Professional Documents

Culture Documents

Personal Property Security Act V. Chattel Mortgage Chattel Mortgage (NCC ACT 1508) PPSA (R.A. 11057)

Uploaded by

Jj Jumalon0 ratings0% found this document useful (0 votes)

226 views8 pagesOriginal Title

PPSA V. CM

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

226 views8 pagesPersonal Property Security Act V. Chattel Mortgage Chattel Mortgage (NCC ACT 1508) PPSA (R.A. 11057)

Uploaded by

Jj JumalonCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 8

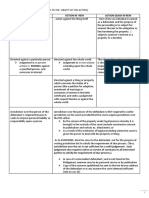

COMPARATIVE TABLE OF PERSONAL PROPERTY SECURITY ACT AS AGAINST CHATTEL

MORTGAGE, PLEDGE AND PREFERENCE OF CREDITS : | JUMALON, Jewelyn A. 4B

PERSONAL PROPERTY SECURITY ACT v. CHATTEL MORTGAGE

CHATTEL MORTGAGE (NCC;

DISTINCTIONS: PPSA (R.A. 11057)

ACT 1508)

Registration requirement: Registration is required by Not required. It is sufficient

law. that there is a security

agreement which will create

Art. 2140 of the NCC: the security interest.

By a chattel mortgage,

personal property is recorded Sec. 6:

in the Chattel Mortgage A security agreement must

Register as a security for the be contained in a written

performance of an contract signed by the

obligation. parties.

It may consist of one or more

writings that, taken together,

establish the intent of the

parties to create a security

interest.

When perfected: By registration. Sec. 11(a):

A security interest shall be

Art. 2140 of the NCC: perfected when it has been

If the movable, instead of created and the secured

being recorded is deliver to creditor has taken one of the

the creditor or a third actions in accordance with

person, the contract is a Sec. 12.

pledge, not a chattel

mortgage. Sec. 12:

A security interest may be

perfected by:

Registration of a

notice with the

Registry;

Possession of the

collateral by the

secured creditor;

Control of investment

property and deposit

account.

Ownership of the collateral: Art. 2085 of the NCC, as Sec.5(b):

suppletory applied, provides A security agreement may

that: provide for the creation of a

The security interest in a future

pledgor/mortgagor property, but the security

COMPARATIVE TABLE OF PERSONAL PROPERTY SECURITY ACT AS AGAINST CHATTEL

MORTGAGE, PLEDGE AND PREFERENCE OF CREDITS : | JUMALON, Jewelyn A. 4B

must be the absolute interest in that property is

owner of the thing created only when the

pledged of mortgaged grantor acquires rights in it or

The persons the power to encumber it.

constituting the

pledge or mortgage Hence, security debtor can

have the free disposal use future property as

of their property, and collateral provided the

in the absence condition set forth in Sec.

thereof, that they be 5(b) has been complied with.

legally authorized for

the purpose

Hence, the

mortgagor/pledgor cannot

use future property as

collateral.

Formalities: Requisites of a chattel Sec. 12:

mortgage: A security interest may be

Art. 2085 of the NCC: (as perfected by:

applied suppletory) Registration of a

The chattel mortgage notice with the

must be constituted Registry;

to secure the Possession of the

fulfillment of a collateral by the

principal obligation secured creditor;

The Control of investment

pledgor/mortgagor property and deposit

must be the absolute account.

owner of the thing

pledged of mortgaged

The persons

constituting the

pledge or mortgage

have the free disposal

of their property, and

in the absence

thereof, that they be

legally authorized for

the purpose

Chattel Mortgage must

COMPARATIVE TABLE OF PERSONAL PROPERTY SECURITY ACT AS AGAINST CHATTEL

MORTGAGE, PLEDGE AND PREFERENCE OF CREDITS : | JUMALON, Jewelyn A. 4B

likewise be in accordance

with Arts. 2085-2123, 2140-

2141 of the NCC.

