Professional Documents

Culture Documents

World Official Gold Holdings September 2010

Uploaded by

nikkei225traderCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

World Official Gold Holdings September 2010

Uploaded by

nikkei225traderCopyright:

Available Formats

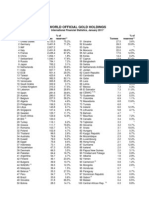

WORLD OFFICIAL GOLD HOLDINGS September 2010*

% of % of

Tonnes reserves** Tonnes reserves**

1 United States 8,133.5 72.1% 51 Ukraine 27.2 3.3%

2 Germany 3,402.5 67.4% 52 Ecuador 26.3 25.6%

3 IMF 2) 2,907.0 2)

53 Syria 25.8 2)

4 Italy 2,451.8 66.2% 54 Morocco 22.0 4.2%

5 France 2,435.4 65.7% 55 Nigeria 21.4 1.8%

6 China 1,054.1 1.5% 56 Sri Lanka 15.3 11.1%

7 Switzerland 1,040.1 15.1% 57 Korea 14.4 0.2%

8 Japan 765.2 2.7% 58 Cyprus 13.9 44.7%

9 Russia 726.0 5.7% 59 Bangladesh 2) 13.5 4.6%

10 Netherlands 612.5 55.8% 60 Serbia 13.1 3.8%

11 India 557.7 7.4% 61 Netherlands Antilles 13.1 36.4%

12 ECB 501.4 25.9% 62 Jordan 12.8 3.9%

13 Taiwan 423.6 4.1% 63 Czech Republic 12.7 1.2%

14 Portugal 382.5 79.6% 64 Cambodia 12.4 12.7%

15 Venezuela 363.9 48.5% 65 Qatar 12.4 2.0%

16 Saudi Arabia 322.9 2.7% 66 Mexico 7.8 0.3%

17 United Kingdom 310.3 15.6% 67 Latvia 7.7 4.0%

18 Lebanon 286.8 25.2% 68 El Salvador 7.3 9.9%

19 Spain 281.6 35.9% 69 CEMAC 6) 7.1 2.0%

20 Austria 280.0 54.3% 70 Guatemala 6.9 4.5%

21 Belgium 227.5 33.8% 71 Colombia 6.9 1.0%

22 Philippines 175.9 13.5% 72 Macedonia 6.8 11.9%

23 Algeria 173.6 4.2% 73 Tunisia 6.8 2.6%

24 Libya 143.8 5.1% 74 Ireland 6.0 10.4%

25 Singapore 127.4 2.3% 75 Lithuania 5.8 3.7%

2)

26 Sweden 125.7 8.7% 76 Bahrain 4.7

27 South Africa 124.9 10.9% 77 Mauritius 4.0 6.5%

28 BIS 3) 120.0 2)

78 Tajikistan 3.5 2)

29 Turkey 116.1 5.6% 79 Canada 3.4 0.2%

30 Greece 111.7 76.5% 80 Slovenia 3.2 11.3%

31 Romania 103.7 8.7% 81 Aruba 3.1 14.8%

32 Poland 102.9 4.2% 82 Hungary 3.1 0.3%

33 Thailand 99.5 2.5% 83 Kyrgyz Republic 2.6 6.2%

34 Australia 79.9 7.0% 84 Luxembourg 2.2 10.8%

2)

35 Kuwait 79.0 85 Hong Kong 2.1 0.0%

36 Egypt 75.6 7.7% 86 Iceland 2.0 1.6%

37 Indonesia 73.1 3.5% 87 Papua New Guinea 2.0 2.8%

38 Kazakhstan 70.4 9.5% 88 Suriname 1.9 9.4%

39 Denmark 66.5 3.1% 89 Albania 1.6 2.7%

40 Pakistan 64.4 14.9% 90 Yemen 1.6 1.0%

41 Argentina 54.7 4.0% 91 Cameroon 0.9 1.0%

42 Finland 49.1 18.1% 92 Mongolia 0.9 2.3%

2)

