Professional Documents

Culture Documents

JK Tyres & Industries LTD: Lower Sales Hinder Performance, Maintain BUY

Uploaded by

Deepa GuptaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

JK Tyres & Industries LTD: Lower Sales Hinder Performance, Maintain BUY

Uploaded by

Deepa GuptaCopyright:

Available Formats

Lower sales hinder performance, maintain BUY

November 2, 2010

Reco Buy CMP Rs 162

Previous Reco Buy Target Price Rs 195

-19/-3 -5 6,118 20,356

Results below est. due to lower tonnage offtake. Tonnage

sales at 64,000 tons (+1.5% YoY and -8% QoQ), despite QoQ increase in utilization rate by 100 bps to 93% hinder rubber prices. High rubber prices (> Rs 190/kg) remains a concern. Price hikes are necessity to protect margins

EBIDTA per ton improve 11% QoQ despite 10% increase in

EPS change FY11E/12E (%) Target Price change (%) Nifty Sensex

Capacity expansion plans on course with total capex of ~ Rs

Price Performance

(%) Absolute Rel. to Nifty

Source: Bloomberg

24 over next four to five years. Capex in first phase is Rs 930 mn funded in the ratio of 2:1 D/E

Lower our FY11E EPS by 19% to Rs 26.9 due to higher rubber

1M (16)

3M (1)

6M 12M (17) 9

(16) (14) (30) (16)

prices. Expect price hike with a lag, fine tune or FY12 EPS to Rs 39.5 (-3%). Retain BUY with a TP of Rs 195

Relative Price Chart

225 Rs % 30 200 20

Sales below estimate due to lower offtake

JK Tyre reported standalone net sales of Rs 114 (est. Rs 12.6bn). This is due to lower tonnage sales (63951 tons 1.5% YoY/-8.5% QoQ) against our est of 71,000 tons. Management did not share financials of Tornel, except that Tornel has reported marginal profits at PAT level

175

10

150

125

-10

100 Nov-09

-20 Dec-09 Feb-10 Apr-10 May-10 Jul-10 Sep-10

EBIDTA EBIDTA per ton improves QoQ

JKT reported standalone EBIDTA of Rs 745mn (est of Rs 911mn). This is largely attributable to lower tonnage sales. RM to sales stood at 71.4% was lower than our est. of 71.7%. Average rubber cost for the quarter stood at Rs 177 per kg (against Rs 160 per kg in 1QFY11). Per ton analysis - standalone

Particulars Tonnage sold Sales RM Staff Other Expenses EBIDTA Q2FY10 63000 149,427 89,483 11,327 26,881 21,737 Q3FY10 51500 155,728 97,907 11,860 27,171 18,790 Q4FY10 66487 157,557 107,865 9,485 28,300 11,908 Q1FY11 69596 167,819 121,934 9,189 26,191 10,505 Q2FY11 63951 178,022 127,079 10,844 28,450 11,650

JK Tyre (LHS)

Rel to Nifty (RHS)

Source: Bloomberg

Stock Details

Sector Bloomberg Equity Capital (Rs mn) Face Value(Rs) No of shares o/s (mn) 52 Week H/L Market Cap (Rs bn/USD mn) Daily Avg Volume (No of sh) Daily Avg Turnover (US$mn)

Auto Ancillaries JKI@IN 411 10 41 236/144 7/157 447734 1.9

Shareholding Pattern (%)

S10 Promoters FII/NRI Institutions Private Corp Public

Source: Capitaline

J10 47.0 9.7 11.4 17.8 14.3

M10 47.0 5.7 10.9 20.0 16.5

Source: Company, Emkay Research

47.0 9.4 8.9 20.0 14.8

Net Profit at Rs 202mn, against expectation of Rs 331mn

Disappointing operating performance and higher interest cost (by RS 100mn) resulted in below expected net profit. Tax rate for the quarter was 35%. Financial Snapshot (Consolidated)

