Professional Documents

Culture Documents

CHP 2 - BRS

Uploaded by

Payal Mehta DeshpandeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CHP 2 - BRS

Uploaded by

Payal Mehta DeshpandeCopyright:

Available Formats

CHAPTER 2: BANK RE CONCIL IATION ST ATEMENT CLASSWORK Problem 1. Prepare BRS of Navin as on 31.07.

2011 from the following information: 1. Balance due from bank as per cash book as on 31.07.2011 Rs. 18,425. 2. Cheques issued were: Party s Name Amount (Rs.) Date of Payment by bank Ankur 3,100 27.07.2011 Bipin 4,700 7.08.2011 Chirag 2,900 29.07.2011 Deepak 4,600 Returned dishonoured 3. The cash book duly shows the dishonor of cheque issued to Deepak. 4. While carrying forward total of receipt side bank column from one page to another , the total of Rs. 6370 was carried forward as Rs. 7360. 5. Cheques deposited but not cleared Rs. 3625. 6. A cheque of Rs. 2140 was issued to Rajesh in full settlement of Rs. 2210. The same appears on the payment side of Cash book with interchanged figures of discount and bank columns. This cheque was paid on 30.07.2011. 7. Bank column on payment side of cash book was undercast by Rs. 1080. 8. Bearer cheque of Rs. 275 was received and the same appears in bank column on receipt side. Problem 2. On 31.03.2007, the pass book of Mitra showed a credit balance of Rs. 2,16,000. A comparison of pass book and cash book revealed the following: Rs. Cheques deposited not cleared by March 1,08,150 Cheques issued by Mitra but not yet presented for payment before 1.04.2007 26,000 Insurance premium paid by bank on behalf of Mitra but not yet recorded in 52,075 cash book Commission charged by bank not yet recorded in cash book 750 Interest on bonds collected by bank on behalf of Mitra not yet recorded in 25000 cash book Bank balance as per cash book as on 31.03.2007 is Rs. 3,25,975. 31st

ConceptAge Classes CS/ICWA Foundation - Accounts

Page 1

Problem 3 On 31.03.2007, the cash book of Ajay Ghosh showed a bank overdraft of Rs. 3,458. On examination of the cash book and bank statement, the following discrepancies were noted: 1. Cheques issued for Rs. 1200 were entered in the cash book but were not presented for payment at the bank till 1st week of April, 2007. 2. Cheques amounting to Rs. 1000 were entered in the cash book on 30th March,2007 but were banked on 2nd April,2007. 3. Cheques amounting Rs. 500 were deposited in the bank but were not collected till March 31st, 2007. 4. A cheque for Rs. 300 received from Mr. Dass Gupta and deposited in the bank was dishonoured but advice of non-payment was not received from the bank upto 31st March. 5. Rs. 3000 being the proceeds of a bill collected on 20th March did not appear in the cash book. 6. Rs. 300 being the proceeds of a bill collected on 20th March was omitted to be credited in the pass book. 7. The pass book showed an amount of Rs. 340, being rent which his tenant Madan Gopal had directly deposited on the bank 0n 31.03.2007. 8. A bill payable of Rs. 600 was duly paid off on 31st March according to the instructions of Ajay Ghosh but this was not entered into cash book. 9. Bank charges of Rs. 30 and interest an overdraft Rs. 170 appeared in the pass book but not in the cash book. Prepare a BRS and find out the balance as per pass book. Problem 4 On 30th April,2007 ; the pass book of Ghosh showed a debit balance of Rs. 32,675. You are required to prepare BRS taking into consideration the following information: Rs. Cheques issued but not yet presented for payment 18,513 Cheques deposited with the bank 1,38,000 But so far credited in the pass book 1,12,000 Interest collected by the bank but not recorded in cash book by Ghosh 1,200 Bank Charges not yet entered in cash book 150 Problem 5 From the following information supplied by Shri Mehta, prepare his bank reconciliation statement as on 31st March, 2007 after amending the cash book on that date:

