Professional Documents

Culture Documents

Bank Recon Part

Uploaded by

dmiahalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bank Recon Part

Uploaded by

dmiahalCopyright:

Available Formats

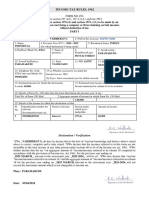

BANK RECON

1. MM Co. provided the bank statement for the month of December which included the ff. information:

Balance Dec. 31 2,800,000

Service charge for December 12,000

Interest paid by bank for MM deposits 10,000

In comparing the bank statement to its own records, the entity found the ff.:

Deposits made but not yet recorded by the bank 350,000

Checks written and mailed but not yet recorded by bank 650,000

In addition, the entity discovered that it had drawn and erroneously recorded a check for 46,000 instead of

64,000. What is the unadjusted balance per ledger? ______________________

2. MM Co. showed a cash account balance of 4,500,000 at the month end. The bank statement did not include a deposit

of 230,000 made on the last day of the month. The bank statement showed a collection by the bank of 94,000 for the

depositor and a costumer check for 32,000 returned because it was NSF. A customer check for 45,000 was recorded by

the depositor as 54,000 and a check written for 79,000 was recorded as 97,000. What amount should be reported as

cash in bank? ______________________

3. MM Co. provided the bank statement for the month of April which included the ff. information:

Bank service charge for April 15,000

Check deposited by MM during April was not collectible and

Has been marked NSF by the bank and returned 40,000

In comparing the bank statement to its records, the entity found the ff.

Deposits made but not recorded by the bank 130,000

Checks written and mailed but not yet recorded by the bank 100,000

All DITs and OCs have been properly recorded in entity’s book.

A customer check of 35,000 payable to MM had not yet been deposited and had not been recorded by the entity.

The cash balance per ledger is 920,000. Adjusted cash in bank for April? ________________________

4. MM Co. kept all ash in a checking account. An examination of the accounting records and bank statement for the

month of June revealed the ff.:

*the cash balance per book on June 30 was 8,500,000

*a depository of 1M placed in bank’s night depository did not appear on bank statement

*the bank statement showed that on June 30 the bank collected note for the entity and credited the proceeds of

950,000 to the entity’s account

*checks outstanding on June 30 amounted to 300,000 including certified check of 100,000

*the entity discovered that a check written in June for 200,000 if payment of an account payable had been

recorded in the entity’s records as 20,000

*included in the June bank statement was NSF check for 250,000 received from a customer on June 26

*the bank statement showed a 20,000 service charge for June

Cash in bank ________________ and balance per bank statement _______________________

5. MM provided the ff. data for the month of January:

Balance per book, January 31 3,130,000

Balance per bank statement, January 31 3,500,000

Deposits in transit 550,000

NSF check received from a customer returned by the bank 50,000

Checks outstanding January 31 650,000

Debit memo for safety deposit box rental 5,000

Creditor check of 30,000 was incorrectly recorded in depositor’s book as 300,000

A customer check for 200,000 was recorded by the depositor as 20,000

Bank by mistake, credited 74,000 to MM account instead of 47,000

The teller erroneously debited MM’s account 135,000 instead of 153,000

Amount to be reported as adjusted cash in bank? ___________________________

You might also like

- QuizDocument2 pagesQuizrysii gamesNo ratings yet

- MOD 03 - Bank ReconDocument3 pagesMOD 03 - Bank ReconIrish VargasNo ratings yet

- Amazing RaceDocument6 pagesAmazing RaceHanns Lexter PadillaNo ratings yet

- ProblemsDocument28 pagesProblemsYou Knock On My DoorNo ratings yet

- AC 1201 Homework 1Document4 pagesAC 1201 Homework 1nericuevas1030No ratings yet

- Problem 59Document1 pageProblem 59YukidoNo ratings yet

- Bank ReconDocument2 pagesBank Reconyjkq4byrj6No ratings yet

- Bank Reconciliation & Proof of CashDocument25 pagesBank Reconciliation & Proof of CashTanya MaxNo ratings yet

