Professional Documents

Culture Documents

IOL Netcom 2009Q2

Uploaded by

mixedbag100%(1)100% found this document useful (1 vote)

198 views1 pageFinancial Report for Q2 of 2008-09 for IOL Netcom, uploaded by www.medianama.com

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFinancial Report for Q2 of 2008-09 for IOL Netcom, uploaded by www.medianama.com

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

198 views1 pageIOL Netcom 2009Q2

Uploaded by

mixedbagFinancial Report for Q2 of 2008-09 for IOL Netcom, uploaded by www.medianama.com

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

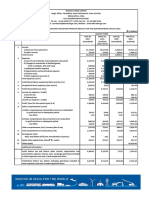

IOL NETCOM LIMITED

(Formerly known as IOL Broadband Ltd.)

Reg. Off: 601, 6th Floor Raheja Centre, Nariman Point, Mumbai - 400 021

FINANCIAL RESULT FOR THE QUARTER &

SIX MONTHS ENDED SEPTEMBER 30, 2008 (Rs. In Lakhs)

Correspond- Year to date Year to date

ing 3 months figure for figure for

ended in Current year Previous

3 Months previous period year period 12 Months

ended year ended ended ended

Sr. 30.09.2008 30.09.2007 30.09.2008 30.09.2007 31.03.08

No

Particulars

Unaudited Unaudited Unaudited Unaudited Audited

1 Net Sales/Income from Operations 1,419.50 362.15 1,719.85 521.64 2,095.30

Other Operating Income -

Total Income 1,419.50 362.15 1,719.85 521.64 2,095.30

2 Expenditure

a. Increase/Decrease in stock in - - - - -

trade and work in progress

b. Operational Cost 281.19 179.21 679.33 302.04 1,276.37

c. Purchase of traded goods - - - - -

d. Employee cost 390.37 140.26 739.63 196.92 1,114.41

e. Rent 101.38 45.12 197.29 67.05 558.04

f. Depreciation 360.91 79.41 775.53 121.39 821.60

g. Other expenditure 175.66 110.00 175.66 194.57 915.41

h. Total 1,309.51 554.00 2,567.44 881.97 4,685.83

3 Profit/(Loss) from Ordinary Activities 109.98 (191.85) (847.60) (360.33) (2,590.53)

before other income,Interest &

Exceptional Items (1-2)

4 Other Income 10.34 4.86 14.12 33.66 241.54

5 Profit/(Loss) before Interest & 120.32 (186.99) (833.48) (326.67) (2,348.99)

Exceptional Items (3+4)

6 Interest 41.86 - 44.32 - 88.72

7 Profit/(Loss) after Interest but before 78.46 (186.99) (877.80) (326.67) (2,437.71)

Exceptional Items (5-6)

8 Exceptional Items - - - -

9 Profit/(Loss) from Ordinary 78.46 (186.99) (877.80) (326.67) (2,437.71)

Activities before tax (7+8)

10 Tax expense (FBT) 5.36 - 17.26 - 15.33

11 Net Profit/ (Loss) from ordinary 73.11 (186.99) (895.05) (326.67) (2,453.05)

activities after tax (9-10)

12 Extraordinary Items (net of tax expense) - - - - 15.41

13 Net Profit / (Loss) for the period (11-12) 73.11 (186.99) (895.05) (326.67) (2,468.46)

14 Paid up Equity Share Capital 2,735.34 2,415.34 2,735.34 2,415.34 2,665.34

(Face Value of Rs. 10 Each)

15 Reserves excluding revaluation reserves as 6,153.39 8,527.35 6,153.39 8,527.35 6,453.44

per balance sheet of previous accounting year

16 EPS for the period (in Rs.)

a. Basic and diluted EPS before Extra Ordinary 0.27 (0.77) (3.27) (1.35) (10.11)

Items for the period , for the year to date and

for the previous year (not to be annualised)

b. Basic and diluted EPS after Extra Ordinary 0.27 (0.77) (3.27) (1.35) (10.11)

Items for the period , for the year to date and

for the previous year (not to be annualised)

17 Public Shareholding

-Number of Shares 26,110,500 23,390,500 26,110,500 23,390,500 23,930,500

-Percentage of Shareholding 95.41% 96.79% 95.41% 96.79% 89.74%

NOTES :

1. The above financial results for the quarter ended September 30, 2008 have been reviewed by the Audit Committee

and approved by the Board at its meeting held on October 31 , 2008.