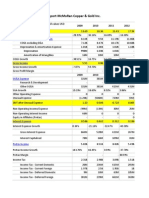

YEMar FY09 FY10P Net Sales 55,227 45,706 58,099 65,848 EBITDA (Core) 2,525 5,024 3,748 4,697 (%) 4.6 11.0 6.5 7.1 APAT -203 2,087 1,105 1,623 EPS (Rs) (4.9) 50.8 26.9 39.5 (47.0) 46.9 EPS % chg RoE (%) (4.4) 32.1 14.0 17.8 P/E (41.4) 4.0 7.6 5.2 EV/ EBITDA 6.0 3.7 3.7 4.0 P/BV 1.3 1.1 1.0 0.9

Chirag Shah chirag.shah@emkayglobal.com +91 22 612 1252

FY11E FY12E

Emkay Global Financial Services Ltd

Result Update

JK Tyres & Industries Ltd

JK Tyres & Industries Ltd.

Result Update

Valuation & view

We have lowered our consolidated FY11E and FY12E EPS by 19% and 3% to Rs 26.9 and Rs 39.5 per share respectively. We have lowered our target price to Rs 195 (earlier Rs 205). We maintain our BUY rating on the stock.

FY11E Particulars Net Sales (Rs mn) EBIDTA (Rs mn) EBIDTA margins (%) Net profits (Rs mn) Earlier 58,988 4,117 7.0 1,367 Revised 58,099 3,748 6.5 1,105 (19.2) % change (1.5) (9.0) Earlier 63,742 4,613 7.2 1,671 FY12E Revised 65,848 4,697 7.1 1,623 (2.9) % change 3.3 1.8

Quarterly Result Summary - Standalone

Rs mn Revenue Expenditure as % of sales Consumption of RM as % of sales Employee Cost as % of sales Other expenditure as % of sales EBITDA Depreciation EBIT Other Income Interest PBT Total Tax Adjusted PAT (Profit)/loss from JV's/Ass/MI Adjusted PAT after MI Extra ordinary items Reported PAT Reported EPS Q2FY10 9,414 8,045 85.5 5,637 59.9 714 7.6 1,694 18.0 1,369 222 1,147 2 234 915 320 595 595 595 14.5 Q3FY10 8,020 7,052 87.9 5,042 62.9 611 7.6 1,399 17.4 968 223 745 1 208 538 173 365 365 365 8.9 Q4FY10 10,476 9,684 92.4 7,172 68.5 631 6.0 1,882 18.0 792 223 569 1 187 383 115 267 267 267 6.5 Q1FY11 11,680 10,948 93.7 8,486 72.7 640 5.5 1,823 15.6 731 223 508 2 208 301 106 195 195 195 4.7 Q2FY11 11,385 10,640 93.5 8,127 71.4 694 6.1 1,819 16.0 745 227 518 1 207 312 110 202 202 202 4.9 (66.1) (66.1) 3.5 3.5 (66.1) 3.5 (65.9) (65.6) (66.1) 3.5 3.5 3.5 (45.6) 2.3 (54.9) (13.3) 1.9 1.8 1.9 (13.3) 7.4 (0.2) (2.8) 8.4 44.2 (4.2) YoY (%) 20.9 32.3 QoQ (%) (2.5) (2.8) YTD11 23,064 21,588 93.6 16,613 72.0 1,333 5.8 3,642 15.8 1,476 451 1,025 3 415 613 216 397 397 397 9.7 YTD10 18,421 15,985 86.8 11,483 62.3 1,298 7.0 3,204 17.4 2,436 414 2,022 7 492 1,537 534 1,003 1,003 1,003 24.4 (60.4) (60.4) (60.4) (39.4) 8.9 (49.3) (57.6) (15.6) (60.1) (59.5) (60.4) 13.7 2.7 44.7 YoY (%) 25.2 35.1

Margins (%) EBIDTA EBIT EBT PAT Effective Tax rate 14.5 12.2 9.7 6.3 35.0 12.1 9.3 6.7 4.5 32.2 7.6 5.4 3.7 2.6 30.1 6.3 4.3 2.6 1.7 35.2 6.5 4.5 2.7 1.8 35.2

(bps) (800.3) (763.9) (698.1) (454.8) 28.5

(bps) 28 20 16 10 (0) 6.4 4.4 2.7 1.7 35.2 13.2 11.0 8.3 5.4 34.8

(bps) 690 680 760 520 1790

Emkay Research

2 November 2010

JK Tyres & Industries Ltd.