- Module in LawDocument4 pagesModule in LawBSIT 1A Yancy CaliganNo ratings yet

- Bank ReconciliationAND - FsanalysisDocument14 pagesBank ReconciliationAND - FsanalysisElixirNo ratings yet

- Far ReviewerDocument2 pagesFar ReviewerKyla Mae OrquijoNo ratings yet

- Lecture Notes On Bank Reconciliation - 000Document3 pagesLecture Notes On Bank Reconciliation - 000judel ArielNo ratings yet

- Acc 106 Quiz BR and Ar NoakDocument8 pagesAcc 106 Quiz BR and Ar Noakhoneyjoy salapantanNo ratings yet

- FINANCIAL ACCOUNTING - Cash To Receivables Problems and SolutionsDocument8 pagesFINANCIAL ACCOUNTING - Cash To Receivables Problems and Solutionsstan iKONNo ratings yet

- QUIZ Proof of CashDocument1 pageQUIZ Proof of CashKemart VillegasNo ratings yet

- Problem 5 PresentationDocument12 pagesProblem 5 PresentationMavi AngelNo ratings yet

- Quiz 2 - Audit Cash - 5ae63b1cb41c4b23e6070f657ddaDocument8 pagesQuiz 2 - Audit Cash - 5ae63b1cb41c4b23e6070f657ddaAlexNo ratings yet

- P1-01 Cash and Cash EquivalentsDocument5 pagesP1-01 Cash and Cash EquivalentsRachel LeachonNo ratings yet

- 100% Key Answers For The 2 First Quizzes - ACT1104Document34 pages100% Key Answers For The 2 First Quizzes - ACT1104moncarla lagonNo ratings yet

- Exam Questionaire in IntermediateDocument5 pagesExam Questionaire in IntermediateJester IlaganNo ratings yet

- Practice Set: Page 5 of 7Document3 pagesPractice Set: Page 5 of 7darren sanchezNo ratings yet

- Bank Recon Problems - Group WorkDocument2 pagesBank Recon Problems - Group WorkKathleenNo ratings yet

- Cash Cash Equivalent Bank ReconDocument4 pagesCash Cash Equivalent Bank Reconmavie arellanoNo ratings yet

- Cash and Cash EquivalentsDocument8 pagesCash and Cash EquivalentsNMCartNo ratings yet

- 3.3 - Bank Reconciliation and Proof of CashDocument5 pages3.3 - Bank Reconciliation and Proof of CashxxxNo ratings yet

- Bank ReconciliationDocument12 pagesBank ReconciliationJieniel ShanielNo ratings yet

- FAR 0 Bank Recon and Proof of Cash Drill ProblemsDocument6 pagesFAR 0 Bank Recon and Proof of Cash Drill Problemsyeeaahh56No ratings yet

- F CFAS-EXAM - Docx 143874436Document48 pagesF CFAS-EXAM - Docx 143874436Athena AthenaNo ratings yet

- PS 1Document4 pagesPS 1BlackRoseNo ratings yet

- Intermediate Accounting 1 - Cash and Cash Equivalent - Test BankDocument9 pagesIntermediate Accounting 1 - Cash and Cash Equivalent - Test BankKabayanNo ratings yet

- FAR Rev Cash To POCDocument6 pagesFAR Rev Cash To POCCattyyy Delos ReyesNo ratings yet

- Bank Recon ExerciseDocument2 pagesBank Recon ExerciseRhea BadanaNo ratings yet

- Activity 3 - Cash and Cash EquivalentsDocument2 pagesActivity 3 - Cash and Cash EquivalentsSean Lester S. NombradoNo ratings yet

- Financial Accounting and Reporting With AnswersDocument11 pagesFinancial Accounting and Reporting With AnswersHades MercadejasNo ratings yet

- ACCTG 102 Practice Sets Quizzes ExamsDocument25 pagesACCTG 102 Practice Sets Quizzes ExamsheythereitsclaireNo ratings yet

