Professional Documents

Culture Documents

Federal Reserve Enforcement Action - Orrstown Bank

Uploaded by

Public OpinionOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Federal Reserve Enforcement Action - Orrstown Bank

Uploaded by

Public OpinionCopyright:

Available Formats

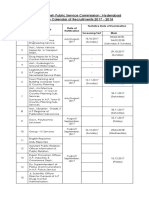

UNITED STATES OF AMERICA BEFORE THE BOARD OF GOVERNORS OF THE FEDERAL RESERVE SYSTEM WASHINGTON, D.C.

Written Agreement by and among ORRSTOWN FINANCIAL SERVICES, INC. Shippensburg, Pennsylvania ORRSTOWN BANK Shippensburg, Pennsylvania and FEDERAL RESERVE BANK OF PHILADELPHIA Philadelphia, Pennsylvania Docket No. 12-021-WA/RB-HC 12-021-WA/RB-SMB

WHEREAS, in recognition of their common goal to maintain the financial soundness of Orrstown Financial Services, Inc, Shippensburg, Pennsylvania (Orrstown), a registered bank holding company, and its subsidiary bank, Orrstown Bank, Shippensburg, Pennsylvania (the Bank), a state-chartered bank that is a member of the Federal Reserve System, Orrstown, the Bank, and the Federal Reserve Bank of Philadelphia (the Reserve Bank) have mutually agreed to enter into this Written Agreement (the Agreement); and WHEREAS, on March 22, 2012, Orrstowns and the Banks boards of directors, at duly constituted meetings, adopted resolutions authorizing and directing Thomas Quinn to consent to this Agreement on behalf of Orrstown and the Bank, and consenting to compliance with each and every applicable provision of this Agreement by Orrstown, the Bank, and their institutionaffiliated parties, as defined in sections 3(u) and 8(b)(3) of the Federal Deposit Insurance Act, as amended (the FDI Act) (12 U.S.C. 1813(u) and 1818(b)(3)).

NOW, THEREFORE, Orrstown, the Bank, and the Reserve Bank agree as follows: Source of Strength 1. The board of directors of Orrstown shall take appropriate steps to fully utilize

Orrstowns financial and managerial resources, pursuant to section 38A of the FDI Act (12 U.S.C. 1831o-1) and section 225.4(a) of Regulation Y of the Board of Governors of the Federal Reserve System (the Board of Governors) (12 C.F.R. 225.4(a)), to serve as a source of strength to the Bank, including, but not limited to, taking steps to ensure that the Bank complies with this Agreement and any other supervisory action taken by the Banks federal or state regulators. Board Oversight 2. Within 60 days of this Agreement, the board of directors of the Bank shall submit

to the Reserve Bank a written plan to strengthen board oversight of the management and operations of the Bank. The plan shall, at a minimum, address, consider, and include: (a) The actions that the board of directors will take to improve the Banks

condition and maintain effective control over, and supervision of, the Banks major operations and activities, including but not limited to, credit risk management, lending and credit administration, asset quality, liquidity, audit, capital, and earnings; (b) the responsibility of the board of directors to monitor managements

adherence to approved policies and procedures, and applicable laws and regulations and to monitor exceptions to approved policies and procedures; (c) steps to improve the information and reports that will be regularly

reviewed by the board of directors and its committees in their oversight of the operations and management of the Bank, including information on the Banks credit risk management, lending

and credit administration, adversely classified assets, interest only loans, allowance for loan and lease losses (ALLL), capital, liquidity, audit, and earnings; and (d) committee meetings. Management Review 3. (a) Within 30 days of this Agreement, the board of directors of the Bank shall the maintenance of adequate and complete minutes of all board and

retain an independent consultant acceptable to the Reserve Bank to conduct a review of all management and staffing needs of the Bank and the qualifications and performance of all senior Bank management (the Management Review), and to prepare a written report of findings and recommendations (the Report). The primary purpose of the Management Review shall be to aid in the development of a suitable management structure that is adequately staffed by qualified and trained personnel. (b) Within 10 days of the Reserve Banks approval of the Banks independent

