Professional Documents

Culture Documents

Issue To The Applicant A Certifcte of Registration

Uploaded by

Girish Arora0 ratings0% found this document useful (0 votes)

10 views8 pagesOriginal Title

Finance

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views8 pagesIssue To The Applicant A Certifcte of Registration

Uploaded by

Girish AroraCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 8

Irda

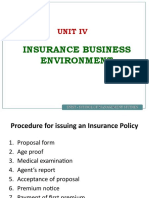

• Issue to the applicant a certifcte of registration ;

to renew,modify , withdraw,or cancel such

registration.

• Protection of interest of policy holdersin matters

concerning assigning policy.

• Specifynf requistie qualification and practical

training for insurance intermediers and agents

• Promoting efficiency in the conduct of insurance

business.

• Promoting and regulating proff org connected with

insurance and reinsurance

• Calling for information from,undertaking inspection

and other org connected with insurance bus.

• Control and regulation of the rates ,terms,and

conditons offered by insurers

• Regulating investmnt of funds by insurance

companies regulating maintainence of margin of

solvency

• Adjuction of disputes btw insurers and

intermediers.

• Supervising the function of tarrif advisory

committee

• Specifyng the %age of premium income of

the insurer

• Exchanging such other powers as may be

prescribed.

Bills of ex

• Demand bill- this is payable immediately ‘at sight’

or ‘on presentment’ to the drawee. A bill on which

no time payment or due date is specified.

• Usance bill- also called time bill.it refers to time

period recoganised by custom or usage for

payment of bills.

• Documentary bill-these are b/e that are

accompanied by documents that confirm that a

trade has taken place .

• -- d/a bills- documentary evidence accompanying

the bill of exchange is deliverable against

acceptance by the drawee.

• -d/p bills– a bill is a ‘documents against payment ‘

bill and has been accepted by th drawee.the doc of

the titlle will be held by the bank till the maturity of

the b/e

• Clean bill- these bills are not accompanied by any

documents that show that a trade has taken place

bw buyer and seller .becaouse of this , the interest

rate charged on such bills is higher than the rate

charged on documentary bills

Utmost Good Faith -

• Is the duty to disclose all material facts relating to the

risk to be covered. A material fact is a fact which would

influence the mind of a prudent underwriter in deciding

whether to accept a risk for insurance and on what

terms.

• Examples:

Motor: Age of drivers, licence status, details of any

accidents, claims or convictions, exact model of vehicle

etc.

Household: Construction of house, location of house ie.

close to river, any previous claims etc.

Subrogation

• Is the right of an insurance company who has paid a claim to

its client to persue another party who may have caused the

incident resulting in the claim.

• Notes:

• The Insurer must exercise the right of recovery in the name

of the Insured (prevents the Insured from obtaining more

than one indemnity)

• Subrogation rights only apply where there is a legal liability

under the policy i.e. where policy cover existed.

• Example:

• A client makes a claim under his/her own comprehensive

policy for damage done to his vehicle by another person.

His/her insurance company pay the claim but persue the

negligent third party for the cost of the claim they have paid.

Insurable Interest

• To insure anything the Insured must have an insurable

interest in the subject matter of insurance, i.e. he/she must

benefit by its safety or be prejudiced by its loss.

• Notes:

Insurable Interest may be created either by:

- Obligation to Insure- Statute- Contract- Custom

• Option to Insure: - Owners- Mortgagors- Lessors- Trustees-

Tenants

• Examples: Everybody would have an insurable interest in

their own personal possessions e.g. house, car, or watch but

your next door neighbour would not normally have an

insurable interest in your house.

You might also like

- General InsuranceDocument21 pagesGeneral InsurancePrashanth KvnNo ratings yet

- 5insurance UnderwritingDocument29 pages5insurance Underwritingtsioney70No ratings yet

- Fire Claims Procedure: On Receipt of A Claim Intimation The First Step Is To Verify ThatDocument40 pagesFire Claims Procedure: On Receipt of A Claim Intimation The First Step Is To Verify ThatNithyanandan RangasamyNo ratings yet

- Dictionary of Insurance TermsDocument23 pagesDictionary of Insurance TermsDharmendra GuptaNo ratings yet

- Introduction To InsuranceDocument28 pagesIntroduction To Insurancearun jacobNo ratings yet