2. Income from operations includes Income from lease from dark fiber

3. The Company operates in only one segment.

4. Number of Investor Complaints Opening - NIL, Received: NIL, Disposed Off: NIL, Pending: NIL.

5. Figures of previous period have been regrouped/ reclassified wherever necessary.

6. Paid up equity share capital has been increased because of conversion of share warrants.

For and on behalf of the Board

Sd/-

Place : Mumbai, P.L. Chaturvedi

Dated : Octobeer 31, 2008 Independent Director

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Iproperty IPGA ProspectusDocument154 pagesIproperty IPGA ProspectusmixedbagNo ratings yet

- Arss Infrastructure Projects Limited: (Rs. in Crores Except For Shares & EPS)Document2 pagesArss Infrastructure Projects Limited: (Rs. in Crores Except For Shares & EPS)Likun sahooNo ratings yet

- Unitech Consolidated 31-03-10Document3 pagesUnitech Consolidated 31-03-10sriramrangaNo ratings yet

- Unaudited Consolidated Financial Results For The Quarter Ended 31 March 2010Document4 pagesUnaudited Consolidated Financial Results For The Quarter Ended 31 March 2010poloNo ratings yet

- Quarter1 2008Document2 pagesQuarter1 2008Raghavendra DevadigaNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Unaudited Financial 0608Document3 pagesUnaudited Financial 0608manish_khabarNo ratings yet

- MMFSL Fin Results Q1 F2019 LODR Clause 33 FianlDocument2 pagesMMFSL Fin Results Q1 F2019 LODR Clause 33 FianlIMAM JAVOORNo ratings yet

- Jamna Auto Industries Limited: Registered Office: Jai Spring Road, Industrial Area, Yamunanagar-135001, HaryanaDocument4 pagesJamna Auto Industries Limited: Registered Office: Jai Spring Road, Industrial Area, Yamunanagar-135001, HaryanapoloNo ratings yet

- Quarter1 2010Document2 pagesQuarter1 2010DhruvRathoreNo ratings yet

- Published Results 31 March 2010Document2 pagesPublished Results 31 March 2010Ravi ChaturvediNo ratings yet

- $&C +$C CCCCCCCCCDocument4 pages$&C +$C CCCCCCCCCAlok SinghalNo ratings yet

- RCOM 4thconsoliated 09-10Document3 pagesRCOM 4thconsoliated 09-10Goutam YenupuriNo ratings yet

- Financial Results Annual 2010 RMWLDocument1 pageFinancial Results Annual 2010 RMWLSanjay GulatiNo ratings yet

- Cipla - Unaudited Fin Result For The Quarter Ended 30th June 2010Document4 pagesCipla - Unaudited Fin Result For The Quarter Ended 30th June 2010thelostbardNo ratings yet

- Publication 30-06-09Document2 pagesPublication 30-06-09SuhasNo ratings yet

- AlokIndustries q1Document2 pagesAlokIndustries q1Abhijeet PimpalgaonkarNo ratings yet

- Indiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)Document6 pagesIndiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)Kumar RajputNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Blue Cloud Softech Solutions Limited: Bse LTDDocument3 pagesBlue Cloud Softech Solutions Limited: Bse LTDShyam SunderNo ratings yet

- The Catholic Syrian Bank LimitedDocument2 pagesThe Catholic Syrian Bank Limitedsaravanan aNo ratings yet