43 Bulgaria 39.9 9.3% 93 Honduras 0.7

44 WAEMU 4) 36.5 11.1% 94 Paraguay 0.7 0.6%

45 Malaysia 36.4 1.4% 95 Dominican Republic 0.6 0.8%

46 Peru 34.7 3.6% 96 Gabon 0.4 0.7%

47 Brazil 33.6 0.5% 97 Malawi 0.4 5.6%

48 Slovakia 31.8 62.8% 98 Mauritania 0.4 6.0%

49 Belarus 30.0 20.0% 99 Central African Rep. 0.3 6.8%

50 Bolivia 28.3 12.6% 100 Chad 0.3 2.7%

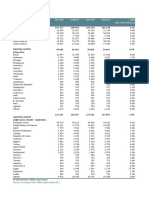

WORLD OFFICIAL GOLD HOLDINGS September 2010*

% of

Tonnes reserves**

101 Congo 0.3 0.3%

102 Uruguay 0.3 0.1%

2)

103 Fiji 0.2

104 Estonia 0.2 0.3%

105 Chile 0.2 0.0%

106 Malta 0.2 1.7%

107 Costa Rica 0.1 0.1%

108 Haiti 0.0 0.2%

109 Burundi 0.0 0.4%

2)

World 30,535.6

All Countries 27,113.0 10.1%

Euro Area (incl. ECB) 10,793.4 58.1%

CBGA 1 signatories 7) 12,108.7 42.3%

CBGA 2 signatories 7) 11,927.4 44.4%

CBGA 3 signatories 7) 11,959.2 44.4%

NOTES

* This table was updated in September, 2010 and reports data available at that time. Data are taken from the International

Monetary Fund's International Financial Statistics (IFS), JSeptember 2010 edition, and other sources where applicable. IFS

data are two months in arrears, so holdings are as of July 2010 for most countries, June 2010 or earlier for late reporters.

The table does not list all gold holders: countries which have not reported their gold holdings to the IMF in the last six

months are not included, while other countries are known to hold gold but they do not report their holdings publicly. Where

the WGC knows of movements that are not reported to the IMF or misprints, changes have been made. The countries

showing as having 0.0 tonnes of gold report some gold but less than 0.05 tonnes to the IMF.

**The percentage share held in gold of total foreign reserves, as calculated by the World Gold Council. The value of gold

holdings is calculated using the end-July gold price of $1169.00 per troy ounce (there are 32,151 troy ounces in a metric

tonne). Data for the value of other reserves are taken from IFS, table ‘Total Reserves minus Gold’.

1. Data have been updated to reflect the Bangladesh Bank's off-market purchase of 10 tonnes of gold from the IMF on Sept

7th. Following the transaction, the IMF has 93 tonnes of gold remaining , which is eligible for sale.

2. BIS and IMF balance sheets do not allow this percentage to be calculated. In the case of any countries, up to date data

for other reserves are not available.

3. BIS data are updated each year from the BIS’s annual report to reflect the Bank’s gold investment assets excluding any

gold held in connection with swap operations, under which the Bank exchanges currencies for physical gold. The bank has

an obligation to return the gold at the end of the contract.

4. West African Economic Monetary Union including the central bank.

5. As of May 1. Including gold on inward swap and excluding gold on outward swap.

6. Central African Economic and Monetary Union including the central bank.

7. Signatories to the first Central Bank Gold Agreement of September 1999 were the ECB and other Eurozone central

banks (excluding Greece which was not a Eurozone member in 1999) plus Sweden, Switzerland and the UK. The second

Agreement announced in March 2004 originally had the same signatories with the addition of Greece and the exclusion of

the UK. Slovenia joined the agreement in December 2006, just prior to their adoption of the euro. Cyprus and Malta joined

in January 2008, just following their adoption of the euro. The third Agreement, which commenced in September 2009, had

the same signatories as CBGA 2 with the addition lof Slovakia.

