Professional Documents

Culture Documents

Form 16 A 2011 12

Uploaded by

Nirmal Kumar BhardwajOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form 16 A 2011 12

Uploaded by

Nirmal Kumar BhardwajCopyright:

Available Formats

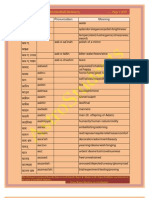

FORM NO.

16

[See rule 31(1)(a)] Part A Certificate under section 203 of the Income-tax Act, 1961 for tax deducted at source on Salary Name and address of the Employer Name and designation of the Employee

PAN of the Deductor

TAN of the Deductor

PAN of the Employee Assessment Year From Period To

CIT(TDS) Address City

Quarter Quarter 1 Quarter 2 Quarter 3 Quarter 4

2011-12 Pin code Summary of tax deducted at source Receipt Numbers of original Amount of tax deducted statements of TDS under subin respect of the section (3) of section 200. employee

Amount of tax deposited/remitted in respect of the employee

DETAILS OF SALARY PAID AND ANY OTHER INCOME AND TAX DEDUCTED 1. Gross salary (a) Salary as per provisions contained in section 17(1) (b) Value of perquisites u/s 17(2) (as per Form No. 12BB, wherever applicable) (c) Profits in lieu of salary under section 17(3) (as per Form No. 12BB, wherever applicable) (d) Total 2. Less : Allowance to the extent exempt under section 10 Allowance `. `. `. `. `. 0

Total 3. Balance (1 2) 4. Deductions : (a) Entertainment allowance (b) Tax on Employment 5. Aggregate of 4(a) and (b) 6. Income chargeable under the head Salaries (3 - 5) 7. Add : Any other income reported by the employee `.

`. `. `. `. `.

0 0

0 `. 0

Total 8. Gross total income (6 + 7)

`. `.

0 0

9. Deductions under Chapter VI-A (A) sections 80C, 80CCC and 80CCD (a) section 80C (i) (ii) (iii) (iv) (v) (vi) (vii) (b) section 80CCC (c) section 80CCD Gross amount `. `. `. `. `. `. `. `. `. Deductible amount

`. `. `.

`. `. `.

Notes : 1. Aggregate amount deductible under section 80C shall not exceed one lakh rupees. 2. Aggregate amount deductible under the three sections, i.e., 80C, 80CCC and 80CCD, shall not exceed one lakh rupees.

(B) other sections (e.g., 80E, 80G etc.) under Chapter VI-A (i) section (ii) section (iii) section (iv) section (v) section 10. Aggregate of deductible amount under Chapter VI-A 11. Total income (8-10) 12. Tax on total income 13. Education Cess @3% (on tax at S. No.12 plus surcharge at S. No.12) 14. Tax payable (12+13) 15. Relief under section 89 (attach details) 16. Tax payable (14-15) `. `. `. `. `. `. `. `. `. `. `. `. `. `. `. `. `. `. `. `. `. `. 0 0 0 0 0 0

Verification

I, [ Rupees nil only , son/daughter of working in the capacity of (designation) do hereby certify that a sum of Rs. (in words)]

has been deducted at source and paid to the credit of the Central Government. I further certify that the information given above is true and correct based on the books of account, documents, TDS statements, TDS deposited and other available records.

Place Signature of the person responsible for deduction of tax Date 5/11/2012 Name

Notes: 1 If an assessee is employed under more than one employer during the year, each of the employers shall issue Part A of the certificate in Form No. 16 pertaining to the period for which such assessee was employed with each of the employers. Part B may be issued by each of the employers or the last employer at the option of the assessee. Government deductors to enclose AnnexureA if tax is paid without production of an income-tax challan and Annexure-B if tax is paid accompanied by an incometax challan. Non-Government deductors to enclose Annexure-B. The deductor shall furnish the address of the Commissioner of Incometax (TDS) having jurisdiction as regards TDS statements of the assessee. This Form shall be applicable only in respect of tax deducted on or after 1st day of April, 2010.