consultant selection, the Bank shall submit an engagement letter to the Reserve Bank for approval. The engagement letter shall require the independent consultant to submit the Report within 90 days of regulatory approval of the engagement letter and to provide a copy of the Report to the Reserve Bank at the same time that it is provided to the Banks board of directors. The Review shall, at a minimum, address, consider, and include: (i) the identification of the type and number of senior officers needed

to manage and supervise properly the affairs of the Bank (ii) an evaluation of each senior officer to determine whether the

individual possesses the ability, experience, and other qualifications to competently perform present and anticipated duties, including their ability to: adhere to applicable laws and

regulations and the Banks established policies and procedures; restore and maintain the Bank to a safe and sound condition; and comply with the requirements of this Agreement; (iii) (iv) (v) an evaluation of reporting lines within the management structure; a management succession plan for key senior officers; and the identification of present and future management and staffing

needs for each area of the Bank, particularly in the areas of credit risk management, lending and credit administration, loan review, and problem asset resolution. 4. Within 30 days of receipt of the Report, the Banks board of directors shall submit

a written management plan to the Reserve Bank that fully addresses the findings and recommendations in the Report and describes the specific actions that the board of directors proposes to take in order to strengthen the Banks management, including, but not limited to plans to hire or appoint additional or replacement personnel Credit Risk Management 5. Within 90 days of this Agreement, the Bank shall submit to the Reserve Bank an

acceptable written plan to strengthen credit risk management practices. The plan shall, at a minimum, address, consider, and include: (a) Procedures to identify, limit and manage concentrations of credit that are

consistent with the Interagency Guidance on Concentrations in Commercial Real Estate Lending, Sound Risk Management Practices, dated December 12, 2006 (SR 07-1); (b) (c) accurate risk ratings; (d) enhanced stress testing of loan and portfolio segments; and procedures for the timely and accurate identification of problem loans; enhancements to the internal loan grading system to ensure timely and

(e)

improvements to the Banks management information systems to ensure

that the board of directors and senior management obtain timely and accurate information regarding the condition of the Banks loan portfolio. Lending and Credit Administration 6. Within 60 days of this Agreement, the Bank shall submit to the Reserve Bank an

acceptable written lending and credit administration program that shall, at a minimum, address, consider, and include: (a) Loan underwriting and credit administration procedures that include and

provide for, at a minimum, documented analysis of: (i) the borrowers repayment sources, global cash flow, and overall debt service ability; and (ii) the value of any collateral; (b) procedures to ensure that appraisals conform to accepted appraisal

standards, as defined in the Uniform Standards of Professional Appraisal Practice, and comply with the requirements of Subpart G of Regulation Y of the Board of Governors (12 C.F.R. Part 225, Subpart G) made applicable to state member banks by section 208.50 of Regulation H of the Board of Governors (12 C.F.R. 208.50), and the Interagency Appraisal and Evaluation Guidelines, dated October 27, 1994 (SR 94-55); (c) (d) (e) document exceptions; (f) enhancements to the loan workout process to ensure that workout plans for standards for interest-only loans; the appropriate use of interest reserves; policies and procedures to minimize and monitor underwriting and

problem loans are consistent with the Interagency Guidance on Prudent Commercial Real Estate Loan Workouts, dated October 30, 2009 (SR 09-7);

(g) (h) (i)

standards for renewing, extending or modifying existing loans; standards for the timely movement of loans to non-accrual status; compensation standards for loan origination officers that include an

assessment of loan performance; and (j) the appropriate accounting treatment of costs incurred in connection with

the maintenance and sale of collateral. Asset Improvement 7. The Bank shall not, directly or indirectly, extend, renew, or restructure any credit

