Professional Documents

Culture Documents

BarCap Commodity Research 090312

Uploaded by

Henry WangOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BarCap Commodity Research 090312

Uploaded by

Henry WangCopyright:

Available Formats

COMMODITIES RESEARCH

9 March 2012

BARCLAYS CAPITAL COMMODITIES RESEARCH RANKINGS MARCH 2012

The exuberance with which commodity markets greeted a much better run of economic data and the easing of sovereign debt concerns in early 2012 has faded, and growth-sensitive sectors such as base metals are now struggling to make much headway. The most important commodity theme right now appears to be the inexorable rise of geopolitical tensions and their effect on boosting oil prices as Iranian sanctions tighten a global oil market already desperately short of shockabsorbing capacity. At present, there seems little likelihood of easing tensions with Iran, which itself has a strong incentive to do whatever it can to ratchet oil prices higher to offset the decline in its own revenues and simultaneously weaken the economies of its main western opponents. Consequently, we are raising our exposure to the energy sector, reducing it to base metals, are at market weight in precious metals and have a small underweight in agricultural commodities. By market, our main overweights this month are in Brent crude and gasoline, while we have much smaller overweights in copper, WTI crude, corn, soybeans and gold. Our largest underweights are in US natural gas, nickel, zinc, aluminium, coffee and sugar. Over the past month, the BCRI has matched the performance of the neutral portfolio (both gaining 2.3%). For the year-to-date, the BCRI is up 8.6%, 0.1% more than the neutral portfolio. So far in 2012, the DJ-UBS reweighted in line with the Barclays Capital Research rankings has gained 3.2%, outperforming the standard benchmark by 0.7 percentage points. Figure 1: BCRI performance since December 2010

125 120 115 110 105 100 95 90 01-Dec Commodities Research Index - Excess Return BCRI Base Portfolio Index - Excess Return 05-Feb 12-Apr 17-Jun 22-Aug 27-Oct 01-Jan 07-Mar Data to March 8th

Kevin Norrish +44 (0)20 7773 0369 kevin.norrish@barcap.com Roxana Mohammadian Molina +44 (0)20 7773 2117 roxana.mohammadian-molina@barcap.com Sudakshina Unnikrishnan +44 (0)20 7773 3797 sudakshina.unnikrishnan@barcap.com www.barcap.com

Source: Barclays Capital

PLEASE SEE ANALYST CERTIFICATIONS AND IMPORTANT DISCLOSURES STARTING AFTER PAGE 9

Barclays Capital | Barclays Capital Commodities Research Rankings March 2012

BCRI performance review

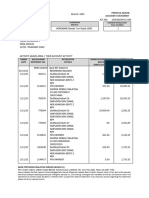

Since last months Barclays Capital Commodities Research Rankings, 3 February 2012, the BCRI is up 2.3%, same as the neutral portfolio in which weights are held constant (Figure 2). By sectors, the BCRI outperformed the neutral portfolio in all the sectors except precious metals. For the year-to-date, the BCRI is up 8.6%, 0.1% more than the neutral portfolio. So far in 2012, the DJ-UBS reweighted in line with the Barclays Capital Research views returned 3.2%, 0.7% more than the plain vanilla version of the DJ-UBS (2.7% outperformance since the BCRI was launched in late 2010). Figure 2: BCRI performance statistics

Change in index Since previous rebalancing (3-February-2012)

Excess Return

Date

Index level

year-to-date

2011

start of index

Commodities Research Index BCRI Base Portfolio BCRI applied to DJ-UBS Standard DJ-UBS BCRI applied to S&PGSCI Standard S&PGSCI Sub Indices BCRI Energy BCRI Ind metals BCRI precious Metals BCRI Agriculture Base Portfolio Energy Base Portfolio Ind metals Base portfolio precious Metals Base Portfolio Agriculture

08-Mar-12 08-Mar-12 08-Mar-12 08-Mar-12 08-Mar-12 08-Mar-12

109.1 110.1 98.4 95.7 111.5 113.5

2.3% 2.3% -0.6% -0.9% 4.6% 5.0%

8.6% 8.5% 3.2% 2.5% 7.7% 8.2%

-5.9% -5.0% -11.3% -13.4% -2.6% -1.2%

9.1% 10.1% -1.6% -4.3% 11.5% 13.5%

08-Mar-12 08-Mar-12 08-Mar-12 08-Mar-12 08-Mar-12 08-Mar-12 08-Mar-12 08-Mar-12

118.1 92.4 116.1 95.6 121.4 91.6 115.9 93.8

7.8% -4.1% -1.5% -1.3% 7.1% -4.3% -1.4% -1.5%

11.3% 8.3% 11.3% -0.6% 10.9% 7.9% 11.3% -0.5%

0.8% -22.4% 0.3% -13.2% 4.3% -22.8% -0.2% -15.2%

18.1% -7.6% 16.1% -4.4% 21.4% -8.4% 15.9% -6.2%

Note: The BCRI was launched on 1 December 2010. Sub index performance does not include the impact of the relative sector weightings. Source: Barclays Capital

