Professional Documents

Culture Documents

VJ - Digital Demand For O3INV-00372-23 - 20230218T031404875

Uploaded by

Hardik RavalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

VJ - Digital Demand For O3INV-00372-23 - 20230218T031404875

Uploaded by

Hardik RavalCopyright:

Available Formats

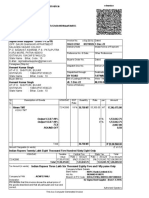

VILAS JAVDEKAR GREENSCAPE DEVELOPERS LLP

306 SIDDHARTH TOWERS,SANGAM PRESS ROADPUNE, PUNE, MAHARASHTRA,

INDIA, PIN:411038

GSTIN 27AASFG4227B1ZH

PAN AASFG4227B

Demand Letter

Customer Name Mr. HARDIK NIRAJKUMAR RAVAL Cumulative Stage 90%

703, TRIMURTI SANGAM SOCIETY, NEAR MAJOR R R

RANE SCHOOL,SANGAMWADI INDIA 411003PUNE Total Consideration Amt 2,231,000.00

Address

MAHARASHTRA

Invoice No O3INV/00372/23

Co Applicant Name : Ms. NAMRATA KIRAN BHATT

Project 67K INCLUSIVE HOUSING Invoice Date 17/02/2023

Wing & Unit Mhadha / 1502 Print Date 18/02/2023

HSN Code : 9954 RERA NO : P52100031301

TAXES

Schedule Name Instalment Amt Taxable Amt Amount

CGST SGST

A (2/3)*B C D A+C+D=E

Completion of Flooring of your Unit 111,550.00 74,367 558.00 558.00 112,666.00

Discount ( ITC Benfit) (B) 0.00 0.00 0.00 0.00

Total Amount (C=A-B) 111,550.00 558.00 558.00 112,666.00

Amount Received in advance (D) 0 0 0 0

Total Amount (E =C-D) 111550 558 558 112666

Amount pending against previous milestones (F) -2 1117 1117 2232

Gross Amount (G =E+F) as on 18/02/2023 111,548.00 1,675.00 1,675.00 114,898.00

Amount in Words : Rupees One Lac Fourteen Thousand Eight Hundred Ninety Eight Only

For Banker

BANK A/C DETAILS FOR CONSIDERATION BANK A/C DETAILS FOR GST

CHEQUE FAVOURING Vilas Javdekar Greenscape Developers LLP CHEQUE FAVOURING Vilas Javdekar Greenscape Developers LLP

ACCOUNT NO. 033805008388 ACCOUNT NO. 033805009730

BANK NAME ICICI BANK LTD BANK NAME ICICI BANK

BRANCH PUNE - KOTHRUD, PUNE BRANCH KOTHRUD BRANCH

IFSC CODE ICIC0000338 IFSC CODE ICIC0000338

AMOUNT 111,548.00 AMOUNT 3,350.00

*THIS DEMAND LETTER IS IN ACCORDANCE WITH ANTI PROFETEERING CLAUSE OF GST LAW.

: ITC = Input Tax Credit.

: Bank charges (if any) will also be payable.

: Interest will be charged as per our registered agreement to sale if the due amount is not received within 10 days

from issue of this letter.

: If your accounts do not tally with our records please contact our office immediately.

: Please mention customer name, project name, unit no. & payment details behind your cheque or DD.

: Taxes as applicable by Govt.

Cumulative Statement - For Customer

Total Cumulative Demand Total Cumulative ITC Total Received From The Balance Due From Customer

Till 18/02/2023 Benfit Till 18/02/2023 Customer Till 18/02/2023 Till 18/02/2023

Total Consideration 2,007,900.00 0.00 1,896,352.00 111,548.00

Service Tax (If Applicable)

Vat (if Applicable)

GST 20,080.00 0.00 16,730.00 3,350.00

Grand Total 2,027,980.00 0.00 1,913,082.00 114,898.00

This is system generated document Not required any Authorization.