ConceptAge Classes CS/ICWA Foundation - Accounts

Page 2

Rs. Bank overdraft as per bank statement 1,65,000 Cheques issued but not presented for payment 87,500 Cheques deposited with the bank but not collected 1,05,000 Cheque recorded in the bank column of the cash book but not sent to the 20,000 bank for collection Payments received from customers direct by the bank 35,000 Bank Charges debited in the statement 200 A bill for Rs. 30,000 (discounted with the bank in February at Rs. 29,780) 100 dishonored on 31st March and noting charges paid by the bank Premium on life policy of Mehta paid by the bank on standing advice 1,800 Overdraft balance (Cr.) on 25.03.2007, Rs. 80,000 carried over as debit balance on the next day Problem 6 From the following information, prepare BRS for Mr. Prakash Agarwal: DR. Date 97 Dec 1 8 10 15 22 28 31 Particulars To Balance b/f To R. Sen To P. Gupta To B.K. Roy To P. Patel To H. Kabir To T.K. Basu Cash A/c (Bank Column) Rs. 450 210 600 780 100 240 300 Date 97 Dec 2 6 8 12 16 22 24 28 30 31 31 Particulars By P.K. Sharma By T. Khanna By A. Amin By L. Narayan By K. Kundu By C. Banerjee By T. Sen By Wages By B.K. Agarwal By L.N. Mishra By Balance c/d Rs. 150 60 10 120 400 300 40 250 150 80 1,120 2,680 CR.

2,680 Bank Statement Date Particulars Dr. (Withdrawn) Cr. (Deposited)

97 Dec Balance b/f 1 6 Cheque 10 Cheque 12 Deposit 13 Cheque

Balance (Rs.) 450 Cr. 300 Cr. 240 Cr. 450 Cr. 440 Cr.

Page 3

150 60 210 10

ConceptAge Classes CS/ICWA Foundation - Accounts

14 15 15 19 20 25 28 29 31

Deposit Bank Charges Cheque Deposit Cheque Deposit Cheque Cash Standing Order Subscription

600 5 120 780 400 100 40 250 Club 100

1,040 Cr. 1,035 Cr. 915 Cr. 1,695 Cr. 1,295 Cr. 1,395 Cr. 1,355 Cr. 1,105 Cr. 1,005 Cr.

HOMEWORK Problem 1: CS Dec 2010 8 marks On 30th June, 2010, the pass book of Nataraj showed a bank overdraft of Rs. 46,000. The following additional information is available. You are required to prepare a BRS as on the above mentioned date: 1. Out of the total cheques issued, cheques for Rs. 22,000 have not been presented for payment so far. 2. Cheques paid into bank for collection, but not yet cleared total Rs. 31,000. 3. Bank has charged Rs. 2,300 as interest on overdraft; it doesnot appear in cash book. 4. A customer has directly deposited Rs. 8,300 with bank in Nataraj s account for which there is no entry in cash book. 5. Dividend on shares collected by bank and credited in the pass book amounts to Rs. 2,000 for which no intimation has been given to Nataraj so far. 6. A bill for Rs. 10,000 discounted with the bank was dishonored on maturity. Bank has debited Nataraj with Rs. 10,100 including Rs. 100 for noting charges, the transaction has not yet been recorded in cash book. Problem 2: CS June 2010 8 marks Rim Zim Ltd. maintains a current account with the State Bank of India. On 31st March, 2010; the bank column of its cash book showed a debit balance of Rs. 1,54,300. However the bank statement showed a different balance as on that date. The following were the reasons for the difference: Cheques deposited, not yet credited by bank Cheques issued, not yet presented for payment Bank charges not yet recorded in the cash book Cheques received by the bank directly from trade debtors Insurance premium paid by bank as per standing instructions, but not yet recorded

ConceptAge Classes CS/ICWA Foundation - Accounts

Rs. 75,450 80,760 1,135 1,35,200 15,400

Page 4

in the cash book Dividend collected by the bank, but not yet recorded in the cash book Find out the balance as per the bank statement as on 31st March, 2010 Problem 3: CS Dec -2009 8 marks

1,000

While comparing the cash book of Mayank with the bank pass book on 30th September, 2009; you find the following: 1. The bank pass book showed a debit balance of Rs. 15,000. 2. Bank paid insurance premium Rs. 2,000, but it was recorded as Rs. 200 only in cash book. 3. Cheques issued in favour of suppliers in September, 2009 amounted to Rs. 55,000 but cheques for Rs. 50,000 only were presented for payment upto 30th September,2009. 4. Direct deposit of Rs. 10,000 in Mayank s bank account by a customer on 25th September, 2009 had not been recorded in the cash book. 5. Dividend collected by bank , but not recorded in cash book Rs. 1,000. 6. Bank charges Rs. 300 for its services, but they were yet to be recorded in the cash book. 7. Cheques amounting to Rs. 78,000 were deposited with the bank in the last week of September, 2009 but cheques for Rs. 51,000 only had been cleared before 1st October, 2009. Prepare the bank reconciliation statement ascertaining bank balance/overdraft as per cash book. Problem 4 CS June 2009 6 marks On the basis of the following information, prepare a bank reconciliation statement as at 31st December, 2008: Bank balance as per cash book as on 31st December, 2008 Rs. 10,000 7,500 50 4,000