Last month, the BCRI outperformed the neutral portfolio in three out of the four sectors we rank (Figure 2). Energy had the largest outperformance and the largest positive contribution to the BCRI return, mainly due to the markets rankings. At the individual market level, we heavily underweighted US natural gas, which ended up being the weakest energy market. Also, we overweighted Brent crude oil and gasoline, two of the strongest energy markets

Figure 3: Energy performed best since BCRI launch

Excess Returns since launch Energy Precious Metals BCRI Agriculture Industrial Metals -10%

Source: Barclays Capital

Figure 4: and also did best since the last reweighting

Excess Returns since last reweighting Energy BCRI Agriculture Precious Metals Industrial Metals

-5%

0%

5%

10%

15%

20%

-5%

Source: Barclays Capital

0%

5%

10%

9 March 2012

Barclays Capital | Barclays Capital Commodities Research Rankings March 2012

since the last reweighing of the BCRI. At the sector level, we underweighted energy relative to the other sectors, but energy outperformed all other sectors (Figure 4). In base metals, the sector with the second-largest positive contribution to the BCRI performance, the outperformance was mainly the result of our market rankings. We relatively overweighted aluminium, copper and lead. All base metals markets have fallen since the last reweighing of the BCRI, but the three markets that we overweighed fell relatively less. Nickel, tin and zinc (the three markets that we underweighted) were the weakest base metals markets. At the sector level, we overweighed base metals, whilst in fact base metals was the weakest sector overall. Within agriculture, the other sector that contributed positively to the BCRI performance, most of the outperformance came from our accurate ranking of the individual markets. Soybean, which we overweighed, was the strongest agriculture market, and coffee, which we underweighted, was the weakest. On the other hand, our ranking of the sugar, corn and wheat markets contributed negatively to the BCRI performance. Last, precious metal was the only sector to underperform the neutral portfolio since the last reweighting of the BCRI. This was mainly due to our strong overweight of the sector, which ended up being the second-weakest commodity sector overall, and also to our relative overweight of gold within the portfolio. At the individual commodity market level, last month we overweighed gold and silver relative to the PGMs. Gold ended up being the weakest precious metal market and contributed negatively to the BCRI performance. On the other hand, our relative overweight of platinum provided a small positive contribution to the BCRI performance since platinum was the precious metal market with the smallest fall. Since the last reweighting of the BCRI, the DJ-UBS reweighted in line with the Barclays Capital Research views has outperformed the standard benchmark version. Indeed, the DJUBS reweighted in line with the Barclays Capital Research views is down 0.6%, 0.3% less than the plain vanilla version of the index. On the other hand, the S&PGSCI index reweighted in line with the Barclays Research views is up 4.6%, 0.3% less than the standard version of the index. On the year-to-date, the DJ-UBS reweighted in line with the Barclays Capital Research views has outperformed the plain vanilla version of the index by 0.7%. The outperformance of the reweighted DJ-UBS relative to the benchmark is 2.7% since the BCRI was launched in late 2010. Figure 5: Performance of research-weighted indices relative to benchmarks

3% 2% 1% 0% -1% -2% Jan-11 Mar-11 May-11 Jul-11 Research weights indices underperform Sep-11 Nov-11 Jan-12 Mar-12 S&PGSCI DJ-UBS BCRI base portfolio Research weights indices outperform

Source: Ecowin, Barclays Capital

9 March 2012

Barclays Capital | Barclays Capital Commodities Research Rankings March 2012

March 2012 rankings

The Barclays Capital Commodity Research Rankings reflect individual sector and market analyst views on the relative strength of fundamentals for each commodity. A ranking of five signifies a very strong market and one a very weak market. For a more detailed explanation of the ranking methodology, see Launching the Barclays Capital Commodities Research Rankings, 2 December 2010, in which we explain how these rankings are used in the under/overweighting of commodities within the BCRI relative to the neutral portfolio. The daily performance of the BCRI is reported on Barclays Capital Live. The March rankings by commodity market and sector are shown below. Figure 6: Individual commodity market rankings

Commodity Aluminium Copper Nickel Zinc Lead Tin WTI Crude Brent Crude Gas Oil Heating Oil Unleaded Gasoline Natural Gas Carbon EUA Carbon CER Gold Silver Palladium Platinum Coffee Cotton Sugar Cocoa Corn Soybeans Wheat Sector Base Metals Base Metals Base Metals Base Metals Base Metals Base Metals Energy Energy Energy Energy Energy Energy Energy Energy Precious Metals Precious Metals Precious Metals Precious Metals Agriculture Agriculture Agriculture Agriculture Agriculture Agriculture Agriculture Ranking 4 5 3 3 4 3 3 4 3 3 4 1 2 2 4 4 4 3 2 3 2 2 4 4 3 Front end TRUE TRUE TRUE TRUE TRUE N/A TRUE TRUE TRUE TRUE FALSE TRUE N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A N/A