You might also like

- Order ID 4477796952Document1 pageOrder ID 4477796952DRX PUNEETNo ratings yet

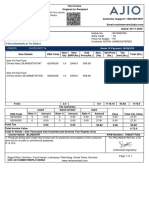

- Ajio 1671590426092Document1 pageAjio 1671590426092NaveenNo ratings yet

- AC GST Tax InvoiceDocument1 pageAC GST Tax InvoiceSuganthi RavindrenNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceGaurav SinghNo ratings yet

- Tax Invoice DetailsDocument1 pageTax Invoice DetailsmsNo ratings yet

- Tax Invoice for Striped CaprisDocument1 pageTax Invoice for Striped CaprissahajathallamNo ratings yet

- Factura AereoDocument3 pagesFactura Aereojuancl87No ratings yet

- Telephone Bill - June 2019Document2 pagesTelephone Bill - June 2019Med Cabojoc Jr.No ratings yet

- Tax Invoice GST DetailsDocument1 pageTax Invoice GST Detailsshakeel ansari5518No ratings yet

- IM Gears Pvt Ltd purchase order for drill body and DMP160 componentsDocument1 pageIM Gears Pvt Ltd purchase order for drill body and DMP160 componentsDinesh RNo ratings yet

- Invoice for 10 HP laptops under Rs. 428,000Document2 pagesInvoice for 10 HP laptops under Rs. 428,000aryandjNo ratings yet

- InvertedDocument2 pagesInvertedShrikant KeskarNo ratings yet

- InvoiceDocument1 pageInvoiceKarshan GarhewalNo ratings yet

- DWAITHA INFRACON-34 - XLSMDocument1 pageDWAITHA INFRACON-34 - XLSMManjitNo ratings yet

- Sold By: Friske Knits ,: Howrah, West Bengal, Uluberia, Howrah, West Bengal, India - 711316, IN-WBDocument1 pageSold By: Friske Knits ,: Howrah, West Bengal, Uluberia, Howrah, West Bengal, India - 711316, IN-WBSimfed SikkimNo ratings yet

- DOCUMENTBIR CAS Permit No. 1908_0126_PTU_CAS_000600 SOA No. 000491870985 Globe Telecom bill detailsDocument3 pagesDOCUMENTBIR CAS Permit No. 1908_0126_PTU_CAS_000600 SOA No. 000491870985 Globe Telecom bill detailsnoibagng928krNo ratings yet

- File JEETDocument1 pageFile JEETrohitNo ratings yet

- Shipping & Billing Address: Ishika Ghosh: Date: 27/09/2022Document2 pagesShipping & Billing Address: Ishika Ghosh: Date: 27/09/2022Ishika GhoshNo ratings yet

- InvoiceDocument1 pageInvoiceOmprakash NandlaNo ratings yet

- JioMart Invoice 16582472940212031ADocument1 pageJioMart Invoice 16582472940212031ADipankarNo ratings yet

- Earphones Invice PDFDocument1 pageEarphones Invice PDFAnnu MalikNo ratings yet

- SAMSUNG Galaxy F23 5G (Aqua Blue, 128 GB) : Grand Total 13528.00Document2 pagesSAMSUNG Galaxy F23 5G (Aqua Blue, 128 GB) : Grand Total 13528.00Sachin HosamaniNo ratings yet

- Invoice - 1599221529948 - FHSL Gurgaon PDFDocument1 pageInvoice - 1599221529948 - FHSL Gurgaon PDFAmar ChauhanNo ratings yet

- E-Invoice Data DictionaryDocument124 pagesE-Invoice Data DictionarySaquib.MahmoodNo ratings yet

- InvoiceDocument1 pageInvoiceshabadNo ratings yet

- Analytics CloudDocument1 pageAnalytics CloudAbhijit SarkarNo ratings yet

- Service Customer in VoiceDocument1 pageService Customer in VoiceDhayananthNo ratings yet

- Payment Slip: Summary of Charges / Payments Current Bill AnalysisDocument4 pagesPayment Slip: Summary of Charges / Payments Current Bill Analysisother dimensionsNo ratings yet

- Retail Tax InvoiceDocument2 pagesRetail Tax InvoiceTanya RaiNo ratings yet

- Tax Invoice SEODocument1 pageTax Invoice SEOPast Pubg MobileNo ratings yet

- Sam A14Document1 pageSam A14TOP 10 MALAD EAST NEWNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Imran KhanNo ratings yet

- Final Invoice for 1 room hotel stayDocument1 pageFinal Invoice for 1 room hotel staysidthefreak809No ratings yet

- 9 Pro BillDocument1 page9 Pro BillMajestic PlastersNo ratings yet

- Tax Invoice SummaryDocument4 pagesTax Invoice SummarySourabh NeemaNo ratings yet

- InvoiceDocument1 pageInvoiceadar tiwNo ratings yet

- OD122547982614750000Document1 pageOD122547982614750000GopalNo ratings yet

- (05D)Document1 page(05D)Yosmell Fritzan Paz UrbizagasteguiNo ratings yet

- Tax Invoice: Bill To: Abinash Jena Original For RecipientDocument1 pageTax Invoice: Bill To: Abinash Jena Original For RecipientbiswanathNo ratings yet

