Professional Documents

Culture Documents

Response To Q3 - Deferred Tax Calculations

Uploaded by

Chris'sonia ClarkeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Response To Q3 - Deferred Tax Calculations

Uploaded by

Chris'sonia ClarkeCopyright:

Available Formats

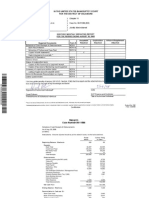

Question 3 Balance Sheet at January 1, 2008

Property, plant & equipment Goodwill Intangible assets Financial assets Total non-current assets Trade and other receivables Other receivables Cash and cash equivalents Total current assets Total assets Interest-bearing loans Trade and other payables Employee benefits Current tax liability Deferred tax liability Total liabilities Issued Capital Revaluation Reserve Retained earnings Total equity Total equity and liabilities $M 7,000 3,000 2,000 6,000 18,000 7,000 1,600 700 9,300 27,300 8,000 4,000 1,000 70 600 13,670 6,000 1,500 6,130 13,630 27,300

Adjustment $M

(400) [see note 3] 500 [see note 3] 100

Adjusted Carrying Value $M 7,000 *NR 1,600 6,500 15,100 7,000 1,600 700 9,300 24,400 8,000 4,000 1,050 70 600 13720

Tax base $M 1,400 *NR 0 7,000 8,400 7,500 1,600 700 9,800 18,200 8,500 3,800 1,000 70 600 13,970

Temporary difference $M 5,600 1,600 (500)

(500) 6,200 500 (200) (50) 250

100

50 [see note 3]

50

NO INCOME TAX CHARGED, AS THESE ARE EQUITY. IN THE CASE OF RETAINED EARNINGS, THE TAX PAYABLE/REFUNDABLE WOULD HAVE BEEN ADJUSTED FROM INCOME STATEMENT

6,450

Therefore, deferred tax provision is $6,450 x 30% = $1,935. *NR Not recognized for deferred tax purposes.

You might also like

- Hanson Ski Products Tables AnswerDocument12 pagesHanson Ski Products Tables AnswerPranjal Kumar33% (3)

- Financial Model of NLMKDocument38 pagesFinancial Model of NLMKIaroslav AfoninNo ratings yet

- ACCT 1005 Worksheet 5 Suggested Solutions 2012Document10 pagesACCT 1005 Worksheet 5 Suggested Solutions 2012ChakShaniqueNo ratings yet

- Assign 1 - Sem II 12-13Document8 pagesAssign 1 - Sem II 12-13Anisha ShafikhaNo ratings yet

- Chemilite Case StudyDocument12 pagesChemilite Case StudyRavi Pratap Singh Tomar100% (3)

- Nu WareDocument22 pagesNu WaresslbsNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Chapter 8 Solutions Cash Flow Statement: Account ClassificationDocument43 pagesChapter 8 Solutions Cash Flow Statement: Account Classificationmit111217No ratings yet

- Tools of Financial Analysis & PlanningDocument68 pagesTools of Financial Analysis & Planninganon_672065362100% (1)

- 10000006490Document17 pages10000006490Chapter 11 DocketsNo ratings yet

- PCC 2008 NPO QuestionDocument10 pagesPCC 2008 NPO QuestionVaibhav MaheshwariNo ratings yet

- F3ch2dilemna Socorro SummaryDocument8 pagesF3ch2dilemna Socorro SummarySushii Mae60% (5)

- Fame Export 1Document16 pagesFame Export 1Seine LaNo ratings yet

- Appendix (Business Analysis Project) : View: Annual DataDocument8 pagesAppendix (Business Analysis Project) : View: Annual DataAshish AgnihotriNo ratings yet

- Cash Flow StatementDocument1 pageCash Flow StatementBharat AroraNo ratings yet

- Stock Sold.: Unit 3 Accounting - AOS 1 Name: - SAC 2 - Practice SACDocument10 pagesStock Sold.: Unit 3 Accounting - AOS 1 Name: - SAC 2 - Practice SACGulleds IbrahimNo ratings yet

- Cash Flow Year 3: Actual 380,000Document60 pagesCash Flow Year 3: Actual 380,000D J Ben UzeeNo ratings yet

- Chaper 1 - FS AuditDocument12 pagesChaper 1 - FS AuditLouie De La Torre60% (5)

- Kunci Jawaban Soal Review InterDocument5 pagesKunci Jawaban Soal Review InterWinarto SudrajadNo ratings yet

- Starbucks Corporation - FinancialsDocument3 pagesStarbucks Corporation - FinancialsAtish GoolaupNo ratings yet

- PepsiCo's Quaker BidDocument54 pagesPepsiCo's Quaker Bidarjrocks23550% (2)

- Consolidated Financial StatementsDocument40 pagesConsolidated Financial StatementsSandeep GunjanNo ratings yet

