Professional Documents

Culture Documents

f402 Case 2

Uploaded by

nash_andrewsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

f402 Case 2

Uploaded by

nash_andrewsCopyright:

Available Formats

Case 2: Dividend Policy at Linear Technology

Group 6

Katie Santangelo Bradley Rue Morgan White Viet Nguyen Pui Lam Ming (Clarissa)

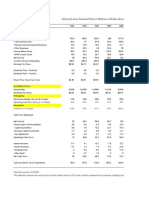

Executive Summary Linear Technology is a corporation that specializes in designing, manufacturing, and marketing semiconductors that are used in electronic applications such as cellular telephones, digital cameras, complex medical devices, and navigation systems. Its headquarters are in Milpitas, California, and it was founded in 1981. In April 2003, Paul Coghlan, the chief financial officer, was faced with the decision of whether to increase Linears dividend that quarter. The CFO and the companys CEO, Robert Swanson, were satisfied with the companys third-quarter financials for the 2003 fiscal year. However, the sales and net income still fell significantly below Linears previous record levels. The sales, gross profit, and net income for Linear Technology were at an all-time high in 2001. That year closed with a net income of $427 million. The net income decreased in 2002 to $198 million. The drop in sales led to lower profit sharing. In the fiscal year of 2003, the company experienced growth. The first half of the year had sales of $287 million, while the second half of 2002 had sales of $241 million. There was evident growth in 2003, but they were still far below sales levels from 2001. The dividend payout policy in other technology firms is a strong factor influencing Linears dividend policy decisions. Intel and Maxim are two firms that paid dividends and were used as benchmarks for Linear Technology. Intel first initiated a quarterly dividend of $0.10 per share and Maxim had a quarterly dividend of $0.02. Microsoft declared an initial quarterly dividend of $0.04 and Cisco uses cash for investment opportunities and buying back stock. Linear Technology has a dividend payout policy that is determined by its CFO. Coghlan decided that increased dividends will move Linear Technologys payout ratio to a level that exceeds its competitors.

The central issues to solve in the case are how Linear should deal with its lagging sales, and how they should address this problem in their dividend policy going forward. Tax and Payout Policy Rollins refers to the proposals by President Bush in 2003 which changed the taxation of investment income. President Bush first wanted to eliminate double taxation on dividends, and adjust capital gains tax by making each investors tax base rise by retained and taxed earnings per share. The bill that ended up being passed by Congress was less costly, taxing dividends and capital gains at a rate of 15%. This was still a large decrease in previous taxes on investments. Before this proposal passed, Rollins preferred companies with minimal or no dividends, because of the high income tax rates that applied to income from dividends. After the proposal however, Rollins is indifferent to the policy that companies choose to share their profits with shareholders. If investors pay out dividends, the tax on these dividends will be a much more manageable amount than previously. The company only needs to be concerned with paying out dividends versus buying back shares when considering their current clientele, as well as the type of investors they would like to attract in the future. Dividend as a way to overcome agency problem Dividends can help overcome agency problems by restricting cash available to managers. As the company pays out dividends, less cash is left on hand for managers to make decisions with. This reduces the likelihood of managers throwing excess cash into projects that may have large short term cash flows and possibly result in bonuses for managers, but ultimately have a negative NPV, destroying shareholder value. Using the excess cash to pay dividends shifts the power into the hands of the shareholders, providing them with a steady income while keeping the managers of the company on a tighter, more restrictive cash policy.