- BANKRECONPROBLEMSDocument3 pagesBANKRECONPROBLEMSPaulAnthonyNo ratings yet

- Financial Accounting Part 1: Cash & Cash EquivalentDocument7 pagesFinancial Accounting Part 1: Cash & Cash EquivalentHillary Grace VeronaNo ratings yet

- Bank Reconciliation (IA)Document7 pagesBank Reconciliation (IA)rufamaegarcia07No ratings yet

- Ia1.activity 3Document1 pageIa1.activity 3kathie alegarme100% (1)

- Audit of Cash - Exercises Exercise 1Document5 pagesAudit of Cash - Exercises Exercise 1IceNo ratings yet

- Auditing 1 AssessmentDocument15 pagesAuditing 1 AssessmentEmilou AustriacoNo ratings yet

- SONS Accounting Tutorial Bank Recon and Proof of Cash Handout PDFDocument4 pagesSONS Accounting Tutorial Bank Recon and Proof of Cash Handout PDFArrow KielNo ratings yet

- Profel1 AC Activity Assets Part1Document2 pagesProfel1 AC Activity Assets Part1Dizon Ropalito P.No ratings yet

- BRS PPT StudentDocument26 pagesBRS PPT StudentgganyanNo ratings yet

- Aud Rev ProblemsDocument12 pagesAud Rev ProblemsPrankyJellyNo ratings yet

- Exercises - Bank Recon - 1.16.20Document4 pagesExercises - Bank Recon - 1.16.20Michelle PamplinaNo ratings yet

- CM 03 Bank ReconciliationDocument7 pagesCM 03 Bank ReconciliationDanicaEsponilla67% (3)

- Practice Set: Audit of Cash and Cash EquivalentsDocument2 pagesPractice Set: Audit of Cash and Cash EquivalentsANGELU RANE BAGARES INTOLNo ratings yet

- Bank Recon - QUESTIONSDocument3 pagesBank Recon - QUESTIONSgkem1014No ratings yet

- Mock Midterm Exam - QuestionnaireDocument13 pagesMock Midterm Exam - QuestionnaireMaeNo ratings yet

- Quiz 1 - Audit of CashDocument4 pagesQuiz 1 - Audit of CashmillescaasiNo ratings yet

- Bank Reconciliation Practice SetDocument2 pagesBank Reconciliation Practice SetMirella AlminarNo ratings yet

- Problem 1Document8 pagesProblem 1Mikaela JeanNo ratings yet

- QUIZ 1 CASH With Answer KeyDocument8 pagesQUIZ 1 CASH With Answer KeyPrincess Vheil SagumNo ratings yet

- Chapters 1-3: Cash and Cash Equivalents, Bank Reconciliation and Proof of CashDocument4 pagesChapters 1-3: Cash and Cash Equivalents, Bank Reconciliation and Proof of CashMarco CruzNo ratings yet

- Problem 8 - 16Document1 pageProblem 8 - 16Jao FloresNo ratings yet

- FAR Practical Exercises Proof of CashDocument3 pagesFAR Practical Exercises Proof of CashAB CloydNo ratings yet

- Sample Problem - Notes Receivable and Loan ImpairmentDocument4 pagesSample Problem - Notes Receivable and Loan ImpairmentYashi SantosNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- I Like Your EyesDocument1 pageI Like Your EyesdmiahalNo ratings yet

- Lesson 1 Economic DevelopmentDocument18 pagesLesson 1 Economic DevelopmentdmiahalNo ratings yet

- FilipinoDocument20 pagesFilipinodmiahalNo ratings yet

- PE 2 Module 2021Document87 pagesPE 2 Module 2021dmiahalNo ratings yet

- Coin Deposit MachinesDocument1 pageCoin Deposit MachinesUmie Adam & HaWaNo ratings yet

- Form 15G 3Document1 pageForm 15G 3lakshmananksme3007No ratings yet

- Rastriya Banijya Bank Limited: Unaudited Financial Results First Quarter Ending FY 2080/81 (2023-24)Document3 pagesRastriya Banijya Bank Limited: Unaudited Financial Results First Quarter Ending FY 2080/81 (2023-24)Sagar ThakurNo ratings yet

