Professional Documents

Culture Documents

Microfinance India Summit 2011 - MFIs: Painting A Recovery

Uploaded by

Rang DeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Microfinance India Summit 2011 - MFIs: Painting A Recovery

Uploaded by

Rang DeCopyright:

Available Formats

mint

WEDNESDAY, DECEMBER 14, 2011, DELHI WWW.LIVEMINT.COM

IN DETAIL 11

HEMANT MISHRA/MINT

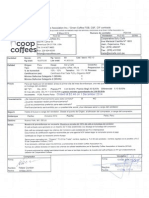

MFIs: PAINTING A RECOVERY

Comparative performance of top five MFIs

2010 2011 2010 2011

SKS

Clients (million) Growth (%)

5.80 6.24

Loans (R crore)

8%

2,970 4,111 38%

Spandana

Clients (million) Growth (%)

3.66 4.18 14%

Loans from financial institutions for MFIs

Public sector banks Private sector banks Foreign banks RRB's Sidbi*

Top 10 MFIs by outreach

Rank Name Outreach (million) Loan outstanding (R crore) Own funds Borrowings

Loans (R crore)

2,160 3,458 60%

Loans disbursed during 2010-11

Total 732.84

(R crore)

Outstanding loans as on 31 March 2011 (R crore)

Total 1,261.88

1 2 3 4 5 6 7 8 9 10

SKS Spandana Bandhan SHARE Basix SKDRDP Asmita Equitas Grama Vidial Ujjivan Total

6.24 4.18 3.25 2.84 1.53 1.38 1.34 1.30 0.93 0.84 23.85

4,111 3,458 2,507 2,065 1,249 958 1,325 794 520 625 17,611

1,781 NA 377 301 210 25 215 304 90 116 3,419

2,236 1,195 1,848 2,098 1,231 871 1,194 592 347 472 10,889

504.8 409.5 284.62 362.29 1.55 0.01 84.38

*Small Industries Development Bank of India

Bandhan

Clients (million) Growth (%)

2.30 3.25

Loans (Rcrore)

42%

43.37 0.03 304.18

1,210 2,507

107%

The regional story: a skewed trend

North North-East East Central West South

Client outreach and loan values: how the MFIs fared

Size of portfolio Class No. of MFIs

SHARE

Clients (million) Growth (%)

2.36 2.84 20%

Share of clients (in%)

2009-10

Share of loans (in%)

2009-10 2010-11

More than R100 crore R50 to 100 crore R10 to 50 crore Less than R10 crore

Mega Large Medium Small

Total 82

2.1 1.9 21.3 9.5 14.2

2010-11

4.8 3.2 17.9 16.7 12.1

4.3 1.8 22.5 9.9 6.8

3.7 3.6 18.1 14.3 11.4

27

15

26

14

Loans (Rcrore)

1,720 2,065 20%

Client outreach by size of MFIs

4.83%

Large

Share of loan values, size-wise

4.58%

Large

BASIX

Clients (million) Growth (%)

1.11

51.1

45.3

54.8

48.9

1.53

37%

3.95%

Medium Small

90.73%

Mega

3.07%

Medium Small

92%

Mega

Loans (R billion)

790 1,249

0.50%

0.35%

58%

Web-based microfinance

Rang De is Indias first online microlending platform. The Web-based social initiative supports rural entrepreneurs with access to cost effective capital for business and education needs. Rang De raises social capital from individuals who can become social investors by lending as little as R100. Through this fundraising model, Rang De is able to reduce the cost of capital to the end user. Social investors get back their investments with a nominal financial return of 2% per annum. They have the ability to track the progress of their investments and interact with the borrowers who they have lent money to. Rang De has reached out to more than 10,127 borrowers across India with the help of 2,906 social investors. The organization has raised and disbursed more than R5 crore to borrowers and has a repayment rate of 98.56%. Rang De works with 25 field partners across Orissa, West Bengal, Manipur, Madhya Pradesh, Maharashtra, Karnataka, Tamil Nadu, Kerala, Jharkhand, Bihar and Gujarat.