Note: The default position for all the commodities being ranked is at the front end of the curve which is represented with TRUE. Alternatively, for each of the base metals (except tin) and for each energy commodity excluding carbon, the analyst is able to select a forward deferred position, represented by FALSE. For each commodity the deferred position represents a rolling six-month forward exposure, with the exception of US natural gas where the forward position refers to the next December point on the forward curve, with that position rolling forward to the next December position in October. Source: Barclays Capital

Figure 7: Sector rankings

Sectors Base Metals Energy Precious Metals Agriculture

Source: Barclays Capital

Ranking 3 5 4 3

9 March 2012

Barclays Capital | Barclays Capital Commodities Research Rankings March 2012

March 2012 rankings commentary

Sector ranking

The key macro drivers of commodities so far this year have been three-fold. Firstly, a brighter economic environment, comprising a stronger-than-expected flow of economic data out of the US, increasing signs that China will achieve a soft landing and an improvement in business confidence. These were the main drivers through January and were especially supportive for the base metals sector, which traditionally exhibits a high beta to global growth expectations. Secondly, the steady receding of European sovereign debt contagion fears, which has been positive for all risk assets and has reversed some of the heavy liquidation of commodity positions, especially in precious metals, that were a feature of late 2011. Thirdly, and more recently, the inexorable rise of geopolitical tensions and their effect in boosting oil prices as Iranian sanctions have tightened a global oil market already desperately short of shock-absorbing capacity in the form of either spare capacity or inventory. We think this third factor is likely to prove the most pervasive over the next month or so, and we have raised our exposure to energy as a result. At present, there seems little likelihood of easing tensions with Iran, which itself has a strong incentive to do whatever it can to ratchet oil prices higher, both to offset the decline in its own revenues due to lower export quantities as the result of sanctions and to weaken the economies of its main western opponents. The exuberance with which markets greeted the better economic data and easing of sovereign debt concerns in early 2012 has already faded in commodities markets, and it is notable that the growth-sensitive base metals sector has struggled to make much headway since its early January surge. This situation has been exacerbated by the impression that China may have overstocked in key base metals such as copper in late 2011/early 2012. High oil prices themselves are also generating concerns about global growth; if prices continue to rise, these concerns will worsen. Consequently, we are altering our sectoral rankings this month to favour energy and precious metals, a significant change to last months rankings when base metals was our top ranked sector. As a result, we are heavily overweight energy in our portfolio (especially Brent crude, though we are underweight US natural gas), are neutral in precious metals (though with a modest overweight in gold), underweight in base metals (though modestly overweight copper) and underweight in agriculture (though with small overweights in corn and soybeans).

Energy

We have made several changes to our energy weightings this month. Individual market rankings have changed little, and the changes result mainly from a higher sectoral ranking to energy, as discussed in the previous section. The key change is a big increase in our overweight position in Brent. We also have a bigger weighting to US gasoline and have moved from an underweight in WTI to a small overweight, while our small underweights in gas oil and heating oil are now even smaller. Meanwhile, our main underweights, in US natural gas and carbon, have been reduced somewhat. In crude oil, geopolitical risks have clearly provided significant upside risk to oil prices, but extremely strong fundamentals have also played a part. In 2010, when spare capacity was almost 6 mb/d, the ability of the oil market to absorb supply shocks was far greater. Today, the lack of buffers is having the opposite effect on price volatility and market sentiment.

9 March 2012 5

Barclays Capital | Barclays Capital Commodities Research Rankings March 2012

OECD inventories are now more than 65 mb lower than the five-year average, with European stocks at a 15-year low. Equally, what was global spare sustainable capacity of over 4 mb/d this time last year is not much higher than 1.7 mb/d today. The combination of stronger-than-expected growth in Asian demand has more than offset weakness in the US, while a plethora of outages in non-OPEC supply centres, ranging from technical problems (eg, in North Sea, China) to geopolitical issues (eg, in Syria, Yemen and Sudan) have curtailed a huge amount of supply. In fact, the weakness in supply has more than offset any demand weakness, resulting in inventories falling further. While we are maintaining our Q1 and 2012 annual price forecasts for both Brent and WTI, should the steady deterioration in Irans external relations with no resolution in 2012 continue to force itself into the base case, then we would expect annual averages to be as much as $20 per barrel higher than currently forecast. We remain positive on Brent, which should continue to outperform WTI as US Midwest balances look heavy given the lack of infrastructure and growing production, which is likely to send through significant volumes to Cushing, a trend that has already started. On products, while the current strength in gasoline prices appears overdone, summer gasoline remains constrained, while the end of the winter demand juxtaposed with spring refinery maintenance makes us neutral on the middle distillates. We remain bearish overall for US natural gas, as the surplus created by still-growing supply and a significant overhang in storage continues to require gas to price well into coal prices to find new demand. The end of winter could force some gas out of storage (for contractual reasons), creating even weaker prices. European carbon is now highly exposed to policy developments, with a proposal by the EC to reduce supply, at least in the short term, trying to make its way through the legislative channels. If the EC succeeds in being able to set aside a large volume of allowances from 2013, this will provide some upside to the market. If the proposal fails, the market will fall again as the market has seen a bounce since the proposals have started to clear the regulatory hurdles. While we think it more likely than not the proposals will pass, the road remains difficult and the risk of this failing is not immaterial. In the short term at least, this is a market to be approached with some caution.