Result Update

Key Financials - Consolidated

Income Statement

Y/E, Mar (Rs. mn) Net Sales Growth (%) Expenditure Materials Consumed Employee Cost Other Exp EBITDA Growth (%) EBITDA margin (%) Depreciation EBIT EBIT margin (%) Other Income Interest expenses PBT Tax Effective tax rate (%) Adjusted PAT Growth (%) Net Margin (%) (Profit)/loss from JV's/Ass/MI Adjusted PAT after MI E/O items Reported PAT Growth (%) FY09 55,227 96.1 52,702 39,254 3,820 9,628 2,525 (0.8) 4.6 1,225 1,300 2.4 203 1,377 126 329 260.8 -203 (0.4) 0 -203 -203 FY10 45,706 (17.2) 40,682 28,409 4,321 7,952 5,024 98.9 11.0 996 4,028 8.8 149 1,157 3,020 933 30.9 2,087 4.6 0 2,087 115 2,202 FY11E 58,099 27.1 54,351 41,566 3,910 8,874 3,748 (25.4) 6.5 1,117 2,632 4.5 258 1,131 1,758 653 37.2 1,105 (47.0) 1.9 0 1,105 1,105 (49.8) FY12E 65,848 13.3 61,151 47,070 4,357 9,725 4,697 25.3 7.1 1,273 3,424 5.2 298 1,198 2,524 901 35.7 1,623 46.9 2.5 0 1,623 1,623 46.9 Gross Block Less: Depreciation Net block Capital work in progress Investment Current Assets Inventories Sundry debtors Cash & bank balance Loans & advances Other current assets Current lia & Prov Current liabilities Provisions Net current assets Misc. exp Total Assets 28,405 12,284 16,120 2,905 759 13,336 4,838 5,490 513 2,495 11,312 10,268 1,044 2,024 0 21,809 31,325 13,686 17,640 1,882 805 15,204 5,557 6,279 910 2,458 14,050 12,385 1,666 1,154 0 21,480 33,625 14,802 18,823 7,500 805 16,177 6,215 6,824 275 2,863 18,575 18,427 148 -2,399 0 24,728 38,425 16,075 22,350 5,000 805 18,532 7,043 7,710 535 3,245 21,021 20,705 316 -2,489 0 25,666

Balance Sheet

Y/E, Mar (Rs. mn) Equity share capital Reserves & surplus Net worth Secured Loans Unsecured Loans Loan Funds Net deferred tax liability Total Liabilities FY09 411 6454 6,865 11,071 2,753 13,824 1,120 21,809 FY10 411 8089 8,500 7,135 4,455 11,589 1,391 21,480 FY11E 411 9051 9,462 10,675 3,201 13,875 1,391 24,728 FY12E 411 10489 10,899 10,175 3,201 13,375 1,391 25,666

(130.5) (1,127.4)

(130.5) (1,184.1)

Cash Flow

Y/E, Mar (Rs. mn) PBT (Ex-Other income) Depreciation Interest Provided Other Non-Cash items Chg in working cap Tax paid Operating Cashflow Capital expenditure Free Cash Flow Other income Investments Investing Cashflow Equity Capital Raised Loans Taken / (Repaid) Interest Paid Dividend paid (incl tax) Income from investments Others Financing Cashflow Net chg in cash Opening cash position Closing cash position (1,561) 1,709 213 300 513 60 (3,500) 396 513 910 1,012 -635 910 275 -1,884 259 275 535 FY09 -77 1,225 1,377 (73) 845 -329 2968 (9,546) -6,578 5,127 -45 (4,464) 103 4,675 -1,377 (130) FY10 2,871 996 1,157 292 1,267 -933 5650 (1,897) 3,753 189 -46 (1,753) 0 -2,235 -1,157 (168) FY11E 1,500 1,117 1,131 0 2,918 -653 6,013 (7,918) -1,905 258 0 -7,660 0 2,286 -1,131 (143) FY12E 2,226 1,273 1,198 0 349 -901 4,145 (2,300) 1,845 298 0 -2,002 0 -500 -1,198 (186)