Alternatives Both dividend payment and stock repurchase are ways for companies to share earnings with their stockholders. The former would distribute real cash payments which increase stockholders return per share, while the latter increases earnings per share through decreasing the number of shares outstanding. Although both options are appealing towards investors, stock repurchase offers more incentive to investors to continue investing in the stocks as well as to managers to further increase firms value. Repurchasing stocks offers several benefits to both investors and managers over paying dividends. First and foremost, stock repurchase are not taxed while dividends are taxed. Effectively, it would provide more earnings to investors. In addition, dividends are a one-time payment which increases earnings periodically and there is no guarantee that there would definitely be a dividend payment in the case of a bad quarter, whereas with stock repurchase, there would be a continuous increase in earnings because profits earned are split among fewer shares. Secondly, buying back stock can increase a companys return on equity, especially when shares are undervalued. If share prices are undervalued, investors would feel more confident in purchasing the stock, and thus increases demand for the stock in the market. This would lead to an increase in share price and thus earnings per share and return on equity both increase. Moreover, when repurchasing stocks, companies would offer a price higher than the current stock price in order to provide more incentive for investors to sell the stocks. The price offered by the company would indicate the best price the company feels that the stock should be valued at, and this would boost investors confidence.

Thirdly, with dividend payments, stock price tends to decrease which decreases stockholders benefits momentarily, whereas with an effective stock repurchase, stock price would go up, increasing stockholders return. However, there are also disadvantages with stock repurchase option. In order to make full use of stock repurchase, companies need to value their stock correctly. If the stocks are already overpriced, and companies continue to buy back their stocks, it would hurt the stockholders instead. Moreover, unless there is an extremely bad quarter, dividends, once started, are usually paid out periodically, yet stock repurchase may be a one-time action, and thus only benefit stockholders at that time. Scenario Analysis Based on the financial information given, we found out how a special dividend would affect the share price, the earnings and the earnings per share. Using the data, we have found out that a special dividend would result in a dividend of $4.91 per share. That would be the entire cash flow of $1,552 million divided by the total number of shares outstanding which at FYE 2002 was 316.2 million common stock shares. So as of the ex-dividend date, the share price would lower by the amount of the dividend which would make the share price $26.52. Paying out the dividend would have no effect on earnings or earnings per share. If the shares are repurchased then they would repurchase 49,379,574 shares or $1,552 million divided by the original FYE share price of $31.43. If they retained the cash then they earn the interest on the cash. Thus, the $1,552 million would turn into $1,598,560,000 due to the 3% interest rate on retained cash.

Decision Time Now the decision remains whether or not Linear Technology should increase the dividends. The pros of increasing a dividend are that it is a positive signal towards investors. Increasing dividends shows that earnings are up and that the company has the ability to sustain or increase future earnings. Increasing dividends also makes shareholders happy. Shareholders enjoy the increase, because it is an increase in their income. The downside of increasing dividends is that there is less money to invest in positive NPV projects. This means that there is a decreased chance of increasing earnings. Another con is that at the ex-dividend date, the share price decreases. We decided that since the earnings are down that Linear Technology should just maintain or very slightly increase the dividend. With the decrease in earnings we find it unwise to increase the dividend until the economy takes an upswing and earnings are going back in the positive direction. The reason we need to at least sustain our dividend is so we do not send negative signals to investors. If the dividend is increased, it should not be by more than .03 cents per share.

You might also like

- Linear Technology Dividend Policy and Shareholder ValueDocument4 pagesLinear Technology Dividend Policy and Shareholder ValueAmrinder SinghNo ratings yet

- Linear Technology Case - Ashmita SrivastavaDocument4 pagesLinear Technology Case - Ashmita SrivastavaAshmita Srivastava0% (1)

- Case Study - Linear Tech - Christopher Taylor - SampleDocument9 pagesCase Study - Linear Tech - Christopher Taylor - Sampleakshay87kumar8193No ratings yet

- Maximizing Shareholder Value Through Optimal Dividend and Buyback PolicyDocument2 pagesMaximizing Shareholder Value Through Optimal Dividend and Buyback PolicyRichBrook7No ratings yet

- Linear Technology's dividend policy decision: pay dividends or repurchase sharesDocument6 pagesLinear Technology's dividend policy decision: pay dividends or repurchase sharesprashantkumarsinha007100% (1)