Graphics by Sandeep Bhatnagar/Mint

You might also like

- Initiating Coverage Report - YES BankDocument35 pagesInitiating Coverage Report - YES Bankarnabmoitra11No ratings yet

- Employee Satisfaction Kotak MahindraDocument79 pagesEmployee Satisfaction Kotak MahindraMansi Gauba100% (2)

- HDFC Bank CAMELS Analysis and DuPont ModelDocument31 pagesHDFC Bank CAMELS Analysis and DuPont Modelasifbhaiyat33% (3)

- Session 6 Financial Inclusion and MSMEs Access To Finance in NepalDocument26 pagesSession 6 Financial Inclusion and MSMEs Access To Finance in NepalPrem YadavNo ratings yet

- ShafiDocument29 pagesShafiMuhammed Shafi MkNo ratings yet

- Emerging Trends in Indian Microfinance Industry Role of Financial Technology and Inclusive PoliciesDocument6 pagesEmerging Trends in Indian Microfinance Industry Role of Financial Technology and Inclusive PoliciesMuhammed Shafi MkNo ratings yet

- SKS MicrofinanceDocument13 pagesSKS MicrofinanceprojectbpfpNo ratings yet

- BranchlessBanking Oct Dec 2011Document13 pagesBranchlessBanking Oct Dec 2011Mankiran KaurNo ratings yet

- Emergence and Flourishment of Microfinance in India: Mrs.B.Ramya Hariganesan, M.F.C.,M.Phil, Research ScholarDocument29 pagesEmergence and Flourishment of Microfinance in India: Mrs.B.Ramya Hariganesan, M.F.C.,M.Phil, Research ScholarramyathecuteNo ratings yet

- Reliance Mutual Fund-FinalDocument7 pagesReliance Mutual Fund-FinalTamanna Mulchandani100% (1)

- Banking Industry StructureDocument10 pagesBanking Industry StructureRohit GuptaNo ratings yet

- A Summer Internship Report: Multistate Scheduled BankDocument23 pagesA Summer Internship Report: Multistate Scheduled BankHetalKachaNo ratings yet

- Yes BankDocument30 pagesYes BankVivek PrakashNo ratings yet

- Sapm Final DeckDocument45 pagesSapm Final DeckShasank JalanNo ratings yet

- Org Study Canara Bank 150904183048 Lva1 App6892Document81 pagesOrg Study Canara Bank 150904183048 Lva1 App6892shivaraj p yNo ratings yet

- 08-06 - Snapshot of India Micro Finance - Quick SummaryDocument7 pages08-06 - Snapshot of India Micro Finance - Quick Summarysmartboysam07No ratings yet

- 2 Plenary - Introducing ADB by RSubramaniam 15mar2016Document20 pages2 Plenary - Introducing ADB by RSubramaniam 15mar2016Butch D. de la CruzNo ratings yet

- Strategy PresentationDocument32 pagesStrategy PresentationPrincy AgrawalNo ratings yet

- Yes BankDocument17 pagesYes BankNicks VermaNo ratings yet

- Small Money Big Impact: Fighting Poverty with MicrofinanceFrom EverandSmall Money Big Impact: Fighting Poverty with MicrofinanceNo ratings yet

- Axis BankDocument22 pagesAxis Bankअक्षय गोयल67% (3)

- Do Contributions of Islamic Banks Stakeholders Influence Profit and Loss Sharing Financing?: Empirical Evidence in IndonesiaDocument17 pagesDo Contributions of Islamic Banks Stakeholders Influence Profit and Loss Sharing Financing?: Empirical Evidence in IndonesiatamereldamatyNo ratings yet

- Competitiveness of Indian Banking SectorDocument41 pagesCompetitiveness of Indian Banking Sectorsahil_saini298No ratings yet

- 10 Years HighlightsDocument11 pages10 Years HighlightsManoj KumarNo ratings yet

- Role of Microfinance in Fighting Rural PovertyDocument16 pagesRole of Microfinance in Fighting Rural PovertySajijul IslamNo ratings yet

- Shriram Transport Finance Company LTD.: Investor PresentationDocument44 pagesShriram Transport Finance Company LTD.: Investor PresentationAbhishek AgarwalNo ratings yet

