Professional Documents

Culture Documents

Oil's Uncertain Future: What You Need To Know

Uploaded by

ericotavaresOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Oil's Uncertain Future: What You Need To Know

Uploaded by

ericotavaresCopyright:

Available Formats

N O V E M B E R 2 0 11

a u t o m o t i v e o p e r a t i o n s

&

a s s e m b l y

p r a c t i c e

o i l

&

g a s

p r a c t i c e

p r a c t i c e

s t r a t e g y

p r a c t i c e

Special report

Oils uncertain future

What you need to know

Over the past six months, oil prices have dropped sharply, amid concerns about a double-dip recession, and approached $120 a barrel as supply disruptions in Libya roiled global markets. Hang onto your hats because we may just be getting started. Read in this package about long-term supply-and-demand trends that could, if not mitigated through coordinated global action, cause a price shock. Then explore the strategic implications of high, volatile oil prices and the actions some supply chain leaders are already taking to prepare.

2 Another oil shock? Tom Janssens, Scott Nyquist, and Occo Roelofsen 6 The automotive sectors road to greater fuel efficiency Russell Hensley and Andreas Zielke

12 Anticipating economic headwinds Jonathan Ablett, Lowell Bryan, and Sven Smit 15 Building a supply chain that can withstand high oil prices Knut Alicke and Tobias Meyer

Another oil shock?

Tom Janssens, Scott Nyquist, and Occo Roelofsen

Its possible, though far from certain, that oil prices will spike in the years ahead. Heres whyand how you can prepare.

Its been a while since the world has been truly preoccupied with the threat of sustained high oil prices. The global economic recovery has been muted, and a double-dip recession remains possible.

But that dour prospect shouldnt make executives sanguine about the risk of another oil shock. Emerging markets are still in the midst of a historic transition toward greater energy consumption. When global economic performance becomes more robust, oil demand is likely to grow faster than supply capacity can. As that happens, at some point before too long supply and demand could collidegently or ferociously. The case for the benign scenario rests on a steady evolution away from oil consumption in areas such as transportation, chemical production, power, and home heating. Moves by many major economies to impose tougher automotive fuel efficiency standards are a step in this direction. However, fully achieving the needed transition will take more stringent regulation, such as the abolition of fuel subsidies in oil-producing countries, Asia, and elsewhere, as well as widespread consumer behavior changes. And historically, governments, companies, and consumers have been disinclined to tackle tough policy choices or make big changes until their backs are against the wall. This inertia suggests another scenarioone thats sufficiently plausible and underappreciated that we think its worth exploring: the prospect that within this decade, the world could experience a period of significant volatility, with oil prices leaping upward and oscillating

between $125 and $175 a barrel (or higher) for some time. The resulting economic pain would be significant. Economic modeling by our colleagues suggests that by 2020, global GDP would be about $1.5 trillion smaller than expected, if oil prices spiked and stayed high for several years. But like any difficult transition, this one also would create major opportunitiesfor consumers of energy to differentiate their cost structures from competitors that arent prepared and for a host of energy innovators to create substitutes for oil and tap into new sources of supply. Furthermore, if we endured a period of high and volatile prices that lasted for two or three years, by 2020 or so oil could face real competition from other energy sources. To paint a clearer picture for senior executives of what such a world would mean for themand how to prepare nowwe asked several colleagues to join us in a thought experiment about the impact of a prolonged oil price spike. Russell Hensley and Andreas Zielke, from McKinseys automotive practice, explain how intensified regulation already is leading a transition toward greater fuel economy, as well as the potential for higher oil prices to reinforce that momentum. Jonathan Ablett, Lowell Bryan, and Sven Smit, from McKinseys strategy practice, assess the global economic impact of an oil price spike and the strategic implications of a slower-growth environment. Finally, Knut Alicke and Tobias Meyer, from McKinseys operations practice, describe energy-efficient supply chain strategies that some companies are already undertaking.