- Uttam Kumar Sec-A Dividend Policy Linear TechnologyDocument11 pagesUttam Kumar Sec-A Dividend Policy Linear TechnologyUttam Kumar100% (1)

- Kohler CompanyDocument3 pagesKohler CompanyDuncan BakerNo ratings yet

- Linear TechnologyDocument4 pagesLinear TechnologySatyajeet Sahoo100% (2)

- Case StudyDocument10 pagesCase StudyEvelyn VillafrancaNo ratings yet

- Continental Carriers Debt vs EquityDocument10 pagesContinental Carriers Debt vs Equitynipun9143No ratings yet

- Questions - Linear Technologies CaseDocument1 pageQuestions - Linear Technologies CaseNathan Toledano100% (1)

- Dividend Decision at Linear TechnologyDocument8 pagesDividend Decision at Linear TechnologyNikhilaNo ratings yet

- SpyderDocument3 pagesSpyderHello100% (1)

- KOHLR &co (A&B) : Asish K Bhattacharyya Chairperson, Riverside Management Academy Private LimitedDocument30 pagesKOHLR &co (A&B) : Asish K Bhattacharyya Chairperson, Riverside Management Academy Private LimitedmanjeetsrccNo ratings yet

- Kohler Co. (A)Document18 pagesKohler Co. (A)Juan Manuel GonzalezNo ratings yet

- Annualized Net Income GrowthDocument25 pagesAnnualized Net Income GrowthAdarsh Chhajed0% (2)

- Debt Policy at Ust IncDocument18 pagesDebt Policy at Ust InctutenkhamenNo ratings yet

- Flash Memory IncDocument3 pagesFlash Memory IncAhsan IqbalNo ratings yet

- M&a Assignment - Syndicate C FINALDocument8 pagesM&a Assignment - Syndicate C FINALNikhil ReddyNo ratings yet

- Dividend Policy at Linear Technology - Case Analysis - G05Document2 pagesDividend Policy at Linear Technology - Case Analysis - G05Srikanth Kumar Konduri60% (5)

- Section I. High-Growth Strategy of Marshall, Company Financing and Its Potential Stock Price ChangeDocument11 pagesSection I. High-Growth Strategy of Marshall, Company Financing and Its Potential Stock Price ChangeclendeavourNo ratings yet

- Stone Container CorporationDocument5 pagesStone Container Corporationalice123h21No ratings yet

- Blaine Kitchenware IncDocument4 pagesBlaine Kitchenware IncUmair ahmedNo ratings yet

- Dividend Policy at Linear TechnologyDocument9 pagesDividend Policy at Linear TechnologySAHILNo ratings yet

- BBB Case Write-UpDocument2 pagesBBB Case Write-UpNeal Karski100% (1)

- Case Background: Kaustav Dey B18088Document9 pagesCase Background: Kaustav Dey B18088Kaustav DeyNo ratings yet

- Case BBBYDocument7 pagesCase BBBYgregordejong100% (1)

- UST IncDocument16 pagesUST IncNur 'AtiqahNo ratings yet

- Facebook IPO Valuation AnalysisDocument13 pagesFacebook IPO Valuation AnalysisMegha BepariNo ratings yet

- case-UST IncDocument10 pagescase-UST Incnipun9143No ratings yet

- Paginas Amarelas Case Week 8 ID 23025255Document4 pagesPaginas Amarelas Case Week 8 ID 23025255Lesgitarmedit0% (1)

- Assignment 7 - Clarkson LumberDocument5 pagesAssignment 7 - Clarkson Lumbertesttest1No ratings yet

- Loewen Group CaseDocument2 pagesLoewen Group CaseSu_NeilNo ratings yet

- Cooper Case SolutionsDocument6 pagesCooper Case SolutionsDarshan Salgia100% (1)

- Cadillac Cody CaseDocument13 pagesCadillac Cody CaseKiran CheriyanNo ratings yet

