Professional Documents

Culture Documents

Invoice for 10 HP laptops under Rs. 428,000

Uploaded by

aryandjOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Invoice for 10 HP laptops under Rs. 428,000

Uploaded by

aryandjCopyright:

Available Formats

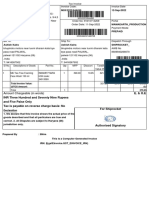

Invoice

GeM Invoice No: GEM-21447736

SELLER DETAILS: GeM Invoice Date: 22-Jul-2022

Address: SUN SYSTEMS

C-387, PALAM EXTENSION, SECTOR 7 DWARKA, DELHI, Order No: GEMC-511687795831800

DELHI, 110075 Order Date: 29-Jun-2022

Email Id: mahaldar@sunsystems.co.in

Contact No : 09818099625

GSTIN: 07AGNPM1739R1ZL Click here to download seller invoice

BILL TO:

SHIPPING TO: Buyer Name: Shailesh Kumar Maurya , DMM MAS

Consignee Name: Syamala Rangarajan Address: Office of the Senior Divisional Material Manager

Address: Office of the Principal Financial Adviser General Divisional Railway Manager Office Chennai Division Park

Managers Office Park Town Chennai-600003 CHENNAI Town,Chennai-600003 Chennai TAMIL NADU 600003 NA N/A

TAMIL NADU 600003 GSTIN: 33AAAGM0289C1ZQ

Department: NA

Contact No: 044-25353353- Office Zone:Southern Railway

GSTIN: 33AAAGM0289C1ZQ Organisation: N/A

Ministry: Ministry of Railways

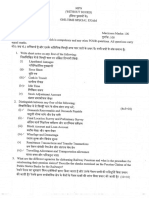

Seller Tax Invoice Number Seller Tax Invoice Date Dispatch Mode Dispatch Date

30T/SUN/22-23 20-Jul-2022 Courier 22-Jul-2022

Type of Transport Tracking No Tracking URL Type & No of Packages

- 442327104 Click here for tracking Box 20

Place of Supply Place of Supply State (State/UT Code) Supply Type Consignee GSTIN Number

Consignee Location Tamil Nadu / 33 Inter-State 33AAAGM0289C1ZQ

Measurem GST UQ Supplied Total Price inclusive

Product Description HSN Code Unit Price

ent Unit Name Qty all Taxes

hp Intel Core i3 10100 4 GB/ 500

GB HDD/ Windows 10 847130 pieces PIECES 10 Rs. 42800.00 Rs. 428000.00

Professional

Taxable Amount Rs. 362711.80

Tax Rate (%) 18

IGST Rs. 65288.12

Cess Rate (%) 0.000

Cess Amount Rs. 0.00

Cess in Quantum Rs. 0.00

Rounding Off Rs. 0.08

Grand Total Rs. 428000.00

I /We hereby declare that our firm/company has been specifically excluded from the requirement to comply with GST e-invoicing

provisions vide Notification number 13/2020-Central Tax dated 21 March 2020, as amended up to date. Accordingly, at present,

we are not covered under the ambit of GST e-invoicing provisions. We do hereby declare that once the said provisions are made

applicable to us, we shall issue the duly complied e-Invoice under GST Law.

All GST invoice or document issued by us shall be properly and timely reported under respective returns under GST by us in line

with the notified provisions and the applicable tax collected from Buyer shall be timely and correctly paid to the respective

Government by us.

In case the Input Tax Credit of GST is denied or demand is recovered from Buyer on account of any act/ omission of us in this

regard, we shall be liable in respect of all claims of tax, penalty and/or interest, loss, damages, costs, expenses and liability that

may arise due to such non-compliance. Buyer shall have the right to recover such amount from any payments due to us or from

Performance Security, or any other legal recourse from us.

INK SIGNED SIGNATURES ARE NOT REQUIRED IN SYSTEM GENERATED DOCUMENTS

Signature Not Verified

Digitally Signed.

