsiBerkshires.comNo ratings yet

- Adams Capital Budget Fiscal 2024Document1 pageAdams Capital Budget Fiscal 2024iBerkshires.comNo ratings yet

- Wahconah Park Design ProposalDocument72 pagesWahconah Park Design ProposaliBerkshires.com100% (1)

- North Adams Planning Board OML ViolationDocument3 pagesNorth Adams Planning Board OML ViolationiBerkshires.comNo ratings yet

- Short-Term Rental RegulationsDocument7 pagesShort-Term Rental RegulationsiBerkshires.comNo ratings yet

- Pittsfield Pickleball Facility Siting Study Final ReportDocument15 pagesPittsfield Pickleball Facility Siting Study Final ReportiBerkshires.comNo ratings yet

- Pittsfield Tobacco RegulationsDocument17 pagesPittsfield Tobacco RegulationsiBerkshires.comNo ratings yet

- North Adams Draft Short-Term Rental OrdinanceDocument7 pagesNorth Adams Draft Short-Term Rental OrdinanceiBerkshires.comNo ratings yet

- Williamstown Select Board OML ViolationDocument5 pagesWilliamstown Select Board OML ViolationiBerkshires.comNo ratings yet

- Draft Tobacco Regulations For DaltonDocument18 pagesDraft Tobacco Regulations For DaltoniBerkshires.comNo ratings yet

- Four New Pittsfield Job DescriptionsDocument9 pagesFour New Pittsfield Job DescriptionsiBerkshires.comNo ratings yet

- North Adams 40R Smart Growth Design StandardsDocument12 pagesNorth Adams 40R Smart Growth Design StandardsiBerkshires.comNo ratings yet

- Dalton Drive-Thru Bylaw Final DraftDocument2 pagesDalton Drive-Thru Bylaw Final DraftiBerkshires.comNo ratings yet

- Citizens Civil Complaint Against Pittsfield, Cell TowerDocument65 pagesCitizens Civil Complaint Against Pittsfield, Cell ToweriBerkshires.comNo ratings yet

- Pittsfield Board of Health Masking DirectiveDocument2 pagesPittsfield Board of Health Masking DirectiveiBerkshires.comNo ratings yet

- FY 22 Tax Classification Hearing North AdamsDocument15 pagesFY 22 Tax Classification Hearing North AdamsiBerkshires.comNo ratings yet

- Pittsfield Election Results 2021Document7 pagesPittsfield Election Results 2021iBerkshires.comNo ratings yet

- North Adams FY2022 Budget ProposalDocument71 pagesNorth Adams FY2022 Budget ProposaliBerkshires.comNo ratings yet

- Pediatric Vaccine Info SheetDocument1 pagePediatric Vaccine Info SheetiBerkshires.comNo ratings yet

- Audit Report: Berkshire County Arc IncDocument41 pagesAudit Report: Berkshire County Arc InciBerkshires.comNo ratings yet

- Bernard Testimony To The Board of Elementary and Secondary EducationDocument4 pagesBernard Testimony To The Board of Elementary and Secondary EducationiBerkshires.comNo ratings yet

- North Adams School FY22 Budget PresentationDocument16 pagesNorth Adams School FY22 Budget PresentationiBerkshires.comNo ratings yet