- Ramco Annual Report 2014Document2 pagesRamco Annual Report 2014nithinNo ratings yet

- CIN - L70101HR1963PLC002484, Website: WWW - Dlf.inDocument8 pagesCIN - L70101HR1963PLC002484, Website: WWW - Dlf.inManan MunshiNo ratings yet

- Tata Power:, CrorejDocument7 pagesTata Power:, Crorejtusharholey90No ratings yet

- BSE Limited National Stock Exchange of India Limited: Company Secretary and Compliance OfficerDocument9 pagesBSE Limited National Stock Exchange of India Limited: Company Secretary and Compliance OfficerABHIRAJ PARMARNo ratings yet

- Go Digit General Insurance Limited Financials Income StatementDocument3 pagesGo Digit General Insurance Limited Financials Income StatementShuchita AgarwalNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Statement of Standalone Unaudited Results For The Quarter Ended December 31, 2012Document3 pagesStatement of Standalone Unaudited Results For The Quarter Ended December 31, 2012Ravi AgarwalNo ratings yet

- q209 - Airtel Published FinancialsDocument7 pagesq209 - Airtel Published Financialsmixedbag100% (2)

- Abridged StatementDocument7 pagesAbridged StatementAnkit BankaNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Consolidated Q4Document6 pagesConsolidated Q4Qazi MudasirNo ratings yet

- Published Result Q-1-10 PrintDocument1 pagePublished Result Q-1-10 Prints natarajanNo ratings yet

- Q1 20 - DhunseriDocument4 pagesQ1 20 - Dhunserica.anup.kNo ratings yet

- Book 2Document2 pagesBook 2Piyush JainNo ratings yet

- Q2 09 ConsolidateDocument1 pageQ2 09 ConsolidatecayogeshguptaNo ratings yet

- Kci-Ufr Q3fy11Document1 pageKci-Ufr Q3fy11Shashi PandeyNo ratings yet

- 2018-Annual-Report Selected PagesDocument11 pages2018-Annual-Report Selected PagesLuis David BriceñoNo ratings yet

- Q4FY19 Press TableDocument9 pagesQ4FY19 Press TableSumit SharmaNo ratings yet

- QR September 2009 VILDocument3 pagesQR September 2009 VILsamarth6665No ratings yet

- Annual Report FY 2022 23Document4 pagesAnnual Report FY 2022 23Piyush PalawatNo ratings yet

- ACC Financial ResultsDocument12 pagesACC Financial ResultsKKVSBNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Colgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Document2 pagesColgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Yash ModiNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For December 31, 2016 (Result)Document1 pageStandalone Financial Results For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results of Hardwyn India Sept 2023Document9 pagesFinancial Results of Hardwyn India Sept 2023prashant_natureNo ratings yet

- Bed FS - 7879Document11 pagesBed FS - 7879Menuka SiwaNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Balance Sheet of ZEE NETWORK (Rs in Crores)Document12 pagesBalance Sheet of ZEE NETWORK (Rs in Crores)abid ali khanNo ratings yet

- Raymond Limited Financial StatementsDocument85 pagesRaymond Limited Financial StatementsVinay KukrejaNo ratings yet

- Tata Steel LTD: Audited Financial Results For The Year Ended On 31st March 2010Document6 pagesTata Steel LTD: Audited Financial Results For The Year Ended On 31st March 2010fifa05No ratings yet

- Q1FY22Document8 pagesQ1FY22Anjalidevi TNo ratings yet

- Book 2Document18 pagesBook 2Aishwarya DaymaNo ratings yet

- ANNEXURE 4 - Q4 FY08-09 Consolidated ResultsDocument1 pageANNEXURE 4 - Q4 FY08-09 Consolidated ResultsPGurusNo ratings yet

- Standalone Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Shyam SunderNo ratings yet

- India 3g Auctions Q&a 2010 25 10 MedianamaDocument98 pagesIndia 3g Auctions Q&a 2010 25 10 MedianamamixedbagNo ratings yet