Name: SATISH

MAHALDAR

Date: 22-Jul-2022 17:10:41

You might also like

- Tax Invoice Footwear SaleDocument1 pageTax Invoice Footwear SaleRashid KhanNo ratings yet

- DWAITHA INFRACON-34 - XLSMDocument1 pageDWAITHA INFRACON-34 - XLSMManjitNo ratings yet

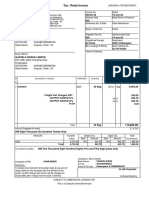

- INR Three Hundred and Seventy Nine Rupees and Five Paise Only Tax Is Payable On Reverse Charge Basis: No E. & O.EDocument1 pageINR Three Hundred and Seventy Nine Rupees and Five Paise Only Tax Is Payable On Reverse Charge Basis: No E. & O.EArnav KalraNo ratings yet

- Flipkart InvoiceDocument1 pageFlipkart InvoiceAishik MukherjeeNo ratings yet

- Amar EnterprisesDocument2 pagesAmar EnterprisesAmit DhochakNo ratings yet

- Invoice ةرﻮﺗﺎﻓ: Credit Card / Mada CardDocument1 pageInvoice ةرﻮﺗﺎﻓ: Credit Card / Mada Carddyeaayaser5No ratings yet

- Tax Invoice SummaryDocument4 pagesTax Invoice SummarySourabh NeemaNo ratings yet

- InvoiceDocument1 pageInvoiceKarshan GarhewalNo ratings yet

- InvoiceDocument1 pageInvoiceAnirban NandiNo ratings yet

- Tax Invoice SEODocument1 pageTax Invoice SEOPast Pubg MobileNo ratings yet

- Arab Machine PDFDocument1 pageArab Machine PDFImran KhanNo ratings yet

- 9 Pro BillDocument1 page9 Pro BillMajestic PlastersNo ratings yet

- Tax Invoice Refrigerator SaleDocument1 pageTax Invoice Refrigerator SaleRaju DarlingNo ratings yet

- CubicDocument1 pageCubicSurajmal TansukhraiNo ratings yet

- Od 226066708152518000Document1 pageOd 226066708152518000dinesh meenaNo ratings yet

- New Business DevicesDocument8 pagesNew Business DevicesSwtzz AmjadNo ratings yet

- Iphone 14 Pro Iphone 14 Pro Max: FinishDocument30 pagesIphone 14 Pro Iphone 14 Pro Max: Finishryan gutterNo ratings yet

- AmazonSmile - Order 104-7766545-0109811 EVGA 970Document2 pagesAmazonSmile - Order 104-7766545-0109811 EVGA 970meeNo ratings yet

- Apple Store Japan DoneDocument1 pageApple Store Japan Donehchauhan2213No ratings yet

- Od328828046770334100 1Document1 pageOd328828046770334100 1smarty boysNo ratings yet

- Flipkart Labels 19 Jul 2020 10 58Document1 pageFlipkart Labels 19 Jul 2020 10 58Shakti MalikNo ratings yet

- Invoice OD305679753918378000 PDFDocument1 pageInvoice OD305679753918378000 PDFSubho DeyNo ratings yet

- Tax Invoice for OnePlus Bullets Wireless HeadphonesDocument1 pageTax Invoice for OnePlus Bullets Wireless HeadphonesBramha FrindrNo ratings yet

- Rashid Jawad-431 PDFDocument1 pageRashid Jawad-431 PDFKhyati KamdarNo ratings yet

- Ma40324061 KemipexDocument1 pageMa40324061 Kemipexsarahbrillante20No ratings yet

- OD123219821210274778Document1 pageOD123219821210274778Abbiee As a DJNo ratings yet

- Buds Air Neo JeveesDocument1 pageBuds Air Neo JeveesPawan SoniNo ratings yet

- InvoiceDocument1 pageInvoiceManish KumarNo ratings yet

- TAX INVOICE TITLEDocument2 pagesTAX INVOICE TITLEbrindhaNo ratings yet

- Tax Invoice Galaxy Tab A7 Book CoverDocument1 pageTax Invoice Galaxy Tab A7 Book CoverVermaNo ratings yet

- Apple Iphone 11 (White, 64 GB) : Grand Total 38028.00Document1 pageApple Iphone 11 (White, 64 GB) : Grand Total 38028.00SamNo ratings yet

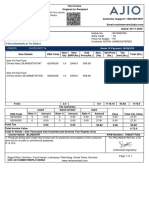

- Ajio 1671590426092Document1 pageAjio 1671590426092NaveenNo ratings yet

- Tax Invoice/Bill of Supply/Cash MemoDocument1 pageTax Invoice/Bill of Supply/Cash MemoPrem ChanderNo ratings yet