A delicate balance

The world is very far from running out of oil. By most estimates, at least a trillion barrels of conventional oil still reside beneath the earths surface, not to mention several trillion more barrels of oil or gas that could be extracted through unconventional sources, such as oil sands. More relevant for prices, though, is how much spare oil production capacity exists in the world. Three million or four million barrels a day typically represents a comfortable buffer when the global economy is healthy. If that buffer shrinks, and markets expect strong demand growth to continue, prices can risesometimes dramatically. Thats what happened prior to the 200809 financial crisis as surging emergingmarket demand strained production capacity and prices approached $150 a barrel. This fly-up was short lived because the ensuing deep reces-

About the research McKinseys global energy perspective rests on detailed modeling of a variety of scenarios for economic growth, for energy demand across 15 industries in 20 regions, and for the evolution of energy supplies extending well beyond conventional oil to include 34 different types of fuel. The gentle collision and violent adjustment scenarios described here arent the only possibilities, of course. Others include a period of prolonged economic stagnation and an intermediate scenario in which prices remained high (say, between $100 and $125 a barrel), slowing demand growth enough to avert an oil price fly-up unless a major supply disruption took place.

sion wiped out between three million and four million barrels a day of demand, sending oil prices sharply down. During the sluggish recovery that followed, the global supply cushion shrank again, punctuated in the first half of 2011 by Libyas civil war, which disrupted supplies from that country and knocked off a million barrels a day of global capacity. That tightness set the stage for price fly-ups to $120 a barrel in the first half of this year and underscores the strength of the pre-2008 fundamentals. Going forward, barring prolonged economic stagnation, demand growth for liquids1 is likely to chug ahead at around 1.5 percent a year. The pace would be even faster without the steady improvements in energy efficiency that we and other energy analysts foresee, particularly for cars and trucks as a result of technology improvements and stiffening regulatory standards that are already on the books.

Could supply growth accelerate to keep pace? Many industry analysts and our own supply model suggest that it wont be easy. Despite high oil prices for much of the past decade and surging investment outlays by many major private and national oil companies alike, capacity has risen by only slightly more than 1 percent a year during that time. The logistics, supply systems, and political alignment needed to extract new oil supplies make that a complex, expensive, and timeconsuming business. And coaxing more output out of existing oil fields, which typically have high production-decline rates, also is costly and challenging. Our current projections suggest that in a business as usual scenario,2 the world could reach a realistic supply capacity of around 100 million barrels a day by 2020, up from 91 million or 92 million today. That, however, would barely suffice to meet the roughly 100 million barrels of liquids the world would consume each day in such a scenario, up from 88 million or 89 million today.

1 For the sake of simplicity, in most of this article we use the term oil as short-hand for

liquids, which comprise all liquid fuels derived from crude oil, as well as liquid fuels from natural-gas liquids (NGLs), biofuels, gas to liquids (GTLs), and coal to liquids (CTLs). 2 Our business-as-usual scenario assumes that between 2010 and 2020, the world economy will grow at the rate currently anticipated by many analysts (3.0 to 3.5 percent) and that oil prices wont significantly exceed $100 a barrel during this period.

When supply and demand collide

Simple math suggests that at some point, something has to give. And when it does, the world will have to start taking steps away from todays oil dependence. The question is how rapid and volatile that transition will be.

The case for a gentle collision

This critical shift could happen in an orderly fashion, without price spikes, if governments, companies, and consumers worked together to accelerate the adoption of measures that reduce demand. Indeed, a common denominator of current forecasts by industry analysts (including ourselves) is a gradual transition in most regions toward lower oil intensity in transportation, power, and residential heating. But according to our analysis, it would take more than current trends in oil conservation (spurred by existing legislation) for supply to meet demand if robust economic growth returned. A few examples illustrate the scale and scope of the task facing the world if we are to realize a gentle transition. Governments would need to raise auto fuel efficiency standards further, and consumers would need to place greater emphasis on fuel economy when they bought new cars (see sidebar, The automotive sectors road to greater fuel efficiency). Policy makers in several developing countries would need to abolish fuel subsidies so that consumers felt the real price of oil. Around the world, wed need to see deeper reductions in the use of oil for heating, power generation, and chemical manufacturing. Some transport by ships and heavy trucks would need to start shifting toward more reliance on natural gas as a fuel. Changes like these could push oil supply and demand roughly into balance. However, they would require new policies and significant changes in how consumers and businesses behave. Whats more, they would need to start now because it will take years before the changes required to constrain oil consumption begin to take effect. If we do not succeed in implementing these changes in a farsighted way, the system faces a risk of falling out of balance.