- Bid 03312013x10q PDFDocument59 pagesBid 03312013x10q PDFpeterlee100No ratings yet

- Accy 517 HW PB Set 1Document30 pagesAccy 517 HW PB Set 1YonghoChoNo ratings yet

- 10000007793Document27 pages10000007793Chapter 11 DocketsNo ratings yet

- Anto AnalysisDocument36 pagesAnto AnalysisEmmanuelNo ratings yet

- Art 'N' Tex Balance Sheet As On 30Th June, 2008: 2008 2007 2008 2007 Capital Rupees Assets Fixed AssetsDocument9 pagesArt 'N' Tex Balance Sheet As On 30Th June, 2008: 2008 2007 2008 2007 Capital Rupees Assets Fixed AssetsSamad RehmanNo ratings yet

- Accounting 1A Exam 1 - Spring 2011 - Section 1 - SolutionsDocument14 pagesAccounting 1A Exam 1 - Spring 2011 - Section 1 - SolutionsRex Tang100% (1)

- Wipro Financial StatementsDocument37 pagesWipro Financial StatementssumitpankajNo ratings yet

- Student Ch03 FOF8eDocument131 pagesStudent Ch03 FOF8eRainey KamNo ratings yet

- Cash Flow TutorialDocument6 pagesCash Flow TutorialEric Chambers100% (1)

- Aert EgyDocument90 pagesAert Egy65486sfasdkfhoNo ratings yet

- Cash Flow Question Paper1Document10 pagesCash Flow Question Paper1CA Sanjeev Jarath100% (3)

- NumberDocument2 pagesNumberHelplineNo ratings yet

- BudgetingDocument48 pagesBudgetingAnji GoyNo ratings yet

- Mpa Trading: Adjustments Worksheet Income Statement Balance SheetDocument6 pagesMpa Trading: Adjustments Worksheet Income Statement Balance SheetJunjun SillezaNo ratings yet

- Acctng 105 Cash Flow QuizDocument19 pagesAcctng 105 Cash Flow QuizMichael A. AlbercaNo ratings yet

- HorngrenIMA14eSM ch07Document57 pagesHorngrenIMA14eSM ch07Aries Siringoringo50% (2)

- t7 A4 ProformaDocument67 pagest7 A4 Proformaapi-251413379No ratings yet

- Fianl AccountsDocument10 pagesFianl AccountsVikram NaniNo ratings yet

- Tugas 6 PerhitunganDocument21 pagesTugas 6 PerhitunganDiah KrismawatiNo ratings yet

- Ectangle Harmaceuticals TD: Prepared byDocument8 pagesEctangle Harmaceuticals TD: Prepared byOndhotara AkasheNo ratings yet

- 35 Ipcc Accounting Practice ManualDocument218 pages35 Ipcc Accounting Practice ManualDeepal Dhameja100% (6)

- Cashflow FoodcourtDocument1 pageCashflow Foodcourtdidin sumpenaNo ratings yet

- M Com Part I Accounts Question PDFDocument15 pagesM Com Part I Accounts Question PDFpink_key711No ratings yet

- Option B ProjectionsDocument6 pagesOption B ProjectionsCedric JohnsonNo ratings yet

- RosettaStone 10Q 20130807 (Deleted)Document48 pagesRosettaStone 10Q 20130807 (Deleted)Edgar BrownNo ratings yet

- Midterm Bi ADocument13 pagesMidterm Bi AFabiana BarbeiroNo ratings yet

- Problems On Cash Flow StatementsDocument12 pagesProblems On Cash Flow StatementsAnjali Mehta100% (1)

- Revenue: Revenue & Net Profit/ (Loss) - 9 Months Ended 31st DecemberDocument2 pagesRevenue: Revenue & Net Profit/ (Loss) - 9 Months Ended 31st DecemberMihiri de SilvaNo ratings yet

- Prac 1 Cash BasisDocument12 pagesPrac 1 Cash BasisMCDABC100% (9)

- Public Storage Inc /ca: Quarterly Report Pursuant To Sections 13 or 15 (D) Filed On 08/06/2012 Filed Period 06/30/2012Document72 pagesPublic Storage Inc /ca: Quarterly Report Pursuant To Sections 13 or 15 (D) Filed On 08/06/2012 Filed Period 06/30/2012got.mikeNo ratings yet

- Aali - Icmd 2010 (A01) PDFDocument2 pagesAali - Icmd 2010 (A01) PDFArdheson Aviv AryaNo ratings yet

- Measuring Business Interruption Losses and Other Commercial Damages: An Economic ApproachFrom EverandMeasuring Business Interruption Losses and Other Commercial Damages: An Economic ApproachNo ratings yet

- Shares and Taxation: A Practical Guide to Saving Tax on Your SharesFrom EverandShares and Taxation: A Practical Guide to Saving Tax on Your SharesNo ratings yet