Professional Documents

Culture Documents

Transferring Your Home To The Kids? You Must Let The IRS Know, Even If Your Estate Is Not Currently Taxable

Uploaded by

Joseph S. KarpOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Transferring Your Home To The Kids? You Must Let The IRS Know, Even If Your Estate Is Not Currently Taxable

Uploaded by

Joseph S. KarpCopyright:

Available Formats

Report Those Gifts

of them never file the The unified gift and required 709. I know estate tax exemption for of many cases where an individual is currentthe parent just goes ly $5 million. Individuals down to the neighmay pass that much, free borhood attorney of estate tax and gift tax, and asks for a quitduring their lifetimes. claim deed. Generally, Under the current law, the attorney does as most of us dont have asked, not discussing taxable estates. the tax or estate planBut hold on. Just because your estate is not Joseph S. Karp, C.E.L.A. ning ramifications or the 709 requirement. currently taxable doesnt According to a recent report in mean it wont be when you pass away. You dont know when that will Kiplingers, 60% to 90% of taxpayers happen. You dont know what your who transfer real property to family asset situation will be at that point, members for little or no consideraeither. And you surely dont know tion do not file the required Form what the tax code will be. The pres- 709. So the revenue-strapped federent estate tax law is due to expire at al government is now cracking down, the end of 2012. Its always been examining land transfer records to a political football, so anything is track these gifts, and auditing taxpayers who have not complied with possible. the 709 requirement. If you make a gift over Listen to Joe Karp and Anita Finley $13,000 to any one person on Saturday, August 20 from 7:30-8:00 AM within any given year, but on WSBR 740AM and on the dont report it, you could Internet at www.wsbrradio.com. be creating a big tax mess Also, remember we are dealing for your heirs. Consult with an experwith the Unified Gift and Estate Tax ienced estate planning attorney to Exemption. Any gifts you make over determine how to effectively make $13,000 to any one individual in any gifts. He or your CPA can also advise one year will be deducted from your you about the steps you must take if lifetime exemption. The IRS wants to youve already made such a gift but know about any such gifts, because not reported it. they could push your estate into taxJoseph S. Karp is a nationally certified able territory. The IRS is not about to and Florida Bar-certified elder law attorney let go of that potential revenue. You (C.E.L.A.) specializing in the practice of are required to report any such gift Trusts, Estates and Elder Law. His offices are located at 2500 Quantum on a Form 709, regardless of whether Lakes Drive, Boynton Beach (561) 752-4550; your estate is currently taxable. If you 2875 PGA Blvd., Palm Beach Gardens havent used up your full lifetime (561) 625-1100; and 1100 SW St. Lucie W. exemption, currently $5 million, Blvd., Port St. Lucie (772) 343-8411. filing the 709 is merely informationToll-free from anywhere: 800-893-9911. al; neither you nor the recipient will E-mail: KLF@Karplaw.com or website owe tax on this gift. www.karplaw.com. One of the transfers seniors often Read The Florida Elder Law and Estate make to adult children is real prop- Planning Blog at erty. And according to the IRS, many www.karplaw.blogspot.com.

# #

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Adult Guardianship in Florida: When It's Necessary, and How To Avoid ItDocument1 pageAdult Guardianship in Florida: When It's Necessary, and How To Avoid ItJoseph S. KarpNo ratings yet

- Protect Your Assets From The Cost of Long-Term CareDocument1 pageProtect Your Assets From The Cost of Long-Term CareJoseph S. KarpNo ratings yet

- Florida Has A New Durable Power of Attorney Law Effective Oct. 1, 2010Document1 pageFlorida Has A New Durable Power of Attorney Law Effective Oct. 1, 2010Joseph S. KarpNo ratings yet

- Laws, Life Always Changing: Reasons To Review Your Estate Plan NowDocument1 pageLaws, Life Always Changing: Reasons To Review Your Estate Plan NowJoseph S. KarpNo ratings yet

- Laws, Life Always Changing: Reasons To Review Your Estate Plan NowDocument1 pageLaws, Life Always Changing: Reasons To Review Your Estate Plan NowJoseph S. KarpNo ratings yet

