100% found this document useful (2 votes)

20K views2 pagesForm 12C

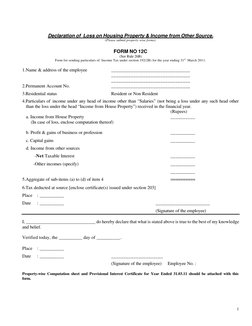

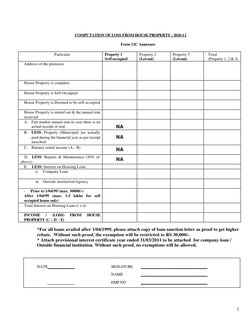

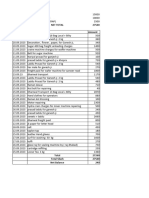

This document contains a form and instructions for employees to report income from other sources besides salary for the tax year ending March 31, 2011. It requests information such as the employee's name, address, PAN number, and residential status. The employee must provide details of income from other sources like house property, business/profession, capital gains, and other income. Supporting documents like computation of loss from house property and interest certificates must be attached.

Uploaded by

AllahBakshCopyright

© Attribution Non-Commercial (BY-NC)

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

100% found this document useful (2 votes)

20K views2 pagesForm 12C

This document contains a form and instructions for employees to report income from other sources besides salary for the tax year ending March 31, 2011. It requests information such as the employee's name, address, PAN number, and residential status. The employee must provide details of income from other sources like house property, business/profession, capital gains, and other income. Supporting documents like computation of loss from house property and interest certificates must be attached.

Uploaded by

AllahBakshCopyright

© Attribution Non-Commercial (BY-NC)

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

- Declaration of Loss on Housing Property & Income

- Computation of Loss from House Property - 2010-11