- Indonesian Banking Development: F: Inancial Services Liberalization, The Regulatory Framework, and Financial StabilityDocument34 pagesIndonesian Banking Development: F: Inancial Services Liberalization, The Regulatory Framework, and Financial StabilityFitta Amellia LestariNo ratings yet

- PNB ProfileDocument7 pagesPNB ProfilepriyathepopularNo ratings yet

- Education Sector - Post-Conference Note - Centrum 23122011Document15 pagesEducation Sector - Post-Conference Note - Centrum 23122011Ashish PatelNo ratings yet

- BranchlessBanking Apr JunDocument13 pagesBranchlessBanking Apr JunAmbeing MmzbNo ratings yet

- Welcome, To Leurs Fashion's PresentationDocument27 pagesWelcome, To Leurs Fashion's PresentationMochHasanNo ratings yet

- Banking Industry Analysis Highlights Key TrendsDocument17 pagesBanking Industry Analysis Highlights Key TrendsChirag ParakhNo ratings yet

- Financing Micro Finance in IndiaDocument7 pagesFinancing Micro Finance in IndiaSourav MaityNo ratings yet

- Summer Placement Presentation InsightsDocument23 pagesSummer Placement Presentation Insightsmannycase13No ratings yet

- B2B Channel Opportunity in Indian Trading BusinessDocument24 pagesB2B Channel Opportunity in Indian Trading BusinessdharshrulzNo ratings yet

- AnalysisDocument11 pagesAnalysisRahul VermaNo ratings yet

- Garuda 1343481Document12 pagesGaruda 1343481MOHAMAD RIZKY DJATI ADMOKONo ratings yet

- Financial Institutions Management A Risk Management Approach 9th Edition Saunders Solutions ManualDocument36 pagesFinancial Institutions Management A Risk Management Approach 9th Edition Saunders Solutions Manualnopalsmuggler8wa100% (22)

- Comparison of Equity Mutual FundsDocument29 pagesComparison of Equity Mutual Fundsabhishekbehal5012No ratings yet

- Banking Weekly Newsletter April 13 2012Document7 pagesBanking Weekly Newsletter April 13 2012abhishekrungta1984No ratings yet

- Assets & Liabilities Management at Union Co-op BankDocument21 pagesAssets & Liabilities Management at Union Co-op BankapluNo ratings yet

- CM Project of Mehak Juneja (18BSP1729)Document5 pagesCM Project of Mehak Juneja (18BSP1729)mehak junejaNo ratings yet

- HR Issues and Challenges in Indian Banking SectorDocument17 pagesHR Issues and Challenges in Indian Banking SectorsownikaNo ratings yet

- BS Adfree 19.05.2019Document9 pagesBS Adfree 19.05.2019Battula Surender SudhamaNo ratings yet

- Project Report-Study On Credit AppraisalDocument57 pagesProject Report-Study On Credit AppraisalPramod Serma100% (1)

- Annual 030502Document40 pagesAnnual 030502Ajay DesaiNo ratings yet

- Annual 030502Document40 pagesAnnual 030502wasi28No ratings yet

- HDFC AMC - PMS Real Estate Portfolio - I: November 2007Document39 pagesHDFC AMC - PMS Real Estate Portfolio - I: November 2007Sandeep BorseNo ratings yet

- Status of Microfinance 2011-12 Full Book2Document180 pagesStatus of Microfinance 2011-12 Full Book2Pinak DebNo ratings yet

- Financial Institutions Management A Risk Management Approach 9th Edition Saunders Solutions ManualDocument26 pagesFinancial Institutions Management A Risk Management Approach 9th Edition Saunders Solutions ManualBradMartiniczn100% (46)

- Sri Lanka Mutual Fund Market Opportunity Outlook 2022Document7 pagesSri Lanka Mutual Fund Market Opportunity Outlook 2022Neeraj ChawlaNo ratings yet

- Project Report On::: Retail Banking StrategyDocument24 pagesProject Report On::: Retail Banking StrategyMadhuri KanadeNo ratings yet

- Study On Mobile PaymentsDocument20 pagesStudy On Mobile Paymentsgautam_hariharanNo ratings yet

- Sip 06 May 201010Document5 pagesSip 06 May 201010Sneha SharmaNo ratings yet

- Scheme Analysis Of: Summer Project Report On HDFC Asset Management Company LTDDocument23 pagesScheme Analysis Of: Summer Project Report On HDFC Asset Management Company LTD8460583571No ratings yet