- Get Help From A Florida Certified Elder Law Attorney When Applying For Medicaid BenefitsDocument1 pageGet Help From A Florida Certified Elder Law Attorney When Applying For Medicaid BenefitsJoseph S. KarpNo ratings yet

- Help May Be Available To Pay For Assisted Living, Home CareDocument1 pageHelp May Be Available To Pay For Assisted Living, Home CareJoseph S. KarpNo ratings yet

- Update On Estate Tax and FDIC RulesDocument1 pageUpdate On Estate Tax and FDIC RulesJoseph S. KarpNo ratings yet

- Good New Year ResolutionsDocument1 pageGood New Year ResolutionsJoseph S. KarpNo ratings yet

- Act Now To Avoid Being Wiped Out by LongTerm Care CostsDocument1 pageAct Now To Avoid Being Wiped Out by LongTerm Care CostsJoseph S. KarpNo ratings yet

- Florida Medicaid Irrevocable Trust Can Protect You From Future Nursing Home CostsDocument1 pageFlorida Medicaid Irrevocable Trust Can Protect You From Future Nursing Home CostsJoseph S. KarpNo ratings yet

- Changes in Florida Homestead Law, Estate Tax LawDocument1 pageChanges in Florida Homestead Law, Estate Tax LawJoseph S. KarpNo ratings yet

- Trusts vs. Payable On Death AccountsDocument1 pageTrusts vs. Payable On Death AccountsJoseph S. KarpNo ratings yet

- Will Contests: Advice For All SidesDocument1 pageWill Contests: Advice For All SidesJoseph S. KarpNo ratings yet

- Holocaust Reparations and Florida Medicaid BenefitsDocument1 pageHolocaust Reparations and Florida Medicaid BenefitsJoseph S. KarpNo ratings yet

- Why I Love My JobDocument1 pageWhy I Love My JobJoseph S. KarpNo ratings yet

- Hurricane Season Is Here: Protect Your Estate Planning DocumentsDocument1 pageHurricane Season Is Here: Protect Your Estate Planning DocumentsJoseph S. KarpNo ratings yet

- 2010 Tax Laws May Jeopardize Your SpouseDocument1 page2010 Tax Laws May Jeopardize Your SpouseJoseph S. KarpNo ratings yet

- Trust Your Trustee!Document1 pageTrust Your Trustee!Joseph S. KarpNo ratings yet

- Legal Steps You Must Take When A Loved One Has Alzheimer'sDocument1 pageLegal Steps You Must Take When A Loved One Has Alzheimer'sJoseph S. KarpNo ratings yet

- Medicaid Gifting Trust A Valuable StrategyDocument1 pageMedicaid Gifting Trust A Valuable StrategyJoseph S. KarpNo ratings yet

- Gift That Keeps On TAKINGDocument1 pageGift That Keeps On TAKINGJoseph S. KarpNo ratings yet

- Stop The MadnessDocument1 pageStop The MadnessJoseph S. KarpNo ratings yet

- Annuities Not An Automatic Medicaid FixDocument1 pageAnnuities Not An Automatic Medicaid FixJoseph S. KarpNo ratings yet

- What To Do After You Sign Your Estate Planning DocumentsDocument1 pageWhat To Do After You Sign Your Estate Planning DocumentsJoseph S. KarpNo ratings yet

- Life Insurance TipsDocument1 pageLife Insurance TipsJoseph S. KarpNo ratings yet

- This Is Your LifeDocument1 pageThis Is Your LifeJoseph S. KarpNo ratings yet

- Veterans Benefits For Long-Term CareDocument1 pageVeterans Benefits For Long-Term CareJoseph S. KarpNo ratings yet

- Your Children Should KnowDocument1 pageYour Children Should KnowJoseph S. KarpNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- (Sarvesh Dhatrak) Derivatives in Stock Market and Their Importance in HedgingDocument79 pages(Sarvesh Dhatrak) Derivatives in Stock Market and Their Importance in Hedgingsarvesh dhatrakNo ratings yet

- Finance & Banking - NU SyllabusDocument8 pagesFinance & Banking - NU SyllabusadctgNo ratings yet

- CSIT Problem QuestionsDocument3 pagesCSIT Problem QuestionsQweku TeyeNo ratings yet

