Professional Documents

Culture Documents

Economics

Uploaded by

Surya Panwar0 ratings0% found this document useful (0 votes)

312 views2 pagesThe incremental principle is applied to business decisions which involve a large increase in total cost and total revenue. Incremental cost includes both fixed and variable costs. Incremental revenue is the increase in revenue due to a business decision.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe incremental principle is applied to business decisions which involve a large increase in total cost and total revenue. Incremental cost includes both fixed and variable costs. Incremental revenue is the increase in revenue due to a business decision.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

312 views2 pagesEconomics

Uploaded by

Surya PanwarThe incremental principle is applied to business decisions which involve a large increase in total cost and total revenue. Incremental cost includes both fixed and variable costs. Incremental revenue is the increase in revenue due to a business decision.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

Incremental Principle

The incremental principle is applied to business decisions which involve a

large increase in total cost and total revenue. Such increase in total cost and

total revenue is called ‘incremental cost’ and incremental revenue,

respectively. Let us first explain the concept of incremental cost.

Incremental cost can be defined as the costs that arise due to a business

decision. For Example, suppose a firm decides to increase production by

adding a new plant to the existing capacity or by setting up a new production

unit. This decision increases the firm’s total cost of production from Rs. 100

million to Rs. 115 million – Rs. 100 million = Rs. 15 million is the

incremental cost. Thus, an increase in the total cost of production due to a

business decision is incremental cost. Incremental cost includes both fixed

and variable costs. However, it does not include the costs already incurred

on the excess capacity or what is the sunk cost or the cost of unused

material.

There are three major components of incremental cost:(i) present

explicit costs, (ii) opportunity cost, and (iii) future costs. Present explicit

costs include (a) fixed cost, i.e. the cost of plant and building, (b) variable

costs including cost of direct labour and materials and overheads like

electricity and indirect labour. Opportunity cost refers to expected income

foregone from the second best use of the resources involved in the present

decision. Future costs of a business decision include depreciation and

advertising costs if the product does not sell as well as expected.

The incremental revenue, on the other hand, is the increase in revenue

due to a business decision. A business decision is taken presumably in

expectation of an increase in the firm’s revenue. When a business decision is

successfully implemented, it does result in a significant increase in its total

revenue. The increase in the total revenue resulting from a business decision

is called incremental revenue. Suppose that after the installation of the new

plant, the total production increases and the firm is able to sell the

incremental product. As a result, the firm’s total sales revenue increases, let

us suppose, from Rs. 130 million to Rs. 148 million. Thus, the post-decision

total revenue of Rs. 148 million less the pre-decision total revenue of Rs.

130 million = Rs. 18 million is the incremental revenue.

Time Perspective Principle

All business decisions are taken with a certain time perspective. The

time perspective refers to the duration of time period extending from the

relevant past and foreseeable future taken in view while taking a business

decision. Relevant past refers to the period of past experiences and the trends

which are relevant for business decision with long-run implications. All

business decisions do not have the same time perspective. Some business

decisions have short-run repercussions and, therefore, involve short-run time

perspective. For example, a decision to buy explosive materials for

manufacturing crackers involves short-run demand prospects. Similarly, a

decision regarding building inventories of finished product involve short-run

perspective. There are, however, a large number of business decisions which

have long-run repercussions, e.g., investment in plant, building, machinery,

land, expansion of the scale of production, advertisement and investment

abroad. The decision about such business issues may not be profitable in the

short-run but may prove very profitable in the long-run. For example, the

introduction of a new product may not catch up in the market quickly and

smoothly. It may be difficult to even cover the variable costs. But in the

long- run, it may increase labour productivity in a much grater proportion as

compared to an increase in cost. Therefore, while taking a business decision

with long-run implications, it is immensely important to keep a well worked

out time perspective in view.

The business decision-makers must assess and determine the time

perspective of business propositions well in advance and make decisions

accordingly. Determine of time perspective is of a great significance

especially where projections are involved. The decision-makers must decide

on an appropriate future period for projecting the value of a variable.