Agriculture

As with energy, the main changes to our weightings in agriculture this month come from the sectoral ranking, which we have lowered. As a result, most of our agriculture weightings have been reduced. Our main overweights are still in corn and soybeans, with underweights in coffee, sugar and wheat. Grains remain our favoured positive exposure across the agricultural complex this month, with dry weather in South America due to the La Nina weather event tightening global supplies further. We expect South American supply estimates to be lowered, especially for soybeans, with much of the decline in corn output already factored in. Old crop corn fundamentals remain supportive due to damage to the South American crop, which has tightened supplies, strength in US export sales, and inventory levels in the US, which remain very low. Soybean fundamentals also remain positive on lower South American supply estimates and strength in US export demand. Further, the USDAs Agriculture Outlook Forum in February estimated flat y/y US soybean plantings in 2012, which would tighten US inventories in 2012-13. Wheat, in our view, has weaker fundamentals than corn and soybeans, with ample

9 March 2012 6

Barclays Capital | Barclays Capital Commodities Research Rankings March 2012

feed wheat supplies and global inventories at all-time highs. However, cold weather that could lead to winterkill in key Black Sea producer regions and parts of Eastern and Western Europe for winter sown crops are a concern. Cotton has moved higher in a knee-jerk reaction to India (the worlds second-largest producer and exporter) imposing an export ban effective immediately. However, beyond near-term support on this news, we expect prices to come under further pressure, with supply prospects looking robust in key producers, a pick-up in global inventories and demand being lacklustre due to current macro fears abounding. We continue to view soft commodities less favourably than the grains. Despite lower Brazilian output, the move to a larger surplus in 2011-12 is bearish for sugar prices, as is Indias exportable surplus (we expect further exports to be given the go-ahead) and strong production prospects in key Northern Hemisphere producers such as the EU, Russia and Thailand. Coffee prices have tumbled, and we continue to view the market negatively on expectations of a hefty on-year Brazilian crop weighing on prices and sentiment.

Base metals

Whilst there have been few changes to our metals rankings this month, a lower sectoral ranking for base metals means that weights are lower across the board. Our main overweight is still in copper, and our main underweights are in nickel and zinc. We have further repositioned our portfolio to reflect our expectations for the pricing environment for base metals to strengthen. Economic data point towards an improved growth outlook, which bodes well for future metals consumption. The US is undergoing a recovery, while in China there are early indications of targeted easing in the property market, which should help to stimulate activity in the low-cost/first-time buyer sector. We believe that copper is best positioned to capture further upside and have raised our ranking a notch. Zinc and nickel are at the bottom of our rankings on the basis that they have the weakest fundamentals. We are positive on copper fundamentals because even though the supply outlook is the strongest it has been in a long time, we still expect the deficit to persist and for stocks to fall further. LME inventories are falling fast and cancelled warrants remain elevated, though inventories in China have built. Record-high imports at the end of 2011 against a backdrop of softer demand suggest that import demand could weaken over the coming months. Although this could be a downside risk to prices, it would not come as a surprise to the market, and with early signs of targeted easing in the property market and an expected improvement in growth momentum, we believe demand will improve. In nickel, supply is growing strongly and is expected to continue improving throughout the year, pushing the market into surplus. This will restrict the upside to prices, which we expect to be capped by Chinese NPI supply. The Indonesian export ban could have a significant effect on nickel fundamentals, providing potential upside risk for prices depending on when and how it is implemented so it should be watched closely. The zinc market is in surplus, stocks both on the LME and in China are building fast and mine supply growth is strong. We expect the metal surplus to persist and for stocks to rise to a record high this year. In other base metals, we are relatively neutral. In aluminium, we see price downside as very limited given the proximity of prices to production costs.

9 March 2012

Barclays Capital | Barclays Capital Commodities Research Rankings March 2012

Lead demand in the US could receive a boost from the strengthening transportation market, while in China stocks have fallen to very low levels following the ramp up of battery manufacturing plants. Weaker Chinese tin imports and rising LME stocks have created a less price-supportive environment on the one hand, while discussions about further restrictions in Indonesian exports will provide support on the other.