2 3 4 5

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Kirloskar DG SetDocument12 pagesKirloskar DG SetNirmal Kumar BhardwajNo ratings yet

- Sector 63 Layout OldDocument1 pageSector 63 Layout OldNirmal Kumar BhardwajNo ratings yet

- Lal Kitab 1952 Grammer Portion (Page 1 To 234)Document241 pagesLal Kitab 1952 Grammer Portion (Page 1 To 234)Nirmal Kumar Bhardwaj88% (43)

- PunjabMunicipalBuildingByelaws2018, Ammended 2020Document164 pagesPunjabMunicipalBuildingByelaws2018, Ammended 2020Nirmal Kumar BhardwajNo ratings yet

- Adminisitration Telephone DirectoryDocument32 pagesAdminisitration Telephone DirectoryNirmal Kumar BhardwajNo ratings yet

- How To Judge Vimshotri DahsaDocument7 pagesHow To Judge Vimshotri DahsaNirmal Kumar Bhardwaj100% (22)

- House Kundli Directions As Per LalkitabDocument1 pageHouse Kundli Directions As Per LalkitabNirmal Kumar Bhardwaj67% (3)

- Urdu Hindi English DictioneryDocument67 pagesUrdu Hindi English DictioneryNirmal Kumar Bhardwaj75% (12)

- LalKitab Hindi 1941 With Glossary of Difficult Words & Phrases & Their MeaningsDocument529 pagesLalKitab Hindi 1941 With Glossary of Difficult Words & Phrases & Their MeaningsNirmal Kumar Bhardwaj89% (18)

- Soya or Jagta Ghar As Per Lalkitab 1952Document3 pagesSoya or Jagta Ghar As Per Lalkitab 1952Nirmal Kumar Bhardwaj67% (3)

- Lal Kitab 1939 Edition Original in Urdu ScriptDocument25 pagesLal Kitab 1939 Edition Original in Urdu ScriptNirmal Kumar Bhardwaj63% (8)

- Mooltrikona Rashi - A Different AngleDocument3 pagesMooltrikona Rashi - A Different AngleNirmal Kumar Bhardwaj100% (5)

- Glimpses of Lal Kitab - An Article by SR ChaudharyDocument12 pagesGlimpses of Lal Kitab - An Article by SR ChaudharyNirmal Kumar Bhardwaj100% (2)

- Lalkitab Varshphal ChartDocument6 pagesLalkitab Varshphal ChartNirmal Kumar Bhardwaj79% (29)

- Lalkitab Based Varshphal Making Excel Work Sheet.Document21 pagesLalkitab Based Varshphal Making Excel Work Sheet.Nirmal Kumar Bhardwaj50% (2)

- Kndlis Analysed by PT Rup Chand JoshiJiDocument6 pagesKndlis Analysed by PT Rup Chand JoshiJiNirmal Kumar Bhardwaj100% (5)

- 49-Horoscope in Your HandDocument14 pages49-Horoscope in Your HandSaptarishisAstrology100% (2)

- Lalkitab Planetwise Items Updated Dec2009Document14 pagesLalkitab Planetwise Items Updated Dec2009Nirmal Kumar Bhardwaj100% (11)

- Lalkitab Urdu Words Meanings in HindiDocument8 pagesLalkitab Urdu Words Meanings in HindiNirmal Kumar Bhardwaj85% (20)

- GrahDrishti in Lalkitab in HindiDocument2 pagesGrahDrishti in Lalkitab in HindiNirmal Kumar Bhardwaj100% (5)

- Aspects in LalkitabDocument3 pagesAspects in LalkitabNirmal Kumar Bhardwaj100% (4)

- Planet ThroneDocument1 pagePlanet ThroneNirmal Kumar BhardwajNo ratings yet

- PT Rup Chand JiDocument1 pagePT Rup Chand JiNirmal Kumar Bhardwaj100% (1)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Individual Induction Plan: Sample - Note The Following Plan Is Intended As A Guide Only and Should Be Tailored ToDocument3 pagesIndividual Induction Plan: Sample - Note The Following Plan Is Intended As A Guide Only and Should Be Tailored ToTarteil TradingNo ratings yet

- USN Machine Accountant Training 1966Document385 pagesUSN Machine Accountant Training 1966kgrhoadsNo ratings yet