Cheques deposited for collection, but not credited by the bank before 1st January, 2009 Incidental charges appearing in the pass book on 30th December, 2008 with no advice received yet Cheques issued, but not presented to bank for payment before 1st January,2009

ConceptAge Classes CS/ICWA Foundation - Accounts

Page 5

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- WS - Xi BRS - 2Document5 pagesWS - Xi BRS - 2richshivamshahNo ratings yet

- 6 BRS 08-2023 RegularDocument7 pages6 BRS 08-2023 RegularjahnaviNo ratings yet

- Dkgoel BRS 11Document15 pagesDkgoel BRS 11DhruvNo ratings yet

- BRS PPT StudentDocument26 pagesBRS PPT StudentgganyanNo ratings yet

- Exercises of Bank Reconciliation Statement: Exercise No. IDocument9 pagesExercises of Bank Reconciliation Statement: Exercise No. ITayyab AliNo ratings yet

- Bank Reconciliation StatementDocument44 pagesBank Reconciliation StatementDubai SheikhNo ratings yet

- Bank Reconciliation Statement AssignmentDocument3 pagesBank Reconciliation Statement AssignmentDev KumarNo ratings yet

- Worksheet 3 - Solutions: Topic: Cash Book & Bank ReconciliationDocument2 pagesWorksheet 3 - Solutions: Topic: Cash Book & Bank ReconciliationvipulNo ratings yet

- Bank Reconciliaton Statement Practice Questions: ST ST STDocument2 pagesBank Reconciliaton Statement Practice Questions: ST ST STHuma SamuelNo ratings yet

- Worksheet 3 - Solutions: Topic: Cash Book & Bank ReconciliationDocument2 pagesWorksheet 3 - Solutions: Topic: Cash Book & Bank ReconciliationvipulNo ratings yet

- B.R.S. Test 3Document5 pagesB.R.S. Test 3Sudhir SinhaNo ratings yet

- Work Book Unit 12 Bank Reconcilaition Statement (Solved)Document9 pagesWork Book Unit 12 Bank Reconcilaition Statement (Solved)Zaheer SwatiNo ratings yet

- Chapter 11 - Bank Reconciliation StatementDocument29 pagesChapter 11 - Bank Reconciliation StatementRoh100% (1)

- CA F BRS WithDocument10 pagesCA F BRS WithG. DhanyaNo ratings yet

- 5.bank Reconcile Question and AnswerDocument42 pages5.bank Reconcile Question and AnswerSwarna Mishra100% (1)

- Bank Reconciliation StatementDocument22 pagesBank Reconciliation StatementasimaNo ratings yet

- Bank ReconciliationDocument7 pagesBank ReconciliationMohammad Faizan Farooq Qadri AttariNo ratings yet

- BRS PDFDocument14 pagesBRS PDFGautam KhanwaniNo ratings yet

- Bank Reconciliation StatementDocument40 pagesBank Reconciliation StatementPrashant100% (1)

- BRS Ca FoundationDocument9 pagesBRS Ca FoundationJunaid Iqbal MastoiNo ratings yet

- BRS ProblemsDocument28 pagesBRS ProblemsKutbuddin JawadwalaNo ratings yet

- Accounting For Manager: - CA Ankita JainDocument13 pagesAccounting For Manager: - CA Ankita JainrahulthexNo ratings yet

- Cashbook and Brs ProblemsDocument3 pagesCashbook and Brs Problemsmaheshbendigeri5945No ratings yet

- Bank Reconciliation StatementDocument4 pagesBank Reconciliation StatementRadhakrishna MishraNo ratings yet

- Bank Reconciliation StatementDocument40 pagesBank Reconciliation StatementPrashantNo ratings yet

- Brs WorksheetDocument2 pagesBrs WorksheetSaurabh JainNo ratings yet

- CCP102Document16 pagesCCP102api-3849444No ratings yet

- Worksheet BRSDocument2 pagesWorksheet BRSCA Chhavi Gupta100% (1)

- 16772BRSDocument47 pages16772BRSSketch KathayatNo ratings yet

- Accountancy XI: Pankaj Rajan 9810194206Document4 pagesAccountancy XI: Pankaj Rajan 9810194206A4S ARMY Akshdeep singhNo ratings yet

