Professional Documents

Culture Documents

Preqin Private Equity Venture Report Oct2010

Uploaded by

http://besthedgefund.blogspot.comOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Preqin Private Equity Venture Report Oct2010

Uploaded by

http://besthedgefund.blogspot.comCopyright:

Available Formats

The Venture Capital Industry

A Preqin Special Report

October 2010

Preqin Special Report: The Venture Capital Industry

The Venture Adventure

This special Preqin report will look at the venture capital industry located both locally, and also from the US and Europe. This

from all angles. Using data and intelligence taken from Preqin’s report includes an overview of the makeup of active venture firms

suite of online databases, we show how the industry has by type and geography, using data from the Preqin’s Funds in

performed, the size and scope of active firms worldwide, latest Market and Fund Manager Profiles products, while information

fundraising statistics and the views of institutional investors on collected from our Investor Intelligence service enables us to

venture capital allocations. examine which investors are actively considering making new

commitments.

The venture capital industry as we know it today can trace its

roots back to the 1970s, which saw the inception of a number of Although there are more positive aspects within the industry,

Sand Hill Road investment firms along with the establishment of current sentiment towards the market is understandably mixed;

the NVCA in 1973. The following forty years have seen a number some claim that the venture capital model is broken, while others

of ups and downs in the industry, with the 1980s seeing a period believe that an evolution is required if the industry is to improve

of industry growth amidst variable performance, the late 1990s upon the overall performance experienced in the past 10 years.

delivering exceptional performance with a surge in fundraising,

and the past ten years seeing disappointing returns and There are arguments that improvements in technology have made

fundraising taking place at a far lower level than in the late 90s. it cheaper to launch new businesses, contrasting with the trend of

larger funds which search for higher minimum investments. We

Within Europe especially, overall fundraising has troughed have seen an increasing number of ‘Super Angels’ coming forward

following numerous years of disappointing returns leading to to fill the gap, raising smaller vehicles with more private capital

investor indifference. Figures for the US are also failing to live up than traditional funds in order to access these opportunities.

to expectations, but there are signs of growth within Asian and With many firms now competing for larger deals, there is also talk

Rest of World markets, where fundraising peaked in 2008 at $23 of prices being driven up, therefore endangering future returns for

billion – a higher total than that seen in Europe and a similar level investors.

to the US.

Our data and analysis suggests that the venture capital fund

Although overall fundraising totals and overall performance market is often over-simplified. The reality is that overall industry

returns have proven to be disappointing, there are a number of performance may be disappointing, but there are also many

bright spots within the industry. success stories, growth areas, and an elite group of firms that are

consistently providing investors with excellent returns.

As our performance analysis shows, although overall

performance statistics are somewhat disappointing, there are a Whether venture capital continues to be available via traditional

significant minority of venture managers that provide very strong fund structures, from ‘Super Angels’, or from other means, it

returns. Data taken from Preqin’s Performance Analyst shows that is certain that for the time being it remains a vital asset class

while the days of funds exhibiting 100%+ IRRs may be behind capable of driving growth, innovation and the overall economy. We

us, nearly 20% of 2005 vintage funds currently have net IRRs in hope that you find the data in this special Preqin venture capital

excess of 20%. The evidence for manager expertise within the industry report to be interesting and informative, and as ever we

venture sector is compelling. 70% of firms appearing in the top welcome any feedback that you may have.

quartile have seen their follow-on vehicle exceed the median,

with a number of firms having seen the majority of all funds raised

appearing in the top quartile. While some firms have struggled

to raise capital, those managers with a strong track record have

provided a more compelling case for investment, and raised

new vehicles in relatively quick time, even in the current financial

climate.

Certain areas within the market are seeing a clear increase in

interest, with opportunities in cleantech and renewable energy

leading to a number of new industry-specific firms and funds

being established over the past few years. There are also

exciting opportunities in emerging markets, with growth being

fuelled following a surge in interest from institutional investors

2 Preqin Research Report © 2010 Preqin Ltd. www.preqin.com

Preqin Special Report: The Venture Capital Industry

The Venture Landscape

The Preqin database provides details for over 3,500 firms located have closed have no specific investment stage preference. For

across the globe making venture capital investments, of which the purpose of this analysis, early stage funds include all those

1,365 manage specific closed-end venture capital funds. Fig. 1 funds that have a marked inclination towards seed and start-up

shows historical fundraising for venture firms since 1998 and the investments. Early stage funds raised $12.3 billion in 2005, but

geographic focus of the respective funds. since then have garnered less capital from investors year on year,

irrespective of growth or decline in the aggregate capital raised by

Fundraising venture funds.

Over 3,700 venture vehicles have raised $558 billion since 1998,

with North America-focused funds consistently raising the most Since 2005, expansion funds have consistently increased their

capital each year. The largest annual amount raised was by annual share of the venture fundraising market. Of the $30.3

funds closing in 2000; this record figure came as a result of the billion raised by all venture funds in 2009, expansion funds

dot-com boom. North America-focused funds were responsible accounted for a record 37%, and since 2005 they have raised

for raising 75% of the $84 billion raised by venture firms in 2000 an aggregate $65.8 billion. Pine Brook Road Partners I is one of

and account for 63% of the total capital raised by the sector since the ten largest venture funds to close since 2005, having secured

1998. However, Asia and Rest of World-focused funds have $1.4 billion in capital commitments by its final close in April 2009.

become more prominent within the venture market, and were The fund was raised to provide expansion capital to new or near-

responsible for 37% of the $62 billion raised in 2008. new energy and financial services businesses that are looking to

grow and expand.