Otherwise, projections may prove meaningless from analysis point of view

and decisions based thereon may result in poor pay-offs. For example, in a

business decision regarding the establishment of a Management Institute,

projecting a short-run demand and taking a short-run time perspective will

be unwise, and in buying explosive materials for manufacturing crackers for

Deepawali, a long-run time perspective is unwise.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Principles of Managerial EconomicsDocument7 pagesPrinciples of Managerial EconomicsSurya PanwarNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Role of A Managerial EconomistDocument1 pageRole of A Managerial EconomistSurya PanwarNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Computer Graphics VIII Comp. Sci. & Engg. 8 Semester Question Bank Unit-IDocument5 pagesComputer Graphics VIII Comp. Sci. & Engg. 8 Semester Question Bank Unit-ISurya PanwarNo ratings yet

- List of Attempted Questions and AnswersDocument3 pagesList of Attempted Questions and AnswersSurya PanwarNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Managerial Economics Lecture Firm AlternativeDocument42 pagesManagerial Economics Lecture Firm AlternativeSurya PanwarNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Marginal Ism and Incremental IsmDocument7 pagesMarginal Ism and Incremental IsmSurya PanwarNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Marginal Ism and Incremental IsmDocument7 pagesMarginal Ism and Incremental IsmSurya PanwarNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Performanceiof 04Document14 pagesPerformanceiof 04Surya PanwarNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Managerial EconomicsDocument15 pagesManagerial EconomicsSurya PanwarNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Market Structure Characterized by A Large Number of Small FirmsDocument9 pagesA Market Structure Characterized by A Large Number of Small FirmsSurya PanwarNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Monopolistic Competition: Activity 3-12-1Document11 pagesMonopolistic Competition: Activity 3-12-1Surya PanwarNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Cost Analysis: C.M.JoshiDocument14 pagesCost Analysis: C.M.JoshiSurya PanwarNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Demand Analysis: C.M.JoshiDocument17 pagesDemand Analysis: C.M.JoshiSurya PanwarNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Monopolistic Competition Is A MarketDocument8 pagesMonopolistic Competition Is A MarketSurya PanwarNo ratings yet

- Feenstra Taylor Econ CH06Document64 pagesFeenstra Taylor Econ CH06Surya Panwar100% (2)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Imperfect 3Document17 pagesImperfect 3Surya PanwarNo ratings yet

- Market StructureDocument42 pagesMarket StructureSurya PanwarNo ratings yet

- Monopolistic and Oligopoly: © 2006 Thomson/South-WesternDocument34 pagesMonopolistic and Oligopoly: © 2006 Thomson/South-WesternSurya PanwarNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Chapter 10 Stud VerDocument27 pagesChapter 10 Stud VerSurya PanwarNo ratings yet

- Monopolistic Competition and Product DifferentiationDocument18 pagesMonopolistic Competition and Product DifferentiationSurya PanwarNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Introduction To Economics I Dr. Ka-Fu WONG: ECON 1001 ABDocument29 pagesIntroduction To Economics I Dr. Ka-Fu WONG: ECON 1001 ABSurya PanwarNo ratings yet

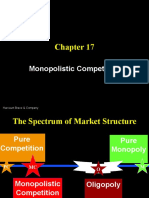

- Monopolistic Competition: Harcourt Brace & CompanyDocument33 pagesMonopolistic Competition: Harcourt Brace & CompanySurya PanwarNo ratings yet

- 2022 Level I IFT Study PlannerDocument29 pages2022 Level I IFT Study PlannerBəhmən OrucovNo ratings yet

- 29AMBPG7773M000 The Odisha State Co-Operative Marketing Federation LimitedDocument1 page29AMBPG7773M000 The Odisha State Co-Operative Marketing Federation LimitedPRASHANT KUMAR SAHOONo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Social Science Dissertation FormatDocument6 pagesSocial Science Dissertation FormatWriteMyPaperIn3HoursCanada100% (1)

- CH 16Document11 pagesCH 16Fahad Javaid50% (2)

