0% found this document useful (0 votes)

67 views4 pagesGDP and Unemployment Regression Analysis

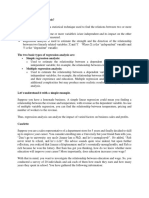

The document analyzes the relationship between GDP growth rate and unemployment rate using regression analysis and statistical tests. It finds a weak negative correlation between GDP and unemployment, but the regression model is not statistically significant for predicting future relationships.

Uploaded by

brmehta06Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

67 views4 pagesGDP and Unemployment Regression Analysis

The document analyzes the relationship between GDP growth rate and unemployment rate using regression analysis and statistical tests. It finds a weak negative correlation between GDP and unemployment, but the regression model is not statistically significant for predicting future relationships.

Uploaded by

brmehta06Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd