Professional Documents

Culture Documents

PrivCo Facebook Valuation: May 2012

Uploaded by

privcoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PrivCo Facebook Valuation: May 2012

Uploaded by

privcoCopyright:

Available Formats

Private Company: Facebook, Inc.

Financial Projections, Valuation Analysis, Share Price Fair Value:

Facebook, Inc.

(NASDAQ: FB) (PrivCo Private Company Ticker: FACEP)

May 16, 2012

Copyright 2012 PrivCo Media LLC. All Rights Reserved.

Private Company: Facebook, Inc.

PrivCo Private Company Financial Analysis

May 16, 2012

Copyright 2012 PrivCo Media LLC. All Rights Reserved.

Private Company: Facebook, Inc.

PrivCo Investment Thesis on the Social Media Industry and Facebook

PrivCo: Social media/social mobile industry remains a strong basket of companies, still capable of massive 20x-100x returns for investors.

PrivCo: Facebook has a solid business model and capable management, but was a great investment 6-7 years ago when it could still generate huge returns given its risks.

PrivCo: A basket of younger private pre-IPO companies with a more attractive valuation such as Twitter, Spotify or Pinterest for example offer greater reward given the high risks of internet industries. (Company names provided are for illustration only and not

investment recommendations)

PrivCo: Facebook at $100B is overvalued and not worth its risk/reward profile. PrivCo investment strategy:

(1)Proxy investments in the pre-IPO social media basket via secondary markets (2)Pair Trades to bet on the long term growth of social media by shorting Facebook while going long on the pre-IPO social internet basket via secondary markets or public companies (e.g. LinkedIn). (Company names provided are for illustration only and not investment recommendations)

Copyright 2012 PrivCo Media LLC. All Rights Reserved.

Private Company: Facebook, Inc.

Material Strength : User Engagement

User Stickiness

450 400 350 Avg. min/user 300 250 200 150 100

Stickiness compared to the competition

Facebook user engagement (405 minutes per month) outperforms rival social networking sites: 4.5x Pinterest and Tumblr, 19.3x Twitter

High Switching Costs

Users have a high barrier to switching to another network, which can involve rebuilding their own network.

Facebook Pinterest Tumblr Twitter

50

0 Avg min/user as of Jan 2012

Network Effects

As more users join, the more useful and valuable the network becomes

Copyright 2012 PrivCo Media LLC. All Rights Reserved.

Private Company: Facebook, Inc.

Material Weakness 1: Decelerating Revenues

PrivCo: During Q1 2012, Facebook had its first ever quarterly revenue decline of -6.4% to $1.06 billion. PrivCo: During Q1 2012, Facebook experienced declines in Ad-revenues (-7%) and Facebook Credits/Payments (-1%). PrivCo: Q1 is seasonally weak for Facebook, but seasonality does not explain the decline. Facebook managed a flat Q4 2010 to Q1 2011. PrivCo: With same ad-revenue based seasonality at this same stage pre-IPO, Google managed sequential revenue growth of 27.2%, dispelling Facebooks explanation of its weak results and 1st quarter revenue declines as due largely to seasonality. If Google could still grow 27% from Q4 to Q1 before its IPO at a similar size and age as Facebook why was Facebook unable to do so?

Copyright 2012 PrivCo Media LLC. All Rights Reserved.

Private Company: Facebook, Inc.

Material Weakness 1: Decelerating Revenues

Copyright 2012 PrivCo Media LLC. All Rights Reserved.

Private Company: Facebook, Inc.

Material Weakness 1: Decelerating Revenues

Q1 2012 vs. Q4 2011

Google managed a slight increase (0.6%) despite the seasonality of the ad spend calendar while Facebook fell.

Q1 Seasonality Argument

Fails to account for decline. Google experienced gains both during 2012 and at the same stage pre-IPO. Facebook's declining growth is specific to Facebook and reflects clear organic slowdowns in its business.

Q2 2012 Projections

PrivCo expects FB will miss Q2 projections as declines are due to rapid mobile usage and Facebooks failure to monetize that format

Copyright 2012 PrivCo Media LLC. All Rights Reserved.

Private Company: Facebook, Inc.

Material Weakness 2: Mobile Adoption

Rapid Mobile Growth

Facebook has yet to discover a monetization solution for its rapidly expanding mobile base where it simply lacks space for ads: 54% of March 2012 monthly active users (MAUs) were mobile users. Rapid growth in mobile and Facebooks inability to monetize it has negatively affected Facebooks profitability. Facebooks reactive acquisition of Instagram and their mobile base was in part to address its own unmonetized mobile base.

$1B Instagram Acquisition

Facebooks S-1 Statement Re: Mobile

We have historically not shown ads to users accessing Facebook through mobile apps or through our mobile website. We do not generate any meaningful revenue from the use of Facebook mobile products.

Copyright 2012 PrivCo Media LLC. All Rights Reserved.

Private Company: Facebook, Inc.

Material Weakness 3: Little Remaining Dry Powder

Rising Facebook Ads per Page

10 8 6 4 2 0 2009 2010 2011

Introduction of new, more intrusive ad formats is a clear response to poor ad performance. Sidebar ads increased from 5 to 7 per page. Forcing the Timeline upon its users to increase page views per visit. Allowing sponsored brand stories in brands fans newsfeeds; then allowing brand ads into fans friends newsfeeds. Larger Premium-ads which offer video and sound capabilities. Facebook has little real-estate remaining to increase advertisements.

PrivCo: Facebooks recent ad changes were for one time revenue infusions pre-IPO and its proceeding quarters. These measures failed to boost Q1 2012 revenue and will not be repeatable in 2013 and beyond.

Copyright 2012 PrivCo Media LLC. All Rights Reserved.

Private Company: Facebook, Inc.

Material Weakness 4: Facebook Fatigue

FB Use Declining Among Internet Users

In 2011, Facebook users globally reduced the frequency of key FB activities: searching for new contacts or sending message to friends

Users Are Rejecting Timeline

Facebook altered its successful platform in favor of timeline which offered greater ad space and clicks per page.

Frictionless Sharing

Automatic newsfeed updates regarding the users songs listened to or articles read because human to human sharing had declined.

PrivCo: Facebooks strict implementation of the timeline platform may be the worst corporate blunder since New Coke in 1985. We would not be surprised to see a re-adoption of Facebooks more popular prior format.

Copyright 2012 PrivCo Media LLC. All Rights Reserved.

Private Company: Facebook, Inc.

Material Weakness 5: Emerging Markets As Cost Centers

Facebook Quarterly Revenue Per Monthly Average User

Average Revenue Per User

Dropped during Q1 2012 to its lowest point in over a year at $1.17.

$1.40

$1.20 $1.00 $0.80 $0.60 $0.40 $0.20 $Q2 Q3 Q4 Q1 2011 2011 2011 2012

Growth in Emerging Markets

Facebooks new users are coming from developing countries, which are difficult to monetize as big brands generally do not advertise in these regions.

Net Cost Centers

Emerging markets must become net profit centers as they are currently increasing costs faster than revenues.

Copyright 2012 PrivCo Media LLC. All Rights Reserved.

Private Company: Facebook, Inc.

Unmodeled Facebook Upside Potential:

China

RenRen Monthly Active Users China (in millions) 200 150 100 50 0 FY 2009 FY 2010 FY 2011 200 150 100 50 0 FY 2009 FY 2010 FY 2011 Facebook Monthly Active Users US & Canada (in millions)

Copyright 2012 PrivCo Media LLC. All Rights Reserved.

Private Company: Facebook, Inc.

Unmodeled Facebook Upside Potential

Untapped China Market:

China has the worlds largest internet market with over 500 million internet users, but Facebook has virtually zero presence there. Chinese equivalent RenRen had 38 million MAUs (7.6% of Chinese internet users) as of FY11, while Facebook had reached 65% of North American internet users at FY11. At that rate, China penetration could offer 325M users.

Facebook App Center:

Facebook has an existing app platform and plans to launch its App-Center soon. Facebook will receive 30% of paid-app sales. (Apples top ranked app store generated approximately $1.6BN during FY11 according to Apple estimates.)

Facebook Social Search Engine:

Facebook has currently integrated its personal information into the new Bing. Facebook has the potential to become its own social search engine given the amounts of personal information and engineering capabilities of Facebook.

Copyright 2012 PrivCo Media LLC. All Rights Reserved.