Key ratios

Y/E, Mar Profitability (%) EBITDA Margin Net Margin ROCE ROE RoIC Per Share Data (Rs) EPS CEPS BVPS DPS Valuations (x) PER P/CEPS P/BV EV / Sales EV / EBITDA Dividend Yield (%) Gearing Ratio (x) Net Debt/ Equity Net Debt/EBIDTA Working Cap Cycle (days) 1.8 5.0 0.4 1.2 2.0 (4.4) 1.4 3.4 (33.9) 1.1 2.6 (33.0) (32.8) 6.5 1.2 0.3 5.0 1.7 3.2 2.2 0.9 0.4 2.0 2.2 6.0 3.0 0.8 0.3 3.4 1.8 4.1 2.3 0.7 0.3 2.6 2.4 (4.9) 24.9 135.3 2.7 50.8 75.1 180.9 3.5 26.9 54.1 204.3 3.0 39.5 70.5 239.3 3.9 4.6 (0.4) 8.7 (4.4) 8.1 11.0 4.6 20.4 32.1 22.7 6.5 1.9 13.1 14.0 15.5 7.1 2.5 15.4 17.8 19.3 FY09 FY10 FY11E FY12E

Emkay Research

2 November 2010

JK Tyre & Industries

Result Update

Recommendation History: JK Tyre & Industries JKI IN

Date 18/08/2010 26/05/2010 21/01/2010 Reports JK Tyre & Industries 1QFY11 Result Update JK Tyre Industries 4QFY10 Result Update JK Tyre & Industries Q3FY10 Result Update Reco Buy Buy Buy CMP 169 179 170 Target 205 225 200

Recent Research Reports

Date 02/11/2010 29/10/2010 29/10/2010 25/10/2010 Reports Motherson Sumi Q2FY11 Result Update M&M Q2FY11 Result Update Hero Honda Q2FY11 Result Update TVS Motor Q2FY11 Result Update Reco Accumulate Buy Reduce Reduce CMP 186 732 1,866 74 Target 200 880 1,720 72

Emkay Global Financial Services Ltd. Paragon Center, H -13 -16, 1st Floor, Pandurang Budhkar Marg, Worli, Mumbai 400 013. Tel No. 6612 1212. Fax: 6624 2410

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and may not be reproduced or redistributed to any other person. The manner

of circulation and distribution of this document may be restricted by law or regulation in certain countries, including the United States. Persons into whose possession this document may come are required to inform themselves of, and to observe, such restrictions. This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. No person associated with Emkay Global Financial Services Ltd. is obligated to call or initiate contact with you for the purposes of elaborating or following up on the information contained in this document. The material is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon. Neither Emkay Global Financial Services Ltd., nor any person connected with it, accepts any liability arising from the use of this document. The recipient of this material should rely on their own investigations and take their own professional advice. Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavor to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. We and our affiliates, officers, directors, and employees world wide, including persons involved in the preparation or issuance of this material may; (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company (ies) discussed herein or may perform or seek to perform investment banking services for such company(ies)or act as advisor or lender / borrower to such company(ies) or have other potential conflict of interest with respect to any recommendation and related information and opinions. The same persons may have acted upon the information contained here. No part of this material may be duplicated in any form and/or redistributed without Emkay Global Financial Services Ltd.'s prior written consent. No part of this document may be distributed in Canada or used by private customers in the United Kingdom. In so far as this report includes current or historical information, it is believed to be reliable, although its accuracy and completeness cannot be guaranteed.

Emkay Research

2 November 2010

www.emkayglobal.com

You might also like

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Spice JetDocument9 pagesSpice JetAngel BrokingNo ratings yet

- GAIL 2QF12 Result ReviewDocument6 pagesGAIL 2QF12 Result ReviewdikshitmittalNo ratings yet

- 4Q 2006Document2 pages4Q 2006doansiscusNo ratings yet

- Prime Focus - Q4FY12 - Result Update - Centrum 09062012Document4 pagesPrime Focus - Q4FY12 - Result Update - Centrum 09062012Varsha BangNo ratings yet

- Maruti Suzuki: Performance HighlightsDocument12 pagesMaruti Suzuki: Performance HighlightsAngel BrokingNo ratings yet