Why the adjustment could be violent

That brings us to a second scenario: its possible to imagine global supply and demand for oil colliding faster, and more ferociously, resulting in a price spike as the global capacity buffer melted away. As weve said, anticipated economic growth alone could cause demand to expand faster than supply. Another possible trigger: supply disruption, which

does happen from time to time. The possibilities include an exceptionally severe hurricane in the Gulf of Mexico, violence in the Niger Delta, instability in Venezuela, and further tension in the Middle East. If this new price spike took place, it could have a more significant impact on global consumption patterns than most executives expect. For starters, it would hit global growth, which in turn would immediately knock down oil demand. In addition, there would be some rapid behavioral effects, such as a reduction in car, air, and sea travel. If the spike lasted longer, it could cause several more structural shifts, such as prompting individuals to use different modes of transport or even to look for work closer to home, encouraging companies to reverse offshoring

The automotive sectors road to greater fuel efficiency

Russell Hensley and Andreas Zielke

Regulatory standards already in place should dramatically enhance the efficiency of autos around the world. The European Unions carbon emissions rules, for example, require annual improvements of 6 percent a year between 2015 and 2020. This implies, according to our analysis, that new cars driving on European roads will consume 40 to 50 percent less fuel in 2020 than they did in 2010. Regulators in China, Japan, and the United States are also eyeing ambitious rates of improvement, albeit from different starting points. US fuel economy levels in 2020at around 40 miles a gallonwould lag behind Chinas in that year and simply match Europes 2010 levels. The automotive industry, boxed in by fierce global competition and flat

prices, has responded in the past by pushing design improvements and productivity gains that make room for costly new content, including technology required for meeting regulatory standards. Heres one example: if you adjust for inflation the cost of a 2001 Toyota Camry, you see that by 2010, the price of the car to US consumers had actually dropped by $2,500 in real termsalthough the 2010 Camry was better equipped and 10 percent more fuel efficient. As automakers work hard to meet new and tougher fuel economy standards, they are likely to follow the same playbook. The starting point: improving internal-combustion engines, which still offer significant opportunities to enhance efficiency and emissions performance. On the other hand, high battery costs would be likely to require automakers to raise prices, making a sweeping shift to electric vehicles more difficult between now and, say, 2020. A sustained oil price spike could well prompt regulators in mature economies to up the antefor example, by increasing support for

trends and bring supply chains closer to home, accelerating the substitution of videoconferences for air travel, and pushing the freight transport industry to adopt less oil-intensive modes. Because such shifts would take time, a high-price environment could last for years, not months, accelerating several other ongoing trends that, when combined, could lead to even further demand reductions. In other words, a sustained price spike could scare consumers, companies, and governments into more drastic responsesaccelerating the transition to a less oil-dependent economy. A price spike of one to three years could be long enough to make governments raise standards for fuel efficiency at an accelerated pace and prompt automakers, reacting to regulatory

electric vehiclesand speed a broader adoption of tougher standards in developing economies, which will represent most of the new demand for transportation fuel going forward. This would create additional momentum for change. Still, for a major shift in the global automotive stock to occur within the decade, consumer behavior or technology would need to change in dramatic and currently unforeseen ways. One possibility would be for a higher proportion of car buyers to begin prioritizing fuel economy. While the importance of this factor varies around the world, our consumer research suggests that in two major car markets, Germany and the United States, car buyers rank this attribute outside the top ten they consider when buying a new car.1 Significant consumer change is likely to require compelling economics that dont take many years of ownership to realize. Comparing Europe and the United States highlights the magnitude of the challenge: although gasoline prices are twice as high in the

former, the share of autos running on oil-based derivatives (gasoline and diesel) and alternative fuels is roughly the same in both. For the economics to become more appealing, advanced technology, especially electricvehicle batteries, would need to come down the cost curve faster than expected while oil and gasoline prices crossed some new threshold of pain.

1We conducted online interviews with

2,200 new-vehicle buyers in Germany and the United States. The sample included purchasers of cars, trucks, flex-fuel vehicles, and diesel vehicles, weighted to match the demographic characteristics and brand and power train preferences of each national market. Consumer rankings of attributes, derived through conjoint analysis, represented the implied importance attached to them by buyers. Implied importance often differs from stated importance but can be more accurate because it is less likely to reflect respondents beliefs about the answers they are expected to provide.