Precious metals

Once again the main changes to our precious metals weights result from a downgrading of its sectoral ranking from last month. Consequently, gold remains our main overweight, but the portfolio is much less exposed to gold than it was last month. Our main underweight in precious metals is in platinum, and we are neutral in palladium and silver. Prices came under pressure in the past month as concerns about Chinas growth materialised and the Feds comments failed to signal further quantitative easing; however, underlying dynamics vary significantly across the complex. Platinum has been driven higher by potential supply disruptions, as well as greater-than expected actual supply disruptions at the second-largest producer. Notably, in contrast to Q4 11, when safety-related stoppages increased, investment demand has turned positive, and the combination of the two has tightened the balance in the short term. But now that Impala Platinum is looking to restart its operations, the elevated investor interest in platinum exposes prices to further profit-taking in the near term. Gold had been boosted by investor interest but sidelined the mixed physical market. While some physical interest has emerged upon the sharp price correction, the cushion for prices has not proved to be solid thus far, but the external backdrop remains gold-supportive. Palladiums underlying market trends have been supportive with our auto analysts raising their 2012 SAAR forecast for the US and ETP holdings rising to their highest since October, whereas ETP outflows had proved to be a drag on palladium prices last year. Silver has also been boosted by investment demand, and speculative positioning. While the price floor remains fragile, silver maintains the scope to outperform gold should investment demand pick up, though we think that unlikely in the short term.

9 March 2012

Barclays Capital | Barclays Capital Commodities Research Rankings March 2012

COMMODITIES RESEARCH ANALYSTS

Barclays Capital 5 The North Colonnade London E14 4BB Gayle Berry Commodities Research +44 (0)20 3134 1596 gayle.berry@barcap.com Miswin Mahesh Commodities Research +44 (0)20 77734291 miswin.mahesh@barcap.com Trevor Sikorski Commodities Research +44 (0)20 3134 0160 trevor.sikorski@barcap.com Shiyang Wang Commodities Research +1 212 526 7464 shiyang.wang@barcap.com Commodities Sales Craig Shapiro Head of Commodities Sales +1 212 412 3845 craig.shapiro@barcap.com Martin Woodhams Commodity Structuring +44 (0)20 7773 8638 martin.woodhams@barcap.com Suki Cooper Commodities Research +1 212 526 7896 suki.cooper@barcap.com Roxana Mohammadian-Molina Commodities Research +44 (0)20 7773 2117 roxana.mohammadian-molina@barcap.com Nicholas Snowdon Commodities Research +1 212 526 7279 nicholas.snowdon@barcap.com Michael Zenker Commodities Research +1 212 526 2081 michael.zenker@barcap.com Helima Croft Commodities Research +1 212 526 0764 helima.croft@barcap.com Kevin Norrish Commodities Research +44 (0)20 7773 0369 kevin.norrish@barcap.com Kate Tang Commodities Research +44 (0)20 7773 0930 kate.tang@barcap.com Paul Horsnell Commodities Research +44 (0)20 7773 1145 paul.horsnell@barcap.com Amrita Sen Commodities Research +44 (0)20 3134 2266 amrita.sen@barcap.com Sudakshina Unnikrishnan Commodities Research +44 (0)20 7773 3797 sudakshina.unnikrishnan@barcap.com

9 March 2012

Analyst Certification(s) We, Roxana Mohammadian Molina, Kevin Norrish and Sudakshina Unnikrishnan, hereby certify (1) that the views expressed in this research report accurately reflect our personal views about any or all of the subject securities or issuers referred to in this research report and (2) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this research report. Important Disclosures For current important disclosures regarding companies that are the subject of this research report, please send a written request to: Barclays Capital Research Compliance, 745 Seventh Avenue, 17th Floor, New York, NY 10019 or refer to http://publicresearch.barcap.com or call 212-526-1072. Barclays Capital does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that Barclays Capital may have a conflict of interest that could affect the objectivity of this report. Any reference to Barclays Capital includes its affiliates. Barclays Capital and/or an affiliate thereof (the "firm") regularly trades, generally deals as principal and generally provides liquidity (as market maker or otherwise) in the debt securities that are the subject of this research report (and related derivatives thereof). The firm's proprietary trading accounts may have either a long and / or short position in such securities and / or derivative instruments, which may pose a conflict with the interests of investing customers. Where permitted and subject to appropriate information barrier restrictions, the firm's fixed income research analysts regularly interact with its trading desk personnel to determine current prices of fixed income securities. The firm's fixed income research analyst(s) receive compensation based on various factors including, but not limited to, the quality of their work, the overall performance of the firm (including the profitability of the investment banking department), the profitability and revenues of the Fixed Income Division and the outstanding principal amount and trading value of, the profitability of, and the potential interest of the firms investing clients in research with respect to, the asset class covered by the analyst. To the extent that any historical pricing information was obtained from Barclays Capital trading desks, the firm makes no representation that it is accurate or complete. All levels, prices and spreads are historical and do not represent current market levels, prices or spreads, some or all of which may have changed since the publication of this document. Barclays Capital produces a variety of research products including, but not limited to, fundamental analysis, equity-linked analysis, quantitative analysis, and trade ideas. Recommendations contained in one type of research product may differ from recommendations contained in other types of research products, whether as a result of differing time horizons, methodologies, or otherwise. In order to access Barclays Capital's Statement regarding Research Dissemination Policies and Procedures, please refer to https://live.barcap.com/publiccp/RSR/nyfipubs/disclaimer/disclaimer-research-dissemination.html.