Enforcement of the security: Sec. 14 of Act 1508: Either through:

The mortgagee, his executor, Recovery (Sec. 48);

his administrator, or assign, Disposition (Sec. 49);

may after 30 days from the Retention (Sec. 54).

time of condition broken,

cause the mortgaged In certain cases, secured

property, or any part thereof, creditor must first seek

to be sold at a public auction REPOSSESSION (Sec.47) of

by a public officer at a public the collateral, which may be

place in the municipality undertaken with judicial

where the mortgagor resides, process or without judicial

or where the property is process.

situated.

PNB v. Manila Investment

Construction, Inc. (G.R. No.:

L-27132, April 29, 1971):

The sale may be a private

one, if permitted by the

agreement of the parties.

There is nothing immoral or

against public order in such

agreement entered into

freely and voluntarily, in line

with the provisions of

substantive law giving the

contracting parties full

freedom to contract provided

their agreement is not

contrary to law, morals, good

customs, public order or

public policy.

Right of lender to recover Allowed. Allowed.

deficiency:

Bicol Savings and Loans Sec. 52:

Association v. Guinhawa The secured creditor,

(G.R. No.: L-62415, August whether a mortgagee or

20, 1990) pledgee, shall account to the

In extra-judicial grantor for any surplus, and

COMPARATIVE TABLE OF PERSONAL PROPERTY SECURITY ACT AS AGAINST CHATTEL

MORTGAGE, PLEDGE AND PREFERENCE OF CREDITS : | JUMALON, Jewelyn A. 4B

foreclosure of CM, unless otherwise agreed, the

the deficiency maybe debtor is liable for any

recovered by deficiency.

instituting a separate

civil action for that

purpose.

In judicial foreclosure

of CM, the creditor

may ask for the

execution of the

judgment against any

other property of the

mortgagor for the

payment of the

balance.

Right of the borrower to Allowed. Allowed.

recover surplus:

Sec. 14 of Act. 1508: Sec. 52(b):

The proceeds of such sale The secured creditor,

shall be applied to the whether a mortgagee or

payment, first, of the cost pledgee, shall account to the

and expenses of keeping and grantor for any surplus, and

sale, and then to the unless otherwise agreed, the

payment of the demand or debtor is liable for any

obligation secured by such deficiency.

mortgage, and the residue

shall be paid to persons

holding subsequent

mortgages in their order, and

the balance, after paying the

mortgages, shall be paid to

the mortgagor or person

holding under him on

demand.

Lender’s right of action in Caltex v. IAC, 176 SCRA 741 Sec. 49:

case of default by the (1989): (a) After default, a

borrower: The mortgagee has a choice secured creditor may

of one of the two remedies, sell or otherwise

BUT HE CANNOT HAVE dispose of the

BOTH: collateral, publicly or

Foreclose the privately, in its

mortgage; present condition or

COMPARATIVE TABLE OF PERSONAL PROPERTY SECURITY ACT AS AGAINST CHATTEL

MORTGAGE, PLEDGE AND PREFERENCE OF CREDITS : | JUMALON, Jewelyn A. 4B

File an ordinary action following any

to collect the debt. commercially

reasonable

preparation or

processing.

(b) The secured creditor

may buy the collateral

at any public

disposition, or at

private disposition

but only if the

collateral is of a kid

that is customarily

sold on a recognized

market or the subject

of widely distributed

standard price

quotations.

Right of Redemption: None. Allowed.

(Sibal v. Valdez, 50 Phil. 512;

Sps. Paray v. Rodriguez, G.R. Sec. 45:

No.: 132287, January 24, Any person who is entitled to

2006.) receive a notification of

disposition is entitled to

redeem the collateral by

paying or otherwise

performing the secured

obligation in full, including

the reasonable cost of

enforcement.

COMPARATIVE TABLE OF PERSONAL PROPERTY SECURITY ACT AS AGAINST CHATTEL

MORTGAGE, PLEDGE AND PREFERENCE OF CREDITS : | JUMALON, Jewelyn A. 4B

PERSONAL PROPERTY SECURITY ACT v. PLEDGE

DISTINCTIONS: PLEDGE (NCC) PPSA (R.A. 11057)

When perfected: Delivery. Delivery is not necessary.