Fig. 2 reveals that 49% of the 1,365 venture fund managers are

headquartered in North America. Europe hosts 25% of venture Late stage funds are often raised by specialized later stage

firms, and Europe-focused funds have raised 16% of aggregate venture capital firms such as the Silicon Valley-based Meritech

capital commitments between 1998 and 2010. 25 Europe-focused Capital Partners. 2010 has already seen four late-stage venture

funds have closed in 2010 to date, raising $7.6 billion in capital funds close, raising an aggregate $1.8 billion, and one of the

commitments. A quarter of venture firms are located in Asia and largest venture funds to close recently was the late stage-focused

Rest of World, and this figure is likely to increase as emerging Institutional Venture Partners XIII. California-based Institutional

economies continue to develop. Venture Partners closed its eighth technology fund in June 2010

on $750 million, significantly surpassing its initial $600 million

Venture Investment Stage target, showing that even in these tough times for fundraising,

Fig. 3 displays a breakdown of venture funds by their investment firms with a compelling proposition and track record can achieve

stage focus. Venture funds with no specific stage focus have great success.

consistently raised the largest proportion of overall venture capital

fundraising and so far in 2010, 39% of the venture funds that

Fig. 1: Breakdown of Annual Venture Fundraising by Geographic Fig. 2: Breakdown of Venture Firms by Geographic Location

Focus: 1998 - 2010 YTD

Aggregate Capital ($bn)

Vintage Year

Source: Preqin Source: Preqin

3 Preqin Research Report © 2010 Preqin Ltd. www.preqin.com

Preqin Special Report: The Venture Capital Industry

Venture Fund Size Fig. 3: Breakdown of Annual Venture Fundraising by Fund Type:

Fig. 4 illustrates the breakdown of venture capital firms by 2005 - 2010 YTD

the largest fund they have raised or are currently raising,

demonstrating that 78% of venture firms have never raised a

fund greater than $250 million and only 8% of firms have raised a

Aggregate Capital Raised ($bn)

venture fund which has closed on $500 million or more.

Venture Fund Industry Preference

Venture capital is traditionally associated with high technology

industries such as biotechnology and information technology due

to their innovative nature and the potential rates of return from

disruptive technology. Fig. 5 shows the industry preferences of

venture funds that have closed between 2005 and 2010 and those

funds that are currently in market seeking capital. Information

technology remains the most popular industry for venture funds

to invest in. The health care industry is also prominent, with over

35% of both closed funds and those fundraising seeking to include Source: Preqin

health care in their portfolios. It is also interesting to note that the

industrials sector is listed as an industry preference by twice the

proportion of funds currently raising compared to funds closed

Fig. 4: Breakdown of Venture Firms by Largest Fund Raised or

between 2005 and 2010. Currently Raising

Most Active Firms by Fundraising

Fig. 6 shows the largest firms by venture capital funds raised over

the last 10 years. Oak Investment Partners and New Enterprise

Associates have raised the most capital, each having raised $6.4

billion through four and five venture funds respectively. Sequoia

Capital has raised the most funds of all firms in the top 10, with its

10 venture funds raising an aggregate $4.1 billion in the last 10

years.

Data Sources:

Source: Preqin

Preqin Funds in Market

Included as part of Preqin’s integrated 360° online private

equity database, or available as a separate module, Funds Fig. 5: Breakdown of Venture Funds by Industrial Focus:

in Market provides detailed and extensive information on 2005 - 2010 YTD

private equity funds seeking capital, including over 460

venture funds. 60% 52%

50% 39% 43%

www.preqin.com/fim 40% 36%

31% 28% 29%

30% 27%

18% 23%20%

20% 12% 14% 15% 13%

Preqin Fund Manager Profiles 15%

10% 5% 5%

0% Closed Funds

Energy and Utilities

Raising Funds

Materials

Business Services

Food and Agriculture

Industrials

Discretionary

and Communications

Technology

Health Care

Information

Included as part of Preqin’s integrated 360° online private

Consumer

Telecoms, Media

equity database, or available as a separate module,

Fund Manager Profiles provides detailed and extensive

information on over 5,000 private equity fund managers,

including 3,500 venture fund managers.

www.preqin.com/fmp

Source: Preqin

4 Preqin Research Report © 2010 Preqin Ltd. www.preqin.com

Preqin Special Report: The Venture Capital Industry

Fig. 6: Largest Firms by Venture Funds Raised in the Last 10 Years

Manager Aggregate Capital Raised ($bn) Number of Funds Raised

Oak Investment Partners 6.4 4

New Enterprise Associates 6.4 5

Citi Venture Capital International 5.8 3

Technology Crossover Ventures 5.3 3

Sequoia Capital 4.1 10

Carlyle Group 3.8 6

Kleiner Perkins Caufield & Byers 3.0 7

Austin Ventures 2.9 3

Accel Partners 2.9 8

Matrix Partners 2.8 5

Source: Preqin

5 Preqin Research Report © 2010 Preqin Ltd. www.preqin.com

Preqin Special Report: The Venture Capital Industry

Venture Performance

Preqin’s Performance Analyst is the industry’s most extensive vintage 1996 venture funds in the sample, and more than half of

source of net to LP private equity fund performance, with full vintage 1997 funds, have produced IRRs of 20% or more. Nearly

metrics for over 5,100 named vehicles. In terms of capital raised, one-fifth of vintage 1998 funds have also done so, but the figures

Performance Analyst contains data for over 70% of all funds then fall away further for vintages following this, with less than 5%

raised historically. of vintage 1999 and 2000 venture funds returning 20% or more.

The figure for vintage 2005 funds suggests some improvement

It is well known that the collective performance of venture capital in venture fund performance, with nearly 20% of funds achieving

funds over the past decade, since the crash of the technology an IRR of 20% or more, despite the median fund still being in the

bubble, has not lived up to expectations. Fig. 1, which is based red. This demonstrates the importance of good fund selection for

on performance data for more than 700 venture capital funds venture capital fund investors. The proportion of funds achieving

(excluding early stage funds), shows the median IRR of venture an IRR of 20% or more is lower for both vintage 2006 and vintage

funds by vintage for the years 1996 to 2007. Vintage 1997 funds 2007, but these funds have had less time to add value to their

have the highest median IRR of all of the vintages shown, at portfolio investments and are still early in their J-curves.

around 23%, and funds of this vintage require extremely high

returns – in excess of 75% – to be considered a top quartile fund Fig. 3 shows the mean IRR and the standard deviation of IRRs

in terms of IRR. As Fig. 1 shows, the best performing vintage for each vintage year for venture funds of vintages 1996 to 2007.