You might also like

- Making Sense of Data II: A Practical Guide to Data Visualization, Advanced Data Mining Methods, and ApplicationsFrom EverandMaking Sense of Data II: A Practical Guide to Data Visualization, Advanced Data Mining Methods, and ApplicationsNo ratings yet

- Deagel Analysis UpdatedDocument7 pagesDeagel Analysis UpdatedAll News PipelineNo ratings yet

- Economic Freedom Index 2019Document496 pagesEconomic Freedom Index 2019Hernando BispoNo ratings yet

- Deagel AnalysisDocument6 pagesDeagel AnalysisDaniel Karlsson100% (2)

- World Official Gold Holdings Mar 2009Document2 pagesWorld Official Gold Holdings Mar 2009ericwinchellNo ratings yet

- World Official Gold Holdings January 2011Document2 pagesWorld Official Gold Holdings January 2011Sim PhonyNo ratings yet

- World Official Gold Holdings As of August2015 IFSDocument3 pagesWorld Official Gold Holdings As of August2015 IFSJULIAN REYESNo ratings yet

- Giignl 2021 Annual Report Apr27Document2 pagesGiignl 2021 Annual Report Apr27Andres SerranoNo ratings yet

- CGPSS4 Section IIIRetail PaymentsDocument94 pagesCGPSS4 Section IIIRetail PaymentsEko YuliantoNo ratings yet

- Footprint Report 2008 HDocument25 pagesFootprint Report 2008 H陳建文No ratings yet

- Asia-Harti TematiceDocument1 pageAsia-Harti TematiceAlexandra LupuNo ratings yet

- ICIrankings2009 10Document1 pageICIrankings2009 10christianegNo ratings yet

- List of The Largest Trading Partners of China - WikipediaDocument1 pageList of The Largest Trading Partners of China - WikipediaSubrat DasNo ratings yet

- Cost - of - Living FINALDocument9 pagesCost - of - Living FINALAmrutha VNo ratings yet

- Correlation Coefficient (R) Sample Size (N) T P ValueDocument79 pagesCorrelation Coefficient (R) Sample Size (N) T P ValueRuoyuNo ratings yet

- Berikut Merupakan Hasil Output R Memanggil Data: Perbandingan Menggunakan Bootstrap Dan JackknifeDocument14 pagesBerikut Merupakan Hasil Output R Memanggil Data: Perbandingan Menggunakan Bootstrap Dan JackknifeAlivia ZahraNo ratings yet

- Regression StatisticsDocument5 pagesRegression StatisticsIsmayaCahyaningPutriNo ratings yet

- AsiaDocument1 pageAsiaLavinia BaciuNo ratings yet

- WJS Perceived Influences - AggregatedDocument27 pagesWJS Perceived Influences - AggregatedpldamascenoNo ratings yet

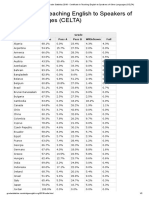

- Cambridge English - Grade Statistics 2017 - Certificate in Teaching English To Speakers of Other Languages (CELTA)Document2 pagesCambridge English - Grade Statistics 2017 - Certificate in Teaching English To Speakers of Other Languages (CELTA)Lali SalamiNo ratings yet

- In Thousand 60kg Bags: Monthly Export Statistics - January 2018Document1 pageIn Thousand 60kg Bags: Monthly Export Statistics - January 2018dorie_dorinaNo ratings yet

- Indice BigmacDocument71 pagesIndice BigmacDidier RamosNo ratings yet

- Pilot 2006 Environmental Performance IndexDocument25 pagesPilot 2006 Environmental Performance IndexVeronica KumururNo ratings yet

- CountriesDocument4 pagesCountriesSims LauNo ratings yet

- Heritage 2018 Highlights PDFDocument16 pagesHeritage 2018 Highlights PDFFreddy MoralesNo ratings yet

- Acum Exporta Jul2017Document12 pagesAcum Exporta Jul2017juandomcNo ratings yet

- NR - Crt. Statul ANUL 2020 Populaţie (Mil - Loc.) Densitate (Loc/km) P (Mil - Loc.) 1Document2 pagesNR - Crt. Statul ANUL 2020 Populaţie (Mil - Loc.) Densitate (Loc/km) P (Mil - Loc.) 1Marynusha MaryNo ratings yet

- Pensión Funds-in-Figures-2021Document6 pagesPensión Funds-in-Figures-2021elena huertaNo ratings yet