Russell Hensley is a principal in McKinseys Detroit office, and Andreas Zielke is a director in the Berlin office.

changes, to modify their product-development road maps. Ultimately, all this would lead to more rapid efficiency gains and potentially to faster electric-vehicle penetration. A prolonged price spike also could prompt investments in infrastructure needed to support the use of electric vehicles or other alternatives (such as natural gas and hydrogen) to traditional fuel sources. Such investments could have an impact on oil demand for trucking, light vehicles, and shipping. Whats more, very high oil prices would intensify energy efficiency efforts up and down the supply chain and reduce the amount of plastics used in packaging, thus shrinking demand for oil in chemicals. Additional government action, in the form of either more stringent regulation on the use of plastics or subsidized financing that reduced the up-front cost to consumers of switching away from fuel oil in residential heating, could play an important role in this transition. All along the way, of course, these reactions, plus slower global growth, would do their part to exert some downward pressure on oil prices. Expanded supply would also play a role. From now to 2020, OPEC3 could increase its capacity by, say, two million barrels a day above currently assumed increases, and new investments in mature assets could slow decline rates, leading to an additional one million to two million barrels of daily production. Furthermore, additional investments in unconventional oil sources, such as oil sands, could increase supply by, say, one million to two million barrels a day. Biofuels, too, would have room to grow. But given the time it would take to pursue some of the available opportunitiesand the danger that they could quickly become uneconomic once oil prices fellthe supply response is likely to be slower and more muted than that of demand. In the end, once all the efficiency gains and supply expansions described above kicked in (exhibit), the world could again wind up in balance and with significant excess capacity, so that eventuallyperhaps by 2020, perhaps laterprices fell below the $80 to $100 range. Until then, however, given how slowly many of the demand changes would unfold, its only prudent to imagine the possibility that the world could experience a prolonged period of both significant volatility and generally much higher prices.

3 Organization of the Petroleum Exporting Countries.

Q4 2011 Oil price spikes Exhibit 1 of 1

If a sustained oil price shock took place in the years ahead, conservation measures could reduce oil demand by 10 million to 20 million barrels a day.

Demand for liquids,1 million barrels a day (rounded estimates) Light vehicles Mid2011 Marine Medium/heavy Air trafc Power Chemicals Buildings vehicles

17 11 8 5 4 5

Other industries

19 ~8889

20

Business-as-usual scenario 2020

22 20 14 9 6 5 4 20 100

Scenario with conservation measures 2020

1719 1517 12.513.0 7.5 8.5 4.5 ~4.5 5.5

2.53.0 1719 ~8090

Examining the difference between business as usual in 2020 and a scenario with conservation measures, reduction in liquids1 demand in million barrels a day (mbd)

Relative contribution to reduction in consumption Immediate reduction caused by slower GDP growth and other factors as noted Structural reduction, requiring investment by consumers or industry

Light vehicles

Total reduction of

Medium/ heavy vehicles Immediate: less discretionary travel Structural: permanent shifts in consumer behavior and accelerated technology development (eg, gas mileage improvements and penetration by alternative power trains)

Total reduction of

3.05.0

mbd

3.05.0

mbd

Immediate: no-regret, low-investment moves (eg, truck-route optimization, smarter driving) Structural: increasing truck sizes, accelerating improvements in eet efciency, powering vehicles with natural gas, and transporting more goods by rail

Chemicals

Total reduction of

Buildings Some substitution away from certain end products (eg, plastic packaging, polyester ber) and toward different feedstocks (eg, palm oil, natural rubber, gas)

Total reduction of

1.01.5

mbd

0.51.5

mbd

Increasing efforts by governments to encourage consumers and industries to move away from use of oil in heating

Air trafc

Total reduction of

Marine Immediate: decrease in passenger travel, shifting of some freight to other modes (eg, to maritime shipping) Structural: moving production processes closer to consumption markets, increasing rail infrastructure in countries such as China

Total reduction of

0.51.5

mbd

~0.5

mbd

Immediate: no-regret moves such as reducing vessel speed Structural: using natural gas as a fuel (particularly in coastal waters) and moving production processes closer to consumption markets

Power generation

Total reduction of

Other industries Accelerating efforts to move away from use of oil in power generation, especially in the Middle East

Total reduction of

1.01.5

mbd

1.03.0

mbd

Immediate: reduction in oil-rening demand due to lower production Structural: potential for fuel efciency improvements or substitution away from oil-based inputs (eg, in agriculture, construction, oil rening, and rail transport)

1 All liquid fuels derived from crude oil, natural-gas liquids (NGLs), biofuels, gas to liquids (GTLs), and coal to liquids (CTLs).