- Diageo RefenceDocument7 pagesDiageo RefenceKenny HoNo ratings yet

- Jones Electrical Faces Cash Shortfall Despite ProfitsDocument5 pagesJones Electrical Faces Cash Shortfall Despite ProfitsAsif AliNo ratings yet

- Dividend Policy at PFL GroupDocument5 pagesDividend Policy at PFL GroupWthn2kNo ratings yet

- Airthread Connections Case Work SheetDocument45 pagesAirthread Connections Case Work SheetBhuvnesh Prakash100% (1)

- Massey Ferguson CaseDocument6 pagesMassey Ferguson CaseMeraSultan100% (1)

- Updated Stone Container PaperDocument6 pagesUpdated Stone Container Paperonetime699100% (1)

- Burton SensorsDocument4 pagesBurton SensorsAbhishek BaratamNo ratings yet

- Jones Electrical DistributionDocument4 pagesJones Electrical Distributioncagc333No ratings yet

- AirThread Valuation MethodsDocument21 pagesAirThread Valuation MethodsSon NguyenNo ratings yet

- Group2 - Clarkson Lumber Company Case AnalysisDocument3 pagesGroup2 - Clarkson Lumber Company Case AnalysisDavid WebbNo ratings yet

- Income Statements and Balance Sheets for Flash Memory, Inc. (2007-2009Document25 pagesIncome Statements and Balance Sheets for Flash Memory, Inc. (2007-2009Theicon420No ratings yet

- Apple Cash Case StudyDocument2 pagesApple Cash Case StudyJanice JingNo ratings yet

- Williams CEO evaluates $900M financing offer and long-term strategyDocument1 pageWilliams CEO evaluates $900M financing offer and long-term strategyYun Clare Yang0% (1)

- Ameritrade Case SolutionDocument31 pagesAmeritrade Case Solutionsanz0840% (5)

- Midland Energy ResourcesDocument21 pagesMidland Energy ResourcesSavageNo ratings yet

- Lex Service PLCDocument11 pagesLex Service PLCArup Dey0% (1)

- Nike Case - Team 5 Windsor - FinalDocument10 pagesNike Case - Team 5 Windsor - Finalalosada01No ratings yet

- Jones Electrical SlidesDocument6 pagesJones Electrical SlidesRohit AwadeNo ratings yet

- JetBlue 2012 Fuel Hedging StrategyDocument3 pagesJetBlue 2012 Fuel Hedging StrategyPritam Karmakar0% (1)

- FM II Chapter 1Document23 pagesFM II Chapter 1Amanuel AbebawNo ratings yet

- LinearDocument3 pagesLinearAEKaidarovNo ratings yet

- Chapter 14-1Document73 pagesChapter 14-1Naeemullah baigNo ratings yet

- Module4 Dividend PolicyDocument5 pagesModule4 Dividend PolicyShihad Panoor N KNo ratings yet

- Payout Policy: Suggested Answer To Opener-in-Review QuestionDocument15 pagesPayout Policy: Suggested Answer To Opener-in-Review QuestionChoudhry TradersNo ratings yet

- Beximco Chapter 2Document15 pagesBeximco Chapter 2Tanvir Ahmed Rana100% (2)

- 20 Basic Accounting Terms List For Preparation of PPSC, FPSC & NTS Tests - Government Jobs & Private Jobs in Pakistan 2018Document3 pages20 Basic Accounting Terms List For Preparation of PPSC, FPSC & NTS Tests - Government Jobs & Private Jobs in Pakistan 2018Dustar Ali HaideriNo ratings yet

- Lecture Law On Negotiable InstrumentDocument27 pagesLecture Law On Negotiable InstrumentDarryl Pagpagitan100% (3)

- Value Line Research Report GuideDocument23 pagesValue Line Research Report GuideCarl HsiehNo ratings yet