Private Company: Facebook, Inc.

Unmodeled Facebook Potential Downside

Mass Migration to Competitor:

Facebook operates in a competitive industry where users have other social media options such as Google+, Twitter, or Pinterest. Internet industries are also susceptible to unknown new start-ups which can upend an established competitor similar to Facebooks elimination of MySpace.

Mobile Adoption Becoming Ubiquitous:

Mass mobile adoption will threaten Facebooks ability to generate ad revenues.

Weakness of Competitive Position:

Facebook cannot sustain costly acquisitions of young competitors such as Instagram who rapidly threaten its base. Instagrams $1 billion price tag demonstrates how a young company can quickly pose a serious threat to Facebooks competitive position.

Copyright 2012 PrivCo Media LLC. All Rights Reserved.

Private Company: Facebook, Inc.

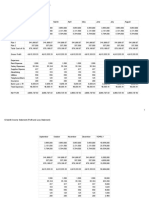

PrivCos Facebook Forecasts

Copyright 2012 PrivCo Media LLC. All Rights Reserved.

Private Company: Facebook, Inc.

PrivCos Facebook Forecasts

PrivCos Assumptions:

Facebooks revenue will continue to be adversely affected by rapid mobile adoption. Facebooks costs will continue to rise as its user base expands particularly via unmonetizable emerging markets and mobile. Facebook Payments revenue will grow at a faster rate than advertisements as Facebook introduces new features such as the App Center, Search and Facebook Offers.

Copyright 2012 PrivCo Media LLC. All Rights Reserved.

Private Company: Facebook, Inc.

Facebook Valuation: Current Stock Price

Facebooks $34-$38 price range offers an initial valuation $85.4B$95.5B. PrivCo projects the final share valuation could be adjusted by as much as $2 above the high-end range with an ultimate target valuation of $95.5B-$100.5B. Facebooks final private market trades went for $44.10, giving a valuation of $104B. At a $100B valuation, Facebook is asking for 18.6x its forecasted 2012 revenues of $5.4B.

Copyright 2012 PrivCo Media LLC. All Rights Reserved.

Private Company: Facebook, Inc.

Facebook Valuation 1:Public Comparables

(Enterprise-Value to Revenue Multiples)

Revenue* Google Yahoo! AOL LinkedIn Yelp $35,460,000,000 $4,470,000,000 $2,120,000,000 $908,000,000 $131,000,000 Enterprise Valuation $197,310,000,000 $18,630,000,000 $2,430,000,000 $11,080,000,000 $1,240,000,000 Rev Multiple 4.3 3.7 1.0 11.5 8.5

PrivCo estimates a typical valuation of a tech company around 5x-10x revenues while Facebook currently asks for 18.6x. Given forecasted OI of $2.07B for 2012, Facebook is asking for slightly below 48x OI multiple which is much larger than its publicly traded peers.

*Projected 2012 Revenues

Copyright 2012 PrivCo Media LLC. All Rights Reserved.

Private Company: Facebook, Inc.

Facebook Valuation 1:Public Comparables

(Enterprise-Value to Revenue Multiples)

Based on these comparable companies weighted average of enterprise value to revenue multiples, PrivCo believes a 9x revenue multiple accurately reflects Facebook and should be applied to its projected 2012 revenues.

Copyright 2012 PrivCo Media LLC. All Rights Reserved.

Private Company: Facebook, Inc.

Facebook Valuation 1:Public Comparables

(Enterprise-Value to Revenue Multiples)

Applying a 9x revenue multiple to Facebooks projected 2012 revenues of $5.4B results in a Facebook valuation of $60.3B. Based on the valuation and Facebooks 2.5 billion shares outstanding, PrivCo prices fair value of Facebooks stock at $24.12/share, significantly below the $34-$38 IPO price range.

Copyright 2012 PrivCo Media LLC. All Rights Reserved.

Private Company: Facebook, Inc.

Facebook Valuation 2: Discounted Cash Flow

Present value calculations for all future cash flows (net income) plus cash on hand results in a Facebook valuation of $62.6B. Based the valuation, PrivCo prices fair value of Facebook stock at $25.05/share, significantly lower than the IPO price range.

Copyright 2012 PrivCo Media LLC. All Rights Reserved.