- Secured Transactions: UCC Title 9Document17 pagesSecured Transactions: UCC Title 9Rebel X86% (7)

- Under WritingDocument18 pagesUnder Writingfrnds4everzNo ratings yet

- Principles of Insurance: Insurable Interest, Utmost Good Faith & MoreDocument25 pagesPrinciples of Insurance: Insurable Interest, Utmost Good Faith & MoreHairul AziziNo ratings yet

- Chapter 2Document29 pagesChapter 2Moh'ed Crc QaajeNo ratings yet

- Underwriting in Insurance ProcessDocument18 pagesUnderwriting in Insurance Processfrnds4everzNo ratings yet

- Lecture 7 - Common Issues in Contract and TortDocument17 pagesLecture 7 - Common Issues in Contract and TortMyke BarnetsonNo ratings yet

- 7.2 Motor Insurance ClaimsDocument79 pages7.2 Motor Insurance Claimstsioney70No ratings yet

- DisclosureDocument4 pagesDisclosurejohnmanueldevopsNo ratings yet

- Insurance IDocument30 pagesInsurance IpushkarNo ratings yet

- Dr. S.G. Rama Rao: Financial ServicesDocument20 pagesDr. S.G. Rama Rao: Financial ServicesChitra MudaliyarNo ratings yet

- Session 3-4Document16 pagesSession 3-4SARA KOSHY RCBSNo ratings yet

- Legal Aspects of InsuranceDocument38 pagesLegal Aspects of Insurancebapparoy100% (1)

- Breakdown Cover A DiscussionDocument19 pagesBreakdown Cover A DiscussionsbacidemNo ratings yet

- Insurance PrincipleDocument15 pagesInsurance Principlemanyasingh100% (1)

- AAPAI-2015-Akseptasi - Resiko - Dan - Klaim-Okt-15 by Willy I SianiparDocument35 pagesAAPAI-2015-Akseptasi - Resiko - Dan - Klaim-Okt-15 by Willy I SianipargfNo ratings yet

- Insurance - Lecture 23Document13 pagesInsurance - Lecture 23MunyNo ratings yet

- Claims AdjustingDocument49 pagesClaims AdjustingJaime DaliuagNo ratings yet

- Factoring Vs ForfeitingDocument27 pagesFactoring Vs ForfeitingShruti AshokNo ratings yet

- Chapter 3 StudentVersionDocument24 pagesChapter 3 StudentVersionJoseph LimNo ratings yet

- Factoring vs Forfaiting: Key DifferencesDocument22 pagesFactoring vs Forfaiting: Key DifferencesRajinder Kaur100% (1)

- Property and Pecuniary Insurance Coverage TypesDocument112 pagesProperty and Pecuniary Insurance Coverage TypesGashawNo ratings yet

- 7.2 Motor Insurance ClaimsDocument18 pages7.2 Motor Insurance Claimstsioney70No ratings yet

- Dr. S.G. Rama Rao: Financial ServicesDocument20 pagesDr. S.G. Rama Rao: Financial ServicesthensureshNo ratings yet

- BNK602SEM: Legal Aspects of Banking: TOPIC 7: Nature of SecurityDocument36 pagesBNK602SEM: Legal Aspects of Banking: TOPIC 7: Nature of SecurityaliaNo ratings yet

- Unit 3 BFSDocument69 pagesUnit 3 BFSCHANDAN CHANDUNo ratings yet

- Insurance Intermediaries: Agents IC 223: Fundamentals of InsuranceDocument10 pagesInsurance Intermediaries: Agents IC 223: Fundamentals of InsuranceMerupranta SaikiaNo ratings yet

- Re Bank of Credit and Commerce International SADocument49 pagesRe Bank of Credit and Commerce International SAMeera HayatNo ratings yet

- Module V-2Document12 pagesModule V-2kashifidaplNo ratings yet

- Claims MGTDocument76 pagesClaims MGTMujo TiNo ratings yet

- Commercial Paper BasicsDocument45 pagesCommercial Paper BasicsSimranNo ratings yet

- Factoring, Forfaiting Services & Off-Balance Sheet Items, BASEL-IIDocument28 pagesFactoring, Forfaiting Services & Off-Balance Sheet Items, BASEL-IIkanamarlapudiNo ratings yet

- Ypothecation OF Ovable Achinery Letter OF Credit Packing CreditDocument38 pagesYpothecation OF Ovable Achinery Letter OF Credit Packing Creditdiksha_motwaniNo ratings yet