- Shoppers Stop 4qfy11 Results UpdateDocument5 pagesShoppers Stop 4qfy11 Results UpdateSuresh KumarNo ratings yet

- Tulip Telecom LTD: Results In-Line, Retain BUYDocument5 pagesTulip Telecom LTD: Results In-Line, Retain BUYadatta785031No ratings yet

- First Resources: Singapore Company FocusDocument7 pagesFirst Resources: Singapore Company FocusphuawlNo ratings yet

- Maruti Suzuki, 1Q FY 2014Document16 pagesMaruti Suzuki, 1Q FY 2014Angel BrokingNo ratings yet

- Top Glove 140618Document5 pagesTop Glove 140618Joseph CampbellNo ratings yet

- TVS Motor Company: Performance HighlightsDocument12 pagesTVS Motor Company: Performance HighlightsAngel BrokingNo ratings yet

- Mahindra N Mahindra, 1Q FY 2014Document14 pagesMahindra N Mahindra, 1Q FY 2014Angel BrokingNo ratings yet

- SpiceJet Result UpdatedDocument9 pagesSpiceJet Result UpdatedAngel BrokingNo ratings yet

- 6 - Zee Entertainment Enterprises 2QF15Document7 pages6 - Zee Entertainment Enterprises 2QF15girishrajsNo ratings yet

- Performance Highlights: 2QFY2013 Result Update - Auto AncillaryDocument11 pagesPerformance Highlights: 2QFY2013 Result Update - Auto AncillaryAngel BrokingNo ratings yet

- BGR Energy Systems LTD: Revenue Below Estimates Multiple Hurdles For Growth, Downgrade To REDUCEDocument5 pagesBGR Energy Systems LTD: Revenue Below Estimates Multiple Hurdles For Growth, Downgrade To REDUCEmittleNo ratings yet

- Apol Lo Tyres Result UpdatedDocument13 pagesApol Lo Tyres Result UpdatedAngel BrokingNo ratings yet

- Supreme Industries: Near-Term Lower Margins With Inventory Loss Upgrade To BuyDocument6 pagesSupreme Industries: Near-Term Lower Margins With Inventory Loss Upgrade To BuygirishrajsNo ratings yet

- NMDC Result UpdatedDocument7 pagesNMDC Result UpdatedAngel BrokingNo ratings yet

- ITC Result UpdatedDocument15 pagesITC Result UpdatedAngel BrokingNo ratings yet

- Maruti Suzuki: Performance HighlightsDocument13 pagesMaruti Suzuki: Performance HighlightsAngel BrokingNo ratings yet

- ACC Q4CY11 Result Update Fortune 09022012Document5 pagesACC Q4CY11 Result Update Fortune 09022012anknkulsNo ratings yet

- TVS Motor 4Q FY 2013Document13 pagesTVS Motor 4Q FY 2013Angel BrokingNo ratings yet

- Peak Sport Products (1968 HK) : Solid AchievementsDocument9 pagesPeak Sport Products (1968 HK) : Solid AchievementsSai Kei LeeNo ratings yet

- Hero Moto Corp, 1Q FY 2014Document14 pagesHero Moto Corp, 1Q FY 2014Angel BrokingNo ratings yet

- TVS Motor, 4th February, 2013Document12 pagesTVS Motor, 4th February, 2013Angel BrokingNo ratings yet

- Bajaj Auto: Performance HighlightsDocument12 pagesBajaj Auto: Performance HighlightsAngel BrokingNo ratings yet

- Allcargo Global Logistics LTD.: CompanyDocument5 pagesAllcargo Global Logistics LTD.: CompanyjoycoolNo ratings yet

- CIL (Maintain Buy) 3QFY12 Result Update 25 January 2012 (IFIN)Document5 pagesCIL (Maintain Buy) 3QFY12 Result Update 25 January 2012 (IFIN)Gaayaatrii BehuraaNo ratings yet

- Bajaj Electricals: Pinch From E&P To End SoonDocument14 pagesBajaj Electricals: Pinch From E&P To End SoonYash BhayaniNo ratings yet

- Cairn India Result UpdatedDocument11 pagesCairn India Result UpdatedAngel BrokingNo ratings yet