- 7 Top Recruitment Agencies in Germany For English Speakers - FasthireDocument8 pages7 Top Recruitment Agencies in Germany For English Speakers - FasthireShijo PodiyanNo ratings yet

- Payslip ConfigurationDocument70 pagesPayslip ConfigurationAarohiSoodNo ratings yet

- PM Mandhan Scheme DetailsDocument1 pagePM Mandhan Scheme Detailspave.scgroupNo ratings yet

- Bibliografie Certificari HR Club Dec2019Document5 pagesBibliografie Certificari HR Club Dec2019Gabriela Diana MedlineNo ratings yet

- CVDocument3 pagesCVvishveshNo ratings yet

- Military Spouse Resume HelpDocument4 pagesMilitary Spouse Resume Helpidyuurvcf100% (2)

- Free - Manager New York State Employment Contract - by CompactLawDocument9 pagesFree - Manager New York State Employment Contract - by CompactLawCompactLaw USNo ratings yet

- RCM ModuleDocument30 pagesRCM ModuleVipan100% (1)

- Ra 207 m6 Case StudyDocument2 pagesRa 207 m6 Case Studyapi-2589346110% (1)

- Professional Regulatory Board of NursingDocument2 pagesProfessional Regulatory Board of NursingOscar Cruz100% (1)

- Questions Related To Pension in The Parliament 2Document18 pagesQuestions Related To Pension in The Parliament 2RavishankarNo ratings yet

- Bpcl-Kochi Refinery: To The Hon. Jury Members of Safety Innovation Awards 2008-2009Document62 pagesBpcl-Kochi Refinery: To The Hon. Jury Members of Safety Innovation Awards 2008-2009Satya Prabhat0% (1)

- Pilot Induction ProgramDocument9 pagesPilot Induction ProgramSilvia Oana Paulescu100% (1)

- Income Tax Notes Till Salary 2022 by Sachin Arora SEH PDFDocument69 pagesIncome Tax Notes Till Salary 2022 by Sachin Arora SEH PDF1234t dvhhNo ratings yet

- Chapter-1 Plan of The StudyDocument45 pagesChapter-1 Plan of The StudyRahul ChaudharyNo ratings yet

- History Essay-Caribbean Working & Health Conditions in The 1930'sDocument1 pageHistory Essay-Caribbean Working & Health Conditions in The 1930'sshryahNo ratings yet

- Theory X and Theory YDocument7 pagesTheory X and Theory YdanballaisNo ratings yet

- Northampton County Nepotism PolicyDocument2 pagesNorthampton County Nepotism PolicyBernieOHareNo ratings yet

- On The Job Training ReportDocument23 pagesOn The Job Training ReportPatricia Joie Clamonte100% (1)

- Department of Labor: ILA LU1398 08-02-07Document2 pagesDepartment of Labor: ILA LU1398 08-02-07USA_DepartmentOfLaborNo ratings yet

- Derrycourt Employee Handbook 2022 V0.3Document56 pagesDerrycourt Employee Handbook 2022 V0.3mari.tarau74No ratings yet

- MBA 509-1 HRM Lecture 5 IUB FinalDocument23 pagesMBA 509-1 HRM Lecture 5 IUB FinalMd. Muhinur Islam AdnanNo ratings yet

- CH - 2Document9 pagesCH - 2Hetal PatelNo ratings yet

- Performance Management Theory A Look From The Performer S Perspective With Implications For HRDDocument16 pagesPerformance Management Theory A Look From The Performer S Perspective With Implications For HRDKhoulita CherifNo ratings yet

- 1611 Job Order CostingDocument21 pages1611 Job Order CostingDiane PascualNo ratings yet

- Chapter 1: Management FundamentalsDocument47 pagesChapter 1: Management Fundamentalsapi-296300471No ratings yet

- CV - Ingles Simiao Fenias - 2018Document5 pagesCV - Ingles Simiao Fenias - 2018Simiao FeniasNo ratings yet

- Qna Lactation BookletDocument28 pagesQna Lactation BookletZaela EfronNo ratings yet