- Principles of Insurance: IndemnityDocument27 pagesPrinciples of Insurance: IndemnitytaijulshadinNo ratings yet

- Insurence 04Document2 pagesInsurence 04Teja MariduNo ratings yet

- Fire InsuranceDocument59 pagesFire InsuranceparishaNo ratings yet

- Unit Iv: Insurance Business EnvironmentDocument20 pagesUnit Iv: Insurance Business Environmentmtechvlsitd labNo ratings yet

- Principal-agent, indemnity, guarantee and government contracts explainedDocument26 pagesPrincipal-agent, indemnity, guarantee and government contracts explainedKathiravan RajendranNo ratings yet

- Module 3Document104 pagesModule 3VK GamerNo ratings yet

- Mortgage Fraud Recoupment:: Procedural Requirements and Issues Relating To Insurance, Bonds & Contractual IndemnitiesDocument18 pagesMortgage Fraud Recoupment:: Procedural Requirements and Issues Relating To Insurance, Bonds & Contractual IndemnitiesCairo AnubissNo ratings yet

- Financial Services Assignment: Q.A) Process of Credit RatingDocument17 pagesFinancial Services Assignment: Q.A) Process of Credit Ratingshiv mehraNo ratings yet

- Financialservices: Name - Kanikabhasin Roll No. - 01Document20 pagesFinancialservices: Name - Kanikabhasin Roll No. - 01kanikaNo ratings yet

- Fidelity and Body PartsDocument61 pagesFidelity and Body PartsTripathi OjNo ratings yet

- Insurance, Bonds, GuranteesDocument36 pagesInsurance, Bonds, GuranteesPandula MaddumageNo ratings yet

- Dit School of Business Presentation ON Debentures: Presented By:-Saju Thomas Abhishek Singh Sunil SharmaDocument13 pagesDit School of Business Presentation ON Debentures: Presented By:-Saju Thomas Abhishek Singh Sunil Sharmasajuthomas1987No ratings yet

- Session 5 - Insurance AspectsDocument7 pagesSession 5 - Insurance AspectsJames Patrick PedrosoNo ratings yet

- Introduction To Life Insurance V 1.2 Jan 10Document21 pagesIntroduction To Life Insurance V 1.2 Jan 10vij_raajeev5534No ratings yet

- Exam 2 ReviewDocument4 pagesExam 2 ReviewPaige ElNo ratings yet

- Topic 2 Chapter 6 Insurance Company OperationsDocument28 pagesTopic 2 Chapter 6 Insurance Company OperationsYu WenNo ratings yet

- Audit of Insurance CompaniesDocument5 pagesAudit of Insurance Companiesdavidkecelyn06No ratings yet

- Bar Review. Insurance Day 1 2018Document232 pagesBar Review. Insurance Day 1 2018Devilleres Eliza DenNo ratings yet

- Know Your Rights and DutiesDocument3 pagesKnow Your Rights and DutieslulughoshNo ratings yet

- Structured Trade Finance 8-1Document15 pagesStructured Trade Finance 8-1subash1111@gmail.comNo ratings yet

- SYBBA Unit 4.PptxDocument40 pagesSYBBA Unit 4.Pptxidea8433No ratings yet

- Checklist For Sleep Lab ContructionDocument4 pagesChecklist For Sleep Lab ContructionGirish AroraNo ratings yet

- Swami VivekanandaDocument6 pagesSwami VivekanandaGirish AroraNo ratings yet

- Risk Analysis: Presented By:-Girish Arora 74 Sec-B PGDM 2009-2011Document43 pagesRisk Analysis: Presented By:-Girish Arora 74 Sec-B PGDM 2009-2011Girish Arora100% (1)

- Artificial Skin Grafting: Presented By: Girish AroraDocument11 pagesArtificial Skin Grafting: Presented By: Girish AroraGirish AroraNo ratings yet

- Targeting Indian Women's Unique Body TypesDocument9 pagesTargeting Indian Women's Unique Body Typespriya0608No ratings yet

- Samsung CorbyDocument11 pagesSamsung CorbyGirish AroraNo ratings yet

- History of The Stethoscope PDFDocument10 pagesHistory of The Stethoscope PDFjmad2427No ratings yet