10

Preparing for the unexpected

If the shock scenario outlined above unfolded, sustained high oil prices would challenge the top and bottom lines of many companies. However, high prices also could create opportunities for companies to differentiate themselves from competitors whose cost structures and operating approaches were ill suited to the new environment. And for companies on the front lines of the resource productivity revolution, a prolonged oil price increase would be beneficial. Providers of a range of new technologies from car batteries for electric vehicles, to horizontal drilling and other tools for unconventional oil extraction, to biofuel production techniques, to electricity cogeneration equipment for manufacturerswould see their businesses grow, faster, than they would in a world of lower oil prices. In many cases, these companies would be supplying or partnering with more established firms: oil companies in need of unconventional extraction technologies, auto manufacturers trying to create the winning vehicle of the future, and chemical companies hoping to take advantage of new feedstock sources, for example. From a strategic perspective, the interesting question is who would grab the most profitable positions in the new energy ecosystem. No less fascinating are the managerial implications of the second-order and feedback effects that would occur as this ferocious collision played itself out. For example, our analysis suggests that even if prices subsequently fell, companies that pursued strategies for reducing their dependence on oil would be unlikely to regret it. One reason is that many strategies are already in the money at todays prices. If prices got high enough, they would concentrate the attention of consumers, businesses, and governments sufficiently to promote many positive-return investments that havent been implemented so far, because of behavioral inertia. This development would accelerate the changes in our capital stock, while leaving them economically viable even if prices fell again.

If the shock scenario unfolded, sustained high oil prices would challenge the top and bottom lines of many companies. However, high prices also could create opportunities.

11

Furthermore, many technologies could become significantly cheaper as demand for them increased and their providers went down learning curves. Examples include batteries for vehicles, highly efficient internalcombustion engines, and certain biofuel technologies, such as those that are cellulosic or perhaps even based on algae. In a high-price environment, more capital would flow into these technologies, enabling them to scale up. The time needed for them to become economically attractive would fall by five or even ten years compared with the time frame if oil prices stayed at lower levels, potentially making these technologies economically viable even if oil prices subsequently fell. Indeed, a striking and often-underestimated feature of energy price shocks is the nonlinearity of their impact. Take electric vehicles. The market for car batteries would likely be about five or ten times larger if oil prices stayed for a considerable period at $150 a barrel than it would be at $100 a barrel. Few corporate-planning processes, however, place sufficient emphasis on extremes like thiseven though these are precisely the scenarios that produce many of the most interesting opportunities and powerful threats for a business. Building corporate processes and skills that enable thoughtful reflection on a wider, more volatile range of outcomes could be a significant competitive differentiator in the years to come.

In the long run, these structural changes could well be a positive development for the worldresulting in more predictable and sustainable energy supplies and prices. But navigating the transition would be challenging and would reward the well prepared. The time is now for companies to start planning for the possibility of another price shock and a powerful market response.

The authors wish to acknowledge the contributions of Tim Fitzgibbon, Pedro Haas, Yousuf Habib, Matt Rogers, Valerie Tann, and Koen Vermeltfoort to the development of this article. Tom Janssens is a principal in McKinseys Houston office, where Scott Nyquist is a director; Occo Roelofsen is a principal in the Amsterdam office.

12

Anticipating economic headwinds

Jonathan Ablett, Lowell Bryan, and Sven Smit

High, volatile oil prices would place a premium on fine-grained growth approaches and dynamic management processes.

If crude-oil prices rose to $125 or $150 a barrel and stayed there long enoughfor years, not monthsglobal growth would undoubtedly suffer. Indeed, we estimate that this type of shock would drive down global growth by 0.6 to 0.9 percentage points in the first year.1 Over time, as economies adjusted to the new higher prices (and shifted to different types of fuel, technologies, and production techniques) the impact would diminish. But the rate of global GDP growth would be affected for years. By 2020, the global economy would be between $1.1 trillion and $1.7 trillion smaller than the baseline outlook: the equivalent of losing Spains or Italys output for a year.

A sustained growth drag of that magnitude would be serious, particularly for Europe and the United States, which are already suffering from sluggish recoveries and lingering unemployment. It could contribute to a double-dip recession in those markets and to trouble in the global economy as a whole, which also is fragile and faces other potential shocks, including sovereign-debt defaults, inflation in emerging markets, and problems in the Chinese financial sector. Senior executives can reduce the odds of getting whip-sawed by the impact of an oil price spike if they push their planning teams to evaluate, at a fairly granular level, the likely growth impact of surging energy

1 All GDP and growth estimates in this article are the result of economic analysis we and our

colleagues in McKinseys strategy practice conducted using the firms global-growth model, a tool for long-term scenario planning. The model links energy and capital markets to output and highlights relationships between growth and structural factors such as urbanization, education, and industry structure shifts. It can generate globally consistent scenarios for 20 countries, nine regions, and the world as a whole.