- Market Penetration Of Stock Broking Firms And Services OfferedDocument56 pagesMarket Penetration Of Stock Broking Firms And Services OfferedGaurav KambojNo ratings yet

- r600210013-18 Analysis On National Is Ed Banks Assignment 2Document15 pagesr600210013-18 Analysis On National Is Ed Banks Assignment 2Kannan SubramanianNo ratings yet

- Green Bond Market Survey for the Lao People's Democratic Republic: Insights on the Perspectives of Institutional Investors and UnderwritersFrom EverandGreen Bond Market Survey for the Lao People's Democratic Republic: Insights on the Perspectives of Institutional Investors and UnderwritersNo ratings yet

- Thailand’s Evolving Ecosystem Support for Technology StartupsFrom EverandThailand’s Evolving Ecosystem Support for Technology StartupsNo ratings yet

- EIB Working Papers 2019/01 - Blockchain, FinTechs: and their relevance for international financial institutionsFrom EverandEIB Working Papers 2019/01 - Blockchain, FinTechs: and their relevance for international financial institutionsNo ratings yet

- Report On Training of BeneficiariesDocument4 pagesReport On Training of BeneficiariesRang DeNo ratings yet

- NABARD Project Field Mentor WorkshopDocument6 pagesNABARD Project Field Mentor WorkshopRang DeNo ratings yet

- Rang de Default Policy Version 1.0Document2 pagesRang de Default Policy Version 1.0Rang DeNo ratings yet

- Introducing Rang deDocument1 pageIntroducing Rang deRang DeNo ratings yet

- Rang de Featured in SanjevaniDocument1 pageRang de Featured in SanjevaniRang DeNo ratings yet

- WWW Dnaindia ComDocument2 pagesWWW Dnaindia ComRang DeNo ratings yet

- Rang de Featured in Times of IndiaDocument1 pageRang de Featured in Times of IndiaRang DeNo ratings yet

- Rang de Featured in Dainik BhaskarDocument1 pageRang de Featured in Dainik BhaskarRang DeNo ratings yet

- Rang de Featured in Microfinance India: State of The Sector Report 2012Document1 pageRang de Featured in Microfinance India: State of The Sector Report 2012Rang DeNo ratings yet

- Rang de Featured in India NowDocument1 pageRang de Featured in India NowRang DeNo ratings yet

- Rang de Annual Report 2011 12Document22 pagesRang de Annual Report 2011 12Rang DeNo ratings yet

- Deccan Chronicle - Funding The Poor: Not A Bad Idea at AllDocument2 pagesDeccan Chronicle - Funding The Poor: Not A Bad Idea at AllRang DeNo ratings yet

- Microfinance India Summit 2011 - From Despair To HopeDocument1 pageMicrofinance India Summit 2011 - From Despair To HopeRang DeNo ratings yet

- Rang de Co-Founder Smita in Article - Women's Day Deccan Chronicle 2012Document1 pageRang de Co-Founder Smita in Article - Women's Day Deccan Chronicle 2012Rang DeNo ratings yet

- Manthan Awards 2011 - Digital Innovations For The Larger Good - 1Document1 pageManthan Awards 2011 - Digital Innovations For The Larger Good - 1Rang DeNo ratings yet

- Letter From Hope IrdsDocument2 pagesLetter From Hope IrdsRang DeNo ratings yet

- Manthan Awards 2011 - Digital Innovations For The Larger Good - 2Document1 pageManthan Awards 2011 - Digital Innovations For The Larger Good - 2Rang DeNo ratings yet

- Rang de World Cup Fever On Economic TimesDocument1 pageRang de World Cup Fever On Economic TimesRang DeNo ratings yet

- Letter From Hope IrdsDocument2 pagesLetter From Hope IrdsRang DeNo ratings yet

- Rang de - Gandhi JayanthiDocument1 pageRang de - Gandhi JayanthiRang DeNo ratings yet

- Rang de Featured in Outlook BusinessDocument3 pagesRang de Featured in Outlook BusinessRang DeNo ratings yet