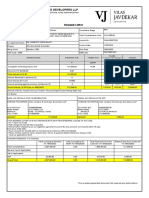

- VJ - Digital Demand For O3INV-00372-23 - 20230218T031404875Document1 pageVJ - Digital Demand For O3INV-00372-23 - 20230218T031404875Hardik RavalNo ratings yet

- Flipkart Invoice 25 Aug 2023-11-06Document14 pagesFlipkart Invoice 25 Aug 2023-11-06Doms DomsNo ratings yet

- Tax Invoice for Camera PurchaseDocument1 pageTax Invoice for Camera PurchaseArnab goswamiNo ratings yet

- Tax InvoiceDocument2 pagesTax InvoiceVenky SamNo ratings yet

- Mobile HandsetDocument2 pagesMobile HandsetnykbswNo ratings yet

- InvoiceDocument1 pageInvoicemanoj reddyNo ratings yet

- PO Add WorkDocument1 pagePO Add Workwinda novaNo ratings yet

- Your Reliance Bill: Summary of Current Charges Amount (RS)Document3 pagesYour Reliance Bill: Summary of Current Charges Amount (RS)contactmeprabirNo ratings yet

- Invoice: SGPPL Karachi Sales OfficeDocument1 pageInvoice: SGPPL Karachi Sales Officeapi-19903489No ratings yet

- Od 109808140176625000Document1 pageOd 109808140176625000anuragNo ratings yet

- Noc Goyal - Dec22Document1 pageNoc Goyal - Dec22Mobile Gallery Samsung tabNo ratings yet

- Tax InvoiceDocument1 pageTax Invoicesa4314256No ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Imran KhanNo ratings yet

- Sales Invoice Report New-4Document1 pageSales Invoice Report New-4NRJ PANDITNo ratings yet

- InvoiceDocument2 pagesInvoicebasilkhan78425No ratings yet

- Quotation Vadapalani: Vadapalani Showroom Anna Nagar Showroom Purasai Showroom Laptop Service CentreDocument1 pageQuotation Vadapalani: Vadapalani Showroom Anna Nagar Showroom Purasai Showroom Laptop Service CentresmithNo ratings yet

- Amazon 2020Document1 pageAmazon 2020Lavish SoodNo ratings yet

- Tax Invoice Cement SaleDocument2 pagesTax Invoice Cement SaleJwalant JadavNo ratings yet

- HMB Ispat Pi 81022Document1 pageHMB Ispat Pi 81022Suman PramanikNo ratings yet

- GST Invoice Format No. 5Document1 pageGST Invoice Format No. 5Kritik PatlareNo ratings yet

- InvoiceDocument1 pageInvoiceawan groupNo ratings yet

- Catalyst - C22-2300505Document1 pageCatalyst - C22-2300505Tea CozyNo ratings yet

- خالد الخالدDocument1 pageخالد الخالدaana rkshNo ratings yet

- DownloadReceiptMon14Mar2022 PDFDocument2 pagesDownloadReceiptMon14Mar2022 PDFHarish P ANo ratings yet

- Poco F3GTDocument1 pagePoco F3GTsameer AlexNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)jeet meharNo ratings yet

- Canon Printer InvoiceDocument2 pagesCanon Printer InvoiceTYCS35 SIDDHESH PENDURKARNo ratings yet

- Vig SethuramakrishnanDocument1 pageVig SethuramakrishnanaryandjNo ratings yet

- TVL Ministry of Railways ADT 9Document2 pagesTVL Ministry of Railways ADT 9aryandjNo ratings yet

- Cracdocument 93033970 - Signed0 - 2022 08 04 12 36 40Document1 pageCracdocument 93033970 - Signed0 - 2022 08 04 12 36 40aryandjNo ratings yet

- Chexxxxx4g 24Q Q4 2021-22 V0.0Document3 pagesChexxxxx4g 24Q Q4 2021-22 V0.0aryandjNo ratings yet

- Chexxxxx4g 24Q Q4 2021-22 V0.0Document3 pagesChexxxxx4g 24Q Q4 2021-22 V0.0aryandjNo ratings yet

- GRP 2022 Appendix3 Question PaperDocument3 pagesGRP 2022 Appendix3 Question PaperaryandjNo ratings yet