Private Company: Facebook, Inc.

PrivCos Facebook (NASDAQ: FB) Share Value Conclusions:

Short-Term BUY

Facebook shares will Pop in their opening days due to (1) media attention, (2) retail investor puts (i.e. small investors will buy regardless of price providing a built-in demand backstop to short term price), and (3) limited allocations to IPO investors which will increase FBs price upon opening trades. Recommendation: Buy at IPO price of $34-$38 to flip into short-term pops.

Long-Term SELL

Facebook is materially overvalued in its current range between $85B and $95B. Facebook will experience a post lock-up sell-off that will drive down future prices. PrivCo analysis concludes that markets will likely correct FBs price after an initial pop into a long-term fair value $24-$25 range, which falls significantly below the $34-$38 IPO price range.

Copyright 2012 PrivCo Media LLC. All Rights Reserved.

Private Company: Facebook, Inc.

PrivCos Facebook (NASDAQ: FB) Share Value Conclusions:

PrivCo Predicts a Post Lock-up Sell-off of FB Shares due to the following:

1. RSUs:

RSUs are taxable immediately upon vesting/conversion to FB shares. FB shares must be sold to cover shareholder tax costs.

2. Rising Capital Gains Tax:

President Obama plans to allow the George Bush Capital Gains Tax Cut to expire next year. FBs lock-up period ends 1-month before the increase, and shareholders will off-load FB positions before the increased tax. Facebooks float on public markets post lock-up will be massive in an absolute sense with over 1 billion shares - over $40 billion in public float: larger than most of the S&P 500s market capitalization..

3. Public Float

Copyright 2012 PrivCo Media LLC. All Rights Reserved.

Private Company: Facebook, Inc.

PrivCos Final Forecasts of Where Facebook (NASDAQ: FB) Will Trade:

Facebook will be offered above or at the high-end of its $34-$38 range. Facebooks initial trades will pop well-above the IPO price given its hype, and massive demand by IPO investors. HOWEVER, PrivCo believes that Facebook is ultimately overvalued at $100B, and markets will correct Facebooks price per share below its IPO range into a $24-$25 range with a post lock-up sell-off that could further further diminish FB share price. PrivCos Final Conclusion: Facebook (NASDAQ: FB) is a very short-term BUY, and a long-term SELL.

Copyright 2012 PrivCo Media LLC. All Rights Reserved.

Private Company: Facebook, Inc.

Analyst Contacts:

Sam Hamadeh, J.D./M.B.A. Phone: 917-701-1887 Email: sam@privco.com Christopher Minora Phone: 646-499-4550 Email: christopher@privco.com Jeffrey Wayne Phone: 212-645-1686 Email: jeff@privco.com

Disclaimer

Neither PrivCo nor its employees are owners or stakeholders in Facebook stock. PrivCo does not offer investment banking services. PrivCo assumes no responsibility for decisions based on information presented in this report.

Copyright 2012 PrivCo Media LLC. All Rights Reserved.

You might also like

- IPO Model and SPAC ValuationDocument5 pagesIPO Model and SPAC ValuationJohnNo ratings yet

- Fina6000 Module 2c - Capital RaisingDocument22 pagesFina6000 Module 2c - Capital RaisingMar SGNo ratings yet

- MergedDocument634 pagesMergedRishabh DabasNo ratings yet

- Formal Letter Opf DemandDocument8 pagesFormal Letter Opf DemandrcpanganibanNo ratings yet

- Simon Lim, Director - Listings 26 March 2008: Singapore ExchangeDocument40 pagesSimon Lim, Director - Listings 26 March 2008: Singapore ExchangenetworkedNo ratings yet

- 12-Month Income Statement Profit-And-Loss Statement - Sheet1Document2 pages12-Month Income Statement Profit-And-Loss Statement - Sheet1api-462952636100% (1)

- OpenSAP Leo4 All SlidesDocument52 pagesOpenSAP Leo4 All SlidesPradeep KavangalNo ratings yet

- 04.situation Analysis Value ChainDocument32 pages04.situation Analysis Value ChainSubham DuttaNo ratings yet