- Lesson 11 Introduction To EasyLanguageDocument18 pagesLesson 11 Introduction To EasyLanguageJose Alfredo CabreraNo ratings yet

- Credit Valuation AdjustmentDocument14 pagesCredit Valuation Adjustmenttasneem chherawalaNo ratings yet

- Daftar Akun Nomor Nama Akun Fungsi Untuk Mencatat Mutasi NilaiDocument4 pagesDaftar Akun Nomor Nama Akun Fungsi Untuk Mencatat Mutasi NilaiFhina LarioNo ratings yet

- Share CapitalDocument58 pagesShare CapitalCyreene RodelasNo ratings yet

- Why I Am Leaving Goldman Sachs EthicsDocument3 pagesWhy I Am Leaving Goldman Sachs EthicsChan CkNo ratings yet

- Edelweiss Project HRDocument45 pagesEdelweiss Project HRMehak AggarwalNo ratings yet

- Due Diligence InvestmentsDocument6 pagesDue Diligence InvestmentselinzolaNo ratings yet

- DOJ Opinion Denies UE Stock SaleDocument5 pagesDOJ Opinion Denies UE Stock Salea_vlaureNo ratings yet

- Basel Norms in Banking SectorsDocument36 pagesBasel Norms in Banking SectorsSaikat ChatterjeeNo ratings yet

- Knowledge Appropriateness Test Ebook - AU - v4 - With ZH LinkDocument9 pagesKnowledge Appropriateness Test Ebook - AU - v4 - With ZH LinkBeverly HillsNo ratings yet

- Audit procedures and evidenceDocument7 pagesAudit procedures and evidenceJun Ladrillo100% (1)

- International Capital BudgetingDocument28 pagesInternational Capital BudgetingMatt ToothacreNo ratings yet

- Document PDFDocument2 pagesDocument PDFFelicia PeralezNo ratings yet

- Working and Organization of Mutual Fund Company: Roshan Shukla and Shikha GuptaDocument9 pagesWorking and Organization of Mutual Fund Company: Roshan Shukla and Shikha GuptaGhulam NabiNo ratings yet

- (Principle of Commerce) T, C & B MCQS: Rade Ommerce UsinessDocument18 pages(Principle of Commerce) T, C & B MCQS: Rade Ommerce UsinessGhalib HussainNo ratings yet

- 08 Risk Management QuestionnaireDocument7 pages08 Risk Management QuestionnaireBhupendra ThakurNo ratings yet

- RBL Bank Ltd. BUYDocument7 pagesRBL Bank Ltd. BUYpajadhavNo ratings yet

- Assignment Number 4Document8 pagesAssignment Number 4AsadNo ratings yet

- Pabrai Investment Funds Annual Meeting Notes - 2014 - Bits - ) BusinessDocument8 pagesPabrai Investment Funds Annual Meeting Notes - 2014 - Bits - ) BusinessnabsNo ratings yet

- CA Final SFM Compiler Ver 6.0Document452 pagesCA Final SFM Compiler Ver 6.0Accounts Primesoft100% (1)

- CH 17 - Related Party DisclosuresDocument6 pagesCH 17 - Related Party DisclosuresJoyce Anne Garduque100% (1)

- Keith Brown ResumeDocument2 pagesKeith Brown ResumekeithbrownfinanceNo ratings yet

- ANZ Commodity Daily 867 220713Document5 pagesANZ Commodity Daily 867 220713David SmithNo ratings yet

- The Companies Act 1994Document5 pagesThe Companies Act 1994Shabnam BarshaNo ratings yet

- 11 Foreign Currency Transactionsxx PDFDocument111 pages11 Foreign Currency Transactionsxx PDFAnjell Reyes71% (17)

- Final ThesisDocument67 pagesFinal Thesisshoaib_hafeez50% (2)

- Frequently Asked Questions About Foreign Private IssuersDocument28 pagesFrequently Asked Questions About Foreign Private IssuersSougata KunduNo ratings yet