Q4 2011 Oil and growth sidebar Exhibit 1 of 1

13

Highly industrialized, export-oriented economies are more vulnerable to oil price shocks.

Potential reduction in GDP growth in rst year of high oil prices, percentage points China South Africa 28% Germany, India, Japan ~30% France, United Kingdom, United States ~21% 0.4

Industrial sectors share of GDP, 2010

50%

0.6 $125 a barrel 1.0

0.6

0.6 1.0 $150 a barrel 1.5 0.9

prices. Where are customers most vulnerable to energy cost increases, and where would they be less significant? In fact, our modeling suggests that the country-level impact of spiking oil prices would be quite uneven and not just because of differences in the energy efficiency of various economies. Even more important, our analysis indicates, are variations in the relative size of the industrial sector in different countries. That means export-oriented advanced manufacturing economies, such as Germany and Japan, are more vulnerable than their relative energy efficiency might indicate (exhibit). In addition, business leaders should be preparing for a world in which energy-related growth slowdowns could occur in an oscillating and unpredictable manner. For example, oil prices might fly up to a point (far in excess of $125 a barrel) where global GDP growth completely stalled and new sources of energy supply rapidly became economic. That, in turn, might drive prices down somewhat, leading to a resumption of economic growth and a repetition of the cycle. In a world like that, management approaches that some companies experimented with during the financial crisissuch as shorter financial-planning cycles or even moving away from calendar-based approaches to budgeting and planningmay be important.2 When you combine the likelihood of oil price volatility with related uncertaintiessuch as the potential for swings in the dollar versus other

2 For more on principles for managing in extreme uncertainty, see Lowell Bryan, Dynamic

management: Better decisions in uncertain times, mckinseyquarterly.com, December 2009.

14

currencies and commodities as global economic activity rebalances from the developed world toward emerging marketsyou may want to abandon any presumption that you can predict medium-term oil prices.3 Indeed, it may be more fruitful to stress-test your financial plans and strategies for different oil (and currency) prices, see what happens to the plans at the extremes, and then prepare for contingencies. One example: if oil prices rose significantly, that would accelerate the accumulation of capital by sovereign-wealth funds in oil-producing countries, complicating financing decisions and raising the importance of building strong relationships with a diverse group of capital suppliers.4 In general, using multiple scenarios for even base-case planning, and developing a portfolio of responses to each scenario, will enable you to act swiftly when you can see where prices are moving.

3 For more on uncertainties related to global economic rebalancing, see Lowell Bryan, 4 For more on diversifying sources of financing, see Richard Dobbs, Susan Lund, and

Globalizations critical imbalances, mckinseyquarterly.com, June 2010.

Andreas Schreiner, How the growth of emerging markets will strain global finance, mckinseyquarterly.com, December 2010.

Jonathan Ablett is a consultant in McKinseys Waltham Knowledge Center, Lowell Bryan is a director in McKinseys New York office, and Sven Smit is a director in the Amsterdam office.

15

Building a supply chain that can withstand high oil prices

Knut Alicke and Tobias Meyer Opportunities abound to boost supply chain efficiency. Most are in the money today, and will become even more attractive if oil prices rise.

We dont need to look very hard for a live case study of what happens to global supply chains when oil prices spike. Just three years ago, when they shot up to $125 and beyond, it became painfully obvious to many companies that their supply chains were not viable at those levels.

Research we conducted at that time indicated that even if oil prices were as low as $40 a barrel, it would still make economic sense for companies to take a variety of actions that collectively would reduce the energy intensity of global supply chains by almost one-fourth. Energy intensity could be reduced by more than one-third if oil prices stayed above $100 a barrel for a prolonged period (exhibit). The potential would be even greater at higher prices. Here are some of the opportunities that far-sighted companies are beginning to act on:

Utilizing space-saving packages. A retailer and a wholesaler partnered

to create a new, stackable format for milk containers. As a result, they no longer need traditional shipping crates for truck transport, thus freeing up additional space for other cargo and avoiding the need to haul back the empty crates.

Operating larger ships and trucks. Vale, the Brazil-based miner, took

delivery this year of its first new ultralarge ore carrier, with 400,000 deadweight tons of capacitymore than twice that of todays standard vessel on the most important trade routesto ship iron ore from Brazil to China. Scale is important because doubling the capacity of a transport

Q4 2011 Supply chain sidebar 16 Exhibit 1 of 1

If oil is priced at $100 a barrel, a number of activities to reduce the energy intensity of global supply chains become economically feasible.