- Pecking OrderDocument24 pagesPecking OrderaniketkaushikNo ratings yet

- 5 Stages of A SPACDocument6 pages5 Stages of A SPACmichaelNo ratings yet

- CapgeminiOfferLetter 29122011 PDFDocument23 pagesCapgeminiOfferLetter 29122011 PDFsreeharivaleti100% (1)

- Estates and Trust PDFDocument4 pagesEstates and Trust PDFJustin Robert Roque100% (1)

- China IPO Exits: Key Findings on ProspectsDocument23 pagesChina IPO Exits: Key Findings on ProspectsShirlene TsuiNo ratings yet

- Sustainable Accounting and Financial ManagementDocument21 pagesSustainable Accounting and Financial ManagementkwanNo ratings yet

- 2020 2021 Adv Fin 10 Company Valuation and Financing DecisionsDocument108 pages2020 2021 Adv Fin 10 Company Valuation and Financing DecisionsCharbel HatemNo ratings yet

- GFMP - Debt Markets - Money MarketDocument16 pagesGFMP - Debt Markets - Money MarketrudypatilNo ratings yet

- AFA 3e PPT Chap10Document79 pagesAFA 3e PPT Chap10Quỳnh NguyễnNo ratings yet

- Ballerina Tech Assumptions & SummaryDocument48 pagesBallerina Tech Assumptions & Summaryapi-25978665No ratings yet

- Financial ManagementDocument886 pagesFinancial ManagementKRISHNA PRASAD SAMUDRALANo ratings yet

- Cvccreditpartnerseuropeanopportunitiesjul 16Document48 pagesCvccreditpartnerseuropeanopportunitiesjul 16Mus ChrifiNo ratings yet

- RSM - MBA - FAV - Lecture 3 - 2016 - EV and Equity Valuation PDFDocument98 pagesRSM - MBA - FAV - Lecture 3 - 2016 - EV and Equity Valuation PDFAli Gokhan KocanNo ratings yet

- Relative Valuation Guide for Business ValuationDocument35 pagesRelative Valuation Guide for Business ValuationChad HallNo ratings yet

- 2022 - Chapter01 - Why Value ValueValueDocument13 pages2022 - Chapter01 - Why Value ValueValueElias MacherNo ratings yet

- Derivative Risk Management: BY Ca Umesh KolapkarDocument42 pagesDerivative Risk Management: BY Ca Umesh KolapkarBhakti KhannaNo ratings yet

- Innovations in Green Credit Markets (Working Paper) - Esohe Denise Odaro, Head of Investor Relations IFCDocument19 pagesInnovations in Green Credit Markets (Working Paper) - Esohe Denise Odaro, Head of Investor Relations IFCedo7No ratings yet

- SwapsDocument38 pagesSwapsNavleen KaurNo ratings yet

- Osprey equity raising to accelerate commercialisationDocument24 pagesOsprey equity raising to accelerate commercialisationMaryJane WermuthNo ratings yet

- Fundamentals of FinancemangementDocument103 pagesFundamentals of FinancemangementjajoriavkNo ratings yet

- Advance Corporate FinanceDocument53 pagesAdvance Corporate FinanceIdham Idham IdhamNo ratings yet

- ACCT7107 Lecture 7 1 Slide Per Page 1 PDFDocument92 pagesACCT7107 Lecture 7 1 Slide Per Page 1 PDFAubrey Rañeses SisonNo ratings yet

- Lecture 2Document24 pagesLecture 2Bình MinhNo ratings yet

- Lending ActivtiesDocument28 pagesLending ActivtiesabsrocksibsNo ratings yet

- International Finance - Module VDocument38 pagesInternational Finance - Module VVishnu VishnuNo ratings yet

- Corporate Finance Cap Structure 1Document140 pagesCorporate Finance Cap Structure 1Sabrina AlbaneseNo ratings yet

- Swaps NewDocument46 pagesSwaps NewSimón AltkornNo ratings yet

- Malaysia Bursa IPO Vs HKEX IPO (Brief Guide To Listing)Document6 pagesMalaysia Bursa IPO Vs HKEX IPO (Brief Guide To Listing)nestleomegasNo ratings yet

- Corporate Finance Lecture Note Packet 2 Capital Structure, Dividend Policy and ValuationDocument262 pagesCorporate Finance Lecture Note Packet 2 Capital Structure, Dividend Policy and ValuationBhargavVithalaniNo ratings yet