- Presentation On IOCL - PPT On SUMMER INTERNSHIP PROJECTDocument15 pagesPresentation On IOCL - PPT On SUMMER INTERNSHIP PROJECTMAHENDRA SHIVAJI DHENAK33% (3)

- Transcription Doc Foreign Trade: Speaker: Chris OatesDocument9 pagesTranscription Doc Foreign Trade: Speaker: Chris OatesAnirban BhattacharyaNo ratings yet

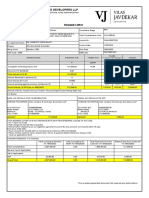

- VJ - Digital Demand For O3INV-00372-23 - 20230218T031404875Document1 pageVJ - Digital Demand For O3INV-00372-23 - 20230218T031404875Hardik RavalNo ratings yet

- Generally Accepted Accounting PrinciplesDocument12 pagesGenerally Accepted Accounting PrinciplesMARIA ANGELICA100% (1)

- Solved Exercises 2Document10 pagesSolved Exercises 2ScribdTranslationsNo ratings yet

- An Assignment OnDocument25 pagesAn Assignment OnJalal HossainNo ratings yet

- 2316 Jan 2018 ENCS FinalDocument2 pages2316 Jan 2018 ENCS FinalKirsten Bairan100% (2)

- Profile Summary: Harkesh GargDocument3 pagesProfile Summary: Harkesh Gargharkesh gargNo ratings yet

- 04 QuestionsDocument7 pages04 QuestionsfaizthemeNo ratings yet

- 3.2 Accounting For Corporation Reviewer With Sample ProblemDocument82 pages3.2 Accounting For Corporation Reviewer With Sample Problemlavender hazeNo ratings yet

- Doing Business in BrazilDocument164 pagesDoing Business in BrazilVarupNo ratings yet

- Mergent Residences Sample ComputationDocument1 pageMergent Residences Sample Computationrx5426.homerouterNo ratings yet

- Bir 2Q 2020Document4 pagesBir 2Q 2020Leo Archival ImperialNo ratings yet

- Citi Card Pay PDFDocument1 pageCiti Card Pay PDFShamim KhanNo ratings yet

- Cash and Cash EquivalentsDocument33 pagesCash and Cash EquivalentsMerry Julianne DaymielNo ratings yet

- CFTC Commitments of Traders Report - CME (Futures Only) 06082013Document10 pagesCFTC Commitments of Traders Report - CME (Futures Only) 06082013Md YusofNo ratings yet

- SRM Sem1 Exam Fee ReceiptDocument2 pagesSRM Sem1 Exam Fee Receiptdeeksha6548gkNo ratings yet

- The Philip Fisher Screen That Fishes Quality StocksDocument3 pagesThe Philip Fisher Screen That Fishes Quality StocksMartinNo ratings yet

- FY23 Maximus Investor Presentation - AugDocument15 pagesFY23 Maximus Investor Presentation - AugMarisa DemarcoNo ratings yet

- IT Critique - Goyal 2018Document11 pagesIT Critique - Goyal 2018Aditya GuptaNo ratings yet

- Hyperin Ation in Venezuela: Research Question, Aim and GoalDocument2 pagesHyperin Ation in Venezuela: Research Question, Aim and GoalMilica NikolicNo ratings yet

- CH 3 Open Economy Macroeconomics (Chap 3-2017) NewDocument63 pagesCH 3 Open Economy Macroeconomics (Chap 3-2017) NewLemma MuletaNo ratings yet

- Bzu, Bahadur Sub-Campus Layyah: Submitted To: Mr. Muhammad Saleem Student GroupDocument23 pagesBzu, Bahadur Sub-Campus Layyah: Submitted To: Mr. Muhammad Saleem Student GroupMuhammad Ihsan ToorNo ratings yet

- Fema Add CHDocument54 pagesFema Add CHMukesh DholakiaNo ratings yet

- Follow Fibonacci Ratio Dynamic Approach in TradeDocument4 pagesFollow Fibonacci Ratio Dynamic Approach in TradeLatika DhamNo ratings yet

- NHB Vishal GoyalDocument24 pagesNHB Vishal GoyalSky walkingNo ratings yet

- Business Studies Form Four NotesDocument66 pagesBusiness Studies Form Four Notestimothy muyumbiNo ratings yet