- Countries 120Document3 pagesCountries 120sophieliubcNo ratings yet

- Gender Equality in The Wake of COVID 19 Annexes enDocument89 pagesGender Equality in The Wake of COVID 19 Annexes enAbid RidoNo ratings yet

- Anbis PenafsiranDocument4 pagesAnbis PenafsiranYour AlgaeNo ratings yet

- Table A1.1: Total Population (Mid-Year) : (Million)Document3 pagesTable A1.1: Total Population (Mid-Year) : (Million)MikhaelNo ratings yet

- Gini SwatiDocument21 pagesGini SwatiSwati VermaNo ratings yet

- Highlights of The: Terry Miller Anthony B. Kim James M. Roberts With Patrick TyrrellDocument20 pagesHighlights of The: Terry Miller Anthony B. Kim James M. Roberts With Patrick TyrrellSteph ClicheNo ratings yet

- Countries in The WorldDocument12 pagesCountries in The WorldRanjith KNo ratings yet

- Ppul25342 Sup 0001 Suplementary - TableDocument3 pagesPpul25342 Sup 0001 Suplementary - TableIgnacio GuzmánNo ratings yet

- Development AssignmentDocument11 pagesDevelopment AssignmentRICHMOND GYAMFI BOATENGNo ratings yet

- Survey of Mining Companies 2014 Figures and TablesDocument203 pagesSurvey of Mining Companies 2014 Figures and TablesCamilo SierraNo ratings yet

- Transparency International Corruption Rankings 2010Document1 pageTransparency International Corruption Rankings 2010VaibhavJainNo ratings yet

- Índice de Libertad Mundial 2020 PDFDocument524 pagesÍndice de Libertad Mundial 2020 PDFBryan PalmaNo ratings yet

- Highlights of The: Terry Miller Anthony B. Kim James M. Roberts With Patrick TyrrellDocument20 pagesHighlights of The: Terry Miller Anthony B. Kim James M. Roberts With Patrick TyrrellYarith Azucena Paredes ErazoNo ratings yet

- Table A3. Education: Primary Level Net Enrolment Ratio, Pupils StartingDocument2 pagesTable A3. Education: Primary Level Net Enrolment Ratio, Pupils Startingapi-17744395No ratings yet

- 100) For 149 Countries Included in The 2016 SDG IndexDocument2 pages100) For 149 Countries Included in The 2016 SDG IndexEngin BoztepeNo ratings yet

- PibDocument4 pagesPibTeresalinapNo ratings yet

- 4.2 Structure of Value AddedDocument5 pages4.2 Structure of Value AddedCesar Gabriel Zapata CasariegoNo ratings yet

- Datos Esperanza Vida PIB Per CapitaDocument6 pagesDatos Esperanza Vida PIB Per CapitaJavier espiNo ratings yet

- Ecological Footprint by CountryDocument8 pagesEcological Footprint by CountryMichael SmithNo ratings yet

- WNA Pocket Guide 2019 BookletDocument44 pagesWNA Pocket Guide 2019 Bookletalizidan40No ratings yet

- New Consumption TableDocument1 pageNew Consumption TableinstalloverloadzNo ratings yet

- Gold Mining Production Volumes DataDocument6 pagesGold Mining Production Volumes DataM Rallupy MeyraldoNo ratings yet

- Fsi 2022 DownloadDocument5 pagesFsi 2022 DownloadEvreehiiNo ratings yet

- Index 2015 PDFDocument508 pagesIndex 2015 PDFpruebaNo ratings yet

- Index 2015 PDFDocument508 pagesIndex 2015 PDFpruebaNo ratings yet

- GSCI Scores 2023-1Document14 pagesGSCI Scores 2023-1ladyvampire206No ratings yet

- Data ResearchDocument78 pagesData ResearchRRSNo ratings yet

- Data-Modelling-Exam by NaikDocument20 pagesData-Modelling-Exam by NaikManjunatha Sai UppuNo ratings yet

- International Debt Report 2022: Updated International Debt StatisticsFrom EverandInternational Debt Report 2022: Updated International Debt StatisticsNo ratings yet