- Ch-3 BRSDocument8 pagesCh-3 BRSAFTAB KHANNo ratings yet

- MGT 101Document4 pagesMGT 101Taiba ShehzadiNo ratings yet

- 06 SLLC - 2021 - Acc - Review Question - Set 03Document7 pages06 SLLC - 2021 - Acc - Review Question - Set 03Chamela MahiepalaNo ratings yet

- Chapter EightDocument5 pagesChapter EightEng Abdulkadir MahamedNo ratings yet

- Time:-01:00Hr. F.M.:-25Document2 pagesTime:-01:00Hr. F.M.:-25mishralakshay629No ratings yet

- BRS Class 11Document1 pageBRS Class 11tarun aroraNo ratings yet

- Prepare Bank Reconciliation Statement From The Following: (I) Debit Balance As Per The Cash BookDocument10 pagesPrepare Bank Reconciliation Statement From The Following: (I) Debit Balance As Per The Cash BookPragya ShuklaNo ratings yet

- BRS WSDocument2 pagesBRS WSShrajith A NatarajanNo ratings yet

- Class Exercise - Bank ReconciliationDocument5 pagesClass Exercise - Bank Reconciliationmoosanippp0% (2)

- Additional Practical Problems-13-1Document5 pagesAdditional Practical Problems-13-1sharmaarmaan103No ratings yet

- Bank Reconciliation StatementDocument33 pagesBank Reconciliation StatementMd TahirNo ratings yet

- 0c26dbank Reconciliation Statement Practice QuestionsDocument2 pages0c26dbank Reconciliation Statement Practice QuestionsRahul AgarwalNo ratings yet

- Bank Reconciliation Statement August 17Document10 pagesBank Reconciliation Statement August 17NO NAMENo ratings yet

- BRS Statement IllustrationsDocument3 pagesBRS Statement Illustrationssurekha khandebharadNo ratings yet

- Cash Book ProblemsDocument6 pagesCash Book Problemsshahid sjNo ratings yet

- Class Exercise Bank ReconciliationDocument6 pagesClass Exercise Bank ReconciliationDalia ElarabyNo ratings yet

- Bank Reconciliation QuestionsDocument2 pagesBank Reconciliation Questionsmercknjoro100% (1)

- Bank Reconciliation Statement 70Document6 pagesBank Reconciliation Statement 70xyzNo ratings yet

- Bank Reconciliation QuestionDocument2 pagesBank Reconciliation QuestionFinnNo ratings yet

- Bank Reconciliation Statement: Correct AnswerDocument4 pagesBank Reconciliation Statement: Correct AnswerFaisal Ali100% (1)

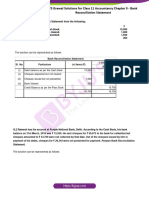

- Ts Grewal Solutions For Class 11 Accountancy Chapter 9 BankDocument34 pagesTs Grewal Solutions For Class 11 Accountancy Chapter 9 Bankmyankjindal9No ratings yet

- Bank Recon PartDocument2 pagesBank Recon PartdmiahalNo ratings yet

- BRSDocument29 pagesBRSBaskar ANgadeNo ratings yet

- CA Foundation June 23 BRS Problem - CTC ClassesDocument2 pagesCA Foundation June 23 BRS Problem - CTC ClassesMohit SharmaNo ratings yet

- Practical - Bank Reconciliation StatementDocument5 pagesPractical - Bank Reconciliation StatementUniversal SoldierNo ratings yet

- Charges Sheet Served On Himadri Shekhar BhattacharjeeDocument42 pagesCharges Sheet Served On Himadri Shekhar Bhattacharjeehimadri_bhattacharjeNo ratings yet

- Bank Reconcilement Statement (BRS) AccountsDocument5 pagesBank Reconcilement Statement (BRS) AccountsVedanth RamNo ratings yet

- Financial AccountingDocument19 pagesFinancial Accountingshankar1287No ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- Unit - 3: Performance AppraisalDocument24 pagesUnit - 3: Performance AppraisalPayal Mehta DeshpandeNo ratings yet

- CHP 4 - Materials IDocument7 pagesCHP 4 - Materials IPayal Mehta DeshpandeNo ratings yet

- Detailed Project Report On Underwater RestaurantDocument14 pagesDetailed Project Report On Underwater RestaurantPayal Mehta DeshpandeNo ratings yet

- Entre ReportDocument13 pagesEntre ReportPayal Mehta DeshpandeNo ratings yet