Art. 2093 of the NCC: Sec. 11(a):

In addition to the requisites A security interest shall be

prescribed in Art. 2085, it is perfected when it has been

necessary, in order to created and the secured

constitute the contract of creditor has taken one of the

pledge, that the thing actions in accordance with

pledged be placed in the Sec. 12.

possession of the creditor, or

of a third person by common Sec. 12:

agreement. A security interest may be

perfected by:

Registration of a

notice with the

Registry;

Possession of the

collateral by the

secured creditor;

Control of investment

property and deposit

account.

Formalities: Requisites of Pledge: The following must be

Art. 2085 of the NCC: present:

The pledge must be

constituted to secure 1.) Written security

the fulfillment of a agreement signed by

principal obligation the parties. (Sec. 6)

The 2.) Description of the

pledgor/mortgagor collateral. (Sec. 7)

must be the absolute 3.) Perfection of security

owner of the thing interest. (Secs. 11 &

pledged of mortgaged 12)

The persons

constituting the

pledge or mortgage

have the free disposal

of their property, and

in the absence

thereof, that they be

COMPARATIVE TABLE OF PERSONAL PROPERTY SECURITY ACT AS AGAINST CHATTEL

MORTGAGE, PLEDGE AND PREFERENCE OF CREDITS : | JUMALON, Jewelyn A. 4B

legally authorized for

the purpose

Right of borrower to recover Not allowed. Allowed.

surplus:

Art. 2115 of the NCC: Sec. 52(b):

If the price of the sale is less The secured creditor,

(than the amount of the whether a mortgagee or

principal obligation), neither pledgee, shall account to the

shall the creditor be entitled grantor for any surplus, and

to recover the deficiency, unless otherwise agreed, the

notwithstanding any debtor is liable for any

stipulation to the contrary. deficiency.

Right of lender to recover Not allowed, generally. Not allowed, generally.

deficiency:

Art. 2115 of the NCC: Sec. 52(b):

If the price of the sale is The secured creditor,

more than said amount (of whether a mortgagee or

the principal obligation), thepledgee, shall account to the

debtor shall not be entitled grantor for any surplus, and

to the excess, UNLESS it is unless otherwise agreed, the

otherwise agreed. debtor is liable for any

deficiency.

Enforcement of security: Notarial Sale. Either through:

o Two auctions may be Recovery (Sec. 48);

had, and if the thing Disposition (Sec. 49);

pledged had not been Retention (Sec. 54).

sold after the two

auctions, the pledgee In certain cases, secured

may appropriate the creditor must first seek

thing pledged with REPOSSESSION (Sec.47) of

the effect of the collateral, which may be

extinguishment of undertaken with judicial

debt. process or without judicial

process.

Art. 2112 of the NCC:

The creditor to whom the

credit has not been satisfied

in due time, may proceed

before a Notary Public to the

sale of the thing pledged.

This sale shall be made at a

public auction, and with the

COMPARATIVE TABLE OF PERSONAL PROPERTY SECURITY ACT AS AGAINST CHATTEL

MORTGAGE, PLEDGE AND PREFERENCE OF CREDITS : | JUMALON, Jewelyn A. 4B

notification to the debtor and

the owner of the thing

pledged in a proper case,

stating the amount for which

the public sale is to be held.

If at the first auction the

thing is not sold, a second

one with the same

formalities shall be held; and

if at the second auction there

is no sale either, the creditor

may appropriate the thing

pledged. In this case, he shall

give an acquittance for his

entire claim.

Binding effect to 3rd parties: Description of the thing Need not be in public

pledged and date of pledge instrument.

must appear in a public

instrument. It is enough that there is a

written security agreement

Art. 2096 of the NCC: and is signed by the parties.

A pledge shall not take effect (Sec.6)

against third persons if a

description of the thing

pledged and the date of

pledge do not appear in a

public instrument.