Disclaimer This publication has been prepared by Barclays Capital, the investment banking division of Barclays Bank PLC, and/or one or more of its affiliates as provided below. It is provided to our clients for information purposes only, and Barclays Capital makes no express or implied warranties, and expressly disclaims all warranties of merchantability or fitness for a particular purpose or use with respect to any data included in this publication. Barclays Capital will not treat unauthorized recipients of this report as its clients. Prices shown are indicative and Barclays Capital is not offering to buy or sell or soliciting offers to buy or sell any financial instrument. Without limiting any of the foregoing and to the extent permitted by law, in no event shall Barclays Capital, nor any affiliate, nor any of their respective officers, directors, partners, or employees have any liability for (a) any special, punitive, indirect, or consequential damages; or (b) any lost profits, lost revenue, loss of anticipated savings or loss of opportunity or other financial loss, even if notified of the possibility of such damages, arising from any use of this publication or its contents. Other than disclosures relating to Barclays Capital, the information contained in this publication has been obtained from sources that Barclays Capital believes to be reliable, but Barclays Capital does not represent or warrant that it is accurate or complete. The views in this publication are those of Barclays Capital and are subject to change, and Barclays Capital has no obligation to update its opinions or the information in this publication. The analyst recommendations in this publication reflect solely and exclusively those of the author(s), and such opinions were prepared independently of any other interests, including those of Barclays Capital and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Barclays Capital recommends that investors independently evaluate each issuer, security or instrument discussed herein and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results. This communication is being made available in the UK and Europe primarily to persons who are investment professionals as that term is defined in Article 19 of the Financial Services and Markets Act 2000 (Financial Promotion Order) 2005. It is directed at, and therefore should only be relied upon by, persons who have professional experience in matters relating to investments. The investments to which it relates are available only to such persons and will be entered into only with such persons. Barclays Capital is authorized and regulated by the Financial Services Authority ('FSA') and member of the London Stock Exchange. Barclays Capital Inc., U.S. registered broker/dealer and member of FINRA (www.finra.org), is distributing this material in the United States and, in connection therewith accepts responsibility for its contents. Any U.S. person wishing to effect a transaction in any security discussed herein should do so only by contacting a representative of Barclays Capital Inc. in the U.S. at 745 Seventh Avenue, New York, New York 10019. Non-U.S. persons should contact and execute transactions through a Barclays Bank PLC branch or affiliate in their home jurisdiction unless local regulations permit otherwise. Barclays Bank PLC, Paris Branch (registered in France under Paris RCS number 381 066 281) is regulated by the Autorit des marchs financiers and the Autorit de contrle prudentiel. Registered office 34/36 Avenue de Friedland 75008 Paris. This material is distributed in Canada by Barclays Capital Canada Inc., a registered investment dealer and member of IIROC (www.iiroc.ca). Subject to the conditions of this publication as set out above, Absa Capital, the Investment Banking Division of Absa Bank Limited, an authorised financial services provider (Registration No.: 1986/004794/06), is distributing this material in South Africa. Absa Bank Limited is regulated by the South African Reserve Bank. This publication is not, nor is it intended to be, advice as defined and/or contemplated in the (South African) Financial Advisory and Intermediary Services Act, 37 of 2002, or any other financial, investment, trading, tax, legal, accounting, retirement, actuarial or other professional advice or service whatsoever. Any South African person or entity wishing to effect a transaction in any security discussed herein should do so only by contacting a representative of Absa Capital in South Africa, 15 Alice Lane, Sandton, Johannesburg, Gauteng 2196. Absa Capital is an affiliate of Barclays Capital. In Japan, foreign exchange research reports are prepared and distributed by Barclays Bank PLC Tokyo Branch. Other research reports are distributed to institutional investors in Japan by Barclays Capital Japan Limited. Barclays Capital Japan Limited is a joint-stock company incorporated in Japan with registered office of 6-10-1 Roppongi, Minato-ku, Tokyo 106-6131, Japan. It is a subsidiary of Barclays Bank PLC and a registered financial instruments firm regulated by the Financial Services Agency of Japan. Registered Number: Kanto Zaimukyokucho (kinsho) No. 143. Barclays Bank PLC, Hong Kong Branch is distributing this material in Hong Kong as an authorised institution regulated by the Hong Kong Monetary Authority. Registered Office: 41/F, Cheung Kong Center, 2 Queen's Road Central, Hong Kong. This material is issued in Taiwan by Barclays Capital Securities Taiwan Limited. This