1996 venture funds also produced impressive returns, with an For vintages 1996 to 1998, standard deviations are in excess of

IRR over 62% required for a fund to be in the top quartile for this 45 percentage points, mainly due to the extremely large returns

vintage. produced by some funds of these vintages (some funds in the

sample have IRRs in excess of 500%). Following the burst of

For the vintages following these, the technology crash affected the technology bubble, standard deviations have been much

the overall performance of venture funds, and returns have lower, but appear to be trending upwards since the lows seen for

struggled to recover since. The median vintage 1998 venture fund vintages of the early 2000s, suggesting an increasing importance

has still produced a positive IRR, at just over 6%, and a 17.5% in fund selection. Vintage 2005 funds have one of the highest

IRR is required for a fund to be in the top quartile. However, standard deviations of recent vintages, at around 25 percentage

the median fund for each of the three following vintages has a points, once more showing the variation in the performance of

negative IRR, and top quartile performance is also significantly funds from this vintage. The mean IRR for vintage 2005 funds

lower. stands at just over 6%. When compared to the median IRR

of -1.9%, this suggests that some funds of this vintage are

Fig. 2 shows the proportion of venture funds for each vintage year significantly outperforming their respective median benchmarks.

from 1996 to 2007 that have achieved an IRR of 20% or more, While the median venture capital fund’s performance has

portraying a similar story to that shown in Fig. 1. Nearly 35% of fluctuated around 0% for vintages 1999 to 2007, investors with

Fig. 1: Venture Funds: Median Net IRRs and Quartile Boundaries Fig. 2: Proportion of Venture Funds Achieving an IRR of 20% or More

by Vintage Year

Net IRR Since Inception (%)

Proportioon of Funds

Vintage Year Vintage Year

Source: Preqin Source: Preqin

6 Preqin Research Report © 2010 Preqin Ltd. www.preqin.com

Preqin Special Report: The Venture Capital Industry

good fund selection skills are still able to achieve significant Fig. 3: Venture Funds: Median Net IRR and Standard Deviationof

returns from the asset class. IRRs by Vintage Year

80%

74.7%

Venture Assets under Management 68.4%

70%

Assets under management of venture fund managers rose

Net IRR Since Inception (%)

60%

steadily between 2003 and 2007, as illustrated in Fig. 5. Dry

powder levels peaked in 2008, when venture firms held $163 50% 47.7%

49.1%

billion as they began to hold back from making investments 40%

in the uncertain economic climate. The aggregate unrealized 28.9%

30% 25.2%

24.8%

value of their portfolio companies fell somewhat in 2008 due

20% 16.4% 17.0%

to the downturn, before recovering the next year following the 12.6% 13.5% 13.5%

10.5% 12.4% 12.1%

improvement in valuations in the second half of 2009. 10% 6.2%

3.5%

6.1%

2.5%

0.0%

0% -3.6% -0.3% -2.3% -3.4%

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

Fig. 4 overleaf shows the top 10 performing venture funds. The -10%

fund universe was restricted to venture funds with fund sizes Mean IRR Standard Deviation of IRRs

of at least USD 50 million. 1998 vintage Matrix Partners V tops Vintage Year

the list, with a net IRR of 514.3%. Columbia Capital managed Source: Preqin

two of the top 10 performing venture funds – Columbia Capital

Equity Partners I-A and I-B. Both were early stage funds, of

vintages 1989 and 1995 respectively. I-A raised $73 million and

achieved a net IRR of 198.5%, while its successor raised $90

million, and its net IRR was 192.3%.

Data Source:

Preqin Performance Analyst

Preqin’s Performance Benchmark module is available free to industry professionals. To sign up for this free private equity

benchmark service please visit:

www.preqin.com/benchmarks

Preqin’s Performance Monitor is the industry’s most extensive source of net to LP private equity fund performance, with full metrics

for over 5,100 named vehicles. In terms of capital raised, Performance Analyst contains data for over 70% of all funds raised

historically.

www.preqin.com/pm

7 Preqin Research Report © 2010 Preqin Ltd. www.preqin.com

Preqin Special Report: The Venture Capital Industry

Fig. 4: Top 10 Performing Venture Funds *

Rank Fund Fund Manager Vintage Fund Size (Mn) Type Net IRR (%)

1 Matrix Partners V Matrix Partners 1998 200 USD Venture (General) 514.3

Benchmark

2 Benchmark Capital Partners II 1997 125 USD Venture (General) 267.8

Capital

3 Matrix Partners IV Matrix Partners 1995 125 USD Venture (General) 218.3

4 Focus Ventures I Focus Ventures 1997 106 USD Venture (General) 213

Columbia Capital Equity Columbia

5 1989 73 USD Early Stage 198.5

Partners I-A Capital

6 Mayfield IX Mayfield Fund 1997 252 USD Venture (General) 195.7

Columbia Capital Equity Columbia

7 1995 90 USD Early Stage 192.3

Partners I-B Capital

8 Accel V Accel Partners 1996 150 USD Venture (General) 188.4

Celtic House International Celtic House

9 1998 241 USD Early Stage 180.1

Corporation Venture Partners

10 Sequoia Capital VII Sequoia Capital 1996 150 USD Early Stage 167.4

Source: Preqin

* Fund universe restricted to funds with sizes of over $50 million

8 Preqin Research Report © 2010 Preqin Ltd. www.preqin.com

Preqin Special Report: The Venture Capital Industry

Investors in Venture Funds

Preqin’s Investor Intelligence database contains information on is targeting investments in the life sciences sector in Europe and

2,167 venture capital investors from across the globe. Just under the US. TRF is included in Fig. 3, which lists 15 notable investors

half (49%) are based in North America, almost a third (32%) are in venture funds that have closed in the last six months.