You might also like

- Reviewer Personal Property Security ActDocument34 pagesReviewer Personal Property Security ActSbl Irv100% (15)

- PPSA SummaryDocument9 pagesPPSA Summarykarl100% (17)

- Yoni TantraDocument28 pagesYoni Tantradrept555100% (10)

- Revised PPSA V. Chattel Mortgage, Pledge, Preference of CreditDocument8 pagesRevised PPSA V. Chattel Mortgage, Pledge, Preference of CreditJj Jumalon67% (3)

- PPSA V Civil CodeDocument3 pagesPPSA V Civil CodeElaizza ConcepcionNo ratings yet

- Understanding RA 11057 and Its Effect With NCC and Prior LawsDocument2 pagesUnderstanding RA 11057 and Its Effect With NCC and Prior LawsKym Algarme100% (2)

- Magic Maze: Props IncludedDocument4 pagesMagic Maze: Props IncludedarneuhüdNo ratings yet

- Notes From Dean Salaos Lecture On Personal Property Security ActDocument9 pagesNotes From Dean Salaos Lecture On Personal Property Security ActCassie GacottNo ratings yet

- PPSA V CIVIL CODE & CHATTEL MORTGAGE LAWDocument7 pagesPPSA V CIVIL CODE & CHATTEL MORTGAGE LAWElaizza Concepcion100% (1)

- Personal Property Security Act: Section 2. Declaration of PolicyDocument20 pagesPersonal Property Security Act: Section 2. Declaration of PolicyRikka Reyes100% (4)

- Notes On DotDocument27 pagesNotes On DotBrod LenamingNo ratings yet

- Judge Serrano NotesDocument35 pagesJudge Serrano NotesambonulanNo ratings yet

- Petitioner Respondents: Diwa T. Tayao, - Republic of The Philippines and Beatriz A. WhiteDocument5 pagesPetitioner Respondents: Diwa T. Tayao, - Republic of The Philippines and Beatriz A. WhiteKallum AndersonNo ratings yet

- Comparison PPSA NCC CMLDocument6 pagesComparison PPSA NCC CMLNur Omar100% (1)

- 1801 - Estate Tax ReturnDocument2 pages1801 - Estate Tax ReturnErikajane BolimaNo ratings yet

- RA 11057 vs. Repealed LawsDocument2 pagesRA 11057 vs. Repealed LawsSage Rainelle LingatongNo ratings yet

- Cred Trans - PpsaDocument10 pagesCred Trans - PpsaJane Galicia100% (3)

- Course SyllabusDocument9 pagesCourse SyllabusNajimNo ratings yet

- Commercial Law Syllabus 2021Document6 pagesCommercial Law Syllabus 2021Francisco BanguisNo ratings yet

- Personal Property Security Act From Scratch 1Document18 pagesPersonal Property Security Act From Scratch 1Ralph Ronald CatipayNo ratings yet

- Group 3 Law On Credit Transaction 18-11-2022.docx 1Document18 pagesGroup 3 Law On Credit Transaction 18-11-2022.docx 1Angela AmpidanNo ratings yet

- Prerogative Writs Matrix 1Document6 pagesPrerogative Writs Matrix 1Perla ArroyoNo ratings yet

- RA No. 11057 Its IRR ConsolidatedDocument157 pagesRA No. 11057 Its IRR ConsolidatedErika Angela Galceran33% (3)

- 2019 BANKING TSN Third ExamDocument83 pages2019 BANKING TSN Third ExamBANanaispleetNo ratings yet

- Credit Transactions UM TSN 2015Document42 pagesCredit Transactions UM TSN 2015Master GanNo ratings yet

- Korea Technologies Co., Ltd. v. Hon. Alberto A. Lerma and Pacific General Steel Manufacturing CorporationDocument2 pagesKorea Technologies Co., Ltd. v. Hon. Alberto A. Lerma and Pacific General Steel Manufacturing CorporationJustin SalazarNo ratings yet

- Hizon Notes - Legal EthicsDocument43 pagesHizon Notes - Legal EthicsAQAANo ratings yet

- Michelin & Cie, 58 Phil. 261 (1933) .: Notes On Corporation Law - RM SantiagoDocument39 pagesMichelin & Cie, 58 Phil. 261 (1933) .: Notes On Corporation Law - RM SantiagoMark Joseph M. VirgilioNo ratings yet