- Cairn India - 2QFY15 - HDFC SecDocument7 pagesCairn India - 2QFY15 - HDFC Secsatish_xpNo ratings yet

- Apol Lo Tyres Angel 160511Document13 pagesApol Lo Tyres Angel 160511sohamdasNo ratings yet

- Msil 4Q Fy 2013Document15 pagesMsil 4Q Fy 2013Angel BrokingNo ratings yet

- Container Corp of India: Valuations Appear To Have Bottomed Out Upgrade To BuyDocument4 pagesContainer Corp of India: Valuations Appear To Have Bottomed Out Upgrade To BuyDoshi VaibhavNo ratings yet

- Motherson Sumi Systems Result UpdatedDocument14 pagesMotherson Sumi Systems Result UpdatedAngel BrokingNo ratings yet

- Hero Motocorp: CMP: Inr3,707 TP: Inr3,818 (+3%)Document12 pagesHero Motocorp: CMP: Inr3,707 TP: Inr3,818 (+3%)SAHIL SHARMANo ratings yet

- Bank of Baroda: Q4FY11 - Core Numbers On Track CMPDocument5 pagesBank of Baroda: Q4FY11 - Core Numbers On Track CMPAnkita GaubaNo ratings yet

- Bajaj Auto Result UpdatedDocument11 pagesBajaj Auto Result UpdatedAngel BrokingNo ratings yet

- Indian Oil Corporation LTD: Key Financial IndicatorsDocument4 pagesIndian Oil Corporation LTD: Key Financial IndicatorsBrinda PriyadarshiniNo ratings yet

- Mphasis Result UpdatedDocument13 pagesMphasis Result UpdatedAngel BrokingNo ratings yet

- MOIL Result UpdatedDocument10 pagesMOIL Result UpdatedAngel BrokingNo ratings yet

- Copia de FCXDocument16 pagesCopia de FCXWalter Valencia BarrigaNo ratings yet

- Supreme Infrastructure: Poised For Growth BuyDocument7 pagesSupreme Infrastructure: Poised For Growth BuySUKHSAGAR1969No ratings yet

- Ashok Leyland: CMP: INR115 TP: INR134 (+17%)Document10 pagesAshok Leyland: CMP: INR115 TP: INR134 (+17%)Jitendra GaglaniNo ratings yet

- Bajaj Auto 4Q FY 2013Document14 pagesBajaj Auto 4Q FY 2013Angel BrokingNo ratings yet

- Havells India 3QF14 Result Review 30-01-14Document8 pagesHavells India 3QF14 Result Review 30-01-14GaneshNo ratings yet

- Hero Honda Motors LTD.: Results ReviewDocument7 pagesHero Honda Motors LTD.: Results ReviewVidhan KediaNo ratings yet

- Bosch 1qcy2014ru 290414Document12 pagesBosch 1qcy2014ru 290414Tirthajit SinhaNo ratings yet

- Apollo Tyres ProjectDocument10 pagesApollo Tyres ProjectChetanNo ratings yet

- GSPL 4Q Fy 2013Document10 pagesGSPL 4Q Fy 2013Angel BrokingNo ratings yet

- Eclerx Services (Eclser) : Chugging Along..Document6 pagesEclerx Services (Eclser) : Chugging Along..shahavNo ratings yet

- Ashok Leyland: Performance HighlightsDocument13 pagesAshok Leyland: Performance HighlightsAngel BrokingNo ratings yet

- Cairn India: Performance HighlightsDocument10 pagesCairn India: Performance HighlightsAngel BrokingNo ratings yet

- Oil and Natural Gas Corporation: Income StatementDocument10 pagesOil and Natural Gas Corporation: Income StatementpraviskNo ratings yet

- Tata Motors: JLR at Full Throttle India SteadyDocument13 pagesTata Motors: JLR at Full Throttle India SteadyAnonymous y3hYf50mTNo ratings yet

- Acc 2Q Cy 2013Document10 pagesAcc 2Q Cy 2013Angel BrokingNo ratings yet

- Hindalco: Performance HighlightsDocument15 pagesHindalco: Performance HighlightsAngel BrokingNo ratings yet

- Bajaj Auto: Performance HighlightsDocument13 pagesBajaj Auto: Performance HighlightsAngel BrokingNo ratings yet