- TS4-F - Fire SafetyDocument2 pagesTS4-F - Fire SafetyDominic SantiagoNo ratings yet

- 2 English Course BDocument8 pages2 English Course BAnjana27No ratings yet

- Himalayan University Fees Structure 1-1-19Document8 pagesHimalayan University Fees Structure 1-1-19Anonymous F4GQLmyPZNo ratings yet

- wch13 01 Rms 20230817Document24 pageswch13 01 Rms 20230817halcieeschNo ratings yet

- of Types of Nuclear ReactorDocument33 pagesof Types of Nuclear Reactormandhir67% (3)

- Rockwool 159: 2.2 Insulation ProductsDocument1 pageRockwool 159: 2.2 Insulation ProductsZouhair AIT-OMARNo ratings yet

- Board Review Endocrinology A. ApiradeeDocument47 pagesBoard Review Endocrinology A. ApiradeePiyasak NaumnaNo ratings yet

- Executive Order 000Document2 pagesExecutive Order 000Randell ManjarresNo ratings yet

- Auramo Oy spare parts listsDocument12 pagesAuramo Oy spare parts listsYavuz ErcanliNo ratings yet

- Jairo Garzon 1016001932 G900003 1580 Task4Document12 pagesJairo Garzon 1016001932 G900003 1580 Task4Jairo Garzon santanaNo ratings yet

- Human Capital FormationDocument9 pagesHuman Capital Formationtannu singh67% (6)

- FinalsDocument8 pagesFinalsDumpNo ratings yet

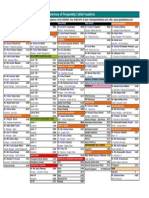

- Directory of Frequently Called Numbers: Maj. Sheikh RahmanDocument1 pageDirectory of Frequently Called Numbers: Maj. Sheikh RahmanEdward Ebb BonnoNo ratings yet

- Growth Developt Pearl MilletDocument17 pagesGrowth Developt Pearl MilletdarmaNo ratings yet

- Request For Review FormDocument11 pagesRequest For Review FormJoel MillerNo ratings yet

- LabyrinthDocument4 pagesLabyrinthAyezaZuberyNo ratings yet

- The National Building Code of The PhilippinesDocument390 pagesThe National Building Code of The PhilippinesJohn Joseph EstebanNo ratings yet

- Indonesia Organic Farming 2011 - IndonesiaDOCDocument18 pagesIndonesia Organic Farming 2011 - IndonesiaDOCJamal BakarNo ratings yet

- LH 11 180 190 220 230 270 280 390 400 Breaker Safety & Operating InstructionsDocument304 pagesLH 11 180 190 220 230 270 280 390 400 Breaker Safety & Operating InstructionshadensandorNo ratings yet

- Manual Masina de Spalat Slim SamsungDocument1,020 pagesManual Masina de Spalat Slim SamsungPerfectreviewNo ratings yet

- GTT Module 5Document156 pagesGTT Module 5ABDULRAHIMAN RAJEKHANNo ratings yet

- Roadblocks Overcome Cruise PurchaseTITLE Top 15 Cruise Hesitations Answered TITLE How to Convince People Cruises Worth CostDocument4 pagesRoadblocks Overcome Cruise PurchaseTITLE Top 15 Cruise Hesitations Answered TITLE How to Convince People Cruises Worth CostJanel Castillo Balbiran33% (3)

- Pet - WikipediaDocument12 pagesPet - Wikipediabdalcin5512No ratings yet

- Ensure Even Preload with Proper Tightening Tools and SequenceDocument2 pagesEnsure Even Preload with Proper Tightening Tools and SequenceMachineryengNo ratings yet

- 559 Fault CodeDocument4 pages559 Fault Codeabdelbagi ibrahim100% (1)

- Benefits and Limitations of Vojta ApproachDocument50 pagesBenefits and Limitations of Vojta ApproachAlice Teodorescu100% (3)

- The Secret of The House WTDocument22 pagesThe Secret of The House WTPetr -50% (2)

- PERSONS Finals Reviewer Chi 0809Document153 pagesPERSONS Finals Reviewer Chi 0809Erika Angela GalceranNo ratings yet

- Dip Obst (SA) Past Papers - 2020 1st Semester 1-6-2023Document1 pageDip Obst (SA) Past Papers - 2020 1st Semester 1-6-2023Neo Latoya MadunaNo ratings yet