- Case Digest Compilation - Atty Zarah Villanueva-Castro CollumnizedDocument108 pagesCase Digest Compilation - Atty Zarah Villanueva-Castro CollumnizedBAMFNo ratings yet

- Provisional Remedies (57-61) by Prof. George S.D. AquinoDocument58 pagesProvisional Remedies (57-61) by Prof. George S.D. AquinoPnix HortinelaNo ratings yet

- Question: What Is Indefeasibility of Title?: AnswerDocument3 pagesQuestion: What Is Indefeasibility of Title?: AnswerHanna Liia GeniloNo ratings yet

- Manual For Personnel: ProposedDocument11 pagesManual For Personnel: Proposedjsopena27No ratings yet

- SRC - TSN NazarenoDocument6 pagesSRC - TSN NazarenoNLainie OmarNo ratings yet

- Sample Case DigestDocument2 pagesSample Case DigestEmmanuel FernandezNo ratings yet

- Access Devise Regulation ActDocument5 pagesAccess Devise Regulation ActPolo MartinezNo ratings yet

- Sps Cha and Us v. CA and CksDocument3 pagesSps Cha and Us v. CA and CksSNo ratings yet

- Affairs, Enrique A. Manalo Signed The Statute. by Its Provision, However, It Is Requiring That It Be Ratified byDocument18 pagesAffairs, Enrique A. Manalo Signed The Statute. by Its Provision, However, It Is Requiring That It Be Ratified byching113No ratings yet

- ADR Nov 20Document4 pagesADR Nov 20Lara De los SantosNo ratings yet

- FINAL PAPER Practicum 2 - BIRAODocument31 pagesFINAL PAPER Practicum 2 - BIRAOAianna Bianca Birao (fluffyeol)No ratings yet

- JDC - Insurance Law Reviewer - 3c2020Document38 pagesJDC - Insurance Law Reviewer - 3c2020Megan AglauaNo ratings yet

- Albert Vs GanganDocument8 pagesAlbert Vs GanganJoel G. AyonNo ratings yet

- 115-People vs. Menil G.R. No. 115054-66 September 12, 1999Document17 pages115-People vs. Menil G.R. No. 115054-66 September 12, 1999Jopan SJNo ratings yet

- Banking TSN 2018 2nd ExamDocument54 pagesBanking TSN 2018 2nd ExamAngel DeiparineNo ratings yet

- Metropolitan Bank and Trust Co V AlejoDocument2 pagesMetropolitan Bank and Trust Co V AlejoNiajhan PalattaoNo ratings yet

- Rule 103, Rule 108 and RA 9048 As Amended by RA 10172Document3 pagesRule 103, Rule 108 and RA 9048 As Amended by RA 10172Karen L HapaNo ratings yet

- Evidence Questions 1995-1997Document4 pagesEvidence Questions 1995-1997Shalini Kristy S DalisNo ratings yet

- 161264306-Court of Appeals Sample-Decision PDFDocument30 pages161264306-Court of Appeals Sample-Decision PDFrobertoii_suarezNo ratings yet

- 3 Canlas vs. Napico HomeownersDocument4 pages3 Canlas vs. Napico HomeownersAnonymousNo ratings yet

- Magno Vs PeopleDocument11 pagesMagno Vs PeopleDili Si ShanNo ratings yet

- Banking Laws Villanueva OCRDocument20 pagesBanking Laws Villanueva OCRJohn Rey Bantay RodriguezNo ratings yet

- TableDocument21 pagesTableKim Barrios100% (1)

- Gilat Satellite Networks, Ltd. vs. UCPBDocument4 pagesGilat Satellite Networks, Ltd. vs. UCPBJeffrey MedinaNo ratings yet

- GN 2 PDFDocument53 pagesGN 2 PDFKenette Diane CantubaNo ratings yet

- Phil Rules of CourtDocument244 pagesPhil Rules of Courtjinnee_jinx100% (1)

- Personal Property Securities Act RA 11057Document77 pagesPersonal Property Securities Act RA 11057Ann QuirimitNo ratings yet