- Sample Paper Speaking BEC PreliminaryDocument2 pagesSample Paper Speaking BEC PreliminaryPham Van Khoa100% (1)

- Tapas y Cuellos BericapDocument2 pagesTapas y Cuellos BericapMelvin Mateo Rodriguez100% (1)

- Nabanita Das - Senior Integration (Software AG Webmethods) Consultant 03242023Document12 pagesNabanita Das - Senior Integration (Software AG Webmethods) Consultant 03242023vipul tiwariNo ratings yet

- Technical Letter StructureDocument33 pagesTechnical Letter Structuresayed Tamir janNo ratings yet

- Max AR Final 130812 PDFDocument731 pagesMax AR Final 130812 PDFsnjv2621No ratings yet

- Design Books and Price Books for American Federal-Period Card TablesDocument16 pagesDesign Books and Price Books for American Federal-Period Card TablesJosh ChoughNo ratings yet

- Philips V NLRC PDFDocument7 pagesPhilips V NLRC PDFIoa WnnNo ratings yet

- Goldsavers Food Enterprises - Business PlanDocument50 pagesGoldsavers Food Enterprises - Business PlanAyie Rose HernandezNo ratings yet

- The Suitability of Sales Promotion Competitions: As A Social Marketing Too)Document330 pagesThe Suitability of Sales Promotion Competitions: As A Social Marketing Too)Nabuweya NoordienNo ratings yet

- CRT 3rd Year NewDocument232 pagesCRT 3rd Year NewAkshat agrawalNo ratings yet

- Accounting Information System: Midterm ExamDocument35 pagesAccounting Information System: Midterm ExamHeidi OpadaNo ratings yet

- K WaterDocument113 pagesK WaterAmri Rifki FauziNo ratings yet

- Methods of Valuation of FirmsDocument90 pagesMethods of Valuation of Firmsmuskaan bhadadaNo ratings yet

- Agile Development: © Lpu:: Cap437: Software Engineering Practices: Ashwani Kumar TewariDocument28 pagesAgile Development: © Lpu:: Cap437: Software Engineering Practices: Ashwani Kumar TewariAnanth KallamNo ratings yet

- New Invt MGT KesoramDocument69 pagesNew Invt MGT Kesoramtulasinad123No ratings yet

- Pre ProductionDocument2 pagesPre ProductionRajrupa SahaNo ratings yet

- The Digital Marketing Blueprint 2023Document23 pagesThe Digital Marketing Blueprint 2023Loura FitnessNo ratings yet

- Authority To Sell ExtensionDocument1 pageAuthority To Sell ExtensionPaul BaesNo ratings yet

- The Following Information Is Available To Reconcile Style Co SDocument2 pagesThe Following Information Is Available To Reconcile Style Co SAmit PandeyNo ratings yet

- Export Oriented UnitsDocument10 pagesExport Oriented UnitsMansi GuptaNo ratings yet

- CH 32 A Macroeconomic Theory of The Open EconomyDocument45 pagesCH 32 A Macroeconomic Theory of The Open EconomyveroirenNo ratings yet

- Nepal Health Service Act 2053 BSDocument72 pagesNepal Health Service Act 2053 BSDinesh YadavNo ratings yet

- Chapter 1 KTQTDocument38 pagesChapter 1 KTQTHà LiênNo ratings yet

- Capr 1-1Document2 pagesCapr 1-1Giovanni CambareriNo ratings yet

- Consumer Behaviour, 2nd Edition - Chapter 1Document42 pagesConsumer Behaviour, 2nd Edition - Chapter 1guptamadras100% (1)

- 30 Free Leed Ap BD+C Sample QuestionsDocument23 pages30 Free Leed Ap BD+C Sample QuestionsSubhranshu PandaNo ratings yet

- Technical Appraisal: Unit 5Document16 pagesTechnical Appraisal: Unit 5DIPAKNo ratings yet

- Payment of Wages Act 1936 Key ProvisionsDocument12 pagesPayment of Wages Act 1936 Key ProvisionsRinu VargheseNo ratings yet

- MSc Sales & Marketing Statement of PurposeDocument1 pageMSc Sales & Marketing Statement of PurposeDaud LawrenceNo ratings yet

- PEST AnalysisDocument7 pagesPEST AnalysisWaqas Ul HaqueNo ratings yet