- Chicago Board of Trade - (CBOT)Document10 pagesChicago Board of Trade - (CBOT)Debdoot MukherjeeNo ratings yet

- Overview of an Initial Public OfferingDocument12 pagesOverview of an Initial Public Offeringqaraj44No ratings yet

- SM Cycle 7 Session 4Document76 pagesSM Cycle 7 Session 4OttilieNo ratings yet

- Basics On Investments FinalDocument105 pagesBasics On Investments FinalRohitGuleriaNo ratings yet

- Kohinoor Chemicals Balance Sheet Analysis 2016-2019Document37 pagesKohinoor Chemicals Balance Sheet Analysis 2016-2019Sharif KhanNo ratings yet

- Cours Corporate FinanceDocument126 pagesCours Corporate FinanceAlexandraNo ratings yet

- Term LoanDocument39 pagesTerm Loanashok_gupta077No ratings yet

- Class Notes - 1Document32 pagesClass Notes - 1ushaNo ratings yet

- Credit Derivatives & Structured Products: FRM (Term V) 2013Document21 pagesCredit Derivatives & Structured Products: FRM (Term V) 2013NishantNo ratings yet

- Chapter 15 Measurement of Economic Performance (I)Document61 pagesChapter 15 Measurement of Economic Performance (I)Jason Chung100% (1)

- S8 Options Online VersionDocument51 pagesS8 Options Online Versionconstruction omanNo ratings yet

- International Trade and Foreign Direct InvestmentDocument26 pagesInternational Trade and Foreign Direct InvestmentNgoc Linh BuiNo ratings yet

- ITS Module 2Document57 pagesITS Module 2Holy BankNo ratings yet

- Class NotesDocument77 pagesClass NotesSphamandla MakalimaNo ratings yet

- cdf58sm Mod 3.1Document68 pagescdf58sm Mod 3.1vibhuti goelNo ratings yet

- Hello & Welcome To Presentation: Lets Get StartedDocument8 pagesHello & Welcome To Presentation: Lets Get StartedAalaa MohamedNo ratings yet

- SXSW V2venture ApplicationDocument22 pagesSXSW V2venture ApplicationMatthew MorrisNo ratings yet

- Cfa l1 CurrencyDocument35 pagesCfa l1 CurrencyRajesh ShahNo ratings yet

- 1 Corporate Finance IntroductionDocument41 pages1 Corporate Finance IntroductionPooja KaulNo ratings yet

- Dextrin From Starch Project Report PDFDocument14 pagesDextrin From Starch Project Report PDFAnonymous vFwQuKrtSNo ratings yet

- The Optimal Capital Structure: Balancing the Costs and Benefits of DebtDocument127 pagesThe Optimal Capital Structure: Balancing the Costs and Benefits of DebtMailyn Castro-VillaNo ratings yet

- Securefund Crowdfunding Using BlockchainDocument6 pagesSecurefund Crowdfunding Using BlockchainIJRASETPublicationsNo ratings yet

- Marks and Spencer Marketing MixDocument27 pagesMarks and Spencer Marketing MixTushar Sharma50% (4)

- SME Financing: Submitted To Mr. S. Clement September 17,2010Document29 pagesSME Financing: Submitted To Mr. S. Clement September 17,2010scribddddddddddddNo ratings yet

- Case No. 1 BWFM5013Document8 pagesCase No. 1 BWFM5013Shashi Kumar NairNo ratings yet

- GE 113 Module 1 2023Document75 pagesGE 113 Module 1 2023France PilapilNo ratings yet

- Valuation Models for Security AnalysisDocument44 pagesValuation Models for Security AnalysisArun KumarNo ratings yet

- Long Term Finance Shares Debentures and Term LoansDocument21 pagesLong Term Finance Shares Debentures and Term LoansBhagyashree DevNo ratings yet

- 04+AWS+Startup+Day Fundraising PDFDocument77 pages04+AWS+Startup+Day Fundraising PDFedopdxNo ratings yet

- Investing in Natural Capital for a Sustainable Future in the Greater Mekong SubregionFrom EverandInvesting in Natural Capital for a Sustainable Future in the Greater Mekong SubregionNo ratings yet

- PrivCo Financial Presentation 2014Document25 pagesPrivCo Financial Presentation 2014privcoNo ratings yet