to or for the benefit of any borrower, including any related interest of the borrower, whose loans or other extensions of credit are criticized in the report of the joint examination conducted by the Reserve Bank and the Pennsylvania Department of Banking that commenced on May 16, 2011 (the Report of Examination) or in any subsequent report of examination, without the prior approval of a majority of the full board of directors or a designated committee thereof. The board of directors or its committee shall document in writing the reasons for the extension of credit, renewal, or restructuring, specifically certifying that: (i) the Banks risk management policies and practices for loan workout activity are acceptable; (ii) the extension of credit is necessary to improve and protect the Banks interest in the ultimate collection of the credit already granted and maximize its potential for collection; (iii) the extension of credit reflects prudent underwriting based on reasonable repayment terms and is adequately secured; and all necessary loan documentation has been properly and accurately prepared and filed; (iv) the Bank has performed a comprehensive credit analysis indicating that the borrower has the willingness and ability to repay the debt as supported by an adequate workout plan, as necessary; and (v) the board of directors or its designated committee reasonably believes that the extension of credit

will not impair the Banks interest in obtaining repayment of the already outstanding credit and that the extension of credit or renewal will be repaid according to its terms. The written certification shall be made a part of the minutes of the meetings of the board of directors or its committee, as appropriate, and a copy of the signed certification, together with the credit analysis and related information that was used in the determination, shall be retained by the Bank in the borrowers credit file for subsequent supervisory review. 8. (a) Within 60 days of this Agreement, the Bank shall submit to the Reserve

Bank an acceptable written plan designed to improve the Banks position through repayment, amortization, liquidation, additional collateral, or other means on each loan, relationship, or other asset in excess of $750,000, including other real estate owned (OREO), that (i) is past due as to principal or interest more than 90 days as of the date of this Agreement; (ii) is on the Banks problem loan list; or (iii) was adversely classified in the Report of Examination. (b) Within 30 days of the date that any additional loan, relationship, or other

asset in excess of $750,000, including OREO, becomes past due as to principal or interest for more than 90 days, is on the Banks problem loan list, or is adversely classified in any subsequent report of examination of the Bank, the Bank shall submit to the Reserve Bank an acceptable written plan to improve the Banks position on such loan or asset. (c) Within 45 days after the end of each calendar quarter thereafter, the Bank

shall submit a written progress report to the Reserve Bank to update each asset improvement plan, which shall include, at a minimum, the carrying value of the loan or other asset and changes in the nature and value of supporting collateral, along with a copy of the Banks current problem loan list, a list of all loan renewals and extensions without full collection of interest in the last quarter, and past due/non-accrual report.

Allowance for Loan and Lease Losses 9. (a) The Bank shall, within 30 days from the receipt of any federal or state

report of examination, charge off all assets classified loss unless otherwise approved in writing by the Reserve Bank. (b) Within 60 days of this Agreement, the Bank shall review and revise its

ALLL methodology consistent with relevant supervisory guidance, including the Interagency Policy Statements on the Allowance for Loan and Lease Losses, dated July 2, 2001 (SR 01-17 (Sup)) and December 13, 2006 (SR 06-17), and the findings and recommendations regarding the ALLL set forth in the Report of Examination, and submit a description of the revised methodology to the Reserve Bank. The revised ALLL methodology shall be designed to maintain an adequate ALLL and shall address, consider, and include, at a minimum, the reliability of the Banks loan grading system, the volume of criticized loans, concentrations of credit, the current level of past due and nonperforming loans, past loan loss experience, evaluation of probable losses in the Banks loan portfolio, including adversely classified loans, and the impact of market conditions on loan and collateral valuations and collectibility. (c) Within 60 days of this Agreement, the Bank shall submit to the Reserve