material on securities not traded in Taiwan is not to be construed as 'recommendation' in Taiwan. Barclays Capital Securities Taiwan Limited does not accept orders from clients to trade in such securities. This material may not be distributed to the public media or used by the public media without prior written consent of Barclays Capital. This material is distributed in South Korea by Barclays Capital Securities Limited, Seoul Branch. All equity research material is distributed in India by Barclays Securities (India) Private Limited (SEBI Registration No: INB/INF 231292732 (NSE), INB/INF 011292738 (BSE), Registered Office: 208 | Ceejay House | Dr. Annie Besant Road | Shivsagar Estate | Worli | Mumbai - 400 018 | India, Phone: + 91 22 67196363). Other research reports are distributed in India by Barclays Bank PLC, India Branch. Barclays Bank PLC Frankfurt Branch distributes this material in Germany under the supervision of Bundesanstalt fr Finanzdienstleistungsaufsicht (BaFin). This material is distributed in Malaysia by Barclays Capital Markets Malaysia Sdn Bhd. This material is distributed in Brazil by Banco Barclays S.A. This material is distributed in Mexico by Barclays Bank Mexico, S.A. Barclays Bank PLC in the Dubai International Financial Centre (Registered No. 0060) is regulated by the Dubai Financial Services Authority (DFSA). Principal place of business in the Dubai International Financial Centre: The Gate Village, Building 4, Level 4, PO Box 506504, Dubai, United Arab Emirates. Barclays Bank PLC-DIFC Branch, may only undertake the financial services activities that fall within the scope of its existing DFSA licence. Related financial products or services are only available to Professional Clients, as defined by the Dubai Financial Services Authority. Barclays Bank PLC in the UAE is regulated by the Central Bank of the UAE and is licensed to conduct business activities as a branch of a commercial bank incorporated outside the UAE in Dubai (Licence No.: 13/1844/2008, Registered Office: Building No. 6, Burj Dubai Business Hub, Sheikh Zayed Road, Dubai City) and Abu Dhabi (Licence No.: 13/952/2008, Registered Office: Al Jazira Towers, Hamdan Street, PO Box 2734, Abu Dhabi). Barclays Bank PLC in the Qatar Financial Centre (Registered No. 00018) is authorised by the Qatar Financial Centre Regulatory Authority (QFCRA). Barclays Bank PLC-QFC Branch may only undertake the regulated activities that fall within the scope of its existing QFCRA licence. Principal place of business in Qatar: Qatar Financial Centre, Office 1002, 10th Floor, QFC Tower, Diplomatic Area, West Bay, PO Box 15891, Doha, Qatar. Related financial products or services are only available to Business Customers as defined by the Qatar Financial Centre Regulatory Authority. This material is distributed in the UAE (including the Dubai International Financial Centre) and Qatar by Barclays Bank PLC. This material is distributed in Saudi Arabia by Barclays Saudi Arabia ('BSA'). It is not the intention of the Publication to be used or deemed as recommendation, option or advice for any action (s) that may take place in future. Barclays Saudi Arabia is a Closed Joint Stock Company, (CMA License No. 09141-37). Registered office Al Faisaliah Tower, Level 18, Riyadh 11311, Kingdom of Saudi Arabia. Authorised and regulated by the Capital Market Authority, Commercial Registration Number: 1010283024. This material is distributed in Russia by OOO Barclays Capital, affiliated company of Barclays Bank PLC, registered and regulated in Russia by the FSFM. Broker License #177-11850-100000; Dealer License #177-11855-010000. Registered address in Russia: 125047 Moscow, 1st Tverskaya-Yamskaya str. 21. This material is distributed in Singapore by the Singapore branch of Barclays Bank PLC, a bank licensed in Singapore by the Monetary Authority of Singapore. For matters in connection with this report, recipients in Singapore may contact the Singapore branch of Barclays Bank PLC, whose registered address is One Raffles Quay Level 28, South Tower, Singapore 048583. Barclays Bank PLC, Australia Branch (ARBN 062 449 585, AFSL 246617) is distributing this material in Australia. It is directed at 'wholesale clients' as defined by Australian Corporations Act 2001. IRS Circular 230 Prepared Materials Disclaimer: Barclays Capital and its affiliates do not provide tax advice and nothing contained herein should be construed to be tax advice. Please be advised that any discussion of U.S. tax matters contained herein (including any attachments) (i) is not intended or written to be used, and cannot be used, by you for the purpose of avoiding U.S. tax-related penalties; and (ii) was written to support the promotion or marketing of the transactions or other matters addressed herein. Accordingly, you should seek advice based on your particular circumstances from an independent tax advisor. Barclays Capital is not responsible for, and makes no warranties whatsoever as to, the content of any third-party web site accessed via a hyperlink in this publication and such information is not incorporated by reference. Copyright Barclays Bank PLC (2012). All rights reserved. No part of this publication may be reproduced in any manner without the prior written permission of Barclays Capital or any of its affiliates. Barclays Bank PLC is registered in England No. 1026167. Registered office 1 Churchill Place, London, E14 5HP. Additional information regarding this publication will be furnished upon request.