- Case Analysis New - Earth - Mining - FinalDocument29 pagesCase Analysis New - Earth - Mining - FinalImran100% (2)

- LBO Modeling Test Example - Street of WallsDocument18 pagesLBO Modeling Test Example - Street of WallsVineetNo ratings yet

- LBO Modeling Test ExampleDocument19 pagesLBO Modeling Test ExampleJorgeNo ratings yet

- CIBC - 9th Annual Easter Insitutional Investor ConferenceDocument120 pagesCIBC - 9th Annual Easter Insitutional Investor Conferencegr33ngi4ntNo ratings yet

- Banking R & B InfraDocument29 pagesBanking R & B InfraGaurav IngleNo ratings yet

- Mercury Athletic Footwear - Valuing The OpportunityDocument55 pagesMercury Athletic Footwear - Valuing The OpportunityKunal Mehta100% (2)

- India's Sectoral Valuation Study: Historical Absolute Levels Vs Normalized Levels January 25, 2018Document27 pagesIndia's Sectoral Valuation Study: Historical Absolute Levels Vs Normalized Levels January 25, 2018brijsingNo ratings yet

- Tugas Finance Management Individu - MBA ITB - CCE58 2018 ExcelDocument10 pagesTugas Finance Management Individu - MBA ITB - CCE58 2018 ExcelDenssNo ratings yet

- 2012 - ALTO - ALTO - Annual Report PDFDocument120 pages2012 - ALTO - ALTO - Annual Report PDFNuvita Puji KriswantiNo ratings yet

- Notes PDFDocument107 pagesNotes PDFMule148No ratings yet

- Eclerx Services LTD: Initiating CoverageDocument25 pagesEclerx Services LTD: Initiating CoverageAjay AroraNo ratings yet

- Minerva Foods - Strategic AnalysesDocument28 pagesMinerva Foods - Strategic AnalysesLeonardo De Oliveira GaldianoNo ratings yet

- MTI Overview (August 2018) PDFDocument23 pagesMTI Overview (August 2018) PDFAnubhav TripathiNo ratings yet

- 18 Annual ReportDocument87 pages18 Annual ReportAlin IoanNo ratings yet

- Intermediate Accounting: Reporting Financial PerformanceDocument45 pagesIntermediate Accounting: Reporting Financial PerformancenasduioahwaNo ratings yet

- Company Final AccountsDocument13 pagesCompany Final Accountsshanthala mNo ratings yet

- Android App Development For Dummies 3rd EditionDocument377 pagesAndroid App Development For Dummies 3rd EditionSiva KarthikNo ratings yet

- TigerDocument95 pagesTigerraviNo ratings yet

- Linc Pens Annual Report 2018 19Document132 pagesLinc Pens Annual Report 2018 19निशांत मित्तलNo ratings yet

- CNPF Ratio AnalysisDocument8 pagesCNPF Ratio AnalysisSheena Ann Keh LorenzoNo ratings yet

- Navios Maritime Holdings Inc - Form 20-F (Apr-06-2011)Document261 pagesNavios Maritime Holdings Inc - Form 20-F (Apr-06-2011)charliej973No ratings yet

- Etihad AirwaysDocument14 pagesEtihad AirwaysDennis Onyango100% (1)

- Aries AgroDocument257 pagesAries AgroSaravanan BalakrishnanNo ratings yet

- Problemset5 AnswersDocument11 pagesProblemset5 AnswersHowo4DieNo ratings yet

- Chapter 1 NumericalsDocument11 pagesChapter 1 Numericalssuraj banNo ratings yet

- Bharti Infratel ProjectDocument29 pagesBharti Infratel ProjectSOURAV SUMANNo ratings yet

- Project Finance ValuationDocument141 pagesProject Finance ValuationRohit KatariaNo ratings yet

- BW Plantation PDFDocument253 pagesBW Plantation PDFPutriani utamiNo ratings yet

- Econex Researchnote 4Document4 pagesEconex Researchnote 4Sizakele Portia MbeleNo ratings yet

- Ar 2019 # Samindo-4 PDFDocument271 pagesAr 2019 # Samindo-4 PDFpradityo88100% (1)