Bank an acceptable written program for the maintenance of an adequate ALLL. The program shall include policies and procedures to ensure adherence to the revised ALLL methodology and provide for periodic reviews and updates to the ALLL methodology, as appropriate. The program shall also provide for a review of the ALLL by the board of directors on at least a quarterly calendar basis. Any deficiency found in the ALLL shall be remedied in the quarter it is discovered, prior to the filing of the Consolidated Reports of Condition and Income, by additional provisions. The board of directors shall maintain written documentation of its review,

including the factors considered and conclusions reached by the Bank in determining the adequacy of the ALLL. During the term of this Agreement, the Bank shall submit to the Reserve Bank, within 30 days after the end of each calendar quarter, a written report regarding the board of directors quarterly review of the ALLL and a description of any changes to the methodology used in determining the amount of ALLL for that quarter. Capital Plan 10. Within 90 days of this Agreement, Orrstown shall submit to the Reserve Bank an

acceptable written plan to maintain sufficient capital at Orrstown on a consolidated basis, and Orrstown and the Bank shall submit an acceptable joint written plan to maintain sufficient capital at the Bank as a separate legal entity on a stand-alone basis. The plans shall, at a minimum, address, consider, and include: (a) Orrstowns current and future capital requirements, including compliance

with the Capital Adequacy Guidelines for Bank Holding Companies: Risk-Based Measure and Tier 1 Leverage Measure, Appendices A and D of Regulation Y of the Board of Governors (12 C.F.R. Part 225, App. A and D); (b) the Banks current and future capital requirements, including compliance

with the Capital Adequacy Guidelines for State Member Banks: Risk-Based Measure and Tier 1 Leverage Measure, Appendices A and B of Regulation H of the Board of Governors (12 C.F.R. Part 208, App. A and B); (c) the adequacy of the Banks capital, taking into account the volume of

classified assets, concentrations of credit, the adequacy of the ALLL, current and projected asset growth, projected retained earnings, and anticipated and contingency funding needs;

(d)

the source and timing of additional funds to fulfill Orrstowns and the

Banks future capital requirements; and (e) the requirements of section 225.4(a) of Regulation Y of the Board of

Governors that Orrstown serve as a source of strength to the Bank. 11. Orrstown and the Bank shall notify the Reserve Bank, in writing, no more than 30

days after the end of any calendar quarter in which any of Orrstowns consolidated capital ratios or the Banks capital ratios (total risk-based, Tier 1 risk-based, or leverage) fall below the approved capital plans minimum ratios. No more than 60 days after the end of any such calendar quarter, Orrstown and the Bank shall submit an acceptable written plan that details the steps Orrstown or the Bank, as appropriate, will take to increase Orrstowns or the Banks capital ratios to or above the approved capital plans minimums. Internal Audit 12. Within 60 days of this Agreement, the Bank shall submit to the Reserve Bank an

acceptable enhanced written internal audit program that shall, at a minimum, provide for: (a) Improved oversight of all aspects of the audit program by the board of

directors audit committee; (b) timely resolution of audit findings and follow-up reviews to ensure

completion of corrective measures; and (c) comprehensive tracking and reporting of the status and resolution of audit

and examination findings to the audit committee. Strategic Plan and Budget

10

13.

(a)

Within 90 days of this Agreement, the Bank shall submit to the Reserve

Bank a strategic plan to improve the Banks earnings and a budget for 2012. The written plan and budget shall include, but not be limited to: (i) Identification of the major areas where, and means by which, the

board of directors will seek to improve the Banks operating performance; (ii) a realistic and comprehensive budget for the remainder of calendar

year 2012, including income statement and balance sheet projections; and (iii) a description of the operating assumptions that form the basis for,

and adequately support, major projected income, expense, and balance sheet components. (b) A strategic plan and budget for each calendar year subsequent to 2012

shall be submitted to the Reserve Bank at least 30 days prior to the beginning of that calendar year. Liquidity and Funds Management 14. Within 60 days of this Agreement, the Bank shall submit to the Reserve Bank an

acceptable revised written contingency funding plan that, at a minimum, identifies available sources of liquidity and includes adverse scenario planning. Interest Rate Risk Management 15. Within 60 days of this Agreement, the Bank shall submit to the Reserve Bank

an acceptable written plan to improve interest rate risk management practices that are appropriate for the size and complexity of the Bank. The plan shall, at a minimum, include procedures and controls to ensure that the inputs and assumptions used to model and control the vulnerability of the Banks net interest income due to changes in interest rates are accurate and reflect the Banks current balance sheet structure and market conditions.