based in Europe and the remaining 19% are based in Asia and As discussed in other sections of this special report, venture has

Rest of World. seen real growth in Asia. A significant proportion of capital for

Asian funds is coming from domestic investors such as China-

Investor Intelligence monitors a broad range of investors in based Suzhou Ventures Group, which is focused on investing

venture funds. Some 20 different LP types make up Preqin’s solely in domestic venture opportunities. The CNY 6 billion fund

venture investor universe, including fund of funds managers, of funds manager is currently raising its latest venture-focused

public pension funds, private sector pension funds, endowment vehicle, SIP Venture Capital Fund of Funds II, which is targeting

plans, foundations, family offices, banks, investment companies overall commitments of CNY 5 billion. Suzhou Ventures Group

and sovereign wealth funds, amongst others. tends to focus on investments in start-up and early stage growth

funds, mainly in the IT, bio-medicine, energy and environmental

Fig. 1 shows that public pension funds and fund of funds protection fields, but the firm aims to create a diverse portfolio

managers represent the highest proportion of venture investors, and will consider opportunities in all sectors and across all

each accounting for 12% of the investor community. venture stages.

A number of US-based public pension funds include venture Fig. 2 shows the number of venture firms active since 1980.

fund investments as part of a diverse portfolio of private equity The total number of venture capital firms in the industry peaked

fund interests. One such investor is Indiana State Teachers’ in 2009, when there were 1790 firms active in the market. The

Retirement Fund (TRF). The $4.2 billion pension fund has 7.2% number of new firms entering the market peaked in 2000, when

of its overall assets allocated to private equity funds, of which 204 new firms entered the industry. A number of these firms

22% is invested in venture and early stage vehicles. It has made have not raised a fund since then, and are now considered to

commitments to a number of venture funds currently raising or be inactive (assuming a 10-year fund life), meaning that the total

that have reached a final close in the last six months, including annual number of currently active venture firms has fallen for the

a $5 million commitment to California-based Opus Capital II, first time.

which is currently on the road seeking capital. Opus Capital

Partners’ fund is targeting $250 million to invest in early stage

internet, software, networking and semiconductor companies

in the US and Israel. TRF also allocated $13 million to Forbion

Capital Partners’ recently closed Forbion Venture Fund II, which

Fig. 1: Make Up of Investor Universe by Type Fig. 2: Number of Venture Firms Active, 1980 - 2010 YTD

2,000

1,800

1,600

1,400

1,200

1,000

New

800 Existing

600

400

200

0

1980

1981

1982

1983

1984

1985

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

Source: Preqin Source: Preqin

9 Preqin Research Report © 2010 Preqin Ltd. www.preqin.com

Preqin Special Report: The Venture Capital Industry

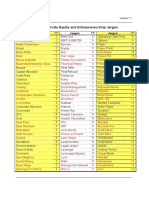

Fig. 3: Notable Investors in Recently Closed Venture Funds

Assets under PE Proportion of

Investor Recent Venture Funds

Investor City Management Allocation PE Portfolio in

Type Invested In

($bn) ($bn) Venture Funds (%)

Alaska Retirement Public Battery Ventures IX; Oak Investment

Juneau 13 1 27%

Management Board Pension Fund Partners XIII

California Public Employees' CalCEF Angel Fund; Chrysalix

Public

Retirement System Sacramento 205 30 16% Energy III; Rembrandt Venture

Pension Fund

(CalPERS) Partners II

Fund of

Credit Suisse Customized Chrysalix Energy III; Early Stage

Funds New York 25 25 N/A

Fund Investment Group Partners Fund II

Manager

Chalmers Innovation Seed Fund AB;

Fund of

Forbion Venture Fund II; Leapfrog

European Investment Fund Funds Luxembourg 5 5 N/A

Microfinance Inclusion Fund; WHEB

Manager

Ventures Private Equity Fund II

European Regional Government Brandenburg Früphasen Fonds;

London 4 N/A N/A

Development Fund Agency Exceed - Midlands Advantage Fund

Indiana State Teachers' Public DCM VI; Forbion Venture Fund II;

Indianapolis 4 0.3 22%

Retirement Fund Pension Fund Oak Investment Partners XIII

International Finance Government Bancroft III; Ignia Fund I; Leapfrog

Washington N/A 3 N/A

Corporation (IFC) Agency Microfinance Inclusion Fund

Los Angeles Fire and Police Public DCM VI; Drug Royalty II; NGN

Los Angeles 12 1 15%

Pension System Pension Fund BioMed Opportunity Fund II

Massachusetts Pension Battery Ventures IX; Polaris Venture

Public

Reserves Investment Boston 44 4 15% Partners VI; Rembrandt Venture

Pension Fund

Management Board Partners II; SV Life Sciences Fund V

Investment Ignia Fund I; Leapfrog Microfinance

Omidyar Network Redwood City 0.2 0.01 100%

Company Inclusion Fund

San Francisco City & County

Public

Employees' Retirement San Francisco 13 1.7 17% DCM VI; Polaris Venture Partners VI

Pension Fund

System

Small Industries Investment

Lucknow 7 0.1 N/A SME Growth Fund II

Development Bank of India Bank

Soros Economic Ignia Fund I; Leapfrog Microfinance

Foundation New York 0.1 N/A 100%

Development Fund Inclusion Fund

State of Wisconsin Public Drug Royalty II; Oak Investment

Madison 78 4 7%

Investment Board Pension Fund Partners XIII

West Midlands Pension Public

Wolverhampton 12 1 5% DCM VI; Atomico Ventures II

Fund Pension Fund

Source: Preqin

Data Source:

Preqin Investor Intelligence Database

Preqin’s Investor Intelligence database currently monitors 2,167 global investors in venture funds of all types from early stage

through to expansion and late stage vehicles. In total, these investors are managing approximately $1.7 trillion in private equity

assets.

www.preqin.com/ii

10 Preqin Research Report © 2010 Preqin Ltd. www.preqin.com

Preqin Online Services

Order Form

For more information on any of Preqin’s online services, please visit: wwww.preqin.com

Order? Order?