- UTV Software Communications LimitedDocument13 pagesUTV Software Communications LimitedmixedbagNo ratings yet

- IAMAI - Pre Budget MemorandumDocument21 pagesIAMAI - Pre Budget MemorandummixedbagNo ratings yet

- India 3g Auctions Notice Inviting Applications 2010 25 10 MedianamaDocument113 pagesIndia 3g Auctions Notice Inviting Applications 2010 25 10 MedianamamixedbagNo ratings yet

- Doordarshan MobileTV Tender MediaNamaDocument39 pagesDoordarshan MobileTV Tender MediaNamamixedbag100% (5)

- GSM Monthly Oct08 Medianama - ComDocument9 pagesGSM Monthly Oct08 Medianama - Commixedbag100% (1)

- Tel No:-011-2321 7914 Fax: - 011-2321 1998 Email: - Skgupta@trai - Gov.in WebsiteDocument5 pagesTel No:-011-2321 7914 Fax: - 011-2321 1998 Email: - Skgupta@trai - Gov.in Websitemixedbag100% (1)

- Annual Report - 2007-08 Info EdgeDocument121 pagesAnnual Report - 2007-08 Info EdgemixedbagNo ratings yet

- Q3 2009 UTV Software Communications Financials Uploaded by MediaNamaDocument1 pageQ3 2009 UTV Software Communications Financials Uploaded by MediaNamamixedbagNo ratings yet

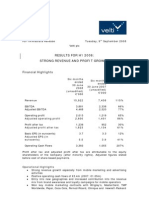

- Results For H1 2008: Strong Revenue and Profit Growth: Financial HighlightsDocument18 pagesResults For H1 2008: Strong Revenue and Profit Growth: Financial HighlightsmixedbagNo ratings yet

- Rbi-Guidelines - Prepaid-Payments-Medianama - ComDocument7 pagesRbi-Guidelines - Prepaid-Payments-Medianama - Commixedbag100% (2)

- q1 09 IOL Netcom ResultsDocument1 pageq1 09 IOL Netcom ResultsmixedbagNo ratings yet

- q209 - Airtel Published FinancialsDocument7 pagesq209 - Airtel Published Financialsmixedbag100% (2)

- Utv Earnings Release 2qfy2009Document9 pagesUtv Earnings Release 2qfy2009mixedbagNo ratings yet

- Web18-Q2-2008-09 FinancialsDocument14 pagesWeb18-Q2-2008-09 Financialsmixedbag100% (1)

- Annual Report - 2007-08 Info EdgeDocument121 pagesAnnual Report - 2007-08 Info EdgemixedbagNo ratings yet

- NDTV Q2-09 ResultsDocument8 pagesNDTV Q2-09 ResultsmixedbagNo ratings yet

- Annual Report 2007 2008 AirtelDocument162 pagesAnnual Report 2007 2008 AirtelHarsh MaddyNo ratings yet

- Nokia Conference Call Third Quarter 2008 Financial Results: October 16, 2008 15.00 Helsinki Time 8.00 New York TimeDocument19 pagesNokia Conference Call Third Quarter 2008 Financial Results: October 16, 2008 15.00 Helsinki Time 8.00 New York TimemixedbagNo ratings yet

- Banks Reports-Aug2008Document5 pagesBanks Reports-Aug2008mixedbagNo ratings yet

- Q109 Airtel FinancialsDocument45 pagesQ109 Airtel FinancialsmixedbagNo ratings yet

- India - RBI Mobile Banking Guidelines - 20081010 Via Medianama - ComDocument7 pagesIndia - RBI Mobile Banking Guidelines - 20081010 Via Medianama - Commixedbag100% (3)

- Rbi - Operative Guidelines For Mobile BankingDocument7 pagesRbi - Operative Guidelines For Mobile Bankingmixedbag100% (2)