11

Dividends and Payments 16. (a) Orrstown and the Bank shall not declare or pay any dividends without the

prior written approval of the Reserve Bank and the Director of the Division of Banking Supervision and Regulation of the Board of Governors. (b) Orrstown shall not take any other form of payment representing a

reduction in capital from the Bank without the prior written approval of the Reserve Bank. (c) All requests for prior approval shall be received at least 30 days prior to

the proposed dividend declaration date. All requests shall contain, at a minimum, current and projected information, as appropriate, on the parents capital, earnings, and cash flow; the Banks capital, asset quality, earnings and ALLL needs; and identification of the sources of funds for the proposed payment or distribution. For requests to declare or pay dividends, Orrstown and the Bank, as appropriate, must also demonstrate that the requested declaration or payment of dividends is consistent with the Board of Governors Policy Statement on the Payment of Cash Dividends by State Member Banks and Bank Holding Companies, dated November 14, 1985 (Federal Reserve Regulatory Service, 4-877 at page 4-323). Debt and Stock Redemption 17. (a) Orrstown shall not, directly or indirectly, incur, increase, or guarantee any

debt without the prior written approval of the Reserve Bank. All requests for prior written approval shall contain, but not be limited to, a statement regarding the purpose of the debt, the terms of the debt, and the planned source(s) for debt repayment, and an analysis of the cash flow resources available to meet such debt repayment. (b) Orrstown shall not, directly or indirectly, purchase or redeem any shares

of its stock without the prior written approval of the Reserve Bank.

12

Compliance with Laws and Regulations 18. (a) In appointing any new director or senior executive officer, or changing the

responsibilities of any senior executive officer so that the officer would assume a different senior executive officer position, the Bank shall comply with the notice provisions of section 32 of the FDI Act (12 U.S.C. 1831i) and Subpart H of Regulation Y of the Board of Governors (12 C.F.R. 225.71 et seq.). (b) The Bank shall comply with the restrictions on indemnification and

severance payments of section 18(k) of the FDI Act (12 U.S.C. 1828(k)) and Part 359 of the Federal Deposit Insurance Corporations regulations (12 C.F.R. Part 359). Compliance with the Agreement 19. Within 30 days after the end of each calendar quarter following the date of this

Agreement, the boards of directors of Orrstown and the Bank shall jointly submit to the Reserve Bank written progress reports detailing the form and manner of all actions taken to secure compliance with this Agreement and the results thereof. Approval and Implementation of Plans, Programs, and Engagement Letter 20. (a) The Bank, and as applicable, Orrstown, shall submit written plans,

programs, and engagement letter that are acceptable to the Reserve Bank within the applicable time periods set forth in paragraphs 3(b), 5, 6, 8(a), 9(c), 10, 12, 14, and 15 of this Agreement. (b) Within 30 days of approval by the Reserve Bank, the Bank, and as

applicable Orrstown, shall adopt the approved plans, programs, and engagement letter. Upon adoption, the Bank, and as applicable Orrstown, shall promptly implement the approved plans and programs and thereafter fully comply with them.

13

(c)

During the term of this Agreement, the approved plans, programs, and

engagement letter shall not be amended or rescinded without the prior written approval of the Reserve Bank. Communications 21. All communications regarding this Agreement shall be sent to: (a) Mr. Christopher C. Henderson Assistant Vice President Federal Reserve Bank of Philadelphia Ten Independence Mall Philadelphia, Pennsylvania 19106 Mr. Thomas R. Quinn, Jr. President and Chief Executive Officer Orrstown Financial Services, Inc. and Orrstown Bank 77 East King Street Shippensburg, Pennsylvania 17244

(b)

Miscellaneous 22. Notwithstanding any provision of this Agreement, the Reserve Bank may, in its

sole discretion, grant written extensions of time to Orrstown and the Bank to comply with any provision of this Agreement. 23. The provisions of this Agreement shall be binding upon Orrstown and the Bank

and their institution-affiliated parties, in their capacities as such, and their successors and assigns. 24. Each provision of this Agreement shall remain effective and enforceable until

stayed, modified, terminated, or suspended in writing by the Reserve Bank. 25. The provisions of this Agreement shall not bar, estop, or otherwise prevent the

Board of Governors, the Reserve Bank, or any other federal or state agency from taking any other action affecting Orrstown and the Bank or any of their current or former institutionaffiliated parties and their successors and assigns.