Name Standard License Premium License

(Please Tick) (Please Tick)

Private Equity Online £5,050 £10,500

(All Five PE Services - includes 10% discount)

Performance Analyst £1,150 £2,350

Funds in Market £550 £1,025

Fund Manager Profiles £1,050 £2,650

Investor Intelligence £1,700 £3,300

Deals Analyst £1,150 £2,350

Real Estate Online £1,400 £2,850

Real Estate Capital Source £550 £1,025

Infrastructure Online £1,050 £2,850

Hedge Investor Profiles £1,150 £2,350

10% discount is available for any four private equity modules, please contact us at info@preqin.com for more information.

Completed Order

Payment Details: Premium Licence Details:

Forms:

Post: Cheque enclosed (please make cheque payable to ‘Preqin’) Multi-User Names:

Preqin,

Scotia House, Credit Card Amex Mastercard

33 Finsbury Square,

London,EC2A 1BB Visa Please invoice me

Preqin,

230 Park Avenue Card Number:

10th Floor,

New York, NY 10169 Name on Card:

Expiration Date:

Fax:

Multi-User Emails:

+44 (0)87 0330 5892 Security Code:

+1 440 445 9595

Email:

info@preqin.com

Telephone:

+44 (0)20 7065 5100

American Express, four digit Visa and Mastercard, last

+1 212 808 3008 three digits printed on the

code printed on the front of

the card. signature strip.

Term of subscription for online services is twelve months from the date of this Subscription Form, during which time Preqin Ltd. will supply the service as listed above, and the

Customer will pay the subscription fee and comply with all other provisions of the Terms and Conditions listed on Preqin’s website and also the Subscription Form, collectively

the “Agreement”. Upon completion of the initial and subsequent twelve month subscription periods, the subscription will be renewed for a further period of twelve months at the

then current subscription price, unless terminated prior to renewal by the Client. Preqin undertakes to give the Client notification of each impending renewal at least 30 days

prior to each renewal. This Subscription Form and the Terms and Conditions, comprise the entire Agreement between the Customer and Preqin Ltd.

I have read the terms and conditions and agree to abide by them:

Signature: Date:

You might also like

- Venture Investing After The Bubble: A Decade of EvolutionDocument10 pagesVenture Investing After The Bubble: A Decade of Evolutionsweber7079No ratings yet

- PitchBook US Institutional Investors 2016 PE VC Allocations ReportDocument14 pagesPitchBook US Institutional Investors 2016 PE VC Allocations ReportJoJo GunnellNo ratings yet

- Venture Capital in Emerging MarketsDocument2 pagesVenture Capital in Emerging Marketscamilo nietoNo ratings yet

- PE VC Funding An OverviewDocument20 pagesPE VC Funding An OverviewGautam MehtaNo ratings yet

- Private Equity Secondaries China - PEI Magazine WhitepaperDocument2 pagesPrivate Equity Secondaries China - PEI Magazine WhitepaperpfuhrmanNo ratings yet

- Role of Merger Acquisition in BankingDocument113 pagesRole of Merger Acquisition in BankingParag MoreNo ratings yet

- Structuring Venture Capital, Private Equity, and Entrepreneural Transactions (Review)Document3 pagesStructuring Venture Capital, Private Equity, and Entrepreneural Transactions (Review)wclonnNo ratings yet

- Initial Public Offerings An Issuers Guide 1Document105 pagesInitial Public Offerings An Issuers Guide 1Milos MilosNo ratings yet

- Allied Minds (ALM LN)Document28 pagesAllied Minds (ALM LN)kerrisdalecapitalNo ratings yet

- DDR Presentation For239482934Document45 pagesDDR Presentation For239482934shital_vyas1987No ratings yet

- FINA 652 Private Equity: Class I Introduction To The Private Equity IndustryDocument53 pagesFINA 652 Private Equity: Class I Introduction To The Private Equity IndustryHarsh SrivastavaNo ratings yet

- Private Equity in Turkey - SantaDocument36 pagesPrivate Equity in Turkey - SantaOzan CigizogluNo ratings yet

- Fundamental Requirements For Building An Islamic Venture Capital Model PDFDocument12 pagesFundamental Requirements For Building An Islamic Venture Capital Model PDFNader MehdawiNo ratings yet

- 2016 Preqin Global Private Equity and Venture Capital Report Sample Pages PERACS PersistenceDocument2 pages2016 Preqin Global Private Equity and Venture Capital Report Sample Pages PERACS PersistenceTDGoddardNo ratings yet

- 2021 09 Private Equity Venture Capital (6QQMN562) - Assessment Overview and Marking CriteriaDocument5 pages2021 09 Private Equity Venture Capital (6QQMN562) - Assessment Overview and Marking CriteriaEshaan SharmaNo ratings yet

- Institutional Ownership, Tender Offers, and Long-Term InvestmentsDocument23 pagesInstitutional Ownership, Tender Offers, and Long-Term InvestmentsJanetLindenmuthNo ratings yet

- Advantages and Disadvantages of An IPODocument2 pagesAdvantages and Disadvantages of An IPOHemali100% (1)

- 2021 07 06 Private-Equity-Food-Fight-NlDocument26 pages2021 07 06 Private-Equity-Food-Fight-NlXavier StraussNo ratings yet

- Progyny S-1 FilingDocument217 pagesProgyny S-1 FilingCrain's New York BusinessNo ratings yet

- Facebook Ipo Roadshow Presentation PDFDocument2 pagesFacebook Ipo Roadshow Presentation PDFKyleNo ratings yet

- Ê, in Finance, Is AnDocument11 pagesÊ, in Finance, Is AnJome MathewNo ratings yet

- OQ Methodolgy For Hedge FundsDocument23 pagesOQ Methodolgy For Hedge FundsSteve KravitzNo ratings yet