Potential reduction in energy intensity (fuel consumption per gross output) from 2007 baseline,1 % Levers for supply chain setup

Overall potential fuel savings = 38%

Increase value density2

Reduce packing volume

Reduce average transportation distance

Redesign geography of production and sourcing to reduce distance that products travel Shift from air freight or trucking to shipping or rail

Change the mix of transportation modes Levers for transport assets

20

Address asset technology (eg, rail, tanker, trucking)

Increase scale, reduce relative drag, increase payload ratio,3 improve efciency of propulsion systems Address factors such as speed, load factor, maintenance regime, and route planning Find ways to avoid congestion, upgrade infrastructure, or engage in smart trafc management

12

Assess usage of individual assets Assess usage of collective assets

1 Assumes informed behavior by shippers, providers, investors, and government, over 10-year period; gures for rst 3 levers are based

2Value density is measure of products economic value against its weight or volume. 3Relative drag is energy needed for propulsion of a unit of given size at given speed; payload ratio is cargo-carrying capacity of transport

on fuel consumption after other 3 levers have been implemented. When used in combination, multiple levers do not yield the sum of their individual potential, because each successive lever addresses an already reduced base. asset relative to its total weight when fully loaded.

asset typically increases its energy efficiency by one-fourth. The same goes for trucks too. In emerging markets, where average truck size is less than half that in OECD1 countries, partly because of poorer infrastructure and smaller retail outlets, every percentage point of average truck size would reduce fuel consumption per unit of capacity by about 0.4 to 0.6 points.

Combining new technologies. Maersk, the Danish container liner, used

most of the available technological advances when it placed orders for its new 400-meter-long vessels, each with space for 18,000 20-foot container units. These vessels set a new benchmark in maritime energy efficiency by virtue of their size, slower speed, design improvements, and a waste heatrecovery system that reduces the engines fuel consumption.

Switching to alternative fuels. A road transport company recently esti-

mated that it would save 15,000 a year per truck by converting its small fleet to run on vegetable oil rather than traditional diesel fuel. Because of North Americas recent flood of supply of natural gas, companies could also convert fleets to run on liquified natural gas (LNG) instead of diesel.

1 Organisation for Economic Co-operation and Development.

17

Practicing smarter driving. Examining data collected by onboard com-

puters, a logistics company found significant differences in the driving patterns and fuel consumption of drivers. Shifting to best practice could shave 10 percent off its $4 million annual fuel bill, with onboard computers helping employees drive more economically. Regulators also have a role to play. In the United States, the fuel efficiency gain of lowering the cap on truck speeds on highways could be 7 to 10 percent. Truck speeds are already capped to lower levels in Europe. But there are still opportunitiesfor instance, allowing longer (and potentially heavier) truck/trailer combinations in Europes road transport market could reduce its use of diesel by around 15 percent. These examples are just the tip of the iceberg. Further existing technological opportunitiessuch as trucks with better aerodynamics and ocean vessels with new, friction-reducing hull coatingsare economical at the $100-a-barrel prices that have prevailed recently. High prices also should induce companies to cut the distance products travel. Moving final assembly into regions of demand would make it sensible to manufacture less valuable components there, such as primary packaging, manuals, or power cables for electric goods. An alternative is to ship products with low value density by slow and more energy efficient modes of transport. Optimizing the energy efficiency of a supply chains production process, location footprint, transportation, and inventory is a complex task made harder by inevitable tensions between the supply chain group and functions such as sales, service, and product development. There are thorny trade-offsfor example, between service levels and the lower speed of energy-efficient transport. Part of the answer will be creating nimbler supply chainsfor example, by using slower, more energy-efficient modes (such as ocean freight) for the base load and reserving the faster, less energy-efficient modes (such as air freight) for peak demand. CEOs also will need to facilitate meaningful discussion of important cross-functional supply chain issues so that executives can collaborate to uphold a companys best interests.

Knut Alicke is a consultant in McKinseys Stuttgart office, and Tobias Meyer is a principal in the Frankfurt office.

