Professional Documents

Culture Documents

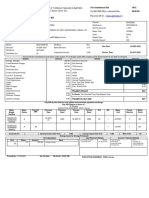

Taxation Report

Uploaded by

Anne ElamparoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxation Report

Uploaded by

Anne ElamparoCopyright:

Available Formats

Modes of payment of internal revenue taxes

Under Rev. Regs. No. 16-2002, aside from the electronic payment system currently used by some

taxpayers in paying their BIR taxes, the rest shall pay their taxes through an accredited agent bank

(AAB), using any of the following acceptable modes of payments:

(1) Over-the-counter cash payment. – It refers to payment of tax liabilities to authorized agent

banks (ABBs) in the currencies (paper bills or coins) that are legal tender in the Philippines. The

maximum amount allowed per tax payment shall not exceed P10,000.00; OR

(2) Bank debit system. – It refers to the system whereby the taxpayer, through a bank debit

memo/advice, authorizes withdrawals from his/its existing bank accounts for payment of tax

liabilities. It is allowed only if the taxpayer has a bank account with the AAB branch where he/it

intends to file and pay is/its tax return/form/declaration, provided said AAB branch is within the

jurisdiction of the BIR Revenue District Office (RDO)/Large Taxpayers District Office (LTDO)

where the tax payment is due and payable; or

(3) Check. – It refers to a bill of exchange or order instructed drawn on a bank payable on demand.

In the issuance and accomplishment of checks for the payment of internal revenue

taxes, the taxpayer shall indicate in the space provided for “PAY TO THE ORDER OF” the

following data: (a) presenting/collecting bank where the payment is to be coursed; and

(b) FAO (For the Account OF) Bureau of Internal Revenue; and under the “ACCOUNT

NAME,” the taxpayer identification number.

The following checks are, however, not acceptable as check payments to internal revenue taxes:

(a) Accommodation checks or checks issued or drawn by a party other than the taxpayer making

the payment.

(b) Second endorsed checks or checks issued to the taxpayer as payee who indorses the same as

payment for the taxes.

(c) Stale checks or checks dated more than six (6) months prior to presentation to the authorized

agent bank.

(d) Postdated check of checks dated a day or several days after the date of presentation to the

authorized agent bank;

(e) Unsigned checks or checks with no signature of the drawer; and

(f) Altered checks or checks with alteration/erasures.

AABs accepting checks for the payment of BIR taxes and other charges must see to it that the check

covers one tax type for one return period only. Moreover, ABBs must strictly comply with the system

and procedures for the reception, processing, clearing and accounting of the checks to be prescribed

under a separate regulation.

Second endorsement of checks which are payable to the Bureau of Internal Revenue is absolutely

prohibited. (Sec. 3 thereof.)

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Reaction Paper in Seminar Entitled "Build Your Career Image and Skills Enhancement For Personal Career Success"Document1 pageReaction Paper in Seminar Entitled "Build Your Career Image and Skills Enhancement For Personal Career Success"Anne Elamparo87% (31)

- Gardenia Reaction PaperDocument1 pageGardenia Reaction PaperAnne ElamparoNo ratings yet

- AppetizerDocument1 pageAppetizerAnne ElamparoNo ratings yet

- DONOR's TaxDocument4 pagesDONOR's TaxAnne Elamparo50% (4)

- Taxation General Provisions ReportDocument2 pagesTaxation General Provisions ReportAnne ElamparoNo ratings yet

- MIS LetterDocument2 pagesMIS LetterAnne ElamparoNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Business Process Design Document: Host To Host Finance Host To HostDocument10 pagesBusiness Process Design Document: Host To Host Finance Host To HostManish Bhasin100% (2)

- April 11, 2023: Honda Financial Services Is A DBA of American Honda Finance CorporationDocument1 pageApril 11, 2023: Honda Financial Services Is A DBA of American Honda Finance CorporationChristina EscobarNo ratings yet

- Auction Notice Mahendragarh - Bhiwani PDFDocument19 pagesAuction Notice Mahendragarh - Bhiwani PDFhashimhasnainhadiNo ratings yet