- Privcap: Portfolio Operations YearbookDocument36 pagesPrivcap: Portfolio Operations YearbookMEGNo ratings yet

- A Study On Private Equity in IndiaDocument21 pagesA Study On Private Equity in IndiaPrabakar NatrajNo ratings yet

- Private Equity Insiders GuideDocument13 pagesPrivate Equity Insiders GuidemsmetoNo ratings yet

- Going Public - Due Diligence ChecklistDocument5 pagesGoing Public - Due Diligence ChecklistDarthTrader69No ratings yet

- IAVC - Venture Capital Training PDFDocument77 pagesIAVC - Venture Capital Training PDFvikasNo ratings yet

- IB - Sessions Private EquityDocument4 pagesIB - Sessions Private EquityDivya Jain50% (2)

- PWC Executing Successful IpoDocument13 pagesPWC Executing Successful Ipolalitkumar_itmbmNo ratings yet

- Due DilligenceDocument26 pagesDue Dilligencedonny_khosla100% (1)

- Get Your Team Up To Speed: Benefits IncludeDocument2 pagesGet Your Team Up To Speed: Benefits IncludeAmol ShikariNo ratings yet

- 1Q 14 VCchart PDFDocument25 pages1Q 14 VCchart PDFBayAreaNewsGroupNo ratings yet

- First Round Capital Slide Deck PDFDocument10 pagesFirst Round Capital Slide Deck PDFEmily StanfordNo ratings yet

- The New Takeover Code, 2011 PDFDocument16 pagesThe New Takeover Code, 2011 PDFHarsh BansalNo ratings yet

- Funding of AcquisitionsDocument41 pagesFunding of AcquisitionssandipNo ratings yet

- Limited PartnersDocument2 pagesLimited PartnersDavid TollNo ratings yet

- IBM Capital StructureDocument53 pagesIBM Capital Structureyajkr0% (1)

- Pere 50Document15 pagesPere 50Ravin JagooNo ratings yet

- UBS Outlook 2024Document120 pagesUBS Outlook 2024Vivek TiwariNo ratings yet

- Pere 2013 Top 50Document15 pagesPere 2013 Top 50brettgrobNo ratings yet

- Private Equity JargonDocument14 pagesPrivate Equity JargonWilling ZvirevoNo ratings yet

- AdvanceAutoPartsConference Call Presentation101613Document18 pagesAdvanceAutoPartsConference Call Presentation101613aedcbf123No ratings yet

- Listing Procedure and IPO ProcessDocument27 pagesListing Procedure and IPO ProcessJade EdajNo ratings yet

- EMPEA Emerging Markets Mezzanine Report May 2014 WEBDocument32 pagesEMPEA Emerging Markets Mezzanine Report May 2014 WEBJurgenNo ratings yet

- Zero Revenue IPOsDocument16 pagesZero Revenue IPOsAshe MarpleNo ratings yet

- The Economic Case For Private EquityDocument34 pagesThe Economic Case For Private EquitymarkbankingsNo ratings yet

- Anti TakeoverDocument24 pagesAnti TakeoverMallesh MysoreNo ratings yet

- EY Funding For Growth The EY Guide To Going PublicDocument2 pagesEY Funding For Growth The EY Guide To Going PublicAayushi AroraNo ratings yet

- Valuation Q&A McKinseyDocument4 pagesValuation Q&A McKinseyZi Sheng NeohNo ratings yet

- HEC - Dow Jones - PE Fitness Rankings - FAQ - FinalDocument11 pagesHEC - Dow Jones - PE Fitness Rankings - FAQ - FinalDan PrimackNo ratings yet

- Venture Capital Deal TermsDocument53 pagesVenture Capital Deal TermsTrang TranNo ratings yet

- A Guide To Venture CapitalDocument4 pagesA Guide To Venture CapitalgargramNo ratings yet

- Private Equity, FOF OperatorsDocument5 pagesPrivate Equity, FOF Operatorspeplayer1No ratings yet

- 2017 Investor Day FinalDocument131 pages2017 Investor Day FinalAlin RewaxisNo ratings yet

- Macquarie ESG Perspective PDFDocument20 pagesMacquarie ESG Perspective PDFDare SmithNo ratings yet

- Venture-Capital Financing and The Growth of Startup FirmsDocument31 pagesVenture-Capital Financing and The Growth of Startup Firmstripledash100% (1)

- The Five Types of Successful AcquisitionsDocument7 pagesThe Five Types of Successful Acquisitionsbubb_rubbNo ratings yet

- Dokumen - Tips - Middle East Venture Capital Private Equity DirectoryDocument15 pagesDokumen - Tips - Middle East Venture Capital Private Equity DirectorySadeq ObaidNo ratings yet

- TransdigmDocument4 pagesTransdigmTMFUltimateNo ratings yet

- Private Equity Solar InvestmentsDocument2 pagesPrivate Equity Solar Investmentshttp://besthedgefund.blogspot.comNo ratings yet

- Primer On Private EquityDocument19 pagesPrimer On Private Equityhttp://besthedgefund.blogspot.comNo ratings yet

- Private Equity Bench MarkingDocument2 pagesPrivate Equity Bench Markinghttp://besthedgefund.blogspot.comNo ratings yet

- Private Equity in AsiaDocument4 pagesPrivate Equity in Asiahttp://besthedgefund.blogspot.comNo ratings yet

- Preqin Report Cleantech in Emerging MarketsDocument6 pagesPreqin Report Cleantech in Emerging Marketshttp://besthedgefund.blogspot.comNo ratings yet

- New Securities Law RegulationDocument4 pagesNew Securities Law Regulationhttp://besthedgefund.blogspot.comNo ratings yet

- Preqin Private Equity Investor Survey Oct2010Document9 pagesPreqin Private Equity Investor Survey Oct2010http://besthedgefund.blogspot.comNo ratings yet

- AIMA Journal: Alternative Investment Management AssociationDocument32 pagesAIMA Journal: Alternative Investment Management Associationhttp://besthedgefund.blogspot.comNo ratings yet