14

26.

Pursuant to section 50 of the FDI Act (12 U.S.C. 1831aa), this Agreement is

enforceable by the Board of Governors under section 8 of the FDI Act (12 U.S.C. 1818). IN WITNESS WHEREOF, the parties have caused this Agreement to be executed as of the 22nd day of March, 2012.

ORRSTOWN FINANCIAL SERVICES, INC.

FEDERAL RESERVE BANK OF PHILADELPHIA

By: /s/ Thomas R. Quinn, Jr. Thomas R. Quinn, Jr. President and Chief Executive Officer

By: /s/ Christopher C. Henderson Christopher C. Henderson Assistant Vice President

ORRSTOWN BANK

By: /s/ Thomas R. Quinn, Jr. Thomas R. Quinn, Jr. President and Chief Executive Officer

15

You might also like

- Affidavit of Probable Cause: Amy GipeDocument10 pagesAffidavit of Probable Cause: Amy GipePublic Opinion100% (1)

- Shreffler OpinionDocument18 pagesShreffler OpinionPublic OpinionNo ratings yet

- Dusman v. Padasak: Opinion On Certification For Interlocutory AppealDocument8 pagesDusman v. Padasak: Opinion On Certification For Interlocutory AppealPublic OpinionNo ratings yet

- PA Vehicle Registration Renewal FormDocument1 pagePA Vehicle Registration Renewal FormPublic OpinionNo ratings yet

- Billy Hodge Charged With DUI: Affidavit of Probable CauseDocument6 pagesBilly Hodge Charged With DUI: Affidavit of Probable CausePublic Opinion0% (1)

- CASD School Board ResponsesDocument15 pagesCASD School Board ResponsesPublic OpinionNo ratings yet

- LiveWorkLearn@Central ProjectDocument5 pagesLiveWorkLearn@Central ProjectPublic OpinionNo ratings yet

- CASD Proposed 2015-16 CalendarDocument2 pagesCASD Proposed 2015-16 CalendarPublic OpinionNo ratings yet

- Opinion On CASD v. ZoellerDocument22 pagesOpinion On CASD v. ZoellerPublic OpinionNo ratings yet

- Letter in Response To DOJ ComplaintDocument2 pagesLetter in Response To DOJ ComplaintPublic OpinionNo ratings yet

- Petition For Allowance of AppealDocument72 pagesPetition For Allowance of AppealPublic OpinionNo ratings yet

- Justice Management Institute ReportDocument149 pagesJustice Management Institute ReportPublic OpinionNo ratings yet

- MacBook Lottery ApplicationDocument1 pageMacBook Lottery ApplicationPublic OpinionNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Cheap TBE Inverter TeardownsDocument33 pagesCheap TBE Inverter TeardownsWar Linux92% (12)

- ISBAR For Clear CommunicationDocument6 pagesISBAR For Clear Communicationmehara1920No ratings yet

- CampingDocument25 pagesCampingChristine May SusanaNo ratings yet

- 2023 VGP Checklist Rev 0 - 23 - 1 - 2023 - 9 - 36 - 20Document10 pages2023 VGP Checklist Rev 0 - 23 - 1 - 2023 - 9 - 36 - 20mgalphamrn100% (1)

- Bulk-Fill Composite RestorationsDocument9 pagesBulk-Fill Composite RestorationssusethNo ratings yet

- Lohmann GuideDocument9 pagesLohmann GuideRomulo Mayer FreitasNo ratings yet

- Full Bridge Phase Shift ConverterDocument21 pagesFull Bridge Phase Shift ConverterMukul ChoudhuryNo ratings yet

- Umur Ekonomis Mesin RevDocument3 pagesUmur Ekonomis Mesin Revrazali akhmadNo ratings yet