- LawBO (Students'Copy)Document3 pagesLawBO (Students'Copy)JImlan Sahipa IsmaelNo ratings yet

- Module 5 NotesDocument20 pagesModule 5 NotesHarshith AgarwalNo ratings yet

- PEA144Document4 pagesPEA144coffeepathNo ratings yet

- Kasut You DistributionDocument9 pagesKasut You DistributionNo Buddy100% (1)

- Shubham MoreDocument60 pagesShubham MoreNagesh MoreNo ratings yet

- Application of Game TheoryDocument65 pagesApplication of Game Theorymithunsraj@gmail.com100% (2)

- American Medical Assn. v. United States, 317 U.S. 519 (1943)Document9 pagesAmerican Medical Assn. v. United States, 317 U.S. 519 (1943)Scribd Government DocsNo ratings yet

- Cabanlit - Module 2 SPDocument2 pagesCabanlit - Module 2 SPJovie CabanlitNo ratings yet

- Sri Ganesh Engg - ProfileDocument19 pagesSri Ganesh Engg - Profileshikharc100% (1)

- Sending DDDDWith Multiple Tabs of Excel As A Single Attachment in ABAPDocument4 pagesSending DDDDWith Multiple Tabs of Excel As A Single Attachment in ABAPKumar Krishna KumarNo ratings yet

- Employee Suggestion Programs Save MoneyDocument3 pagesEmployee Suggestion Programs Save Moneyimran27pk100% (1)

- SHELF CORP SECRETS 3 FLIPPING CORPORATIONSDocument24 pagesSHELF CORP SECRETS 3 FLIPPING CORPORATIONSRamon RogersNo ratings yet

- Jama Bandi RecordsDocument4 pagesJama Bandi RecordsImran KhanNo ratings yet

- 21PGDM177 - I&E AssignmentDocument6 pages21PGDM177 - I&E AssignmentShreya GuptaNo ratings yet

- PRMG 6007 - Procurement Logistics and Contracting Uwi Exam Past Paper 2012Document3 pagesPRMG 6007 - Procurement Logistics and Contracting Uwi Exam Past Paper 2012tilshilohNo ratings yet

- Ghuirani Syabellail Shahiffa/170810301082/Class X document analysisDocument2 pagesGhuirani Syabellail Shahiffa/170810301082/Class X document analysisghuirani syabellailNo ratings yet

- Pakistan Is Not A Poor Country But in FactDocument5 pagesPakistan Is Not A Poor Country But in Factfsci35No ratings yet

- Lesson 6 Internal ControlDocument24 pagesLesson 6 Internal ControlajithsubramanianNo ratings yet

- General Mcqs On Revenue CycleDocument6 pagesGeneral Mcqs On Revenue CycleMohsin Kamaal100% (1)

- Max232 DatasheetDocument9 pagesMax232 DatasheetprincebahariNo ratings yet

- AgribusinessDocument6 pagesAgribusinessshevadanzeNo ratings yet

- GA3-240202501-AA2. Presentar Funciones de Su OcupaciónDocument2 pagesGA3-240202501-AA2. Presentar Funciones de Su OcupaciónDidier Andres Núñez OrdóñezNo ratings yet

- Sample Deed of Partnership for IT FirmDocument5 pagesSample Deed of Partnership for IT FirmAsif SadiqNo ratings yet

- Key Differences Between Islamic and Conventional BankingDocument2 pagesKey Differences Between Islamic and Conventional BankingNoor Hafizah0% (2)

- Sap CloudDocument29 pagesSap CloudjagankilariNo ratings yet

- Delhi Bank 2Document56 pagesDelhi Bank 2doon devbhoomi realtorsNo ratings yet

- Jay Abraham - Let Them Buy Over TimeDocument2 pagesJay Abraham - Let Them Buy Over TimeAmerican Urban English LoverNo ratings yet

- Analysis Working Capital Management PDFDocument5 pagesAnalysis Working Capital Management PDFClint Jan SalvañaNo ratings yet

- Oracle ACE WPDocument23 pagesOracle ACE WPSyed Fahad KhanNo ratings yet

- Syllabus Corporate GovernanceDocument8 pagesSyllabus Corporate GovernanceBrinda HarjanNo ratings yet