- Preqin Report - Infrastructure Deals Q3 2010Document1 pagePreqin Report - Infrastructure Deals Q3 2010http://besthedgefund.blogspot.comNo ratings yet

- Making The Case: Private EquityDocument8 pagesMaking The Case: Private Equityhttp://besthedgefund.blogspot.comNo ratings yet

- Legal Update The Eu Directive On Alternative Investment Fund ManagersDocument6 pagesLegal Update The Eu Directive On Alternative Investment Fund Managershttp://besthedgefund.blogspot.comNo ratings yet

- KP Hedge Funds NewsletterDocument4 pagesKP Hedge Funds Newsletterhttp://besthedgefund.blogspot.comNo ratings yet

- Credit Performance of Private Equity Backed Companies in Great RecessionDocument29 pagesCredit Performance of Private Equity Backed Companies in Great Recessionhttp://besthedgefund.blogspot.comNo ratings yet

- Channel Islands Will Meet Aifmd CriteriaDocument1 pageChannel Islands Will Meet Aifmd Criteriahttp://besthedgefund.blogspot.comNo ratings yet

- 50 Largest Hedge Funds in The WorldDocument6 pages50 Largest Hedge Funds in The Worldhttp://besthedgefund.blogspot.comNo ratings yet

- 50 Largest Hedge Fund Managers in EuropeDocument12 pages50 Largest Hedge Fund Managers in Europehttp://besthedgefund.blogspot.comNo ratings yet

- 50 Largest Hedge Fund Managers in USDocument12 pages50 Largest Hedge Fund Managers in UShttp://besthedgefund.blogspot.com100% (1)

- Hedge Fund Profile-PioneerDocument2 pagesHedge Fund Profile-Pioneerhttp://besthedgefund.blogspot.comNo ratings yet

- Hedge Fund Profile-IskandiaDocument2 pagesHedge Fund Profile-Iskandiahttp://besthedgefund.blogspot.comNo ratings yet

- The Preqin Quarterly Q3 2010Document28 pagesThe Preqin Quarterly Q3 2010http://besthedgefund.blogspot.comNo ratings yet

- Survey of Investors in Hedge Funds 2010Document6 pagesSurvey of Investors in Hedge Funds 2010http://besthedgefund.blogspot.comNo ratings yet

- Hedge Fund Profile-CheyneDocument2 pagesHedge Fund Profile-Cheynehttp://besthedgefund.blogspot.comNo ratings yet

- Hedge Fund Profile-NumenDocument2 pagesHedge Fund Profile-Numenhttp://besthedgefund.blogspot.comNo ratings yet

- EPC Industry in IndiaDocument54 pagesEPC Industry in IndiaHarsh Kedia100% (1)

- Dealogic IntroductionDocument7 pagesDealogic IntroductionAndrás ÁcsNo ratings yet

- Ch02 TB Loftus 3e - Textbook Solution Ch02 TB Loftus 3e - Textbook SolutionDocument12 pagesCh02 TB Loftus 3e - Textbook Solution Ch02 TB Loftus 3e - Textbook SolutionTrinh LêNo ratings yet

- Chhaya, G., & Nigam, P. (2015) - Value Investing With Price-Earnings Ratio in India. IUP Journal of Applied Finance, 21 (2), 34-48.Document16 pagesChhaya, G., & Nigam, P. (2015) - Value Investing With Price-Earnings Ratio in India. IUP Journal of Applied Finance, 21 (2), 34-48.firebirdshockwaveNo ratings yet

- Hedge Presentation Vishnu C KH - Bu.p2mba20058 b5crm60Document15 pagesHedge Presentation Vishnu C KH - Bu.p2mba20058 b5crm60Vishnu CNo ratings yet

- Foreign Exchange RateDocument8 pagesForeign Exchange RateDishaNo ratings yet

- The Irate DistributorDocument29 pagesThe Irate DistributorSnehashish Chowdhary100% (7)

- Globalisation and Technology 2023Document8 pagesGlobalisation and Technology 2023TasmineNo ratings yet

- Mizuho - AssociationsDocument4 pagesMizuho - AssociationsNaresh KumarNo ratings yet

- Solved On March 31 2018 Wolfson Corporation Acquired All of TheDocument1 pageSolved On March 31 2018 Wolfson Corporation Acquired All of TheAnbu jaromiaNo ratings yet

- RITES - Limited - AR - 2020 21 - PDF 2021 Sep 04 21 19 58Document280 pagesRITES - Limited - AR - 2020 21 - PDF 2021 Sep 04 21 19 58Rajni SharmaNo ratings yet

- Capex Cycle MultibaggersDocument4 pagesCapex Cycle MultibaggersJaikumar KrishnaNo ratings yet

- Master The MarketsDocument144 pagesMaster The Marketsicm6394% (16)

- Case Analysis of Investment Banking at Thomas Weisel PartnersDocument2 pagesCase Analysis of Investment Banking at Thomas Weisel PartnersabhinavNo ratings yet

- Operating Cash InflowDocument11 pagesOperating Cash InflowRarajNo ratings yet

- Ratio AnalysisDocument71 pagesRatio AnalysisSubramanya DgNo ratings yet

- Money SupplyDocument6 pagesMoney SupplyShreya RaiNo ratings yet

- Mercantile Law 2010 Bar ExaminationDocument7 pagesMercantile Law 2010 Bar ExaminationMichiko CosicoNo ratings yet

- Starbucks Financial AnalysisDocument4 pagesStarbucks Financial AnalysisVanillaNo ratings yet

- FRM SwapsDocument64 pagesFRM Swapsakhilyerawar7013No ratings yet

- Group 5 Case of Financial StatementDocument6 pagesGroup 5 Case of Financial StatementDhomas AgastyaNo ratings yet

- QUIZ7 Audit of LiabilitiesDocument3 pagesQUIZ7 Audit of LiabilitiesCarmela GulapaNo ratings yet