- Laws and Regulation Related To FoodDocument33 pagesLaws and Regulation Related To FoodDr. Satish JangraNo ratings yet

- Quinta RuedaDocument20 pagesQuinta RuedaArturo RengifoNo ratings yet

- APPSC Calender Year Final-2017Document3 pagesAPPSC Calender Year Final-2017Krishna MurthyNo ratings yet

- Practical Cookery 14th Edition SAMPLEDocument16 pagesPractical Cookery 14th Edition SAMPLETendaiNo ratings yet

- Assignment 2: Loan Submission For Equipment FinanceDocument6 pagesAssignment 2: Loan Submission For Equipment FinanceIT'S SIMPLENo ratings yet

- Signage Method of Statement and Risk AssessmentDocument3 pagesSignage Method of Statement and Risk AssessmentNajmal AmanNo ratings yet

- RCM Design and ImplementationDocument34 pagesRCM Design and ImplementationRozi YudaNo ratings yet

- Multilevel Full Mock Test 5: Telegramdagi KanalDocument20 pagesMultilevel Full Mock Test 5: Telegramdagi KanalShaxzod AxmadjonovNo ratings yet

- Ineffective Breastfeeding - NCPDocument10 pagesIneffective Breastfeeding - NCPJullian PloyaNo ratings yet

- Snap Bore Ring PDFDocument8 pagesSnap Bore Ring PDFlaaliNo ratings yet

- Owner'S Manual: Explosion-Proof Motor Mf07, Mf10, Mf13Document18 pagesOwner'S Manual: Explosion-Proof Motor Mf07, Mf10, Mf13mediacampaigncc24No ratings yet

- US Army Medical Course MD0722-100 - Microbiology For The Veterinary SpecialistDocument114 pagesUS Army Medical Course MD0722-100 - Microbiology For The Veterinary SpecialistGeorges100% (2)

- BARCODESDocument7 pagesBARCODESChitPerRhosNo ratings yet

- TelfastDocument3 pagesTelfastjbahalkehNo ratings yet

- Gintex DSDocument1 pageGintex DSRaihanulKabirNo ratings yet

- D05 Directional Control Valves EngineeringDocument11 pagesD05 Directional Control Valves EngineeringVentas Control HidráulicoNo ratings yet

- Revised List of Maharashtra HospitalsDocument16 pagesRevised List of Maharashtra Hospitalsdummy data100% (1)

- Qualification of Analytical Instruments For Use in Pharmaceutical Industry-A Scientific ApproachDocument23 pagesQualification of Analytical Instruments For Use in Pharmaceutical Industry-A Scientific Approachmicrobioasturias100% (4)

- Gloria Pfoltzer Theresa Morris, an Infant, by Mother and Next Friend Christopher Morris, an Infant, by Mother and Next Friend Randy Morris, an Infant, by Mother and Next Friend v. Fairfax County Department of Human Development Susan Manzo Paulette Byrd Florence Hannigan, and Louis Villafane, 966 F.2d 1443, 4th Cir. (1992)Document10 pagesGloria Pfoltzer Theresa Morris, an Infant, by Mother and Next Friend Christopher Morris, an Infant, by Mother and Next Friend Randy Morris, an Infant, by Mother and Next Friend v. Fairfax County Department of Human Development Susan Manzo Paulette Byrd Florence Hannigan, and Louis Villafane, 966 F.2d 1443, 4th Cir. (1992)Scribd Government DocsNo ratings yet

- Module 2: Environmental Science: EcosystemDocument8 pagesModule 2: Environmental Science: EcosystemHanna Dia MalateNo ratings yet

- Toaz - Info Fermentation of Carrot Juice Wheat Flour Gram Flour Etc PRDocument17 pagesToaz - Info Fermentation of Carrot Juice Wheat Flour Gram Flour Etc PRBhumika SahuNo ratings yet

- Science 9-Quarter 2-Module-3Document28 pagesScience 9-Quarter 2-Module-3Mon DyNo ratings yet