- PrivCo PresentationDocument10 pagesPrivCo PresentationprivcoNo ratings yet

- PrivCo Financial Presentation 2014Document25 pagesPrivCo Financial Presentation 2014privcoNo ratings yet

- Financial Presentation (1-16-2015)Document24 pagesFinancial Presentation (1-16-2015)privcoNo ratings yet

- PrivCo's Academic PresentationDocument27 pagesPrivCo's Academic PresentationprivcoNo ratings yet

- PrivCo Financial PresentationDocument27 pagesPrivCo Financial PresentationprivcoNo ratings yet

- The Private Company Financial Data AuthorityDocument26 pagesThe Private Company Financial Data AuthorityprivcoNo ratings yet

- PrivCo-AMAA Presentation-Dec-2012Document17 pagesPrivCo-AMAA Presentation-Dec-2012privco100% (1)

- Statements of Accounting Standards (AS 10) : Accounting For Fixed AssetsDocument6 pagesStatements of Accounting Standards (AS 10) : Accounting For Fixed AssetsSantoshca1984No ratings yet

- News Letter January 2017Document19 pagesNews Letter January 2017Sujata SinghNo ratings yet

- Proposal Tanaman MelonDocument3 pagesProposal Tanaman Melondr walferNo ratings yet

- Exercises LBODocument2 pagesExercises LBORafael Lizana ZúñigaNo ratings yet

- A Product Project Report On Gokul Cotton SeedsDocument31 pagesA Product Project Report On Gokul Cotton SeedspRiNcE DuDhAtRaNo ratings yet

- PFSDocument59 pagesPFSWendy CagapeNo ratings yet

- Indian Aviation Industry: Presented By: Steveford Marwein (547) Anupam NathDocument14 pagesIndian Aviation Industry: Presented By: Steveford Marwein (547) Anupam Nathanupam_2010No ratings yet

- Fortis Healthcare - Submission PDFDocument3 pagesFortis Healthcare - Submission PDFKumar Praharsh RakhejaNo ratings yet

- Part 1 - Section D Cost Management 1.1 Cost Drivers and Cost FlowsDocument114 pagesPart 1 - Section D Cost Management 1.1 Cost Drivers and Cost FlowsGaleli PascualNo ratings yet

- SLM-19615-B Com-INCOME TAX LAW AND ACCOUNTS - 0Document308 pagesSLM-19615-B Com-INCOME TAX LAW AND ACCOUNTS - 0Deva T NNo ratings yet

- Pages From Filed ComplaintDocument9 pagesPages From Filed Complaintmbamman-1No ratings yet

- The Nature and Scope of Cost & Management AccountingDocument17 pagesThe Nature and Scope of Cost & Management Accountingfreshkidjay100% (5)

- Smartcat-10609 Verbal Ability and Reading Comprehension Instructions For Questions 1 To 4: The Passage Given Below Is Followed by A Set ofDocument34 pagesSmartcat-10609 Verbal Ability and Reading Comprehension Instructions For Questions 1 To 4: The Passage Given Below Is Followed by A Set ofsrksamNo ratings yet

- CIR Failed Observe Due Process Rendering Assessments VoidDocument4 pagesCIR Failed Observe Due Process Rendering Assessments VoidCyruz TuppalNo ratings yet

- Domestic Work Contract PDFDocument3 pagesDomestic Work Contract PDFGo DedeNo ratings yet

- BondAnalytics GlossaryDocument4 pagesBondAnalytics GlossaryNaveen KumarNo ratings yet

- Corporate Finance: Topic: Company Analysis "Infosys"Document6 pagesCorporate Finance: Topic: Company Analysis "Infosys"Anuradha SinghNo ratings yet

- Audit Documentation GuideDocument12 pagesAudit Documentation Guideagnymahajan100% (1)

- Bennett v. Commissioner IRS, 1st Cir. (1998)Document9 pagesBennett v. Commissioner IRS, 1st Cir. (1998)Scribd Government DocsNo ratings yet

- Multiplier EffectDocument8 pagesMultiplier EffectCamille LaraNo ratings yet

- Depriciation and AccountingDocument3 pagesDepriciation and AccountingGurkirat TiwanaNo ratings yet