Copyright 2011 McKinsey & Company. All rights reserved. We welcome your comments on this article. Please send them to quarterly_comments@mckinsey.com.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Commodities As An Asset ClassDocument7 pagesCommodities As An Asset ClassvaibhavNo ratings yet

- Cadbury Marketing StrategiesDocument63 pagesCadbury Marketing Strategiespratik99670% (1)

- December BillDocument9 pagesDecember BillPrakash RajaNo ratings yet

- Circular Flow of Income, Expenditure and Output - A Level Economics B Edexcel Revision - Study RocketDocument4 pagesCircular Flow of Income, Expenditure and Output - A Level Economics B Edexcel Revision - Study RocketdhaiwatNo ratings yet

- Pos Malaysia Berhad Ar 2015Document195 pagesPos Malaysia Berhad Ar 2015Sulaiman KashimNo ratings yet

- Lesson 5-Bollinger MR StrategyDocument27 pagesLesson 5-Bollinger MR StrategyHasan Zaman86% (7)

- 1 - Basic Economic ConceptsDocument4 pages1 - Basic Economic ConceptsEric NgNo ratings yet

- IM Unit 1Document29 pagesIM Unit 1Sahil AgrawalNo ratings yet

- Mbmonthly20170601 PDFDocument72 pagesMbmonthly20170601 PDFAnonymous g5l9spl1No ratings yet

- NEWTHESISDocument64 pagesNEWTHESISReivalf DueNo ratings yet

- 1.heart of AlgebraDocument29 pages1.heart of AlgebraTako Pochkhua0% (1)

- Decision Making For StudentsDocument18 pagesDecision Making For Students12007856No ratings yet

- 2.3 Paper 2.3 - Accounting For Business - 1Document6 pages2.3 Paper 2.3 - Accounting For Business - 1Himanshu SinghNo ratings yet

- Bubble Rush Shampoo The New Venture of Business Plan ReportDocument54 pagesBubble Rush Shampoo The New Venture of Business Plan ReportKainat RasheedNo ratings yet

- Portofoliu Comunicare - Fratica Bianca MariaDocument22 pagesPortofoliu Comunicare - Fratica Bianca MariaBianca FrăticăNo ratings yet

- Microsoft Word - Qa 1 PracticalDocument9 pagesMicrosoft Word - Qa 1 PracticalmansiNo ratings yet

- Descriptive SituationsDocument9 pagesDescriptive SituationsRiya PandeyNo ratings yet

- VAT ExemptionsDocument2 pagesVAT ExemptionsReena MaNo ratings yet

- Classification of Housing Units in The MarketDocument3 pagesClassification of Housing Units in The MarketAron Stephen PlanNo ratings yet

- Pre Listing Packet SBDocument7 pagesPre Listing Packet SBNoah J. Park100% (2)

- Capital BudjetingDocument94 pagesCapital Budjetingtulasinad123100% (1)

- Introduction To PMRDocument6 pagesIntroduction To PMRbastian_wolfNo ratings yet

- 5 Force PorterDocument8 pages5 Force PorterAnindito W WicaksonoNo ratings yet

- Capitalist EconomyDocument3 pagesCapitalist EconomyManish Mehta100% (1)

- AIS16Exercises SCDocument6 pagesAIS16Exercises SCSarah GherdaouiNo ratings yet

- 9-204-066 Dividend Policy - 204702-XLS-ENGDocument17 pages9-204-066 Dividend Policy - 204702-XLS-ENGValant Rivas DerteNo ratings yet

- ECE333 Renewable Energy Systems 2015 Lect7Document43 pagesECE333 Renewable Energy Systems 2015 Lect7rdelgranadoNo ratings yet

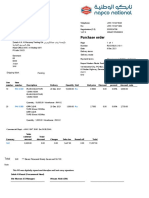

- Purchase Order: Napco Modern Plastic Products Co. - Sack DivisionDocument1 pagePurchase Order: Napco Modern Plastic Products Co. - Sack Divisionمحمد اصدNo ratings yet

- Kia Motors Corporation 231 Yangjae-Dong, Seocho-Gu, Seoul, 137-938, Korea Tel: 82-2-3464-5668 / Fax: 82-2-3464-5964Document14 pagesKia Motors Corporation 231 Yangjae-Dong, Seocho-Gu, Seoul, 137-938, Korea Tel: 82-2-3464-5668 / Fax: 82-2-3464-5964Abhishek SinghNo ratings yet

- Icici Prudential Asset Management Company LTD.: Revision and Practice Test Kit Version 3Document21 pagesIcici Prudential Asset Management Company LTD.: Revision and Practice Test Kit Version 3Neeraj KumarNo ratings yet