- Iphone 14 Pro Iphone 14 Pro Max: FinishDocument30 pagesIphone 14 Pro Iphone 14 Pro Max: Finishryan gutterNo ratings yet

- Delhi woman's electricity bill detailsDocument3 pagesDelhi woman's electricity bill detailsGeetanjaliNo ratings yet

- Noc Goyal - Dec22Document1 pageNoc Goyal - Dec22Mobile Gallery Samsung tabNo ratings yet

- WelcomeLetter 3396301000001791Document2 pagesWelcomeLetter 3396301000001791Usman Saeed KhanNo ratings yet

- Tax Invoice for Bluetooth SmartwatchDocument1 pageTax Invoice for Bluetooth Smartwatchkunal GoyalNo ratings yet

- Flipkart PDFDocument1 pageFlipkart PDFThe TradisttNo ratings yet

- INCOTERMS: FCA Shipping Point Purchase Order No. Master Tracker NoDocument2 pagesINCOTERMS: FCA Shipping Point Purchase Order No. Master Tracker Nomitchel taylorNo ratings yet

- Jio BillDocument1 pageJio Billshiva keerthiNo ratings yet

- My InvoiceDocument2 pagesMy InvoiceAchintyaNo ratings yet

- OD126068795255959000Document1 pageOD126068795255959000Raju SkpNo ratings yet

- Black Vs BlueDocument4 pagesBlack Vs BlueDhrisha MehtaNo ratings yet

- Invoice (27) (28) New VivoDocument1 pageInvoice (27) (28) New VivoRamesh GowdaNo ratings yet

- ItineraryDocument4 pagesItinerarySVETA YADAVNo ratings yet

- Airtel Bill For The Period From 05.04.2023 To 04.5.2023 PDFDocument129 pagesAirtel Bill For The Period From 05.04.2023 To 04.5.2023 PDFdlco pvpNo ratings yet

- Abhimanyu Indane LPG invoice for Amit SaxenaDocument2 pagesAbhimanyu Indane LPG invoice for Amit SaxenaAmit SaxenaNo ratings yet

- DownloadReceiptMon14Mar2022 PDFDocument2 pagesDownloadReceiptMon14Mar2022 PDFHarish P ANo ratings yet

- Invoice E11FE4AA 0002 PDFDocument1 pageInvoice E11FE4AA 0002 PDFJohnny RichardNo ratings yet

- CRN7119836032 (2305843009213960675)Document4 pagesCRN7119836032 (2305843009213960675)vikramNo ratings yet

- JurnalDocument5 pagesJurnalAhmad Sobri AhmadNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument3 pagesMobile Services: Your Account Summary This Month'S ChargesSrinjoy SealNo ratings yet

- Inv TG B1 60409095 101630937035 April 2022 1Document2 pagesInv TG B1 60409095 101630937035 April 2022 1Lokesh reddyNo ratings yet

- Serveware Insulated Curry Servers Keep Food FreshDocument12 pagesServeware Insulated Curry Servers Keep Food FreshHardik RavalNo ratings yet

- Description: THRO (Set of 4) THRO (Set of 2) THRO Vase (Set of 1)Document1 pageDescription: THRO (Set of 4) THRO (Set of 2) THRO Vase (Set of 1)Hardik RavalNo ratings yet

- To GoDocument36 pagesTo GoHardik RavalNo ratings yet

- Borosil NutriFresh Blender Helps Prepare Healthy MealsDocument38 pagesBorosil NutriFresh Blender Helps Prepare Healthy MealsHardik RavalNo ratings yet

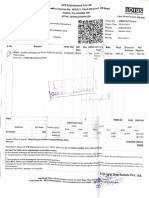

- Axis Bank Details For Ms Firelink Services LLP & GST NoDocument1 pageAxis Bank Details For Ms Firelink Services LLP & GST NoHardik RavalNo ratings yet

- Hardik Last 6 Months Bank Statement PDFDocument19 pagesHardik Last 6 Months Bank Statement PDFHardik RavalNo ratings yet

- 13th Feb Navsari-Brc 4 PaxDocument1 page13th Feb Navsari-Brc 4 PaxHardik RavalNo ratings yet

- Melody Makers Certificate PDFDocument1 pageMelody Makers Certificate PDFHardik RavalNo ratings yet