- Baesa, Patrick Jeremel - FM - 03act1Document4 pagesBaesa, Patrick Jeremel - FM - 03act1Patrick JeremelNo ratings yet

- Book Review Why Smartnmess Will Not Save YouDocument8 pagesBook Review Why Smartnmess Will Not Save YouMuhammad Bilal AfzalNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Import Export ManagementDocument130 pagesImport Export ManagementNishita ShahNo ratings yet

- The TOWS Matrix A Tool For Situational AnalysisDocument13 pagesThe TOWS Matrix A Tool For Situational Analysisanon_174427911No ratings yet

- The Effectiveness of 50 Discount Pricing Strategy of Bread and Pastry Shops in Bonifacio High Street, Bonifacio Global City To The People Living in Taguig CityDocument74 pagesThe Effectiveness of 50 Discount Pricing Strategy of Bread and Pastry Shops in Bonifacio High Street, Bonifacio Global City To The People Living in Taguig CityCedrick Earl ManaliliNo ratings yet

- Global Strategic PlanningDocument36 pagesGlobal Strategic PlanningSimona Stancioiu100% (1)

- AC Camera Segment Performance (Week 6)Document10 pagesAC Camera Segment Performance (Week 6)PHI THAI NHATNo ratings yet

- Vijay Kumar SynopsisDocument6 pagesVijay Kumar SynopsisSwapna SwapnaNo ratings yet

- Factors Influencing Indian Supply ChainsDocument11 pagesFactors Influencing Indian Supply ChainsGourav SihariyaNo ratings yet

- Mcdonald ProjectDocument8 pagesMcdonald ProjectHelpdesk0% (1)

- The Management of Society's Resources Is Important Because Resources Is ScarceDocument1 pageThe Management of Society's Resources Is Important Because Resources Is ScarceRodel Amante MedicoNo ratings yet

- Security Characteristic LineDocument2 pagesSecurity Characteristic LineayyazmNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Market Models For AggregatorsDocument14 pagesMarket Models For AggregatorsJagälskar Den MaissaNordicNo ratings yet

- Oligopoly Is A Market Structure in Which A Small Number of Firms Have The Large MajorityDocument8 pagesOligopoly Is A Market Structure in Which A Small Number of Firms Have The Large MajorityJhullian Frederick Val VergaraNo ratings yet

- Sales PramotionsDocument40 pagesSales Pramotionsvarun guptaNo ratings yet

- Brand LoyaltyDocument18 pagesBrand Loyaltymithuncea0% (1)

- Introduction To Production and Operation Management: Chapter OutlineDocument12 pagesIntroduction To Production and Operation Management: Chapter Outlineyza gunidaNo ratings yet

- Enam - National Agriculture MarketDocument24 pagesEnam - National Agriculture MarketTAMILAZHAKI100% (2)

- Mas M 1404 Financial Statements AnalysisDocument22 pagesMas M 1404 Financial Statements Analysisxxx101xxxNo ratings yet

- Lecture Slides ECON861 - Week 2Document78 pagesLecture Slides ECON861 - Week 2taranpreetNo ratings yet

- Chapter 10 Shareholders EquityDocument10 pagesChapter 10 Shareholders EquityMarine De CocquéauNo ratings yet

- Penshoppe Swot GRP 4Document10 pagesPenshoppe Swot GRP 4Lhiamar CorpuzNo ratings yet

- Institutional Economics - Concise NotesDocument42 pagesInstitutional Economics - Concise Notespoorvishetty2005No ratings yet

- 01 Cohen Ch01Document24 pages01 Cohen Ch01Sukayna AmeenNo ratings yet

- JWCH 08Document29 pagesJWCH 08007featherNo ratings yet

- Algorithm Trading System ProjectDocument9 pagesAlgorithm Trading System Projectsataparamaulik1No ratings yet

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsFrom EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsRating: 5 out of 5 stars5/5 (1)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItFrom EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItRating: 5 out of 5 stars5/5 (13)