- As You Sow, 3 Studies On The Soucial Consecuences of Agri-BuisnessDocument535 pagesAs You Sow, 3 Studies On The Soucial Consecuences of Agri-BuisnessjimborenoNo ratings yet

- CAIIB BFM Numerical Case Study by MuruganDocument36 pagesCAIIB BFM Numerical Case Study by MuruganRakesh Singh84% (44)

- Feasibilitystudies 120104022056 Phpapp01Document39 pagesFeasibilitystudies 120104022056 Phpapp01Asif JeelaniNo ratings yet

- Axis Smallcap FundDocument1 pageAxis Smallcap FundManoj JainNo ratings yet

- Monmouth Case SolutionDocument16 pagesMonmouth Case SolutionAjaxNo ratings yet

- Case Study - 5Document7 pagesCase Study - 5CA Saurabh LonawatNo ratings yet

- NYSF Leveraged Buyout Model Solution Part TwoDocument20 pagesNYSF Leveraged Buyout Model Solution Part TwoBenNo ratings yet

- Project Report On "Comparative Analysis of Stock Brokers"Document19 pagesProject Report On "Comparative Analysis of Stock Brokers"Kunal KhandelwalNo ratings yet

- Generative AI: The Insights You Need from Harvard Business ReviewFrom EverandGenerative AI: The Insights You Need from Harvard Business ReviewRating: 4.5 out of 5 stars4.5/5 (2)

- Four Battlegrounds: Power in the Age of Artificial IntelligenceFrom EverandFour Battlegrounds: Power in the Age of Artificial IntelligenceRating: 5 out of 5 stars5/5 (5)

- Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent MoneyFrom EverandDigital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent MoneyRating: 4 out of 5 stars4/5 (51)

- Scary Smart: The Future of Artificial Intelligence and How You Can Save Our WorldFrom EverandScary Smart: The Future of Artificial Intelligence and How You Can Save Our WorldRating: 4.5 out of 5 stars4.5/5 (55)

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumFrom EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumRating: 3 out of 5 stars3/5 (12)

- The AI Advantage: How to Put the Artificial Intelligence Revolution to WorkFrom EverandThe AI Advantage: How to Put the Artificial Intelligence Revolution to WorkRating: 4 out of 5 stars4/5 (7)

- The Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyFrom EverandThe Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyNo ratings yet

- AI Superpowers: China, Silicon Valley, and the New World OrderFrom EverandAI Superpowers: China, Silicon Valley, and the New World OrderRating: 4.5 out of 5 stars4.5/5 (399)

- The E-Myth Revisited: Why Most Small Businesses Don't Work andFrom EverandThe E-Myth Revisited: Why Most Small Businesses Don't Work andRating: 4.5 out of 5 stars4.5/5 (709)

- The Master Algorithm: How the Quest for the Ultimate Learning Machine Will Remake Our WorldFrom EverandThe Master Algorithm: How the Quest for the Ultimate Learning Machine Will Remake Our WorldRating: 4.5 out of 5 stars4.5/5 (107)

- The Bitcoin Standard: The Decentralized Alternative to Central BankingFrom EverandThe Bitcoin Standard: The Decentralized Alternative to Central BankingRating: 4.5 out of 5 stars4.5/5 (41)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNFrom Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNRating: 4.5 out of 5 stars4.5/5 (3)

- YouTube Secrets: The Ultimate Guide on How to Start and Grow Your Own YouTube Channel, Learn the Tricks To Make a Successful and Profitable YouTube ChannelFrom EverandYouTube Secrets: The Ultimate Guide on How to Start and Grow Your Own YouTube Channel, Learn the Tricks To Make a Successful and Profitable YouTube ChannelRating: 4.5 out of 5 stars4.5/5 (48)

- The World's Most Dangerous Geek: And More True Hacking StoriesFrom EverandThe World's Most Dangerous Geek: And More True Hacking StoriesRating: 4 out of 5 stars4/5 (50)

- 100M Offers Made Easy: Create Your Own Irresistible Offers by Turning ChatGPT into Alex HormoziFrom Everand100M Offers Made Easy: Create Your Own Irresistible Offers by Turning ChatGPT into Alex HormoziNo ratings yet

- Who's Afraid of AI?: Fear and Promise in the Age of Thinking MachinesFrom EverandWho's Afraid of AI?: Fear and Promise in the Age of Thinking MachinesRating: 4.5 out of 5 stars4.5/5 (13)

- Data-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseFrom EverandData-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseRating: 3.5 out of 5 stars3.5/5 (12)

- HBR's 10 Must Reads on AI, Analytics, and the New Machine AgeFrom EverandHBR's 10 Must Reads on AI, Analytics, and the New Machine AgeRating: 4.5 out of 5 stars4.5/5 (69)

- Artificial Intelligence: The Insights You Need from Harvard Business ReviewFrom EverandArtificial Intelligence: The Insights You Need from Harvard Business ReviewRating: 4.5 out of 5 stars4.5/5 (104)

- Binary Option Trading: Introduction to Binary Option TradingFrom EverandBinary Option Trading: Introduction to Binary Option TradingNo ratings yet

- The $100 Startup by Chris Guillebeau: Summary and AnalysisFrom EverandThe $100 Startup by Chris Guillebeau: Summary and AnalysisRating: 4 out of 5 stars4/5 (8)

- Your AI Survival Guide: Scraped Knees, Bruised Elbows, and Lessons Learned from Real-World AI DeploymentsFrom EverandYour AI Survival Guide: Scraped Knees, Bruised Elbows, and Lessons Learned from Real-World AI DeploymentsNo ratings yet

- Eric Ries’ The Lean Startup How Today's Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses SummaryFrom EverandEric Ries’ The Lean Startup How Today's Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses SummaryRating: 4.5 out of 5 stars4.5/5 (11)

- Build: An Unorthodox Guide to Making Things Worth MakingFrom EverandBuild: An Unorthodox Guide to Making Things Worth MakingRating: 5 out of 5 stars5/5 (123)