- Bank statement summaryDocument19 pagesBank statement summaryHardik RavalNo ratings yet

- 3aDocument5 pages3aHardik RavalNo ratings yet

- Baagon Me Kaise Ye PhoolDocument1 pageBaagon Me Kaise Ye PhoolHardik RavalNo ratings yet

- Indonesian CSR Awards 2011Document16 pagesIndonesian CSR Awards 2011Achmad SubagioNo ratings yet

- The Woody Case StudyDocument5 pagesThe Woody Case StudyniaaNo ratings yet

- 505 AllDocument509 pages505 AllBokul HossainNo ratings yet

- Partnership Formation ReviewerDocument24 pagesPartnership Formation ReviewerJyasmine Aura V. AgustinNo ratings yet

- Duty Entitlement Pass Book SchemeDocument6 pagesDuty Entitlement Pass Book SchemePiyush SoniNo ratings yet

- Report ThursdayDocument6 pagesReport ThursdayReginald ValenciaNo ratings yet

- Manufacturing ReviewerDocument14 pagesManufacturing ReviewerJenifer D. CariagaNo ratings yet

- Gazette Order Details 1995 Drugs PricesDocument26 pagesGazette Order Details 1995 Drugs PricesNaveenbabu SoundararajanNo ratings yet

- Capitec FinancialsDocument12 pagesCapitec FinancialsRenau LwambaNo ratings yet

- VikasNagPrasanna CV PDFDocument1 pageVikasNagPrasanna CV PDFRahul NagrajNo ratings yet

- Ethics in Production/Operation ManagementDocument29 pagesEthics in Production/Operation ManagementSuyog Pitale78% (18)

- BAAB1014 Assignment EliteDocument5 pagesBAAB1014 Assignment Elitejinosini ramadasNo ratings yet

- PA 201 (KarenSio) - TERM PAPERDocument24 pagesPA 201 (KarenSio) - TERM PAPERKaren SioNo ratings yet

- Risk Based ThinkingDocument10 pagesRisk Based Thinkingnorlie0% (1)

- Comparing Financial Statements and RatiosDocument11 pagesComparing Financial Statements and RatiosVincentDenhereNo ratings yet

- Shopper Marketing StrategyDocument22 pagesShopper Marketing StrategyMuhammad Faiq SiddiquiNo ratings yet

- 568066067-The-Performance-Pyramid للاستفادةDocument11 pages568066067-The-Performance-Pyramid للاستفادةworood.khalifih90No ratings yet

- Corporate GovernanceDocument30 pagesCorporate GovernanceMehdi BouaniaNo ratings yet

- JU Penjahit YantiDocument14 pagesJU Penjahit Yantiecjeb100% (2)

- Contemporary Logistics: Twelfth Edition, Global EditionDocument47 pagesContemporary Logistics: Twelfth Edition, Global EditionEge GoksuzogluNo ratings yet

- Workmen'S Compensation Insurance Proposal FormDocument2 pagesWorkmen'S Compensation Insurance Proposal Formashu420No ratings yet

- Unit 3: Supply Chain, Purchase and Stores Management: Prepared by Dr. R. ArivazhaganDocument58 pagesUnit 3: Supply Chain, Purchase and Stores Management: Prepared by Dr. R. ArivazhaganSusrii SangitaNo ratings yet

- E-BOOK 30 Consumer Behavior Shiftings Welcome The New Normal PDFDocument40 pagesE-BOOK 30 Consumer Behavior Shiftings Welcome The New Normal PDFMr SetiawanNo ratings yet

- Abigail Santos Boutique, Financial Statement For MerchandisingDocument9 pagesAbigail Santos Boutique, Financial Statement For MerchandisingFeiya Liu100% (1)

- Discipline and Grievance ManagementDocument176 pagesDiscipline and Grievance ManagementTMTCS HR100% (1)

- Ch. 13 Notes: Financial Statement Analysis BreakdownDocument9 pagesCh. 13 Notes: Financial Statement Analysis BreakdownLê Tuấn AnhNo ratings yet

- Invoice SummaryDocument3 pagesInvoice SummaryoluwainvNo ratings yet

- How COVID-19 Will Change The Geography of CompetitionDocument5 pagesHow COVID-19 Will Change The Geography of CompetitionGan YunshanNo ratings yet

- Info Sheet Assessing RiskDocument5 pagesInfo Sheet Assessing RiskalkalkiaNo ratings yet

- Annual Meeting MinutesDocument4 pagesAnnual Meeting MinutesMuhdnursalam ZolkepliNo ratings yet