EU18322

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- SocGen Quant Strategy - Pricing Bespoke CDOsDocument21 pagesSocGen Quant Strategy - Pricing Bespoke CDOsHenry WangNo ratings yet

- JP Morgan Valuation Training MaterialsDocument49 pagesJP Morgan Valuation Training MaterialsAdam Wueger92% (26)

- BNEF Re Imagining Us Solar FinancingDocument28 pagesBNEF Re Imagining Us Solar FinancingHenry WangNo ratings yet

- BarCap Credit Research 110312Document32 pagesBarCap Credit Research 110312Henry WangNo ratings yet

- Cisco CLUE IndexDocument17 pagesCisco CLUE IndexHenry WangNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Noda v. Cruz-Arnaldo DigestDocument2 pagesNoda v. Cruz-Arnaldo DigestFrancis GuinooNo ratings yet

- Revolving Credit AgreementDocument2 pagesRevolving Credit AgreementRocketLawyerNo ratings yet

- Unit IV Fire InsuranceDocument7 pagesUnit IV Fire InsuranceEswaran LakshmananNo ratings yet

- Global Wealth Databook 2018Document167 pagesGlobal Wealth Databook 2018José DíazNo ratings yet

- Banking Mohtasib Pakistan Annual Reprot 2014Document70 pagesBanking Mohtasib Pakistan Annual Reprot 2014SALMANRIZNo ratings yet

- City of Philadelphia vs. FufariDocument15 pagesCity of Philadelphia vs. Fufarichristoofar2190No ratings yet

- World Islamic Banking Competitiveness Report 2016Document68 pagesWorld Islamic Banking Competitiveness Report 2016The SolutionNo ratings yet

- Swift Gpi Overview January 2019Document20 pagesSwift Gpi Overview January 2019Anuj AnandNo ratings yet

- Importance of A Trial BalanceDocument1 pageImportance of A Trial Balancedanookyere100% (3)

- Paytm CrisisDocument6 pagesPaytm CrisisrishikaNo ratings yet

- Working Capital Management Means The Management of A Firm's Short-Term Assets and Its ShortDocument6 pagesWorking Capital Management Means The Management of A Firm's Short-Term Assets and Its ShortIqbal HossainNo ratings yet

- BancassuranceDocument18 pagesBancassuranceMahipal GadhaviNo ratings yet

- Nov 2023Document7 pagesNov 2023applybizzNo ratings yet

- Chapter 3Document23 pagesChapter 3jannessh100% (2)

- Gracefx Vix StrategyDocument10 pagesGracefx Vix StrategyPrinceNo ratings yet

- Tailored Debt Structures: With A Refinance AssumptionDocument2 pagesTailored Debt Structures: With A Refinance AssumptionKaran VasheeNo ratings yet

- List of Government Scheme 2019 State Wise PDFDocument7 pagesList of Government Scheme 2019 State Wise PDFDhiraj SinghNo ratings yet

- Banking GlossaryDocument419 pagesBanking GlossarynitjinNo ratings yet

- Calculo de Un Credito para HipotecaDocument26 pagesCalculo de Un Credito para HipotecaREINALDO VELASQUEZNo ratings yet

- Insurance Law ProjectDocument17 pagesInsurance Law ProjectAprajeet Ankit SinghNo ratings yet

- 6th Oct 2nd LotDocument12 pages6th Oct 2nd Lotapi-3705615No ratings yet

- Project On Kotak Mutual FundDocument63 pagesProject On Kotak Mutual FundAnupamJena33% (3)

- Draft Accounting Manual For Panchayati RajDocument71 pagesDraft Accounting Manual For Panchayati RajRavinder KhullarNo ratings yet

- Disbursement VoucherDocument1 pageDisbursement VoucherGeorgina Intia100% (1)

- CC TutorDocument10 pagesCC TutorheadpncNo ratings yet

- CBSE Class 11 Accountancy Sample Paper 2013 PDFDocument12 pagesCBSE Class 11 Accountancy Sample Paper 2013 PDFsivsyadav100% (1)

- FORM16Document5 pagesFORM16sunnyjain19900% (1)

- 5T 1st TrancheDocument6 pages5T 1st TrancheEsteban Enrique Posan Balcazar100% (1)

- 6 Model Inovasi Peningkatan Pelayanan Prima & Kepuasan CustomerDocument3 pages6 Model Inovasi Peningkatan Pelayanan Prima & Kepuasan CustomerhendyNo ratings yet

- Lecture-10 Bad Debts and Allowance For Doubtful DebtsDocument13 pagesLecture-10 Bad Debts and Allowance For Doubtful DebtsAzeemNo ratings yet