- PPSA Notes™Document33 pagesPPSA Notes™聖乃明名No ratings yet

- 6 - 2023 UP BOC Remedial Law LMTs v2Document21 pages6 - 2023 UP BOC Remedial Law LMTs v2Azel FajaritoNo ratings yet

- REPUBLIC ACT (R.A.) NO. 11057: Otherwise Known As The "Personal Property Security Act"Document10 pagesREPUBLIC ACT (R.A.) NO. 11057: Otherwise Known As The "Personal Property Security Act"Al MarvinNo ratings yet

- This Study Resource Was: Credit TransactionsDocument9 pagesThis Study Resource Was: Credit TransactionsChristian FloraldeNo ratings yet

- Credit Transactions MatrixDocument1 pageCredit Transactions MatrixRon PaguioNo ratings yet

- CredTrans Pledge ReviewerDocument8 pagesCredTrans Pledge ReviewerLayaNo ratings yet

- Personal Property Security Act 2Document22 pagesPersonal Property Security Act 2Francis PunoNo ratings yet

- Personal Property Security ActDocument18 pagesPersonal Property Security ActFrancis PunoNo ratings yet

- NORTHWEST AIRLINES, INC., Petitioner, vs. STEVEN P. CHIONG, Respondent. G.R. No. 155550 January 31, 2008, Nachura, J.: FactsDocument2 pagesNORTHWEST AIRLINES, INC., Petitioner, vs. STEVEN P. CHIONG, Respondent. G.R. No. 155550 January 31, 2008, Nachura, J.: FactsJj JumalonNo ratings yet

- SisonDocument2 pagesSisonJj JumalonNo ratings yet

- UY KIAO ENG, Petitioner, vs. NIXON LEE, RespondentDocument1 pageUY KIAO ENG, Petitioner, vs. NIXON LEE, RespondentJj JumalonNo ratings yet

- CangDocument2 pagesCangJj JumalonNo ratings yet

- AdonisDocument2 pagesAdonisJj JumalonNo ratings yet

- Alberta Yobido and Cresencio Yobido vs. Ca, Leny Tumboy, Ardee Tumboy and Jasmin Tumboy G.R. No. 113003, October 17, 1997, Romero, J. FactsDocument2 pagesAlberta Yobido and Cresencio Yobido vs. Ca, Leny Tumboy, Ardee Tumboy and Jasmin Tumboy G.R. No. 113003, October 17, 1997, Romero, J. FactsJj JumalonNo ratings yet

- Civ CaravanDocument4 pagesCiv CaravanJj JumalonNo ratings yet

- Lee vs. Sales, Et. AlDocument3 pagesLee vs. Sales, Et. AlJj JumalonNo ratings yet

- Topic: Judgment On Compromise Res Judicata Nestor T. Gadrinab, Petitioner - Versus-Norat Salamanca, Antonio Talao and ELENA LOPEZ, RespondentsDocument3 pagesTopic: Judgment On Compromise Res Judicata Nestor T. Gadrinab, Petitioner - Versus-Norat Salamanca, Antonio Talao and ELENA LOPEZ, RespondentsJj JumalonNo ratings yet

- Civ BilyoteDocument2 pagesCiv BilyoteJj JumalonNo ratings yet

- Lee vs. Sales, Et. AlDocument3 pagesLee vs. Sales, Et. AlJj JumalonNo ratings yet

- LandbankDocument4 pagesLandbankJj JumalonNo ratings yet

- Civ CaravanDocument4 pagesCiv CaravanJj JumalonNo ratings yet

- Alberta Yobido and Cresencio Yobido vs. Ca, Leny Tumboy, Ardee Tumboy and Jasmin Tumboy G.R. No. 113003, October 17, 1997, Romero, J. FactsDocument2 pagesAlberta Yobido and Cresencio Yobido vs. Ca, Leny Tumboy, Ardee Tumboy and Jasmin Tumboy G.R. No. 113003, October 17, 1997, Romero, J. FactsJj JumalonNo ratings yet

- Civ BilyoteDocument2 pagesCiv BilyoteJj JumalonNo ratings yet

- Torts 345 PDFDocument88 pagesTorts 345 PDFJj JumalonNo ratings yet

- Transpo FinalDocument2 pagesTranspo FinalJj JumalonNo ratings yet

- Associated Bank Vs CADocument13 pagesAssociated Bank Vs CAJj JumalonNo ratings yet

