Professional Documents

Culture Documents

Tax

Uploaded by

Tushar GautamOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax

Uploaded by

Tushar GautamCopyright:

Available Formats

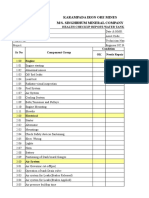

ARYAN INSTITUTE OF TECHNOLOGY

GHAZIABAD

LECTURE PLAN AND OUTLINE SYLLABUS

COURSE:- MBA(2009-2011)

SEMESTER:- 4th

SUBJECT:- TAX PLANNING AND MANAGEMENT.

SUBJECT CODE:-MBA FM 04

NO. OF LECTURE REQUIRED:- 40(FORTY)

FACULTY:- SARITA SRIVASTAV, e-mailid-srivastavsarita@yahoo.com,(M)-9716182207

OBJECTIVES :- The Objective of this course is to make the students aware of the taxation system

of India.How to calculate tax on the income of an individual and corporates.What are the criterias

given by the Income Tax Department for that and much more. The study of this course will enhance

the knowledge of the students. This course will make them aware of the INCOME TAX

ACT,1961 and the provisions there in.

PEDAGOGY :- Course materials will be presented by combining lectures with active classroom

discussions,in class and homework problems.

Session Plan :

Unit Topic Content No. of lectures Date Remarks

required

I Nature & Scope Of Nature of Tax Management 10 (Ten)

Tax Planning Objective of Tax Management

Tax Planning

Tax Avoidance & Evasion

Meaning Of Assessment Year &

Previous Year

Who is an Assessee?

Types of Assessee

Residential Status

Non – resident Indians.

II Tax On Individual Computation of Tax under the 10 (Ten)

Income heads of Salaries

Income from House Property

Profits & Gains of Business

Capital Gains

Income from Other Sources

TDS (Tax Deductible at source)

III Corporate Income Tax Concessions & incentives to 12 (Twelve)

Tax be taken for corporate decision

Tax Planning for Depriciation

Treatment of lossess &

unabsorbed items

Carry forward and set off lossess

Tax and business reorganisations

i.e. merger & amalgamation

Tax Planning regarding

Employess Remuneration

Tax Appeals

Revision & Review

Wealth Tax on closely held

companies

Method of Valuation of assets

Procedure of filing of returns

Assessment

Appeals

Review

Revision & Rectification.

IV Central Excise What is Customs Act? 8 (Eight)

Act,1994 & Excise How Custom dusties Planning

Planning are done?

Discussions about Consumer

Protection Act 1962 &

Customers Planning

(Working Knowledge is required

for all these).

SUGGESTED READINGS :-

(1) Bhatia H L – Public Finance (Vikas, 1999, 20th Edition).

(2) Lakhotia R N – How to Save Wealth Tax (Vision Book 2001, 9th Edition).

(3) Prasad Bhagwati – Income Tax Law & Practice (Vishwa Prakashan).

(4) Santaram R – Tax Planning by Reports (Taxmann, 1978).

(5) Singhania V K – Direct Taxes, Law & Practice (Taxmann, 40th Edition).

(6) Datey V.S. - Indirect Taxes – Law & Practice (Taxmann, 20th Edition).

(7) Singhania V K, Singhania Monica – Student Guide to Income Tax (Taxmann).

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Student Exploration: Digestive System: Food Inio Simple Nutrien/oDocument9 pagesStudent Exploration: Digestive System: Food Inio Simple Nutrien/oAshantiNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hetal Patel: Team Leader - SalesDocument2 pagesHetal Patel: Team Leader - SalesPrashant kumarNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Revit 2023 Architecture FudamentalDocument52 pagesRevit 2023 Architecture FudamentalTrung Kiên TrầnNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- DxDiag Copy MSIDocument45 pagesDxDiag Copy MSITạ Anh TuấnNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Department of Education: Income Generating ProjectDocument5 pagesDepartment of Education: Income Generating ProjectMary Ann CorpuzNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- FSM Syllabus20071228 1Document3 pagesFSM Syllabus20071228 1Institute of Fengshui BaziNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Project Manager PMP PMO in Houston TX Resume Nicolaas JanssenDocument4 pagesProject Manager PMP PMO in Houston TX Resume Nicolaas JanssenNicolaasJanssenNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- MECANISMOS de Metais de TransicaoDocument36 pagesMECANISMOS de Metais de TransicaoJoão BarbosaNo ratings yet

- Q4 Music 6 Module 2Document15 pagesQ4 Music 6 Module 2Dan Paolo AlbintoNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Centrifuge ThickeningDocument8 pagesCentrifuge ThickeningenviroashNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Dehn Brian Intonation SolutionsDocument76 pagesDehn Brian Intonation SolutionsEthan NealNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- SEC CS Spice Money LTDDocument2 pagesSEC CS Spice Money LTDJulian SofiaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Internship ReportDocument36 pagesInternship ReportM.IMRAN0% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- How Can Literary Spaces Support Neurodivergent Readers and WritersDocument2 pagesHow Can Literary Spaces Support Neurodivergent Readers and WritersRenato Jr Bernadas Nasilo-anNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Tachycardia Algorithm 2021Document1 pageTachycardia Algorithm 2021Ravin DebieNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Research On Export Trade in BangladeshDocument7 pagesResearch On Export Trade in BangladeshFarjana AnwarNo ratings yet

- Discrete Mathematics and Its Applications: Basic Structures: Sets, Functions, Sequences, and SumsDocument61 pagesDiscrete Mathematics and Its Applications: Basic Structures: Sets, Functions, Sequences, and SumsBijori khanNo ratings yet

- N50-200H-CC Operation and Maintenance Manual 961220 Bytes 01Document94 pagesN50-200H-CC Operation and Maintenance Manual 961220 Bytes 01ANDRESNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Toxemias of PregnancyDocument3 pagesToxemias of PregnancyJennelyn LumbreNo ratings yet

- PCI Bridge ManualDocument34 pagesPCI Bridge ManualEm MarNo ratings yet

- Session4 Automotive Front End DesignDocument76 pagesSession4 Automotive Front End DesignShivprasad SavadattiNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- GTA IV Simple Native Trainer v6.5 Key Bindings For SingleplayerDocument1 pageGTA IV Simple Native Trainer v6.5 Key Bindings For SingleplayerThanuja DilshanNo ratings yet

- Geometry and IntuitionDocument9 pagesGeometry and IntuitionHollyNo ratings yet

- List of Phrasal Verbs 1 ColumnDocument12 pagesList of Phrasal Verbs 1 ColumnmoiibdNo ratings yet

- Ebops PDFDocument2 pagesEbops PDFtuan nguyen duyNo ratings yet

- Japanese GardensDocument22 pagesJapanese GardensAnmol ChughNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Water Tanker Check ListDocument8 pagesWater Tanker Check ListHariyanto oknesNo ratings yet

- Lesson: The Averys Have Been Living in New York Since The Late NinetiesDocument1 pageLesson: The Averys Have Been Living in New York Since The Late NinetiesLinea SKDNo ratings yet

- Tetra IntroductionDocument65 pagesTetra Introductionuniversidaddistrital100% (2)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)