- Personal Property Security Act V. Chattel Mortgage Chattel Mortgage (NCC ACT 1508) PPSA (R.A. 11057)Document8 pagesPersonal Property Security Act V. Chattel Mortgage Chattel Mortgage (NCC ACT 1508) PPSA (R.A. 11057)Jj JumalonNo ratings yet

- Paying Your Local Property Tax (LPT) For 2024: PROPERTY ID: 2753264IH PIN: ZD23TX47Document2 pagesPaying Your Local Property Tax (LPT) For 2024: PROPERTY ID: 2753264IH PIN: ZD23TX47fcm79pkn6nNo ratings yet

- Lesson-3 EeDocument15 pagesLesson-3 EeChristian MagdangalNo ratings yet

- Quiz 01 Financial Management Total Marks 30Document1 pageQuiz 01 Financial Management Total Marks 30Repunzel RaajNo ratings yet

- Stay Ahead in The Game of Knowledge! ? Dive Deep Into Current Affairs With K3ias.?Document1 pageStay Ahead in The Game of Knowledge! ? Dive Deep Into Current Affairs With K3ias.?K3 IASNo ratings yet

- Bank StatementDocument3 pagesBank StatementAbdul BasitNo ratings yet

- Op Transaction History 03!09!2023Document2 pagesOp Transaction History 03!09!2023Kuljinder SinghNo ratings yet

- 7 Loan ReceivableDocument10 pages7 Loan ReceivableAYEZZA SAMSONNo ratings yet

- Bandhan Bank Statement.Document1 pageBandhan Bank Statement.ssbajajbethua22No ratings yet

- Credit Collection Module 2Document9 pagesCredit Collection Module 2Crystal Jade Apolinario RefilNo ratings yet

- Tata Consultancy Services Employees' Provident Fund: PF NoDocument1 pageTata Consultancy Services Employees' Provident Fund: PF NoTanmay AdhikaryNo ratings yet

- Solutions To Selected End-Of-Chapter 4 Problem Solving QuestionsDocument10 pagesSolutions To Selected End-Of-Chapter 4 Problem Solving QuestionsVân Anh Đỗ LêNo ratings yet

- Structured Flowchart of The Loan Computation: StartDocument6 pagesStructured Flowchart of The Loan Computation: StarthalerNo ratings yet

- Estmt - 2024 02 22Document10 pagesEstmt - 2024 02 22jpneebNo ratings yet

- Extra Judicial ForeclosureDocument3 pagesExtra Judicial ForeclosureANGIE BERNALNo ratings yet

- Lecture-Chapter 5Document5 pagesLecture-Chapter 5kimdemelyn cerenoNo ratings yet

- XXXX96 01 01 2023to28 08 2023Document18 pagesXXXX96 01 01 2023to28 08 2023dabu choudharyNo ratings yet

- DCB BANK - Statement of AccountDocument2 pagesDCB BANK - Statement of Accountzuber shaikhNo ratings yet

- All ThesisDocument111 pagesAll ThesisArjun kumar ShresthaNo ratings yet

- Rem 111 Group 9Document7 pagesRem 111 Group 9Nicole CantosNo ratings yet

- First Time Home Buyers Seminar: Welcome!Document31 pagesFirst Time Home Buyers Seminar: Welcome!DianaNo ratings yet

- Example - New HUD 1Document3 pagesExample - New HUD 151 Pegasi100% (2)

- Internship Report of ADBLDocument41 pagesInternship Report of ADBLconXn Communication & CyberNo ratings yet

- Exercises On Central Bank InterventionDocument4 pagesExercises On Central Bank InterventionNguyễn TuyềnNo ratings yet

- Gakpo 18Document2 pagesGakpo 18denekew lesemiNo ratings yet

- 3rd Floor, JP Techno Park, No.3/1, Millers Road, Bangalore 560001, IndiaDocument1 page3rd Floor, JP Techno Park, No.3/1, Millers Road, Bangalore 560001, IndiaGamer JiNo ratings yet

- Transaction Procedure EngDocument1 pageTransaction Procedure EngzagogNo ratings yet