- Civ CaravanDocument4 pagesCiv CaravanJj JumalonNo ratings yet

- Appellate BriefDocument3 pagesAppellate Briefelan de noir100% (1)

- LRD Waiting ListDocument209 pagesLRD Waiting ListPrince PatelNo ratings yet

- Science Camp Day 1Document13 pagesScience Camp Day 1Mariea Zhynn IvornethNo ratings yet

- Novena To ST JudeDocument2 pagesNovena To ST JudeBeatrice Mae ChuaNo ratings yet

- Intermediate Macroeconomics Sec 222Document163 pagesIntermediate Macroeconomics Sec 222Katunga MwiyaNo ratings yet

- Pamrex - Manhole CoversDocument6 pagesPamrex - Manhole CoversZivadin LukicNo ratings yet

- Chap3 Laterally Loaded Deep FoundationDocument46 pagesChap3 Laterally Loaded Deep Foundationtadesse habtieNo ratings yet

- Assignment/ TugasanDocument12 pagesAssignment/ TugasanfletcherNo ratings yet

- Antenatal Assessment of Fetal Well Being FileminimizerDocument40 pagesAntenatal Assessment of Fetal Well Being FileminimizerPranshu Prajyot 67No ratings yet

- Abhimanshree SampleDocument4 pagesAbhimanshree SampleMandar KurkureNo ratings yet

- Oracle® Inventory: Consigned Inventory From Supplier Process Guide Release 12.1Document76 pagesOracle® Inventory: Consigned Inventory From Supplier Process Guide Release 12.1Guillermo ToddNo ratings yet

- 1 Assignment-2Document8 pages1 Assignment-2abhiNo ratings yet

- Gesc 112Document10 pagesGesc 112Kalpavriksha1974No ratings yet

- BankingDocument50 pagesBankingKishore MallarapuNo ratings yet

- UWI St. Augustine Student Wireless Network - Instruction / Setup GuideDocument2 pagesUWI St. Augustine Student Wireless Network - Instruction / Setup GuideBrendan B. MastayNo ratings yet

- Accomplishment and Narrative Report OctDocument4 pagesAccomplishment and Narrative Report OctGillian Bollozos-CabuguasNo ratings yet

- Art of CharacterizationDocument4 pagesArt of CharacterizationAli RazaNo ratings yet

- Masculine Ideal in The Old Man and The SeaDocument5 pagesMasculine Ideal in The Old Man and The Seaapi-295869808No ratings yet

- NCM101Document485 pagesNCM101NeheLhie100% (3)

- Make An Acknowledgment Receipt Showing A Full Payment of A Loan (Extinguishment by Payment)Document5 pagesMake An Acknowledgment Receipt Showing A Full Payment of A Loan (Extinguishment by Payment)Kim Cyrah Amor GerianNo ratings yet

- Power Plant Setting Company in CGDocument6 pagesPower Plant Setting Company in CGdcevipinNo ratings yet

- Law On Intellectual Property TRADEMARK ASSIGNMENTDocument5 pagesLaw On Intellectual Property TRADEMARK ASSIGNMENTCarene Leanne BernardoNo ratings yet

- Definition and Characteristics of LawDocument7 pagesDefinition and Characteristics of LawJeannylyn NavarroNo ratings yet

- ACS880 IGBT Supply Control Program: Firmware ManualDocument254 pagesACS880 IGBT Supply Control Program: Firmware ManualGopinath PadhiNo ratings yet

- Gender Inequality in Bangladesh PDFDocument20 pagesGender Inequality in Bangladesh PDFshakilnaimaNo ratings yet

- Atty. SungaDocument22 pagesAtty. SungaKris MercadoNo ratings yet

- SlumsDocument6 pagesSlumsRidhima Ganotra100% (1)

- Nestle Philippines, Inc., v. PuedanDocument1 pageNestle Philippines, Inc., v. PuedanJoycee ArmilloNo ratings yet