- Statement 011417 PDFDocument3 pagesStatement 011417 PDFKathleen MendegorinNo ratings yet

- Engagement Letter New Client (Sample-Modify As Appropriate) : Provided)Document4 pagesEngagement Letter New Client (Sample-Modify As Appropriate) : Provided)Triton007100% (1)

- Coles No Annual Fee Platinum Mastercard 5969 22102023 3Document2 pagesColes No Annual Fee Platinum Mastercard 5969 22102023 3dc464tzvtvNo ratings yet

- Bank Reconciliation StatementDocument3 pagesBank Reconciliation StatementKritika HarlalkaNo ratings yet

- 123-Dec2019 RMDocument9 pages123-Dec2019 RMsatishNo ratings yet

- Statement of Account: Date of Opening Account Status Account Type Currency Arini TradesDocument7 pagesStatement of Account: Date of Opening Account Status Account Type Currency Arini Tradesanbu karunakaranNo ratings yet

- How To Write A Salt Room Business PlanDocument15 pagesHow To Write A Salt Room Business Planwaleed saeedNo ratings yet

- WWW - Sssc.gov - In: Stenographer Grade-IiiDocument9 pagesWWW - Sssc.gov - In: Stenographer Grade-Iiimohit yadavNo ratings yet

- BILL Noc MergedDocument2 pagesBILL Noc Mergednispaksh awasthiNo ratings yet

- How To Pay InternationalDocument2 pagesHow To Pay InternationalAhmed AliNo ratings yet

- Bill PPPPPDocument6 pagesBill PPPPPsnelu1178No ratings yet

- Comparative Study of LG Electronics With Its CompetotorsDocument73 pagesComparative Study of LG Electronics With Its Competotorsdabralvipin0% (1)

- CWD 2020 1st Edition CCDocument113 pagesCWD 2020 1st Edition CCClevia TabinasNo ratings yet

- Council Tax 2023 - 2023-03-06 - 1Document2 pagesCouncil Tax 2023 - 2023-03-06 - 1tunlinoo.067433No ratings yet

- SwiftcashDocument33 pagesSwiftcashLibinNo ratings yet

- Kushaq: Ambition 1.0 at Style 1.0 at Style 1.5 atDocument2 pagesKushaq: Ambition 1.0 at Style 1.0 at Style 1.5 atAditi Reddy ChittetiNo ratings yet

- Tlokweng Prospectus Pre and Primary 1Document6 pagesTlokweng Prospectus Pre and Primary 1GustafaGovachefMotivatiNo ratings yet

- Instructions For Form W-8BEN-E: (Rev. October 2021)Document20 pagesInstructions For Form W-8BEN-E: (Rev. October 2021)Samuel Albert PedroNo ratings yet

- KPTDocument115 pagesKPTUsama AkhtarNo ratings yet

- 226.23 Right of RescissionDocument12 pages226.23 Right of RescissionNetjer Lexx TVNo ratings yet

- Soneri Bank Internship ReportDocument24 pagesSoneri Bank Internship ReportOvaIs MoInNo ratings yet

- Five Hundred Thousand Great Britain Pounds: Our Ref: Cbn/Ohg/Oxd1/2014 Payment File: RBI/id1033/2014 Payment AmountDocument2 pagesFive Hundred Thousand Great Britain Pounds: Our Ref: Cbn/Ohg/Oxd1/2014 Payment File: RBI/id1033/2014 Payment AmountShaswat SinghNo ratings yet

- End To End Configuration of AR in R12Document19 pagesEnd To End Configuration of AR in R12강태민No ratings yet

- How To File Your Income Tax Return in The Philippines-COMPENSATIONDocument10 pagesHow To File Your Income Tax Return in The Philippines-COMPENSATIONmiles1280No ratings yet

- Bustonera Chito Noel D. July2022 GADocument3 pagesBustonera Chito Noel D. July2022 GAJohn Carlo D. EngayNo ratings yet

- Give It Back To Me PLEDGE-DEPOSITDocument3 pagesGive It Back To Me PLEDGE-DEPOSITRoland IntudNo ratings yet

- Choco NutsDocument4 pagesChoco NutsKuttyNo ratings yet